Key Insights

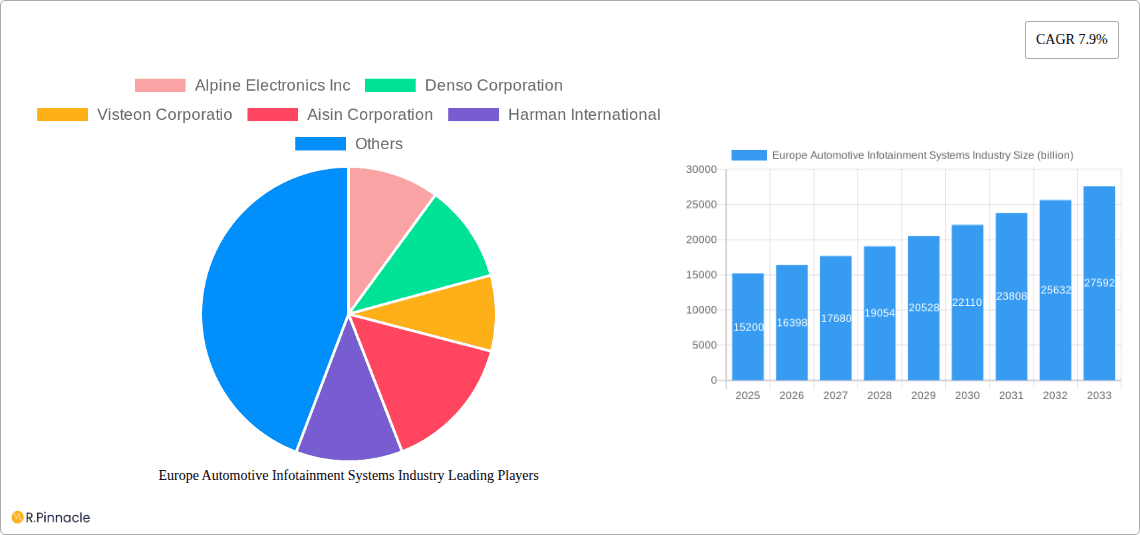

The European automotive infotainment systems market is poised for significant expansion, projected to reach a substantial USD 15.2 billion in 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 7.9% through 2033. This growth is primarily fueled by an escalating demand for advanced in-car connectivity, enhanced entertainment options, and integrated navigation systems across both passenger cars and commercial vehicles. The increasing adoption of sophisticated features like artificial intelligence-powered voice assistants, over-the-air updates, and personalized user experiences are key drivers. Furthermore, stringent safety regulations mandating advanced driver-assistance systems (ADAS) that often integrate with infotainment platforms are contributing to market momentum. The trend towards connected vehicles and the growing consumer expectation for seamless digital integration within their vehicles are creating a fertile ground for innovation and market penetration by key players like Continental AG, Robert Bosch GmbH, and Harman International.

Europe Automotive Infotainment Systems Industry Market Size (In Billion)

The European automotive infotainment systems landscape is characterized by a dynamic interplay of technological advancements and evolving consumer preferences. While the market is driven by the desire for richer in-car experiences, certain factors could temper the pace of growth. The high initial cost of advanced infotainment systems and the complexity associated with their integration into vehicle architectures can present challenges. Moreover, the increasing rate of technological obsolescence necessitates continuous investment in research and development, which can impact profit margins. However, the continuous innovation in display technologies, the integration of 5G capabilities for faster data transmission, and the burgeoning development of in-car e-commerce and gaming applications are expected to outweigh these restraints. The market segments of In-Dash Infotainment and Rear Seat Infotainment are both expected to witness considerable growth, driven by a diverse range of vehicle types, from compact passenger cars to heavy-duty commercial vehicles. Europe, with its strong automotive manufacturing base and high consumer spending power, is a critical region for this market's development.

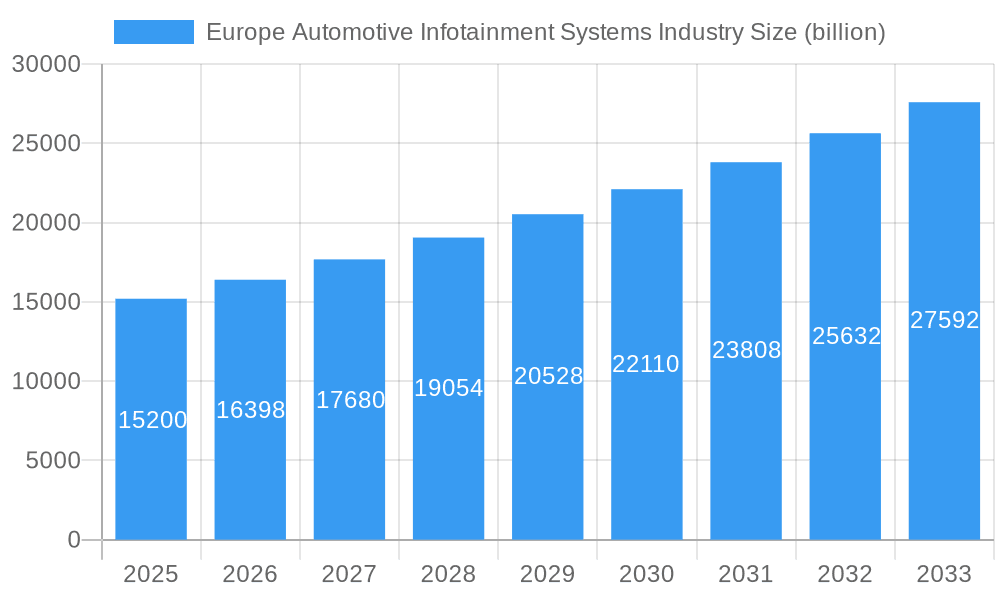

Europe Automotive Infotainment Systems Industry Company Market Share

Europe Automotive Infotainment Systems Industry Market Structure & Innovation Trends

The Europe automotive infotainment systems market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Key players like Robert Bosch GmbH, Continental AG, and Harman International are at the forefront of innovation, driving advancements in the sector. Innovation drivers include the escalating demand for enhanced in-car experiences, the integration of advanced driver-assistance systems (ADAS), and the proliferation of connected car technologies. Regulatory frameworks in Europe, particularly concerning data privacy and cybersecurity, play a crucial role in shaping product development and market entry strategies. Product substitutes, while emerging in the form of smartphone mirroring technologies, are increasingly being integrated into OEM infotainment systems rather than acting as standalone replacements. End-user demographics reveal a growing preference among younger, tech-savvy consumers for sophisticated and personalized in-car entertainment and information systems. Mergers and acquisition (M&A) activities, such as the acquisition of Harman International by Samsung Electronics Co. Ltd, have been instrumental in consolidating market positions and fostering technological synergy. The total value of M&A deals in the automotive infotainment sector over the study period is estimated to be in the hundreds of billions of euros, reflecting strategic consolidation and investment in future technologies.

Europe Automotive Infotainment Systems Industry Market Dynamics & Trends

The Europe automotive infotainment systems market is poised for robust growth, driven by a confluence of technological advancements, evolving consumer expectations, and supportive industry initiatives. The market penetration of advanced infotainment systems is expected to witness a significant surge, fueled by the increasing adoption of smart vehicle features and the demand for seamless connectivity. The Compound Annual Growth Rate (CAGR) for the Europe automotive infotainment systems market is projected to be in the range of 8.5% to 10.5% over the forecast period of 2025–2033. This upward trajectory is primarily propelled by the escalating demand for personalized and immersive in-car experiences, encompassing advanced navigation, entertainment streaming, voice assistants, and in-car payment solutions. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing infotainment systems, enabling predictive functionalities and adaptive user interfaces. The growing prevalence of electric vehicles (EVs) and the ongoing push towards autonomous driving are further accelerating the adoption of sophisticated infotainment solutions, which often serve as the central hub for vehicle management and passenger interaction.

Technological disruptions, including the development of augmented reality (AR) and virtual reality (VR) integration, are set to redefine the in-car entertainment landscape, offering novel ways for occupants to engage with digital content. The increasing focus on over-the-air (OTA) updates is ensuring that infotainment systems remain current with the latest software features and security patches, thereby enhancing customer satisfaction and vehicle longevity. Consumer preferences are rapidly shifting towards systems that offer intuitive user interfaces, seamless smartphone integration (e.g., Apple CarPlay, Android Auto), and access to a wide array of digital services. The competitive dynamics within the market are intense, with established automotive suppliers, technology giants, and emerging startups vying for market share. Strategic collaborations and partnerships are becoming increasingly common as companies seek to leverage each other's expertise and accelerate innovation. The market is also witnessing a growing emphasis on cybersecurity to protect sensitive user data and prevent unauthorized access to vehicle systems. The overall market size is anticipated to reach several hundred billion euros by the end of the forecast period, underscoring the significant economic impact and growth potential of this sector.

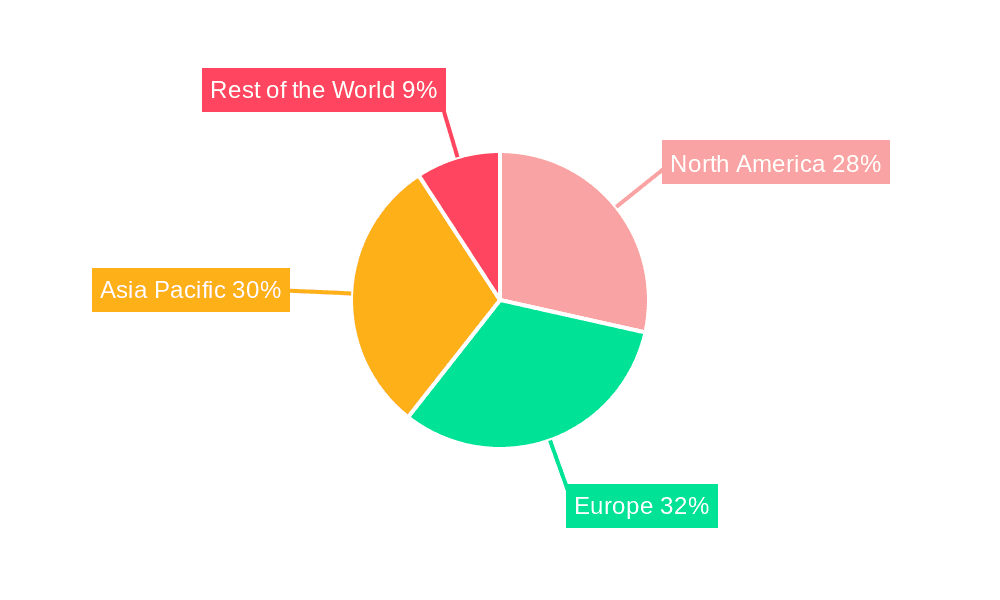

Dominant Regions & Segments in Europe Automotive Infotainment Systems Industry

Within the Europe automotive infotainment systems industry, Germany stands out as the dominant region, consistently leading in terms of market share and technological adoption. This leadership is underpinned by its strong automotive manufacturing base, significant R&D investments, and a consumer base that readily embraces advanced automotive technologies. The economic policies in Germany, which prioritize innovation and sustainable mobility, further bolster the growth of the infotainment systems market.

In-Dash Infotainment systems are the dominant segment by installation type.

- Key Drivers for In-Dash Infotainment Dominance:

- Driver Focus and Safety: Centralized display for navigation, communication, and essential vehicle information minimizes driver distraction.

- Integration with Vehicle Systems: Seamless integration with other vehicle functions, such as climate control, vehicle settings, and ADAS.

- Technological Advancements: Rapid evolution of touchscreen technology, high-resolution displays, and intuitive user interfaces.

- OEM Integration: Manufacturers increasingly embed advanced in-dash systems as standard or premium features.

Passenger Cars represent the leading vehicle type segment.

- Key Drivers for Passenger Cars Dominance:

- Higher Sales Volume: Passenger cars constitute the largest segment of vehicle sales in Europe, leading to a broader addressable market for infotainment systems.

- Consumer Demand for Features: Buyers of passenger cars typically prioritize in-car comfort, entertainment, and connectivity features.

- Luxury and Premium Segments: These segments often lead in the adoption of cutting-edge infotainment technologies, driving market trends.

- Fleet Purchases: The large volume of passenger cars in company fleets also contributes to sustained demand for advanced infotainment.

The infrastructure in Germany, characterized by high-speed internet penetration and a well-developed charging network for EVs, also supports the widespread use of connected infotainment features. Other significant markets within Europe include France, the United Kingdom, and Italy, each contributing substantially to the overall market size due to their robust automotive industries and evolving consumer preferences. The trend towards digitalization and the increasing demand for personalized digital experiences within vehicles are common across these major European automotive markets. The economic policies encouraging the adoption of smart and connected vehicles, coupled with stringent safety regulations that often necessitate advanced display technologies, further cement the dominance of these regions and segments. The market size for passenger car infotainment systems alone is projected to be in the tens of billions of euros annually within the forecast period.

Europe Automotive Infotainment Systems Industry Product Innovations

The Europe automotive infotainment systems industry is characterized by rapid product innovation focused on enhancing the user experience and integrating advanced functionalities. Key developments include the creation of interactive and immersive displays, such as Continental's Switchable Privacy Display, which allows dynamic viewing modes to prevent driver distraction while enabling passenger entertainment. Harman's acoustic innovations, like Ready Together and Software Enabled Branded Audio, are elevating in-car sound quality and communication, fostering a more engaging and personalized audio environment. Robert Bosch GmbH's high-performance infotainment domain computing system is a significant advancement, enabling the swift integration of a wide array of features including in-car payments, video streaming, and advanced voice assistants. These innovations collectively push the boundaries of what in-car systems can offer, driving competitive advantages through superior user engagement, enhanced safety, and unparalleled convenience.

Report Scope & Segmentation Analysis

The Europe Automotive Infotainment Systems Industry report offers comprehensive market segmentation analysis across key categories. The study encompasses Installation Type, covering both In-Dash Infotainment and Rear Seat Infotainment. Vehicle Type segmentation includes Passenger Cars and Commercial Vehicles.

In-Dash Infotainment: This segment is projected to experience substantial growth, driven by its central role in vehicle control and driver information. Its market size is anticipated to reach tens of billions of euros, with a projected CAGR of over 9%. Competitive dynamics are characterized by integration challenges and the demand for user-friendly interfaces.

Rear Seat Infotainment: While a smaller segment, Rear Seat Infotainment is expected to witness strong growth, particularly in premium passenger cars and for family-oriented vehicles. Its market size is estimated to be in the billions of euros, with a projected CAGR exceeding 7%. Key drivers include enhanced passenger comfort and entertainment options.

Passenger Cars: This segment constitutes the largest portion of the market, benefiting from high sales volumes and consumer demand for advanced features. Its market size is projected to be in the hundreds of billions of euros, with a steady CAGR in the high single digits. Competitive dynamics are intense, with a focus on offering premium and connected experiences.

Commercial Vehicles: This segment is showing promising growth, driven by the increasing need for fleet management tools, driver safety features, and productivity enhancements integrated into infotainment systems. Its market size is estimated to be in the billions of euros, with a projected CAGR in the mid-single digits. Innovation in this segment is focused on durability, efficiency, and integrated communication solutions.

Key Drivers of Europe Automotive Infotainment Systems Industry Growth

The Europe automotive infotainment systems industry is propelled by several key drivers. Technological advancements are paramount, with the continuous development of AI, advanced displays, and seamless connectivity solutions. The increasing consumer demand for sophisticated in-car experiences fuels the adoption of features like high-definition audio, immersive entertainment, and intuitive navigation. Stringent safety regulations in Europe often mandate the integration of advanced driver-assistance systems (ADAS) and driver monitoring features, which are intricately linked with infotainment systems. Furthermore, the growing electrification of vehicles is creating new opportunities for infotainment systems to manage charging, range, and energy consumption, thus acting as a central control hub. The proliferation of 5G connectivity is enabling faster data transmission, paving the way for real-time streaming and advanced cloud-based services within vehicles. These combined factors are creating a fertile ground for sustained market expansion, with an estimated market size of several hundred billion euros projected.

Challenges in the Europe Automotive Infotainment Systems Industry Sector

Despite the robust growth, the Europe automotive infotainment systems industry faces several challenges. Regulatory hurdles, particularly concerning data privacy (e.g., GDPR) and cybersecurity, require significant investment and compliance efforts from manufacturers, impacting product development timelines. Supply chain disruptions, as evidenced by recent global events, can lead to component shortages and increased production costs. High development costs associated with advanced technologies, such as AI integration and sophisticated display solutions, can strain the profitability of smaller players. Intense competition from both established automotive suppliers and technology giants necessitates continuous innovation and cost optimization. Furthermore, the fragmentation of consumer preferences across different demographics and regions adds complexity to product design and marketing strategies. The lifecycle of automotive technology, which is longer than consumer electronics, also presents challenges in keeping infotainment systems up-to-date with rapidly evolving digital trends.

Emerging Opportunities in Europe Automotive Infotainment Systems Industry

Emerging opportunities in the Europe automotive infotainment systems industry are abundant, driven by evolving consumer expectations and technological advancements. The integration of augmented reality (AR) and virtual reality (VR) for navigation, entertainment, and educational purposes presents a significant untapped market. The expansion of in-car e-commerce and payment solutions offers new revenue streams for manufacturers and service providers. The growing trend of personalized in-car experiences, leveraging AI to adapt system settings and content to individual user preferences, is a key area for differentiation. The increasing adoption of over-the-air (OTA) updates creates opportunities for continuous software enhancement and the introduction of new services post-purchase. Furthermore, the demand for enhanced driver monitoring systems and advanced safety features, often integrated with infotainment, is a growing segment. The development of next-generation connected services, facilitated by 5G and edge computing, will unlock new possibilities for real-time data exchange and sophisticated in-car applications. The estimated market size for these emerging opportunities is expected to contribute several tens of billions of euros to the overall market.

Leading Players in the Europe Automotive Infotainment Systems Industry Market

- Alpine Electronics Inc

- Denso Corporation

- Visteon Corporation

- Aisin Corporation

- Harman International

- Continental AG

- BorgWarner Inc

- JVCKENWOOD Corporation

- Robert Bosch GmbH

- Pioneer Corporation

- Panasonic Corporation

Key Developments in Europe Automotive Infotainment Systems Industry Industry

- August 2022: Continental announced the creation of an innovative display that allows vehicle information to be dynamically displayed in either a private or public mode. The so-called Switchable Privacy Display, a new display technology, lets front passengers use the infotainment system or multimedia content like videos without distracting the driver from the road. This development enhances passenger experience and driver safety simultaneously.

- February 2022: HARMAN, a wholly-owned subsidiary of Samsung Electronics Co. Ltd, announced two new acoustic innovations, Ready Together and Software Enabled Branded Audio, during the HARMAN EXPLORE 2022 event. Both innovations help to enhance in-vehicle communication and entertainment, focusing on improving audio quality and personalized sound experiences.

- January 2022: Robert Bosch GmbH developed a high-performance infotainment domain computing system. The system brings features like in-car communication, in-car payment, video streaming, voice assistants, and more to vehicles quickly. This advancement streamlines the integration of complex infotainment functionalities and accelerates time-to-market for new features.

Future Outlook for Europe Automotive Infotainment Systems Industry Market

The future outlook for the Europe automotive infotainment systems industry is exceptionally bright, poised for sustained growth and innovation. The ongoing digital transformation of the automotive sector, coupled with increasing consumer expectations for connected and personalized experiences, will continue to be the primary growth accelerators. We anticipate a significant rise in the integration of artificial intelligence, augmented reality, and advanced cybersecurity measures within infotainment systems. The transition towards electric and autonomous vehicles will further propel the demand for sophisticated, centralized infotainment hubs that manage a wide array of vehicle functions and passenger interactions. Strategic collaborations between automotive OEMs, Tier-1 suppliers, and technology companies will intensify, fostering a dynamic ecosystem for rapid development and market penetration. The market size is projected to expand significantly, reaching several hundred billion euros, driven by the introduction of novel functionalities and the increasing adoption of premium infotainment solutions across all vehicle segments. Opportunities in subscription-based services, personalized digital content, and seamless integration with smart home ecosystems will also shape the future landscape.

Europe Automotive Infotainment Systems Industry Segmentation

-

1. Installation Type

- 1.1. In-Dash Infotainment

- 1.2. Rear Seat Infotainment

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Europe Automotive Infotainment Systems Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Infotainment Systems Industry Regional Market Share

Geographic Coverage of Europe Automotive Infotainment Systems Industry

Europe Automotive Infotainment Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For ADAS features in Vehicles

- 3.3. Market Restrains

- 3.3.1. High Up-Front Cost And Maintenance Cost

- 3.4. Market Trends

- 3.4.1. In-Dash Infotainment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Infotainment Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Installation Type

- 5.1.1. In-Dash Infotainment

- 5.1.2. Rear Seat Infotainment

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Installation Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpine Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Visteon Corporatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aisin Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harman International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BorgWarner Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JVCKENWOOD Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pioneer Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Alpine Electronics Inc

List of Figures

- Figure 1: Europe Automotive Infotainment Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Infotainment Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Infotainment Systems Industry Revenue billion Forecast, by Installation Type 2020 & 2033

- Table 2: Europe Automotive Infotainment Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Europe Automotive Infotainment Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Automotive Infotainment Systems Industry Revenue billion Forecast, by Installation Type 2020 & 2033

- Table 5: Europe Automotive Infotainment Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Infotainment Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Automotive Infotainment Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Infotainment Systems Industry?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Europe Automotive Infotainment Systems Industry?

Key companies in the market include Alpine Electronics Inc, Denso Corporation, Visteon Corporatio, Aisin Corporation, Harman International, Continental AG, BorgWarner Inc, JVCKENWOOD Corporation, Robert Bosch GmbH, Pioneer Corporation, Panasonic Corporation.

3. What are the main segments of the Europe Automotive Infotainment Systems Industry?

The market segments include Installation Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For ADAS features in Vehicles.

6. What are the notable trends driving market growth?

In-Dash Infotainment is Dominating the Market.

7. Are there any restraints impacting market growth?

High Up-Front Cost And Maintenance Cost.

8. Can you provide examples of recent developments in the market?

In August2022, Continental announced the creation of a innovative display that allows vehicle information to be dynamically displayed in either a private or public mode.The so-called Switchable Privacy Display, a new display technology, lets front passengers use the infotainment system or multimedia content like videos without distracting the driver from the road.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Infotainment Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Infotainment Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Infotainment Systems Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Infotainment Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence