Key Insights

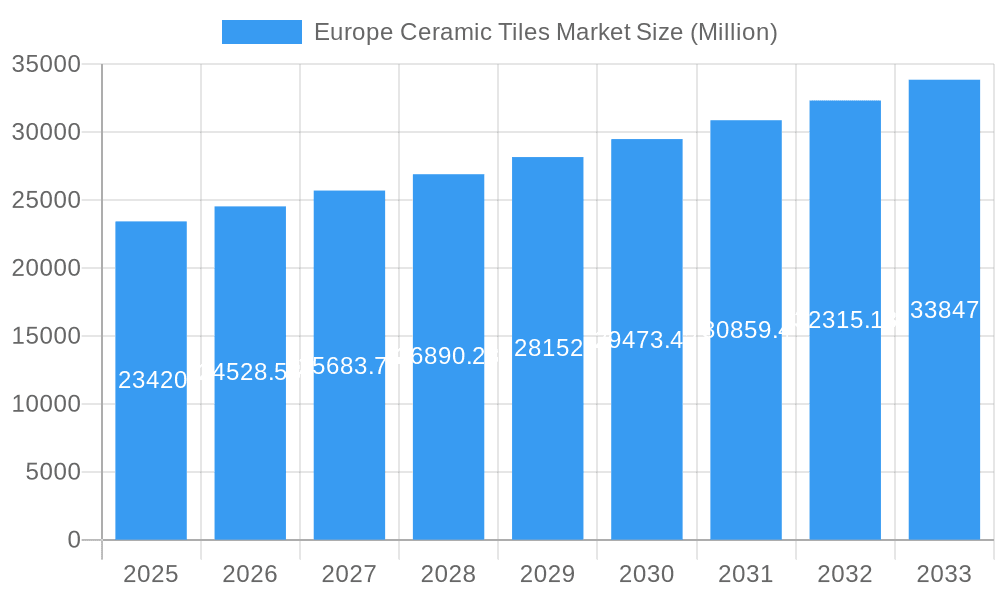

The European ceramic tile market, valued at €23.42 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.66% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the resurgence in construction activity across Europe, particularly in new residential and commercial projects, is significantly boosting demand. Renovation and replacement projects also contribute substantially, reflecting a growing preference for durable and aesthetically pleasing ceramic tiles. Secondly, evolving design trends are favoring larger format tiles, sophisticated patterns, and innovative surface finishes (like scratch-free options), prompting consumers and businesses to upgrade their spaces. The market is segmented by construction type (new construction, replacement & renovation), end-user type (residential, commercial), product type (glazed, porcelain, scratch-free, others), and application (floor tiles, wall tiles, other tiles). Germany, France, Italy, and the United Kingdom represent major market segments within Europe, benefiting from established construction sectors and high consumer spending on home improvement. However, increasing raw material costs and potential supply chain disruptions pose challenges to sustained growth, requiring manufacturers to implement cost-efficient strategies and explore sustainable sourcing options. Competition is fierce, with established players like Crossville Inc, RAK Ceramics, and Porcelanosa Group vying for market share alongside regional and emerging manufacturers.

Europe Ceramic Tiles Market Market Size (In Billion)

The projected growth trajectory suggests a significant increase in market value over the forecast period. The consistent demand from both residential and commercial sectors is expected to offset any potential headwinds. Further expansion is likely to be driven by technological advancements in tile manufacturing, leading to improved product quality, durability, and diverse design choices. Strategies focusing on eco-friendly manufacturing processes and sustainable product offerings are expected to gain traction, catering to the rising environmental consciousness amongst consumers and businesses. The continued expansion of the construction industry across major European economies, along with focused marketing and strategic partnerships, will be crucial for industry players to maintain their competitive edge and benefit from this promising growth opportunity.

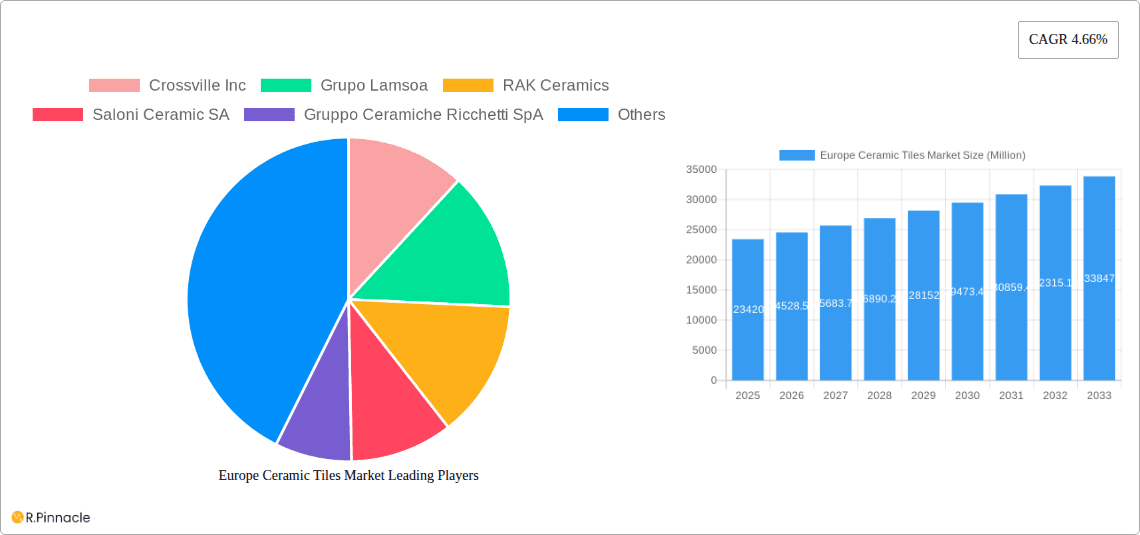

Europe Ceramic Tiles Market Company Market Share

Europe Ceramic Tiles Market: A Comprehensive Report 2019-2033

This in-depth report provides a comprehensive analysis of the Europe Ceramic Tiles Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report delves into market structure, dynamics, key players, and future trends. Expect detailed segmentation analysis across construction type, end-user, product type, and application, supported by robust data and actionable insights. The report projects a market value of xx Million by 2033, offering a detailed forecast to guide your strategic decisions.

Europe Ceramic Tiles Market Market Structure & Innovation Trends

This section provides a comprehensive analysis of the competitive landscape within the European ceramic tile market. We delve into market concentration, key innovation drivers, the influence of regulatory frameworks, and significant market activities. The impact of mergers and acquisitions (M&A) on market share dynamics is meticulously examined, identifying crucial deals and their strategic implications. Furthermore, we explore the interplay of factors influencing product substitution and the evolving characteristics of end-user demographics.

- Market Concentration: The European ceramic tile market is characterized by a moderately concentrated structure. Approximately 5-7 major players collectively command a significant market share, estimated to be around 60-70%. This indicates a landscape where established brands hold substantial influence, yet opportunities for niche players and strategic alliances persist.

- Innovation Drivers: Advancements in material science are at the forefront of innovation, with a strong focus on developing scratch-free and highly durable surfaces. Evolving design aesthetics, driven by architectural trends and consumer demand for sophisticated looks, are another critical driver. Furthermore, a growing emphasis on sustainable manufacturing processes and the development of eco-friendly tiles are significantly shaping product development. Technological breakthroughs enabling the production of larger format tiles and enhanced resistance to wear and tear are also key areas of focus.

- Regulatory Framework: European Union regulations pertaining to building materials, environmental protection, and safety standards exert a considerable influence on market dynamics. Manufacturers face stringent compliance requirements regarding material sourcing, production processes, and product performance. These evolving sustainability mandates and associated compliance costs necessitate continuous adaptation and investment in greener technologies, impacting operational strategies and product offerings.

- Product Substitutes: The ceramic tile market faces ongoing competition from alternative flooring and wall covering materials, including engineered wood, luxury vinyl tiles (LVT), natural stone, and composite materials. The report meticulously analyzes the competitive pressures exerted by these substitutes, evaluating their respective strengths, weaknesses, and evolving market penetration in various application segments.

- M&A Activity: Significant merger and acquisition activity has been a notable feature of the European ceramic tile market. Over the past three to five years, aggregate deal values are estimated to have reached upwards of €500 Million. These strategic acquisitions have demonstrably reshaped the competitive landscape, driven market consolidation, and facilitated market entry or expansion for key players. Notable examples include [Company A's acquisition of Company B in 2022, focusing on sustainable tile production] and [Company C's strategic partnership with a technology provider to enhance digital printing capabilities].

- End-User Demographics: Shifting demographics, particularly the ongoing trend of urbanization and the rise of multi-generational households in metropolitan areas, are significantly influencing demand patterns for specific tile types and designs. The report provides an in-depth analysis of how evolving lifestyles, an increasing preference for minimalist and natural aesthetics, and a growing awareness of hygiene and ease of maintenance are impacting market segmentation and product preferences.

Europe Ceramic Tiles Market Market Dynamics & Trends

This section undertakes a detailed exploration of the pivotal factors propelling market growth, the transformative impact of technological disruptions, the evolving landscape of consumer preferences, and the intricate competitive dynamics within the European ceramic tile market. We meticulously analyze historical growth trajectories and leverage robust forecasting models to project future market performance.

The European ceramic tile market is experiencing robust growth, driven by a confluence of economic, societal, and technological factors. A primary growth driver is the sustained demand from the residential construction and renovation sectors, fueled by rising disposable incomes, increasing homeownership rates, and a persistent trend towards home improvements. The commercial sector, particularly hospitality, retail, and office spaces, also contributes significantly, with ongoing development and refurbishment projects demanding durable and aesthetically pleasing surfacing solutions. Technologically, digital printing technology has revolutionized the industry, enabling manufacturers to produce an unprecedented array of designs, textures, and finishes with remarkable realism, mimicking natural materials like wood, stone, and concrete. This innovation allows for high levels of customization, catering to diverse architectural styles and individual preferences. Automation in manufacturing processes further enhances efficiency, reduces costs, and improves product consistency. Consumer preferences are increasingly leaning towards large-format tiles, which offer a seamless look and minimize grout lines, contributing to a more modern and sophisticated aesthetic. There is also a pronounced and growing demand for sustainable and eco-friendly tiles, made from recycled materials or produced using energy-efficient methods, reflecting a heightened environmental consciousness among consumers and regulatory bodies. Specific regional preferences also play a role; for instance, warmer, earthy tones are popular in Southern Europe, while cooler, contemporary designs are favored in Northern European markets. The competitive dynamics are characterized by intense price competition in the mass market segment, balanced by a growing emphasis on product differentiation through design, innovation, and sustainability in the premium segment. Companies are actively investing in R&D to develop advanced functionalities such as antimicrobial surfaces and enhanced slip resistance. Industry reports consistently indicate a positive growth outlook, with projections for a Compound Annual Growth Rate (CAGR) of 4.5-5.5% during the forecast period (2025-2033). This growth is primarily propelled by the aforementioned factors, alongside a steady increase in construction activities across the continent. The market penetration of porcelain tiles, renowned for their superior durability and aesthetic versatility, is projected to reach 70-75% by 2033, solidifying their position as the dominant product type.

Dominant Regions & Segments in Europe Ceramic Tiles Market

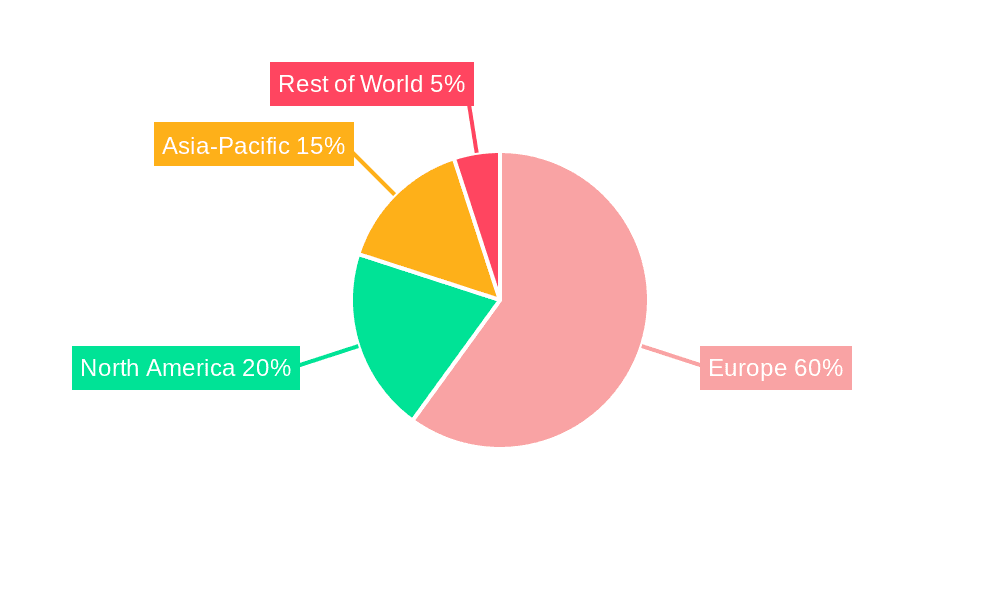

This section meticulously identifies the leading geographical regions, pivotal countries, and significant market segments within the dynamic European ceramic tile market. We conduct a detailed analysis of the underlying drivers of their dominance, taking into account prevailing economic conditions, ongoing infrastructure development, and specific consumer preferences.

Dominant Regions: Western Europe is projected to maintain its position as the dominant region in the European ceramic tile market. This dominance is underpinned by higher per capita disposable incomes, a well-established construction industry with continuous demand for both new builds and extensive renovation projects, and a strong consumer preference for high-quality, aesthetically pleasing interior finishes. Within this region, Italy and Spain stand out as not only major consuming markets but also as leading global producers and exporters of ceramic tiles, leveraging their long-standing expertise and design heritage. Germany represents a substantial market driven by its robust economy and significant investment in residential and commercial infrastructure. France also contributes significantly, with a strong demand for both contemporary and traditional tile designs. Emerging Eastern European economies are also showing promising growth potential, driven by rapid urbanization and infrastructure development.

Dominant Segments:

- By Construction Type: The replacement and renovation segment is anticipated to continue its dominance, driven by an aging building stock across Europe, a growing emphasis on modernizing existing homes, and the increasing popularity of DIY projects. While new construction remains a vital contributor, the renovation market offers a more consistent and substantial demand stream.

- By End-User Type: The residential segment is expected to hold a larger market share. This is largely attributable to the high volume of housing units across Europe and the consistent need for tiling in kitchens, bathrooms, and living areas. The commercial segment, encompassing hospitality, retail, healthcare, and office spaces, also presents significant opportunities, particularly in urban centers and for projects requiring high-performance and visually appealing surfaces.

- By Product Type: Porcelain tiles are predicted to dominate the market. Their exceptional durability, low water absorption, resistance to stains and scratches, and versatility in replicating the look of natural stone, wood, and concrete make them an ideal choice for a wide range of applications. Glazed ceramic tiles and other specialty tiles, such as those with antimicrobial properties or advanced surface textures, will also see steady growth.

- By Application: Floor tiles are projected to command the largest market share. This is largely driven by their extensive use in residential kitchens, bathrooms, living rooms, and commercial high-traffic areas, where durability and ease of maintenance are paramount. Wall tiles, while a significant segment, often follow flooring trends and are used to enhance aesthetic appeal and provide functional benefits in specific areas like backsplashes and shower enclosures.

Key Drivers:

- Residential Segment: Rising disposable incomes, increasing urbanization, growing demand for aesthetically pleasing interior designs, DIY renovation trends, and the desire for durable and low-maintenance flooring and wall solutions.

- Commercial Segment: Growth in the hospitality sector (hotels, restaurants), expansion of retail spaces, modernization of office environments, investments in healthcare facilities, and the demand for visually appealing and high-performance surfaces in public spaces.

- Dominant Regions (e.g., Western Europe): Strong economic performance, substantial government investment in infrastructure development and urban regeneration projects, high consumer spending power, and a well-established construction industry with a focus on quality and design innovation.

- Dominant Segments (e.g., Porcelain Tiles): Superior durability and longevity, resistance to water and stains, wide range of designs and finishes, suitability for both indoor and outdoor applications, and increasing adoption due to technological advancements in manufacturing.

Europe Ceramic Tiles Market Product Innovations

The European ceramic tile market is a vibrant hub of continuous product innovation, consistently driven by cutting-edge advancements in material science, evolving design aesthetics, and sophisticated manufacturing technologies. Recent breakthroughs include the development and widespread adoption of large-format tiles, offering expansive and seamless visual appeal. Significant progress has also been made in creating highly scratch-resistant and durable surfaces, enhancing the longevity and practicality of tiles in high-traffic areas. Furthermore, there is a pronounced shift towards incorporating sustainable materials and eco-friendly production processes, aligning with growing environmental consciousness. Manufacturers are increasingly leveraging digital printing technologies to achieve unparalleled customization, enabling the replication of intricate patterns, natural textures, and bespoke designs that cater to diverse architectural styles and niche market demands. The integration of advanced surface treatments and specialized finishes is enhancing tile performance by improving properties such as slip resistance, stain repellency, and antimicrobial characteristics, making them suitable for a broader spectrum of demanding applications. Consequently, the competitive edge in this market is increasingly defined by the ability to offer products that excel in superior performance, boast unique and trend-setting designs, and demonstrate a strong commitment to sustainability.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the European ceramic tiles market across several key segments:

- By Construction Type: New Construction and Replacement & Renovation. [Include growth projections and market size for each segment.]

- By End-User Type: Residential and Commercial. [Include growth projections and market size for each segment.]

- By Product Type: Glazed, Porcelain, Scratch Free, and Other Product Types. [Include growth projections and market size for each segment.]

- By Application: Floor Tiles, Wall Tiles, and Other Tiles. [Include growth projections and market size for each segment.]

[Add a brief paragraph describing the competitive dynamics within each segment.]

Key Drivers of Europe Ceramic Tiles Market Growth

The growth of the European ceramic tile market is propelled by several factors. Firstly, sustained growth in the construction sector, particularly in residential and commercial building projects, fuels significant demand for ceramic tiles. Secondly, increasing disposable incomes in several European countries have enabled homeowners to invest in home improvements, including tiling upgrades. Thirdly, innovative product developments, such as larger format tiles, improved durability, and sustainable options, are attracting consumers seeking high-quality and aesthetically pleasing tiles. Finally, supportive government policies and initiatives related to infrastructure development and building regulations contribute to market expansion.

Challenges in the Europe Ceramic Tiles Market Sector

The European ceramic tile market faces challenges, including fluctuating raw material costs, impacting production expenses and profitability. Furthermore, the intense competition from alternative flooring materials puts pressure on pricing and requires constant product innovation. Stringent environmental regulations concerning manufacturing processes and waste disposal can increase compliance costs for producers. Supply chain disruptions, as experienced in recent years, can significantly affect production and delivery timelines, impacting market stability. The overall impact of these challenges on the market's growth is estimated to be around xx%.

Emerging Opportunities in Europe Ceramic Tiles Market

Emerging opportunities include the growing demand for sustainable and eco-friendly tiles, aligning with increasing environmental consciousness. The adoption of digital printing technologies offers opportunities for personalized and customized tile designs, catering to specific architectural needs. Expansion into niche markets, such as specialized tiles for industrial applications or high-end residential projects, represents another significant avenue for growth. The rise of online retail channels opens new avenues for market penetration and customer engagement.

Leading Players in the Europe Ceramic Tiles Market Market

- Crossville Inc

- Grupo Lamsoa

- RAK Ceramics

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Porcelanosa Group

- NITCO

- Atlas Concorde S P A

- Johnson Tiles

- Mohawk Industries Inc

- Siam Cement Group

- Centura Tile Inc

- Blackstone Industrial (Foshan) Ltd

- China Ceramics Co Ltd

Key Developments in Europe Ceramic Tiles Market Industry

- February 2023: Atlas Concorde unveiled its comprehensive 2023 general catalog of ceramic tiles. This extensive release features a sophisticated product system designed to facilitate seamless coordination across diverse environments, offering an expansive array of stylish surfaces. This strategic launch significantly broadens design possibilities and enhances the product selection available to architects, designers, and end-users.

- March 2022: Johnson Tile, in collaboration with The Material Lab, participated in the Tile Trace Trend & Format Forum. This engagement provided crucial insights into the latest interior design trends and their practical translation into commercial tiling products. This initiative underscores Johnson Tile's commitment to understanding and adapting to evolving market demands and contemporary design aesthetics, demonstrating their responsiveness to industry shifts.

Future Outlook for Europe Ceramic Tiles Market Market

The future of the European ceramic tile market appears promising, driven by continued growth in the construction sector, innovative product developments, and changing consumer preferences. The increasing focus on sustainability and eco-friendly products will further drive market expansion. Companies that strategically invest in research and development, embrace digital technologies, and cater to evolving consumer needs are likely to gain a competitive edge. The market is expected to witness a period of sustained growth, presenting significant opportunities for industry players.

Europe Ceramic Tiles Market Segmentation

-

1. Product Type

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Product Types

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User Type

- 4.1. Residential

- 4.2. Commercial

Europe Ceramic Tiles Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Belgium

- 7. Poland

- 8. Rest of Europe

Europe Ceramic Tiles Market Regional Market Share

Geographic Coverage of Europe Ceramic Tiles Market

Europe Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Increasing Regulations and Tariffs

- 3.4. Market Trends

- 3.4.1. Italy is the Major Exporter of Ceramic Tiles in Europe Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. Germany

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Russia

- 5.5.6. Belgium

- 5.5.7. Poland

- 5.5.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Tiles

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement & Renovation

- 6.4. Market Analysis, Insights and Forecast - by End-User Type

- 6.4.1. Residential

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Tiles

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement & Renovation

- 7.4. Market Analysis, Insights and Forecast - by End-User Type

- 7.4.1. Residential

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Tiles

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement & Renovation

- 8.4. Market Analysis, Insights and Forecast - by End-User Type

- 8.4.1. Residential

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Tiles

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement & Renovation

- 9.4. Market Analysis, Insights and Forecast - by End-User Type

- 9.4.1. Residential

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Tiles

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement & Renovation

- 10.4. Market Analysis, Insights and Forecast - by End-User Type

- 10.4.1. Residential

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Belgium Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Glazed

- 11.1.2. Porcelain

- 11.1.3. Scratch Free

- 11.1.4. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Floor Tiles

- 11.2.2. Wall Tiles

- 11.2.3. Other Tiles

- 11.3. Market Analysis, Insights and Forecast - by Construction Type

- 11.3.1. New Construction

- 11.3.2. Replacement & Renovation

- 11.4. Market Analysis, Insights and Forecast - by End-User Type

- 11.4.1. Residential

- 11.4.2. Commercial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Poland Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Glazed

- 12.1.2. Porcelain

- 12.1.3. Scratch Free

- 12.1.4. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Floor Tiles

- 12.2.2. Wall Tiles

- 12.2.3. Other Tiles

- 12.3. Market Analysis, Insights and Forecast - by Construction Type

- 12.3.1. New Construction

- 12.3.2. Replacement & Renovation

- 12.4. Market Analysis, Insights and Forecast - by End-User Type

- 12.4.1. Residential

- 12.4.2. Commercial

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Europe Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Glazed

- 13.1.2. Porcelain

- 13.1.3. Scratch Free

- 13.1.4. Other Product Types

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Floor Tiles

- 13.2.2. Wall Tiles

- 13.2.3. Other Tiles

- 13.3. Market Analysis, Insights and Forecast - by Construction Type

- 13.3.1. New Construction

- 13.3.2. Replacement & Renovation

- 13.4. Market Analysis, Insights and Forecast - by End-User Type

- 13.4.1. Residential

- 13.4.2. Commercial

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Crossville Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Grupo Lamsoa

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 RAK Ceramics

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Saloni Ceramic SA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gruppo Ceramiche Ricchetti SpA

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Porcelanosa Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NITCO

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Atlas Concorde S P A

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Johnson Tiles

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mohawk Industries Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Siam Cement Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Centura Tile Inc **List Not Exhaustive

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Blackstone Industrial (Foshan) Ltd

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 China Ceramics Co Ltd

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Crossville Inc

List of Figures

- Figure 1: Europe Ceramic Tiles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 5: Europe Ceramic Tiles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 9: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 14: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 15: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 19: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 20: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 24: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 25: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 29: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 30: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 34: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 35: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 40: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 44: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 45: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ceramic Tiles Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Europe Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc **List Not Exhaustive, Blackstone Industrial (Foshan) Ltd, China Ceramics Co Ltd.

3. What are the main segments of the Europe Ceramic Tiles Market?

The market segments include Product Type, Application, Construction Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings.

6. What are the notable trends driving market growth?

Italy is the Major Exporter of Ceramic Tiles in Europe Region.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Increasing Regulations and Tariffs.

8. Can you provide examples of recent developments in the market?

February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, The Atlas Concorde product system and a stylish assortment of surfaces are both inside to help customers design finished coordinated environments. Large slabs, kitchen counters, tables, and accessories, as well as sinks and bathroom fixtures, are all design elements that can broaden the design options for any intended application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Europe Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence