Key Insights

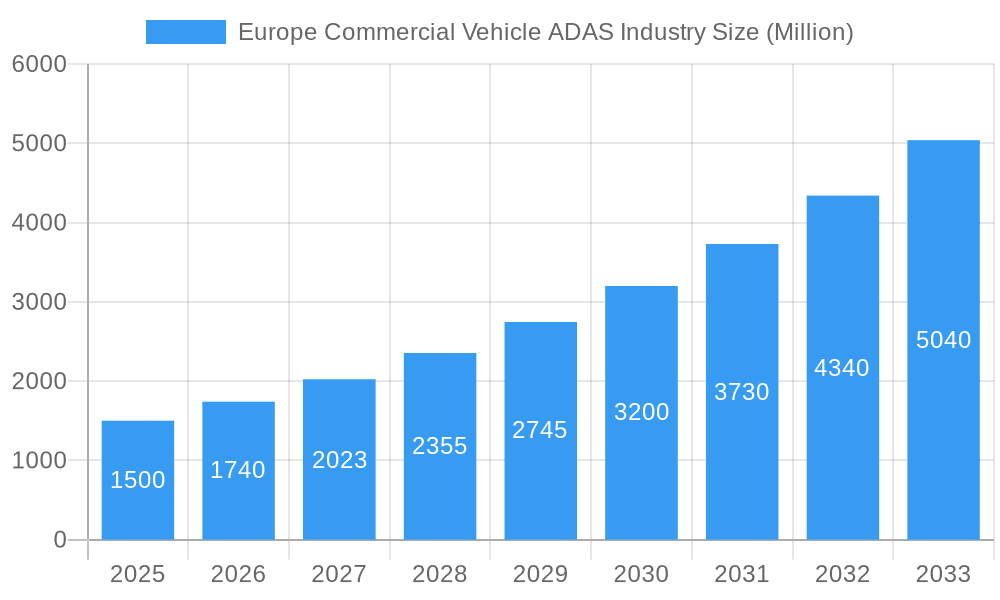

The European commercial vehicle Advanced Driver-Assistance Systems (ADAS) market is poised for significant expansion, propelled by stringent safety mandates, escalating demand for enhanced driver comfort and fuel efficiency, and the rapid integration of autonomous driving technologies. The market, valued at 4.2 billion in the base year 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2033, forecasting a market value exceeding 5 billion by 2033. Key growth catalysts include the compulsory adoption of ADAS features in new commercial vehicles across European nations and growing fleet operator awareness of safety improvements and operational cost reductions. The increasing proliferation of connected car technology and the advancement of sophisticated sensor fusion algorithms further bolster market momentum. While initial ADAS integration costs present a challenge, the long-term benefits, including reduced accident rates, improved fuel economy, and enhanced driver productivity, significantly outweigh these upfront investments. The market is segmented by system type (e.g., parking assist, adaptive lighting, night vision), underlying technologies (radar, LiDAR, camera), and vehicle categories (trucks, buses, vans). Germany, France, and the UK are leading the market, supported by strong automotive manufacturing sectors and supportive government policies.

Europe Commercial Vehicle ADAS Industry Market Size (In Billion)

The competitive arena is dominated by global leaders such as Bosch, Autoliv, Harman, Delphi, Continental, and Hyundai Mobis, who are actively engaged in innovation to refine ADAS functionalities and lower production costs. Future market growth will be contingent upon advancements in artificial intelligence, the development of superior sensor technologies, and the standardization of ADAS communication protocols. Enhanced collaboration between ADAS manufacturers and commercial vehicle OEMs is essential for seamless integration into new and existing fleets. The growing demand for automated driving features in long-haul trucking and public transportation is expected to further stimulate market growth. However, potential challenges such as the imperative for robust cybersecurity measures and ongoing discussions surrounding liability in automated driving functions must be addressed to ensure sustained growth.

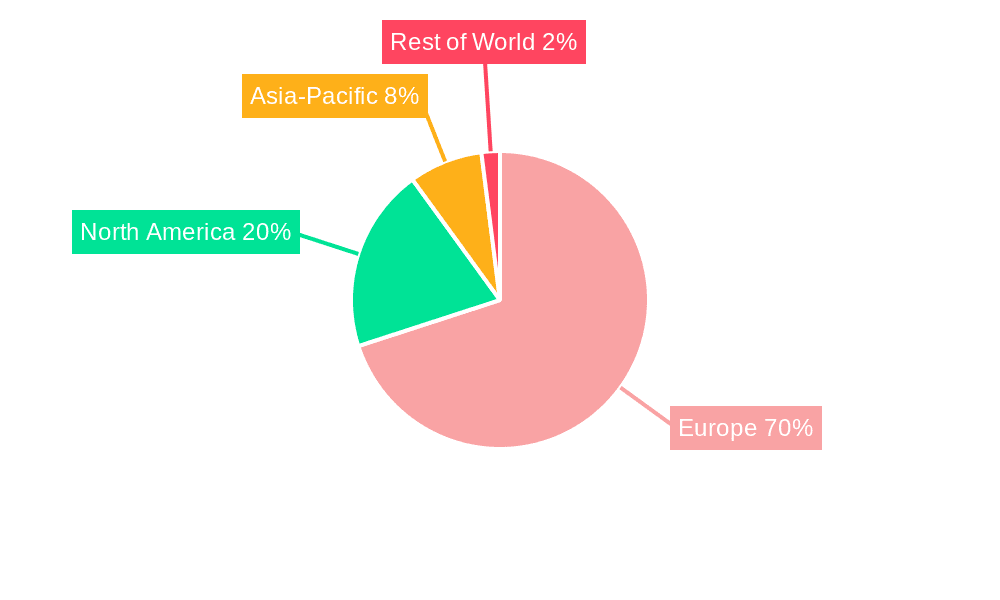

Europe Commercial Vehicle ADAS Industry Company Market Share

Europe Commercial Vehicle ADAS Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Commercial Vehicle Advanced Driver-Assistance Systems (ADAS) market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report illuminates market structure, dynamics, key players, and future growth potential. The report leverages extensive data analysis and expert insights to provide actionable intelligence for navigating this rapidly evolving sector.

Europe Commercial Vehicle ADAS Industry Market Structure & Innovation Trends

The European Commercial Vehicle ADAS market exhibits a moderately concentrated structure, with key players like Bosch Group, Continental AG, Autoliv AB, and others holding significant market share. The exact market share distribution is dynamic and subject to ongoing M&A activities and product innovation. The estimated market size in 2025 is approximately xx Million. Innovation is driven by stringent safety regulations, increasing demand for fuel efficiency, and the continuous advancement of sensor technology.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation Drivers: Stringent EU safety regulations, fuel efficiency mandates, and technological advancements in sensor technology (Radar, LiDAR, Camera).

- Regulatory Frameworks: EU regulations play a crucial role, mandating ADAS features in new commercial vehicles.

- Product Substitutes: Limited direct substitutes, with competition primarily focused on feature differentiation and performance.

- End-User Demographics: Predominantly large fleet operators, logistics companies, and individual businesses operating commercial vehicles.

- M&A Activities: Significant M&A activity observed in recent years, with deal values exceeding xx Million in aggregate from 2019-2024. Examples include the January 2022 partnership between Bosch and Cariad.

Europe Commercial Vehicle ADAS Industry Market Dynamics & Trends

The European Commercial Vehicle ADAS market is experiencing robust growth, driven by several key factors. The market is expected to register a CAGR of xx% during the forecast period (2025-2033). Increasing adoption of ADAS features among fleet operators to enhance safety and reduce operational costs is a major growth driver. Technological advancements, particularly in sensor fusion and artificial intelligence, are further accelerating market expansion. Consumer preference is shifting towards vehicles equipped with advanced safety features. Competitive dynamics are characterized by intense R&D investments and strategic partnerships. Market penetration of ADAS in commercial vehicles is estimated at xx% in 2025, projected to reach xx% by 2033.

Dominant Regions & Segments in Europe Commercial Vehicle ADAS Industry

Germany, France, and the UK are the leading regional markets for commercial vehicle ADAS in Europe. This dominance is attributed to strong automotive manufacturing bases, well-developed infrastructure, and higher consumer purchasing power. Within segments:

- By Type: Blind Spot Detection and Lane Departure Warning systems hold the largest market share, driven by their crucial role in enhancing road safety.

- By Technology: Radar technology currently dominates due to its cost-effectiveness and reliability; however, LiDAR is gaining traction due to its superior performance in complex environments.

- By Vehicle Type: The commercial vehicle segment is a key growth area, propelled by increasing fleet sizes and stringent safety regulations.

Key Drivers:

- Strong Automotive Industry: Established automotive manufacturing hubs drive demand.

- Favorable Government Policies: Supportive regulatory frameworks and incentives for ADAS adoption.

- Developed Infrastructure: Efficient logistics networks and transportation systems facilitate widespread adoption.

Europe Commercial Vehicle ADAS Industry Product Innovations

Recent product innovations focus on improving sensor fusion, enhancing object recognition capabilities, and integrating ADAS features with connected car technologies. The development of more sophisticated algorithms and machine learning techniques are crucial to advancing system accuracy and reliability. This leads to improved safety, fuel efficiency, and driver comfort, thereby increasing market fit and competitive advantage.

Report Scope & Segmentation Analysis

This report segments the European Commercial Vehicle ADAS market by:

- Type: Parking Assist System, Adaptive Front-lighting, Night Vision System, Blind Spot Detection, Lane Departure Warning, Other Types. Each segment shows varying growth rates based on specific technology advancements and regulatory mandates.

- Technology: Radar, LiDAR, Camera. Technological advancements are driving market expansion, with market share dynamics changing rapidly.

- Vehicle Type: Passenger Cars and Commercial Vehicle. The commercial vehicle segment is a major area of focus due to its growth potential. Growth projections for each segment vary depending on several factors.

Key Drivers of Europe Commercial Vehicle ADAS Industry Growth

The European Commercial Vehicle ADAS market is driven by:

- Stringent Safety Regulations: EU regulations are pushing for enhanced safety features.

- Technological Advancements: Continuous improvements in sensor technology and AI algorithms.

- Fuel Efficiency Demands: ADAS features contribute to improved fuel economy.

Challenges in the Europe Commercial Vehicle ADAS Industry Sector

Challenges include:

- High Initial Investment Costs: Implementing ADAS can be expensive for fleet operators.

- Data Security Concerns: Protecting sensitive vehicle data is critical.

- Supply Chain Disruptions: Global supply chain issues can impact production.

Emerging Opportunities in Europe Commercial Vehicle ADAS Industry

Opportunities lie in:

- Autonomous Driving Technologies: Integration of ADAS with autonomous driving systems.

- Advanced Sensor Fusion: Combining data from multiple sensors to enhance performance.

- Expansion into Emerging Markets: Growing adoption in Eastern European countries.

Leading Players in the Europe Commercial Vehicle ADAS Industry Market

Key Developments in Europe Commercial Vehicle ADAS Industry Industry

- April 2023: Continental and HERE Technologies partnered with IVECO to integrate intelligent speed assistance and fuel-saving functions in commercial vehicles.

- January 2022: Bosch and Cariad (Volkswagen subsidiary) partnered to develop technology for automated vehicles and advanced driver-aid systems.

Future Outlook for Europe Commercial Vehicle ADAS Industry Market

The future outlook for the European Commercial Vehicle ADAS market is positive, driven by continuous technological advancements, stricter safety regulations, and the increasing demand for fuel-efficient vehicles. Strategic partnerships and mergers & acquisitions will continue to shape the market landscape, leading to further consolidation and innovation. The market is poised for significant growth in the coming years, offering attractive opportunities for companies operating in this sector.

Europe Commercial Vehicle ADAS Industry Segmentation

-

1. Type

- 1.1. Parking Assist System

- 1.2. Adaptive Front-lighting

- 1.3. Night Vision System

- 1.4. Blind Spot Detection

- 1.5. Lane Departure Warning

- 1.6. Other Types

-

2. Technology

- 2.1. Radar

- 2.2. Li-Dar

- 2.3. Camera

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicle

Europe Commercial Vehicle ADAS Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Italy

- 4. France

- 5. Rest of Europe

Europe Commercial Vehicle ADAS Industry Regional Market Share

Geographic Coverage of Europe Commercial Vehicle ADAS Industry

Europe Commercial Vehicle ADAS Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For ADAS features in Vehicles

- 3.3. Market Restrains

- 3.3.1. High Up-Front Cost And Maintenance Cost

- 3.4. Market Trends

- 3.4.1. Growing Demand For ADAS Features in Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Parking Assist System

- 5.1.2. Adaptive Front-lighting

- 5.1.3. Night Vision System

- 5.1.4. Blind Spot Detection

- 5.1.5. Lane Departure Warning

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Radar

- 5.2.2. Li-Dar

- 5.2.3. Camera

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. France

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Parking Assist System

- 6.1.2. Adaptive Front-lighting

- 6.1.3. Night Vision System

- 6.1.4. Blind Spot Detection

- 6.1.5. Lane Departure Warning

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Radar

- 6.2.2. Li-Dar

- 6.2.3. Camera

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Parking Assist System

- 7.1.2. Adaptive Front-lighting

- 7.1.3. Night Vision System

- 7.1.4. Blind Spot Detection

- 7.1.5. Lane Departure Warning

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Radar

- 7.2.2. Li-Dar

- 7.2.3. Camera

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Italy Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Parking Assist System

- 8.1.2. Adaptive Front-lighting

- 8.1.3. Night Vision System

- 8.1.4. Blind Spot Detection

- 8.1.5. Lane Departure Warning

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Radar

- 8.2.2. Li-Dar

- 8.2.3. Camera

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Parking Assist System

- 9.1.2. Adaptive Front-lighting

- 9.1.3. Night Vision System

- 9.1.4. Blind Spot Detection

- 9.1.5. Lane Departure Warning

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Radar

- 9.2.2. Li-Dar

- 9.2.3. Camera

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Commercial Vehicle ADAS Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Parking Assist System

- 10.1.2. Adaptive Front-lighting

- 10.1.3. Night Vision System

- 10.1.4. Blind Spot Detection

- 10.1.5. Lane Departure Warning

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Radar

- 10.2.2. Li-Dar

- 10.2.3. Camera

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bosch Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Autoliv AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Harman International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Delphi Automotive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Continental AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hyundai Mobi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hella KGaA Hueck & Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Panasonic Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Bosch Group

List of Figures

- Figure 1: Europe Commercial Vehicle ADAS Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Commercial Vehicle ADAS Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 15: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 16: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 20: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 23: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Europe Commercial Vehicle ADAS Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Commercial Vehicle ADAS Industry?

The projected CAGR is approximately 18%.

2. Which companies are prominent players in the Europe Commercial Vehicle ADAS Industry?

Key companies in the market include Bosch Group, Autoliv AB, Harman International, Delphi Automotive, Continental AG, Hyundai Mobi, Hella KGaA Hueck & Co, Panasonic Corporatio.

3. What are the main segments of the Europe Commercial Vehicle ADAS Industry?

The market segments include Type, Technology, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For ADAS features in Vehicles.

6. What are the notable trends driving market growth?

Growing Demand For ADAS Features in Vehicles.

7. Are there any restraints impacting market growth?

High Up-Front Cost And Maintenance Cost.

8. Can you provide examples of recent developments in the market?

April 2023: Continental and HERE Technologies announced a partnership with IVECO to offer intelligent speed assistance (ISA) and fuel-saving functions for its commercial vehicles segment across Europe. Through this collaboration, starting in 2023, IVECO's heavy-duty, medium-duty, buses, and light-duty vehicles intended for the European Union (EU) market will integrate HERE maps specifically tailored for advanced driver assistance systems (ADAS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Commercial Vehicle ADAS Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Commercial Vehicle ADAS Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Commercial Vehicle ADAS Industry?

To stay informed about further developments, trends, and reports in the Europe Commercial Vehicle ADAS Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence