Key Insights

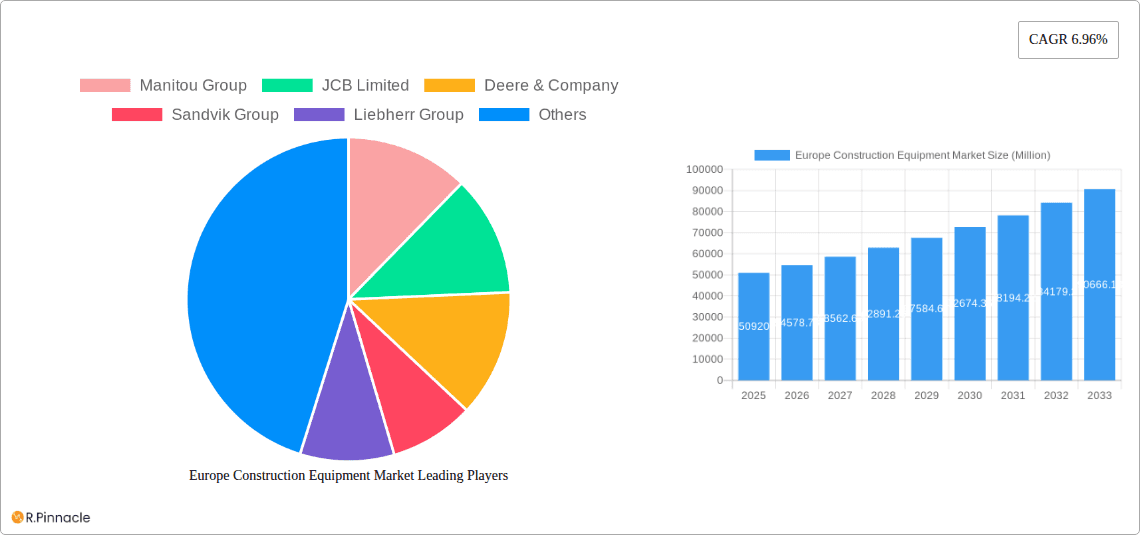

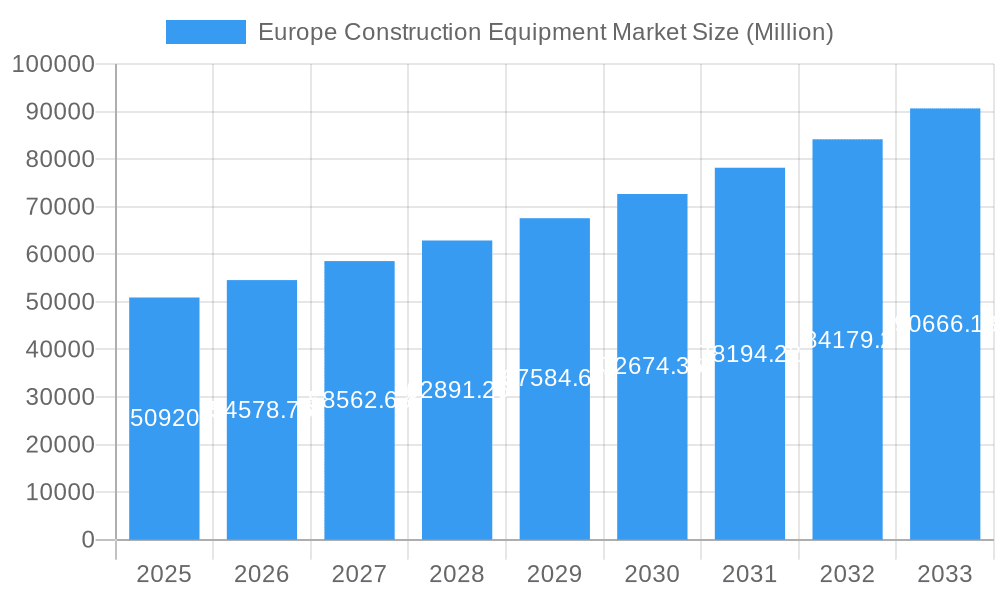

The European construction equipment market, valued at €50.92 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.96% from 2025 to 2033. This expansion is fueled by several key factors. Significant infrastructure development projects across major European nations, particularly in Germany, the United Kingdom, and France, are stimulating demand for construction machinery. Furthermore, the increasing adoption of technologically advanced equipment, such as electric and hybrid models, is contributing to market growth. These environmentally friendly options are gaining traction due to stricter emission regulations and a growing focus on sustainability within the construction sector. While the market faces potential restraints like fluctuations in raw material prices and economic uncertainties, the overall positive outlook is reinforced by ongoing investments in housing and commercial construction, coupled with government initiatives promoting infrastructure modernization across the region. The market segmentation reveals strong performance across various machinery types, with cranes, excavators, and loaders consistently driving demand. The shift towards electric and hybrid drive types is a notable trend, representing a significant opportunity for manufacturers to capitalize on evolving environmental concerns and technological advancements. Competition among leading players like Manitou Group, JCB Limited, and Caterpillar Inc. remains intense, further fostering innovation and driving market growth.

Europe Construction Equipment Market Market Size (In Billion)

The regional distribution of the market highlights Germany, the United Kingdom, and France as key contributors to the overall market size. However, other European countries are also witnessing substantial growth, albeit at varying paces. The continued growth is expected to be driven by a combination of factors, including sustained investment in infrastructure projects funded by both public and private entities, the ongoing recovery from the economic challenges of recent years, and an increasing emphasis on efficient and sustainable construction practices. The consistent development of new technologies within the construction equipment industry, such as improved automation and remote operation capabilities, is further enhancing productivity and reducing operational costs, which will continue to propel market expansion in the years to come. While economic headwinds and geopolitical uncertainties present some challenges, the fundamental drivers of growth remain strong, indicating a positive trajectory for the European construction equipment market throughout the forecast period.

Europe Construction Equipment Market Company Market Share

Europe Construction Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Construction Equipment Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, identifies key players, and forecasts future growth potential. The study uses 2025 as the base year and projects the market's trajectory until 2033.

Europe Construction Equipment Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting innovation drivers, regulatory influences, and market dynamics. The report examines market concentration, revealing the market share held by key players such as Manitou Group, JCB Limited, Deere & Company, Sandvik Group, Liebherr Group, Hitachi Construction Machinery Co Ltd, Volvo Construction Equipment, Caterpillar Inc, CNH Industrial NV, and Atlas Copco Group. The analysis includes an assessment of M&A activities within the sector, detailing deal values (xx Million) and their impact on market share distribution. The report further examines the influence of regulatory frameworks, the presence of substitute products, and evolving end-user demographics on market structure.

- Market Concentration: The market is characterized by [Describe Market Concentration - e.g., high concentration with a few dominant players, fragmented market, etc.]. xx% of the market is held by the top 5 players.

- Innovation Drivers: [List key innovation drivers - e.g., automation, digitalization, sustainable technologies].

- M&A Activity: [Summarize M&A activity with examples and impact on market share, e.g., "The acquisition of X by Y in 2022 resulted in a xx% increase in Y's market share."]

- Regulatory Frameworks: [Discuss key regulations and their influence on market dynamics].

Europe Construction Equipment Market Dynamics & Trends

This section delves into the driving forces shaping market growth, examining technological advancements, consumer preferences, and competitive dynamics. The report details the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) and provides insights into market penetration rates for key segments. Factors influencing market growth include [Discuss market drivers, e.g., infrastructure development, urbanization, government investment in construction projects]. Technological disruptions, such as the increasing adoption of electric and hybrid machinery, are analyzed in terms of their impact on market share and growth projections. Competitive dynamics are assessed through an examination of pricing strategies, product differentiation, and marketing initiatives.

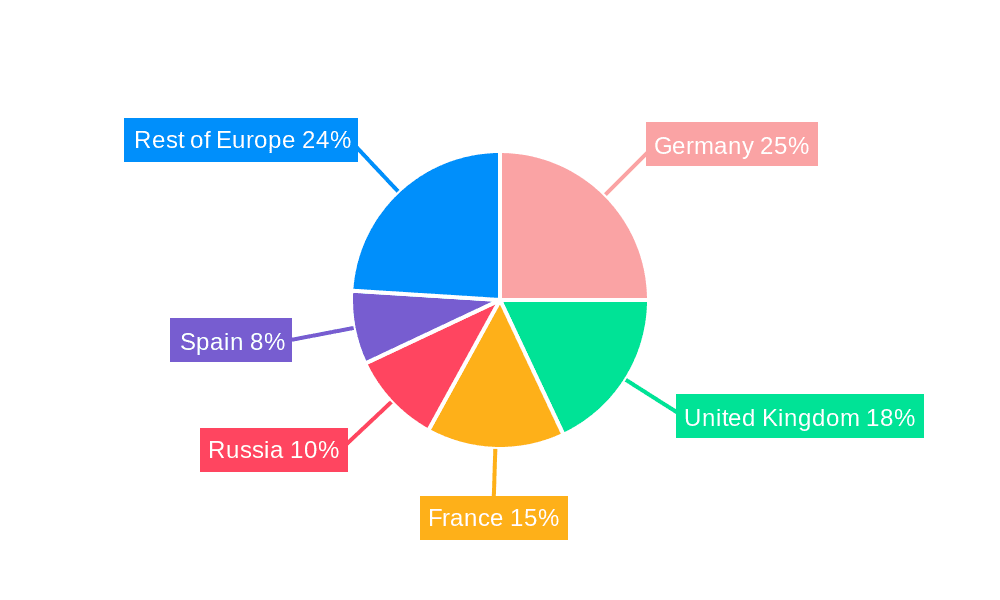

Dominant Regions & Segments in Europe Construction Equipment Market

This section provides a comprehensive overview of the leading regions and significant segments shaping the European construction equipment market. A detailed analysis is presented for key geographical markets including Germany, the United Kingdom, France, Russia, Spain, and the collective "Rest of Europe." Furthermore, the market is segmented by crucial machinery types such as Cranes, Telescopic Handling, Excavators, Loaders and Backhoe, Motor Graders, and Other Machinery Types, alongside an examination of prevailing drive types: IC Engine and Electric and Hybrid.

By Country:

- Germany: Germany stands as a powerhouse in the European construction equipment market, driven by its robust economy, significant investment in large-scale infrastructure projects like high-speed rail and renewable energy installations, and a strong manufacturing base for construction machinery. The nation's emphasis on modernization and sustainable building practices further bolsters demand.

- United Kingdom: The UK market is characterized by substantial government initiatives focused on infrastructure upgrades, including transport networks and housing developments. A growing emphasis on urban regeneration projects and the adoption of advanced construction technologies are key drivers for equipment demand.

- France: France exhibits a dynamic construction equipment market, propelled by ongoing urban development, extensive public infrastructure investments such as the Grand Paris Express project, and a consistent demand for modernizing existing facilities. The country's commitment to green building standards also influences equipment choices.

- Russia: The Russian construction equipment market is influenced by large-scale energy and infrastructure projects, particularly in its vast geographical expanse. Economic conditions and geopolitical factors play a significant role in market dynamics, with a notable demand for heavy-duty equipment.

- Spain: Spain's market is experiencing a resurgence driven by tourism-related construction, urban renewal initiatives, and a renewed focus on infrastructure projects. The demand for efficient and versatile construction machinery is on the rise.

- Rest of Europe: This collective segment encompasses a diverse range of markets, including Italy, Poland, and the Nordic countries, each contributing to the overall European demand. Emerging economies within this region are showing significant growth potential due to increasing urbanization and infrastructure development.

By Machinery Type:

- Excavator: Excavators are a cornerstone of the European construction equipment market, dominating in terms of sales volume and market share. Their versatility across various applications, from excavation and demolition to material handling and road construction, makes them indispensable. Key drivers include ongoing urban development, infrastructure renewal, and the demand for precise and efficient earthmoving solutions.

- Other Segments: The broader "Other Segments" category encompasses a wide array of essential construction machinery. Cranes are vital for high-rise construction and infrastructure projects. Telescopic handlers are indispensable for material lifting and placement on challenging terrains. Loaders and backhoes offer dual functionality for excavation and loading. Motor graders are crucial for road construction and maintenance. The collective demand for these specialized and multi-functional machines remains robust, driven by diverse project needs.

By Drive Type:

- IC Engine: Internal Combustion (IC) Engine-powered construction equipment continues to hold a significant market share due to its established performance, robust power output, and extensive refueling infrastructure. While facing increasing competition from alternative technologies, IC engines remain the preferred choice for many heavy-duty applications and remote sites where charging infrastructure is limited.

- Electric and Hybrid: The segment for Electric and Hybrid construction equipment is experiencing rapid growth, fueled by increasing environmental consciousness, stringent emission regulations, and technological advancements. These machines offer reduced operating costs, lower noise pollution, and a smaller carbon footprint, making them increasingly attractive for urban projects and eco-friendly construction initiatives.

Europe Construction Equipment Market Product Innovations

This section highlights recent product developments, focusing on technological advancements and their market impact. The analysis emphasizes the competitive advantages offered by innovative products and their alignment with evolving customer needs. [Paragraph summarizing key product innovations, e.g., autonomous machinery, improved fuel efficiency, enhanced safety features].

Report Scope & Segmentation Analysis

This report meticulously segments the Europe Construction Equipment Market to provide granular insights into its intricate dynamics. The analysis covers segmentation by machinery type, drive type, and country. For each segment, the report offers detailed market size estimations, future growth projections, and an in-depth analysis of competitive landscapes and key players.

- By Machinery Type: This segment details the market share, growth trajectory, and specific applications for Excavators, Cranes, Telescopic Handlers, Loaders and Backhoes, Motor Graders, and Other Construction Machinery. Focus is placed on evolving demand patterns and technological innovations within each category.

- By Drive Type: This segmentation analyzes the market dominance and future prospects of IC Engine-driven equipment versus the rapidly expanding Electric and Hybrid segments. It examines the factors influencing the transition towards electrification and the market penetration of advanced power solutions.

- By Country: A comprehensive country-wise breakdown provides market size, growth rates, and key market influencers for Germany, the United Kingdom, France, Russia, Spain, and the Rest of Europe. This analysis highlights regional specificities and economic drivers impacting equipment demand.

Key Drivers of Europe Construction Equipment Market Growth

The sustained growth of the European construction equipment market is propelled by a multifaceted interplay of driving forces. Significant governmental investments in ambitious infrastructure development projects, encompassing transportation networks, renewable energy facilities, and urban regeneration, are a primary catalyst. Escalating urbanization continues to fuel the demand for new residential, commercial, and industrial constructions. Technological advancements are at the forefront, with manufacturers introducing equipment that offers enhanced efficiency, superior productivity, increased safety features, and improved operational intelligence through digitalization and automation. Furthermore, supportive economic policies, including stimulus packages and favorable tax incentives, coupled with evolving regulatory frameworks that encourage sustainable and efficient construction practices, are collectively contributing to a robust and optimistic market outlook.

Challenges in the Europe Construction Equipment Market Sector

The European construction equipment market navigates several significant challenges that can impact its growth trajectory. Fluctuations in the prices of raw materials, such as steel and rare earth minerals, directly affect manufacturing costs and profitability. Persistent global supply chain disruptions can lead to production delays, increased lead times, and elevated logistics expenses. Stringent environmental regulations and emissions standards necessitate substantial investments in research and development for cleaner technologies and alternative powertrains, adding to the cost of compliance. The market is also characterized by intense competition among well-established global manufacturers and the emergence of new, agile players, which exerts considerable pressure on profit margins. The collective impact of these challenges is estimated to moderate market growth by approximately 8-12% over the next five years, underscoring the need for strategic adaptation and innovation.

Emerging Opportunities in Europe Construction Equipment Market

The European construction equipment market is ripe with emerging opportunities that promise substantial growth and innovation. The burgeoning demand for sustainable and environmentally friendly construction equipment, including battery-powered machinery and those utilizing alternative fuels, presents a significant avenue for expansion. The increasing adoption of digital technologies and automation, such as IoT-enabled equipment, AI-driven analytics, and robotic systems, offers enhanced efficiency, predictive maintenance capabilities, and improved safety on construction sites. Furthermore, the untapped potential within niche markets that require specialized construction equipment, such as demolition, tunneling, and modular construction, provides opportunities for targeted product development and market penetration.

Leading Players in the Europe Construction Equipment Market Market

- Manitou Group

- JCB Limited

- Deere & Company

- Sandvik Group

- Liebherr Group

- Hitachi Construction Machinery Co Ltd

- Volvo Construction Equipment

- Caterpillar Inc

- CNH Industrial NV

- Atlas Copco Group

Key Developments in Europe Construction Equipment Market Industry

- [List key developments with dates, e.g., "January 2023: Caterpillar launched its new electric excavator model."]

- [List key developments with dates, e.g., "June 2022: Merger between X and Y companies."]

Future Outlook for Europe Construction Equipment Market Market

The European construction equipment market is poised for sustained growth over the forecast period, driven by ongoing infrastructure projects, urbanization trends, and technological advancements. Strategic investments in research and development, focusing on sustainable and technologically advanced equipment, will be crucial for securing a competitive edge. The market is expected to experience a CAGR of xx% during 2025-2033, reaching a value of xx Million by 2033.

Europe Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Telescopic Handling

- 1.3. Excavators

- 1.4. Loaders and Backhoe

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric and Hybrid

Europe Construction Equipment Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Construction Equipment Market Regional Market Share

Geographic Coverage of Europe Construction Equipment Market

Europe Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments in Infrastructure Deployment

- 3.3. Market Restrains

- 3.3.1. Rapid Expansion of Construction Equipment Rental Services Across the Region

- 3.4. Market Trends

- 3.4.1. The Electric Drive Type is Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Telescopic Handling

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoe

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric and Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manitou Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JCB Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sandvik Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Construction Machinery Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo Construction Equipment

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Caterpillar Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNH Industrial NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atlas Copco Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Manitou Group

List of Figures

- Figure 1: Europe Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Europe Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Europe Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 5: Europe Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Europe Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Construction Equipment Market?

The projected CAGR is approximately 6.96%.

2. Which companies are prominent players in the Europe Construction Equipment Market?

Key companies in the market include Manitou Group, JCB Limited, Deere & Company, Sandvik Group, Liebherr Group, Hitachi Construction Machinery Co Ltd, Volvo Construction Equipment, Caterpillar Inc, CNH Industrial NV, Atlas Copco Group.

3. What are the main segments of the Europe Construction Equipment Market?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments in Infrastructure Deployment.

6. What are the notable trends driving market growth?

The Electric Drive Type is Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Rapid Expansion of Construction Equipment Rental Services Across the Region.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Europe Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence