Key Insights

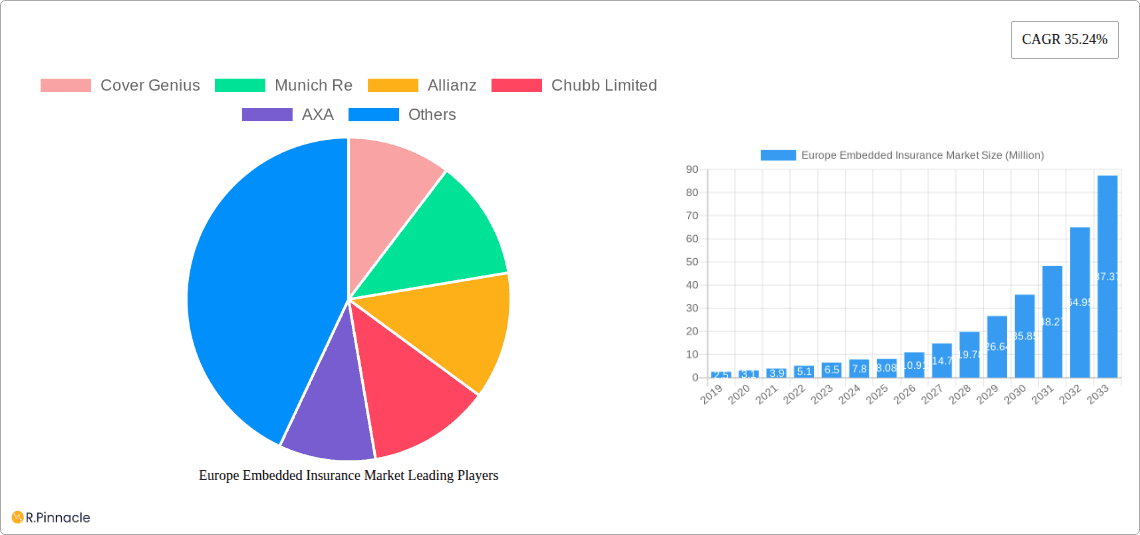

The European Embedded Insurance market is poised for remarkable expansion, projected to reach 8.08 Million in value by 2025, with a CAGR of 35.24% anticipated over the forecast period. This robust growth is primarily fueled by the increasing integration of insurance products seamlessly into the customer journey across various touchpoints. Key drivers include the growing consumer demand for convenient and contextually relevant insurance solutions, particularly within the burgeoning e-commerce landscape. As businesses across sectors like electronics, furniture, and travel increasingly adopt embedded insurance models, they are simplifying the purchasing process for consumers, leading to higher adoption rates and market penetration. Furthermore, advancements in digital platforms and APIs are enabling insurers to offer more personalized and flexible products, enhancing customer experience and driving market momentum. The 'Other Insurance Lines' segment is expected to witness significant traction as innovative insurance solutions emerge for niche markets.

Europe Embedded Insurance Market Market Size (In Million)

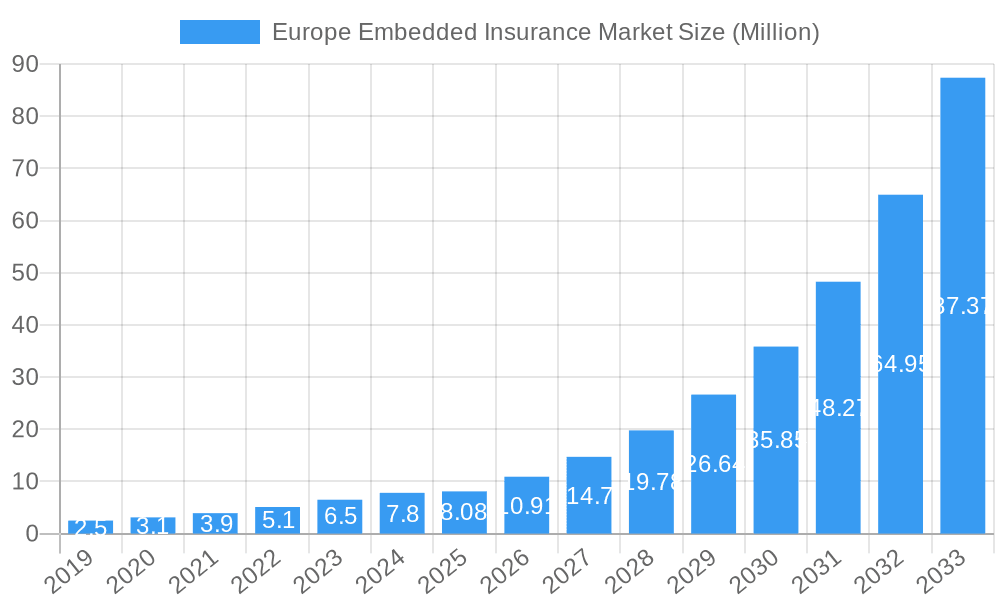

The market's trajectory is further supported by the clear shift towards online distribution channels, which offer scalability and cost-effectiveness for insurers. While offline channels retain a presence, the digital-first approach is paramount for capturing new customer segments and expanding market reach. However, the market is not without its challenges. Regulatory complexities and the need for robust data privacy measures can present hurdles, alongside the inherent inertia in consumer behavior towards adopting new insurance models. Despite these restraints, the overwhelming trend towards convenience, digital integration, and personalized offerings, coupled with the strategic expansion efforts of leading companies such as Cover Genius, Munich Re, Allianz, and Chubb Limited, is set to propel the European Embedded Insurance market to unprecedented heights. The forecast period of 2025-2033 is thus set to be a transformative era for embedded insurance in Europe, fundamentally reshaping how consumers access and perceive insurance.

Europe Embedded Insurance Market Company Market Share

This comprehensive market research report offers an in-depth analysis of the Europe Embedded Insurance Market, providing critical insights and actionable intelligence for industry stakeholders. Covering the historical period of 2019–2024, a base year of 2025, and a robust forecast period of 2025–2033, this report is an indispensable resource for understanding current trends, market dynamics, and future opportunities. With a focus on embedded insurance solutions, B2B insurance partnerships, and embedded protection for consumers, this study delves into the evolving landscape of insurance distribution across Europe.

Europe Embedded Insurance Market Market Structure & Innovation Trends

The Europe Embedded Insurance Market is characterized by a moderately concentrated structure, with a blend of established insurance giants and agile insurtech startups vying for market share. Innovation is primarily driven by the increasing demand for seamless, integrated insurance offerings at the point of sale, facilitated by advancements in digital technologies. Regulatory frameworks are evolving to accommodate these new distribution models, with a focus on consumer protection and data privacy. Product substitutes are emerging, including extended warranties and service contracts, although embedded insurance offers a more comprehensive and regulated solution. End-user demographics are increasingly tech-savvy, seeking convenience and personalized protection. Mergers and acquisitions (M&A) are a significant trend, with deal values reaching hundreds of millions, as larger players seek to acquire innovative technologies and expand their reach. Key M&A activities indicate a consolidation trend, aiming to achieve economies of scale and broader market penetration.

- Market Concentration: Moderately concentrated, with key players like Munich Re, Allianz, and AXA competing with insurtechs such as Cover Genius and Qover.

- Innovation Drivers: Digitalization, API integration, customer-centricity, and the demand for frictionless purchasing experiences.

- Regulatory Frameworks: Evolving; focus on consumer protection, data security (GDPR), and fair competition.

- Product Substitutes: Extended warranties, service contracts, and standalone protection plans.

- End-User Demographics: Young, digitally connected consumers and businesses seeking integrated, convenient solutions.

- M&A Activities: High; driven by strategic acquisitions to gain technological capabilities and market access. Estimated deal values in the hundreds of millions.

Europe Embedded Insurance Market Market Dynamics & Trends

The Europe Embedded Insurance Market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period. This expansion is fueled by a confluence of powerful market drivers. Firstly, the pervasive digitalization of commerce across all sectors creates fertile ground for embedding insurance seamlessly into customer journeys. E-commerce platforms, travel booking sites, and even service providers are increasingly recognizing the value proposition of offering relevant insurance products at the precise moment of need, thereby enhancing customer value and generating new revenue streams. This trend is further amplified by shifting consumer preferences, which increasingly favor convenience, personalization, and instant gratification. Consumers are no longer willing to navigate complex insurance purchasing processes; instead, they expect tailored protection to be readily available when and where they engage with a product or service.

Technological advancements are another pivotal growth driver. The rise of Application Programming Interfaces (APIs) has enabled effortless integration of insurance functionalities into existing platforms, allowing for real-time quoting, underwriting, and policy issuance. Insurtech companies, in particular, are at the forefront of developing these innovative solutions, leveraging data analytics, artificial intelligence (AI), and machine learning (ML) to personalize product offerings and streamline claims processing. This technological prowess not only enhances the customer experience but also improves operational efficiency for both insurers and distribution partners. The competitive landscape is dynamic, characterized by intense competition between traditional insurers looking to adapt to the digital age and nimble insurtechs that are disrupting established models. Partnerships are becoming increasingly common, as insurers collaborate with technology providers and distribution channels to expand their embedded insurance offerings. Market penetration is still in its nascent stages in certain segments, indicating substantial headroom for future growth. The increasing awareness of the benefits of embedded insurance among businesses, particularly SMEs, is also contributing to market expansion, as they seek to offer added value to their customers and differentiate themselves in competitive markets.

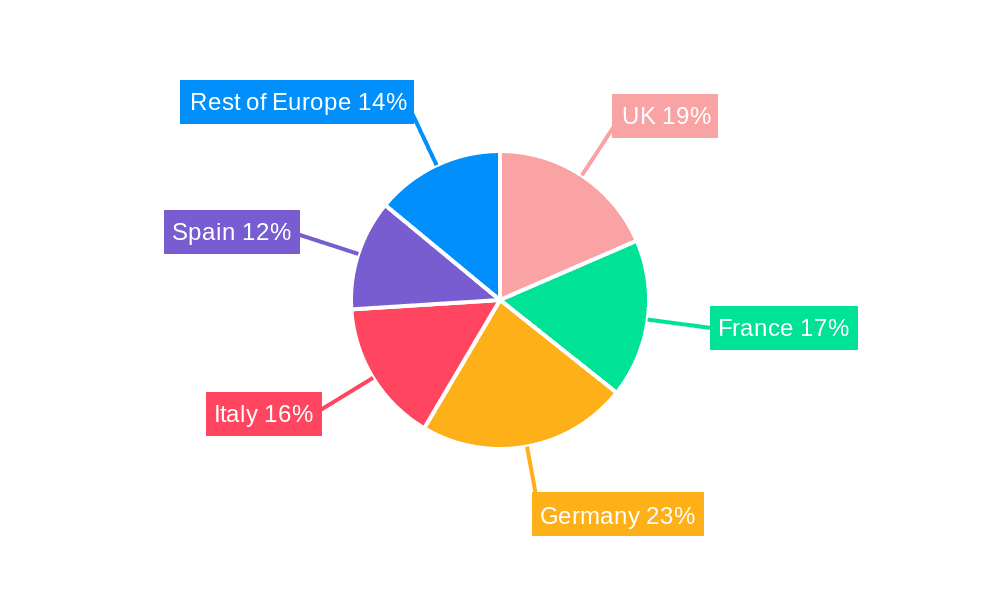

Dominant Regions & Segments in Europe Embedded Insurance Market

The Europe Embedded Insurance Market exhibits significant regional and segmental variations, with certain areas and product categories demonstrating stronger adoption and growth trajectories.

Dominant Region: Western Europe Western Europe, particularly countries like the United Kingdom, Germany, and France, currently dominates the embedded insurance market. This leadership is attributable to several key factors:

- Economic Policies: Robust economic stability and high disposable incomes foster greater consumer spending on products and services that often include embedded insurance.

- Digital Infrastructure: Advanced digital infrastructure, including widespread internet penetration and high smartphone adoption rates, supports seamless online transactions and insurance integration.

- Consumer Sophistication: Consumers in these regions are generally more tech-savvy and receptive to new digital offerings, including embedded insurance solutions.

- Regulatory Maturity: While evolving, regulatory frameworks in Western Europe are generally conducive to innovation in financial services, fostering an environment for embedded insurance to thrive.

Dominant Insurance Lines:

- Travel Insurance: This segment has seen substantial growth in embedded offerings, particularly on airline and booking websites. The inherent uncertainty and risk associated with travel make it a natural fit for point-of-purchase protection. The ease of adding travel insurance during the booking process appeals to a broad consumer base.

- Electronics Insurance: The proliferation of electronic devices, from smartphones to laptops, has created a massive market for embedded protection against damage, theft, and malfunction. Retailers across online and offline channels are increasingly integrating these offerings at checkout.

- Other Insurance Lines: This broad category encompasses a variety of growing segments, including protection for home appliances, sporting goods, and even digital subscriptions. The adaptability of embedded insurance to diverse product categories is a key growth driver.

Dominant Channel:

- Online Channel: The online channel is unequivocally the dominant force in embedded insurance distribution. This is driven by the inherent nature of e-commerce and digital platforms, where the integration of insurance into the customer journey is most seamless. Online retailers, travel aggregators, and app-based service providers are prime examples of this trend. The ability to use APIs for instant underwriting and policy issuance makes the online channel highly efficient for embedded solutions.

The dominance of these regions and segments is projected to continue, although emerging markets and niche product lines are expected to witness accelerated growth in the coming years. The interplay of economic conditions, technological adoption, and consumer behavior will continue to shape the landscape of embedded insurance in Europe.

Europe Embedded Insurance Market Product Innovations

The Europe Embedded Insurance Market is witnessing a surge in product innovations, driven by a desire for greater relevance and convenience. Innovations focus on hyper-personalization of coverage, offering tailored protection based on individual user data and purchasing habits. For instance, electronics insurance is evolving beyond basic accidental damage to include coverage for software malfunctions and data recovery. In travel insurance, policies are becoming more dynamic, adapting to real-time travel disruptions. The key competitive advantage lies in the seamless integration into existing customer journeys, eliminating friction and increasing purchase conversion rates. These innovations are powered by AI-driven risk assessment and claims processing, leading to faster payouts and enhanced customer satisfaction.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Europe Embedded Insurance Market, segmented across key dimensions.

Insurance Line Segmentation: The market is analyzed by: Electronics Insurance, Furniture Insurance, Sports Equipment Insurance, Travel Insurance, and Other Insurance Lines. Each segment represents distinct consumer needs and distribution strategies for embedded protection. Growth projections and market sizes vary, with electronics and travel currently leading in adoption and projected revenue. Competitive dynamics within each line are shaped by the specific product types and the integration partners involved.

Channel Segmentation: The analysis also covers the Online and Offline distribution channels. The online channel dominates due to its inherent suitability for digital integration and automated processes. However, the offline channel, particularly through physical retail partnerships and point-of-sale systems, remains a relevant and growing segment for embedded insurance. Understanding the interplay between these channels is crucial for strategic market entry and expansion.

Key Drivers of Europe Embedded Insurance Market Growth

The Europe Embedded Insurance Market's growth is propelled by a synergistic blend of technological advancements, evolving consumer behaviors, and strategic business initiatives. The primary driver is the increasing demand for seamless, integrated customer experiences, where insurance is offered as a natural extension of a primary purchase. Digitalization across industries, from e-commerce to mobility, provides fertile ground for embedding insurance at the point of need. Technological enablers, such as API integrations and cloud-based platforms, facilitate the frictionless delivery of embedded insurance products. Furthermore, consumer preferences for convenience and personalization are paramount; customers increasingly seek immediate, relevant protection without the hassle of traditional insurance processes. The growing realization by businesses of embedded insurance's potential to enhance customer loyalty, reduce cart abandonment, and create new revenue streams is also a significant growth catalyst.

Challenges in the Europe Embedded Insurance Market Sector

Despite its promising growth, the Europe Embedded Insurance Market faces several notable challenges. Regulatory complexities and evolving compliance requirements can hinder rapid expansion, particularly across different European jurisdictions. Data privacy concerns and the need for robust cybersecurity measures are paramount, given the sensitive personal information handled. Consumer education and trust remain critical; some consumers may be wary of insurance offered as an add-on without full understanding. Achieving true scalability and seamless integration across diverse partner platforms requires significant technical investment and ongoing maintenance. Intense competition and price pressures from both traditional insurers and emerging insurtechs can impact profitability. Finally, managing the claims process efficiently and effectively within an embedded framework is crucial for customer satisfaction and retention, posing an operational challenge.

Emerging Opportunities in Europe Embedded Insurance Market

The Europe Embedded Insurance Market is ripe with emerging opportunities, driven by ongoing technological innovation and evolving consumer demands. The expansion of the Internet of Things (IoT) presents a significant opportunity for embedding insurance for connected devices, from smart home appliances to wearable technology. The growth of the gig economy and sharing economy platforms creates a need for flexible, on-demand insurance solutions that can be easily embedded into these services. Sustainability and ESG (Environmental, Social, and Governance) factors are increasingly influencing consumer choices, opening doors for embedded insurance products that support eco-friendly practices or provide protection against climate-related risks. Furthermore, the application of AI and big data analytics offers advanced opportunities for highly personalized product offerings and predictive underwriting, enhancing both customer value and insurer profitability. Exploring new vertical markets and underserved customer segments will also be key to unlocking future growth.

Leading Players in the Europe Embedded Insurance Market Market

- Cover Genius

- Munich Re

- Allianz

- Chubb Limited

- AXA

- Assicurazioni Generali

- Companjon

- Qover

- Swiss Re

- Zurich

Key Developments in Europe Embedded Insurance Market Industry

- March 2024: Chubb Limited recently unveiled a global platform aimed at offering transactional risk liability insurance products in international markets.

- January 2024: Cover Genius, a leading insurtech for embedded protection, and Vueling, Spain's prominent low-cost airline, unveiled an exclusive partnership aimed at safeguarding over 30 million travelers. By tapping into Cover Genius' robust global technology, this collaboration empowers Vueling to expand its reach beyond Spain, effectively addressing the evolving demands of the global travel community.

- November 2023: Cover Genius, a prominent insurtech specializing in embedded protection, and SAS, the premier airline in Scandinavia, unveiled an exclusive and tailor-made protection program. This program spans over 25 European countries and the United States and has the potential for global expansion. By integrating comprehensive travel protection directly into the customer booking process, passengers not only enjoy AI-driven price optimization and personalized product suggestions but also a hassle-free claims process.

Future Outlook for Europe Embedded Insurance Market Market

The future outlook for the Europe Embedded Insurance Market is exceptionally positive, driven by sustained innovation and increasing adoption. The market is poised for significant growth as more businesses recognize the strategic advantage of integrating insurance into their customer propositions. Advancements in AI, IoT, and blockchain technology will further enhance the personalization, efficiency, and security of embedded insurance offerings. The trend towards preventative and parametric insurance solutions, triggered by specific events, will also gain traction within the embedded space. Strategic partnerships between insurers, insurtechs, and non-insurance businesses will continue to be a dominant theme, fostering new distribution channels and product categories. As consumer expectations for seamless digital experiences evolve, embedded insurance is set to become an indispensable component of the modern commerce landscape, unlocking substantial market potential and offering exciting strategic opportunities for stakeholders to capitalize on this transformative trend.

Europe Embedded Insurance Market Segmentation

-

1. Insurance Line

- 1.1. Electronics

- 1.2. Furniture

- 1.3. Sports Equipment

- 1.4. Travel Insurance

- 1.5. Other Insurance Lines

-

2. Channel

- 2.1. Online

- 2.2. Offline

Europe Embedded Insurance Market Segmentation By Geography

- 1. UK

- 2. France

- 3. Germany

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Embedded Insurance Market Regional Market Share

Geographic Coverage of Europe Embedded Insurance Market

Europe Embedded Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 35.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market

- 3.4. Market Trends

- 3.4.1. Digitalization and High-speed Internet to Propel the European Embedded Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Embedded Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Line

- 5.1.1. Electronics

- 5.1.2. Furniture

- 5.1.3. Sports Equipment

- 5.1.4. Travel Insurance

- 5.1.5. Other Insurance Lines

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UK

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Line

- 6. UK Europe Embedded Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Line

- 6.1.1. Electronics

- 6.1.2. Furniture

- 6.1.3. Sports Equipment

- 6.1.4. Travel Insurance

- 6.1.5. Other Insurance Lines

- 6.2. Market Analysis, Insights and Forecast - by Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Insurance Line

- 7. France Europe Embedded Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Line

- 7.1.1. Electronics

- 7.1.2. Furniture

- 7.1.3. Sports Equipment

- 7.1.4. Travel Insurance

- 7.1.5. Other Insurance Lines

- 7.2. Market Analysis, Insights and Forecast - by Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Insurance Line

- 8. Germany Europe Embedded Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Line

- 8.1.1. Electronics

- 8.1.2. Furniture

- 8.1.3. Sports Equipment

- 8.1.4. Travel Insurance

- 8.1.5. Other Insurance Lines

- 8.2. Market Analysis, Insights and Forecast - by Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Insurance Line

- 9. Italy Europe Embedded Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Line

- 9.1.1. Electronics

- 9.1.2. Furniture

- 9.1.3. Sports Equipment

- 9.1.4. Travel Insurance

- 9.1.5. Other Insurance Lines

- 9.2. Market Analysis, Insights and Forecast - by Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Insurance Line

- 10. Spain Europe Embedded Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Line

- 10.1.1. Electronics

- 10.1.2. Furniture

- 10.1.3. Sports Equipment

- 10.1.4. Travel Insurance

- 10.1.5. Other Insurance Lines

- 10.2. Market Analysis, Insights and Forecast - by Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Insurance Line

- 11. Rest of Europe Europe Embedded Insurance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Insurance Line

- 11.1.1. Electronics

- 11.1.2. Furniture

- 11.1.3. Sports Equipment

- 11.1.4. Travel Insurance

- 11.1.5. Other Insurance Lines

- 11.2. Market Analysis, Insights and Forecast - by Channel

- 11.2.1. Online

- 11.2.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Insurance Line

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cover Genius

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Munich Re

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Allianz

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Chubb Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Assicurazioni Generali

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Companjon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Qover

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Swiss Re

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Zurich**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cover Genius

List of Figures

- Figure 1: Global Europe Embedded Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Embedded Insurance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: UK Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2025 & 2033

- Figure 4: UK Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2025 & 2033

- Figure 5: UK Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2025 & 2033

- Figure 6: UK Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2025 & 2033

- Figure 7: UK Europe Embedded Insurance Market Revenue (Million), by Channel 2025 & 2033

- Figure 8: UK Europe Embedded Insurance Market Volume (Billion), by Channel 2025 & 2033

- Figure 9: UK Europe Embedded Insurance Market Revenue Share (%), by Channel 2025 & 2033

- Figure 10: UK Europe Embedded Insurance Market Volume Share (%), by Channel 2025 & 2033

- Figure 11: UK Europe Embedded Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 12: UK Europe Embedded Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 13: UK Europe Embedded Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: UK Europe Embedded Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 15: France Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2025 & 2033

- Figure 16: France Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2025 & 2033

- Figure 17: France Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2025 & 2033

- Figure 18: France Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2025 & 2033

- Figure 19: France Europe Embedded Insurance Market Revenue (Million), by Channel 2025 & 2033

- Figure 20: France Europe Embedded Insurance Market Volume (Billion), by Channel 2025 & 2033

- Figure 21: France Europe Embedded Insurance Market Revenue Share (%), by Channel 2025 & 2033

- Figure 22: France Europe Embedded Insurance Market Volume Share (%), by Channel 2025 & 2033

- Figure 23: France Europe Embedded Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: France Europe Embedded Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 25: France Europe Embedded Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: France Europe Embedded Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Germany Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2025 & 2033

- Figure 28: Germany Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2025 & 2033

- Figure 29: Germany Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2025 & 2033

- Figure 30: Germany Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2025 & 2033

- Figure 31: Germany Europe Embedded Insurance Market Revenue (Million), by Channel 2025 & 2033

- Figure 32: Germany Europe Embedded Insurance Market Volume (Billion), by Channel 2025 & 2033

- Figure 33: Germany Europe Embedded Insurance Market Revenue Share (%), by Channel 2025 & 2033

- Figure 34: Germany Europe Embedded Insurance Market Volume Share (%), by Channel 2025 & 2033

- Figure 35: Germany Europe Embedded Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Germany Europe Embedded Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Germany Europe Embedded Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Germany Europe Embedded Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Italy Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2025 & 2033

- Figure 40: Italy Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2025 & 2033

- Figure 41: Italy Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2025 & 2033

- Figure 42: Italy Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2025 & 2033

- Figure 43: Italy Europe Embedded Insurance Market Revenue (Million), by Channel 2025 & 2033

- Figure 44: Italy Europe Embedded Insurance Market Volume (Billion), by Channel 2025 & 2033

- Figure 45: Italy Europe Embedded Insurance Market Revenue Share (%), by Channel 2025 & 2033

- Figure 46: Italy Europe Embedded Insurance Market Volume Share (%), by Channel 2025 & 2033

- Figure 47: Italy Europe Embedded Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Italy Europe Embedded Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Italy Europe Embedded Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Italy Europe Embedded Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Spain Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2025 & 2033

- Figure 52: Spain Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2025 & 2033

- Figure 53: Spain Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2025 & 2033

- Figure 54: Spain Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2025 & 2033

- Figure 55: Spain Europe Embedded Insurance Market Revenue (Million), by Channel 2025 & 2033

- Figure 56: Spain Europe Embedded Insurance Market Volume (Billion), by Channel 2025 & 2033

- Figure 57: Spain Europe Embedded Insurance Market Revenue Share (%), by Channel 2025 & 2033

- Figure 58: Spain Europe Embedded Insurance Market Volume Share (%), by Channel 2025 & 2033

- Figure 59: Spain Europe Embedded Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Spain Europe Embedded Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Spain Europe Embedded Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Spain Europe Embedded Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2025 & 2033

- Figure 64: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2025 & 2033

- Figure 65: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2025 & 2033

- Figure 66: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2025 & 2033

- Figure 67: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Channel 2025 & 2033

- Figure 68: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Channel 2025 & 2033

- Figure 69: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Channel 2025 & 2033

- Figure 70: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Channel 2025 & 2033

- Figure 71: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2020 & 2033

- Table 2: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2020 & 2033

- Table 3: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 4: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2020 & 2033

- Table 5: Global Europe Embedded Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Europe Embedded Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2020 & 2033

- Table 8: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2020 & 2033

- Table 9: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 10: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2020 & 2033

- Table 11: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2020 & 2033

- Table 14: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2020 & 2033

- Table 15: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 16: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2020 & 2033

- Table 17: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2020 & 2033

- Table 20: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2020 & 2033

- Table 21: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 22: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2020 & 2033

- Table 23: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2020 & 2033

- Table 26: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2020 & 2033

- Table 27: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 28: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2020 & 2033

- Table 29: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2020 & 2033

- Table 32: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2020 & 2033

- Table 33: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 34: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2020 & 2033

- Table 35: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2020 & 2033

- Table 38: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2020 & 2033

- Table 39: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2020 & 2033

- Table 40: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2020 & 2033

- Table 41: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Embedded Insurance Market?

The projected CAGR is approximately 35.24%.

2. Which companies are prominent players in the Europe Embedded Insurance Market?

Key companies in the market include Cover Genius, Munich Re, Allianz, Chubb Limited, AXA, Assicurazioni Generali, Companjon, Qover, Swiss Re, Zurich**List Not Exhaustive.

3. What are the main segments of the Europe Embedded Insurance Market?

The market segments include Insurance Line, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market.

6. What are the notable trends driving market growth?

Digitalization and High-speed Internet to Propel the European Embedded Insurance Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market.

8. Can you provide examples of recent developments in the market?

March 2024: Chubb Limited recently unveiled a global platform aimed at offering transactional risk liability insurance products in international markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Embedded Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Embedded Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Embedded Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Embedded Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence