Key Insights

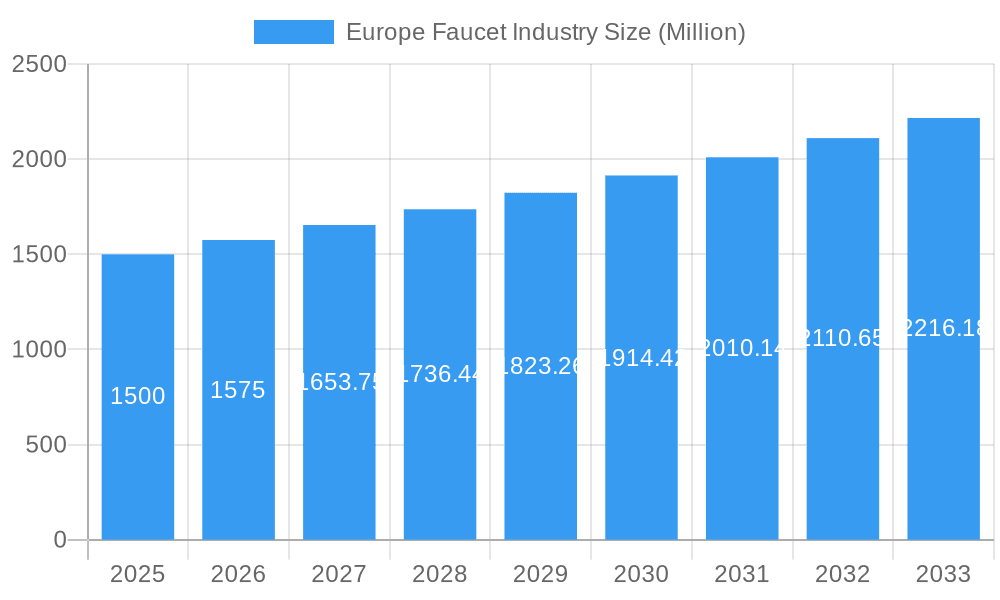

The European faucet market is projected to reach €21.1 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.3% through 2033. This growth is propelled by increasing renovation and new construction across residential and commercial sectors in key European economies. Demand is further stimulated by the rising preference for technologically advanced faucets, including automatic and sensor-operated models. Growing adoption of water-efficient fixtures, driven by environmental concerns and stricter regulations, also contributes to a positive market outlook. Additionally, the trend towards stylish, durable faucet designs in various materials enhances consumer spending.

Europe Faucet Industry Market Size (In Billion)

Despite challenges such as fluctuating raw material prices and potential economic downturns, strategic opportunities exist. Market segmentation by product type, technology, material, application, and end-use allows for targeted product development and penetration. Key players like Grohe, LIXIL, and Kohler indicate a competitive landscape where innovation and brand reputation are vital. Regional variations in preferences and regulations require careful consideration for market entry and expansion.

Europe Faucet Industry Company Market Share

Europe Faucet Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe faucet industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry professionals, investors, and strategic decision-makers. The total market value in 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

Europe Faucet Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European faucet market, examining market concentration, innovation drivers, regulatory influences, product substitution trends, end-user demographics, and mergers and acquisitions (M&A) activity. The market is moderately concentrated, with key players such as Grohe, LIXIL Corporation, and Kohler holding significant market share (xx%).

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Growing demand for water-efficient and technologically advanced faucets, along with increasing consumer awareness of sustainable products, is driving innovation.

- Regulatory Frameworks: EU regulations on water efficiency and material safety significantly impact product design and manufacturing.

- Product Substitutes: The emergence of smart home technologies and integrated plumbing systems presents potential substitution threats.

- End-User Demographics: The report analyzes end-user preferences based on age, income, and lifestyle, focusing on residential, commercial, and industrial segments.

- M&A Activities: Recent M&A activities in the European faucet market have involved deals valued at an estimated xx Million in the past five years, primarily focused on expanding product portfolios and geographic reach.

Europe Faucet Industry Market Dynamics & Trends

This section delves into the market dynamics, examining growth drivers, technological disruptions, consumer preferences, and competitive pressures. The European faucet market is experiencing steady growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033.

Market growth is primarily driven by rising disposable incomes, increasing urbanization, and a surge in new construction projects across Europe. The market penetration of smart faucets is increasing, driven by the growing popularity of smart homes and the convenience of automated features. The report also assesses consumer preference shifts towards sustainable and aesthetically pleasing faucets. Competitive dynamics are characterized by product differentiation, branding, and pricing strategies.

Dominant Regions & Segments in Europe Faucet Industry

This section identifies the leading regions, countries, and product segments within the European faucet market. The report provides a detailed analysis of market dominance and key drivers for each segment, focusing on:

- By Product Type: The disc faucet segment currently holds the largest market share, driven by its durability and ease of use. Other segments include ball, cartridge, and compression faucets.

- By Technology: Automatic faucets are experiencing rapid growth, propelled by advancements in sensor technology and increasing demand for hygiene and water conservation.

- By Material: Stainless steel and chrome faucets maintain a significant market share due to their resistance to corrosion and aesthetic appeal.

- By Application: Bathroom faucets dominate the market, followed by kitchen faucets.

- By End-Use: The residential sector constitutes the largest segment, followed by commercial and industrial applications.

Key drivers include economic growth, infrastructure development, and government policies promoting sustainable water management. Germany and the UK are projected to maintain their positions as leading markets.

Europe Faucet Industry Product Innovations

Recent innovations focus on water-saving technologies, smart features, and improved aesthetics. Manufacturers are increasingly incorporating sensor technology, automatic shutoff mechanisms, and water-efficient aerators to reduce water consumption. The integration of smart home technologies allows for remote control and monitoring of faucet operation. Design innovations include sleek, minimalist styles and a wider range of finishes to cater to diverse consumer preferences.

Report Scope & Segmentation Analysis

This report provides a comprehensive overview of the European faucet industry, segmented by product type (ball, disc, cartridge, compression), technology (manual, automatic), material (stainless steel, chrome, bronze, plastic, others), application (bathroom, kitchen, others), and end-use (residential, commercial, industrial). Each segment's market size, growth projections, and competitive dynamics are analyzed separately. For example, the automatic faucet segment is projected to experience the highest growth rate due to increasing demand for water-saving and hygienic features.

Key Drivers of Europe Faucet Industry Growth

Growth is fueled by several factors, including rising disposable incomes and increased spending on home improvement, coupled with stringent water conservation regulations. Technological advancements, such as the introduction of smart faucets with integrated water-saving technologies, are also contributing to market expansion. Government initiatives promoting water efficiency and sustainable building practices further stimulate growth.

Challenges in the Europe Faucet Industry Sector

The industry faces challenges such as fluctuating raw material prices and supply chain disruptions, impacting production costs and profitability. Intense competition from both established and emerging players also presents challenges. Stricter environmental regulations may increase compliance costs for manufacturers.

Emerging Opportunities in Europe Faucet Industry

The growing adoption of smart home technologies presents significant opportunities for the faucet industry. The increasing demand for water-efficient and sustainable products opens avenues for eco-friendly materials and technologies. Expansion into underserved markets and developing new product lines (e.g., specialized faucets for healthcare settings) offer further opportunities.

Leading Players in the Europe Faucet Industry Market

- Grohe

- LIXIL Corporation

- Briggs Plumbing

- Kohler

- Masco Corporation

- Lota Corporation

- Elkay

- Roka

- Toto

- Fortune Brands

Key Developments in Europe Faucet Industry

- March 2022: TOTO launches two new automatic faucet sets featuring water-saving ECO CAP and SELFPOWER technologies, winning Red Dot and Green Design Awards.

- May 2020: TOTO enhances its WASHLET models with an optional automated flush, improving bathroom hygiene and convenience.

Future Outlook for Europe Faucet Industry Market

The European faucet market is poised for continued growth, driven by sustained demand for modern, efficient, and aesthetically appealing faucets. Technological innovations, increasing consumer awareness of water conservation, and supportive government policies will fuel market expansion. Strategic partnerships and acquisitions will shape the competitive landscape, while a focus on sustainability and smart home integration will become increasingly crucial.

Europe Faucet Industry Segmentation

-

1. product type

- 1.1. Ball

- 1.2. Disc

- 1.3. Cartridge

- 1.4. Compression

-

2. technology

- 2.1. Manual

- 2.2. Automatic

-

3. Material used

- 3.1. Stainless steel

- 3.2. Chrome

- 3.3. Bronze Plastic

- 3.4. Others

-

4. application

- 4.1. Bathroom

- 4.2. Kitchen

- 4.3. Others

-

5. end use

- 5.1. Residential

- 5.2. Commercial

- 5.3. Industrial

Europe Faucet Industry Segmentation By Geography

-

1. Europe

- 1.1. UK

- 1.2. Italy

- 1.3. France

- 1.4. Germany

- 1.5. Rest of Europe

Europe Faucet Industry Regional Market Share

Geographic Coverage of Europe Faucet Industry

Europe Faucet Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising New Construction of Residential Apartment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Faucet Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by product type

- 5.1.1. Ball

- 5.1.2. Disc

- 5.1.3. Cartridge

- 5.1.4. Compression

- 5.2. Market Analysis, Insights and Forecast - by technology

- 5.2.1. Manual

- 5.2.2. Automatic

- 5.3. Market Analysis, Insights and Forecast - by Material used

- 5.3.1. Stainless steel

- 5.3.2. Chrome

- 5.3.3. Bronze Plastic

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by application

- 5.4.1. Bathroom

- 5.4.2. Kitchen

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by end use

- 5.5.1. Residential

- 5.5.2. Commercial

- 5.5.3. Industrial

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grohe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LIXIL Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Briggs Plumbing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Masco Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lota Corporation**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elkay

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roka

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortune Brands

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Grohe

List of Figures

- Figure 1: Europe Faucet Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Faucet Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 2: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 3: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 4: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 5: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 6: Europe Faucet Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 8: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 9: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 10: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 11: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 12: Europe Faucet Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: UK Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Faucet Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Faucet Industry?

Key companies in the market include Grohe, LIXIL Corporation, Briggs Plumbing, Kohler, Masco Corporation, Lota Corporation**List Not Exhaustive, Elkay, Roka, Toto, Fortune Brands.

3. What are the main segments of the Europe Faucet Industry?

The market segments include product type, technology, Material used, application, end use.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising New Construction of Residential Apartment.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

In March 2022, TOTO introduces two new automatic faucet sets that include the water-saving ECO CAP and SELFPOWER technologies. These series, which are ideal for hotel bathrooms and public restrooms, have each won the international Red Dot Award and Green Design Award for their exceptional designs. There is a great faucet for every washbasin, from self-rim and undercounter washbasins to furniture washbasins and vessels, and they are all available in a variety of various forms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Faucet Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Faucet Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Faucet Industry?

To stay informed about further developments, trends, and reports in the Europe Faucet Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence