Key Insights

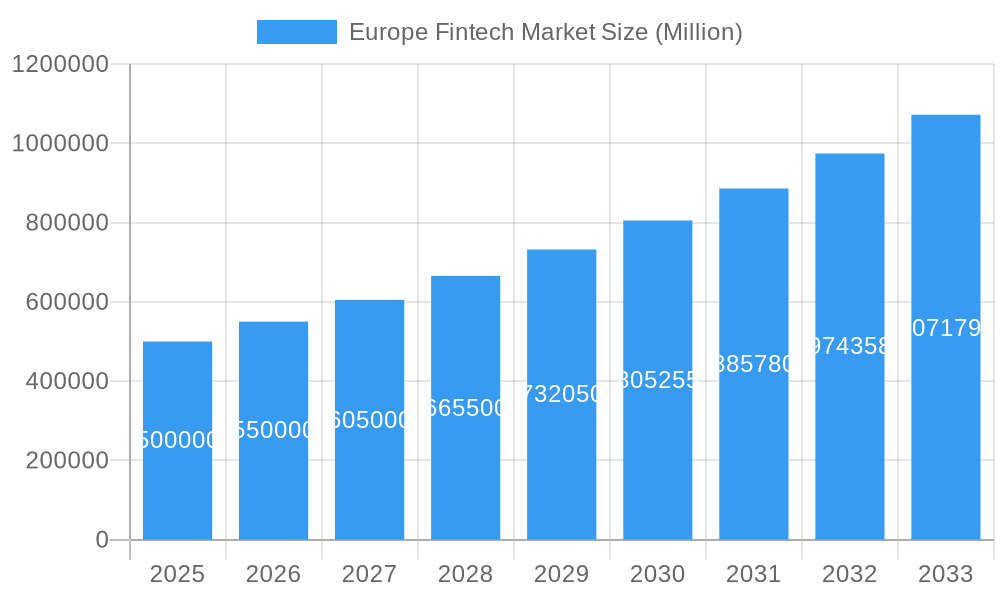

The European Fintech market, projected at 98.1 billion in 2025, is poised for significant expansion, with a Compound Annual Growth Rate (CAGR) of 24.22% expected through 2033. Key growth catalysts include widespread smartphone adoption and enhanced internet connectivity, expanding digital financial service accessibility. A digitally native demographic is readily adopting innovative payment solutions, lending platforms, and investment tools. Supportive regulatory frameworks, alongside ongoing efforts in data privacy and security, are cultivating a favorable environment for fintech innovation. The market's service segmentation highlights the dominance of money transfer and payments, driven by cross-border transactions and super-app integration. Digital lending and marketplace lending are also experiencing robust growth due to demand for expedited and accessible credit. The online insurance and marketplace segment is benefiting from a consumer shift towards digital channels and personalized offerings. Despite challenges such as cybersecurity risks and complex regulatory compliance, the market's outlook remains positive, supported by continuous technological advancements and evolving consumer financial preferences.

Europe Fintech Market Market Size (In Billion)

The United Kingdom, Germany, and France are currently leading the European Fintech market, with substantial growth anticipated across all regions. Leading innovators like Wise, Revolut, Klarna, and Adyen are spearheading market evolution and fostering competition. The market is characterized by a fragmented landscape, featuring numerous specialized startups alongside established financial institutions. Future success for fintech enterprises will depend on their agility in responding to dynamic consumer demands, their adoption of emerging technologies such as AI and blockchain, and their adeptness in managing regulatory requirements. Sustained investor confidence and the development of innovative solutions addressing unfulfilled consumer needs within the financial services sector will be critical for continued market expansion.

Europe Fintech Market Company Market Share

Europe Fintech Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Fintech market, covering the period 2019-2033, with a focus on key trends, growth drivers, challenges, and opportunities. The report offers actionable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. Projected market value for 2025 is estimated at xx Million, with a forecast period extending to 2033.

Europe Fintech Market Structure & Innovation Trends

This section analyzes the competitive landscape of the European Fintech market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. We delve into the dynamics of key players such as N, TransferWise, Rapyd, Nexi, Oaknorth, Funding Circle, Revolut, Klarna, Adyen, and Monzo, assessing their market share and contributions to innovation.

- Market Concentration: The European Fintech market exhibits a moderately concentrated structure, with several large players holding significant market share. However, numerous smaller, specialized firms also contribute significantly to innovation and competition. Market share data will be detailed within the full report.

- Innovation Drivers: Key drivers include advancements in mobile technology, increasing digital adoption among consumers, supportive regulatory environments (in certain regions), and the need for more efficient and accessible financial services.

- Regulatory Frameworks: Varying regulatory landscapes across European countries significantly influence market dynamics. The report analyzes the impact of regulations on specific Fintech segments and geographic regions.

- Product Substitutes: Traditional financial institutions continue to be a key competitor, but their services are increasingly challenged by Fintech solutions offering greater convenience and accessibility.

- End-User Demographics: The report explores the demographics of Fintech users, identifying key segments and their preferences.

- M&A Activities: We analyze past and projected M&A activity in the European Fintech market, examining deal values and their impact on market consolidation. Data on deal values (in Millions) will be provided within the complete report.

Europe Fintech Market Dynamics & Trends

This section delves into the market's growth trajectory, exploring key dynamics that shape its evolution. We examine market growth drivers, technological disruptions, evolving consumer preferences, and the competitive landscape. The report will feature a detailed analysis of Compound Annual Growth Rate (CAGR) and market penetration rates for different segments.

- Market size projections and CAGR across different segments and geographical regions will be available in the full report.

- Technological advancements such as AI, blockchain, and open banking will be analyzed for their impact on the market.

- Changing consumer behaviors and expectations will be explored.

- Competitive analysis covering pricing strategies, product differentiation and market positioning.

Dominant Regions & Segments in Europe Fintech Market

This section identifies the leading regions and segments within the European Fintech market. The analysis will cover the United Kingdom, Germany, France, and the Rest of Europe, examining key drivers of dominance in each region and segment (Money Transfer and Payments, Savings and Investments, Digital Lending and Lending Marketplaces, Online Insurance and Insurance Marketplaces, Other Service Propositions).

- United Kingdom: Strong digital infrastructure and a relatively supportive regulatory environment contribute to the UK's leading position in certain Fintech segments. Detailed analysis will be provided in the full report.

- Germany: A large and well-established financial sector, alongside a growing digital adoption rate, positions Germany as a key European Fintech hub.

- France: Government initiatives promoting Fintech innovation, coupled with a sophisticated financial ecosystem, makes France a significant player.

- Rest of Europe: The report will identify emerging Fintech hubs and factors contributing to their growth.

Europe Fintech Market Product Innovations

The European fintech landscape is experiencing a surge of groundbreaking product innovations, driven by cutting-edge technologies and a keen understanding of evolving consumer and business needs. This section delves into the latest product developments, spotlighting the technological trends that are redefining the market and the strategic fit of these innovations. We focus on novel applications that are creating significant competitive advantages and shaping the future of financial services.

We will explore new product introductions, the integration of innovative features, and the overarching market trends that are influencing the product ecosystem. Illustrative examples of transformative fintech products include API-driven B2B and B2C solutions for savings and sophisticated portfolio management, pioneered by companies like Raisin DS, which offer seamless integration and enhanced user experiences.

Report Scope & Segmentation Analysis

This comprehensive report offers a granular segmentation of the Europe Fintech market, providing in-depth insights into its diverse components. It delivers robust growth projections, detailed market size estimations, and a thorough analysis of the competitive dynamics within each segment, empowering stakeholders with strategic market intelligence.

- Service Proposition: We will present a detailed market analysis and size (in Millions) for each key service proposition, including:

- Money Transfer and Payments

- Savings and Investments

- Digital Lending and Lending Marketplaces

- Online Insurance and Insurance Marketplaces

- Other Service Propositions

- Country: The report will provide market size (in Millions) and critical growth projections for key European markets, specifically:

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

Key Drivers of Europe Fintech Market Growth

This section outlines the key factors driving growth in the Europe Fintech market.

- Increased digitalization and mobile penetration

- Growing demand for convenient and accessible financial services

- Supportive regulatory frameworks in some European countries

- Technological advancements (AI, blockchain, open banking)

Challenges in the Europe Fintech Market Sector

This section addresses the challenges and restraints impacting the European Fintech market.

- Regulatory uncertainty and differing regulatory frameworks across Europe

- Cybersecurity threats and data privacy concerns

- Intense competition from established financial institutions and other Fintech players

Emerging Opportunities in Europe Fintech Market

This section identifies emerging trends and opportunities within the European Fintech market.

- Expansion into underserved markets

- Adoption of new technologies (e.g., embedded finance)

- Growth in specific Fintech segments (e.g., sustainable finance, DeFi)

Leading Players in the Europe Fintech Market Market

- Wise (formerly TransferWise)

- Rapyd

- Nexi

- OakNorth

- Funding Circle

- Revolut

- Klarna

- Adyen

- Monzo

- N26

Key Developments in Europe Fintech Market Industry

- March 2022: Adyen significantly advanced its strategy by announcing ambitious plans to expand its offerings beyond core payment processing into the realm of embedded financial products, aiming to provide a more integrated financial experience for its merchants.

- June 2021: A landmark development occurred with the merger of Raisin and Deposit Solutions, culminating in the formation of a powerful, pan-European savings and investment platform designed to offer a unified and streamlined experience for savers and investors across the continent.

Future Outlook for Europe Fintech Market Market

The European Fintech market is poised for continued growth, driven by technological innovation, increasing digital adoption, and evolving consumer preferences. Strategic opportunities exist for companies that can leverage new technologies, adapt to evolving regulations, and cater to the specific needs of different customer segments. The market is expected to witness significant consolidation and further expansion into new areas, including embedded finance and sustainable finance.

Europe Fintech Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending and Lending Marketplaces

- 1.4. Online Insurance and Insurance Marketplaces

- 1.5. Other Service Propositions

Europe Fintech Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Fintech Market Regional Market Share

Geographic Coverage of Europe Fintech Market

Europe Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Innovative Tracking Technologies

- 3.3. Market Restrains

- 3.3.1. Rising Competition of Banks with Fintech and Financial Services

- 3.4. Market Trends

- 3.4.1. Favourable Regulatory Landscape is Driving the European Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending and Lending Marketplaces

- 5.1.4. Online Insurance and Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 N

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transferwise

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rapyd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nexi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oaknorth

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Funding Circle**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Revolut

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Klarna

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adyen

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Monzo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 N

List of Figures

- Figure 1: Europe Fintech Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Fintech Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 2: Europe Fintech Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Fintech Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 4: Europe Fintech Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Fintech Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Fintech Market?

The projected CAGR is approximately 24.22%.

2. Which companies are prominent players in the Europe Fintech Market?

Key companies in the market include N, Transferwise, Rapyd, Nexi, Oaknorth, Funding Circle**List Not Exhaustive, Revolut, Klarna, Adyen, Monzo.

3. What are the main segments of the Europe Fintech Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Innovative Tracking Technologies.

6. What are the notable trends driving market growth?

Favourable Regulatory Landscape is Driving the European Fintech Market.

7. Are there any restraints impacting market growth?

Rising Competition of Banks with Fintech and Financial Services.

8. Can you provide examples of recent developments in the market?

Mar 2022: Adyen, a global financial technology platform of choice for leading businesses, planned to expand beyond payments to build embedded financial products. These products will enable platforms and marketplaces to create tailored financial experiences for their users, such as small business owners or individual sellers. The suite of products will allow platforms to unlock new revenue streams and increase user loyalty.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Fintech Market?

To stay informed about further developments, trends, and reports in the Europe Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence