Key Insights

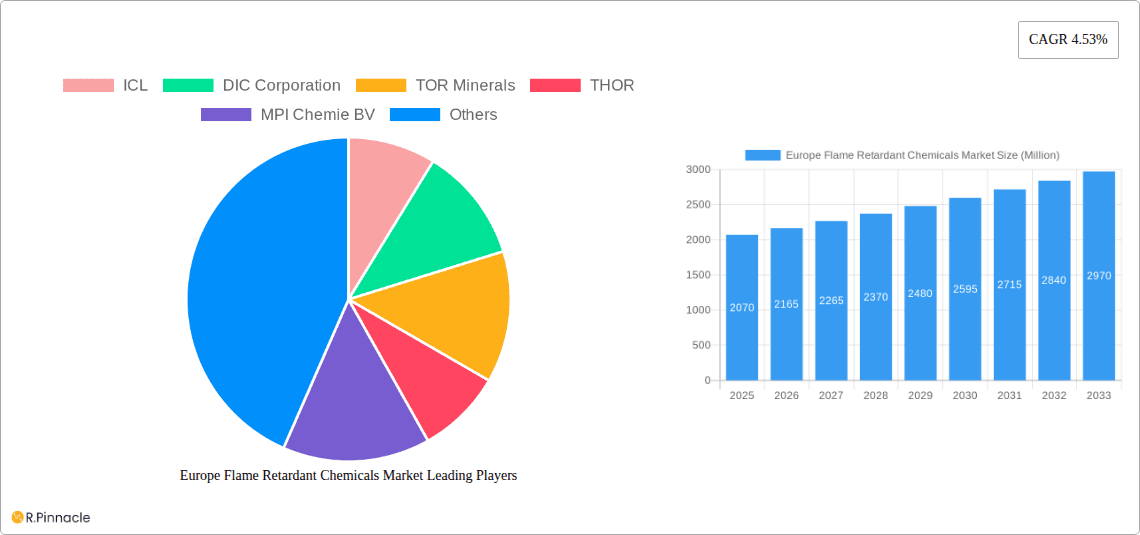

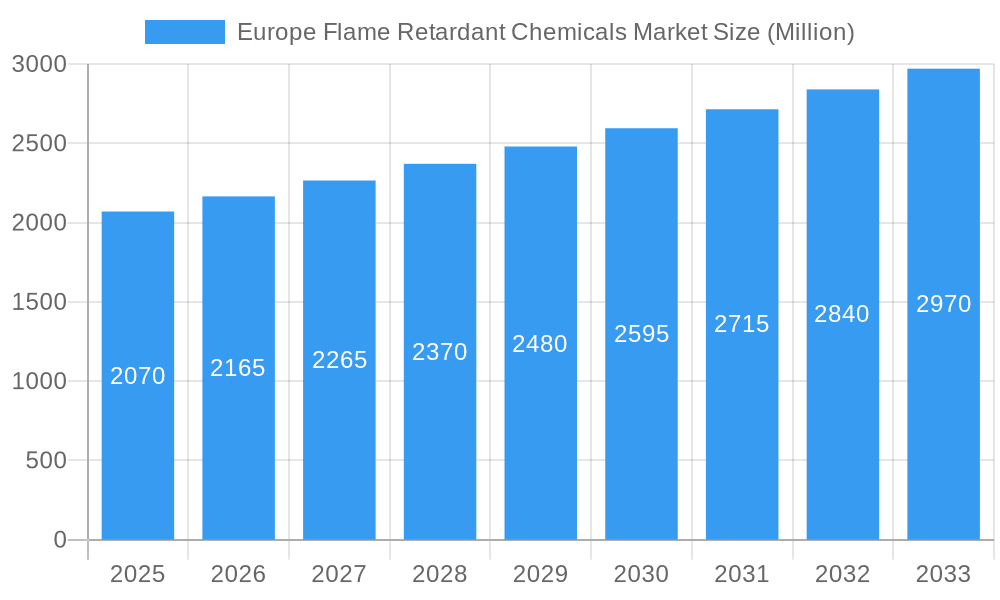

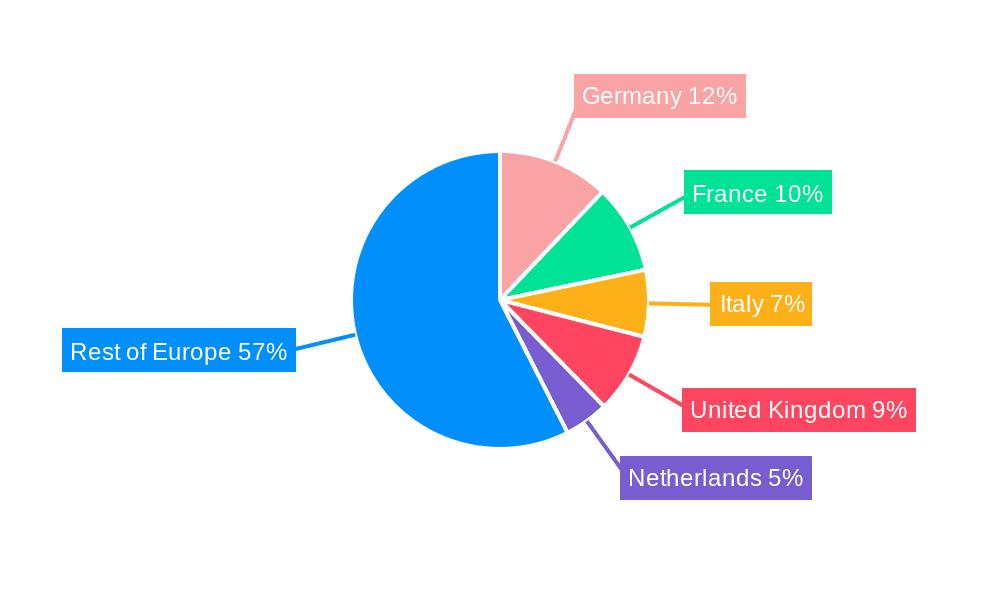

The European flame retardant chemicals market, valued at €2.07 billion in 2025, is projected to experience steady growth, driven by robust demand from key sectors such as electrical and electronics, building and construction, and transportation. A compound annual growth rate (CAGR) of 4.53% from 2025 to 2033 indicates a substantial market expansion over the forecast period. This growth is fueled by stringent safety regulations mandating the use of flame retardants in various applications to prevent fire hazards and comply with building codes. The increasing adoption of flame-retardant materials in electric vehicles and electronics further contributes to market expansion. Non-halogenated flame retardants, particularly aluminum hydroxide and magnesium hydroxide, are witnessing significant demand owing to their environmentally friendly nature and growing concerns regarding the toxicity of halogenated alternatives. However, the market faces challenges from fluctuating raw material prices and stringent environmental regulations governing the manufacturing and disposal of certain flame retardant chemicals. Market segmentation reveals a strong presence of key players like ICL, DIC Corporation, and BASF SE, highlighting the competitive landscape. The regional breakdown, with detailed data for Germany, France, Italy, the United Kingdom, and the Netherlands, provides insights into specific market dynamics within Europe. Growth is expected to be relatively consistent across these major European markets, reflecting the widespread adoption of flame retardants within the region’s various industries.

Europe Flame Retardant Chemicals Market Market Size (In Billion)

The dominance of established players is expected to continue, although smaller companies specializing in innovative and sustainable flame retardant solutions may gain market share. Ongoing research and development focus on developing eco-friendly and high-performance flame retardants, which will likely shape the market's trajectory in the coming years. The adoption of sustainable practices and circular economy principles within the manufacturing sector are expected to influence demand for environmentally benign flame retardant options. Therefore, companies focused on research and development of alternative, sustainable flame retardants are likely to experience significant growth opportunities in the European market. The consistent regulatory landscape in Europe, pushing for increased safety standards, will further reinforce the demand for flame retardant chemicals in diverse applications, thereby ensuring sustained market growth.

Europe Flame Retardant Chemicals Market Company Market Share

Europe Flame Retardant Chemicals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Flame Retardant Chemicals Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth drivers, competitive landscapes, and future opportunities. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033, and a historical period of 2019-2024.

Europe Flame Retardant Chemicals Market Structure & Innovation Trends

This section analyzes the market structure, focusing on concentration, innovation drivers, regulatory frameworks, and competitive activity. The market is characterized by a moderate level of concentration, with key players such as ICL, DIC Corporation, and BASF SE holding significant market share (estimated at xx% combined in 2025). Innovation is driven by stringent safety regulations, the rising demand for sustainable materials, and the need for enhanced performance in various applications.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Innovation Drivers: Stringent safety regulations, growing demand for sustainable products, and the need for superior flame retardant properties.

- Regulatory Frameworks: REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations significantly influence product development and market dynamics.

- Product Substitutes: The market faces competition from alternative materials, but their adoption is limited due to performance limitations.

- End-User Demographics: The key end-use sectors are building and construction, electrical & electronics, transportation, and textiles & furniture.

- M&A Activities: The market has witnessed xx M&A deals in the past five years, with an estimated total value of xx Million. These deals primarily focused on expanding product portfolios and geographical reach.

Europe Flame Retardant Chemicals Market Dynamics & Trends

The Europe Flame Retardant Chemicals Market is experiencing robust growth, driven by factors such as increasing construction activities, the rising adoption of flame-retardant materials in electronics, and stringent safety standards across various industries. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration for non-halogenated flame retardants is steadily increasing due to environmental concerns, projected to reach xx% by 2033. Competitive dynamics are characterized by both product differentiation and price competition. Technological advancements, like the development of nanomaterials-based flame retardants, are creating new growth avenues.

Dominant Regions & Segments in Europe Flame Retardant Chemicals Market

Germany and France are the leading markets in Europe, driven by robust construction activities and a strong manufacturing base within these nations. The Non-halogenated segment dominates the Product Type category, driven by growing environmental concerns and stricter regulations. Within the Non-halogenated segment, Aluminum Hydroxide holds the largest share due to its cost-effectiveness and wide applicability.

Key Drivers in Germany & France:

- Strong construction sector

- Well-established manufacturing industry

- Stringent fire safety regulations

- Favorable government policies

Dominant Segments:

- Product Type: Non-halogenated

- Inorganic Type: Aluminum Hydroxide

- End-user Industry: Electrical and Electronics and Buildings and Construction

The dominance of these segments stems from factors such as increasing construction activities (driving demand for Aluminum Hydroxide in building applications), the growing need for flame-retardant materials in electronics and a preference towards environmentally friendly alternatives.

Europe Flame Retardant Chemicals Market Product Innovations

Recent innovations have focused on developing non-halogenated flame retardants with enhanced performance and sustainability. Companies are focusing on developing products with superior thermal stability, improved processability, and reduced environmental impact. Key technological trends include nanotechnology and the incorporation of bio-based materials. These innovations address specific market demands for safety, sustainability, and enhanced performance across various applications.

Report Scope & Segmentation Analysis

This comprehensive report delves into the Europe Flame Retardant Chemicals Market, offering a granular analysis of its structure and dynamics. The market is meticulously segmented by Product Type, distinguishing between Non-halogenated and Halogenated flame retardants. Within the Non-halogenated category, further sub-segmentation includes Inorganic compounds such as Aluminum Hydroxide, Magnesium Hydroxide, Boron Compounds, and Other Types. The report also provides an in-depth analysis of key End-user Industries, encompassing Electrical and Electronics, Buildings and Construction, Transportation, and Textiles and Furniture. Each identified segment's projected growth trajectory, current market size, and the competitive landscape are thoroughly examined. Driven by escalating environmental consciousness and evolving regulatory frameworks, the Non-Halogenated segment is anticipated to experience the most rapid expansion. Concurrently, the Buildings and Construction sector is projected to maintain its position as the largest and most significant end-user segment throughout the entire forecast period, underscoring its sustained demand for advanced fire safety solutions.

Key Drivers of Europe Flame Retardant Chemicals Market Growth

The market's growth is primarily fueled by several key factors. Stringent safety regulations regarding fire prevention and the increasing demand for energy-efficient buildings and electronics are significant drivers. Moreover, growing concerns about environmental regulations and the push for sustainable products are propelling the adoption of eco-friendly flame retardants.

Challenges in the Europe Flame Retardant Chemicals Market Sector

The Europe Flame Retardant Chemicals Market navigates a complex landscape characterized by several significant challenges. Volatile raw material prices, subject to global supply and demand fluctuations, can significantly impact production costs and profitability. Intense competition among established players and emerging entrants necessitates continuous innovation and strategic pricing. Furthermore, the market is increasingly shaped by stringent regulatory compliance requirements, particularly concerning environmental impact and health and safety standards. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, pose a persistent threat to market stability. The ongoing trend towards stricter environmental regulations, including potential bans or limitations on certain chemical substances, presents further obstacles. The cumulative impact of these challenges is estimated to create a moderate reduction in the otherwise projected growth over the next five years, necessitating adaptive strategies from market participants.

Emerging Opportunities in Europe Flame Retardant Chemicals Market

The Europe Flame Retardant Chemicals Market is ripe with significant growth opportunities, primarily driven by the relentless pursuit of high-performance and sustainable flame retardant solutions. The growing global emphasis on eco-friendly and non-toxic alternatives is creating a robust demand for advanced, environmentally responsible materials. Emerging applications, such as the burgeoning field of electric vehicles and the expansion of renewable energy infrastructure (including solar panels and wind turbines), present considerable market potential, requiring specialized flame retardant properties. Furthermore, the exploration and development of novel materials and cutting-edge technologies, such as bio-based retardants and intumescent systems, promise to unlock new avenues for innovation and market penetration. Collaboration between chemical manufacturers, end-users, and research institutions will be pivotal in capitalizing on these emerging trends.

Key Developments in Europe Flame Retardant Chemicals Market Industry

- September 2022: LANXESS launched Emerald Innovation NH 500, a non-halogenated flame retardant for glass fiber-reinforced plastics, particularly targeting the electrical and electronics industry. This development significantly strengthens their position in the market by meeting the increasing demand for sustainable, high-performance flame retardants.

- July 2022: BASF SE partnered with THOR GmbH to develop a non-halogenated flame retardant additive, enhancing sustainability and meeting safety standards. This collaboration highlights the industry's focus on sustainable solutions and reflects the growing importance of partnerships in driving innovation.

Future Outlook for Europe Flame Retardant Chemicals Market Market

The Europe Flame Retardant Chemicals Market is strongly positioned for sustained and robust growth in the coming years. This expansion will be primarily fueled by the unwavering demand for advanced fire-safe materials across a diverse array of end-use sectors, ranging from construction and electronics to transportation and consumer goods. To effectively navigate the evolving market landscape and secure a competitive advantage, strategic investments in research and development will be paramount. A key focus of these R&D efforts will be on developing and commercializing sustainable, high-performance, and regulatory-compliant solutions. Forward-thinking companies will prioritize innovation in areas like halogen-free alternatives and novel application technologies. The market is projected to achieve a substantial valuation, reaching an estimated XX Million by 2033, reflecting the growing importance of fire safety in modern industry and daily life.

Europe Flame Retardant Chemicals Market Segmentation

-

1. Product Type

-

1.1. Non-halogenated

-

1.1.1. Inorganic

- 1.1.1.1. Aluminum Hydroxide

- 1.1.1.2. Magnesium Hydroxide

- 1.1.1.3. Boron Compounds

- 1.1.2. Phosphorus

- 1.1.3. Nitrogen

- 1.1.4. Other Types

-

1.1.1. Inorganic

-

1.2. Halogenated

- 1.2.1. Brominated Compounds

- 1.2.2. Chlorinated Compounds

-

1.1. Non-halogenated

-

2. End-user Industry

- 2.1. Electrical and Electronics

- 2.2. Buildings and Construction

- 2.3. Transportation

- 2.4. Textiles and Furniture

Europe Flame Retardant Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. Rest of Europe

Europe Flame Retardant Chemicals Market Regional Market Share

Geographic Coverage of Europe Flame Retardant Chemicals Market

Europe Flame Retardant Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Electrical and Electronic Goods Manufacturing; Rise in Safety Standards in Building and Construction; Rise in Standard of Living in the Eastern European Countries

- 3.3. Market Restrains

- 3.3.1. Environmental and Health Concerns Regarding Brominated Flame Retardants; Other Restraints

- 3.4. Market Trends

- 3.4.1. Buildings and Construction Segment to Dominate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flame Retardant Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Non-halogenated

- 5.1.1.1. Inorganic

- 5.1.1.1.1. Aluminum Hydroxide

- 5.1.1.1.2. Magnesium Hydroxide

- 5.1.1.1.3. Boron Compounds

- 5.1.1.2. Phosphorus

- 5.1.1.3. Nitrogen

- 5.1.1.4. Other Types

- 5.1.1.1. Inorganic

- 5.1.2. Halogenated

- 5.1.2.1. Brominated Compounds

- 5.1.2.2. Chlorinated Compounds

- 5.1.1. Non-halogenated

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Electrical and Electronics

- 5.2.2. Buildings and Construction

- 5.2.3. Transportation

- 5.2.4. Textiles and Furniture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Flame Retardant Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Non-halogenated

- 6.1.1.1. Inorganic

- 6.1.1.1.1. Aluminum Hydroxide

- 6.1.1.1.2. Magnesium Hydroxide

- 6.1.1.1.3. Boron Compounds

- 6.1.1.2. Phosphorus

- 6.1.1.3. Nitrogen

- 6.1.1.4. Other Types

- 6.1.1.1. Inorganic

- 6.1.2. Halogenated

- 6.1.2.1. Brominated Compounds

- 6.1.2.2. Chlorinated Compounds

- 6.1.1. Non-halogenated

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Electrical and Electronics

- 6.2.2. Buildings and Construction

- 6.2.3. Transportation

- 6.2.4. Textiles and Furniture

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Flame Retardant Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Non-halogenated

- 7.1.1.1. Inorganic

- 7.1.1.1.1. Aluminum Hydroxide

- 7.1.1.1.2. Magnesium Hydroxide

- 7.1.1.1.3. Boron Compounds

- 7.1.1.2. Phosphorus

- 7.1.1.3. Nitrogen

- 7.1.1.4. Other Types

- 7.1.1.1. Inorganic

- 7.1.2. Halogenated

- 7.1.2.1. Brominated Compounds

- 7.1.2.2. Chlorinated Compounds

- 7.1.1. Non-halogenated

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Electrical and Electronics

- 7.2.2. Buildings and Construction

- 7.2.3. Transportation

- 7.2.4. Textiles and Furniture

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Italy Europe Flame Retardant Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Non-halogenated

- 8.1.1.1. Inorganic

- 8.1.1.1.1. Aluminum Hydroxide

- 8.1.1.1.2. Magnesium Hydroxide

- 8.1.1.1.3. Boron Compounds

- 8.1.1.2. Phosphorus

- 8.1.1.3. Nitrogen

- 8.1.1.4. Other Types

- 8.1.1.1. Inorganic

- 8.1.2. Halogenated

- 8.1.2.1. Brominated Compounds

- 8.1.2.2. Chlorinated Compounds

- 8.1.1. Non-halogenated

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Electrical and Electronics

- 8.2.2. Buildings and Construction

- 8.2.3. Transportation

- 8.2.4. Textiles and Furniture

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France Europe Flame Retardant Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Non-halogenated

- 9.1.1.1. Inorganic

- 9.1.1.1.1. Aluminum Hydroxide

- 9.1.1.1.2. Magnesium Hydroxide

- 9.1.1.1.3. Boron Compounds

- 9.1.1.2. Phosphorus

- 9.1.1.3. Nitrogen

- 9.1.1.4. Other Types

- 9.1.1.1. Inorganic

- 9.1.2. Halogenated

- 9.1.2.1. Brominated Compounds

- 9.1.2.2. Chlorinated Compounds

- 9.1.1. Non-halogenated

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Electrical and Electronics

- 9.2.2. Buildings and Construction

- 9.2.3. Transportation

- 9.2.4. Textiles and Furniture

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Flame Retardant Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Non-halogenated

- 10.1.1.1. Inorganic

- 10.1.1.1.1. Aluminum Hydroxide

- 10.1.1.1.2. Magnesium Hydroxide

- 10.1.1.1.3. Boron Compounds

- 10.1.1.2. Phosphorus

- 10.1.1.3. Nitrogen

- 10.1.1.4. Other Types

- 10.1.1.1. Inorganic

- 10.1.2. Halogenated

- 10.1.2.1. Brominated Compounds

- 10.1.2.2. Chlorinated Compounds

- 10.1.1. Non-halogenated

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Electrical and Electronics

- 10.2.2. Buildings and Construction

- 10.2.3. Transportation

- 10.2.4. Textiles and Furniture

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Flame Retardant Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Non-halogenated

- 11.1.1.1. Inorganic

- 11.1.1.1.1. Aluminum Hydroxide

- 11.1.1.1.2. Magnesium Hydroxide

- 11.1.1.1.3. Boron Compounds

- 11.1.1.2. Phosphorus

- 11.1.1.3. Nitrogen

- 11.1.1.4. Other Types

- 11.1.1.1. Inorganic

- 11.1.2. Halogenated

- 11.1.2.1. Brominated Compounds

- 11.1.2.2. Chlorinated Compounds

- 11.1.1. Non-halogenated

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Electrical and Electronics

- 11.2.2. Buildings and Construction

- 11.2.3. Transportation

- 11.2.4. Textiles and Furniture

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ICL

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DIC Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 TOR Minerals

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 THOR

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 MPI Chemie BV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 LANXESS

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BASF SE

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 RTP Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Dow

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 CLARIANT

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nabaltec AG

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 J M Huber Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Italmatch Chemicals S p A

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Albemarle Corporation

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Eti Maden

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 ICL

List of Figures

- Figure 1: Europe Flame Retardant Chemicals Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Flame Retardant Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 15: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 17: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 21: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 29: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 33: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 35: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 39: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 41: Europe Flame Retardant Chemicals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Europe Flame Retardant Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flame Retardant Chemicals Market?

The projected CAGR is approximately 4.53%.

2. Which companies are prominent players in the Europe Flame Retardant Chemicals Market?

Key companies in the market include ICL, DIC Corporation, TOR Minerals, THOR, MPI Chemie BV, LANXESS, BASF SE, RTP Company, Dow, CLARIANT, Nabaltec AG, J M Huber Corporation, Italmatch Chemicals S p A, Albemarle Corporation, Eti Maden.

3. What are the main segments of the Europe Flame Retardant Chemicals Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Electrical and Electronic Goods Manufacturing; Rise in Safety Standards in Building and Construction; Rise in Standard of Living in the Eastern European Countries.

6. What are the notable trends driving market growth?

Buildings and Construction Segment to Dominate the Market Growth.

7. Are there any restraints impacting market growth?

Environmental and Health Concerns Regarding Brominated Flame Retardants; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: LANXESS developed a non-halogen flame retardant for use in glass fiber-reinforced plastics, particularly for the electrical and electronics industry. The company will offer these products under the Emerald Innovation NH 500 brand name.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flame Retardant Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flame Retardant Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flame Retardant Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Flame Retardant Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence