Key Insights

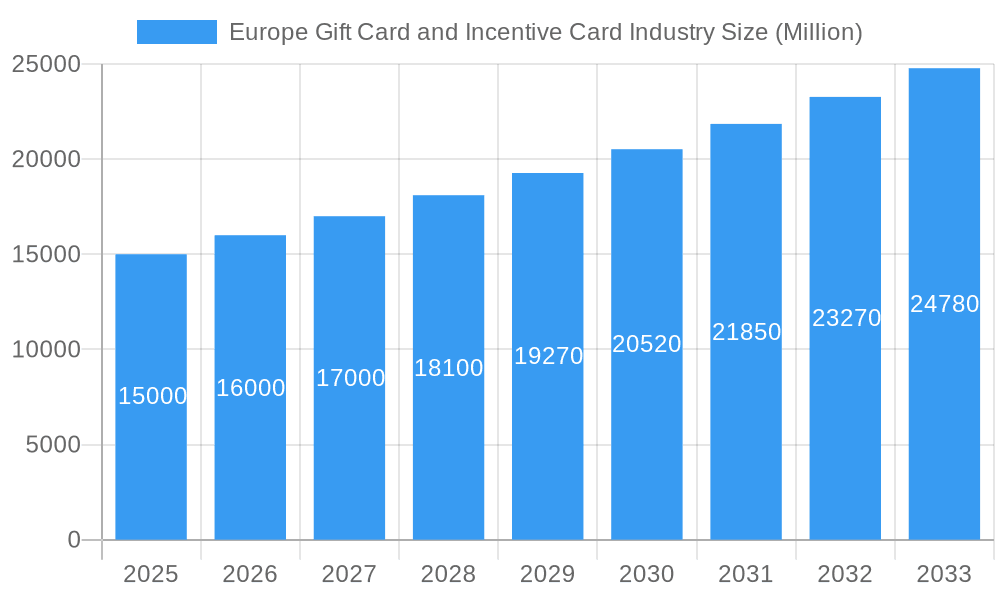

The European gift card and incentive card market is poised for substantial expansion, propelled by robust consumer spending, the pervasive influence of e-commerce, and the widespread adoption of digital solutions. The market demonstrates a strong upward trajectory with a projected Compound Annual Growth Rate (CAGR) of 8.5%. This growth is underpinned by increasing consumer preference for experience-based gifts and the growing utilization of gift cards for corporate incentives. The expanding e-commerce landscape and the seamless integration of digital gift cards into online purchasing journeys are key drivers of market evolution. Innovations such as customizable gift cards and integrated loyalty programs further enhance market appeal. Leading companies are leveraging technological advancements to optimize user experience and broaden market penetration. While challenges persist, including digital security concerns and regulatory adherence, the market outlook remains highly positive.

Europe Gift Card and Incentive Card Industry Market Size (In Billion)

The market's segmentation is anticipated to be diverse, encompassing physical and digital card types, online and offline distribution channels, and corporate incentive and consumer gift demographics. A significant growth surge is expected within the digital segment, mirroring broader e-commerce trends. Key European economies, such as Germany, the UK, and France, are expected to lead market share. The competitive landscape is dynamic, featuring both established global players and specialized niche providers. Future growth hinges on sustained innovation, the development of secure digital platforms, and effective marketing initiatives. Market success is intrinsically linked to consumer confidence and economic stability.

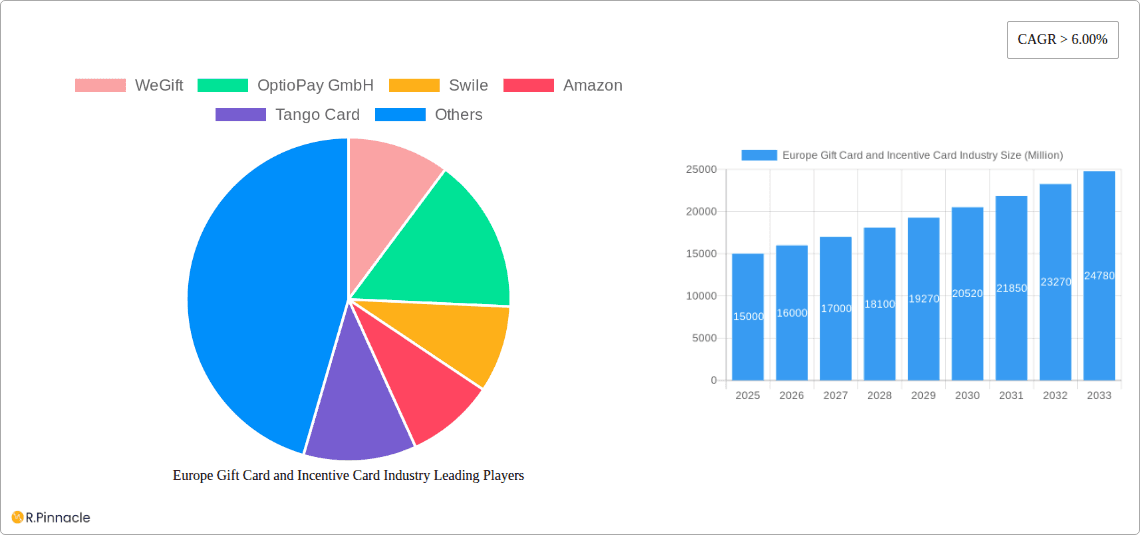

Europe Gift Card and Incentive Card Industry Company Market Share

Europe Gift Card and Incentive Card Industry: Market Analysis & Forecast 2025-2033

This comprehensive report delivers an in-depth analysis of the European gift card and incentive card industry, providing critical insights for stakeholders. Spanning the forecast period 2025-2033, this report details market dynamics, growth catalysts, challenges, and emerging opportunities. The analysis, based on a rigorous research methodology, offers accurate market sizing and forecasts. The estimated market size for the base year 2025 is 78.9 billion.

Europe Gift Card and Incentive Card Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities within the European gift card and incentive card market. The market is characterized by a mix of large established players and smaller, specialized firms.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players holding significant market share (estimated at xx%). However, numerous smaller companies compete fiercely, particularly in niche segments.

- Innovation Drivers: Technological advancements, such as mobile payments and digital gift card platforms, are key innovation drivers. Furthermore, the rising demand for personalized and experiential rewards fuels innovation in product offerings and delivery methods.

- Regulatory Framework: EU regulations concerning consumer protection and data privacy significantly influence market operations. Compliance with these regulations is crucial for all market participants.

- Product Substitutes: Other reward systems, such as loyalty programs and direct cash incentives, pose competitive threats. However, the convenience and flexibility of gift cards maintain their market appeal.

- End-User Demographics: The target demographic is broad, encompassing businesses (for employee rewards and client incentives) and individuals (for personal gifting). The expanding digital native population fuels market growth.

- M&A Activities: The industry has witnessed significant M&A activity in recent years, with deal values totaling an estimated €xx Million. These mergers and acquisitions aim to consolidate market share and expand product portfolios. Examples include (but aren’t limited to) strategic partnerships like the one between Hub Engage and Tango Card.

Europe Gift Card and Incentive Card Industry Market Dynamics & Trends

This section explores market growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the European gift card and incentive card market. The market exhibits a robust growth trajectory.

The European gift card and incentive card market is experiencing significant growth, driven by increasing consumer spending, the rise of e-commerce, and the growing popularity of digital gift cards. Technological advancements, such as mobile payment options and digital platforms, are further accelerating market growth. The CAGR for the period 2025-2033 is projected to be xx%, with market penetration expected to reach xx% by 2033. Changing consumer preferences towards experiential gifts and personalized rewards also contribute to market expansion. Intense competition among industry players drives innovation and influences pricing strategies.

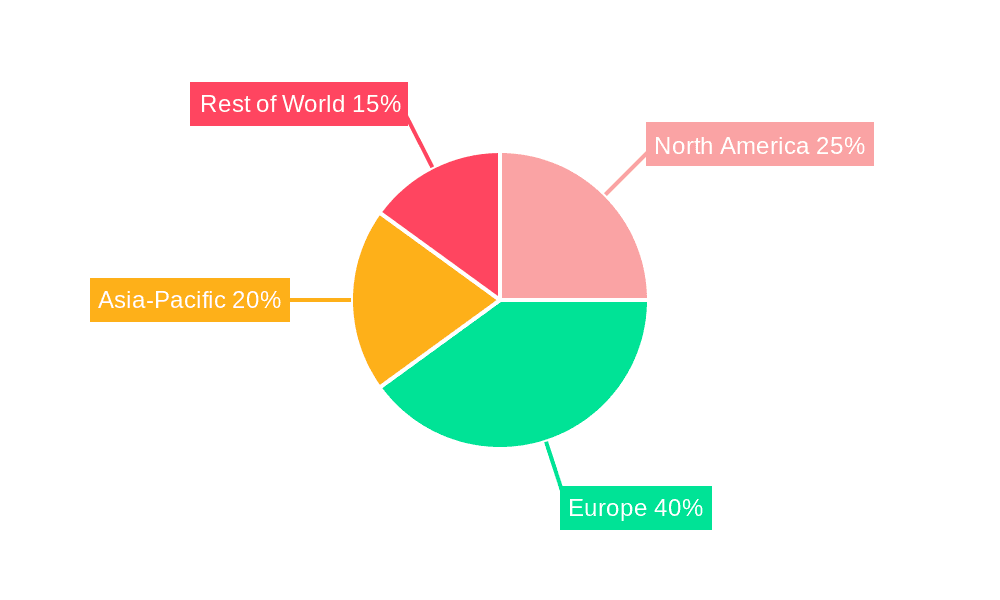

Dominant Regions & Segments in Europe Gift Card and Incentive Card Industry

This section identifies the leading regions, countries, and segments within the European gift card and incentive card market.

- Key Drivers of Regional Dominance:

- Strong Economic Growth: Countries with robust economic growth experience higher consumer spending and increased demand for gift cards and incentives.

- Developed E-commerce Infrastructure: Regions with well-developed e-commerce infrastructure facilitate the seamless adoption and usage of digital gift cards.

- Favorable Regulatory Environment: Countries with supportive regulatory frameworks encourage market expansion and attract investments.

- High Smartphone Penetration: High smartphone penetration drives the adoption of mobile payment solutions and digital gift card platforms.

The United Kingdom currently holds the leading position in the European gift card and incentive card market, followed by Germany and France. This dominance is attributed to a combination of factors, including strong economic growth, advanced e-commerce infrastructure, and high consumer spending. The dominance of the UK is also propelled by the established presence of several multinational gift card companies, enabling swift innovation and adaptation.

Europe Gift Card and Incentive Card Industry Product Innovations

The European gift card and incentive card industry is witnessing continuous product innovation. Digital gift cards, mobile payment integration, and personalized rewards programs are reshaping the market landscape. The focus is on enhancing user experience through seamless integration with various platforms and improving the personalization of rewards. Technological advancements like blockchain technology and AI-driven recommendation systems present significant opportunities for innovation and product differentiation, further expanding market reach and customer engagement.

Report Scope & Segmentation Analysis

This report segments the European gift card and incentive card market based on several factors, including distribution channels (online vs. offline), card type (physical vs. digital), and end-user industry (retail, corporate, etc.). Each segment exhibits unique growth trajectories and competitive dynamics. Growth projections for each segment are presented within the full report.

Key Drivers of Europe Gift Card and Incentive Card Industry Growth

Several factors drive the growth of the European gift card and incentive card industry. These include the increasing adoption of digital technologies, the rising popularity of e-commerce, and the growing preference for personalized rewards. Favorable economic conditions and supportive government policies further contribute to the expansion of this market. Furthermore, the convenience and versatility of gift cards as both gifts and employee incentives fuel market growth.

Challenges in the Europe Gift Card and Incentive Card Industry Sector

The European gift card and incentive card industry faces several challenges, including regulatory complexities surrounding data privacy and security, fluctuating economic conditions that influence consumer spending, and the rising costs associated with fraud prevention and transaction processing. Competition from alternative reward systems and the need to adapt to constantly evolving consumer preferences also pose significant challenges. The impact of these factors is reflected in reduced profit margins for some market players and increased operating costs.

Emerging Opportunities in Europe Gift Card and Incentive Card Industry

Several emerging opportunities exist within the European gift card and incentive card industry, driven by technological advancements and changing consumer preferences. The rising popularity of mobile payments presents significant opportunities for the market to expand. Moreover, personalized experiences and unique rewards, such as event tickets or experiences, represent untapped potential. Focus on corporate wellness programs and sustainable initiatives also presents a growing opportunity space.

Leading Players in the Europe Gift Card and Incentive Card Industry Market

- WeGift

- OptioPay GmbH

- Swile

- Amazon

- Tango Card

- HUBUC

- MyBeezBox

- Bitrefill

- Buybox

- Retailo

Key Developments in Europe Gift Card and Incentive Card Industry

- September 2021: Amazon One expands beyond retail, partnering with AXS for palm-based entry at events globally, including Europe. This significantly impacted the adoption of biometric payment solutions within the European market.

- August 2021: Hub Engage and Tango Card launch a strategic partnership, offering enhanced employee engagement platforms and expanded gift card catalogs across Europe. This development broadened the reach of gift card incentives within corporate settings.

Future Outlook for Europe Gift Card and Incentive Card Industry Market

The future outlook for the European gift card and incentive card industry is positive. Continued technological innovation, evolving consumer preferences, and the expansion of e-commerce will drive market growth. Strategic partnerships and mergers and acquisitions will shape the competitive landscape. The market's expansion is likely to be fueled by greater adoption of digital solutions and increasing consumer preference for convenient and personalized gifting and reward options. The industry's focus on enhanced security measures and innovative reward options will further accelerate its growth trajectory.

Europe Gift Card and Incentive Card Industry Segmentation

-

1. Consumer

- 1.1. Individual

- 1.2. Corporate

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Product

- 3.1. E-Gift Card

- 3.2. Physical Card

Europe Gift Card and Incentive Card Industry Segmentation By Geography

- 1. UK

- 2. France

- 3. Germany

- 4. Italy

- 5. Rest of Europe

Europe Gift Card and Incentive Card Industry Regional Market Share

Geographic Coverage of Europe Gift Card and Incentive Card Industry

Europe Gift Card and Incentive Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in the Sales of Smart Phones in Europe helps in Gift card Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Gift Card and Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 5.1.1. Individual

- 5.1.2. Corporate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. E-Gift Card

- 5.3.2. Physical Card

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. UK

- 5.4.2. France

- 5.4.3. Germany

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 6. UK Europe Gift Card and Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Consumer

- 6.1.1. Individual

- 6.1.2. Corporate

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. E-Gift Card

- 6.3.2. Physical Card

- 6.1. Market Analysis, Insights and Forecast - by Consumer

- 7. France Europe Gift Card and Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Consumer

- 7.1.1. Individual

- 7.1.2. Corporate

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. E-Gift Card

- 7.3.2. Physical Card

- 7.1. Market Analysis, Insights and Forecast - by Consumer

- 8. Germany Europe Gift Card and Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Consumer

- 8.1.1. Individual

- 8.1.2. Corporate

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. E-Gift Card

- 8.3.2. Physical Card

- 8.1. Market Analysis, Insights and Forecast - by Consumer

- 9. Italy Europe Gift Card and Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Consumer

- 9.1.1. Individual

- 9.1.2. Corporate

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Product

- 9.3.1. E-Gift Card

- 9.3.2. Physical Card

- 9.1. Market Analysis, Insights and Forecast - by Consumer

- 10. Rest of Europe Europe Gift Card and Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Consumer

- 10.1.1. Individual

- 10.1.2. Corporate

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Product

- 10.3.1. E-Gift Card

- 10.3.2. Physical Card

- 10.1. Market Analysis, Insights and Forecast - by Consumer

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WeGift

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 OptioPay GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Swile

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amazon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tango Card

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HUBUC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MyBeezBox

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bitrefill

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Buybox

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Retailo**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WeGift

List of Figures

- Figure 1: Global Europe Gift Card and Incentive Card Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: UK Europe Gift Card and Incentive Card Industry Revenue (billion), by Consumer 2025 & 2033

- Figure 3: UK Europe Gift Card and Incentive Card Industry Revenue Share (%), by Consumer 2025 & 2033

- Figure 4: UK Europe Gift Card and Incentive Card Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: UK Europe Gift Card and Incentive Card Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: UK Europe Gift Card and Incentive Card Industry Revenue (billion), by Product 2025 & 2033

- Figure 7: UK Europe Gift Card and Incentive Card Industry Revenue Share (%), by Product 2025 & 2033

- Figure 8: UK Europe Gift Card and Incentive Card Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: UK Europe Gift Card and Incentive Card Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: France Europe Gift Card and Incentive Card Industry Revenue (billion), by Consumer 2025 & 2033

- Figure 11: France Europe Gift Card and Incentive Card Industry Revenue Share (%), by Consumer 2025 & 2033

- Figure 12: France Europe Gift Card and Incentive Card Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: France Europe Gift Card and Incentive Card Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: France Europe Gift Card and Incentive Card Industry Revenue (billion), by Product 2025 & 2033

- Figure 15: France Europe Gift Card and Incentive Card Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: France Europe Gift Card and Incentive Card Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: France Europe Gift Card and Incentive Card Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Germany Europe Gift Card and Incentive Card Industry Revenue (billion), by Consumer 2025 & 2033

- Figure 19: Germany Europe Gift Card and Incentive Card Industry Revenue Share (%), by Consumer 2025 & 2033

- Figure 20: Germany Europe Gift Card and Incentive Card Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Germany Europe Gift Card and Incentive Card Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Germany Europe Gift Card and Incentive Card Industry Revenue (billion), by Product 2025 & 2033

- Figure 23: Germany Europe Gift Card and Incentive Card Industry Revenue Share (%), by Product 2025 & 2033

- Figure 24: Germany Europe Gift Card and Incentive Card Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Germany Europe Gift Card and Incentive Card Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Italy Europe Gift Card and Incentive Card Industry Revenue (billion), by Consumer 2025 & 2033

- Figure 27: Italy Europe Gift Card and Incentive Card Industry Revenue Share (%), by Consumer 2025 & 2033

- Figure 28: Italy Europe Gift Card and Incentive Card Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Italy Europe Gift Card and Incentive Card Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Italy Europe Gift Card and Incentive Card Industry Revenue (billion), by Product 2025 & 2033

- Figure 31: Italy Europe Gift Card and Incentive Card Industry Revenue Share (%), by Product 2025 & 2033

- Figure 32: Italy Europe Gift Card and Incentive Card Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Italy Europe Gift Card and Incentive Card Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue (billion), by Consumer 2025 & 2033

- Figure 35: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue Share (%), by Consumer 2025 & 2033

- Figure 36: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 37: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue (billion), by Product 2025 & 2033

- Figure 39: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue Share (%), by Product 2025 & 2033

- Figure 40: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of Europe Europe Gift Card and Incentive Card Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 2: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 6: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 10: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 12: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 14: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 16: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 18: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 22: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 24: Global Europe Gift Card and Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Gift Card and Incentive Card Industry?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Europe Gift Card and Incentive Card Industry?

Key companies in the market include WeGift, OptioPay GmbH, Swile, Amazon, Tango Card, HUBUC, MyBeezBox, Bitrefill, Buybox, Retailo**List Not Exhaustive.

3. What are the main segments of the Europe Gift Card and Incentive Card Industry?

The market segments include Consumer, Distribution Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in the Sales of Smart Phones in Europe helps in Gift card Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2021, Amazon One has expanded beyond retail with its first third-party customer, ticketing company AXS. Amazon One from then was available on AXS's mobile ticketing pedestals, giving Red Rocks Amphitheatre event goers the option to enter using just their palms. This was made available across the globe including Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Gift Card and Incentive Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Gift Card and Incentive Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Gift Card and Incentive Card Industry?

To stay informed about further developments, trends, and reports in the Europe Gift Card and Incentive Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence