Key Insights

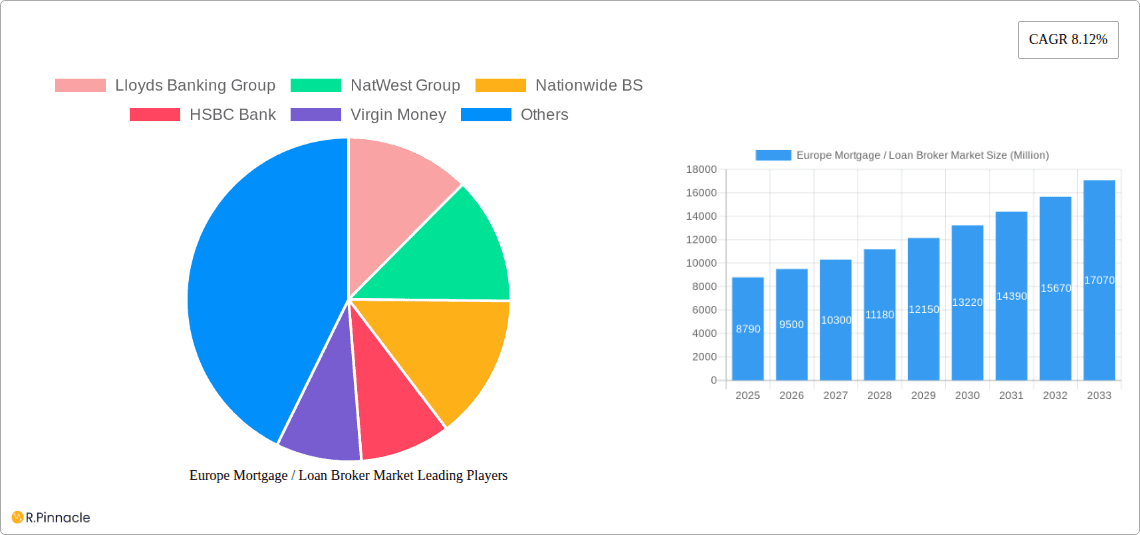

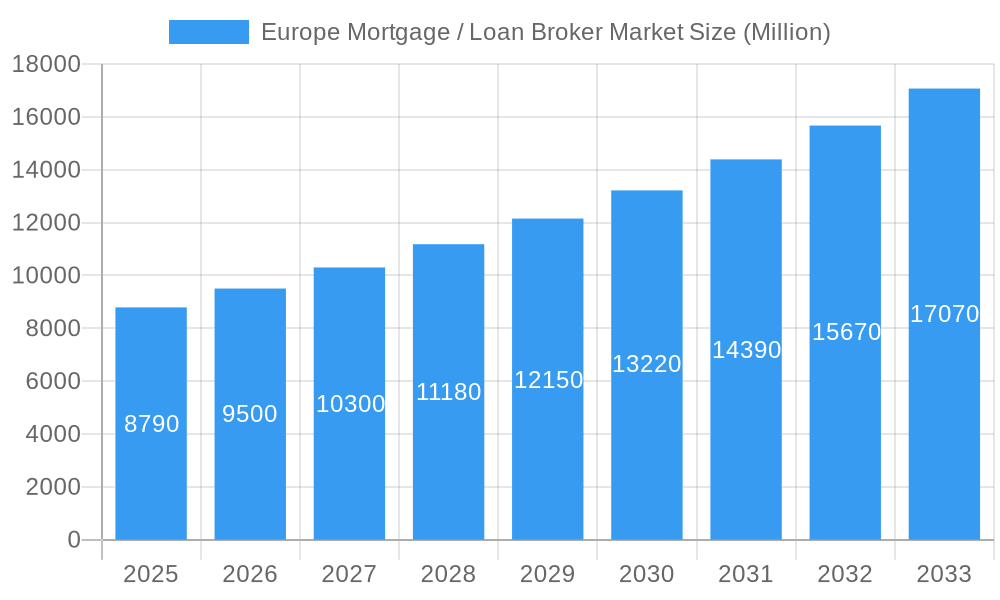

The European mortgage and loan broker market, valued at €8.79 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.12% from 2025 to 2033. This expansion is fueled by several key factors. Increasing demand for mortgages and loans, particularly from first-time homebuyers and individuals seeking refinancing options, is a significant driver. The rise of online platforms and fintech companies offering streamlined mortgage comparison and application processes is further accelerating market growth. Additionally, stricter regulatory frameworks in some European countries are pushing consumers to seek professional guidance from mortgage brokers to navigate the complexities of the loan application process. Competition among established players like Lloyds Banking Group, NatWest Group, and HSBC Bank, alongside the emergence of smaller, specialized brokers, is shaping the market landscape. While potential economic downturns and fluctuations in interest rates pose challenges, the overall market outlook remains positive, driven by persistent demand and technological innovation.

Europe Mortgage / Loan Broker Market Market Size (In Billion)

The market segmentation within Europe is likely diverse, with variations across countries reflecting unique housing markets and regulatory environments. While precise segment data is unavailable, it's reasonable to expect segmentation based on loan type (residential mortgages, commercial loans, etc.), customer demographics (first-time buyers, high-net-worth individuals), and service offerings (full-service brokerage, niche services). Regional variations are also anticipated, with markets in countries exhibiting higher property price growth and economic activity likely demonstrating higher growth rates. The presence of major players like Lloyds, NatWest, and HSBC indicates a strong competitive landscape, and understanding their strategic moves will be crucial in assessing future market trends. The forecast period to 2033 suggests a long-term optimistic view on the market's sustained growth potential, emphasizing the importance of adaptable strategies for companies operating within this sector.

Europe Mortgage / Loan Broker Market Company Market Share

This comprehensive report provides an in-depth analysis of the Europe Mortgage/Loan Broker Market, covering the period 2019-2033. It offers actionable insights for industry professionals, investors, and stakeholders seeking to understand the market's structure, dynamics, and future potential. The report utilizes robust data and analysis to forecast market growth, identify key players, and highlight emerging trends. The base year for this report is 2025, with estimations for 2025 and a forecast period spanning 2025-2033. The historical period covered is 2019-2024.

Europe Mortgage / Loan Broker Market Market Structure & Innovation Trends

The European mortgage/loan broker market exhibits a moderately concentrated structure, with several large players commanding significant market share. Top players include Lloyds Banking Group, NatWest Group, Nationwide BS, HSBC Bank, Virgin Money, Santander UK, Barclays, Coventry BS, Yorkshire BS, and TSB Bank. However, the market also features numerous smaller, specialized brokers, creating a diverse competitive landscape. The market share of the top 5 players is estimated to be approximately xx% in 2025.

- Market Concentration: Moderate, with a few dominant players and many smaller firms.

- Innovation Drivers: Technological advancements (e.g., AI-powered platforms, online applications), regulatory changes, and evolving consumer preferences.

- Regulatory Frameworks: Vary across European countries, influencing market access and operational costs.

- Product Substitutes: Direct lending from banks and other financial institutions.

- End-User Demographics: A mix of individual borrowers and commercial clients.

- M&A Activities: Significant M&A activity, driven by consolidation and expansion strategies. Recent deals include Barclays' acquisition of Kensington Mortgage Company for approximately $2.8 Billion in June 2023 and OneDome's acquisition of CMME Mortgage and Protection Ltd. in January 2023, demonstrating a trend towards increased market consolidation and the expansion of online brokerage capabilities. The total value of M&A deals in the market during 2022-2023 is estimated at xx Million.

Europe Mortgage / Loan Broker Market Market Dynamics & Trends

The European mortgage/loan broker market is characterized by dynamic growth driven by several factors. Rising homeownership rates, favorable government policies supporting homeownership, and low interest rates contribute significantly. Technological disruptions, particularly the rise of online platforms and fintech solutions, are transforming how consumers access and manage mortgages. Consumer preferences are shifting towards greater transparency, personalization, and convenience in mortgage services.

The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033). Market penetration is estimated at xx% in 2025, with significant potential for further growth as awareness of brokerage services increases. Competitive dynamics are intensifying, with established players facing increasing pressure from agile fintech startups and the rise of direct-to-consumer lending platforms. This is forcing market participants to adapt and innovate to maintain a competitive edge.

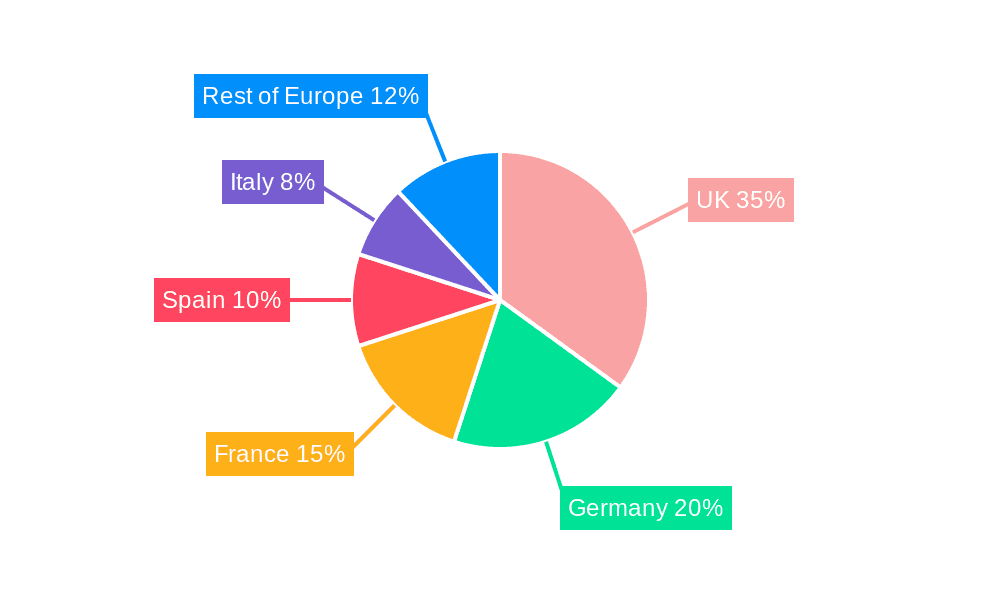

Dominant Regions & Segments in Europe Mortgage / Loan Broker Market

The UK currently dominates the European mortgage/loan broker market, driven by factors such as a robust housing market, high rates of homeownership, and the presence of several large, established players. Other key markets include Germany, France, and Spain, which offer considerable growth opportunities.

- Key Drivers for UK Dominance:

- Robust housing market.

- Established financial infrastructure.

- Strong presence of major mortgage brokers.

- Relatively higher adoption of digital technologies.

Further analysis reveals that the residential mortgage segment holds the largest share of the market due to high demand, while the commercial mortgage segment exhibits significant growth potential owing to increased investment in commercial real estate.

Europe Mortgage / Loan Broker Market Product Innovations

Recent innovations in the market include the development of AI-powered mortgage platforms, online comparison tools, and digital lending solutions. These innovations aim to enhance customer experience, improve efficiency, and reduce costs. Integration of blockchain technology for greater transparency in mortgage processing is also showing promise. The success of these innovations hinges on their ability to meet the specific needs of various customer segments and comply with relevant regulatory requirements.

Report Scope & Segmentation Analysis

This report segments the market based on several key parameters:

- By Product Type: Residential Mortgages, Commercial Mortgages

- By Distribution Channel: Online, Offline

- By Customer Type: Individual Borrowers, Commercial Entities

- By Geography: UK, Germany, France, Spain, Italy, and other European countries.

Each segment's growth projection, market size, and competitive dynamics are extensively analyzed in the report, offering a granular understanding of the market's composition.

Key Drivers of Europe Mortgage / Loan Broker Market Growth

Several factors propel the growth of the European mortgage/loan broker market. These include the increasing demand for mortgages fueled by population growth and rising housing prices, supportive government policies, technological advancements in mortgage processing and application technologies, and expanding financial services sector.

Challenges in the Europe Mortgage / Loan Broker Market Sector

The market faces challenges including stringent regulatory requirements, cybersecurity threats, intense competition from both established and emerging players and economic downturns impacting consumer borrowing. These factors can hinder market expansion and profitability.

Emerging Opportunities in Europe Mortgage / Loan Broker Market

Significant opportunities exist in expanding into underserved markets, developing specialized mortgage products, implementing innovative technologies such as AI and machine learning, and strengthening customer relationships to build brand loyalty.

Leading Players in the Europe Mortgage / Loan Broker Market Market

- Lloyds Banking Group

- NatWest Group

- Nationwide BS

- HSBC Bank

- Virgin Money

- Santander UK

- Barclays

- Coventry BS

- Yorkshire BS

- TSB Bank

- List Not Exhaustive

Key Developments in Europe Mortgage / Loan Broker Market Industry

- January 2023: OneDome acquired CMME Mortgage and Protection Ltd., significantly expanding its mortgage brokerage capabilities.

- June 2023: Barclays acquired Kensington Mortgage Company, strengthening its presence in the UK property sector.

These acquisitions illustrate the ongoing consolidation and growth within the mortgage brokerage sector.

Future Outlook for Europe Mortgage / Loan Broker Market Market

The European mortgage/loan broker market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and the increasing demand for mortgage financing. Strategic partnerships, expansion into new markets, and focus on customer experience will be crucial for success in this dynamic environment. The report projects significant market expansion, with potential for significant growth across various segments.

Europe Mortgage / Loan Broker Market Segmentation

-

1. Enterprise

- 1.1. Large

- 1.2. Small

- 1.3. Mid-sized

-

2. Applications

- 2.1. Home Loans

- 2.2. Commercial and Industrial Loans

- 2.3. Vehicle Loans

- 2.4. Loans to Governments

- 2.5. Other Applications

-

3. End- User

- 3.1. Businesses

- 3.2. Individuals

Europe Mortgage / Loan Broker Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Rest of Europe

Europe Mortgage / Loan Broker Market Regional Market Share

Geographic Coverage of Europe Mortgage / Loan Broker Market

Europe Mortgage / Loan Broker Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Housing Market's Expansion Drives Up Demand for Mortgage Brokers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Mortgage / Loan Broker Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Mid-sized

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Home Loans

- 5.2.2. Commercial and Industrial Loans

- 5.2.3. Vehicle Loans

- 5.2.4. Loans to Governments

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Businesses

- 5.3.2. Individuals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 6. United Kingdom Europe Mortgage / Loan Broker Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 6.1.1. Large

- 6.1.2. Small

- 6.1.3. Mid-sized

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Home Loans

- 6.2.2. Commercial and Industrial Loans

- 6.2.3. Vehicle Loans

- 6.2.4. Loans to Governments

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End- User

- 6.3.1. Businesses

- 6.3.2. Individuals

- 6.1. Market Analysis, Insights and Forecast - by Enterprise

- 7. Germany Europe Mortgage / Loan Broker Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 7.1.1. Large

- 7.1.2. Small

- 7.1.3. Mid-sized

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Home Loans

- 7.2.2. Commercial and Industrial Loans

- 7.2.3. Vehicle Loans

- 7.2.4. Loans to Governments

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End- User

- 7.3.1. Businesses

- 7.3.2. Individuals

- 7.1. Market Analysis, Insights and Forecast - by Enterprise

- 8. France Europe Mortgage / Loan Broker Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Enterprise

- 8.1.1. Large

- 8.1.2. Small

- 8.1.3. Mid-sized

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Home Loans

- 8.2.2. Commercial and Industrial Loans

- 8.2.3. Vehicle Loans

- 8.2.4. Loans to Governments

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End- User

- 8.3.1. Businesses

- 8.3.2. Individuals

- 8.1. Market Analysis, Insights and Forecast - by Enterprise

- 9. Rest of Europe Europe Mortgage / Loan Broker Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Enterprise

- 9.1.1. Large

- 9.1.2. Small

- 9.1.3. Mid-sized

- 9.2. Market Analysis, Insights and Forecast - by Applications

- 9.2.1. Home Loans

- 9.2.2. Commercial and Industrial Loans

- 9.2.3. Vehicle Loans

- 9.2.4. Loans to Governments

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End- User

- 9.3.1. Businesses

- 9.3.2. Individuals

- 9.1. Market Analysis, Insights and Forecast - by Enterprise

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lloyds Banking Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NatWest Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nationwide BS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 HSBC Bank

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Virgin Money

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Santander UK

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Barclays

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Coventry BS

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yorkshire BS

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TSB Bank**List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lloyds Banking Group

List of Figures

- Figure 1: Global Europe Mortgage / Loan Broker Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Mortgage / Loan Broker Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United Kingdom Europe Mortgage / Loan Broker Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 4: United Kingdom Europe Mortgage / Loan Broker Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 5: United Kingdom Europe Mortgage / Loan Broker Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: United Kingdom Europe Mortgage / Loan Broker Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 7: United Kingdom Europe Mortgage / Loan Broker Market Revenue (Million), by Applications 2025 & 2033

- Figure 8: United Kingdom Europe Mortgage / Loan Broker Market Volume (Billion), by Applications 2025 & 2033

- Figure 9: United Kingdom Europe Mortgage / Loan Broker Market Revenue Share (%), by Applications 2025 & 2033

- Figure 10: United Kingdom Europe Mortgage / Loan Broker Market Volume Share (%), by Applications 2025 & 2033

- Figure 11: United Kingdom Europe Mortgage / Loan Broker Market Revenue (Million), by End- User 2025 & 2033

- Figure 12: United Kingdom Europe Mortgage / Loan Broker Market Volume (Billion), by End- User 2025 & 2033

- Figure 13: United Kingdom Europe Mortgage / Loan Broker Market Revenue Share (%), by End- User 2025 & 2033

- Figure 14: United Kingdom Europe Mortgage / Loan Broker Market Volume Share (%), by End- User 2025 & 2033

- Figure 15: United Kingdom Europe Mortgage / Loan Broker Market Revenue (Million), by Country 2025 & 2033

- Figure 16: United Kingdom Europe Mortgage / Loan Broker Market Volume (Billion), by Country 2025 & 2033

- Figure 17: United Kingdom Europe Mortgage / Loan Broker Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: United Kingdom Europe Mortgage / Loan Broker Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Germany Europe Mortgage / Loan Broker Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 20: Germany Europe Mortgage / Loan Broker Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 21: Germany Europe Mortgage / Loan Broker Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 22: Germany Europe Mortgage / Loan Broker Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 23: Germany Europe Mortgage / Loan Broker Market Revenue (Million), by Applications 2025 & 2033

- Figure 24: Germany Europe Mortgage / Loan Broker Market Volume (Billion), by Applications 2025 & 2033

- Figure 25: Germany Europe Mortgage / Loan Broker Market Revenue Share (%), by Applications 2025 & 2033

- Figure 26: Germany Europe Mortgage / Loan Broker Market Volume Share (%), by Applications 2025 & 2033

- Figure 27: Germany Europe Mortgage / Loan Broker Market Revenue (Million), by End- User 2025 & 2033

- Figure 28: Germany Europe Mortgage / Loan Broker Market Volume (Billion), by End- User 2025 & 2033

- Figure 29: Germany Europe Mortgage / Loan Broker Market Revenue Share (%), by End- User 2025 & 2033

- Figure 30: Germany Europe Mortgage / Loan Broker Market Volume Share (%), by End- User 2025 & 2033

- Figure 31: Germany Europe Mortgage / Loan Broker Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Germany Europe Mortgage / Loan Broker Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Germany Europe Mortgage / Loan Broker Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Germany Europe Mortgage / Loan Broker Market Volume Share (%), by Country 2025 & 2033

- Figure 35: France Europe Mortgage / Loan Broker Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 36: France Europe Mortgage / Loan Broker Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 37: France Europe Mortgage / Loan Broker Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 38: France Europe Mortgage / Loan Broker Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 39: France Europe Mortgage / Loan Broker Market Revenue (Million), by Applications 2025 & 2033

- Figure 40: France Europe Mortgage / Loan Broker Market Volume (Billion), by Applications 2025 & 2033

- Figure 41: France Europe Mortgage / Loan Broker Market Revenue Share (%), by Applications 2025 & 2033

- Figure 42: France Europe Mortgage / Loan Broker Market Volume Share (%), by Applications 2025 & 2033

- Figure 43: France Europe Mortgage / Loan Broker Market Revenue (Million), by End- User 2025 & 2033

- Figure 44: France Europe Mortgage / Loan Broker Market Volume (Billion), by End- User 2025 & 2033

- Figure 45: France Europe Mortgage / Loan Broker Market Revenue Share (%), by End- User 2025 & 2033

- Figure 46: France Europe Mortgage / Loan Broker Market Volume Share (%), by End- User 2025 & 2033

- Figure 47: France Europe Mortgage / Loan Broker Market Revenue (Million), by Country 2025 & 2033

- Figure 48: France Europe Mortgage / Loan Broker Market Volume (Billion), by Country 2025 & 2033

- Figure 49: France Europe Mortgage / Loan Broker Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: France Europe Mortgage / Loan Broker Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of Europe Europe Mortgage / Loan Broker Market Revenue (Million), by Enterprise 2025 & 2033

- Figure 52: Rest of Europe Europe Mortgage / Loan Broker Market Volume (Billion), by Enterprise 2025 & 2033

- Figure 53: Rest of Europe Europe Mortgage / Loan Broker Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 54: Rest of Europe Europe Mortgage / Loan Broker Market Volume Share (%), by Enterprise 2025 & 2033

- Figure 55: Rest of Europe Europe Mortgage / Loan Broker Market Revenue (Million), by Applications 2025 & 2033

- Figure 56: Rest of Europe Europe Mortgage / Loan Broker Market Volume (Billion), by Applications 2025 & 2033

- Figure 57: Rest of Europe Europe Mortgage / Loan Broker Market Revenue Share (%), by Applications 2025 & 2033

- Figure 58: Rest of Europe Europe Mortgage / Loan Broker Market Volume Share (%), by Applications 2025 & 2033

- Figure 59: Rest of Europe Europe Mortgage / Loan Broker Market Revenue (Million), by End- User 2025 & 2033

- Figure 60: Rest of Europe Europe Mortgage / Loan Broker Market Volume (Billion), by End- User 2025 & 2033

- Figure 61: Rest of Europe Europe Mortgage / Loan Broker Market Revenue Share (%), by End- User 2025 & 2033

- Figure 62: Rest of Europe Europe Mortgage / Loan Broker Market Volume Share (%), by End- User 2025 & 2033

- Figure 63: Rest of Europe Europe Mortgage / Loan Broker Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of Europe Europe Mortgage / Loan Broker Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Rest of Europe Europe Mortgage / Loan Broker Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of Europe Europe Mortgage / Loan Broker Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 2: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 3: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 4: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Applications 2020 & 2033

- Table 5: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by End- User 2020 & 2033

- Table 6: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by End- User 2020 & 2033

- Table 7: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 10: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 11: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 12: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Applications 2020 & 2033

- Table 13: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by End- User 2020 & 2033

- Table 14: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by End- User 2020 & 2033

- Table 15: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 18: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 19: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 20: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Applications 2020 & 2033

- Table 21: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by End- User 2020 & 2033

- Table 22: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by End- User 2020 & 2033

- Table 23: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 26: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 27: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 28: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Applications 2020 & 2033

- Table 29: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by End- User 2020 & 2033

- Table 30: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by End- User 2020 & 2033

- Table 31: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 34: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 35: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 36: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Applications 2020 & 2033

- Table 37: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by End- User 2020 & 2033

- Table 38: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by End- User 2020 & 2033

- Table 39: Global Europe Mortgage / Loan Broker Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Europe Mortgage / Loan Broker Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Mortgage / Loan Broker Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the Europe Mortgage / Loan Broker Market?

Key companies in the market include Lloyds Banking Group, NatWest Group, Nationwide BS, HSBC Bank, Virgin Money, Santander UK, Barclays, Coventry BS, Yorkshire BS, TSB Bank**List Not Exhaustive.

3. What are the main segments of the Europe Mortgage / Loan Broker Market?

The market segments include Enterprise, Applications, End- User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.79 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Housing Market's Expansion Drives Up Demand for Mortgage Brokers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: OneDome, a UK end-to-end challenger, acquired CMME Mortgage and Protection Ltd. from CMME Group for an undisclosed sum. The acquisition, which involves the integration of CMME Mortgages 65-person team into OneDome, will enable OneDome to dramatically expand its mortgage brokerage capability and support its online clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Mortgage / Loan Broker Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Mortgage / Loan Broker Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Mortgage / Loan Broker Market?

To stay informed about further developments, trends, and reports in the Europe Mortgage / Loan Broker Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence