Key Insights

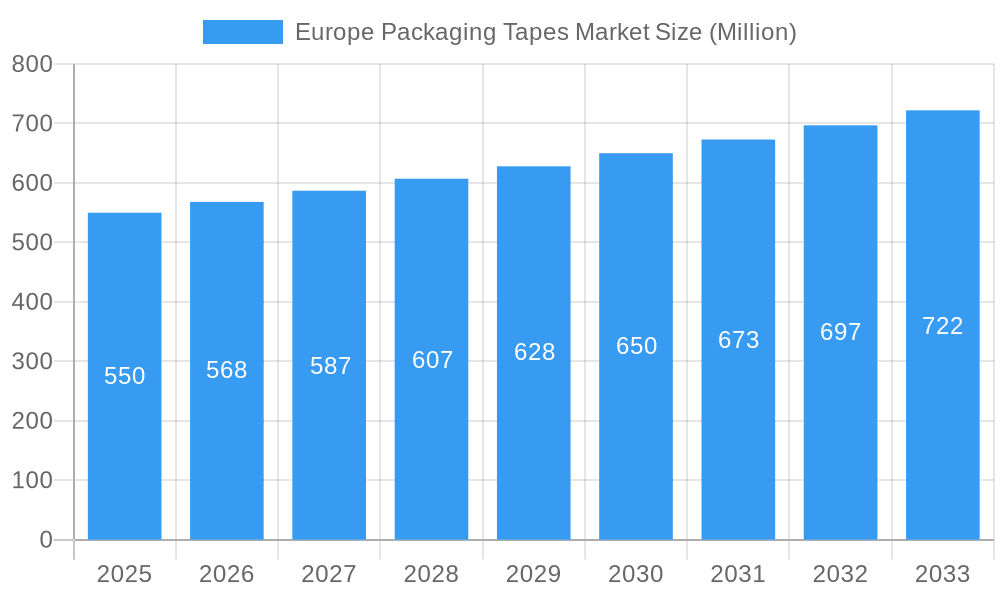

The Europe Packaging Tapes Market is projected for substantial growth, expected to expand at a Compound Annual Growth Rate (CAGR) of 2.3% from 2025 to 2033. This dynamic sector, valued at 85.1 billion, is primarily driven by the burgeoning e-commerce industry's demand for secure and efficient packaging. The escalating consumption of goods and increased online retail adoption across Europe fuel a consistent need for reliable packaging tapes. The food and beverage sector, requiring stringent product integrity and transit safety, is another significant growth catalyst. Sustainable packaging, focusing on recyclable and biodegradable materials, aligns with environmental regulations and consumer preferences, shaping modern tape solutions.

Europe Packaging Tapes Market Market Size (In Billion)

Key market trends include advancements in adhesive technologies, enhancing tack, shear strength, and temperature resistance for diverse applications. The rise of specialized tapes, such as tamper-evident and reinforced options, improves supply chain security. While demand is strong, raw material price volatility (plastics, petrochemicals) can impact manufacturing costs and pricing. The adoption of alternative packaging formats and automated systems also presents challenges. However, the inherent versatility and cost-effectiveness of packaging tapes ensure their continued relevance across retail and various manufacturing segments.

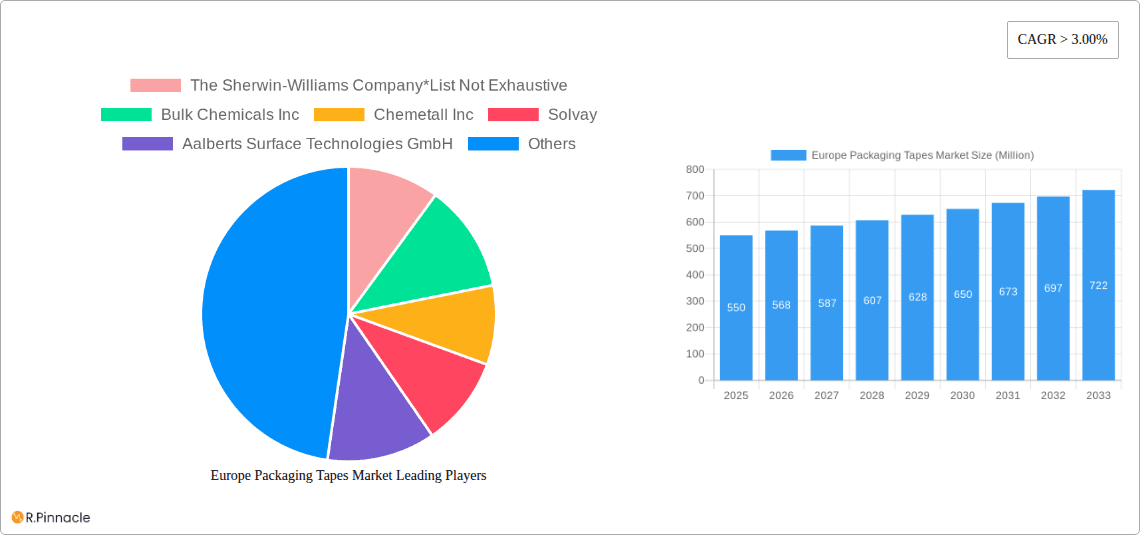

Europe Packaging Tapes Market Company Market Share

Gain comprehensive insights into the Europe Packaging Tapes Market. This report covers the 2019-2033 study period, with the base year and estimated year of 2025. It delivers critical analysis of market dynamics, segmentation, competitive strategies, and future outlook. Utilizing high-ranking keywords such as "packaging tapes Europe," "plastic packaging tapes," "acrylic adhesives," "e-commerce packaging solutions," and "sustainable packaging trends," this report empowers industry professionals with actionable intelligence to navigate and capitalize on this evolving market.

Europe Packaging Tapes Market Market Structure & Innovation Trends

The Europe Packaging Tapes Market exhibits a dynamic structure characterized by a moderate level of concentration, with key players continuously innovating to meet evolving demands. Innovation drivers are primarily fueled by the burgeoning e-commerce sector, demanding robust and efficient packaging solutions, and a growing consumer and regulatory push towards sustainability. The plastic packaging tapes segment, particularly those utilizing advanced adhesive technologies, continues to dominate, but the exploration of paper-based tapes with eco-friendly adhesives is gaining traction. Regulatory frameworks, such as those promoting circular economy principles and recycled content, are significantly influencing product development and material choices. Product substitutes, including strapping and banding, present a competitive challenge, necessitating ongoing product differentiation through enhanced performance, specialized applications, and cost-effectiveness. M&A activities are expected to remain strategic, focusing on acquiring companies with advanced adhesive technologies or strong positions in rapidly growing end-user industries. While specific market share data is proprietary, leading companies are investing heavily in R&D to maintain their competitive edge.

Europe Packaging Tapes Market Market Dynamics & Trends

The Europe Packaging Tapes Market is projected to experience robust growth over the forecast period of 2025–2033, driven by a confluence of powerful market dynamics and evolving trends. The escalating adoption of e-commerce across the continent stands as a primary growth accelerant. As online retail continues its upward trajectory, the demand for reliable, high-performance packaging tapes to ensure secure shipment of goods is amplified. This surge in e-commerce directly translates to an increased need for versatile and durable plastic packaging tapes and those with strong acrylic adhesives capable of adhering to diverse packaging materials under varying environmental conditions.

Technological disruptions are playing a pivotal role in shaping the market. Manufacturers are increasingly investing in advanced adhesive formulations, such as specialized hot melt and rubber-based adhesives, offering enhanced tack, shear strength, and temperature resistance. The focus on sustainability is another significant trend, compelling innovation in the development of tapes made from recycled materials, biodegradable substrates, and water-based adhesives. This aligns with stringent environmental regulations and growing consumer preferences for eco-conscious packaging.

Consumer preferences are shifting towards convenience, security, and an improved unboxing experience. This translates to a demand for tapes that are easy to apply, provide tamper-evident security, and are compatible with automated packaging machinery. Competitive dynamics within the market are intense, with established players and emerging companies vying for market share through product innovation, strategic partnerships, and competitive pricing. The food and beverage industry and the retail industry also remain significant end-users, demanding specialized tapes for product protection, branding, and shelf-life extension. The market penetration of advanced tape solutions is expected to deepen as businesses across all sectors recognize the critical role of effective packaging in maintaining product integrity and brand reputation. The CAGR for the Europe Packaging Tapes Market is predicted to be substantial, reflecting the ongoing expansion and the intrinsic importance of packaging tapes in modern logistics and commerce.

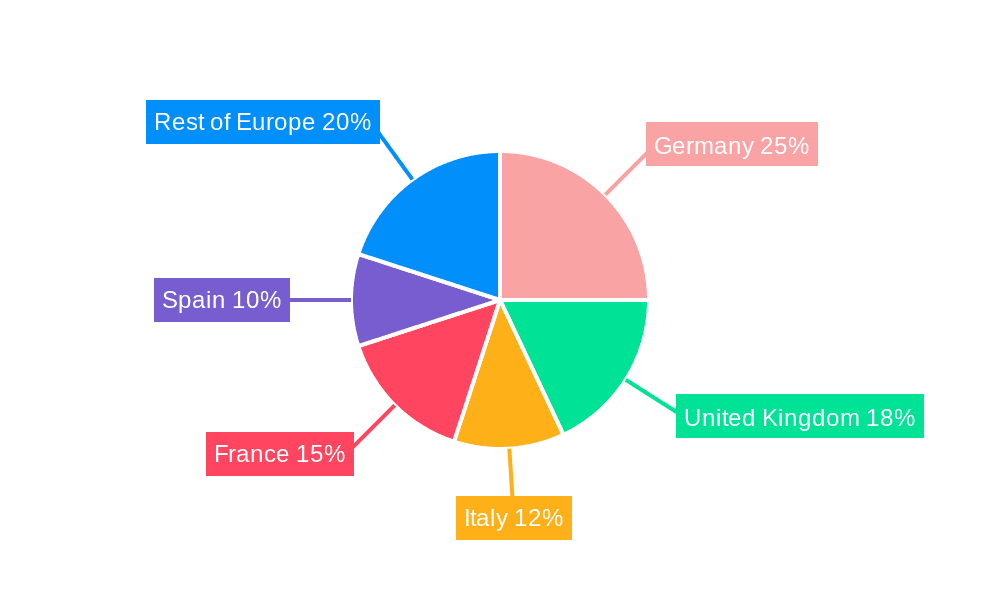

Dominant Regions & Segments in Europe Packaging Tapes Market

The Europe Packaging Tapes Market is segmented by Material Type (Plastic, Paper), Adhesive Type (Acrylic, Hot Melt, Rubber-based, Other Adhesive Types), and End-user Industry (E-Commerce, Food and Beverage Industry, Retail Industry, Other End-user Industries). Geographically, Western Europe, spearheaded by countries like Germany, France, and the United Kingdom, commands a significant market share due to its mature industrial base, high consumer spending power, and advanced logistics infrastructure.

Material Type: Plastic packaging tapes, particularly those made from polypropylene (PP) and polyvinyl chloride (PVC), continue to dominate. Their inherent strength, durability, and cost-effectiveness make them ideal for a wide range of applications. The increasing focus on sustainability is driving innovation in paper packaging tapes, which are gaining traction for their eco-friendly profile.

Adhesive Type: Acrylic adhesives represent the largest segment due to their excellent clarity, UV resistance, and suitability for a broad temperature range. They are a popular choice for general-purpose packaging and labeling applications. Hot melt adhesives are favored for their fast setting times and strong bonding capabilities, particularly in high-speed automated packaging processes. Rubber-based adhesives offer superior tack and adhesion to difficult surfaces, making them suitable for demanding applications.

End-user Industry: The E-Commerce sector is the most dominant and fastest-growing end-user industry. The continuous surge in online retail necessitates a consistent and high demand for secure, tamper-evident, and efficient packaging tapes to handle the vast volumes of shipments. The Food and Beverage Industry is another substantial segment, requiring tapes that meet strict hygiene standards and can withstand varying storage and transportation conditions. The Retail Industry utilizes packaging tapes for product packaging, display, and inventory management.

Key drivers for dominance in these segments include economic policies supporting manufacturing and trade, extensive logistics networks, high levels of consumer demand, and stringent quality and safety regulations. The innovation in tape formulations, such as eco-friendly adhesives and enhanced performance characteristics, further solidifies the dominance of specific segments and regions.

Europe Packaging Tapes Market Product Innovations

Product innovations in the Europe Packaging Tapes Market are increasingly focused on sustainability and enhanced performance. Companies are developing packaging tapes utilizing recycled post-consumer PET backing material, incorporating water-based acrylic glue solutions for reduced environmental impact. Investments in increasing manufacturing capacity and factory efficiency are leading to the deployment of advanced technologies like high-speed, state-of-the-art hotmelt adhesive coaters. These innovations aim to meet the rising demand for labels and packaging materials, offering improved product properties such as higher tensile strength, better adhesion to diverse substrates, and tamper-evident features. The competitive advantage lies in offering sustainable, cost-effective, and high-performing solutions that cater to evolving end-user requirements.

Report Scope & Segmentation Analysis

This report provides a detailed analysis of the Europe Packaging Tapes Market, segmented comprehensively to offer granular insights. The Material Type segmentation includes Plastic and Paper tapes, each with distinct market penetration and growth projections influenced by their specific applications and environmental considerations. The Adhesive Type segmentation covers Acrylic, Hot Melt, Rubber-based, and Other Adhesive Types. Acrylic adhesives lead in current market share due to their versatility, while hot melt and rubber-based adhesives are crucial for specialized applications and high-speed operations. Growth projections vary based on application demands and technological advancements in each adhesive category. The End-user Industry segmentation encompasses E-Commerce, Food and Beverage Industry, Retail Industry, and Other End-user Industries. The e-commerce sector demonstrates the highest growth rate, driven by online retail expansion. The food and beverage and retail industries represent substantial and stable markets. Competitive dynamics within each segment are shaped by innovation, pricing strategies, and the ability to meet specific industry requirements, with each segment projected to witness steady market expansion.

Key Drivers of Europe Packaging Tapes Market Growth

The Europe Packaging Tapes Market growth is propelled by several key factors. The relentless expansion of the e-commerce sector is a primary driver, necessitating an increased volume of shipping and, consequently, packaging tapes. This is further amplified by evolving consumer expectations for secure and efficient delivery. A significant trend is the growing emphasis on sustainability, pushing for the development and adoption of tapes made from recycled materials and biodegradable substrates, aligning with stricter environmental regulations and corporate social responsibility initiatives. Technological advancements in adhesive formulations, leading to tapes with improved performance characteristics like higher tack, shear strength, and temperature resistance, also contribute significantly. Furthermore, the demand from the food and beverage industry for specialized tapes that ensure product integrity and shelf-life, coupled with the continuous needs of the retail industry for product protection and branding, provide a stable base for market expansion.

Challenges in the Europe Packaging Tapes Market Sector

Despite robust growth, the Europe Packaging Tapes Market faces several challenges. Stringent environmental regulations, particularly concerning plastic waste and single-use materials, can increase compliance costs and necessitate significant investment in sustainable alternatives. Fluctuations in raw material prices, such as petrochemicals for plastic films and specialty chemicals for adhesives, can impact profit margins and necessitate agile pricing strategies. Intense competition among numerous global and regional players can lead to price wars and pressure on innovation cycles. Furthermore, supply chain disruptions, as witnessed in recent years, can affect the availability and cost of raw materials and finished goods, impacting delivery timelines and operational efficiency. The development and adoption of truly cost-effective and high-performing biodegradable or compostable tape solutions remain a significant technical and economic hurdle.

Emerging Opportunities in Europe Packaging Tapes Market

Emerging opportunities in the Europe Packaging Tapes Market lie in several key areas. The growing demand for sustainable packaging solutions presents a significant avenue for companies focusing on recycled content, bio-based materials, and water-based adhesives. The continued expansion of e-commerce across new demographic segments and geographic regions within Europe offers potential for market penetration with specialized tapes designed for varying shipping needs and handling conditions. Innovation in smart packaging technologies, integrating features like tamper-evidence, track-and-trace capabilities, and anti-counterfeiting measures, represents a futuristic growth area. The increasing adoption of automation in logistics and warehousing creates opportunities for high-performance tapes compatible with advanced machinery, offering faster application speeds and enhanced security. Furthermore, the development of niche tapes for specialized industries, such as medical devices or sensitive electronics, catering to unique protection and sterility requirements, also presents lucrative prospects.

Leading Players in the Europe Packaging Tapes Market Market

The following companies are recognized as key players in the Europe Packaging Tapes Market. This list is not exhaustive, but it highlights prominent entities shaping the market landscape:

- The Sherwin-Williams Company

- Bulk Chemicals Inc

- Chemetall Inc

- Solvay

- Aalberts Surface Technologies GmbH

- PPG Industries Inc

- Atotech Deutschland GmbH

- DOW

- Henkel AG & Co Ltd

- Aalberts Surface Treatment

- Nippon Paint Holdings Co

- SOCOMORE

- Quaker Chemical Corporation

- Hoeller Electrolyzer GmbH

Key Developments in Europe Packaging Tapes Market Industry

- September 2022: Tesa SE developed a new packaging tape using recycled post-consumer PET backing material. The company is emphasizing sustainability by introducing a new product that has 70% recycled (PCR) PET and a water-based acrylic glue solution. This development directly addresses the growing market demand for eco-friendly packaging solutions and strengthens Tesa's position in the sustainable tape segment.

- May 2022: Avery Dennison Corporation announced two substantial investments in Europe to increase manufacturing capacity and improve factory efficiency to fulfill the rising demand for its label and packaging materials. The company stated that it is one year into a three-year development worth EUR 45 million (~USD 4.66 million) of its Champ-sur-Drac, France, facilities. Improvements include five new logistics buildings totaling more than 8,700 square meters, a new automated warehouse, and a new high-speed, state-of-the-art hotmelt adhesive coater, which is expected to be operational in 2024. These investments signal Avery Dennison's commitment to meeting increased market demand and enhancing its production capabilities, particularly in hotmelt adhesive technologies, which are crucial for high-volume packaging operations.

Future Outlook for Europe Packaging Tapes Market Market

The future outlook for the Europe Packaging Tapes Market remains exceptionally positive, driven by sustained growth in e-commerce and an unwavering commitment to sustainability. Projections indicate continued market expansion, with a significant shift towards eco-friendly and high-performance packaging tapes. Strategic opportunities lie in further innovation in biodegradable and recyclable materials, alongside advancements in adhesive technologies that offer superior bonding and environmental compliance. Investments in automated production facilities and R&D for smart packaging solutions will be crucial for companies aiming to maintain a competitive edge. Collaboration between material suppliers, tape manufacturers, and end-users will be instrumental in developing integrated packaging solutions that meet evolving regulatory demands and consumer preferences for both security and environmental responsibility. The market is poised for innovation, driven by a confluence of technological advancements, economic trends, and a global imperative for greener packaging.

Europe Packaging Tapes Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Paper

-

2. Adhesive Type

- 2.1. Acrylic

- 2.2. Hot Melt

- 2.3. Rubber-based

- 2.4. Other Adhesive Types

-

3. End-user Industry

- 3.1. E-Commerce

- 3.2. Food and Beverage Industry

- 3.3. Retail Industry

- 3.4. Othe End-user Industries

Europe Packaging Tapes Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. Rest of Europe

Europe Packaging Tapes Market Regional Market Share

Geographic Coverage of Europe Packaging Tapes Market

Europe Packaging Tapes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Economic Expansion; Growing demand for Packaging Materials

- 3.3. Market Restrains

- 3.3.1. Changes in Environmental Conditions are one of the Limitations Preventing the Adoption of the Packing Tape Market; Other Restraints

- 3.4. Market Trends

- 3.4.1. Rising Demand in the Food and Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Packaging Tapes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.2. Market Analysis, Insights and Forecast - by Adhesive Type

- 5.2.1. Acrylic

- 5.2.2. Hot Melt

- 5.2.3. Rubber-based

- 5.2.4. Other Adhesive Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. E-Commerce

- 5.3.2. Food and Beverage Industry

- 5.3.3. Retail Industry

- 5.3.4. Othe End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Italy

- 5.4.4. France

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Germany Europe Packaging Tapes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.2. Paper

- 6.2. Market Analysis, Insights and Forecast - by Adhesive Type

- 6.2.1. Acrylic

- 6.2.2. Hot Melt

- 6.2.3. Rubber-based

- 6.2.4. Other Adhesive Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. E-Commerce

- 6.3.2. Food and Beverage Industry

- 6.3.3. Retail Industry

- 6.3.4. Othe End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. United Kingdom Europe Packaging Tapes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.2. Paper

- 7.2. Market Analysis, Insights and Forecast - by Adhesive Type

- 7.2.1. Acrylic

- 7.2.2. Hot Melt

- 7.2.3. Rubber-based

- 7.2.4. Other Adhesive Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. E-Commerce

- 7.3.2. Food and Beverage Industry

- 7.3.3. Retail Industry

- 7.3.4. Othe End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Italy Europe Packaging Tapes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.2. Paper

- 8.2. Market Analysis, Insights and Forecast - by Adhesive Type

- 8.2.1. Acrylic

- 8.2.2. Hot Melt

- 8.2.3. Rubber-based

- 8.2.4. Other Adhesive Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. E-Commerce

- 8.3.2. Food and Beverage Industry

- 8.3.3. Retail Industry

- 8.3.4. Othe End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. France Europe Packaging Tapes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.2. Paper

- 9.2. Market Analysis, Insights and Forecast - by Adhesive Type

- 9.2.1. Acrylic

- 9.2.2. Hot Melt

- 9.2.3. Rubber-based

- 9.2.4. Other Adhesive Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. E-Commerce

- 9.3.2. Food and Beverage Industry

- 9.3.3. Retail Industry

- 9.3.4. Othe End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Spain Europe Packaging Tapes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.2. Paper

- 10.2. Market Analysis, Insights and Forecast - by Adhesive Type

- 10.2.1. Acrylic

- 10.2.2. Hot Melt

- 10.2.3. Rubber-based

- 10.2.4. Other Adhesive Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. E-Commerce

- 10.3.2. Food and Beverage Industry

- 10.3.3. Retail Industry

- 10.3.4. Othe End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Rest of Europe Europe Packaging Tapes Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Material Type

- 11.1.1. Plastic

- 11.1.2. Paper

- 11.2. Market Analysis, Insights and Forecast - by Adhesive Type

- 11.2.1. Acrylic

- 11.2.2. Hot Melt

- 11.2.3. Rubber-based

- 11.2.4. Other Adhesive Types

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. E-Commerce

- 11.3.2. Food and Beverage Industry

- 11.3.3. Retail Industry

- 11.3.4. Othe End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Material Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bulk Chemicals Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Chemetall Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Solvay

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aalberts Surface Technologies GmbH

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PPG Industries Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Atotech Deutschland GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 DOW

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Henkel AG & Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Aalberts Surface Treatment

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nippon Paint Holdings Co

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 SOCOMORE

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Quaker Chemical Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Hoeller Electrolyzer GmbH

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: Europe Packaging Tapes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Packaging Tapes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Packaging Tapes Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Europe Packaging Tapes Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 3: Europe Packaging Tapes Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Packaging Tapes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Packaging Tapes Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Europe Packaging Tapes Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 7: Europe Packaging Tapes Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Packaging Tapes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Packaging Tapes Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: Europe Packaging Tapes Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 11: Europe Packaging Tapes Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Europe Packaging Tapes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Packaging Tapes Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: Europe Packaging Tapes Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 15: Europe Packaging Tapes Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Europe Packaging Tapes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Packaging Tapes Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Europe Packaging Tapes Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 19: Europe Packaging Tapes Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Europe Packaging Tapes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Packaging Tapes Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 22: Europe Packaging Tapes Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 23: Europe Packaging Tapes Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Europe Packaging Tapes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Europe Packaging Tapes Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 26: Europe Packaging Tapes Market Revenue billion Forecast, by Adhesive Type 2020 & 2033

- Table 27: Europe Packaging Tapes Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Europe Packaging Tapes Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Packaging Tapes Market?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the Europe Packaging Tapes Market?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, Bulk Chemicals Inc, Chemetall Inc, Solvay, Aalberts Surface Technologies GmbH, PPG Industries Inc, Atotech Deutschland GmbH, DOW, Henkel AG & Co Ltd, Aalberts Surface Treatment, Nippon Paint Holdings Co, SOCOMORE, Quaker Chemical Corporation, Hoeller Electrolyzer GmbH.

3. What are the main segments of the Europe Packaging Tapes Market?

The market segments include Material Type, Adhesive Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Economic Expansion; Growing demand for Packaging Materials.

6. What are the notable trends driving market growth?

Rising Demand in the Food and Beverage Industry.

7. Are there any restraints impacting market growth?

Changes in Environmental Conditions are one of the Limitations Preventing the Adoption of the Packing Tape Market; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: Tesa SE developed a new packaging tape using recycled post-consumer PET backing material. The company is emphasizing sustainability by introducing a new product that has 70% recycled (PCR) PET and a water-based acrylic glue solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Packaging Tapes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Packaging Tapes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Packaging Tapes Market?

To stay informed about further developments, trends, and reports in the Europe Packaging Tapes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence