Key Insights

The European satellite launch vehicle market, valued at €8.39 billion in 2025, is poised for substantial growth. This expansion is fueled by escalating demand for satellite-derived services across telecommunications, navigation, Earth observation, and defense sectors. A projected Compound Annual Growth Rate (CAGR) of 14.22% from 2025 to 2033 signifies significant market acceleration. Key growth drivers include the increasing deployment of small satellites for diverse applications, technological advancements in launch vehicles enhancing efficiency and reducing costs, and supportive EU policies promoting space exploration and innovation. Germany, France, and the United Kingdom are anticipated to lead national markets due to their established space industries and R&D capabilities. However, intense global competition and the imperative for continuous technological advancement present potential market restraints. The medium-sized launch vehicle segment is expected to dominate, driven by its cost-effectiveness and suitability for a wide array of satellite payloads. The growing emphasis on reusable launch systems promises further cost reductions and increased launch frequency.

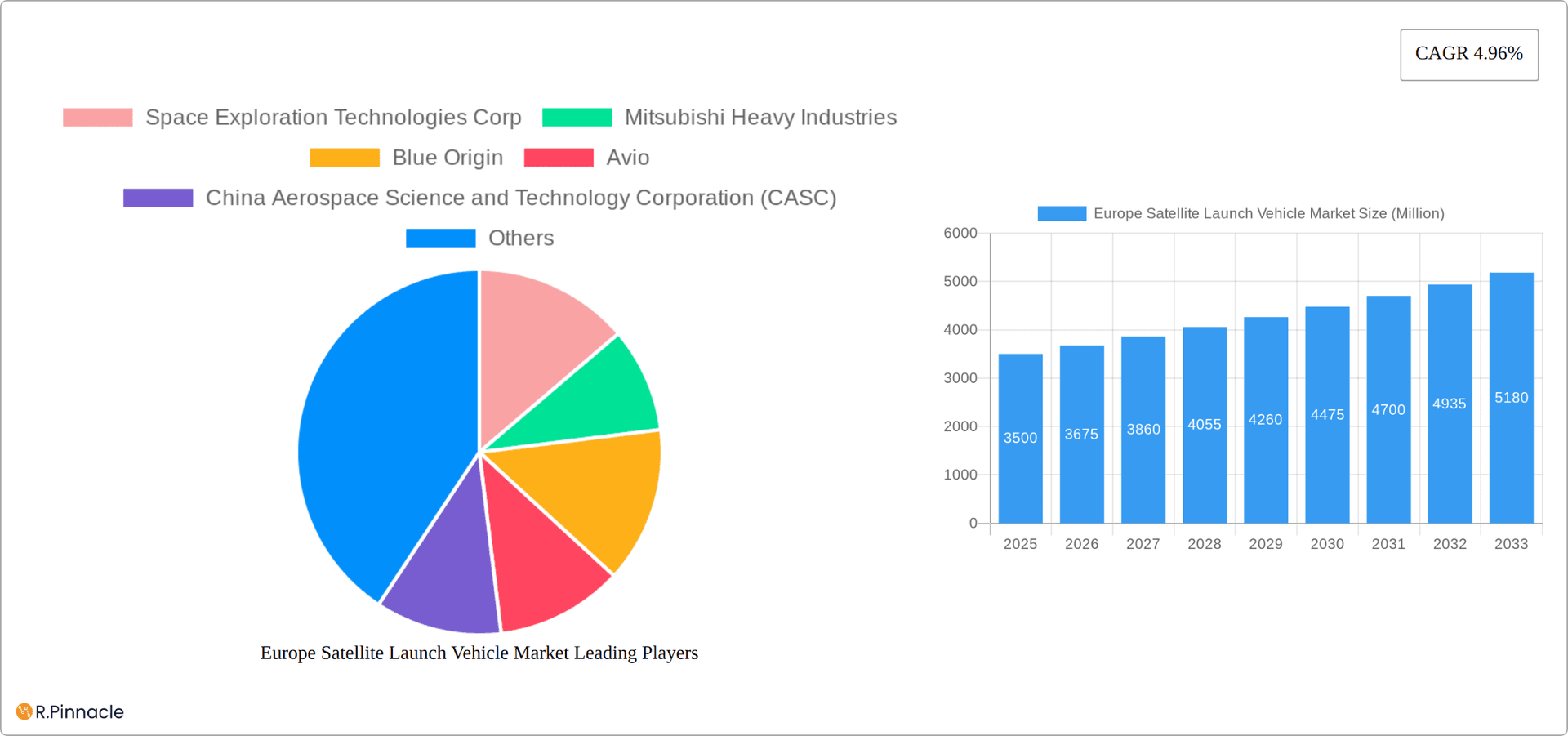

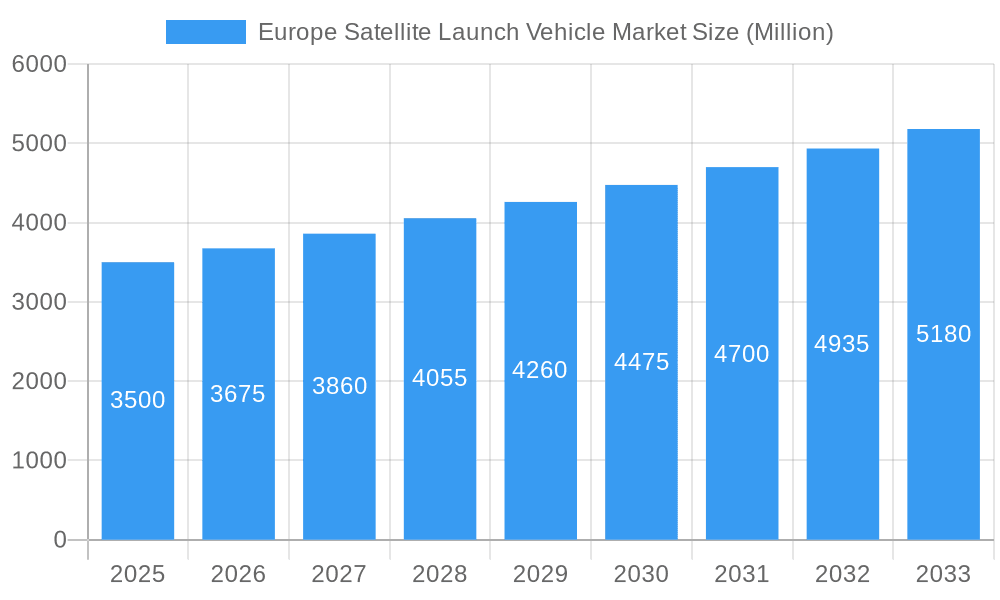

Europe Satellite Launch Vehicle Market Market Size (In Billion)

The competitive environment features a blend of established entities and emerging companies, fostering innovation. Increased private sector participation is further stimulating market growth. Geopolitical developments and international collaborations will influence the market's trajectory. Successful partnerships between European nations and private sector organizations are crucial for innovation and maintaining a leading global position. Government initiatives to cultivate a robust space economy, alongside rising private investment, will likely propel market growth and attract further investment. The ongoing trend of satellite miniaturization is also expected to benefit the market, supporting the growth of small launch vehicles and potentially increasing overall launch frequency.

Europe Satellite Launch Vehicle Market Company Market Share

European Satellite Launch Vehicle Market Analysis and Forecast (2025-2033)

This comprehensive report offers in-depth analysis of the European Satellite Launch Vehicle Market, providing critical insights for industry professionals, investors, and strategic decision-makers. Covering the period 2025-2033, with 2025 as the base year, the analysis includes detailed segmentation by orbit class (GEO, LEO, MEO), launch vehicle MTOW (Heavy, Interplanetary, Light, Medium), and key countries. The report scrutinizes the competitive landscape, highlighting key players and their strategies. Expect robust, data-driven analysis, including market size projections, CAGR estimations, and the identification of emerging opportunities and challenges.

Europe Satellite Launch Vehicle Market Structure & Innovation Trends

The European Satellite Launch Vehicle market exhibits a moderately concentrated structure, with a few major players holding significant market share. ArianeGroup, for example, historically held a substantial share of the European market, but faces growing competition from newer entrants and international players. The market share of key players like SpaceX, Blue Origin, and Rocket Lab is rapidly evolving, driven by innovative launch vehicle designs and business models. The market is characterized by significant innovation, spurred by advancements in reusable launch technologies, reducing launch costs and increasing accessibility. Regulatory frameworks within Europe, such as those governing space debris mitigation and licensing, significantly influence market activity. The presence of both established aerospace companies and ambitious startups creates a dynamic competitive environment, fostering M&A activity. The total value of M&A deals within this sector between 2019 and 2024 reached approximately xx Million, signaling significant consolidation and strategic positioning in the market. Product substitutes, primarily existing ground-based communication infrastructure, still present competition, particularly in certain market segments. The end-user demographics are diverse, encompassing government agencies, commercial satellite operators, and research institutions.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation Drivers: Reusable launch vehicles, advanced propulsion systems, miniaturization of satellites.

- Regulatory Framework: Significant influence on market activity, particularly regarding space debris and licensing.

- M&A Activity: Significant consolidation and strategic positioning, with a total deal value of approximately xx Million (2019-2024).

- Product Substitutes: Ground-based communication infrastructure.

- End-User Demographics: Government agencies, commercial satellite operators, and research institutions.

Europe Satellite Launch Vehicle Market Dynamics & Trends

The European Satellite Launch Vehicle market is experiencing significant growth, driven by increasing demand for satellite-based services across various sectors, including telecommunications, navigation, earth observation, and defense. Technological disruptions, such as the emergence of reusable launch vehicles, are fundamentally altering cost structures and accessibility. Consumer preferences are shifting towards more reliable, cost-effective, and frequent launch services. The competitive dynamics are intense, with both established players and new entrants vying for market share. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing government investments in space exploration, growing commercial satellite constellations, and the demand for higher bandwidth and data capacity. Market penetration of reusable launch technologies is expected to increase significantly by 2033, further shaping the market landscape.

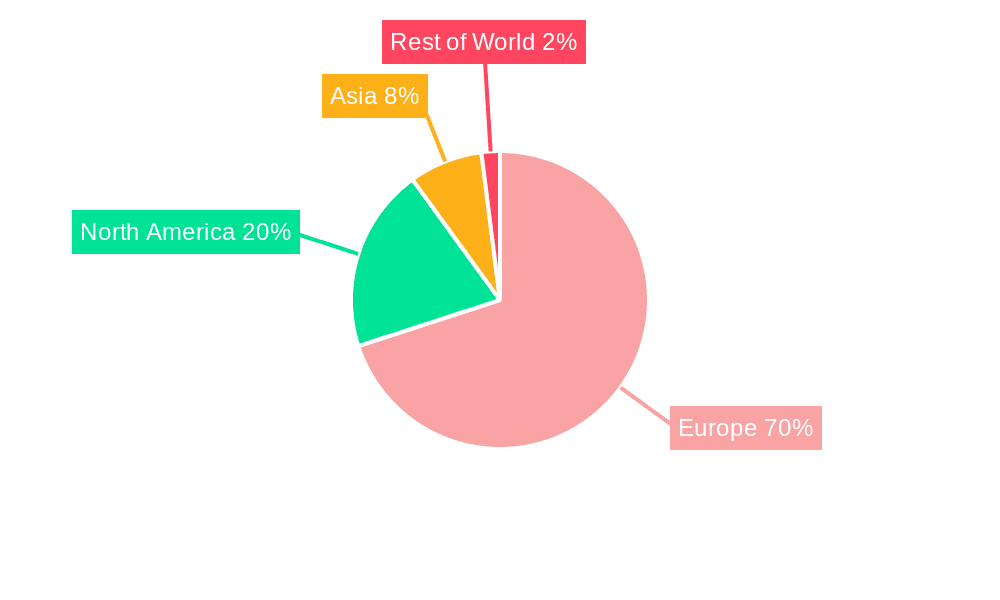

Dominant Regions & Segments in Europe Satellite Launch Vehicle Market

While the entire European market is significant, specific regions and segments show greater dynamism. Russia, with its extensive space heritage and established launch infrastructure, remains a prominent player, particularly in the heavy-lift launch vehicle segment. The LEO segment is experiencing the most rapid growth due to the increasing demand for low-earth orbit constellations for various applications like broadband internet access.

Key Drivers for Russia's Dominance:

- Extensive experience in rocketry and space exploration.

- Established launch infrastructure and facilities.

- Strong governmental support and investment in the space sector.

Key Drivers for LEO Segment Dominance:

- Increasing demand for broadband internet connectivity via satellite constellations.

- Growing adoption of small satellites and CubeSats.

- Cost-effectiveness compared to higher-orbit options.

The analysis details the market size and growth projections for each segment, highlighting the competitive landscape and strategic implications for different stakeholders.

Europe Satellite Launch Vehicle Market Product Innovations

Recent innovations focus on reusable launch systems, reducing launch costs and increasing launch frequency. Improved propulsion systems, lighter materials, and advanced guidance systems are enhancing vehicle performance and reliability. These innovations cater to the growing market demand for cost-effective and reliable satellite deployment services, while simultaneously fostering competitiveness amongst market players. The market is seeing a shift towards modular and flexible launch vehicle designs, allowing for greater customization and adaptability to varying mission requirements.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the European Satellite Launch Vehicle Market across several pivotal dimensions, offering deep insights into market dynamics and growth drivers:

- Orbit Class: The market is analyzed by GEO (Geostationary Earth Orbit), LEO (Low Earth Orbit), and MEO (Medium Earth Orbit). Each orbit class is characterized by distinct market dynamics, driven by specific application requirements and technological advancements. Growth projections exhibit significant variation across these classes, with LEO currently experiencing a period of rapid expansion fueled by the burgeoning demand for high-speed broadband internet constellations and Earth observation services.

- Launch Vehicle MTOW (Maximum Take-Off Weight): Segmentation includes Heavy-lift, Interplanetary, Light, and Medium launch vehicles. This classification directly reflects the payload capacity and diverse application range of different launch systems. Heavy-lift launchers remain indispensable for deploying large, complex satellite payloads, while smaller, more agile vehicles are increasingly catering to the trend of satellite miniaturization and the burgeoning small satellite market. Market dynamics are further influenced by the varying demand for specific launch capabilities, from single large satellite deployments to rideshare missions.

- Country: A detailed geographical breakdown includes Russia and other European countries. This segmentation highlights the varying levels of space industry development, government investment, regulatory frameworks, and indigenous launch capabilities present across different European nations. The analysis provides a nuanced understanding of regional market strengths and emerging opportunities.

Each analyzed segment presents unique strategic opportunities and inherent challenges. The report offers detailed market size estimations and in-depth competitive landscape analyses for every segment, culminating in a thorough and actionable understanding of the European Satellite Launch Vehicle Market.

Key Drivers of Europe Satellite Launch Vehicle Market Growth

Several factors fuel the European Satellite Launch Vehicle market's growth: increasing demand for satellite-based services, technological advancements in launch vehicle technology (like reusable rockets), rising government investment in space exploration, and the proliferation of small satellite constellations for various applications including Earth observation, broadband internet, and navigation. Furthermore, supportive regulatory frameworks in some European countries are encouraging private investment and innovation in the sector.

Challenges in the Europe Satellite Launch Vehicle Market Sector

The European Satellite Launch Vehicle Market is navigating a complex landscape shaped by several significant challenges. Chief among these are the prohibitively high initial investment costs associated with the research, development, and manufacturing of new launch vehicles, coupled with the stringent and evolving safety and regulatory requirements mandated by space agencies and international bodies. Ensuring robust and resilient supply chain management for critical components and services is paramount, especially in an increasingly interconnected global industry. The sector also grapples with intense competition from both established global players and agile new entrants, driving a constant need for innovation and cost optimization. Furthermore, persistent geopolitical uncertainties can significantly impact launch schedules, international collaborations, and access to key markets, contributing to inherent market volatility. The growing concern over space debris poses a significant operational challenge, impacting launch safety and requiring substantial investment in mitigation and remediation strategies. These multifaceted challenges collectively influence profitability, market accessibility, and the overall pace of growth within the sector.

Emerging Opportunities in Europe Satellite Launch Vehicle Market

Emerging opportunities exist in developing reusable launch systems, offering cost-effective solutions and increasing launch frequency. The increasing use of small satellites and constellations opens new opportunities for smaller launch vehicles. Furthermore, partnerships and collaborations between private companies and government agencies can unlock further potential. The development of new propulsion systems and advanced materials presents opportunities for enhancing vehicle performance and reducing environmental impact. Finally, the expansion into new markets and applications, such as space tourism, will drive further growth.

Leading Players in the Europe Satellite Launch Vehicle Market Market

- Space Exploration Technologies Corp (SpaceX)

- Mitsubishi Heavy Industries (Mitsubishi Heavy Industries)

- Blue Origin (Blue Origin)

- Avio

- China Aerospace Science and Technology Corporation (CASC)

- Ariane Group (Ariane Group)

- Virgin Orbit (Virgin Orbit)

- ROSCOSMOS

- Rocket Lab USA Inc (Rocket Lab)

- Indian Space Research Organisation (ISRO)

- The Boeing Company (Boeing)

Key Developments in Europe Satellite Launch Vehicle Market Industry

- March 2023: ISRO successfully launched 36 OneWeb communication satellites into LEO aboard its LVM3 rocket, demonstrating the growing demand for LEO constellations.

- April 2022: The Long March 3B rocket launched the Chinasat 6D communications satellite, highlighting the continued activity in the geostationary orbit segment.

- March 2022: Boeing and MT Aerospace AG signed a contract to supply structural components for NASA's SLS, demonstrating ongoing collaboration and investment in large-scale launch systems.

Future Outlook for Europe Satellite Launch Vehicle Market Market

The European Satellite Launch Vehicle market is poised for continued growth, driven by increasing demand for satellite-based services, technological advancements, and supportive government policies. Reusable launch systems will play a key role in shaping the market landscape, reducing launch costs and improving accessibility. The market is expected to witness significant consolidation and strategic partnerships as companies strive for market leadership. The continued miniaturization of satellites and the rising adoption of mega-constellations in LEO will stimulate further growth. New applications, such as space tourism and increased focus on sustainable space practices, will further define future market dynamics.

Europe Satellite Launch Vehicle Market Segmentation

-

1. Orbit Class

- 1.1. GEO

- 1.2. LEO

- 1.3. MEO

-

2. Launch Vehicle Mtow

- 2.1. Heavy

- 2.2. Inter Planetary

- 2.3. Light

- 2.4. Medium

Europe Satellite Launch Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Satellite Launch Vehicle Market Regional Market Share

Geographic Coverage of Europe Satellite Launch Vehicle Market

Europe Satellite Launch Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Orbit Class

- 5.1.1. GEO

- 5.1.2. LEO

- 5.1.3. MEO

- 5.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 5.2.1. Heavy

- 5.2.2. Inter Planetary

- 5.2.3. Light

- 5.2.4. Medium

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Orbit Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Heavy Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Origin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Avio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Aerospace Science and Technology Corporation (CASC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ariane Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Virgin Orbi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ROSCOSMOS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rocket Lab USA Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indian Space Research Organisation (ISRO)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Boeing Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Europe Satellite Launch Vehicle Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Satellite Launch Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 2: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 3: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 5: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 6: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Satellite Launch Vehicle Market?

The projected CAGR is approximately 14.22%.

2. Which companies are prominent players in the Europe Satellite Launch Vehicle Market?

Key companies in the market include Space Exploration Technologies Corp, Mitsubishi Heavy Industries, Blue Origin, Avio, China Aerospace Science and Technology Corporation (CASC), Ariane Group, Virgin Orbi, ROSCOSMOS, Rocket Lab USA Inc, Indian Space Research Organisation (ISRO), The Boeing Company.

3. What are the main segments of the Europe Satellite Launch Vehicle Market?

The market segments include Orbit Class, Launch Vehicle Mtow.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: ISRO launched 36 communication satellites of Oneweb aboarding its LVM3 rocket into LEO.April 2022: The Long March 3B rocket was launched from the Xichang launch base with the Chinasat 6D, or Zhongxing 6D, communications satellite.March 2022: Boeing and MT Aerospace AG, which is a subsidiary of OHB SE, have signed a contract to supply structural components for NASA's Space Launch System (SLS)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Satellite Launch Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Satellite Launch Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Satellite Launch Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Satellite Launch Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence