Key Insights

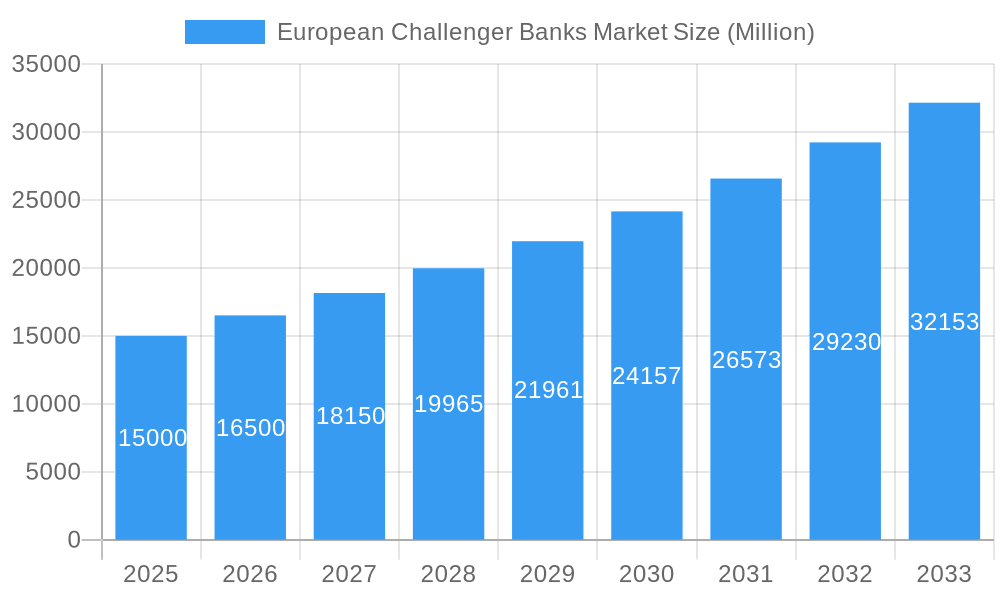

The European challenger bank market is poised for significant expansion, driven by escalating customer demand for digital-first banking and personalized financial services. With a projected Compound Annual Growth Rate (CAGR) of 46.7%, the market is expected to reach 35875.26 million by 2024. Key growth drivers include widespread smartphone adoption, mobile banking prevalence, fintech innovation, and a preference for streamlined, customer-centric experiences. Dissatisfaction with traditional banking models further enhances the competitive advantage of challenger banks. Leading institutions such as Revolut, Monzo, and Starling Bank are capitalizing on this trend with competitive fees, intuitive interfaces, and innovative features like budgeting tools and global money transfers.

European Challenger Banks Market Market Size (In Billion)

The market is further segmented by service offerings (personal and business banking), target demographics (young adults, SMEs), and geographic regions. The competitive environment is dynamic, with established players and emerging fintechs continuously vying for market share through technological advancements, product differentiation, and strategic alliances. The forecast period indicates sustained growth, fueled by evolving customer expectations and continuous innovation within the sector.

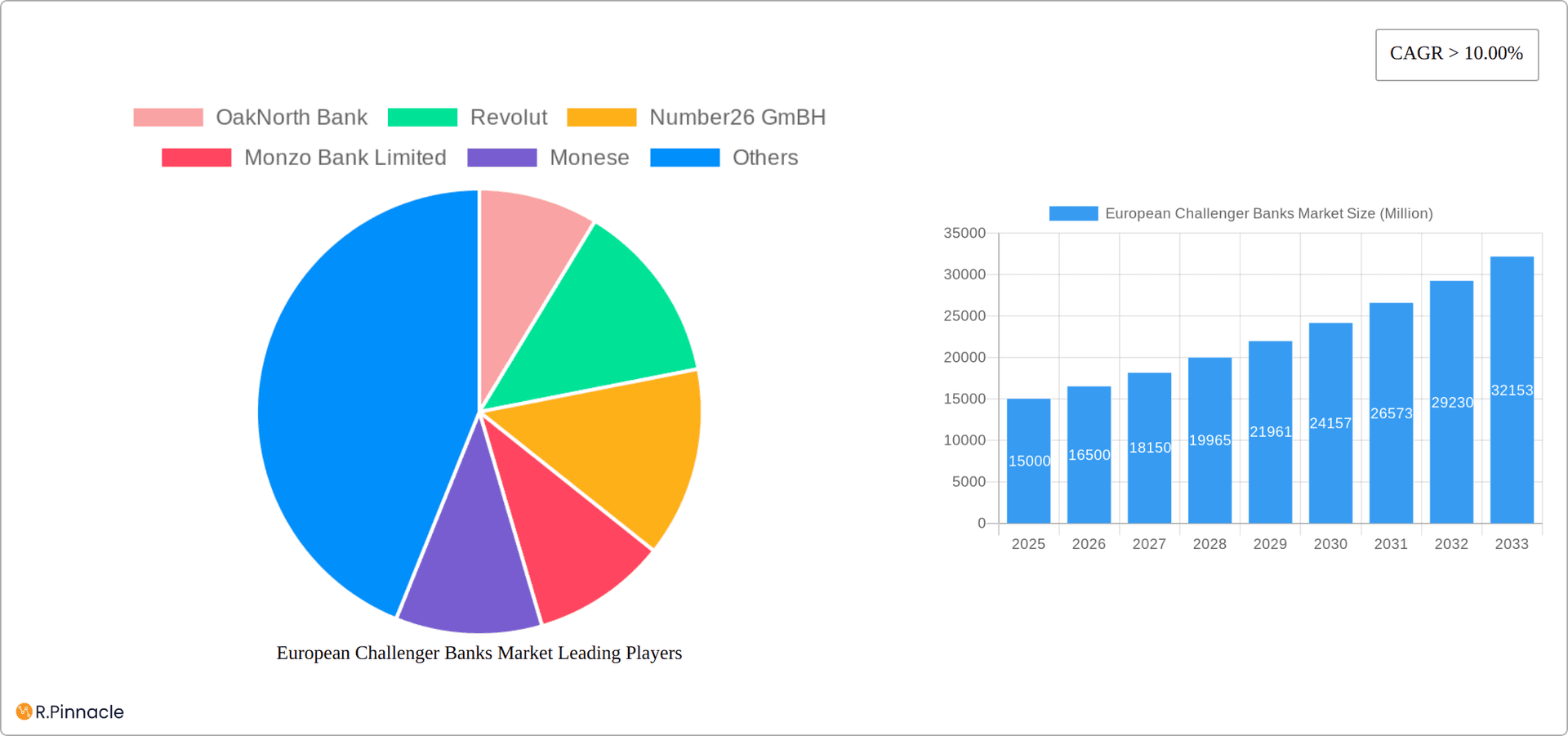

European Challenger Banks Market Company Market Share

European Challenger Banks Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European Challenger Banks Market, covering market structure, innovation trends, dynamics, dominant regions, product innovations, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report leverages extensive data from the historical period (2019-2024) to provide actionable insights for industry professionals. The European Challenger Banks Market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

European Challenger Banks Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment shaping the European Challenger Banks Market. Market concentration is relatively high, with several key players holding significant market share. However, continuous innovation and entry of new players are disrupting the traditional banking landscape.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: Technological advancements (e.g., AI, blockchain), evolving customer expectations, and regulatory changes are key drivers of innovation.

- Regulatory Framework: Stringent regulatory frameworks, including PSD2 and GDPR, impact market operations and compliance.

- M&A Activity: The market witnessed significant M&A activity, with notable deals including OakNorth Bank's acquisition of a 50% stake in ASK Partners in October 2022, signifying a consolidation trend within the sector. The total value of M&A deals in the European Challenger Banks Market from 2019-2024 is estimated at xx Million.

- Product Substitutes: Fintech companies and other non-traditional financial service providers pose a competitive threat.

- End-User Demographics: The target demographic is expanding beyond millennials, encompassing a broader range of age groups and income levels.

European Challenger Banks Market Market Dynamics & Trends

The European Challenger Banks Market is experiencing robust growth, fueled by several key factors. Technological disruptions, changing consumer preferences, and intense competition are reshaping the market dynamics. The market is expected to reach xx Million by 2033, driven by factors such as increased smartphone penetration, growing adoption of digital banking services, and the rising demand for personalized financial solutions.

Market growth is also driven by factors like increasing financial inclusion, the demand for superior customer experience, and the advantages offered by challenger banks such as lower fees and faster service. The market penetration of challenger banks is expected to increase from xx% in 2025 to xx% by 2033. This expansion is further fueled by factors such as increased government support for fintech startups, favorable regulatory environment in some regions, and the adoption of open banking principles. However, challenges such as cybersecurity threats and regulatory compliance remain.

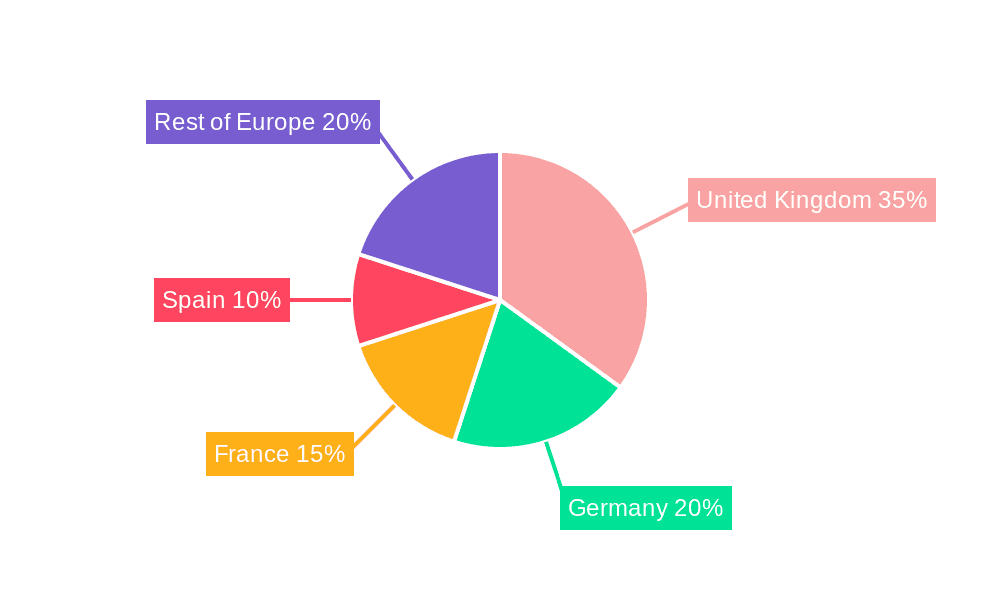

Dominant Regions & Segments in European Challenger Banks Market

The United Kingdom currently leads the European Challenger Banks Market, propelled by a robust fintech ecosystem, supportive regulatory frameworks, and high smartphone penetration. Germany, France, and the Nordics represent other key regions exhibiting substantial growth potential.

- Key Drivers for UK Dominance:

- A thriving fintech ecosystem and proactive government policies.

- High adoption rates of digital banking services and a digitally-savvy population.

- The presence of established and rapidly expanding challenger banks such as Revolut and Monzo, setting a high benchmark for innovation.

- Other Dominant Regions: Germany, France, and the Nordics demonstrate significant growth potential, driven by increasing digitalization and the burgeoning demand for innovative financial solutions tailored to evolving customer needs.

European Challenger Banks Market Product Innovations

Challenger banks are continuously innovating their product offerings to meet evolving customer needs. Key product innovations include personalized financial management tools, advanced AI-powered chatbots for customer service, and seamless integration with other financial platforms. These innovations aim to enhance customer experience, improve operational efficiency, and expand market reach. The focus on mobile-first solutions and personalized financial planning tools is expected to drive further growth in the coming years.

Report Scope & Segmentation Analysis

This report segments the European Challenger Banks Market based on several key parameters: types of banking services offered (current accounts, savings accounts, loans, investment products etc.), business models (direct-to-consumer (D2C), business-to-business (B2B), and hybrid models), and geographic regions (UK, Germany, France, Spain, Italy, Nordics, and others). Each segment exhibits unique growth trajectories and competitive dynamics. For example, the current accounts segment is projected to experience the highest growth rate, driven by the increasing preference for convenient and cost-effective banking options. The report provides a detailed analysis of each segment, offering insights into market size, growth projections, and key competitive players.

Key Drivers of European Challenger Banks Market Growth

Several key factors are propelling the growth of the European Challenger Banks Market. Significant technological advancements, including artificial intelligence (AI) and machine learning (ML), are enabling the development of personalized services and highly efficient operational processes. Supportive regulatory frameworks in specific regions are fostering innovation and encouraging healthy competition. The evolving consumer preference for digital and mobile-first banking solutions is creating substantial demand. Finally, the increasing integration of open banking APIs is a major catalyst for growth, facilitating seamless data sharing and leading to significantly enhanced customer experiences.

Challenges in the European Challenger Banks Market Sector

The European Challenger Banks Market faces several challenges. Stringent regulatory compliance requirements and the need for significant investments in technology are major hurdles. Competition from established players and other fintech companies also exerts pressure on margins and market share. Cybersecurity threats and data privacy concerns pose risks to customer trust and operational stability. Estimates suggest that regulatory compliance costs account for approximately xx% of total operational expenses for challenger banks.

Emerging Opportunities in European Challenger Banks Market

The European Challenger Banks Market presents significant opportunities for growth. Expansion into underserved markets, leveraging embedded finance solutions, and developing innovative financial products tailored to specific customer segments are key strategies. The increasing adoption of blockchain technology and the exploration of decentralized finance (DeFi) applications represent further opportunities for innovation and disruption.

Leading Players in the European Challenger Banks Market Market

- OakNorth Bank

- Revolut

- Number26 GmBH

- Monzo Bank Limited

- Monese

- Tandem Bank

- Pockit

- One Savings Bank

- Shawbrook Bank

- Aldermore

- Atom Bank PLc

- TSB

- Clydesdale

- Virgin Bank

- Metro Bank

- Starling Bank

- Fidor Solutions AG

Key Developments in European Challenger Banks Market Industry

- October 2022: OakNorth Bank's acquisition of a 50% stake in property lender ASK Partners significantly expanded its lending capabilities and market reach within the UK property sector.

- July 2021: Revolut's USD 800 million funding round, resulting in a USD 33 billion valuation, demonstrated the significant investor confidence in the company's potential and fueled its expansion into new markets and the development of its comprehensive financial services super app.

- [Add more recent key developments here with dates and concise descriptions. Include mergers, acquisitions, new product launches, regulatory changes, etc.]

Future Outlook for European Challenger Banks Market Market

The European Challenger Banks Market is poised for continued growth, driven by technological advancements, changing consumer expectations, and increasing financial inclusion. The market will likely witness further consolidation through mergers and acquisitions, as well as the emergence of new innovative business models and partnerships. The focus on enhancing customer experience, strengthening cybersecurity measures, and adapting to evolving regulatory landscapes will be critical for success in the coming years.

European Challenger Banks Market Segmentation

-

1. Service Type

- 1.1. Payments

- 1.2. Savings Products

- 1.3. Current Account

- 1.4. Consumer Credit

- 1.5. Loans

- 1.6. Others

-

2. End-User Type

- 2.1. Business Segment

- 2.2. Personal Segment

European Challenger Banks Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Challenger Banks Market Regional Market Share

Geographic Coverage of European Challenger Banks Market

European Challenger Banks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 46.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Challenger Banks are Gaining Traction in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Challenger Banks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Payments

- 5.1.2. Savings Products

- 5.1.3. Current Account

- 5.1.4. Consumer Credit

- 5.1.5. Loans

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User Type

- 5.2.1. Business Segment

- 5.2.2. Personal Segment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OakNorth Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Revolut

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Number26 GmBH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Monzo Bank Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monese

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tandem Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pockit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 One Savings Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shawbrook Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aldermore

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Atom Bank PLc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 TSB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Clydesdale

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Virgin Bank

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Metro Bank

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Starling Bank

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Fidor Solutions AG**List Not Exhaustive

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 OakNorth Bank

List of Figures

- Figure 1: European Challenger Banks Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: European Challenger Banks Market Share (%) by Company 2025

List of Tables

- Table 1: European Challenger Banks Market Revenue million Forecast, by Service Type 2020 & 2033

- Table 2: European Challenger Banks Market Revenue million Forecast, by End-User Type 2020 & 2033

- Table 3: European Challenger Banks Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: European Challenger Banks Market Revenue million Forecast, by Service Type 2020 & 2033

- Table 5: European Challenger Banks Market Revenue million Forecast, by End-User Type 2020 & 2033

- Table 6: European Challenger Banks Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark European Challenger Banks Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Challenger Banks Market?

The projected CAGR is approximately 46.7%.

2. Which companies are prominent players in the European Challenger Banks Market?

Key companies in the market include OakNorth Bank, Revolut, Number26 GmBH, Monzo Bank Limited, Monese, Tandem Bank, Pockit, One Savings Bank, Shawbrook Bank, Aldermore, Atom Bank PLc, TSB, Clydesdale, Virgin Bank, Metro Bank, Starling Bank, Fidor Solutions AG**List Not Exhaustive.

3. What are the main segments of the European Challenger Banks Market?

The market segments include Service Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 35875.26 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Challenger Banks are Gaining Traction in Europe.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, OakNorth Bank acquired a 50% stake in property lender ASK Partners. The company has lent in excess of £1bn across over 90 transactions through its online platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Challenger Banks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Challenger Banks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Challenger Banks Market?

To stay informed about further developments, trends, and reports in the European Challenger Banks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence