Key Insights

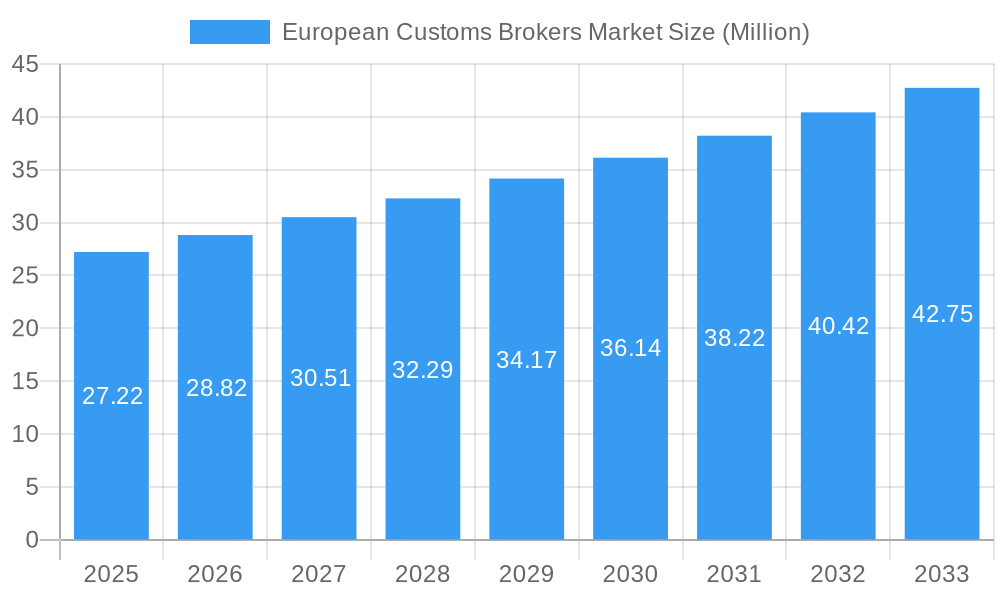

The European customs brokers market is poised for significant expansion, projected to reach a substantial valuation of $27.22 million with a robust Compound Annual Growth Rate (CAGR) of 5.81% between 2025 and 2033. This upward trajectory is primarily fueled by the increasing complexity of international trade regulations, the burgeoning volume of cross-border e-commerce, and the ongoing efforts by businesses to streamline their supply chains for greater efficiency. As trade agreements evolve and geopolitical landscapes shift, the demand for expert customs brokerage services to navigate intricate tariff structures, compliance requirements, and documentation processes will only intensify. Furthermore, the drive towards digital transformation within logistics and trade facilitation, including the adoption of advanced data analytics and automation, is creating new avenues for service innovation and market growth.

European Customs Brokers Market Market Size (In Million)

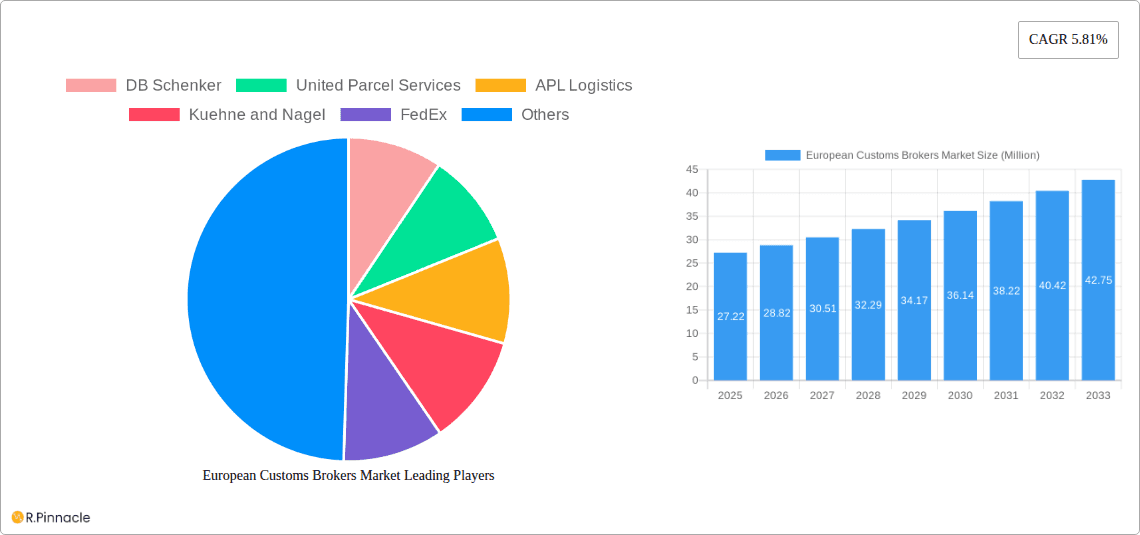

The market is segmented across key modes of transport, with Sea, Air, and Cross-Border Land Transport all contributing to the overall demand for customs brokerage expertise. Leading companies such as DB Schenker, United Parcel Service, APL Logistics, Kuehne + Nagel, FedEx, Maersk Logistics, and DHL Group Logistics are actively shaping this landscape through strategic investments in technology and expanding their service portfolios. Emerging players and established customs specialists like Gaston Schul Logistics and Gerlach Customs are also vying for market share. Geographically, Germany, the United Kingdom, France, the Netherlands, and Italy represent the core markets, with the "Rest of Europe" also demonstrating considerable growth potential. The market's resilience is underscored by its ability to adapt to evolving trade policies and technological advancements, making it a critical component of Europe's interconnected economy.

European Customs Brokers Market Company Market Share

Navigate the complexities of the European customs brokerage landscape with this in-depth market intelligence report. Designed for industry professionals, logistics providers, and strategic planners, this analysis provides critical insights into market structure, dynamics, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this report leverages high-ranking keywords to ensure maximum search visibility and deliver actionable intelligence. Understand market concentration, regulatory evolution, technological advancements, and key growth drivers shaping the European Customs Brokers Market.

European Customs Brokers Market Market Structure & Innovation Trends

The European Customs Brokers Market exhibits a moderately concentrated structure, with a significant presence of established global players alongside specialized regional firms. Innovation is primarily driven by the increasing demand for digital solutions, automation in customs declaration processes, and the need for enhanced compliance management. Regulatory frameworks, such as the Union Customs Code (UCC), continue to influence operational standards and necessitate continuous adaptation. Product substitutes are limited given the mandated nature of customs brokerage, but efficiency gains through technology represent a key competitive advantage. End-user demographics span a wide range, from large multinational corporations requiring extensive import/export services to SMEs seeking simplified compliance solutions. Mergers and acquisitions (M&A) remain a pivotal strategy for consolidation and capability expansion. For instance, December 2023: Kuehne Nagel finalized the acquisition of customs broker Farrow, aiming to bolster its North American customs capabilities and operations at US-Canadian and Mexican borders, with expected completion in Q1 2024. This strategic move underscores the trend of customs brokerage acquisition for market share growth and service diversification.

- Market Concentration: Moderate, with a mix of large global logistics providers and niche customs specialists.

- Innovation Drivers: Digitalization, automation, AI in customs, regulatory compliance software.

- Regulatory Frameworks: Union Customs Code (UCC), national customs regulations.

- Product Substitutes: Limited, but efficiency and technology integration offer competitive edge.

- End-User Demographics: Multinational corporations, SMEs, e-commerce businesses.

- M&A Activities: Key strategy for market consolidation and service expansion.

European Customs Brokers Market Market Dynamics & Trends

The European Customs Brokers Market is experiencing robust growth, propelled by increasing cross-border trade volumes, the burgeoning e-commerce sector, and the ongoing complexities of international trade regulations. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). Technological disruptions are at the forefront of market evolution, with the adoption of Artificial Intelligence (AI) for automated document processing, blockchain for enhanced supply chain transparency and security, and cloud-based platforms for streamlined communication and data management. Consumer preferences are increasingly leaning towards integrated logistics solutions that offer end-to-end visibility and simplified customs clearance. Competitive dynamics are characterized by a race for digital transformation, service customization, and strategic partnerships to enhance global reach and efficiency. Market penetration is high across major European economies, with significant opportunities for expansion in emerging markets and specialized industry verticals. The ongoing geopolitical shifts and the potential for new trade agreements also present dynamic challenges and opportunities.

- Growth Drivers: Rising trade volumes, e-commerce expansion, supply chain resilience needs.

- Technological Disruptions: AI for automation, blockchain for transparency, cloud platforms.

- Consumer Preferences: Integrated solutions, end-to-end visibility, expedited clearance.

- Competitive Dynamics: Digitalization race, service specialization, strategic alliances.

- Market Penetration: High in major economies, growing in emerging European markets.

- Market Size Projection: Expected to reach over XX Million by 2033.

- CAGR: Approximately 5.5% (2025-2033).

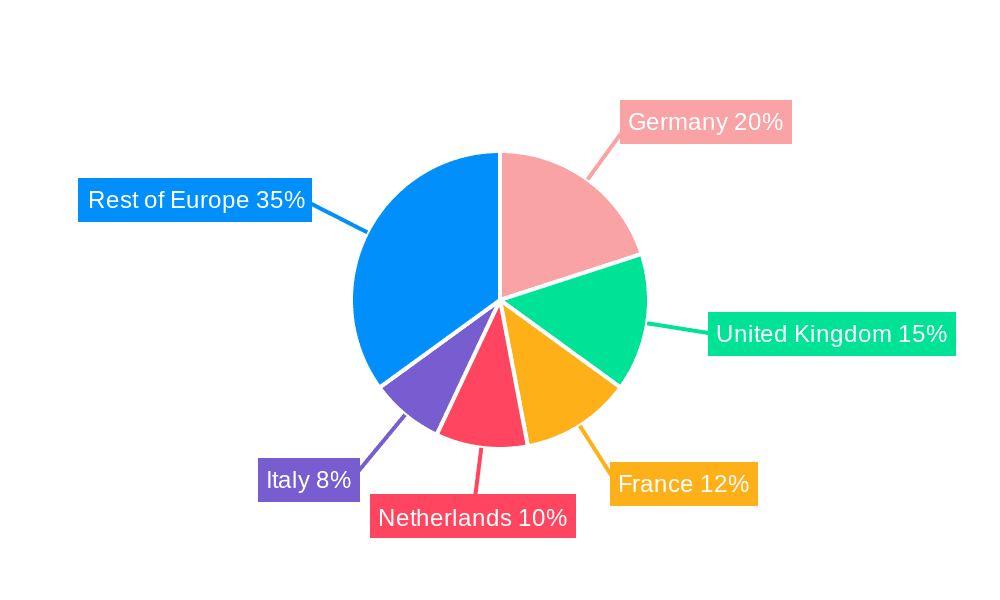

Dominant Regions & Segments in European Customs Brokers Market

The European Customs Brokers Market is dominated by Western European countries, with Germany, France, the Netherlands, and Belgium leading the charge due to their significant trade hubs and established logistics infrastructure. These regions benefit from extensive port facilities, major air cargo gateways, and sophisticated road and rail networks that facilitate seamless cross-border land transport. The Mode Of Transport: Sea segment holds a substantial market share owing to the high volume of containerized goods moved through major European ports like Rotterdam and Antwerp, which serve as critical gateways for global trade into and out of the continent.

- Leading Region: Western Europe, driven by strong economic activity and extensive trade networks.

- Key Countries: Germany, Netherlands, Belgium, France, United Kingdom.

- Dominant Mode of Transport - Sea:

- Key Drivers: High volume of containerized cargo, extensive port infrastructure (Rotterdam, Antwerp, Hamburg), role as global trade gateways.

- Dominance Analysis: The maritime sector remains the backbone of European trade, processing millions of TEUs annually. Customs brokers play a crucial role in managing the complex documentation and regulatory compliance associated with sea freight, from container imports to transshipment operations. The efficiency and capacity of these ports directly correlate with the demand for customs brokerage services.

- Dominant Mode of Transport - Air:

- Key Drivers: Demand for expedited shipments, high-value goods, pharmaceutical and aerospace industries.

- Dominance Analysis: While smaller in volume than sea freight, air cargo is critical for time-sensitive and high-value goods. Major European airports like Frankfurt, Amsterdam Schiphol, and Charles de Gaulle are vital hubs for air freight, requiring specialized customs clearance expertise due to stringent security and regulatory requirements.

- Dominant Mode of Transport - Cross-Border Land Transport:

- Key Drivers: Intra-European trade, road and rail connectivity, just-in-time logistics.

- Dominance Analysis: The interconnectedness of European road and rail networks makes cross-border land transport a significant segment. This is particularly crucial for supply chains operating within the EU's single market, where efficient customs procedures accelerate the movement of goods between member states. Brokers are essential for navigating differing national regulations and ensuring compliance.

European Customs Brokers Market Product Innovations

Recent product innovations in the European Customs Brokers Market focus on digitalization and automation. Cloud-based customs management platforms are gaining traction, offering real-time data synchronization and enhanced collaboration. AI-powered tools are being developed to automate tariff classification, risk assessment, and documentation generation, significantly reducing processing times and human error. The competitive advantage lies in offering integrated solutions that provide end-to-end visibility and proactive compliance management, ensuring smoother transit and reduced delays for businesses.

European Customs Brokers Market Report Scope & Segmentation Analysis

This report segments the European Customs Brokers Market by Mode Of Transport, encompassing Sea, Air, and Cross-Border Land Transport.

- Sea: This segment is anticipated to maintain its dominant market share, driven by the continuous flow of international containerized trade through major European ports. Growth projections indicate a steady expansion, supported by increasing global trade volumes and the ongoing reliance on maritime shipping for bulk goods.

- Air: The airfreight segment is projected to witness robust growth, fueled by the demand for rapid delivery of high-value goods, pharmaceuticals, and time-sensitive e-commerce shipments. Technological advancements in cargo handling and expedited clearance processes will further boost this segment.

- Cross-Border Land Transport: This segment is expected to experience substantial growth due to the integrated nature of the European Union and the increasing emphasis on efficient intra-European supply chains. Advancements in digital customs solutions and streamlined border procedures within the EU will contribute to its expansion.

Key Drivers of European Customs Brokers Market Growth

The European Customs Brokers Market is propelled by several key drivers:

- Increasing Volume of International Trade: Growing global economic interconnectedness and demand for diverse products fuel cross-border movements.

- E-commerce Expansion: The surge in online retail necessitates efficient and rapid customs clearance for a higher volume of smaller shipments.

- Regulatory Complexity: Evolving customs regulations and compliance requirements demand specialized expertise from brokers.

- Technological Advancements: Digitalization, automation, and AI are enhancing efficiency and accuracy in brokerage services.

- Supply Chain Resilience: Businesses are seeking reliable partners to navigate disruptions and ensure smooth trade flows.

Challenges in the European Customs Brokers Market Sector

Despite growth, the European Customs Brokers Market faces significant challenges:

- Navigating Complex and Evolving Regulations: Constant changes in customs laws across different European countries and international agreements create compliance hurdles.

- Talent Shortage: A lack of skilled customs brokers with expertise in digital tools and international trade law can limit service capacity.

- Intense Competition and Margin Pressure: The market is highly competitive, leading to price sensitivity and pressure on profit margins, especially for smaller players.

- Cybersecurity Threats: Digitalization exposes customs brokerage operations to the risk of cyberattacks, necessitating robust security measures.

- Economic Volatility and Geopolitical Instability: Global economic downturns or geopolitical tensions can disrupt trade patterns and impact demand for brokerage services.

Emerging Opportunities in European Customs Brokers Market

The European Customs Brokers Market presents several emerging opportunities:

- Digital Transformation and Automation: Investing in AI, blockchain, and cloud-based platforms to offer more efficient, transparent, and cost-effective services.

- Specialized Industry Verticals: Developing expertise in niche sectors like pharmaceuticals, automotive, or perishables, which have unique customs requirements.

- Green Logistics and Sustainability: Offering customs solutions that support sustainable supply chains and compliance with environmental regulations.

- E-commerce Fulfillment Services: Expanding services to include the entire e-commerce fulfillment process, including customs clearance for direct-to-consumer shipments.

- Data Analytics and Consulting: Leveraging data insights to provide clients with strategic advice on trade compliance, risk management, and optimization.

Leading Players in the European Customs Brokers Market Market

- DB Schenker

- United Parcel Services

- APL Logistics

- Kuehne and Nagel

- FedEx

- Maersk Logistics

- DHL Group Logistics

- Gaston Schul Logistics

- Rhenus Logistics

- Gerlach Customs

Key Developments in European Customs Brokers Market Industry

- December 2023: Kuehne Nagel finalized the acquisition of customs broker Farrow. This strategic move is set to strengthen the company's customs capabilities within the North American market, with a particular focus on improving operations at the US-Canadian and Mexican borders. The transaction is anticipated to be completed in the first quarter of 2024.

- October 2023: Rock-It Freight Forwarding and Logistics, specializing in the live event, entertainment, sports, and broadcast industry, has successfully acquired customs broker Dell Will. This acquisition is part of Rock-It's strategic plan to accelerate growth in the motorsports sector.

Future Outlook for European Customs Brokers Market Market

The future outlook for the European Customs Brokers Market is exceptionally bright, driven by sustained growth in global trade, the unstoppable rise of e-commerce, and the increasing need for specialized expertise in navigating complex international trade landscapes. The ongoing digitalization of trade processes will continue to be a major accelerator, with AI, machine learning, and blockchain technology revolutionizing efficiency and transparency. Strategic opportunities lie in developing integrated, end-to-end logistics and customs solutions, offering data-driven consulting services, and specializing in high-growth industry verticals. Companies that invest in talent development, embrace technological innovation, and foster strong client relationships will be well-positioned to capitalize on the expanding market potential and secure a competitive edge in the years to come. The market is projected to reach XX Million by 2033.

European Customs Brokers Market Segmentation

-

1. Mode Of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-Border Land Transport

European Customs Brokers Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Netherlands

- 5. Italy

- 6. Rest of Europe

European Customs Brokers Market Regional Market Share

Geographic Coverage of European Customs Brokers Market

European Customs Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing international trade; Complex custom regulations

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Geopolitical Uncertainity

- 3.4. Market Trends

- 3.4.1. Germany Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Customs Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-Border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Netherlands

- 5.2.5. Italy

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Germany European Customs Brokers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6.1.1. Sea

- 6.1.2. Air

- 6.1.3. Cross-Border Land Transport

- 6.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7. United Kingdom European Customs Brokers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7.1.1. Sea

- 7.1.2. Air

- 7.1.3. Cross-Border Land Transport

- 7.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8. France European Customs Brokers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8.1.1. Sea

- 8.1.2. Air

- 8.1.3. Cross-Border Land Transport

- 8.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9. Netherlands European Customs Brokers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9.1.1. Sea

- 9.1.2. Air

- 9.1.3. Cross-Border Land Transport

- 9.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10. Italy European Customs Brokers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10.1.1. Sea

- 10.1.2. Air

- 10.1.3. Cross-Border Land Transport

- 10.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 11. Rest of Europe European Customs Brokers Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 11.1.1. Sea

- 11.1.2. Air

- 11.1.3. Cross-Border Land Transport

- 11.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DB Schenker

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 United Parcel Services

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 APL Logistics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kuehne and Nagel

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 FedEx

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Maersk Logistics

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 DHL Group Logistics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Gaston Schul Logistics**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Rhenus Logistics

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Gerlach Customs

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 DB Schenker

List of Figures

- Figure 1: European Customs Brokers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Customs Brokers Market Share (%) by Company 2025

List of Tables

- Table 1: European Customs Brokers Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 2: European Customs Brokers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: European Customs Brokers Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 4: European Customs Brokers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: European Customs Brokers Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 6: European Customs Brokers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Customs Brokers Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 8: European Customs Brokers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: European Customs Brokers Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 10: European Customs Brokers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: European Customs Brokers Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 12: European Customs Brokers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Customs Brokers Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 14: European Customs Brokers Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Customs Brokers Market?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the European Customs Brokers Market?

Key companies in the market include DB Schenker, United Parcel Services, APL Logistics, Kuehne and Nagel, FedEx, Maersk Logistics, DHL Group Logistics, Gaston Schul Logistics**List Not Exhaustive, Rhenus Logistics, Gerlach Customs.

3. What are the main segments of the European Customs Brokers Market?

The market segments include Mode Of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing international trade; Complex custom regulations.

6. What are the notable trends driving market growth?

Germany Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Geopolitical Uncertainity.

8. Can you provide examples of recent developments in the market?

December 2023: Kuehne Nagel finalized the acquisition of customs broker Farrow for an undisclosed amount. This strategic move is set to strengthen the company's customs capabilities within the North American market, with a particular focus on improving operations at the US-Canadian and Mexican borders. The transaction is anticipated to be completed in the first quarter of 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Customs Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Customs Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Customs Brokers Market?

To stay informed about further developments, trends, and reports in the European Customs Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence