Key Insights

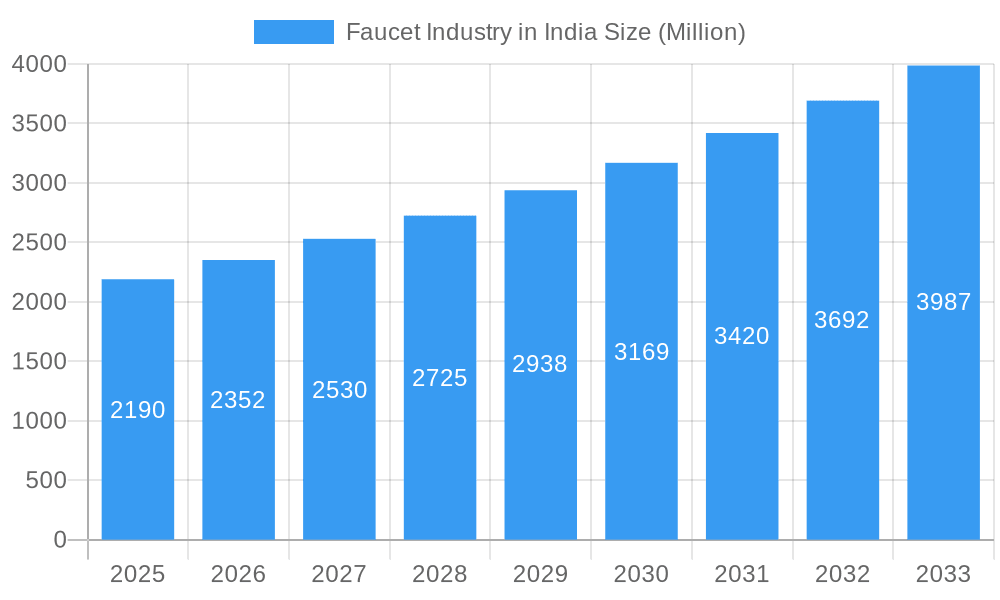

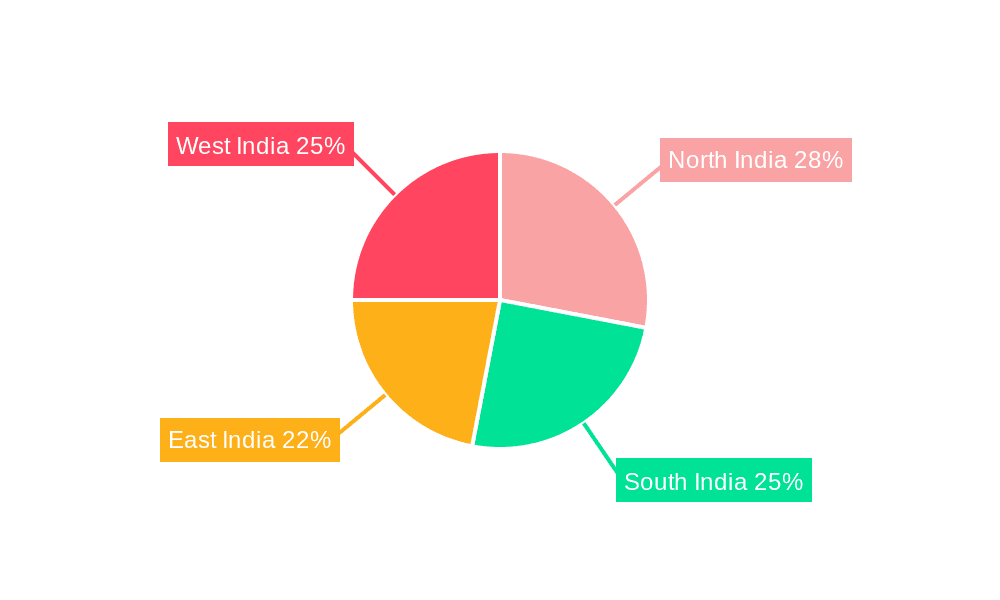

The Indian faucet market, valued at approximately $2.19 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.40% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and increasing urbanization are driving demand for improved home amenities, including modern and aesthetically pleasing faucets. A burgeoning construction sector, encompassing both residential and commercial projects, significantly contributes to market expansion. Furthermore, a shift towards technologically advanced faucets, such as automatic and sensor-based models, is fueling premium segment growth. Consumer preference for durable and stylish materials like stainless steel and chrome also plays a significant role. The market is segmented by product type (ball, disc, cartridge, compression), technology (manual, automatic), installation type (deck mount, wall mount), material (chrome, stainless steel, brass, plastic), application (kitchen, bathroom), end-user (residential, commercial), and distribution channel (B2C, B2B). Major players like Grohe, Delta Faucet, Kohler, Toto, Jaquar, and Hindware compete in this dynamic market, leveraging brand recognition and distribution networks to capture market share. Regional variations exist, with potential for higher growth in urban centers across North, South, East and West India due to infrastructure development and rising real estate activity.

Faucet Industry in India Market Size (In Billion)

The competitive landscape is characterized by both established international brands and prominent domestic players. International brands benefit from strong brand recognition and advanced technology, while domestic players often offer competitive pricing and localized distribution networks. However, increasing competition necessitates continuous product innovation, strategic partnerships, and effective marketing campaigns to maintain a competitive edge. The market also faces some restraints such as fluctuating raw material prices which impact production costs and price competitiveness. Government regulations related to water conservation and responsible manufacturing practices are also expected to shape future market developments. Looking ahead, the Indian faucet market presents significant opportunities for growth, driven by sustained economic development and changing consumer preferences. Strategic investments in research and development, coupled with tailored marketing approaches targeting specific customer segments, will be crucial for success in this expanding market.

Faucet Industry in India Company Market Share

Faucet Industry in India: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Faucet Industry in India, covering market structure, dynamics, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. The study encompasses a detailed segmentation analysis, enabling informed strategic decision-making for industry professionals.

Faucet Industry in India Market Structure & Innovation Trends

This section meticulously analyzes the competitive fabric of the Indian faucet market. We explore the degree of market concentration, identify key drivers of innovation, and assess the influential role of regulatory frameworks. The report further scrutinizes the impact of strategic mergers and acquisitions (M&A) and the potential influence of product substitutes on the evolving market dynamics.

-

Market Concentration: The Indian faucet market is characterized by a moderately concentrated structure. Prominent players like Jaquar, Hindware, Cera Sanitaryware Ltd, and Kohler command a significant market share. However, a vibrant ecosystem of smaller manufacturers also contributes substantially to the overall market volume. The estimated market share of the top 5 players is projected to reach approximately XX% by 2025.

-

Innovation Drivers: A confluence of factors is propelling innovation within the faucet sector. Foremost among these are government-led water conservation initiatives and a burgeoning consumer demand for faucets that are not only aesthetically superior but also technologically advanced. This translates to cutting-edge advancements in water-saving technologies, such as aerators and flow restrictors, and the increasing integration of smart features for enhanced user experience and efficiency.

-

Regulatory Framework: Government mandates and standards pertaining to water conservation and product quality play a pivotal role in shaping the faucet industry. Manufacturers must adhere to these regulations, which directly influence product design, material selection, and manufacturing processes, fostering a more sustainable and standardized market.

-

Product Substitutes: While less common than faucets, certain water-saving devices like low-flow showerheads can be considered indirect substitutes. However, these do not pose a significant threat to the core functionality and demand for faucets. The primary competition remains within the faucet category itself, driven by features, design, and brand value.

-

End-User Demographics: The rapid pace of urbanization across India, coupled with a steady rise in disposable incomes, is significantly fueling the demand for modern, stylish, and technologically advanced faucets. The residential sector, in particular, is a key driver of this trend, with consumers seeking upgrades that enhance both functionality and the aesthetic appeal of their living spaces.

-

M&A Activities: The Indian faucet industry has witnessed a discernible trend of M&A activities in recent years. These strategic moves underscore a concerted effort towards market consolidation, expansion of product portfolios, and strengthening competitive positions. While specific deal valuations are not always publicly disclosed, the estimated total M&A deal value for the period 2019-2024 is anticipated to be around XX Million.

Faucet Industry in India Market Dynamics & Trends

This section provides an in-depth analysis of the market's growth trajectory, meticulously examining the primary growth drivers, transformative technological disruptions, evolving consumer preferences, and the intricate competitive dynamics that shape the market's development. Key trends highlighted include an escalating focus on sustainability, a pronounced consumer preference for sophisticated design and cutting-edge technology, and the burgeoning influence of e-commerce platforms.

The Indian faucet market is currently experiencing a period of robust expansion, with a projected Compound Annual Growth Rate (CAGR) of approximately XX% anticipated during the forecast period from 2025 to 2033. This impressive growth is underpinned by several key factors, including increasing urbanization, a rise in disposable incomes, and a growing demand for contemporary bathroom fittings. The market penetration of technologically sophisticated faucets, such as sensor-activated faucets, is steadily climbing, with a projected penetration rate expected to reach XX% by 2033. Consumer preferences are demonstrably shifting towards faucets that offer both superior aesthetic appeal and enhanced water efficiency. The competitive landscape is highly dynamic, characterized by intense competition among established industry leaders and the strategic emergence of innovative new entrants.

Dominant Regions & Segments in Faucet Industry in India

This section precisely identifies the leading geographical regions and the most significant market segments within the Indian faucet industry. Urban centers in states such as Maharashtra, Tamil Nadu, and the National Capital Region (NCR) are leading the adoption of faucets. The report further evaluates the dominance of specific segments based on critical parameters including product type, technological sophistication, installation method, material composition, application area, and end-user classification.

- By Product Type: Faucets utilizing cartridge mechanisms currently hold the largest market share due to their reliability and performance.

- By Technology: While manual faucets still dominate the market, automatic and smart faucet technologies are experiencing significant growth and adoption.

- By Installation Type: Deck-mounted faucets are more prevalent, offering versatility in installation for various countertop and sink configurations.

- By Material Type: Chrome-plated and brass faucets remain the preferred choices for consumers, valued for their durability and aesthetic appeal.

- By Application: Bathroom faucets constitute the larger market segment, reflecting their essential role in modern sanitation facilities.

- By End User: The residential segment is the primary driver of demand, followed by the commercial sector, which includes hospitality, healthcare, and educational institutions.

- By Distribution Channel: Business-to-Consumer (B2C) channels, particularly retail outlets, are currently the most dominant. However, online B2C sales are exhibiting increasing growth and gaining traction.

Key drivers contributing to the dominance in various segments include:

- Economic Policies: Government initiatives aimed at promoting affordable housing and driving infrastructure development significantly contribute to market growth and demand for faucets.

- Infrastructure Development: The continuous expansion of urban infrastructure across India is a primary growth catalyst, stimulating demand from new construction projects and extensive renovation initiatives.

Faucet Industry in India Product Innovations

Recent product innovations in the Indian faucet industry are marked by the introduction of advanced smart faucets equipped with integrated sensors and sophisticated water-saving features. This trend is strongly influenced by a growing consumer preference for technologically advanced and environmentally conscious products that enhance both convenience and water conservation. Manufacturers are also placing a significant emphasis on design aesthetics, offering an extensive array of styles, finishes, and customizable options to cater to a diverse range of consumer tastes and interior design preferences. Competitive advantages are increasingly being secured through a combination of superior design, innovative functionalities, and robust brand recognition.

Report Scope & Segmentation Analysis

This report offers a comprehensive overview of the faucet market in India, segmented by product type (ball, disc, cartridge, compression), technology (manual, automatic), installation type (deck mount, wall mount), material type (chrome, stainless steel, brass, PTMT plastic, other), application (kitchen, bathroom), end-user (residential, commercial), and distribution channel (B2C/retail, online, B2B/project). Each segment's growth projections, market size, and competitive dynamics are analyzed to provide a granular understanding of the market structure. The market is expected to experience significant growth across all segments during the forecast period.

Key Drivers of Faucet Industry in India Growth

The growth of the Indian faucet industry is fueled by several factors:

- Rising disposable incomes: An expanding middle class with increased purchasing power drives demand for higher-quality and more technologically advanced faucets.

- Urbanization: Rapid urbanization leads to increased housing construction and renovation activities.

- Government initiatives: Water conservation initiatives and infrastructure development projects stimulate market growth.

Challenges in the Faucet Industry in India Sector

The Indian faucet industry faces challenges including:

- Intense competition: A large number of players compete, creating a highly competitive environment.

- Supply chain disruptions: Fluctuations in raw material prices and supply chain inefficiencies can impact production costs.

- Regulatory compliance: Adhering to environmental and safety regulations can be complex and costly.

Emerging Opportunities in Faucet Industry in India

Significant opportunities exist in the Indian faucet market:

- Growing demand for smart faucets: Increasing consumer preference for technologically advanced products creates opportunities for smart faucets.

- Expansion into tier 2 and 3 cities: These cities present untapped market potential.

- Focus on sustainable products: Water-saving and eco-friendly faucets are gaining traction.

Leading Players in the Faucet Industry in India Market

- Grohe

- Delta Faucet

- Waterman India

- Kohler

- Toto

- Cavier

- Cera Sanitaryware Ltd

- Roca

- Jaquar

- Hindware

Key Developments in Faucet Industry in India Industry

August 2023: Hindware Limited launched its "Fabio" and "Agnese" faucet ranges, featuring innovative technology and design. This expansion targets architects, dealers, and builders, focusing on integrated solutions and improved customer convenience.

January 2022: Pearl Precision launched a range of state-of-the-art bathroom accessories, including C.P. Faucets and P.T.M.T. Taps, available in retail hardware and bathware stores.

Future Outlook for Faucet Industry in India Market

The Indian faucet market is poised for continued growth, driven by increasing urbanization, rising disposable incomes, and a growing preference for modern and technologically advanced bathroom fittings. Strategic opportunities lie in developing innovative, water-efficient products, expanding distribution networks, and catering to the evolving needs of a diverse consumer base. The market is expected to witness significant growth across all segments in the coming years.

Faucet Industry in India Segmentation

-

1. Product Type

- 1.1. Ball

- 1.2. Disc

- 1.3. Cartridge

- 1.4. Compression

-

2. Technology

- 2.1. Manual

- 2.2. Automatic

-

3. Installation Type

- 3.1. Deck Mount

- 3.2. Wall Mount

-

4. Material Type

- 4.1. Chrome

- 4.2. Stainless Steel

- 4.3. Brass

- 4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 4.5. Other Material Types

-

5. Application

- 5.1. Kitchen Faucets

- 5.2. Bathroom Faucets

-

6. End User

- 6.1. Residential

- 6.2. Commercial

-

7. Distribution Channel

-

7.1. B2C/Retail

- 7.1.1. Multi-brand Stores

- 7.1.2. Exclusive Stores

- 7.1.3. Online

- 7.2. B2B/Proj

-

7.1. B2C/Retail

Faucet Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Faucet Industry in India Regional Market Share

Geographic Coverage of Faucet Industry in India

Faucet Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction of Residential and Commercial Space; Government Policies Favoring Sales of Faucets in the Market

- 3.3. Market Restrains

- 3.3.1. Highly Competitive Market Affecting Small Faucet Manufacturing Businesses; Price Fluctuation in Raw Materials Affecting the Manufacturers

- 3.4. Market Trends

- 3.4.1. Rising Demand for Automatic Faucets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ball

- 5.1.2. Disc

- 5.1.3. Cartridge

- 5.1.4. Compression

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Manual

- 5.2.2. Automatic

- 5.3. Market Analysis, Insights and Forecast - by Installation Type

- 5.3.1. Deck Mount

- 5.3.2. Wall Mount

- 5.4. Market Analysis, Insights and Forecast - by Material Type

- 5.4.1. Chrome

- 5.4.2. Stainless Steel

- 5.4.3. Brass

- 5.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 5.4.5. Other Material Types

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Kitchen Faucets

- 5.5.2. Bathroom Faucets

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. Residential

- 5.6.2. Commercial

- 5.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.7.1. B2C/Retail

- 5.7.1.1. Multi-brand Stores

- 5.7.1.2. Exclusive Stores

- 5.7.1.3. Online

- 5.7.2. B2B/Proj

- 5.7.1. B2C/Retail

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Ball

- 6.1.2. Disc

- 6.1.3. Cartridge

- 6.1.4. Compression

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Manual

- 6.2.2. Automatic

- 6.3. Market Analysis, Insights and Forecast - by Installation Type

- 6.3.1. Deck Mount

- 6.3.2. Wall Mount

- 6.4. Market Analysis, Insights and Forecast - by Material Type

- 6.4.1. Chrome

- 6.4.2. Stainless Steel

- 6.4.3. Brass

- 6.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 6.4.5. Other Material Types

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Kitchen Faucets

- 6.5.2. Bathroom Faucets

- 6.6. Market Analysis, Insights and Forecast - by End User

- 6.6.1. Residential

- 6.6.2. Commercial

- 6.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.7.1. B2C/Retail

- 6.7.1.1. Multi-brand Stores

- 6.7.1.2. Exclusive Stores

- 6.7.1.3. Online

- 6.7.2. B2B/Proj

- 6.7.1. B2C/Retail

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Ball

- 7.1.2. Disc

- 7.1.3. Cartridge

- 7.1.4. Compression

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Manual

- 7.2.2. Automatic

- 7.3. Market Analysis, Insights and Forecast - by Installation Type

- 7.3.1. Deck Mount

- 7.3.2. Wall Mount

- 7.4. Market Analysis, Insights and Forecast - by Material Type

- 7.4.1. Chrome

- 7.4.2. Stainless Steel

- 7.4.3. Brass

- 7.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 7.4.5. Other Material Types

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Kitchen Faucets

- 7.5.2. Bathroom Faucets

- 7.6. Market Analysis, Insights and Forecast - by End User

- 7.6.1. Residential

- 7.6.2. Commercial

- 7.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.7.1. B2C/Retail

- 7.7.1.1. Multi-brand Stores

- 7.7.1.2. Exclusive Stores

- 7.7.1.3. Online

- 7.7.2. B2B/Proj

- 7.7.1. B2C/Retail

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Ball

- 8.1.2. Disc

- 8.1.3. Cartridge

- 8.1.4. Compression

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Manual

- 8.2.2. Automatic

- 8.3. Market Analysis, Insights and Forecast - by Installation Type

- 8.3.1. Deck Mount

- 8.3.2. Wall Mount

- 8.4. Market Analysis, Insights and Forecast - by Material Type

- 8.4.1. Chrome

- 8.4.2. Stainless Steel

- 8.4.3. Brass

- 8.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 8.4.5. Other Material Types

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Kitchen Faucets

- 8.5.2. Bathroom Faucets

- 8.6. Market Analysis, Insights and Forecast - by End User

- 8.6.1. Residential

- 8.6.2. Commercial

- 8.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.7.1. B2C/Retail

- 8.7.1.1. Multi-brand Stores

- 8.7.1.2. Exclusive Stores

- 8.7.1.3. Online

- 8.7.2. B2B/Proj

- 8.7.1. B2C/Retail

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Ball

- 9.1.2. Disc

- 9.1.3. Cartridge

- 9.1.4. Compression

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Manual

- 9.2.2. Automatic

- 9.3. Market Analysis, Insights and Forecast - by Installation Type

- 9.3.1. Deck Mount

- 9.3.2. Wall Mount

- 9.4. Market Analysis, Insights and Forecast - by Material Type

- 9.4.1. Chrome

- 9.4.2. Stainless Steel

- 9.4.3. Brass

- 9.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 9.4.5. Other Material Types

- 9.5. Market Analysis, Insights and Forecast - by Application

- 9.5.1. Kitchen Faucets

- 9.5.2. Bathroom Faucets

- 9.6. Market Analysis, Insights and Forecast - by End User

- 9.6.1. Residential

- 9.6.2. Commercial

- 9.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.7.1. B2C/Retail

- 9.7.1.1. Multi-brand Stores

- 9.7.1.2. Exclusive Stores

- 9.7.1.3. Online

- 9.7.2. B2B/Proj

- 9.7.1. B2C/Retail

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Ball

- 10.1.2. Disc

- 10.1.3. Cartridge

- 10.1.4. Compression

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Manual

- 10.2.2. Automatic

- 10.3. Market Analysis, Insights and Forecast - by Installation Type

- 10.3.1. Deck Mount

- 10.3.2. Wall Mount

- 10.4. Market Analysis, Insights and Forecast - by Material Type

- 10.4.1. Chrome

- 10.4.2. Stainless Steel

- 10.4.3. Brass

- 10.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 10.4.5. Other Material Types

- 10.5. Market Analysis, Insights and Forecast - by Application

- 10.5.1. Kitchen Faucets

- 10.5.2. Bathroom Faucets

- 10.6. Market Analysis, Insights and Forecast - by End User

- 10.6.1. Residential

- 10.6.2. Commercial

- 10.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.7.1. B2C/Retail

- 10.7.1.1. Multi-brand Stores

- 10.7.1.2. Exclusive Stores

- 10.7.1.3. Online

- 10.7.2. B2B/Proj

- 10.7.1. B2C/Retail

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Grohe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Delta faucet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Waterman India

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kohler

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toto**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cavier

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cera Sanitaryware Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Roca

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jaquar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hindware

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Grohe

List of Figures

- Figure 1: Global Faucet Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 7: North America Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 8: North America Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 9: North America Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: North America Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 13: North America Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: North America Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: North America Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 19: South America Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: South America Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 21: South America Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 23: South America Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 24: South America Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 25: South America Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 26: South America Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 27: South America Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 29: South America Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Europe Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Europe Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 37: Europe Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Europe Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 39: Europe Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 40: Europe Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 41: Europe Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 42: Europe Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 43: Europe Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 44: Europe Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 45: Europe Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 46: Europe Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Europe Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Europe Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 49: Europe Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 51: Middle East & Africa Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 52: Middle East & Africa Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 53: Middle East & Africa Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Middle East & Africa Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 55: Middle East & Africa Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 56: Middle East & Africa Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 57: Middle East & Africa Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 58: Middle East & Africa Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 59: Middle East & Africa Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 60: Middle East & Africa Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 61: Middle East & Africa Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East & Africa Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 64: Middle East & Africa Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 65: Middle East & Africa Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 66: Asia Pacific Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 67: Asia Pacific Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 68: Asia Pacific Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 69: Asia Pacific Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 70: Asia Pacific Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 71: Asia Pacific Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 72: Asia Pacific Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 73: Asia Pacific Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 74: Asia Pacific Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 75: Asia Pacific Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 76: Asia Pacific Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 77: Asia Pacific Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 78: Asia Pacific Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 80: Asia Pacific Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 81: Asia Pacific Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 4: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Faucet Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 9: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 12: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 13: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United States Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Canada Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Mexico Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 23: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 24: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 33: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 34: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 35: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 37: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 38: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 39: United Kingdom Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: France Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Italy Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Spain Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Russia Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Benelux Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Nordics Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 49: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 50: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 51: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 52: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 53: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 54: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 55: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Turkey Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Israel Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: GCC Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: North Africa Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 63: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 64: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 65: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 66: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 67: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 70: China Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 71: India Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 73: South Korea Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: ASEAN Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 75: Oceania Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Faucet Industry in India?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Faucet Industry in India?

Key companies in the market include Grohe, Delta faucet, Waterman India, Kohler, Toto**List Not Exhaustive, Cavier, Cera Sanitaryware Ltd, Roca, Jaquar, Hindware.

3. What are the main segments of the Faucet Industry in India?

The market segments include Product Type, Technology, Installation Type, Material Type, Application, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction of Residential and Commercial Space; Government Policies Favoring Sales of Faucets in the Market.

6. What are the notable trends driving market growth?

Rising Demand for Automatic Faucets is Driving the Market.

7. Are there any restraints impacting market growth?

Highly Competitive Market Affecting Small Faucet Manufacturing Businesses; Price Fluctuation in Raw Materials Affecting the Manufacturers.

8. Can you provide examples of recent developments in the market?

August 2023: Hindware Limited launched an array of innovative faucets in its product line, which consists of two new faucet ranges, “Fabio” and “Agnese,” featuring ground-breaking technology, style, and creativity. The expansion is aimed at providing integrated solutions with improved customer convenience, targeting its range of customers, Architects, Dealers, and Builders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Faucet Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Faucet Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Faucet Industry in India?

To stay informed about further developments, trends, and reports in the Faucet Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence