Key Insights

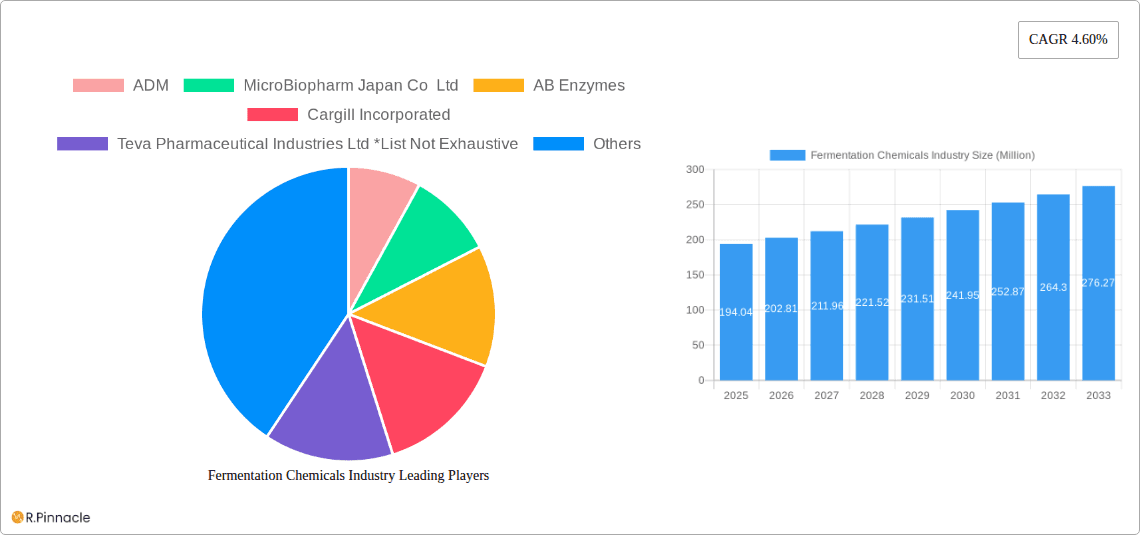

The global Fermentation Chemicals Industry is poised for robust growth, currently valued at approximately $194.04 million. This expansion is driven by a substantial Compound Annual Growth Rate (CAGR) of 4.60%, projected to continue through the forecast period of 2025-2033. The industry's dynamism is fueled by increasing demand across diverse applications, most notably in industrial processes, food and beverage production, and the pharmaceutical and nutritional sectors. The burgeoning need for sustainable and bio-based solutions is a primary catalyst, encouraging manufacturers to invest in advanced fermentation technologies. Furthermore, evolving consumer preferences towards natural ingredients and the rising focus on health and wellness are significantly bolstering the demand for fermentation-derived products. Innovative product development and a growing emphasis on research and development are expected to unlock new market opportunities.

Fermentation Chemicals Industry Market Size (In Million)

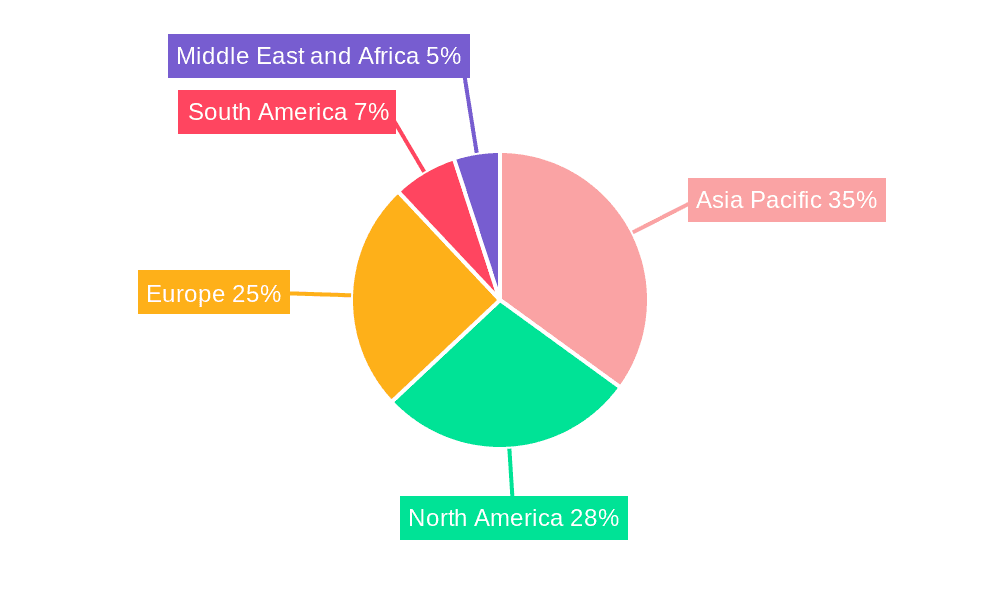

While the industry benefits from strong demand drivers, certain restraints need careful consideration. The initial capital investment required for setting up advanced fermentation facilities can be a significant barrier, particularly for smaller enterprises. Moreover, stringent regulatory frameworks governing the production and application of fermentation chemicals, especially in the food and pharmaceutical segments, can impact market entry and product development timelines. However, the overarching trend towards a circular economy and the inherent sustainability of bioprocesses are expected to outweigh these challenges. Key market players are actively engaged in strategic collaborations and mergers and acquisitions to enhance their product portfolios and expand their geographical reach, indicating a consolidated and competitive landscape. The Asia Pacific region, with its rapidly industrializing economies and growing consumer base, is emerging as a particularly promising market for fermentation chemicals.

Fermentation Chemicals Industry Company Market Share

This in-depth report provides a strategic overview of the global Fermentation Chemicals Industry, offering critical insights for stakeholders aiming to navigate this dynamic and evolving sector. With a comprehensive study period spanning from 2019 to 2033, including a robust base year of 2025 and a detailed forecast period of 2025–2033, this analysis leverages high-ranking keywords to ensure maximum visibility for industry professionals. Discover market concentration, innovation trends, growth drivers, segment dominance, product innovations, and future opportunities within the fermentation chemicals landscape.

Fermentation Chemicals Industry Market Structure & Innovation Trends

The Fermentation Chemicals Industry exhibits a moderate to high market concentration, with key players like ADM, Novozymes, BASF SE, and DSM holding significant market shares, estimated in the range of 10-20% each for the leading entities. Innovation is largely driven by advancements in biotechnology, strain development, and process optimization, aimed at enhancing yields and sustainability. Regulatory frameworks, particularly in food, beverage, and pharmaceutical applications, play a crucial role in shaping market entry and product development. Product substitutes, such as synthetic chemical alternatives, present a challenge, but the growing demand for bio-based and sustainable products is reinforcing the market position of fermentation chemicals. End-user demographics are increasingly favoring healthier, natural, and environmentally conscious products, driving demand across all application segments. Mergers and acquisitions (M&A) activities are moderately prevalent, with deal values often ranging from tens of millions to hundreds of millions of dollars, as companies seek to expand their portfolios and technological capabilities. Notable M&A activities are anticipated to continue in the forecast period.

Fermentation Chemicals Industry Market Dynamics & Trends

The global Fermentation Chemicals Industry is poised for robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including the escalating demand for bio-based and sustainable chemicals across diverse applications, particularly in the food and beverage, pharmaceutical, and industrial sectors. Technological disruptions, such as the refinement of metabolic engineering, synthetic biology, and advanced downstream processing techniques, are enabling the production of novel fermentation chemicals with improved purity, efficiency, and cost-effectiveness. Consumer preferences are increasingly shifting towards natural ingredients and products with a lower environmental footprint, directly benefiting the market for fermentation-derived compounds. The competitive landscape is characterized by intense innovation and strategic partnerships, with established chemical giants and specialized biotechnology firms vying for market leadership. Market penetration is deepening as more industries recognize the economic and environmental advantages of utilizing fermentation-based solutions over traditional petrochemical routes. The rising global population and increasing disposable incomes in emerging economies are further augmenting demand for products reliant on fermentation chemicals, from food additives and nutritional supplements to biofuels and bioplastics. Furthermore, supportive government initiatives promoting the bioeconomy and circular economy principles are providing a favorable environment for market expansion. The ability of fermentation processes to utilize renewable feedstocks also positions the industry favorably in the face of volatile fossil fuel prices and growing concerns about climate change, making fermentation chemicals a cornerstone of a more sustainable industrial future.

Dominant Regions & Segments in Fermentation Chemicals Industry

North America and Europe currently hold significant dominance in the Fermentation Chemicals Industry, driven by advanced research and development capabilities, stringent quality control standards, and a strong consumer preference for bio-based and natural products.

- Leading Region: North America, particularly the United States, is a frontrunner due to its substantial investments in biotechnology research, a well-established pharmaceutical and nutraceutical sector, and supportive governmental policies fostering innovation in the bioeconomy. Economic policies promoting sustainable manufacturing and substantial R&D funding from both public and private sectors contribute to its leading position.

- Dominant Product Type: Enzymes represent a highly dominant segment within the Fermentation Chemicals Industry.

- Key Drivers: The food and beverage industry's continuous demand for enzymes in baking, brewing, dairy processing, and meat tenderization, coupled with their indispensable role in detergent formulations and textile processing, propels this segment's growth. Advancements in enzyme engineering and directed evolution are leading to more efficient and specialized enzymes, expanding their application spectrum. The pharmaceutical sector's increasing reliance on enzymes for drug synthesis and diagnostics further bolsters this segment.

- Dominant Application: Pharmaceutical and Nutritional applications showcase exceptional dominance.

- Key Drivers: The burgeoning global healthcare industry, the increasing prevalence of chronic diseases, and the growing consumer focus on preventative health and wellness are key drivers. Fermentation is crucial for producing active pharmaceutical ingredients (APIs), antibiotics, vitamins, amino acids, and probiotics. The demand for dietary supplements and functional foods, often incorporating fermentation-derived ingredients, further solidifies this application's leading position. The high value associated with pharmaceutical-grade fermentation chemicals and stringent regulatory approvals contribute to market value.

Emerging markets in Asia-Pacific are rapidly gaining traction, fueled by increasing industrialization, a growing middle class, and expanding food and beverage sectors. Investments in bio-manufacturing infrastructure and favorable government policies in countries like China and India are positioning them as significant future growth hubs.

Fermentation Chemicals Industry Product Innovations

Product innovation in the Fermentation Chemicals Industry centers on developing higher-yield strains, optimizing bioprocesses for cost reduction, and creating novel bio-based chemicals with enhanced functionalities. Companies are focusing on producing specialized enzymes for niche applications, such as the synthesis of complex pharmaceuticals, and exploring new organic acids for biodegradable plastics and advanced materials. The competitive advantage lies in achieving superior product purity, scalability, and a reduced environmental footprint compared to traditional chemical synthesis.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Fermentation Chemicals Industry, segmented by Product Type and Application.

- Alcohols: This segment encompasses a wide range of products like ethanol, butanol, and isobutanol, crucial for biofuels, industrial solvents, and chemical intermediates. Growth is projected to be driven by the expanding biofuel market and demand for green solvents.

- Organic Acids: This includes lactic acid, citric acid, acetic acid, and succinic acid, vital for food preservation, biodegradable plastics, and chemical synthesis. The shift towards sustainable materials is a key growth accelerator.

- Enzymes: This segment comprises industrial enzymes used across food and beverage, detergents, textiles, and pharmaceuticals. Innovations in enzyme engineering are continuously expanding their utility and efficiency.

- Other Product Types: This category includes amino acids, vitamins, and biopolymers, serving critical roles in animal feed, human nutrition, and specialized industrial applications.

- Industrial Applications: This segment covers the use of fermentation chemicals as solvents, intermediates, and in the production of biofuels and bioplastics. The drive for sustainable industrial processes is a primary growth factor.

- Food and Beverage Applications: This includes acidulants, flavor enhancers, preservatives, and processing aids. Consumer demand for natural and clean-label products fuels this segment.

- Pharmaceutical and Nutritional Applications: This segment is critical for APIs, antibiotics, vitamins, amino acids, and probiotics, experiencing robust growth due to an aging global population and increased health consciousness.

- Plastics and Fibers: This segment focuses on bio-based polymers and fibers derived from fermentation, offering sustainable alternatives to petrochemical-based materials.

- Other Applications: This encompasses niche uses in agriculture, personal care, and emerging bio-based technologies.

Key Drivers of Fermentation Chemicals Industry Growth

The Fermentation Chemicals Industry is propelled by several key drivers. Technological advancements in genetic engineering and bioprocess optimization are enhancing efficiency and cost-effectiveness. The growing consumer and regulatory push for sustainability favors bio-based chemicals over petroleum-derived counterparts. Furthermore, increasing demand from the pharmaceutical and food & beverage sectors for high-purity ingredients and natural products serves as a significant catalyst. Supportive government policies promoting the bioeconomy and the rising global population contribute to market expansion.

Challenges in the Fermentation Chemicals Industry Sector

Despite its growth, the Fermentation Chemicals Industry faces several challenges. High production costs compared to petrochemical alternatives can limit adoption, especially for bulk chemicals. Strict regulatory hurdles for new product approvals, particularly in food and pharmaceutical applications, can slow market entry. Supply chain volatility for raw materials and competition from established synthetic chemical manufacturers also present significant barriers. Energy-intensive downstream processing and waste management are ongoing concerns.

Emerging Opportunities in Fermentation Chemicals Industry

Emerging opportunities abound in the Fermentation Chemicals Industry. The development of novel bio-based materials and specialty chemicals for advanced applications, such as biodegradable packaging and high-performance bioplastics, presents significant potential. Expanding into emerging markets with growing demand for sustainable products offers vast untapped potential. The integration of AI and machine learning in bioprocess development can further optimize production and reduce costs. Furthermore, the growing interest in circular economy models creates opportunities for valorizing waste streams into valuable fermentation products.

Leading Players in the Fermentation Chemicals Industry Market

- ADM

- MicroBiopharm Japan Co Ltd

- AB Enzymes

- Cargill Incorporated

- Teva Pharmaceutical Industries Ltd

- BioVectra

- Novozymes

- Evonik Industries AG

- Ajinomoto Co Inc

- Chr Hansen Holding A/S

- BASF SE

- Biocon

- DSM

- Novasep

- Lonza

Key Developments in Fermentation Chemicals Industry Industry

- 2023/10: Novozymes and Chr. Hansen announce merger completion, forming Novonesis, a global biosolutions leader.

- 2024/01: BASF SE expands its enzyme production capacity to meet growing demand in the food and feed sectors.

- 2024/03: DSM invests in a new facility for producing high-value nutritional ingredients through fermentation.

- 2024/05: ADM announces strategic partnerships to accelerate the development of bio-based chemicals for industrial applications.

- 2024/07: Cargill Incorporated launches a new line of fermentation-derived flavor enhancers for the food industry.

- 2024/09: Evonik Industries AG develops a novel enzymatic process for pharmaceutical intermediates.

- 2025/02: Lonza announces expansion of its biomanufacturing capabilities for advanced therapeutic products.

- 2025/04: Ajinomoto Co Inc focuses on expanding its amino acid production via advanced fermentation technologies.

Future Outlook for Fermentation Chemicals Industry Market

The future outlook for the Fermentation Chemicals Industry is exceptionally positive, driven by an intensified global focus on sustainability, health, and advanced materials. Continued innovation in synthetic biology and bioprocess engineering will unlock new product categories and improve production economics. The increasing adoption of fermentation chemicals across pharmaceuticals, food & beverage, and materials science will solidify their role as essential components of a bio-based economy. Strategic investments in R&D and manufacturing capacity, alongside collaborative efforts, will be crucial for sustained growth and market leadership. The industry is poised to play a pivotal role in addressing global challenges related to resource scarcity and environmental protection.

Fermentation Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Alcohols

- 1.2. Organic Acids

- 1.3. Enzymes

- 1.4. Other Product Types

-

2. Application

- 2.1. Industrial

- 2.2. Food and Beverage

- 2.3. Pharmaceutical and Nutritional

- 2.4. Plastics and Fibers

- 2.5. Other Applications

Fermentation Chemicals Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Fermentation Chemicals Industry Regional Market Share

Geographic Coverage of Fermentation Chemicals Industry

Fermentation Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Methanol and Ethanol Industry; Increasing Demand from the Pharmaceutical Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost Due to the Complexity Involved in the Manufacturing Process; Other Restraints

- 3.4. Market Trends

- 3.4.1. Food and Beverage Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Alcohols

- 5.1.2. Organic Acids

- 5.1.3. Enzymes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical and Nutritional

- 5.2.4. Plastics and Fibers

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Alcohols

- 6.1.2. Organic Acids

- 6.1.3. Enzymes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical and Nutritional

- 6.2.4. Plastics and Fibers

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Alcohols

- 7.1.2. Organic Acids

- 7.1.3. Enzymes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical and Nutritional

- 7.2.4. Plastics and Fibers

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Alcohols

- 8.1.2. Organic Acids

- 8.1.3. Enzymes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical and Nutritional

- 8.2.4. Plastics and Fibers

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Alcohols

- 9.1.2. Organic Acids

- 9.1.3. Enzymes

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial

- 9.2.2. Food and Beverage

- 9.2.3. Pharmaceutical and Nutritional

- 9.2.4. Plastics and Fibers

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Alcohols

- 10.1.2. Organic Acids

- 10.1.3. Enzymes

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Industrial

- 10.2.2. Food and Beverage

- 10.2.3. Pharmaceutical and Nutritional

- 10.2.4. Plastics and Fibers

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MicroBiopharm Japan Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AB Enzymes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cargill Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teva Pharmaceutical Industries Ltd *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BioVectra

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Novozymes

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik Industries AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ajinomoto Co Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chr Hansen Holding A/S

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASF SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Biocon

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DSM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Novasep

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lonza

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Fermentation Chemicals Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: North America Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Fermentation Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Canada Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fermentation Chemicals Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Fermentation Chemicals Industry?

Key companies in the market include ADM, MicroBiopharm Japan Co Ltd, AB Enzymes, Cargill Incorporated, Teva Pharmaceutical Industries Ltd *List Not Exhaustive, BioVectra, Novozymes, Evonik Industries AG, Ajinomoto Co Inc, Chr Hansen Holding A/S, BASF SE, Biocon, DSM, Novasep, Lonza.

3. What are the main segments of the Fermentation Chemicals Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 194.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Methanol and Ethanol Industry; Increasing Demand from the Pharmaceutical Industry; Other Drivers.

6. What are the notable trends driving market growth?

Food and Beverage Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost Due to the Complexity Involved in the Manufacturing Process; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fermentation Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fermentation Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fermentation Chemicals Industry?

To stay informed about further developments, trends, and reports in the Fermentation Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence