Key Insights

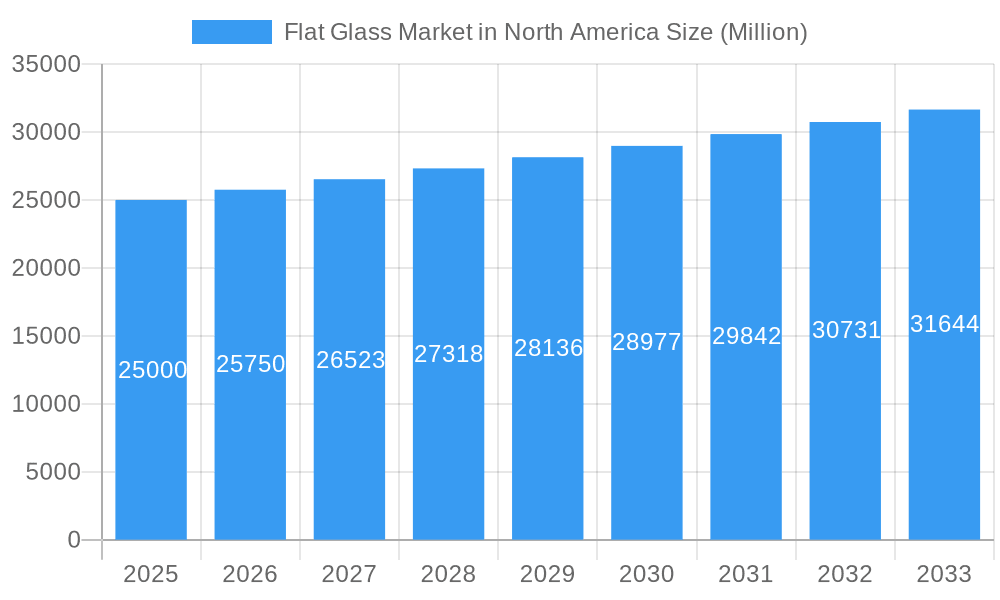

The North American flat glass market, encompassing annealed glass (including tinted), coated, reflective, processed glass, and mirrors, is experiencing robust growth, driven primarily by the burgeoning construction and automotive sectors. The market's size in 2025 is estimated at $XX billion (assuming a reasonable market size based on global market data and North America's economic strength). A compound annual growth rate (CAGR) exceeding 3% suggests a steady expansion through 2033, reaching an estimated value of approximately $YY billion (this value is a projection based on the provided CAGR and 2025 estimate; the exact figure requires more detailed market data). Key drivers include increasing infrastructure development, the rise of energy-efficient buildings demanding high-performance glass, and the growth of the automotive industry, particularly electric vehicles which utilize significant amounts of specialized glass. Trends such as smart glass technology and the increasing use of sustainable materials are further propelling market growth. However, fluctuations in raw material prices and potential economic downturns could act as restraints. The construction segment holds a dominant market share, followed by automotive, with solar and other end-user industries contributing significantly. Major players like Nippon Sheet Glass, Şişecam, Saint-Gobain, and AGC Inc. are fiercely competing, driving innovation and shaping market dynamics. The United States dominates the North American market, followed by Canada and Mexico. Analyzing the market's segmentation and competitive landscape provides valuable insights for strategic decision-making. Further research focused on specific applications within each segment would refine these projections and offer a more nuanced understanding of growth potential within each area.

Flat Glass Market in North America Market Size (In Billion)

The forecast period (2025-2033) anticipates significant growth opportunities fueled by advancements in glass technology and increased demand from diverse sectors. The dominance of large, established players indicates a high level of competition, but also suggests a degree of market stability. However, smaller, specialized firms focusing on niche applications like smart glass or sustainable solutions are also poised to gain traction, shaping the future of the North American flat glass market. Continuous monitoring of raw material prices, government regulations, and technological innovation will be crucial for companies seeking to thrive in this dynamic environment. Analyzing regional differences within North America—particularly variations in construction activity and automotive manufacturing—will be vital for targeting growth opportunities effectively.

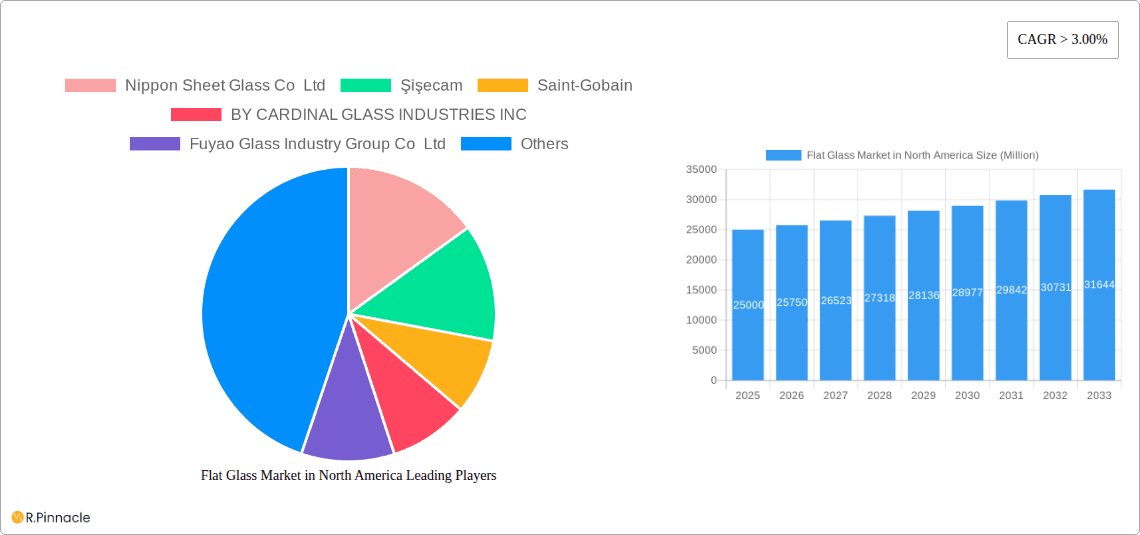

Flat Glass Market in North America Company Market Share

Flat Glass Market in North America: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American flat glass market, offering valuable insights for industry professionals, investors, and strategic planners. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The report leverages detailed data and expert analysis to forecast market trends and unlock actionable strategies.

Flat Glass Market in North America Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the North American flat glass market. We delve into market concentration, assessing the market share held by key players such as Nippon Sheet Glass Co Ltd, Şişecam, Saint-Gobain, BY CARDINAL GLASS INDUSTRIES INC, Fuyao Glass Industry Group Co Ltd, Guardian Industries Holdings, SCHOTT, Vitro, CPS, China Glass Holdings Limited, and AGC Inc. The report also examines the impact of mergers and acquisitions (M&A) activities, including the USD 450 Million acquisition of AGC Inc.'s North American architectural glass business by Cardinal Glass Industries in June 2021. This deal significantly reshaped the market structure, influencing market share and competitive dynamics. Furthermore, we explore innovation drivers, such as advancements in glass coating technologies and the increasing demand for energy-efficient glass solutions. Regulatory frameworks impacting the industry, including environmental regulations and building codes, are also analyzed. The report also considers the impact of substitute products and shifting end-user demographics on market growth. The analysis incorporates key metrics such as market share distribution among the major players and the total value of significant M&A deals within the study period.

Flat Glass Market in North America Market Dynamics & Trends

This section provides a detailed examination of the market dynamics driving growth in the North American flat glass market. We explore factors influencing market expansion, including rising construction activity, the burgeoning automotive industry, and the growing demand for solar energy. Technological advancements in glass manufacturing and coating techniques, such as the development of high-performance, energy-efficient glass, are also analyzed. The report further analyzes consumer preferences and their impact on demand for specific types of flat glass, such as tinted glass and reflective glass. Competitive dynamics, including pricing strategies and product differentiation, are explored, offering valuable insights into the competitive landscape. Key metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates for different product types and end-user industries are provided to quantify the observed trends. This section offers a comprehensive understanding of the market’s trajectory and its responsiveness to various factors. The xx% CAGR and xx% market penetration are estimated values.

Dominant Regions & Segments in Flat Glass Market in North America

This section identifies the leading regions, countries, and segments within the North American flat glass market. Detailed analysis highlights the dominance of specific geographic areas, pinpointing factors driving their success. The segment analysis covers:

- Product Type: Annealed Glass (Including Tinted Glass), Coater Glass, Reflective Glass, Processed Glass, Mirrors. The report identifies the leading product type based on market size, growth rate, and key drivers.

- End-user Industry: Construction, Automotive, Solar, Other End-user Industries. This section explores the leading end-user segment, analyzing its market share, growth projections, and contributing factors.

We use bullet points to showcase key drivers for each dominant segment, including economic policies, infrastructure development, and technological advancements. For example, the growth of the construction sector in specific regions is correlated with increased demand for flat glass, while advancements in solar panel technology drive the demand for specialized glass types. The analysis also encompasses a detailed discussion on the dominance of each segment, providing a comprehensive overview of the market structure.

Flat Glass Market in North America Product Innovations

Recent years have witnessed significant product innovations in the North American flat glass market. Key advancements include the development of self-cleaning glass, energy-efficient coatings, and aesthetically advanced glass designs that cater to diverse architectural and automotive applications. These innovations enhance the functionality, durability, and visual appeal of flat glass products, driving their adoption across various sectors. Companies are focusing on developing high-performance glass solutions that meet stringent energy efficiency standards and sustainability requirements, creating a competitive advantage in the market. The introduction of these new product variants and technological advancements are shaping the future of the flat glass market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North American flat glass market, segmented by product type and end-user industry.

Product Type:

Annealed Glass (Including Tinted Glass): This segment encompasses the largest market share and is experiencing a steady growth rate driven by its widespread use in various applications. The competitive landscape in this segment is characterized by intense competition among several major players.

Coater Glass: The coater glass segment exhibits moderate growth driven by increasing demand for energy-efficient and aesthetically enhanced glass solutions. Competition is moderately intense.

Reflective Glass: This segment showcases substantial growth due to its increasing adoption in buildings for energy efficiency and thermal management. The market is witnessing innovation and competition among major players.

Processed Glass: The processed glass segment demonstrates strong growth driven by specialized applications across various industries. Competition in this segment is driven by the expertise and innovation among players.

Mirrors: The mirrors segment exhibits moderate growth driven by various applications in construction and other end-user industries. This segment is less fragmented compared to others.

End-user Industry:

Construction: This segment constitutes the largest portion of the market, driven by substantial construction activities and the increasing use of flat glass in buildings.

Automotive: The automotive segment represents a significant portion of the market, with sustained growth fueled by rising vehicle production and the rising need for advanced glass solutions in vehicles.

Solar: This segment showcases rapid growth fueled by the increasing adoption of solar energy and the escalating demand for solar panel glass.

Other End-user Industries: This category includes various industries that utilize flat glass, with growth projections depending on the specific industry trends.

Key Drivers of Flat Glass Market in North America Growth

The North American flat glass market is experiencing robust growth driven by several key factors. The construction boom across the region, particularly in commercial and residential buildings, is a significant driver. The growing automotive industry, coupled with the increasing adoption of energy-efficient and technologically advanced glass solutions in vehicles, is another key contributor. Moreover, the rising focus on renewable energy and the expansion of the solar energy sector are significantly boosting demand for specialized flat glass used in solar panels. Government regulations promoting energy efficiency and sustainable building practices further fuel market growth. These factors collectively contribute to a positive outlook for the North American flat glass market.

Challenges in the Flat Glass Market in North America Sector

The North American flat glass market faces several challenges. Fluctuations in raw material prices, particularly silica sand, can significantly impact production costs and profitability. Stringent environmental regulations necessitate significant investments in emission control technologies, posing a financial burden on manufacturers. Intense competition among established players and the entry of new entrants can put pressure on pricing and margins. Supply chain disruptions can also affect production and delivery schedules. These factors present significant hurdles for companies operating in this market, impacting their overall operational efficiency and financial performance.

Emerging Opportunities in Flat Glass Market in North America

The North American flat glass market presents several emerging opportunities. The growing demand for energy-efficient buildings and vehicles is driving the adoption of advanced glass solutions with improved thermal insulation and light transmission properties. The increasing popularity of smart glass technology, offering features such as light dimming and privacy control, presents a significant growth avenue. The expanding solar energy sector creates opportunities for specialized flat glass solutions for solar panels. Additionally, new applications in various industries, such as aerospace and consumer electronics, are opening up new market segments for innovative glass products.

Leading Players in the Flat Glass Market in North America Market

- Nippon Sheet Glass Co Ltd

- Şişecam

- Saint-Gobain

- BY CARDINAL GLASS INDUSTRIES INC

- Fuyao Glass Industry Group Co Ltd

- Guardian Industries Holdings

- SCHOTT

- Vitro

- CPS

- China Glass Holdings Limited

- AGC Inc

Key Developments in Flat Glass Market in North America Industry

June 2021: AGC Inc. sold its North American architectural glass business to Cardinal Glass Industries for USD 450 Million. This included a float glass manufacturing plant in Greenland, Tennessee; a coating facility in Abingdon, Virginia; and a float plant in Spring Hill, Kansas. This significantly altered the market landscape.

June 2021: Canadian Premium Sand planned to build a high-clarity flat glass plant in Winnipeg, Canada, to meet the growing demand for low-iron flat glass in architectural and solar applications. This signifies the expansion of production capacity to address market demand.

Future Outlook for Flat Glass Market in North America Market

The future of the North American flat glass market appears promising, driven by several factors. Continued growth in the construction and automotive sectors will sustain demand for traditional flat glass products. However, the significant growth potential lies in the adoption of advanced glass solutions, such as energy-efficient and smart glass technologies. The expansion of the solar energy industry is also expected to drive demand for specialized glass products. Innovation in glass manufacturing processes and the development of sustainable materials will shape the future landscape, presenting significant opportunities for companies that can effectively adapt and innovate. The market is poised for sustained growth, driven by technological advancements and evolving industry demands.

Flat Glass Market in North America Segmentation

-

1. Product Type

- 1.1. Annealed Glass (Including Tinted Glass)

- 1.2. Coater Glass

- 1.3. Reflective Glass

- 1.4. Processed Glass

- 1.5. Mirrors

-

2. End-user Industry

- 2.1. Construction

- 2.2. Automotive

- 2.3. Solar

- 2.4. Other End-user Industries

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

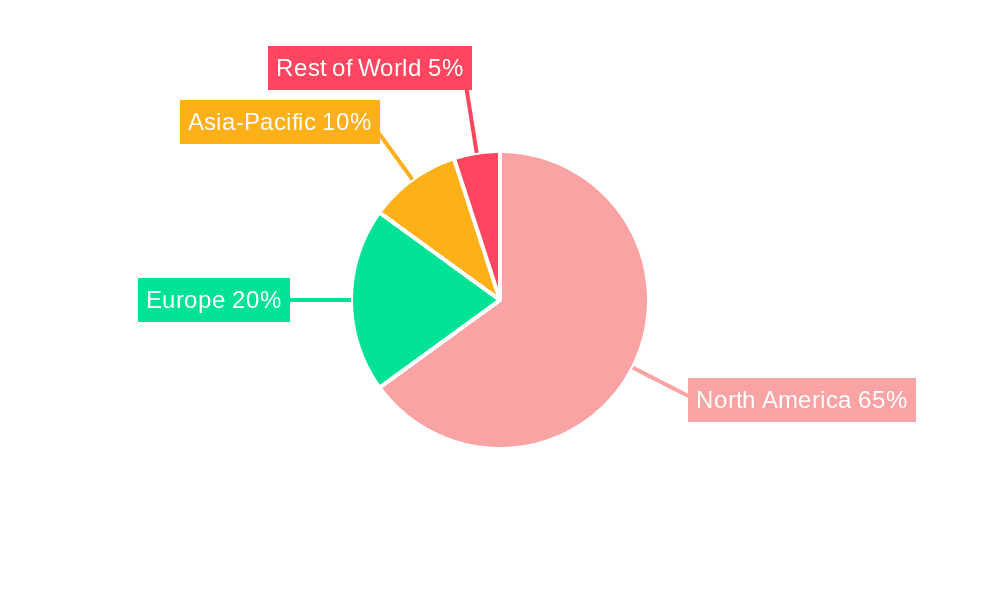

Flat Glass Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

Flat Glass Market in North America Regional Market Share

Geographic Coverage of Flat Glass Market in North America

Flat Glass Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Electronic Displays; Increasing Demand from the Construction Industry

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Construction Industry to Drive the Demand for Flat Glass

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Flat Glass Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Annealed Glass (Including Tinted Glass)

- 5.1.2. Coater Glass

- 5.1.3. Reflective Glass

- 5.1.4. Processed Glass

- 5.1.5. Mirrors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Automotive

- 5.2.3. Solar

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States Flat Glass Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Annealed Glass (Including Tinted Glass)

- 6.1.2. Coater Glass

- 6.1.3. Reflective Glass

- 6.1.4. Processed Glass

- 6.1.5. Mirrors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Automotive

- 6.2.3. Solar

- 6.2.4. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Flat Glass Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Annealed Glass (Including Tinted Glass)

- 7.1.2. Coater Glass

- 7.1.3. Reflective Glass

- 7.1.4. Processed Glass

- 7.1.5. Mirrors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Automotive

- 7.2.3. Solar

- 7.2.4. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico Flat Glass Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Annealed Glass (Including Tinted Glass)

- 8.1.2. Coater Glass

- 8.1.3. Reflective Glass

- 8.1.4. Processed Glass

- 8.1.5. Mirrors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Automotive

- 8.2.3. Solar

- 8.2.4. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America Flat Glass Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Annealed Glass (Including Tinted Glass)

- 9.1.2. Coater Glass

- 9.1.3. Reflective Glass

- 9.1.4. Processed Glass

- 9.1.5. Mirrors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Automotive

- 9.2.3. Solar

- 9.2.4. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nippon Sheet Glass Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Şişecam

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saint-Gobain

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BY CARDINAL GLASS INDUSTRIES INC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fuyao Glass Industry Group Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Guardian Industries Holdings

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SCHOTT

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vitro*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CPS

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 China Glass Holdings Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 AGC Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Nippon Sheet Glass Co Ltd

List of Figures

- Figure 1: Flat Glass Market in North America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Flat Glass Market in North America Share (%) by Company 2025

List of Tables

- Table 1: Flat Glass Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Flat Glass Market in North America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Flat Glass Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Flat Glass Market in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Flat Glass Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Flat Glass Market in North America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Flat Glass Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Flat Glass Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Flat Glass Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Flat Glass Market in North America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Flat Glass Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Flat Glass Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Flat Glass Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Flat Glass Market in North America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Flat Glass Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Flat Glass Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Flat Glass Market in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Flat Glass Market in North America Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: Flat Glass Market in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Flat Glass Market in North America Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flat Glass Market in North America?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Flat Glass Market in North America?

Key companies in the market include Nippon Sheet Glass Co Ltd, Şişecam, Saint-Gobain, BY CARDINAL GLASS INDUSTRIES INC, Fuyao Glass Industry Group Co Ltd, Guardian Industries Holdings, SCHOTT, Vitro*List Not Exhaustive, CPS, China Glass Holdings Limited, AGC Inc.

3. What are the main segments of the Flat Glass Market in North America?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Electronic Displays; Increasing Demand from the Construction Industry.

6. What are the notable trends driving market growth?

Construction Industry to Drive the Demand for Flat Glass.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

June 2021: AGC Inc. has announced to sell its North American architectural glass business to Cardinal Glass Industries, with a transfer deal of USD 450 million. Moreover, the facilities included in the sale include AGC Inc.'s Greenland, Tennessee, float glass manufacturing plant with two furnaces and one coater; its coating facility in Abingdon, Virginia; and a float plant in Spring Hill, Kansas, with one furnace.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flat Glass Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flat Glass Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flat Glass Market in North America?

To stay informed about further developments, trends, and reports in the Flat Glass Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence