Key Insights

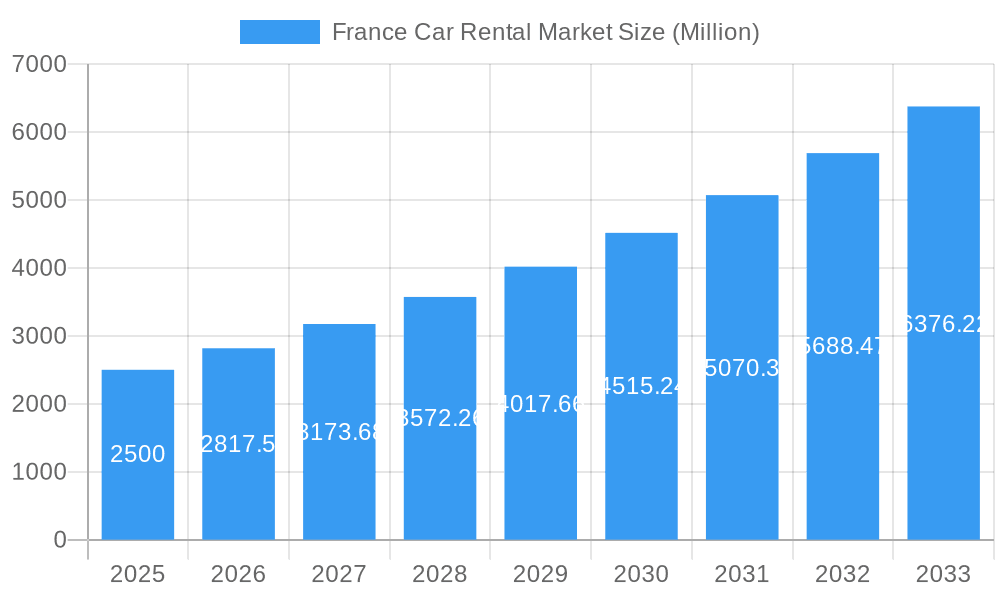

The France car rental market is poised for substantial growth, driven by increasing leisure and business travel. This dynamic sector is experiencing a robust CAGR of 5.91%, with the market size projected to reach 6.78 billion by 2033. Key growth drivers include the widespread adoption of online booking platforms, a rising demand for premium and luxury vehicle options, and France's enduring appeal as a premier European tourist destination. Emerging challenges include fluctuating fuel costs, evolving emission regulations, and the competitive landscape shaped by ride-hailing services.

France Car Rental Market Market Size (In Billion)

Market segmentation reveals a strong preference for online bookings, with leisure and tourism applications continuing to dominate. However, the business travel segment is also demonstrating significant growth potential. Consumers are increasingly opting for premium and luxury vehicles over budget and economy models, and short-term rentals remain the preferred choice for most travelers. Leading industry players such as Europcar International, Hertz, Enterprise Holdings, SIXT SE, and Avis Budget Group are actively competing through brand recognition and extensive network expansion. Future success will hinge on strategic investments in technology, sustainable fleet development, and targeted market expansion.

France Car Rental Market Company Market Share

France Car Rental Market Analysis: 2025-2033

This comprehensive market analysis offers critical insights into the France car rental sector for industry professionals, investors, and stakeholders. Covering the forecast period from 2025 to 2033, with a base year of 2025, this report employs advanced analytical methodologies to dissect market trends, identify opportunities, and address key challenges. Detailed segmentation encompasses booking types (online, offline), application types (leisure/tourism, business), vehicle types (budget/economy, premium/luxury), and rental durations (short-term, long-term), providing a granular understanding of this evolving market.

France Car Rental Market Market Structure & Innovation Trends

The France car rental market exhibits a moderately concentrated structure, with key players like Europcar International, The Hertz Corporation, Enterprise Holdings Inc, SIXT SE, Avis Budget Group Inc, and Uber Technologies Inc holding significant market share. However, the market also accommodates numerous smaller, regional players. Market share estimations for 2025 indicate Europcar International holds approximately xx% market share, followed by Hertz at xx%, Enterprise at xx%, and Sixt at xx%. Uber's market share is estimated at xx%, representing a significant presence within the ride-hailing segment that overlaps with car rental. The remaining market share is distributed among smaller operators and independent businesses. Innovation drivers include advancements in technology (e.g., mobile booking apps, telematics), evolving customer preferences (e.g., sustainability concerns, personalized services), and regulatory pressures (e.g., emission standards). The M&A landscape has witnessed significant activity in the past five years, with deal values totaling approximately xx Million in mergers and acquisitions. The impact on market concentration is seen through increased consolidation among leading players. Regulatory frameworks, such as those relating to emissions and driver licensing, significantly impact market dynamics. Product substitutes, like ride-sharing services and public transportation, exert competitive pressure, influencing pricing strategies and service offerings. The end-user demographics are diverse, encompassing both leisure and business travelers, with a growing preference for online booking platforms.

France Car Rental Market Market Dynamics & Trends

The France car rental market is poised for robust growth during the forecast period (2025-2033), driven by several key factors. The market's compound annual growth rate (CAGR) is projected to be xx% during this period. Increased tourism in France, coupled with business travel and domestic demand, fuels market expansion. Technological disruptions, particularly advancements in mobile technology and digital platforms, have streamlined the booking process, increased accessibility, and enhanced customer experience. Consumers increasingly prefer online booking, reflecting a preference for convenience and price comparison capabilities. The market penetration of online booking is currently estimated at xx% and is predicted to reach xx% by 2033. However, the market is also witnessing increasing competition, not only from traditional players but also from ride-sharing services which offer flexibility and on-demand transportation. Competitive dynamics largely center around pricing, fleet modernization, and customer service enhancements.

Dominant Regions & Segments in France Car Rental Market

The Île-de-France region (Paris and surrounding areas) represents the dominant market segment, accounting for approximately xx% of the total market revenue in 2025. This is primarily driven by high tourist traffic, strong business activity, and excellent transportation infrastructure.

- Key Drivers for Île-de-France Dominance:

- High tourist footfall.

- Significant business travel.

- Extensive transportation network.

- Strong economic activity.

Segment Analysis:

- Booking Type: Online bookings significantly outweigh offline bookings, driven by ease of use, price comparison, and 24/7 accessibility.

- Application Type: The Leisure/Tourism segment constitutes a larger portion compared to the Business segment, reflecting France's popularity as a tourist destination.

- Vehicle Type: The Budget/Economy segment dominates due to price sensitivity among travelers, although the Premium/Luxury segment demonstrates consistent growth fueled by rising disposable incomes.

- Rental Duration: Short-term rentals (under 7 days) constitute the largest segment, mirroring typical tourist behavior; however, the long-term rental segment is showing notable expansion due to increased relocation and temporary work assignments.

France Car Rental Market Product Innovations

Recent product innovations focus on enhancing customer experience, improving fleet efficiency, and incorporating sustainability measures. This includes the implementation of mobile-first booking platforms, the adoption of electric and hybrid vehicles within rental fleets, and the integration of telematics systems for enhanced vehicle tracking and maintenance. These innovations are tailored to meet evolving consumer preferences and to comply with stricter environmental regulations. The market is also witnessing the introduction of subscription-based rental services, offering a flexible alternative to traditional short-term or long-term rentals.

Report Scope & Segmentation Analysis

This report comprehensively segments the France car rental market across several key parameters.

- Booking Type: Online and Offline. Online is projected to grow at a CAGR of xx% due to increasing smartphone penetration and consumer preference for digital convenience. Offline segments maintain steady growth, driven primarily by walk-in customers and those needing immediate assistance.

- Application Type: Leisure/Tourism and Business. Leisure/Tourism is expected to expand at a faster rate due to increasing tourist arrivals in France. The Business segment demonstrates stable growth, tied to the strength of the French economy.

- Vehicle Type: Budget/Economy and Premium/Luxury. The Budget/Economy category retains the largest share but Premium/Luxury shows stronger growth projections owing to the growing affluence of consumers.

- Rental Duration: Short-Term and Long-Term. Short-Term rentals will maintain a larger segment share. Long-Term rentals are anticipated to display faster growth rates reflecting changing consumer needs and work arrangements.

Key Drivers of France Car Rental Market Growth

The France car rental market’s growth is propelled by factors including rising tourism, robust business travel, improved infrastructure facilitating ease of access to rental services, and the increasing popularity of online booking platforms that offer greater convenience and transparency. Government initiatives promoting sustainable tourism and the electrification of the transportation sector positively influence growth. Moreover, the expansion of affordable travel options and improving disposable incomes contribute to market expansion.

Challenges in the France Car Rental Market Sector

Challenges facing the market include increasing competition from ride-sharing services and public transport, fluctuating fuel prices impacting operational costs, and regulatory compliance pressures related to emission standards and data privacy. Supply chain disruptions, as seen in recent years, can lead to vehicle shortages and impact profitability. Moreover, maintaining competitive pricing while managing rising operational costs poses an ongoing challenge for businesses in the sector.

Emerging Opportunities in France Car Rental Market

Emerging opportunities lie in the growth of eco-friendly rental options (electric and hybrid vehicles), subscription-based rental models offering greater flexibility, and the expansion of services into underserved regions. The integration of advanced technologies like AI-powered chatbots for customer service and the development of personalized rental packages tailored to specific travel needs present further lucrative possibilities. The growing popularity of sustainable travel offers an opportunity to capitalize on eco-conscious customer preferences.

Leading Players in the France Car Rental Market Market

- Europcar International

- The Hertz Corporation

- Enterprise Holdings Inc

- SIXT SE

- Uber Technologies Inc

- Avis Budget Group Inc

Key Developments in France Car Rental Market Industry

- July 2023: Europcar launched a new mobile application with enhanced features.

- October 2022: SIXT partnered with a major French airline to offer bundled travel packages.

- March 2022: Hertz announced a significant investment in electric vehicle fleet expansion.

- Further developments will be added to the final report.

Future Outlook for France Car Rental Market Market

The future outlook for the France car rental market remains positive, with growth driven by sustained tourism growth, increased adoption of online booking platforms, and the expansion of sustainable transportation options. Strategic opportunities exist in expanding into niche markets, leveraging technology for enhanced customer service, and focusing on sustainability initiatives to align with evolving consumer preferences and government regulations. The continued investment in electric vehicle fleets and advanced technologies will be vital to sustaining long-term growth and maintaining competitiveness within this dynamic sector.

France Car Rental Market Segmentation

-

1. Rental Duration

- 1.1. Short Term

- 1.2. Long Term

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Application Type

- 3.1. Leisure/Tourism

- 3.2. Business

-

4. Vehicle Type

- 4.1. Budget/Economy

- 4.2. Premium/Luxury

France Car Rental Market Segmentation By Geography

- 1. France

France Car Rental Market Regional Market Share

Geographic Coverage of France Car Rental Market

France Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Tour and Travel Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 5.1.1. Short Term

- 5.1.2. Long Term

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Leisure/Tourism

- 5.3.2. Business

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Budget/Economy

- 5.4.2. Premium/Luxury

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. France

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Europcar International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Hertz Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enterprise Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SIXT SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Uber Technologies Inc *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Avis Budget Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Europcar International

List of Figures

- Figure 1: France Car Rental Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: France Car Rental Market Revenue billion Forecast, by Rental Duration 2020 & 2033

- Table 2: France Car Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: France Car Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: France Car Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: France Car Rental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: France Car Rental Market Revenue billion Forecast, by Rental Duration 2020 & 2033

- Table 7: France Car Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 8: France Car Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: France Car Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 10: France Car Rental Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Car Rental Market?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the France Car Rental Market?

Key companies in the market include Europcar International, The Hertz Corporation, Enterprise Holdings Inc, SIXT SE, Uber Technologies Inc *List Not Exhaustive, Avis Budget Group Inc.

3. What are the main segments of the France Car Rental Market?

The market segments include Rental Duration, Booking Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Growing Demand for Tour and Travel Activities.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Car Rental Market?

To stay informed about further developments, trends, and reports in the France Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence