Key Insights

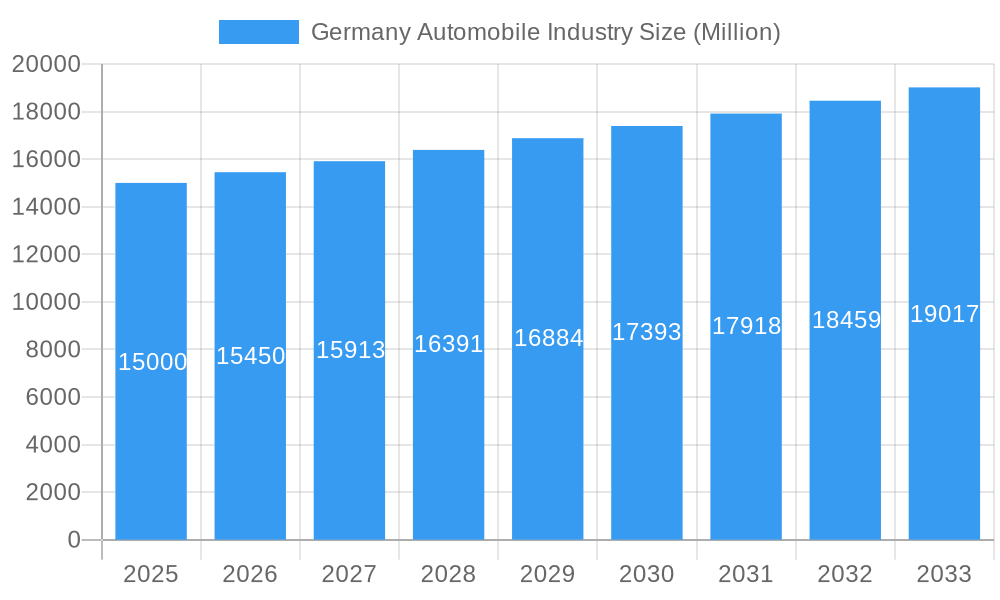

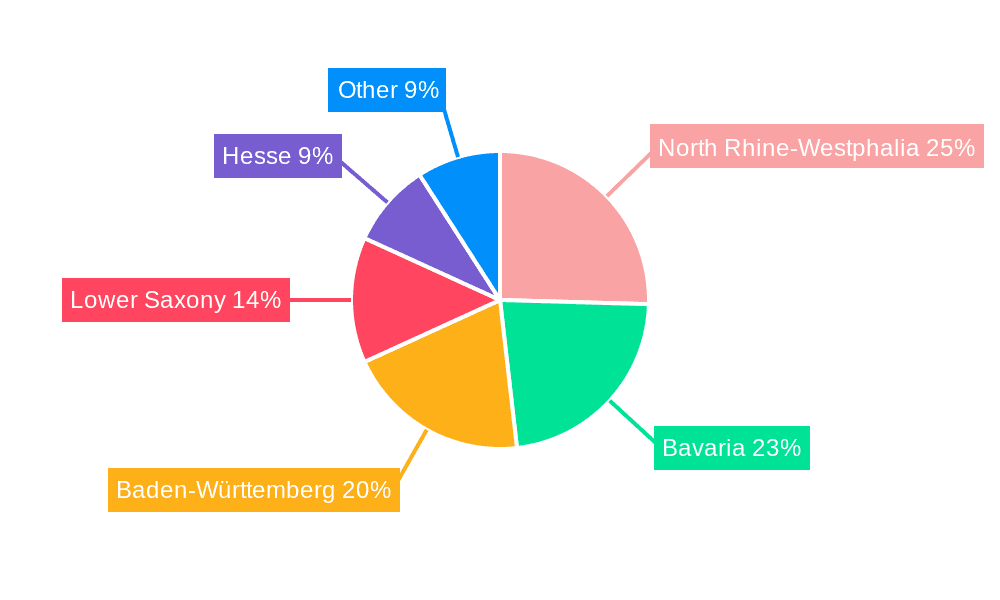

The German automobile logistics market, encompassing finished vehicle transportation, auto component logistics, and associated warehousing, distribution, and inventory management services, presents a robust and expanding landscape. Driven by Germany's established automotive manufacturing prowess and consistent export demand, the market exhibits a Compound Annual Growth Rate (CAGR) exceeding 3% from 2019 to 2033. Key drivers include the ongoing shift towards electric vehicles (EVs), necessitating specialized logistics solutions for battery components and charging infrastructure, and the increasing adoption of just-in-time (JIT) manufacturing methodologies demanding efficient and reliable supply chains. Furthermore, automation and digitalization within logistics operations, such as warehouse automation and improved supply chain visibility through technologies like blockchain and IoT, are contributing to market growth. The market is segmented by type (finished vehicles and auto components) and service (transportation, warehousing, distribution, and inventory management). Leading players like DB Schenker, DHL, Kuehne + Nagel, and others leverage their established networks and expertise to cater to the demands of major automotive manufacturers and their intricate supply chains. Regional concentration within Germany is significant, with states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg holding the largest market share due to their high concentration of automotive manufacturing facilities. The market faces restraints such as rising fuel costs, driver shortages, and geopolitical uncertainties, yet overall growth prospects remain positive driven by industry innovation and the continuous demand for automotive products both domestically and internationally.

Germany Automobile Industry Market Size (In Billion)

The market's future growth trajectory will be shaped by several factors. Sustainability initiatives are becoming increasingly crucial, pushing logistics providers to adopt greener transportation methods and optimize routes to minimize carbon footprints. The ongoing semiconductor shortage, a lingering challenge from recent years, will continue to impact production schedules and necessitate agile logistics solutions. Moreover, the integration of emerging technologies, such as AI-powered route optimization and predictive analytics, will enhance efficiency and reduce operational costs. This will result in intensified competition among logistics providers, driving innovation and potentially leading to consolidation within the market. The German government's continued support for the automotive industry, especially in the transition to electric vehicles, will create further opportunities for growth in this dynamic sector.

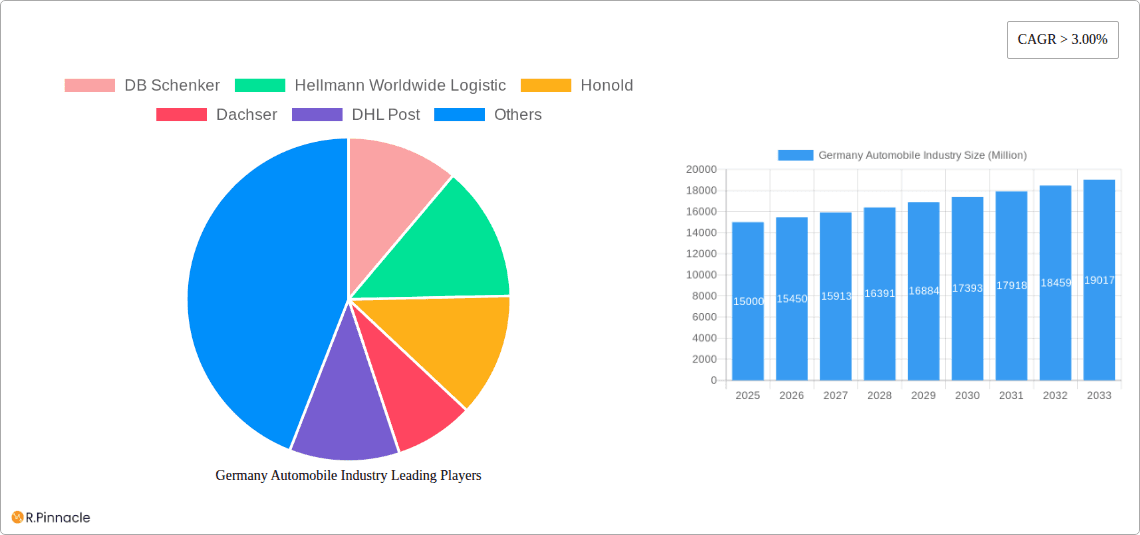

Germany Automobile Industry Company Market Share

Germany Automobile Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the German automobile industry, covering market structure, dynamics, leading players, and future outlook from 2019 to 2033. The study period encompasses historical data (2019-2024), a base year (2025), and a forecast period (2025-2033), offering valuable insights for industry professionals, investors, and strategic decision-makers.

Germany Automobile Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the German automobile industry. We examine market concentration, identifying key players and their respective market shares. The analysis includes an overview of M&A activities, highlighting significant deals and their impact on market structure. Innovation drivers, such as advancements in electric vehicle technology and autonomous driving, are explored, along with the regulatory frameworks that influence industry growth. Product substitutes and their market penetration are also assessed, providing a holistic view of the competitive dynamics. Finally, we delve into end-user demographics and their evolving preferences, influencing the demand for various automotive products and services. We estimate that xx Million in M&A deal value transpired between 2019-2024.

- Market Concentration: Highly concentrated market with a few dominant players controlling a significant market share. Analysis includes specific market share data for key players.

- Innovation Drivers: Advancements in electric vehicle (EV) technology, autonomous driving, and connected car technologies are driving innovation.

- Regulatory Framework: Stringent emission regulations and safety standards are shaping industry strategies.

- Product Substitutes: Growth of public transportation and ride-sharing services pose a competitive threat.

- End-User Demographics: Shifting consumer preferences towards sustainability and technological advancements influence market demand.

- M&A Activities: Significant mergers and acquisitions have reshaped the competitive landscape, with deals exceeding xx Million in value during the historical period.

Germany Automobile Industry Market Dynamics & Trends

This section examines the market's growth trajectory, technological disruptions, and evolving consumer preferences. We analyze key growth drivers, such as increasing vehicle sales, government incentives for EVs, and infrastructure development. The impact of technological disruptions, including the rise of EVs and autonomous driving, on market dynamics is meticulously explored. Consumer preferences, including shifting demand for specific vehicle types and features, are examined. Competitive dynamics, including pricing strategies, product differentiation, and market positioning are analyzed in detail. We project a compound annual growth rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration of EVs reaching xx% by 2033.

Dominant Regions & Segments in Germany Automobile Industry

This section identifies the leading regions and segments within the German automobile industry. We analyze dominance across both "By Type" (Finished Vehicle, Auto Component) and "By Service" (Transportation, Warehousing, Distribution, and Inventory Management, Other Services) categories. Key drivers of regional and segmental dominance are explored, considering factors such as economic policies, infrastructure development, and consumer demand.

- Dominant Regions: [Specific Region/State in Germany with detailed explanation of dominance].

- Dominant Segments (By Type):

- Finished Vehicle: [Explanation of dominance, key drivers, and market size in Million].

- Auto Component: [Explanation of dominance, key drivers, and market size in Million].

- Dominant Segments (By Service):

- Transportation: [Explanation of dominance, key drivers, and market size in Million].

- Warehousing: [Explanation of dominance, key drivers, and market size in Million].

- Distribution: [Explanation of dominance, key drivers, and market size in Million].

- Inventory Management: [Explanation of dominance, key drivers, and market size in Million].

- Other Services: [Explanation of dominance, key drivers, and market size in Million].

Germany Automobile Industry Product Innovations

This section summarizes key product developments, highlighting technological advancements and their market impact. We focus on innovations in vehicle technology, such as advanced driver-assistance systems (ADAS), electric powertrains, and connectivity features. The competitive advantages offered by these innovations are analyzed, and their market fit is assessed.

Report Scope & Segmentation Analysis

This report segments the German automobile industry by "By Type" (Finished Vehicle, Auto Component) and "By Service" (Transportation, Warehousing, Distribution, and Inventory Management, Other Services). Each segment's growth projections, market size (in Million), and competitive dynamics are detailed below.

- Finished Vehicle: [Growth projection, market size, competitive dynamics].

- Auto Component: [Growth projection, market size, competitive dynamics].

- Transportation: [Growth projection, market size, competitive dynamics].

- Warehousing: [Growth projection, market size, competitive dynamics].

- Distribution: [Growth projection, market size, competitive dynamics].

- Inventory Management: [Growth projection, market size, competitive dynamics].

- Other Services: [Growth projection, market size, competitive dynamics].

Key Drivers of Germany Automobile Industry Growth

The growth of the German automobile industry is driven by several factors, including technological advancements in vehicle manufacturing, supportive government policies promoting sustainable transportation, and a robust automotive supply chain. Furthermore, the increasing demand for vehicles, fueled by economic growth and a growing middle class, plays a crucial role.

Challenges in the Germany Automobile Industry Sector

The German automobile industry faces challenges, including stringent emission regulations impacting vehicle production costs, supply chain disruptions affecting production timelines, and intense competition from global automotive manufacturers. These factors contribute to reduced profitability and uncertainty within the industry. The impact of these challenges is quantified in terms of xx Million in potential lost revenue.

Emerging Opportunities in Germany Automobile Industry

Emerging opportunities include the growth of electric vehicles, the increasing demand for autonomous driving technology, and the expansion of connected car services. These trends create new revenue streams and market segments for industry players.

Leading Players in the Germany Automobile Industry Market

- DB Schenker

- Hellmann Worldwide Logistics

- Honold

- Dachser

- DHL Post

- Kuehne + Nagel International AG

- Rhenus Logistics

- Geodis

- DSV Panalpina

- Rudolph Logistics Group

Key Developments in Germany Automobile Industry Industry

- October 2023: AD Ports Group's acquisition of Sesé Auto Logistics for EUR 81 Million signifies a significant consolidation within the finished vehicle logistics sector. This deal is expected to enhance AD Ports' market position and expand its service offerings.

- February 2023: Samvardhana Motherson's acquisition of SAS Autosystemtechnik GmbH strengthens its position in the automotive assembly and logistics services market. This acquisition enhances SMRP BV's capabilities and customer relationships, driving further growth within Germany.

Future Outlook for Germany Automobile Industry Market

The German automobile industry is poised for continued growth, driven by technological innovation, evolving consumer preferences, and strategic investments. The market is expected to experience significant expansion in the electric vehicle and autonomous driving segments, presenting lucrative opportunities for industry players. This growth trajectory is expected to generate xx Million in additional market value by 2033.

Germany Automobile Industry Segmentation

-

1. Type

- 1.1. Finished Vehicle

- 1.2. Auto Component

-

2. Service

- 2.1. Transportation

- 2.2. Warehous

- 2.3. Other Services

Germany Automobile Industry Segmentation By Geography

- 1. Germany

Germany Automobile Industry Regional Market Share

Geographic Coverage of Germany Automobile Industry

Germany Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Automotive Exports driving logistics market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Finished Vehicle

- 5.1.2. Auto Component

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Transportation

- 5.2.2. Warehous

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honold

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dachser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenus Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geodis**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV Panalpina

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rudolph Logistics Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Germany Automobile Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Automobile Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 3: Germany Automobile Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Germany Automobile Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Germany Automobile Industry Revenue undefined Forecast, by Service 2020 & 2033

- Table 6: Germany Automobile Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automobile Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Germany Automobile Industry?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistic, Honold, Dachser, DHL Post, Kuehne + Nagel International AG, Rhenus Logistics, Geodis**List Not Exhaustive, DSV Panalpina, Rudolph Logistics Group.

3. What are the main segments of the Germany Automobile Industry?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Automotive Exports driving logistics market.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

October 2023: AD Ports Group (ADX: ADPORTS), one of the world's premier facilitator of logistics, industry, and trade, announces that Noatum, which now leads its Logistics Cluster operations, has signed the agreement for the acquisition of the 100% equity ownership of Sesé Auto Logistics, the Finished Vehicles Logistics (FVL) business of Grupo Logístico Sesé, for a total purchase consideration (Enterprise Value - EV) of EUR 81 million. The transaction is expected to be completed by Q1 2024, subject to regulatory approvals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automobile Industry?

To stay informed about further developments, trends, and reports in the Germany Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence