Key Insights

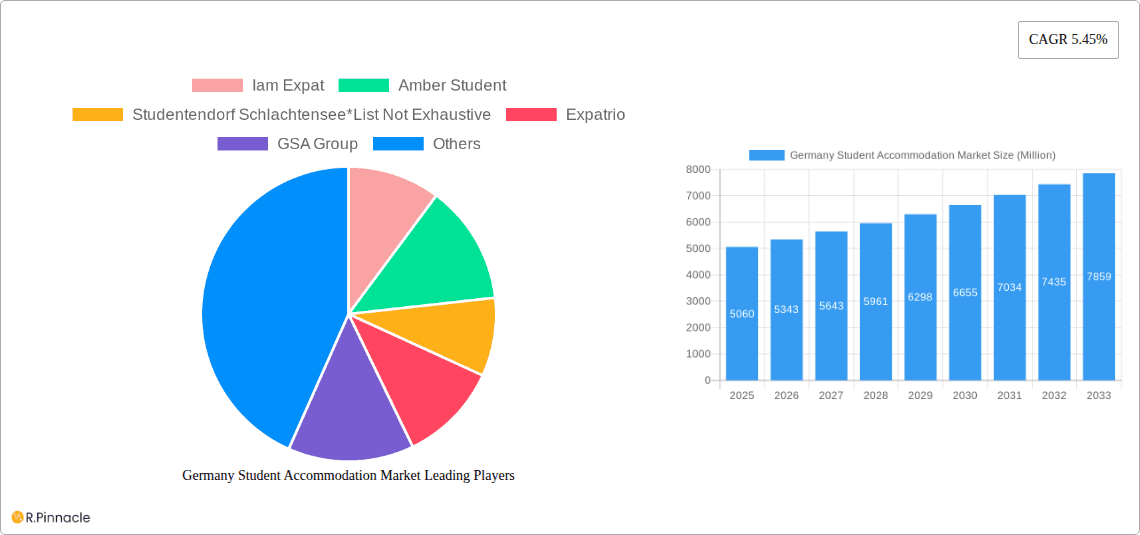

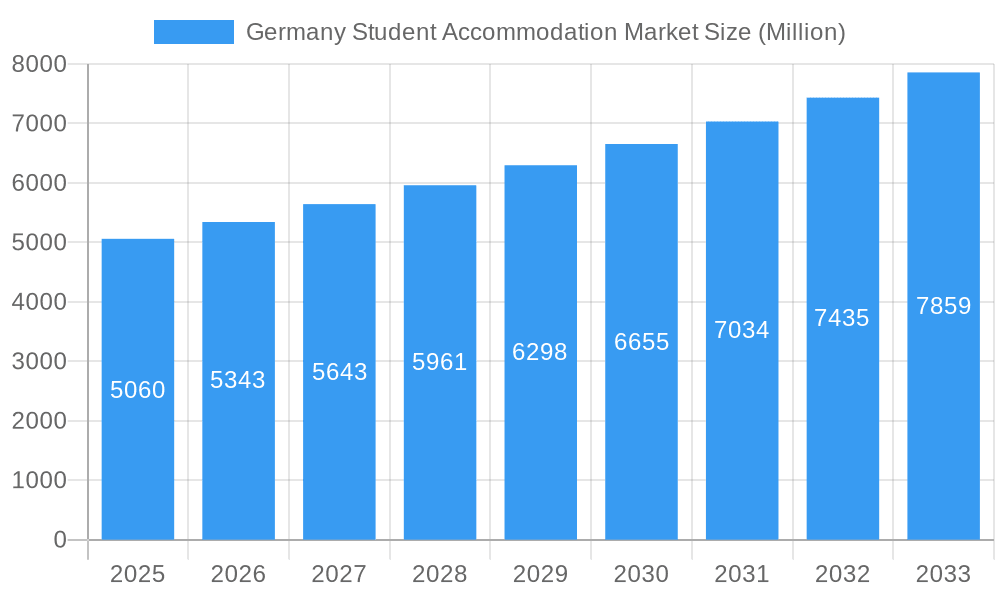

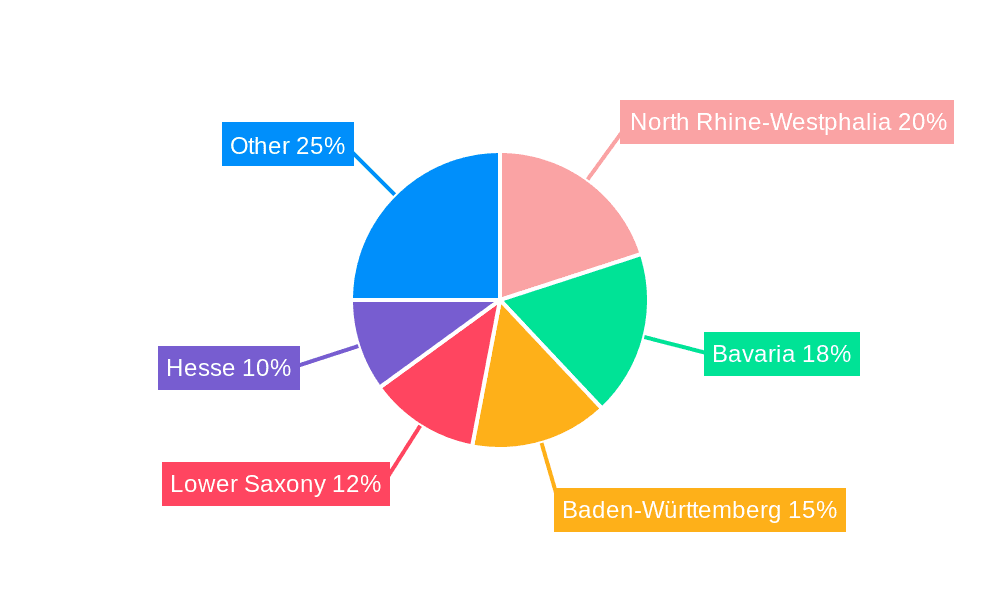

The German student accommodation market, valued at €5.06 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.45% from 2025 to 2033. This growth is fueled by several key factors. Rising student enrollment numbers across German universities, particularly in high-demand fields like engineering and technology, are driving increased demand for accommodation. Furthermore, a shift towards more sophisticated and amenity-rich student housing options, including private student accommodation and those offering flexible rental terms (basic vs. total rent), is contributing to market expansion. The increasing popularity of online platforms for finding student accommodation simplifies the search process and boosts market accessibility. Geographically, city centers remain the most sought-after locations, although demand in peripheral areas is also growing as affordability becomes a more pressing concern for students. Competition is intense, with established players like Unite Group and GSA Group alongside newer entrants like Iam Expat and Amber Student vying for market share. The market is segmented by price point (economy, mid-range, luxury), rental type, mode of booking (online/offline), and accommodation type (halls of residence, rented houses/rooms, private accommodation). The strong economic performance of regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg further supports the positive market outlook.

Germany Student Accommodation Market Market Size (In Billion)

The market's growth, however, faces certain challenges. Construction costs and land scarcity, particularly in city centers, can constrain the supply of new student housing, potentially leading to price increases. The market's sensitivity to economic fluctuations and potential changes in government policies regarding student funding also represent potential risks. Nevertheless, the overall trend points towards continued expansion, driven by the long-term upward trajectory of student enrollment and a persistent demand for convenient, modern, and well-equipped student accommodations. The ongoing digitalization of the sector, with increasing reliance on online platforms, will further shape the market landscape in the coming years, requiring players to adapt and innovate to remain competitive.

Germany Student Accommodation Market Company Market Share

Germany Student Accommodation Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the German student accommodation market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, key players, and future growth potential. The study encompasses various segments, including price points (economy, mid-range, luxury), rent types (basic, total), booking modes (online, offline), accommodation types (halls of residence, rented houses/rooms, private accommodation), and locations (city center, periphery).

Germany Student Accommodation Market Structure & Innovation Trends

The German student accommodation market is characterized by a moderate level of concentration, with a few large players and numerous smaller operators. Market share data for 2024 indicates that the top five players hold approximately xx% of the market, while the remaining xx% is fragmented among smaller companies and independent landlords. Innovation is driven by technological advancements (online booking platforms, smart building technologies), evolving student preferences (demand for co-living spaces, sustainable accommodations), and regulatory changes aimed at improving student housing quality and affordability. The regulatory framework includes building codes, rental laws, and tax incentives that influence market dynamics. Product substitutes include privately rented apartments and shared housing arrangements. The end-user demographic is primarily composed of domestic and international students, with a growing proportion of postgraduate students and young professionals.

M&A activity has been significant in recent years, with several large transactions involving established players and private equity firms. For instance:

- January 2023: International Campus acquired five student apartment blocks for €xx Million, showcasing the ongoing consolidation trend in the market.

- November 2022: Catella Residential Investment Management GmbH (CRIM) completed a significant sale of student housing assets for over USD 65.38 Million.

Germany Student Accommodation Market Market Dynamics & Trends

The German student accommodation market is experiencing robust growth, driven by several key factors. The increasing number of students enrolling in higher education institutions is a major driver, along with rising urbanization and a limited supply of affordable housing in major student cities. Technological disruptions, such as online booking platforms and smart home technologies, are transforming the consumer experience. Consumer preferences are shifting towards more modern, amenity-rich accommodations, including co-living spaces, and sustainable options. Competitive dynamics are shaped by pricing strategies, service offerings, and location advantages. The market’s CAGR is projected to be xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2024 to xx% by 2033.

Dominant Regions & Segments in Germany Student Accommodation Market

The major cities such as Munich, Berlin, and Cologne, dominate the German student accommodation market due to the high concentration of universities and colleges. The most popular segment is mid-range priced accommodation, balancing affordability and quality.

- By Price: Mid-range properties dominate, driven by student affordability and market availability.

- By Rent Type: Total rent (including utilities and services) is the most common rent type, offering convenience and transparency.

- By Mode: Online booking is gaining popularity, with increased market penetration due to ease and convenience.

- By Accommodation Type: Rented houses or rooms are the most dominant accommodation type, reflecting individual preferences.

- By Location: City center locations are favored for proximity to educational institutions and urban amenities.

Key drivers for this dominance include robust economic conditions in these regions, well-developed infrastructure, and policies supporting higher education. The periphery markets are growing, but at a slower pace, largely driven by affordability and improved transport links.

Germany Student Accommodation Market Product Innovations

The student accommodation sector is witnessing significant product innovations, primarily focused on enhancing student experiences. This includes the integration of smart home technology, sustainable building practices, and the creation of co-living spaces. These innovations cater to the demand for modern amenities, comfortable living environments, and technologically advanced spaces. Competitive advantages are derived from superior location, amenities, and value-added services, including study spaces and community events.

Report Scope & Segmentation Analysis

This report segments the German student accommodation market based on price (economy, mid-range, luxury), rent type (basic, total), booking mode (online, offline), accommodation type (halls of residence, rented houses/rooms, private accommodation), and location (city center, periphery). Each segment's growth projections and market sizes are analyzed, along with the competitive dynamics within each segment. Growth rates vary across segments based on several factors, such as price sensitivity and the availability of housing options.

Key Drivers of Germany Student Accommodation Market Growth

Growth in the German student accommodation market is propelled by a number of factors including: an increase in student enrollment across universities, increased urbanization leading to greater demand, government initiatives to support student housing, and the growing adoption of online booking platforms improving accessibility. The improving economy boosts construction activity and investor interest.

Challenges in the Germany Student Accommodation Market Sector

Challenges include a shortage of affordable housing, particularly in major university cities, competition among providers, and regulatory constraints that may restrict development. Rising construction costs and a tight labor market are adding further pressure.

Emerging Opportunities in Germany Student Accommodation Market

Opportunities exist in developing sustainable and eco-friendly accommodation, catering to the growing environmentally conscious student population. Furthermore, expanding into smaller university towns and cities creates untapped market potential.

Leading Players in the Germany Student Accommodation Market Market

- Iam Expat

- Amber Student

- Studentendorf Schlachtensee

- Expatrio

- GSA Group

- Unite Group

- University living

- Uni Acco

Key Developments in Germany Student Accommodation Market Industry

- January 2023: International Campus's acquisition of five student apartment blocks demonstrates significant investment and market consolidation.

- November 2022: Catella Residential Investment Management GmbH (CRIM)’s sale of student housing assets highlights investor interest and the liquidity within the sector.

Future Outlook for Germany Student Accommodation Market Market

The German student accommodation market is poised for continued growth, driven by long-term trends in higher education enrollment, urbanization, and evolving student preferences. Strategic opportunities exist for providers who can innovate, offer flexible accommodations, and cater to the specific needs of a diverse student population. The market will likely see further consolidation, with larger players acquiring smaller operators.

Germany Student Accommodation Market Segmentation

-

1. Accomodation Type

- 1.1. Halls of Residence

- 1.2. Rented Houses or Rooms

- 1.3. Private Student Accommodation

-

2. location

- 2.1. City Center

- 2.2. Periphery

-

3. Price

- 3.1. Economy

- 3.2. Mid-range

- 3.3. Luxury

-

4. Rent Type

- 4.1. Basic Rent

- 4.2. Total Rent

-

5. Mode

- 5.1. Online

- 5.2. Offline

Germany Student Accommodation Market Segmentation By Geography

- 1. Germany

Germany Student Accommodation Market Regional Market Share

Geographic Coverage of Germany Student Accommodation Market

Germany Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Cost of Living In Germany Affecting Student Accommodation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 5.1.1. Halls of Residence

- 5.1.2. Rented Houses or Rooms

- 5.1.3. Private Student Accommodation

- 5.2. Market Analysis, Insights and Forecast - by location

- 5.2.1. City Center

- 5.2.2. Periphery

- 5.3. Market Analysis, Insights and Forecast - by Price

- 5.3.1. Economy

- 5.3.2. Mid-range

- 5.3.3. Luxury

- 5.4. Market Analysis, Insights and Forecast - by Rent Type

- 5.4.1. Basic Rent

- 5.4.2. Total Rent

- 5.5. Market Analysis, Insights and Forecast - by Mode

- 5.5.1. Online

- 5.5.2. Offline

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iam Expat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amber Student

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Studentendorf Schlachtensee*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expatrio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GSA Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unite Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 University living

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Uni Acco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Iam Expat

List of Figures

- Figure 1: Germany Student Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Student Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 2: Germany Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 3: Germany Student Accommodation Market Revenue Million Forecast, by Price 2020 & 2033

- Table 4: Germany Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 5: Germany Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 6: Germany Student Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Germany Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 8: Germany Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 9: Germany Student Accommodation Market Revenue Million Forecast, by Price 2020 & 2033

- Table 10: Germany Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 11: Germany Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 12: Germany Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Student Accommodation Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Germany Student Accommodation Market?

Key companies in the market include Iam Expat, Amber Student, Studentendorf Schlachtensee*List Not Exhaustive, Expatrio, GSA Group, Unite Group, University living, Uni Acco.

3. What are the main segments of the Germany Student Accommodation Market?

The market segments include Accomodation Type, location, Price, Rent Type, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Cost of Living In Germany Affecting Student Accommodation Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

January 2023: International Campus acquired five student apartment blocks from Allianz Real Estate and CBRE Investment Management. This acquisition was one of the largest transactions of an International Campus in German Speaking region. The properties are in Berlin, Frankfurt, am Main, Hanover, and Vienna.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Student Accommodation Market?

To stay informed about further developments, trends, and reports in the Germany Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence