Key Insights

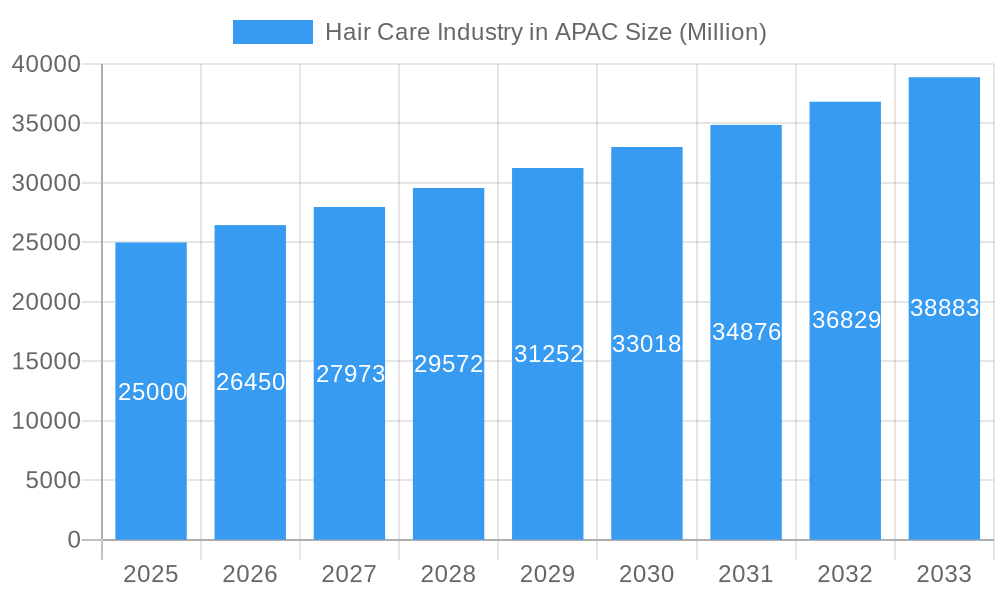

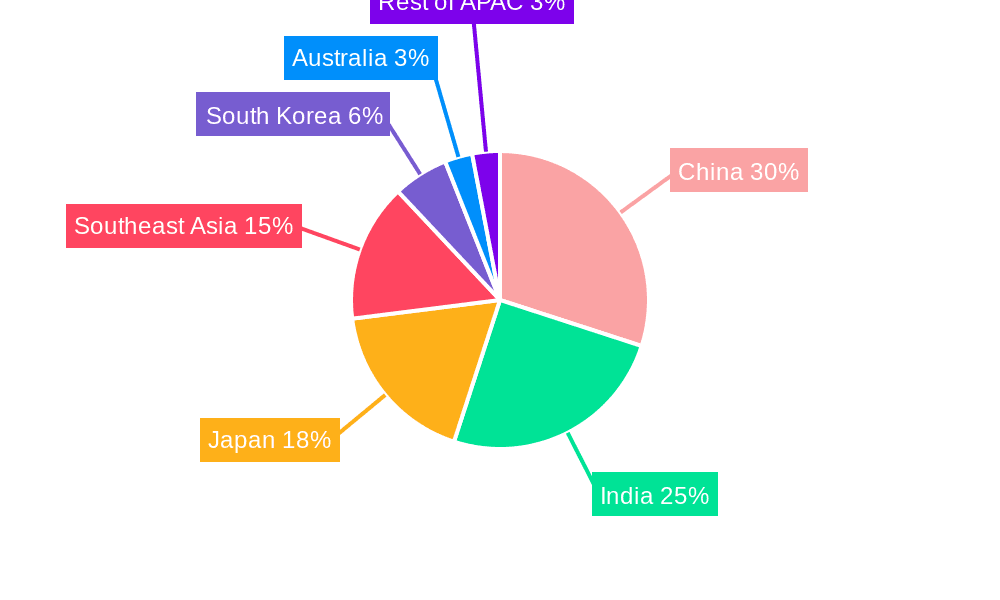

The Asia-Pacific (APAC) hair care market, valued at $109.48 billion in its base year of 2025, is projected for substantial expansion. Forecasts indicate a Compound Annual Growth Rate (CAGR) of 6.14% from 2025 to 2033. This robust growth is underpinned by several key factors. Increased disposable incomes across numerous APAC nations, especially within burgeoning economies such as India and Southeast Asia, are driving higher consumer expenditure on personal care, including premium hair care solutions. Growing consumer awareness regarding hair health and the rising incidence of hair-related concerns are stimulating demand for specialized products like conditioners, hair oils, and styling gels. Moreover, the expanding e-commerce landscape offers enhanced accessibility to a broader array of hair care products, thereby amplifying market penetration. The market is segmented by product type, encompassing colorants, hair sprays, conditioners, styling gels, hair oils, shampoos, and others, and by distribution channel, including supermarkets/hypermarkets, specialty stores, online retail, pharmacies/drug stores, and others. This product diversity effectively addresses varied consumer needs and preferences, further catalyzing market growth. While specific regional data is not detailed, China, India, and Japan are anticipated to hold significant market shares due to their substantial populations and developing economies.

Hair Care Industry in APAC Market Size (In Billion)

However, the market also encounters certain limitations. Volatile raw material prices can influence product pricing and profitability. Intensifying competition from both established international brands and emerging local players necessitates ongoing product innovation and strategic marketing efforts. Furthermore, evolving regulatory frameworks concerning the use of specific chemicals in hair care formulations may present challenges. Despite these obstacles, the overall outlook for the APAC hair care market remains optimistic, propelled by sustained economic development, shifting consumer preferences, and the increasing popularity of innovative hair care solutions. The market's strong performance is expected to persist throughout the forecast period (2025-2033), with continued growth across diverse product segments and distribution channels. The hair oils and conditioners segment, in particular, is anticipated to experience significant expansion, driven by heightened consumer interest in natural and healthier hair care options.

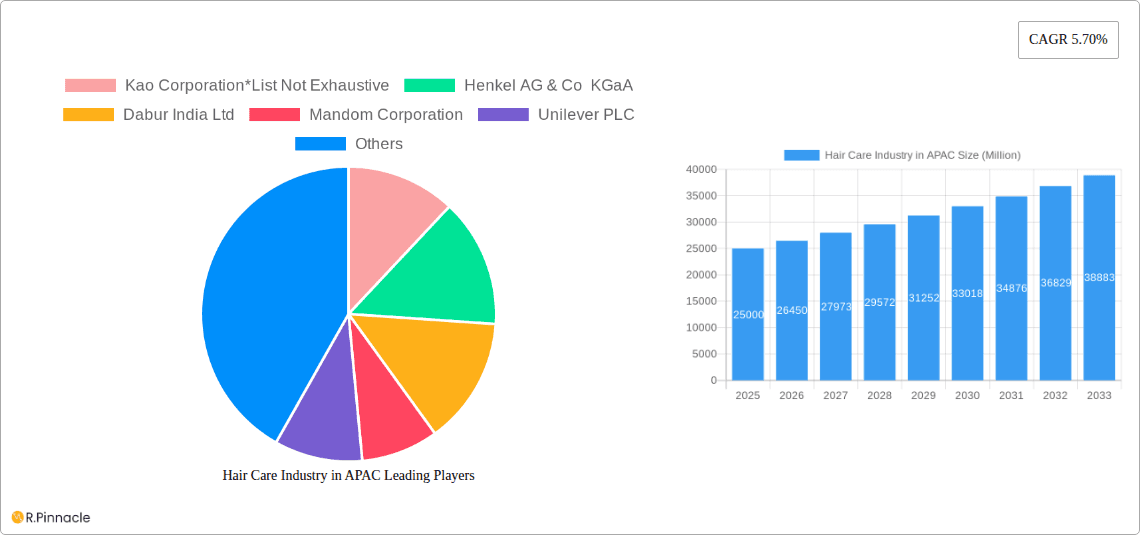

Hair Care Industry in APAC Company Market Share

Hair Care Industry in APAC: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Hair Care Industry in the Asia-Pacific (APAC) region, covering the period from 2019 to 2033. We delve into market structure, innovation trends, dynamics, and future projections, offering actionable insights for industry professionals. The report leverages extensive data analysis and incorporates key industry developments to deliver a clear and concise understanding of this dynamic market. The estimated market size in 2025 is valued at XX Million, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

Hair Care Industry in APAC Market Structure & Innovation Trends

The APAC hair care market is characterized by a mix of multinational giants and regional players. Market concentration is moderate, with the top 10 companies holding an estimated XX% market share in 2025. Key players include Kao Corporation, Henkel AG & Co KGaA, Dabur India Ltd, Mandom Corporation, Unilever PLC, L'Oreal SA, Marico Limited, The Procter & Gamble Company, Hoyu Co Ltd, and Bajaj Consumer Care Ltd. However, the market also features numerous smaller, niche players catering to specific consumer segments and preferences.

- Market Concentration: Top 10 players hold approximately XX% market share (2025).

- Innovation Drivers: Growing consumer demand for natural and organic products, increasing disposable incomes, and technological advancements in hair care formulations.

- Regulatory Frameworks: Vary across countries, impacting product formulations and marketing claims. Harmonization efforts are ongoing, but inconsistencies remain.

- Product Substitutes: Traditional remedies and homemade hair care solutions present some level of competition, particularly in certain segments.

- End-User Demographics: A large and diverse population, with varying hair types and preferences across different age groups and socioeconomic strata, drives market segmentation.

- M&A Activities: The past five years have witnessed several mergers and acquisitions, with deal values totaling approximately XX Million. These activities are driven by expansion strategies and access to new technologies and markets.

Hair Care Industry in APAC Market Dynamics & Trends

The APAC hair care market is experiencing robust growth, driven by several factors. Rising disposable incomes, particularly in emerging economies, fuel demand for premium and specialized hair care products. Increasing awareness of hair health and beauty is also contributing to market expansion. Technological advancements, such as the development of innovative formulations and packaging solutions, further enhance market dynamics. However, competitive pressures from both established players and emerging brands remain significant. Consumer preferences are shifting towards natural, organic, and sustainably sourced products, presenting both opportunities and challenges for businesses. The market penetration of online retail channels is also steadily increasing, transforming distribution channels and consumer behavior. The CAGR for the forecast period (2025-2033) is projected at XX%.

Dominant Regions & Segments in Hair Care Industry in APAC

China and India are the dominant markets within APAC, accounting for a combined XX% of the total market value in 2025. This dominance is attributed to their large populations, rising disposable incomes, and increasing awareness of hair care.

Leading Segments (Product Type):

- Shampoo: Remains the largest segment, driven by high demand and frequent usage.

- Hair Oil: Strong growth, especially in South Asia, due to traditional use and perceived health benefits.

- Conditioner: Consistent demand, fueled by the increasing focus on hair health and conditioning.

Leading Segments (Distribution Channel):

- Supermarkets/Hypermarkets: Remain the primary distribution channel due to widespread accessibility and established infrastructure.

- Online Retail Stores: Experiencing rapid growth, driven by increasing internet penetration and convenience.

Key Drivers:

- Economic Growth: Rising disposable incomes and increased spending power.

- Urbanization: Migration from rural to urban areas drives consumer access and demand.

- Changing Lifestyle: Increasing awareness of personal grooming and beauty standards.

Hair Care Industry in APAC Product Innovations

Recent innovations in the APAC hair care market focus on natural ingredients, sustainable packaging, and convenient formats. The launch of waterless dry shampoos, like the one by Kao, reflects the growing demand for portable and environmentally friendly products. Dabur's expansion into premium shampoos through the Dabur Vatika Select brand demonstrates a shift towards higher-value products. These innovations cater to evolving consumer preferences and address environmental concerns, creating competitive advantages for companies that successfully adapt to these trends.

Report Scope & Segmentation Analysis

This report segments the APAC hair care market by product type (Colorant, Hair Spray, Conditioner, Styling Gel, Hair Oil, Shampoo, Other Products) and distribution channel (Supermarkets/Hypermarkets, Speciality Stores, Online Retail Stores, Pharmacy and Drug Stores, Other Distribution Channels). Each segment's growth projections, market size (2025 values in Million), and competitive dynamics are analyzed in detail. The report projects significant growth in online retail channels, with market size reaching XX Million by 2033, while traditional channels remain substantial contributors to overall revenue.

Key Drivers of Hair Care Industry in APAC Growth

The APAC hair care market's growth is fueled by several key drivers: rising disposable incomes across many APAC countries lead to increased spending on personal care, including hair care. Technological advancements in formulations (e.g., natural ingredients, improved efficacy) and packaging (e.g., sustainable and travel-friendly options) are also driving growth. Finally, changing lifestyles and increased awareness of personal grooming play a vital role.

Challenges in the Hair Care Industry in APAC Sector

The industry faces challenges such as intense competition from both established and emerging brands, leading to price pressures. Regulatory hurdles vary across APAC countries, adding complexities to product registration and marketing. Supply chain disruptions and fluctuating raw material prices also affect profitability. The impact of these challenges varies across different segments and regions. For example, the fluctuations in raw material cost impacted the total industry revenue by approximately XX Million in 2024.

Emerging Opportunities in Hair Care Industry in APAC

Significant opportunities exist in the APAC hair care market. The growing demand for natural and organic products creates a niche for companies offering sustainably sourced and ethically produced hair care. The increasing adoption of online retail channels presents distribution opportunities for brands and personalized marketing. Targeting specific consumer segments with tailored products (e.g., ethnic hair care) offers significant potential for growth.

Leading Players in the Hair Care Industry in APAC Market

- Kao Corporation

- Henkel AG & Co KGaA

- Dabur India Ltd

- Mandom Corporation

- Unilever PLC

- L'Oreal SA

- Marico Limited

- The Procter & Gamble Company

- Hoyu Co Ltd

- Bajaj Consumer Care Ltd

Key Developments in Hair Care Industry in APAC Industry

- April 2022: Kao launched a waterless dry shampoo sheet.

- February 2022: Dabur India Ltd launched Virgin Coconut Oil.

- March 2021: Dabur India launched a premium shampoo line under the Dabur Vatika Select brand.

Future Outlook for Hair Care Industry in APAC Market

The APAC hair care market exhibits strong growth potential. Continued economic growth, increasing urbanization, and evolving consumer preferences will drive market expansion. Strategic investments in research and development, particularly in natural and sustainable products, will be crucial for success. Brands that successfully adapt to changing consumer demands and leverage digital marketing channels are poised for significant growth in the coming years.

Hair Care Industry in APAC Segmentation

-

1. Product Type

- 1.1. Colorant

- 1.2. Hair Spray

- 1.3. Conditioner

- 1.4. Styling Gel

- 1.5. Hair Oil

- 1.6. Shampoo

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online Retail Stores

- 2.4. Pharmacy and Drug Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Japan

- 3.2. China

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Hair Care Industry in APAC Segmentation By Geography

- 1. Japan

- 2. China

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Hair Care Industry in APAC Regional Market Share

Geographic Coverage of Hair Care Industry in APAC

Hair Care Industry in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure

- 3.3. Market Restrains

- 3.3.1. Prevalence of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic/Herbal Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hair Care Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Colorant

- 5.1.2. Hair Spray

- 5.1.3. Conditioner

- 5.1.4. Styling Gel

- 5.1.5. Hair Oil

- 5.1.6. Shampoo

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Pharmacy and Drug Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.4.2. China

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Japan Hair Care Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Colorant

- 6.1.2. Hair Spray

- 6.1.3. Conditioner

- 6.1.4. Styling Gel

- 6.1.5. Hair Oil

- 6.1.6. Shampoo

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Pharmacy and Drug Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Japan

- 6.3.2. China

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China Hair Care Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Colorant

- 7.1.2. Hair Spray

- 7.1.3. Conditioner

- 7.1.4. Styling Gel

- 7.1.5. Hair Oil

- 7.1.6. Shampoo

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Pharmacy and Drug Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Japan

- 7.3.2. China

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Hair Care Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Colorant

- 8.1.2. Hair Spray

- 8.1.3. Conditioner

- 8.1.4. Styling Gel

- 8.1.5. Hair Oil

- 8.1.6. Shampoo

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Pharmacy and Drug Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Japan

- 8.3.2. China

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Hair Care Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Colorant

- 9.1.2. Hair Spray

- 9.1.3. Conditioner

- 9.1.4. Styling Gel

- 9.1.5. Hair Oil

- 9.1.6. Shampoo

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Pharmacy and Drug Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Japan

- 9.3.2. China

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Hair Care Industry in APAC Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Colorant

- 10.1.2. Hair Spray

- 10.1.3. Conditioner

- 10.1.4. Styling Gel

- 10.1.5. Hair Oil

- 10.1.6. Shampoo

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Speciality Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Pharmacy and Drug Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Japan

- 10.3.2. China

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kao Corporation*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Henkel AG & Co KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dabur India Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mandom Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L'Oreal SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Marico Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Procter & Gamble Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hoyu Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bajaj Consumer Care Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Kao Corporation*List Not Exhaustive

List of Figures

- Figure 1: Hair Care Industry in APAC Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Hair Care Industry in APAC Share (%) by Company 2025

List of Tables

- Table 1: Hair Care Industry in APAC Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Hair Care Industry in APAC Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Hair Care Industry in APAC Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Hair Care Industry in APAC Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Hair Care Industry in APAC Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Hair Care Industry in APAC Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Hair Care Industry in APAC Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Hair Care Industry in APAC Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Hair Care Industry in APAC Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Hair Care Industry in APAC Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Hair Care Industry in APAC Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Hair Care Industry in APAC Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Hair Care Industry in APAC Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Hair Care Industry in APAC Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Hair Care Industry in APAC Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Hair Care Industry in APAC Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Hair Care Industry in APAC Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Hair Care Industry in APAC Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Hair Care Industry in APAC Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Hair Care Industry in APAC Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Hair Care Industry in APAC Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Hair Care Industry in APAC Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Hair Care Industry in APAC Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Hair Care Industry in APAC Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hair Care Industry in APAC?

The projected CAGR is approximately 6.14%.

2. Which companies are prominent players in the Hair Care Industry in APAC?

Key companies in the market include Kao Corporation*List Not Exhaustive, Henkel AG & Co KGaA, Dabur India Ltd, Mandom Corporation, Unilever PLC, L'Oreal SA, Marico Limited, The Procter & Gamble Company, Hoyu Co Ltd, Bajaj Consumer Care Ltd.

3. What are the main segments of the Hair Care Industry in APAC?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure.

6. What are the notable trends driving market growth?

Increasing Demand for Organic/Herbal Hair Care Products.

7. Are there any restraints impacting market growth?

Prevalence of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

In April 2022, Kao launched a waterless dry shampoo sheet that was originally created for use in space. In response to the rising need for portable dry shampoos, Merit launched waterless dry shampoo, which included a shampoo sheet design originally created for use in space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hair Care Industry in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hair Care Industry in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hair Care Industry in APAC?

To stay informed about further developments, trends, and reports in the Hair Care Industry in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence