Key Insights

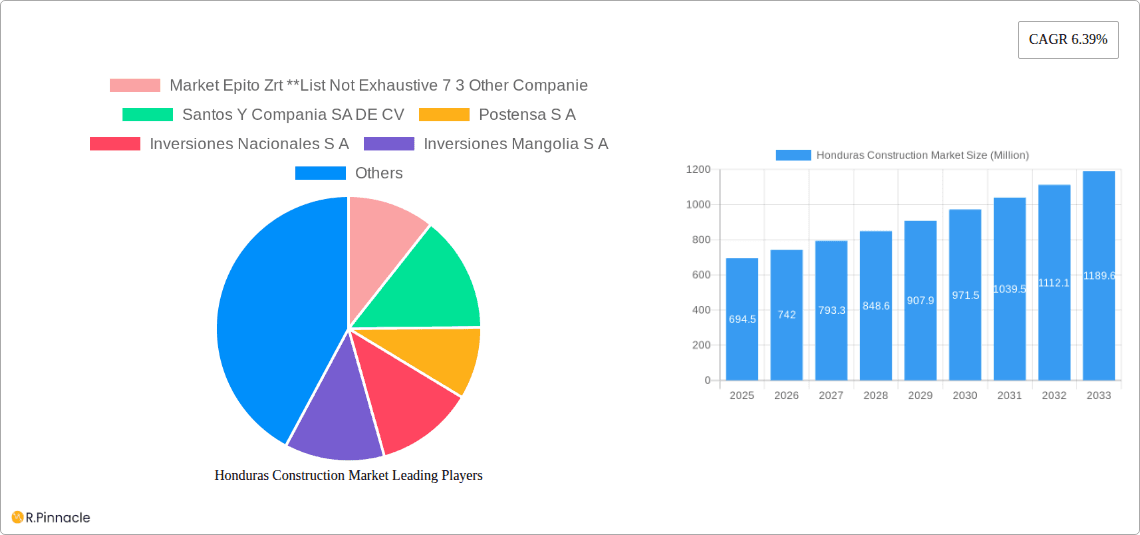

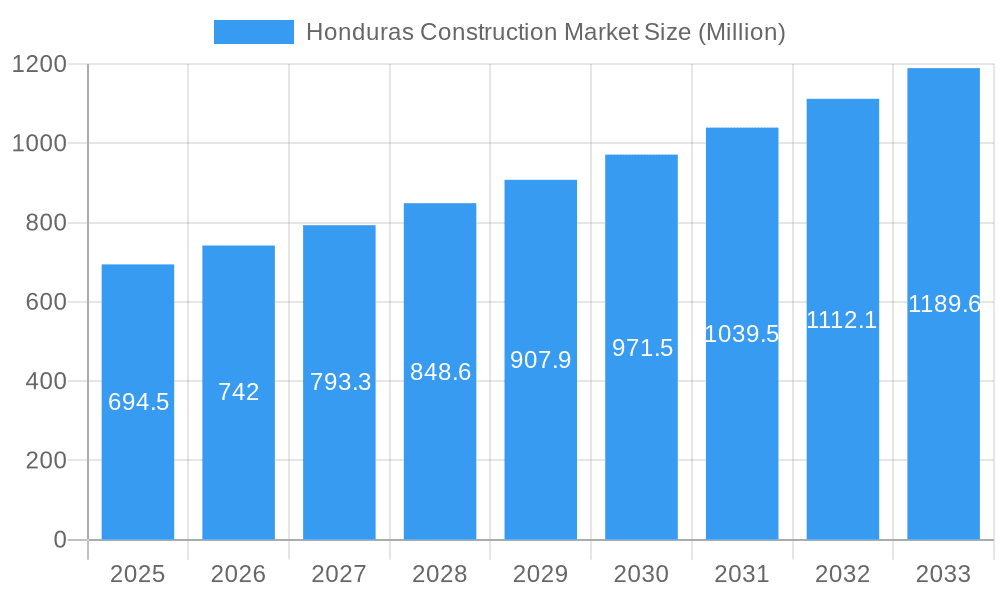

The Honduras construction market, valued at $694.5 million in 2025, is projected to experience robust growth, driven by increasing government investments in infrastructure projects, a growing population necessitating residential development, and expansion of the commercial and industrial sectors. The Compound Annual Growth Rate (CAGR) of 6.39% from 2025 to 2033 indicates a significant expansion over the forecast period. Key growth drivers include government initiatives focused on improving transportation networks, expanding energy infrastructure, and bolstering the country's overall infrastructure to support economic development. The residential construction segment is anticipated to witness substantial growth fueled by population increase and urbanization. However, economic volatility and potential material price fluctuations could pose challenges to the market's sustained expansion. Furthermore, the availability of skilled labor and efficient project management will significantly impact project timelines and overall market growth. The market is segmented by sector, including residential, commercial, industrial, institutional, infrastructure, and energy & utility construction, each segment contributing to the overall market size and growth trajectory. Leading companies like Market Epito Zrt, Santos Y Compania SA DE CV, and others are actively involved in shaping the market landscape.

Honduras Construction Market Market Size (In Million)

The forecast period (2025-2033) presents promising opportunities for growth within the Honduran construction industry. However, careful consideration of external factors, such as economic conditions and international investment, is crucial. Companies operating in this market should focus on adapting to evolving technological trends, such as sustainable construction practices and the adoption of Building Information Modeling (BIM) technology, to improve efficiency and project delivery. A strategy focused on securing skilled labor, managing supply chain risks, and leveraging government initiatives will be crucial for success within this expanding market. The long-term outlook for the Honduran construction market remains positive, driven by the country's ongoing development efforts and its strategic geographical location.

Honduras Construction Market Company Market Share

Honduras Construction Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Honduras construction market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. Expect detailed market sizing (in Millions), CAGR projections, and analysis of key trends shaping this dynamic sector.

Honduras Construction Market Market Structure & Innovation Trends

This section analyzes the Honduras construction market's structure, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. We delve into market share distribution among key players and examine the financial aspects of M&A deals. The analysis considers factors impacting market competitiveness and future growth trajectories. While precise market share data for Honduras is unavailable, we estimate the top 3 players hold approximately xx% of the market, with the remaining share distributed among numerous smaller companies. M&A activity in the Honduras construction market is estimated at xx Million in value over the study period (2019-2024), with an anticipated increase to xx Million during the forecast period.

Honduras Construction Market Market Dynamics & Trends

This section explores the key dynamics and trends influencing the Honduras construction market's growth. We examine growth drivers such as urbanization, infrastructure development, and government initiatives. Technological disruptions like the adoption of Building Information Modeling (BIM) and prefabrication techniques are assessed, alongside changing consumer preferences and competitive dynamics. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), driven primarily by increased government spending on infrastructure projects and a growing residential sector. Market penetration of sustainable building materials is also expected to increase from xx% in 2024 to xx% by 2033.

Dominant Regions & Segments in Honduras Construction Market

This section identifies the leading regions and segments within the Honduras construction market. We analyze the dominance of specific sectors (Residential, Commercial, Industrial, Institutional, Infrastructure, Energy & Utility) across different geographical areas within Honduras. Detailed analysis will highlight the key drivers for each dominant segment, using both bullet points and paragraph form.

- Key Drivers for Dominant Segments:

- Infrastructure Construction: Government investments in transportation networks, energy infrastructure, and water management projects.

- Residential Construction: Growing population, rising middle class, and increasing demand for housing.

- Commercial Construction: Growth of the tourism sector, expansion of retail spaces, and increased foreign investment.

Honduras Construction Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages within the Honduras construction market. The focus is on technological trends such as the increased adoption of sustainable building materials, prefabrication, and innovative construction techniques improving efficiency and reducing environmental impact. These innovations are enhancing the market competitiveness and improving market fit, leading to higher efficiency and customer satisfaction.

Report Scope & Segmentation Analysis

This report segments the Honduras construction market by sector: Residential Construction, Commercial Construction, Industrial Construction, Institutional Construction, Infrastructure Construction, and Energy & Utility Construction. Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed. For example, the Residential Construction segment is anticipated to reach xx Million by 2033, driven by a growing population and rising middle class. The Infrastructure segment is expected to experience substantial growth due to government investments in improving the country's infrastructure.

Key Drivers of Honduras Construction Market Growth

Several factors fuel the growth of the Honduras construction market. These include increased government spending on infrastructure projects, rising urbanization rates boosting demand for residential and commercial construction, and foreign direct investment in various sectors. Furthermore, favorable government policies and initiatives aimed at promoting sustainable construction practices are also significant contributors.

Challenges in the Honduras Construction Market Sector

The Honduras construction market faces challenges such as bureaucratic hurdles in obtaining permits and licenses, which can cause project delays and cost overruns (estimated to impact xx% of projects). Supply chain disruptions, fluctuating material costs, and a shortage of skilled labor are also significant hurdles, impacting overall project timelines and budgets. Furthermore, intense competition among construction firms can pressure profit margins.

Emerging Opportunities in Honduras Construction Market

The Honduras construction market presents significant opportunities. The growing tourism sector offers potential for hotel and resort construction. Government initiatives promoting sustainable building practices create opportunities for eco-friendly construction materials and technologies. Furthermore, investment in renewable energy infrastructure offers prospects for growth in the energy and utility construction segments.

Leading Players in the Honduras Construction Market Market

- Market Epito Zrt

- Santos Y Compania SA DE CV

- Postensa S A

- Inversiones Nacionales S A

- Inversiones Mangolia S A

- Ingenieros Civiles Asociades Inversions

- Conmoxa SRL

- Empresa de Construccion y Transporte Eterna S A De C V

- Servicious de Imgeniera Salvador Garcia y Asociados SRL

- Roaton Zelaya Construction

- Salvador Gracia Constructions

- Kesz Group

- 7-3 Other Companies

Key Developments in Honduras Construction Market Industry

- May 2023: Completion of the MOL Campus in Hungary by Market Építő Zrt., achieving LEED Platinum certification, showcases the growing trend towards sustainable construction.

- May 2023: Successful completion of the Panattoni City Dock in Torokbalint, Hungary, a collaborative project involving Market Építő Zrt. and Aston Construction Zrt., highlights the increasing role of large-scale industrial projects. (Note: While these projects are in Hungary, they illustrate trends relevant to global construction, including Honduras.)

Future Outlook for Honduras Construction Market Market

The Honduras construction market is poised for sustained growth, driven by continued urbanization, infrastructure development, and increasing foreign investment. Strategic opportunities exist for companies that embrace sustainable construction practices, leverage technological advancements, and effectively navigate regulatory challenges. The market's future potential remains significant, promising substantial returns for investors and businesses who seize these emerging opportunities.

Honduras Construction Market Segmentation

-

1. Sector

- 1.1. Residential Construction

- 1.2. Commercial Construction

- 1.3. Industrial Construction

- 1.4. Institutional Construction

- 1.5. Infrastructure Construction

- 1.6. Energy & Utility Construction

Honduras Construction Market Segmentation By Geography

- 1. Honduras

Honduras Construction Market Regional Market Share

Geographic Coverage of Honduras Construction Market

Honduras Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The growing number of high-rise buildings and skyscrapers globally has created a robust market for facade systems4.; Building owners and developers are placing greater emphasis on the overall performance of their structures

- 3.3. Market Restrains

- 3.3.1 4.; High-quality facade materials and designs can be costly

- 3.3.2 making it challenging for some projects to meet budget constraint4.; Facades must comply with building codes and safety regulations

- 3.3.3 which can vary based on location

- 3.4. Market Trends

- 3.4.1. Increase in residential constructions is boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Honduras Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential Construction

- 5.1.2. Commercial Construction

- 5.1.3. Industrial Construction

- 5.1.4. Institutional Construction

- 5.1.5. Infrastructure Construction

- 5.1.6. Energy & Utility Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Honduras

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Market Epito Zrt **List Not Exhaustive 7 3 Other Companie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Santos Y Compania SA DE CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Postensa S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Inversiones Nacionales S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inversiones Mangolia S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingenieros Civiles Asociades Inversions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Conmoxa SRL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Empresa de Construccion y Transporte Eterna S A De C V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Servicious de Imgeniera Salvador Garcia y Asociados SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Roaton Zelaya Construction

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Salvador Gracia Constructions

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kesz Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Market Epito Zrt **List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Honduras Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Honduras Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Honduras Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Honduras Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Honduras Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Honduras Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Honduras Construction Market?

The projected CAGR is approximately 6.39%.

2. Which companies are prominent players in the Honduras Construction Market?

Key companies in the market include Market Epito Zrt **List Not Exhaustive 7 3 Other Companie, Santos Y Compania SA DE CV, Postensa S A, Inversiones Nacionales S A, Inversiones Mangolia S A, Ingenieros Civiles Asociades Inversions, Conmoxa SRL, Empresa de Construccion y Transporte Eterna S A De C V, Servicious de Imgeniera Salvador Garcia y Asociados SRL, Roaton Zelaya Construction, Salvador Gracia Constructions, Kesz Group.

3. What are the main segments of the Honduras Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 694.5 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The growing number of high-rise buildings and skyscrapers globally has created a robust market for facade systems4.; Building owners and developers are placing greater emphasis on the overall performance of their structures.

6. What are the notable trends driving market growth?

Increase in residential constructions is boosting the market.

7. Are there any restraints impacting market growth?

4.; High-quality facade materials and designs can be costly. making it challenging for some projects to meet budget constraint4.; Facades must comply with building codes and safety regulations. which can vary based on location.

8. Can you provide examples of recent developments in the market?

May 2023: Hungary achieved a significant milestone with the completion of the MOL Campus, its inaugural high-rise structure, constructed by Market Építő Zrt. Following the attainment of the BREEAM Excellent certification, this architectural marvel secured the prestigious LEED Platinum certification, signifying the highest level of recognition in sustainable building certification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Honduras Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Honduras Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Honduras Construction Market?

To stay informed about further developments, trends, and reports in the Honduras Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence