Key Insights

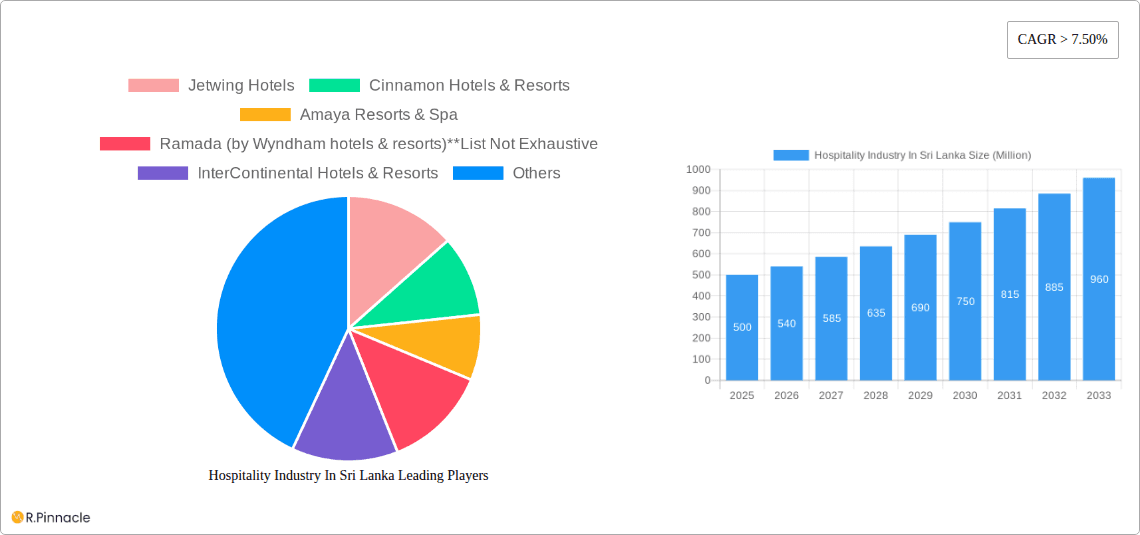

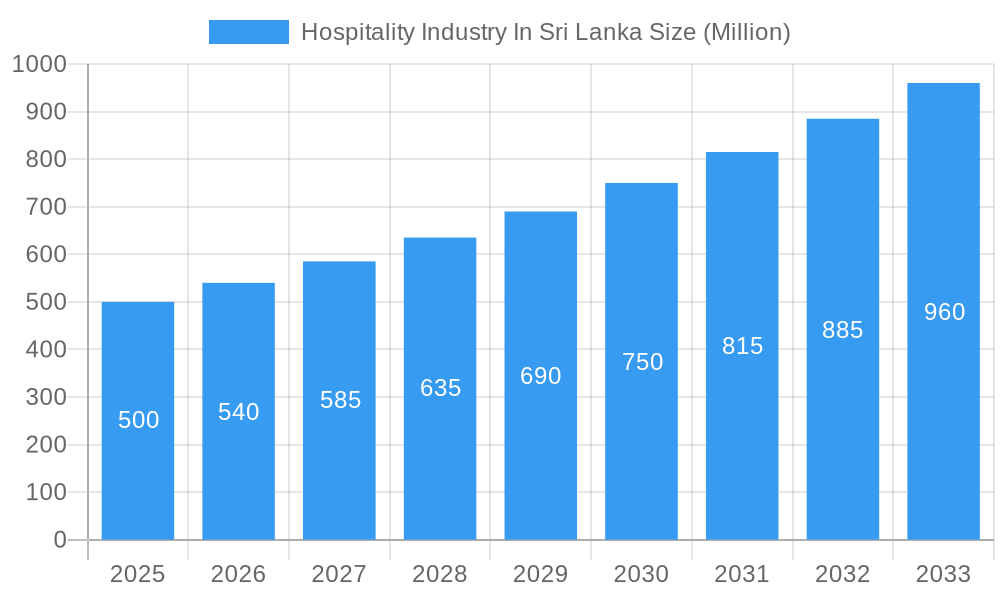

Sri Lanka's hospitality sector demonstrates robust expansion, projected for a Compound Annual Growth Rate (CAGR) of 6.89% between 2025 and 2033. This growth is propelled by increasing tourism, driven by the island's cultural richness and natural allure. Strategic infrastructure development, enhancing accessibility, and diversified accommodation offerings from budget to luxury further fuel this expansion. While seasonal variations and economic factors present challenges, the outlook remains positive. The market is segmented across all categories, including service apartments, with key players like Jetwing Hotels, Cinnamon Hotels & Resorts, Marriott International, and InterContinental Hotels & Resorts actively shaping the landscape. Sustainable tourism and workforce development are crucial for long-term industry viability.

Hospitality Industry In Sri Lanka Market Size (In Million)

The market size is estimated at 503.2 million in the **2025** base year, with substantial annual growth anticipated. The luxury and mid-scale segments are expected to lead growth, driven by rising disposable incomes and a preference for upscale travel. This will continue to attract domestic and international investment, contributing to Sri Lanka’s economic development.

Hospitality Industry In Sri Lanka Company Market Share

Sri Lanka Hospitality Market: Analysis & Forecast 2025-2033

This report offers a comprehensive analysis of the Sri Lankan hospitality industry, providing insights for investors and professionals. The analysis covers the forecast period 2025-2033, with 2025 as the base year. The report details market size, growth, segmentation, key players, and future trends, offering a complete view of this dynamic sector.

Hospitality Industry In Sri Lanka Market Structure & Innovation Trends

This section analyzes the Sri Lankan hospitality market's structure, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities.

The market is characterized by a mix of large international chains and smaller independent hotels. Key players include Jetwing Hotels, Cinnamon Hotels & Resorts, Amaya Resorts & Spa, Ramada (by Wyndham hotels & resorts), InterContinental Hotels & Resorts, Yoho Lanka (Pvt) Ltd, Anatara Hotels Resorts & Spa, Amari Galle, Tangerine Group of Hotel, Shangri-La Hotels and Resorts, and Marriott International Inc. However, the market share held by each player varies significantly. For instance, Cinnamon Hotels & Resorts holds a substantial market share in the luxury segment. The overall market concentration is considered moderate, with no single entity dominating the entire landscape.

Innovation in the sector is driven by the need to cater to evolving customer preferences, particularly regarding technology integration (e.g., online booking platforms, mobile check-in, smart room technology) and sustainability initiatives. The regulatory framework, while generally supportive of tourism, occasionally presents challenges for expansion and operational efficiency. The industry faces competition from alternative accommodation options such as Airbnb and homestays, particularly in the budget and mid-range segments. The end-user demographics are diverse, ranging from budget-conscious travelers to high-spending luxury tourists. M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, driven primarily by expansion strategies and brand consolidation.

Hospitality Industry In Sri Lanka Market Dynamics & Trends

The Sri Lankan hospitality market is a dynamic and evolving landscape, characterized by robust growth and emerging trends. Historically, from 2019 to 2024, the market has witnessed a significant Compound Annual Growth Rate (CAGR) of **[Insert specific CAGR here, e.g., 8.5%]**, primarily fueled by a resurgence and expansion in inbound tourism. The market's penetration is diverse across its segments; while luxury hotels command a premium with higher Average Daily Rates (ADR), the budget and mid-range segments are also experiencing increased activity and development.

Key growth drivers propelling this sector include a consistent rise in international tourist arrivals, an increase in disposable incomes among both local and international travelers, continuous improvements in national infrastructure, and proactive government initiatives dedicated to promoting tourism as a cornerstone of the Sri Lankan economy. The industry is also being profoundly reshaped by technological advancements. The proliferation of Online Travel Agents (OTAs) has revolutionized booking channels, while sophisticated digital marketing strategies are now integral to how hotels attract and engage customers. Furthermore, consumer preferences are shifting towards highly personalized experiences, a growing demand for eco-friendly and sustainable tourism options, and a consistent expectation for excellent value-for-money offerings. Competitive dynamics are intensely shaped by strategic pricing, exceptional service quality, strong brand reputation, and prime location. The burgeoning popularity of alternative accommodations, such as boutique guesthouses and vacation rentals, presents a significant and growing competitive challenge to traditional hotel models.

Dominant Regions & Segments in Hospitality Industry In Sri Lanka

This section highlights the leading regions and segments that define the current Sri Lankan hospitality industry landscape.

Dominant Region: The primary hubs for hospitality in Sri Lanka remain Colombo and the picturesque coastal areas, including Negombo, Bentota, and the historic city of Galle. These regions benefit from well-established infrastructure, proximity to Bandaranaike International Airport, and the enduring appeal of beach tourism, making them prime destinations for a majority of visitors.

Dominant Segment by Type: Currently, chain hotels maintain a larger market share within the industry. Their strength lies in established brand recognition, extensive marketing reach, and robust distribution networks, which often provide a competitive edge over independent establishments.

Dominant Segment by Accommodation Type: The luxury hotel segment continues to be the most lucrative. It attracts a high-spending demographic of both international and domestic travelers who seek and are willing to pay a premium for exceptional service, world-class amenities, and unique experiences. Concurrently, the budget and economy segments are also experiencing notable growth, catering to the increasing number of budget-conscious travelers looking for affordable yet comfortable accommodation options.

Key Drivers:

- Economic Policies: Strategic government incentives for tourism development, coupled with substantial investments in infrastructure, are pivotal in propelling the market's expansion and attracting further investment.

- Infrastructure Development: Ongoing improvements to airport facilities, the expansion and modernization of road networks, and other critical infrastructure projects significantly enhance accessibility and are fundamental to supporting sustained tourism growth.

- Tourism Marketing: Targeted and effective marketing campaigns, designed to attract a diverse range of international tourists and showcase Sri Lanka's unique offerings, are indispensable for ensuring the sector's continued prosperity.

Hospitality Industry In Sri Lanka Product Innovations

Product innovations are driven by technological advances and the desire to enhance guest experiences. Many hotels are adopting smart room technologies, contactless check-in/check-out systems, personalized service offerings, and sustainable practices. These innovations provide competitive advantages by enhancing efficiency, improving guest satisfaction, and attracting environmentally conscious travelers. The market is constantly evolving, making innovation crucial for sustaining competitive positioning.

Report Scope & Segmentation Analysis

This report segments the Sri Lankan hospitality market by type (Chain Hotels and Independent Hotels) and by segment (Service Apartments, Budget and Economy Hotels, Mid and Upper mid-scale Hotels, and Luxury Hotels). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. For instance, the Luxury Hotel segment is expected to show a higher growth rate compared to the budget segment due to increasing high-net-worth traveler segment. The Mid-scale segment benefits from its wide appeal to a broader spectrum of travelers. Service apartments cater to a niche market but are showing significant growth owing to long-stay travelers and corporate clients. Chain Hotels will continue to be a dominant force, although Independent Hotels will benefit from localized services and personalized offerings.

Key Drivers of Hospitality Industry In Sri Lanka Growth

The growth of the Sri Lankan hospitality industry is driven by several factors: a steadily increasing number of international and domestic tourists, government initiatives to promote tourism, investments in infrastructure, the growing popularity of Sri Lanka as a destination, and technological advancements enabling efficient operations and enhanced customer experiences. These factors, coupled with the country's diverse attractions and warm hospitality, contribute to a positive outlook for the sector.

Challenges in the Hospitality Industry In Sri Lanka Sector

The Sri Lankan hospitality sector navigates a complex environment, contending with inherent challenges such as pronounced seasonality in tourist arrivals, intense competition from both established global destinations and emerging regional players, and vulnerability to fluctuations in global economic conditions. In the aftermath of recent global events, supply chain disruptions have presented significant hurdles, impacting operational efficiencies and cost management. Additionally, navigating regulatory complexities and addressing infrastructural limitations in certain promising but less developed areas can impede broader industry growth. The fiercely competitive nature of the market, stemming from both established large-scale operators and agile new entrants, necessitates continuous innovation, strategic adaptation, and a relentless focus on delivering superior guest experiences for sustained success.

Emerging Opportunities in Hospitality Industry In Sri Lanka

The industry presents several significant opportunities, including the development of eco-tourism initiatives, the expansion of wellness and spa offerings, and the integration of technology for enhanced guest experiences. Growth in the luxury segment remains strong, while the rise of experiential travel opens new avenues for attracting discerning tourists. Opportunities also exist for improving connectivity to lesser-known destinations within the country and developing niche tourism segments.

Leading Players in the Hospitality Industry In Sri Lanka Market

- Jetwing Hotels

- Cinnamon Hotels & Resorts

- Amaya Resorts & Spa

- Ramada (by Wyndham hotels & resorts)

- InterContinental Hotels & Resorts

- Yoho Lanka (Pvt) Ltd

- Anantara Hotels Resorts & Spa

- Amari Galle

- Tangerine Group of Hotels

- Shangri-La Hotels and Resorts

- Marriott International Inc

Key Developments in Hospitality Industry In Sri Lanka Industry

- April 2023: Cinnamon Hotels & Resorts made a significant presence at the Arabian Travel Market 2023, actively engaging with potential partners and travelers from the Middle East and internationally to boost visitor numbers.

- January 2023: The opening of Courtyard by Marriott Colombo marked an expansion of luxury accommodation options in the capital, introducing a hotel equipped with a comprehensive range of modern amenities designed to cater to both business and leisure travelers.

Future Outlook for Hospitality Industry In Sri Lanka Market

The future outlook for the Sri Lankan hospitality industry is positive, driven by ongoing investments in infrastructure, government support for tourism, and the country's growing appeal as a travel destination. Continued focus on sustainable practices and technological innovation will be crucial for sustained growth. The sector is well-positioned to capitalize on the increasing demand for experiential travel and personalized services, further strengthening its position in the global tourism market.

Hospitality Industry In Sri Lanka Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper-mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry In Sri Lanka Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry In Sri Lanka Regional Market Share

Geographic Coverage of Hospitality Industry In Sri Lanka

Hospitality Industry In Sri Lanka REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Tourism industry; Increase in the Number of Hotel Projects and Investments

- 3.3. Market Restrains

- 3.3.1. Sustainability and Competition Threaten Industry Success

- 3.4. Market Trends

- 3.4.1. Increase in the Number of SLTDA Registered Accommodation is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper-mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper-mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper-mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper-mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper-mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry In Sri Lanka Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper-mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jetwing Hotels

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cinnamon Hotels & Resorts

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amaya Resorts & Spa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ramada (by Wyndham hotels & resorts)**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 InterContinental Hotels & Resorts

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yoho Lanka (Pvt) Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Anatara Hotels Resorts & Spa

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amari Galle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tangerine Group of Hotel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shangri-La Hotels and Resorts

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mariott International Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Jetwing Hotels

List of Figures

- Figure 1: Global Hospitality Industry In Sri Lanka Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry In Sri Lanka Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry In Sri Lanka Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry In Sri Lanka Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry In Sri Lanka Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry In Sri Lanka?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the Hospitality Industry In Sri Lanka?

Key companies in the market include Jetwing Hotels, Cinnamon Hotels & Resorts, Amaya Resorts & Spa, Ramada (by Wyndham hotels & resorts)**List Not Exhaustive, InterContinental Hotels & Resorts, Yoho Lanka (Pvt) Ltd, Anatara Hotels Resorts & Spa, Amari Galle, Tangerine Group of Hotel, Shangri-La Hotels and Resorts, Mariott International Inc.

3. What are the main segments of the Hospitality Industry In Sri Lanka?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 503.2 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Tourism industry; Increase in the Number of Hotel Projects and Investments.

6. What are the notable trends driving market growth?

Increase in the Number of SLTDA Registered Accommodation is Driving the Market.

7. Are there any restraints impacting market growth?

Sustainability and Competition Threaten Industry Success.

8. Can you provide examples of recent developments in the market?

Apr 2023: Hailing from the idyllic shores and boundless horizon of the Indian Ocean, Cinnamon Hotels & Resorts is set to offer Middle Eastern and international travelers the best of Sri Lanka as they debut at Arabian Travel Market 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry In Sri Lanka," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry In Sri Lanka report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry In Sri Lanka?

To stay informed about further developments, trends, and reports in the Hospitality Industry In Sri Lanka, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence