Key Insights

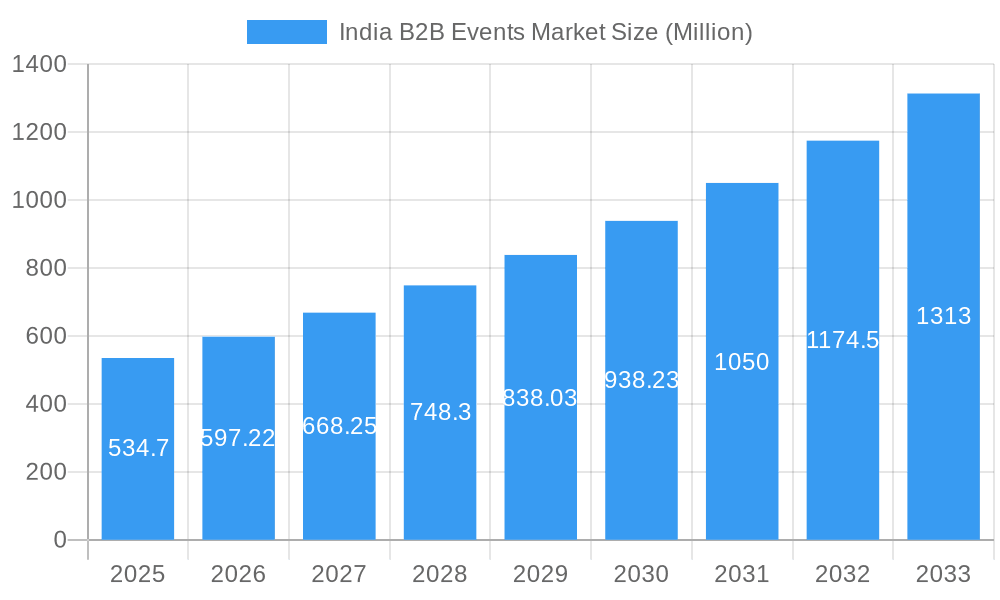

The India B2B events market, valued at ₹534.70 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 11.72% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of digital marketing strategies by businesses necessitates engaging and interactive B2B events, both physical and virtual, to maintain a competitive edge. The rise of experiential marketing, focusing on creating memorable brand experiences, further bolsters market demand. Growth across various end-user verticals, including BFSI (Banking, Financial Services, and Insurance), FMCG (Fast-Moving Consumer Goods), and the burgeoning healthcare sector, significantly contributes to the market's expansion. Regional variations exist, with metropolitan areas like those in North and West India potentially exhibiting faster growth compared to the East and South, primarily due to higher concentrations of businesses and infrastructure. While challenges like economic fluctuations and evolving event management preferences could impact growth, the overall outlook for the India B2B events market remains strongly positive, given the ongoing demand for networking opportunities and effective brand promotion within a diverse business landscape.

India B2B Events Market Market Size (In Million)

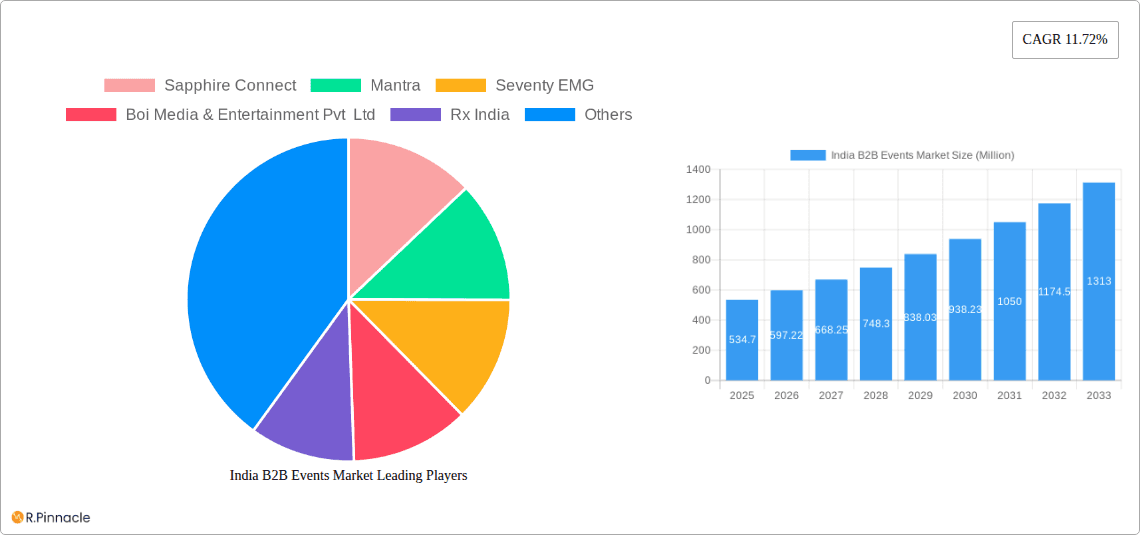

The competitive landscape is characterized by a mix of established players and emerging companies, indicating a dynamic market. Key players like Sapphire Connect, Mantra, and Seventy EMG are leveraging their expertise to adapt to evolving market trends. The increasing integration of technology, such as virtual and hybrid event platforms, is transforming the industry. This technological shift not only expands reach but also enhances efficiency and data analytics capabilities for event organizers. The market segmentation by platform (physical vs. virtual) and end-user verticals provides valuable insights into specific growth drivers within the market. Furthermore, the consistent growth across all regions suggests a broad-based expansion rather than one dominated by specific geographic locations. Understanding these factors is crucial for businesses looking to invest or participate in this expanding market.

India B2B Events Market Company Market Share

India B2B Events Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India B2B events market, offering valuable insights for industry professionals, investors, and strategic planners. With a focus on market structure, dynamics, key players, and future trends, this report covers the period 2019-2033, with a base year of 2025. The report leverages data from the historical period (2019-2024) and projects market growth until 2033. The market is segmented by platform (physical and virtual events), end-user verticals (Food and Beverage, PSU, Luxury, BFSI, FMCG, Retail, Healthcare, Automotive, and Other), and region (North, East, West, South). Key players analyzed include Sapphire Connect, Mantra, Seventy EMG, Boi Media & Entertainment Pvt Ltd, Rx India, TechnologyCounter, CAB, Hexagon Events Private Limited, Wizcraft Entertainment Agency Pvt Lt, Neoniche Integrated Solutions Pvt Ltd, Craftworld Events Management Company, Seventy Seven Entertainment Pvt Ltd, Experential Marketing Solutions Pvt Ltd (Collective Heads), Toast, Blackboard Communications, Laqshya Group (Event Capital), and XP&D (XP and Land). The report reveals a dynamic market poised for significant growth, driven by technological advancements and evolving consumer preferences.

India B2B Events Market Market Structure & Innovation Trends

The India B2B events market exhibits a moderately concentrated structure, with a few large players and numerous smaller niche players. Market share is currently dominated by a handful of companies, with xx% attributed to the top 5 players (estimated). The market is characterized by continuous innovation, driven by the adoption of new technologies, such as virtual and hybrid event platforms, and the increasing demand for engaging and interactive experiences. Regulatory frameworks, while evolving, generally support the growth of the B2B events sector. Product substitutes, such as webinars and online conferences, are present but often lack the networking and experiential benefits of physical events. The end-user demographics are diverse, spanning across various industries with a strong concentration in the BFSI and FMCG sectors. M&A activity has been moderate, with deal values ranging from xx Million to xx Million in recent years (estimated).

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (estimated).

- Innovation Drivers: Technological advancements (virtual/hybrid events), demand for engaging experiences.

- Regulatory Framework: Supportive, with ongoing evolution.

- Product Substitutes: Webinars, online conferences; however, they lack the networking and experience of physical events.

- End-User Demographics: Diverse, with strong presence in BFSI and FMCG.

- M&A Activity: Moderate, deal values ranging from xx Million to xx Million (estimated).

India B2B Events Market Market Dynamics & Trends

The India B2B events market is experiencing robust growth, driven by factors such as increasing business investments, rising disposable incomes, and a growing preference for networking opportunities. The market is witnessing technological disruptions, including the rise of virtual and hybrid events, which are changing how businesses engage with each other. Consumer preferences are shifting towards more interactive and personalized experiences, putting pressure on event organizers to constantly innovate. The competitive dynamics are intense, with companies vying for market share through strategic partnerships, technological advancements, and creative event formats. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

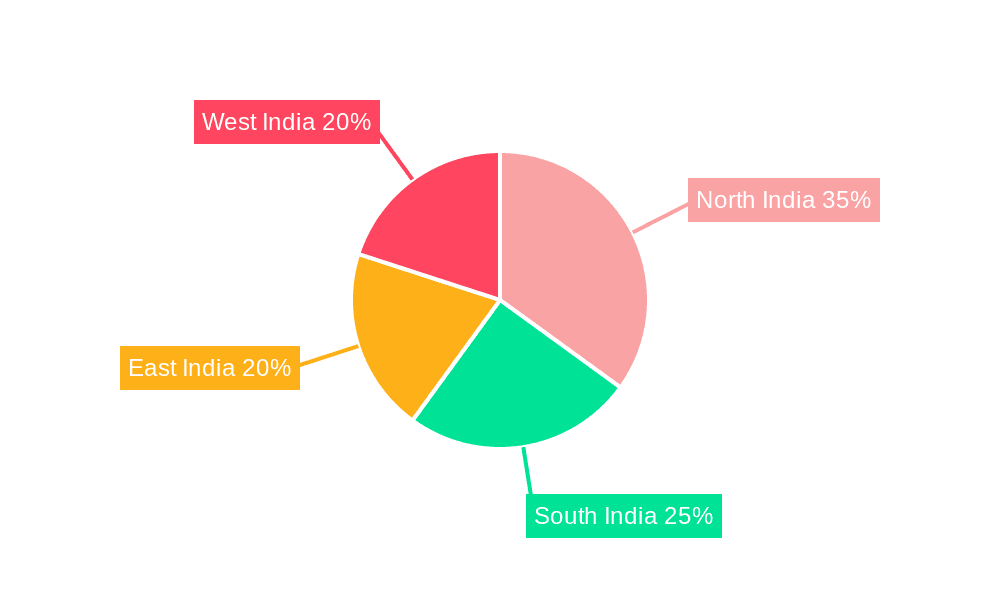

Dominant Regions & Segments in India B2B Events Market

The North region currently dominates the India B2B events market, due to its strong economic activity, advanced infrastructure, and concentration of major businesses. The BFSI and FMCG sectors are the leading end-user verticals, driven by high demand for networking events, product launches, and industry conferences. Physical events continue to hold the largest market share, though virtual events are growing rapidly.

Key Drivers for North Region Dominance:

- Strong economic activity

- Well-developed infrastructure

- High concentration of major businesses.

Key Drivers for BFSI & FMCG Sector Dominance:

- High demand for networking events

- Frequent product launches and industry conferences.

Physical vs. Virtual Events: Physical events still dominate, but virtual events are growing rapidly, offering cost-effective alternatives and broader reach.

India B2B Events Market Product Innovations

The B2B events sector is witnessing rapid product innovation, with a focus on integrating technology to enhance the attendee experience. This includes the use of mobile apps for event management, virtual reality and augmented reality experiences, and data analytics to measure event effectiveness. These innovations offer greater engagement and allow for more personalized interactions, leading to higher satisfaction rates and increased ROI for businesses.

Report Scope & Segmentation Analysis

This report segments the India B2B events market across multiple parameters:

- By Platform: Physical Events (xx Million in 2025, projected growth of xx% by 2033), Virtual Events (xx Million in 2025, projected growth of xx% by 2033). Competitive dynamics are characterized by both established players and new entrants leveraging technological advancements.

- By End-user Verticals: Each vertical (Food and Beverage, PSU, Luxury, BFSI, FMCG, Retail, Healthcare, Automotive, Other) has unique market sizes and growth projections depending on industry trends and economic factors. Competitive dynamics vary significantly across these verticals, with some attracting specialized event organizers.

- By Region: Growth projections for North, East, West, and South regions vary based on regional economic activity and infrastructure development. Competitive landscapes within each region also differ.

Key Drivers of India B2B Events Market Growth

The growth of the India B2B events market is propelled by several key factors: The rise of digital technologies is enabling the creation of innovative and engaging event formats. Favourable government policies and a strong business environment are fostering investment and growth in various sectors. An increase in business travel and networking needs drives participation in B2B events.

Challenges in the India B2B Events Market Sector

The sector faces challenges such as infrastructural limitations in certain regions impacting logistics, competition from virtual events and alternative communication methods, and the cost of participation and event organization. Fluctuating economic conditions can also impact budget allocation for events.

Emerging Opportunities in India B2B Events Market

Emerging opportunities lie in leveraging new technologies such as AI and VR/AR for enhanced event experiences, expanding into niche markets and untapped geographical areas, and creating sustainable and eco-friendly events. The demand for hybrid and virtual events also presents a significant opportunity.

Leading Players in the India B2B Events Market Market

- Sapphire Connect

- Mantra

- Seventy EMG

- Boi Media & Entertainment Pvt Ltd

- Rx India

- TechnologyCounter

- CAB

- Hexagon Events Private Limited

- Wizcraft Entertainment Agency Pvt Lt

- Neoniche Integrated Solutions Pvt Ltd

- Craftworld Events Management Company

- Seventy Seven Entertainment Pvt Ltd

- Experiential Marketing Solutions Pvt Ltd (Collective Heads)

- Toast

- Blackboard Communications

- Laqshya Group (Event Capital)

- XP&D (XP and Land)

Key Developments in India B2B Events Market Industry

- March 2024: Bharat Tex 2024 in New Delhi showcased India's textile capabilities, attracting 100,000 visitors and 3,500 exhibitors.

- November 2023: A mega B2B food event in Delhi attracted 1208 exhibitors, 715 foreign buyers, and 14 country pavilions, highlighting the growth of the food processing industry.

Future Outlook for India B2B Events Market Market

The India B2B events market is poised for continued expansion, driven by technological innovations, economic growth, and evolving business needs. Strategic partnerships, investments in technology, and a focus on delivering engaging and personalized experiences will be critical for success in this dynamic market. The market's future hinges on adapting to evolving preferences, integrating technology, and efficiently managing resources while responding effectively to economic shifts.

India B2B Events Market Segmentation

-

1. Platform

- 1.1. Physical Events

- 1.2. Virtual Events

-

2. End-user Verticals

- 2.1. Food and Beverage

- 2.2. PSU

- 2.3. Luxury

- 2.4. BFSI

- 2.5. FMCG

- 2.6. Retail

- 2.7. Healthcare

- 2.8. Automotive

- 2.9. Other End-user Verticals

India B2B Events Market Segmentation By Geography

- 1. India

India B2B Events Market Regional Market Share

Geographic Coverage of India B2B Events Market

India B2B Events Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Among Government Organizations About New Technologies

- 3.4. Market Trends

- 3.4.1. Retail Sector to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India B2B Events Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Physical Events

- 5.1.2. Virtual Events

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Food and Beverage

- 5.2.2. PSU

- 5.2.3. Luxury

- 5.2.4. BFSI

- 5.2.5. FMCG

- 5.2.6. Retail

- 5.2.7. Healthcare

- 5.2.8. Automotive

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sapphire Connect

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mantra

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Seventy EMG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Boi Media & Entertainment Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rx India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TechnologyCounter

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CAB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexagon Events Private Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wizcraft Entertainment Agency Pvt Lt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Neoniche Integrated Solutions Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CraftworldEvents Management Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seventy Seven Entertainment Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Experential Marketing Solutions Pvt Ltd (Collective Heads)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Toast

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Blackboard Communications

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Laqshya Group(Event Capital)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 XP&D (XP and Land)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Sapphire Connect

List of Figures

- Figure 1: India B2B Events Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India B2B Events Market Share (%) by Company 2025

List of Tables

- Table 1: India B2B Events Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 3: India B2B Events Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India B2B Events Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 6: India B2B Events Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India B2B Events Market?

The projected CAGR is approximately 11.72%.

2. Which companies are prominent players in the India B2B Events Market?

Key companies in the market include Sapphire Connect, Mantra, Seventy EMG, Boi Media & Entertainment Pvt Ltd, Rx India, TechnologyCounter, CAB, Hexagon Events Private Limited, Wizcraft Entertainment Agency Pvt Lt, Neoniche Integrated Solutions Pvt Ltd, CraftworldEvents Management Company, Seventy Seven Entertainment Pvt Ltd, Experential Marketing Solutions Pvt Ltd (Collective Heads), Toast, Blackboard Communications, Laqshya Group(Event Capital), XP&D (XP and Land).

3. What are the main segments of the India B2B Events Market?

The market segments include Platform, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers.

6. What are the notable trends driving market growth?

Retail Sector to be the Largest End User.

7. Are there any restraints impacting market growth?

; Lack of Awareness Among Government Organizations About New Technologies.

8. Can you provide examples of recent developments in the market?

In March 2024, by bringing together 3,500 exhibitors from across the entire value chain under one roof for the first time, the theme of Bharat Tex 2024 emphasized India’s capability to provide end-to-end textile solutions. Spread across nearly two million square feet and attracting 100,000 visitors, this huge event, staged in New Delhi, was organized by a consortium of 11 textile export promotion councils and sponsored by the country’s Ministry of Textile.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India B2B Events Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India B2B Events Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India B2B Events Market?

To stay informed about further developments, trends, and reports in the India B2B Events Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence