Key Insights

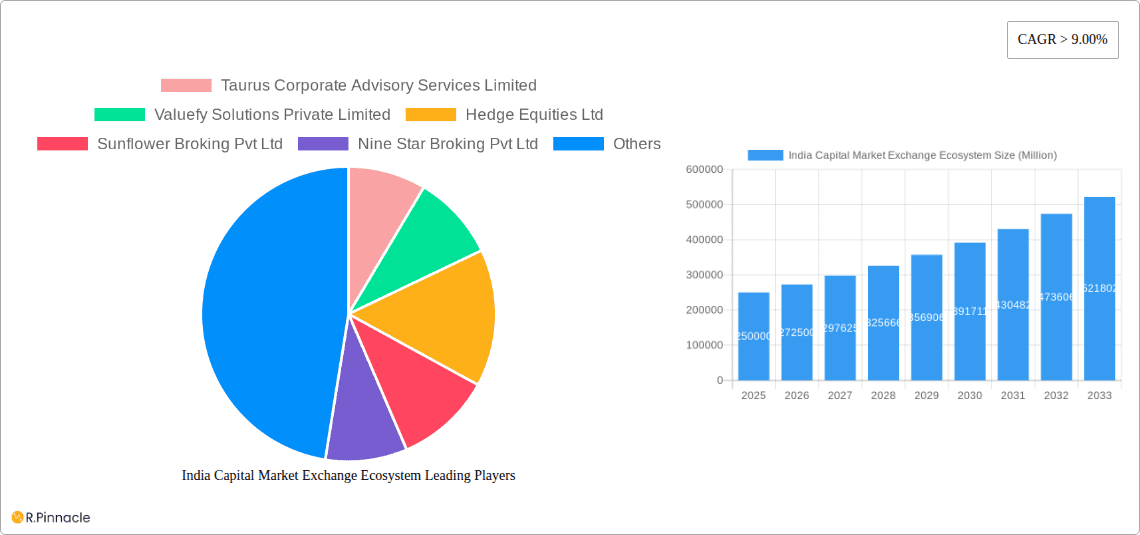

The India Capital Market Exchange Ecosystem is projected for substantial expansion, driven by increased investor engagement, supportive government initiatives for financial inclusion, and the pervasive adoption of digital technologies. The market's projected Compound Annual Growth Rate (CAGR) of 9% over the forecast period underscores a continuously evolving landscape. With a base year of 2025, the market size is estimated at 124 billion. Key growth drivers include a growing base of retail investors in equity and debt markets, facilitated by user-friendly fintech platforms that enhance accessibility. Furthermore, government policies designed to deepen financial markets and bolster investor protection are significant contributors to this expansion.

India Capital Market Exchange Ecosystem Market Size (In Billion)

However, market expansion faces potential headwinds from regulatory complexities and the inherent volatility of capital markets. While specific segment data is not detailed, the equity segment is anticipated to lead market share, followed by debt and derivatives. Intense competition among prominent entities such as Taurus Corporate Advisory Services Limited and Valuefy Solutions Private Limited necessitates ongoing innovation and strategic agility. Geographic concentration is expected in major metropolitan centers, with a gradual outward expansion into Tier-2 and Tier-3 cities. The forecast period (2025-2033) presents significant opportunities, with the sustained CAGR of 9% poised to drive considerable market growth, contingent on a supportive regulatory framework and sustained investor confidence. The increasing inflow of foreign institutional investment will further bolster this trajectory.

India Capital Market Exchange Ecosystem Company Market Share

This comprehensive report delivers an in-depth analysis of the India Capital Market Exchange Ecosystem, providing critical insights for industry stakeholders, investors, and strategic decision-makers. Examining the period from 2019 to 2033, with 2025 as the base year, the report meticulously dissects market structure, dynamics, key participants, and future trends. Leveraging historical data from 2019-2024, the analysis offers precise projections and actionable intelligence. The total market size in 2025 is estimated at 124 billion, with projections indicating a significant increase by 2033.

India Capital Market Exchange Ecosystem Market Structure & Innovation Trends

The Indian capital market exchange ecosystem is characterized by a moderately concentrated market structure, with a few dominant players and numerous smaller firms. Market share data for 2024 reveals that the top three players (estimated) hold approximately 45% of the market, leaving significant room for growth and competition among smaller entities. Innovation is driven primarily by technological advancements, regulatory reforms aimed at improving transparency and efficiency, and evolving investor preferences toward digital platforms. The regulatory framework, while undergoing constant refinement, generally fosters competition and innovation. Product substitutes include peer-to-peer lending platforms and alternative investment vehicles, exerting some pressure on traditional exchanges. The end-user demographic is expanding, with increased participation from retail investors, high-net-worth individuals, and institutional investors. M&A activity in the period 2019-2024 has been moderate, with an estimated total deal value of XX Million, reflecting consolidation efforts and expansion strategies among key players.

India Capital Market Exchange Ecosystem Market Dynamics & Trends

The Indian capital market exchange ecosystem is experiencing robust growth, driven by several key factors. The increasing penetration of the internet and mobile devices is fueling the adoption of digital trading platforms, significantly expanding access to market participants. Rising disposable incomes, coupled with government initiatives to promote financial inclusion, are contributing to an expanding investor base. Technological disruptions, such as the implementation of blockchain technology and artificial intelligence (AI) for algorithmic trading, are transforming market operations and increasing efficiency. The market is witnessing a shift towards personalized investment solutions and sophisticated trading strategies. The competitive landscape is highly dynamic, with players constantly innovating to attract and retain clients. The compound annual growth rate (CAGR) is estimated at XX% during the forecast period (2025-2033). Market penetration, particularly in tier-II and tier-III cities, is expected to increase significantly, driven by improved digital infrastructure and financial literacy programs.

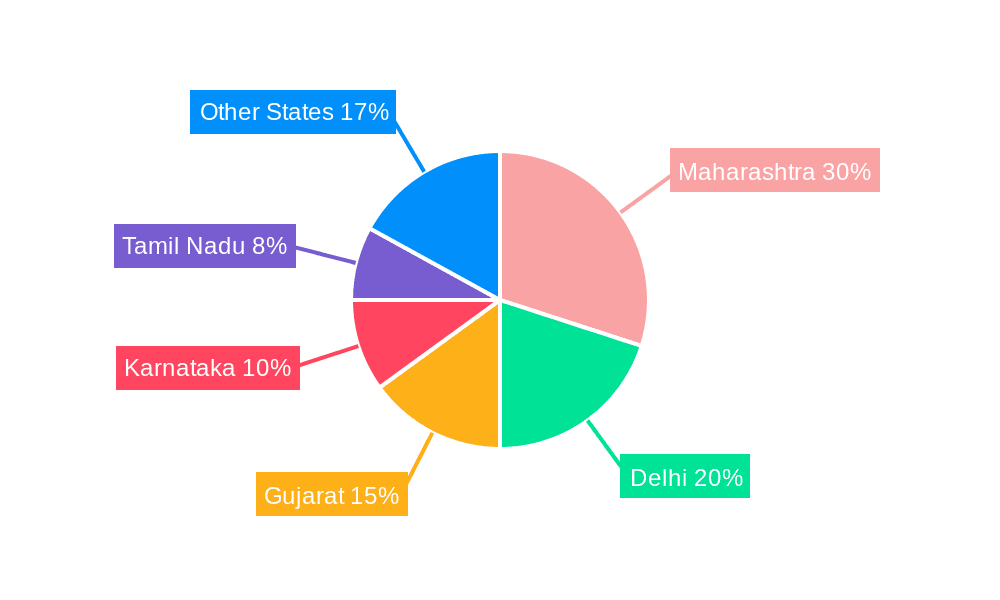

Dominant Regions & Segments in India Capital Market Exchange Ecosystem

The major metropolitan areas such as Mumbai, Delhi, Bangalore, and Chennai are currently the dominant regions in the Indian capital market exchange ecosystem, contributing to the highest proportion of trading volumes and investment activity.

- Key Drivers for Dominant Regions:

- Established financial infrastructure.

- High concentration of financial institutions and businesses.

- Access to a large pool of skilled professionals.

- Supportive regulatory environment.

- Presence of major stock exchanges.

The dominance of these regions is expected to continue throughout the forecast period, although there is potential for growth in other regions as financial literacy and access to digital platforms improve.

India Capital Market Exchange Ecosystem Product Innovations

Recent product innovations include the introduction of advanced trading platforms with sophisticated analytics, algorithmic trading capabilities, and personalized investment recommendations. The integration of AI and machine learning is driving the development of robo-advisors and automated trading systems. These technological trends cater to the growing demand for efficient, convenient, and data-driven investment solutions, enhancing market access and participation while improving investment decision-making.

Report Scope & Segmentation Analysis

This report segments the Indian capital market exchange ecosystem based on various criteria, including:

- By Type: Traditional exchanges, digital platforms, alternative trading systems. The digital platforms segment is poised for the fastest growth.

- By Investor Type: Retail investors, institutional investors, high-net-worth individuals. Institutional investors contribute a significant portion to the overall trading volume.

- By Service Type: Brokerage services, investment advisory services, wealth management services. The brokerage services segment is currently the largest.

Each segment's growth projections, market size, and competitive dynamics are detailed within the report.

Key Drivers of India Capital Market Exchange Ecosystem Growth

Several key factors are driving the growth of the Indian capital market exchange ecosystem:

- Technological advancements: The adoption of advanced technologies like AI, machine learning, and blockchain is streamlining operations and improving market efficiency.

- Government initiatives: Government policies promoting financial inclusion and digitalization are expanding market accessibility.

- Economic growth: The robust growth of the Indian economy is fueling investment activity and increasing market participation.

- Rising disposable incomes: Higher disposable incomes are leading to increased investment among retail investors.

Challenges in the India Capital Market Exchange Ecosystem Sector

The Indian capital market exchange ecosystem faces several challenges:

- Regulatory hurdles: Complex regulatory frameworks and compliance requirements can hinder innovation and growth.

- Cybersecurity threats: The increasing reliance on digital platforms raises concerns about cybersecurity risks and data breaches.

- Competition: Intense competition among market players necessitates continuous innovation and strategic adjustments. The impact of this is a compression of profit margins for smaller players.

Emerging Opportunities in India Capital Market Exchange Ecosystem

The Indian capital market exchange ecosystem presents several promising opportunities:

- Expansion into underserved markets: There's significant potential for growth in tier-II and tier-III cities with increasing internet penetration and financial literacy.

- Development of niche investment products: The demand for customized investment solutions and alternative investment options is growing.

- Adoption of fintech innovations: Emerging fintech solutions can enhance market efficiency and improve the investor experience.

Leading Players in the India Capital Market Exchange Ecosystem Market

- Taurus Corporate Advisory Services Limited

- Valuefy Solutions Private Limited

- Hedge Equities Ltd

- Sunflower Broking Pvt Ltd

- Nine Star Broking Pvt Ltd

- Research Icon

- Agroy Finance and Investment Ltd

- United Stock Exchange of India

- Basan Equity Broking Ltd

- Indira Securities P Ltd

- List Not Exhaustive

Key Developments in India Capital Market Exchange Ecosystem Industry

- Jan 2022: Introduction of a new digital trading platform by a leading brokerage firm.

- May 2023: Implementation of a new regulatory framework aimed at improving market transparency.

- Oct 2024: Successful merger between two mid-sized brokerage firms. (Further details on specific key developments with quantifiable impacts will be provided within the complete report.)

Future Outlook for India Capital Market Exchange Ecosystem Market

The future outlook for the Indian capital market exchange ecosystem is positive, with significant growth potential driven by technological innovation, expanding investor base, and government support. Strategic opportunities lie in adopting cutting-edge technologies, expanding into new markets, and providing customized and personalized investment solutions. The market is projected to witness robust growth, with a considerable increase in trading volumes and market capitalization in the coming years. This necessitates a proactive approach to innovation, regulatory compliance, and risk management among market participants.

India Capital Market Exchange Ecosystem Segmentation

-

1. Primary Markets

- 1.1. Equity Market

- 1.2. Debt Market

- 1.3. Corporate Governance and Compliance Monitoring

- 1.4. Corporate Restructuring

- 1.5. Intermediaries Associated

-

2. Secondary Markets

- 2.1. Cash Market

- 2.2. Equity Derivatives Markets

- 2.3. Commodity Derivatives Market

- 2.4. Currency Derivatives Market

- 2.5. Interest Rate Derivatives Market

- 2.6. Market Infrastructure Institutions

- 2.7. Intermediaries Associated

India Capital Market Exchange Ecosystem Segmentation By Geography

- 1. India

India Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of India Capital Market Exchange Ecosystem

India Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Derivatives Occupied with Major Share in the Secondary Capital Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 5.1.1. Equity Market

- 5.1.2. Debt Market

- 5.1.3. Corporate Governance and Compliance Monitoring

- 5.1.4. Corporate Restructuring

- 5.1.5. Intermediaries Associated

- 5.2. Market Analysis, Insights and Forecast - by Secondary Markets

- 5.2.1. Cash Market

- 5.2.2. Equity Derivatives Markets

- 5.2.3. Commodity Derivatives Market

- 5.2.4. Currency Derivatives Market

- 5.2.5. Interest Rate Derivatives Market

- 5.2.6. Market Infrastructure Institutions

- 5.2.7. Intermediaries Associated

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taurus Corporate Advisory Services Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valuefy Solutions Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hedge Equities Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunflower Broking Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Star Broking Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Research Icon

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agroy Finance and Investment Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Stock Exchange of India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Basan Equity Broking Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indira Securities P Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taurus Corporate Advisory Services Limited

List of Figures

- Figure 1: India Capital Market Exchange Ecosystem Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 2: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 3: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 5: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 6: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Capital Market Exchange Ecosystem?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the India Capital Market Exchange Ecosystem?

Key companies in the market include Taurus Corporate Advisory Services Limited, Valuefy Solutions Private Limited, Hedge Equities Ltd, Sunflower Broking Pvt Ltd, Nine Star Broking Pvt Ltd, Research Icon, Agroy Finance and Investment Ltd, United Stock Exchange of India, Basan Equity Broking Ltd, Indira Securities P Ltd **List Not Exhaustive.

3. What are the main segments of the India Capital Market Exchange Ecosystem?

The market segments include Primary Markets, Secondary Markets.

4. Can you provide details about the market size?

The market size is estimated to be USD 124 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Derivatives Occupied with Major Share in the Secondary Capital Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the India Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence