Key Insights

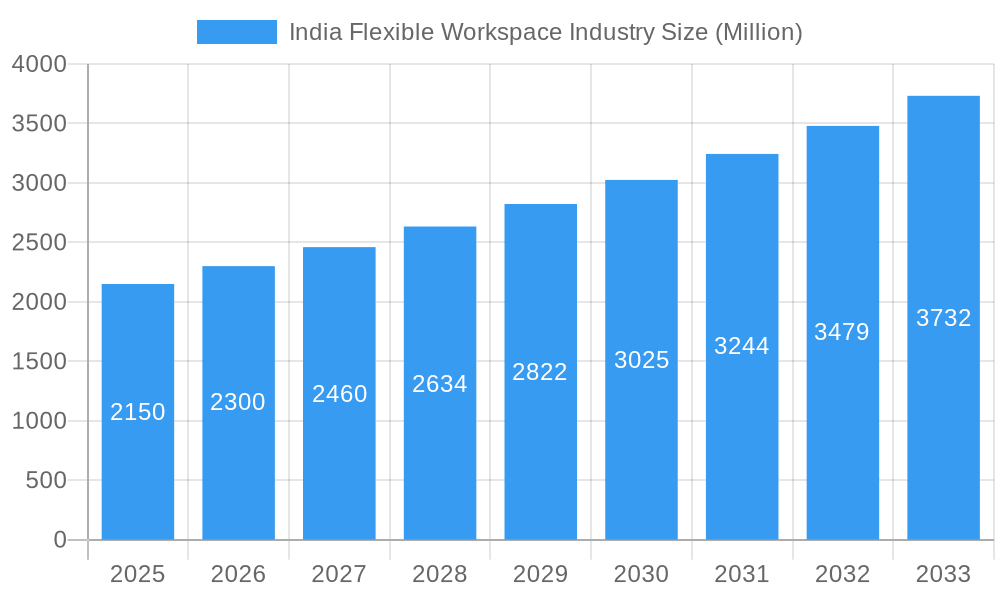

The India flexible workspace market, valued at $2.15 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.05% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning startup ecosystem and the increasing adoption of hybrid work models are significantly boosting demand for flexible office spaces. Furthermore, companies are increasingly seeking cost-effective solutions and greater operational flexibility, making coworking spaces and virtual offices attractive alternatives to traditional leases. The IT and telecommunications sector is a major driver, followed by media and entertainment and retail and consumer goods. Major metropolitan areas like Delhi, Mumbai, Bangalore, Hyderabad, and Pune account for a significant portion of the market, reflecting the concentration of businesses and talent in these cities. However, the market also faces challenges, such as potential oversupply in certain locations and the need for improved infrastructure and technological support in some areas.

India Flexible Workspace Industry Market Size (In Billion)

The market segmentation reveals a dynamic landscape. Private offices maintain a significant share, catering to established businesses requiring dedicated spaces. However, coworking spaces are experiencing rapid growth, driven by their collaborative atmosphere and cost-effectiveness. Virtual offices, offering a cost-efficient solution for smaller businesses and remote workers, are also experiencing steady growth. Looking ahead, the market is expected to witness further consolidation, with larger players expanding their footprint and smaller operators merging or adapting to remain competitive. The increasing focus on sustainability and technology integration within flexible workspaces will further shape the market's evolution, creating opportunities for innovative solutions and services. Regional variations in market growth will persist, with the major metropolitan areas continuing to attract significant investment and expansion.

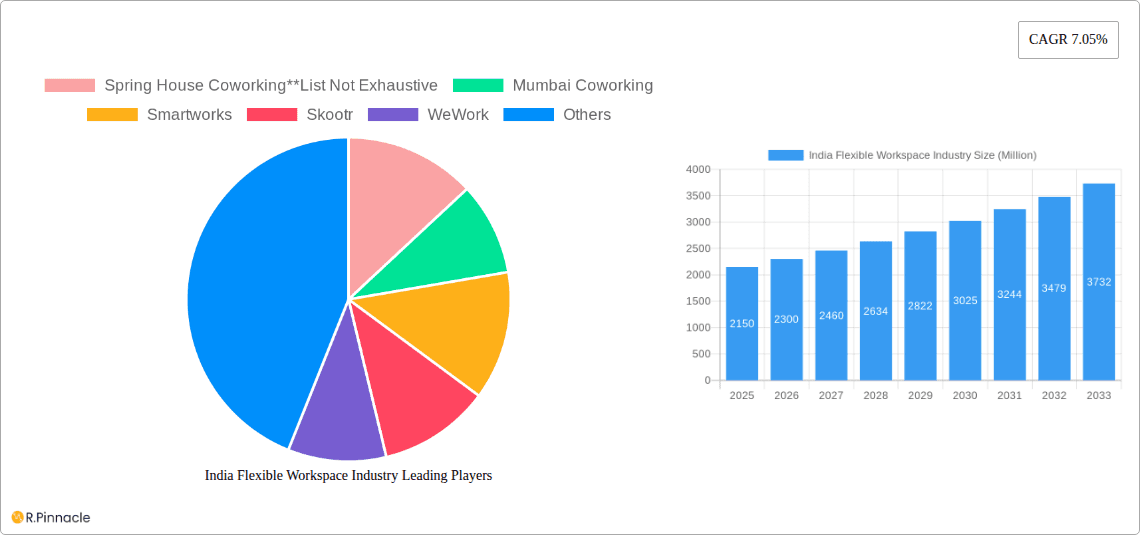

India Flexible Workspace Industry Company Market Share

India Flexible Workspace Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic India flexible workspace industry, covering market size, segmentation, key players, and future growth prospects from 2019 to 2033. Leveraging extensive data and expert insights, this report is an essential resource for industry professionals, investors, and strategic decision-makers.

India Flexible Workspace Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian flexible workspace market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities from 2019 to 2024. The report includes a detailed assessment of market share held by key players and the value of significant M&A deals. The analysis considers the impact of various factors, including technological advancements, evolving consumer preferences, and government regulations, on the market structure. It also explores the role of product substitutes and the demographic characteristics of end-users.

- Market Concentration: The Indian flexible workspace market exhibits a moderately concentrated structure, with a few large players commanding significant market share. The report quantifies this concentration using metrics such as the Herfindahl-Hirschman Index (HHI). Specific market share data for top players like WeWork, IndiQube, and others are provided.

- Innovation Drivers: The increasing adoption of technology, including smart building solutions and flexible lease terms, is a major driver of innovation. The report highlights specific technological advancements and their impact on the market.

- Regulatory Framework: The regulatory environment plays a crucial role in shaping the industry's growth trajectory. The report analyzes relevant regulations and their impact on market players.

- Product Substitutes: The report identifies and assesses potential substitutes for flexible workspaces, including traditional office leasing and remote work arrangements.

- End-User Demographics: The report explores the demographic profile of end-users, including industry sector, company size, and geographic location.

- M&A Activities: The report details significant mergers and acquisitions (M&A) activities in the industry during the historical period (2019-2024). XX Million in M&A deal values are analyzed, highlighting key trends and implications for market consolidation.

India Flexible Workspace Industry Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics from 2019 to 2024 and projects these trends through 2033. The report presents a comprehensive overview of the market's evolution, including a detailed analysis of growth rates and penetration levels.

The Indian flexible workspace market has witnessed significant growth, driven by factors such as the rise of the gig economy, increasing preference for flexible work arrangements, and the growing adoption of technology. The report forecasts a CAGR of XX% from 2025 to 2033, with market penetration reaching XX% by 2033. The impact of technological advancements, including co-working space management software, virtual office platforms and other innovations are discussed at length. The changing preferences of businesses and individual workers are analyzed, with the report focusing on factors like affordability, location, amenities, and technological integration.

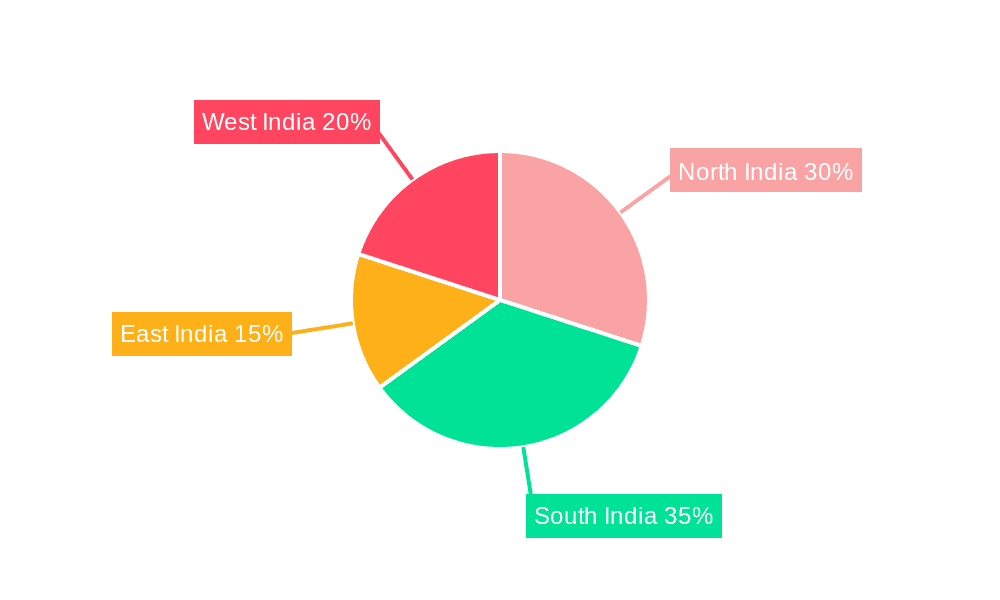

Dominant Regions & Segments in India Flexible Workspace Industry

This section identifies the leading regions and segments within the Indian flexible workspace market. The analysis considers factors such as economic policies, infrastructure development, and the concentration of businesses across different cities and market segments. The dominant segments are defined according to type (Private Offices, Coworking Offices, Virtual Offices), end-user (IT and Telecommunications, Media and Entertainment, Retail and Consumer Goods, Other End Users), and city (Delhi, Mumbai, Bangalore, Hyderabad, Pune, Rest of India).

By Type: Coworking offices are projected to remain the dominant segment, driven by affordability and flexibility. Growth projections are provided for each segment.

By End User: The IT and Telecommunications sector is likely to remain the largest end-user, followed by Media and Entertainment. Growth rates for each end-user sector are included.

By City: Mumbai, Bangalore, and Delhi are projected to be the leading cities in terms of market size and growth, driven by factors such as strong economic activity and established infrastructure. Detailed analysis explaining the dominance is included in the report.

Key Drivers:

- Economic Policies: Government initiatives promoting entrepreneurship and digitalization are key drivers.

- Infrastructure: The availability of high-speed internet and advanced technological infrastructure is crucial.

India Flexible Workspace Industry Product Innovations

This section summarizes recent product developments, applications, and competitive advantages within the Indian flexible workspace market. The report emphasizes technological trends and the extent to which new products meet market needs. This includes an examination of innovative approaches to space design, technological integration within spaces, and the development of value-added services.

Report Scope & Segmentation Analysis

This section details all market segmentations by type, end-user, and city. Growth projections, market sizes, and competitive dynamics are included for each segment. The report provides detailed market sizing for each segment (using Million values) for the base year (2025) and the forecast period (2025-2033). The competitive dynamics are analyzed by providing information on the number of players and the competitive intensity within each segment.

Key Drivers of India Flexible Workspace Industry Growth

This section outlines the key drivers of growth in the Indian flexible workspace industry, focusing on technological, economic, and regulatory factors. Specific examples are provided. The report highlights the influence of factors such as the increasing adoption of remote work, the rise of the gig economy, and government initiatives promoting entrepreneurship.

Challenges in the India Flexible Workspace Industry Sector

This section discusses the barriers and restraints facing the Indian flexible workspace industry. These challenges include regulatory hurdles, supply chain issues, and competitive pressures, quantified where possible by using market data. For example, the report will discuss the impact of rising real estate costs on profitability.

Emerging Opportunities in India Flexible Workspace Industry

This section highlights emerging trends and opportunities in the Indian flexible workspace industry, including new markets, technologies, and consumer preferences. The report suggests future market expansions into less-penetrated regions and the opportunities presented by technological advancements.

Leading Players in the India Flexible Workspace Industry Market

- Spring House Coworking

- Mumbai Coworking

- Smartworks

- Skootr

- WeWork

- Innov

- IndiQube

- Goodworks

- 91Springboard

- Awfis

Key Developments in India Flexible Workspace Industry

- August 2023: WeWork India opened its 50th location in India, a new office in New Delhi (Eldeco Centre) with 700 desks and 54,000 square feet of leased space. This marks their seventh location in Delhi.

- June 2023: WeWork India signed a lease for over 1 lakh square feet in Hyderabad, creating a new facility with over 1,500 seats within Raheja Mindspace. Desk capacity exceeds 1550.

Future Outlook for India Flexible Workspace Industry Market

The future outlook for the India flexible workspace market is positive, driven by continued urbanization, a growing millennial workforce, and the increasing adoption of flexible work arrangements. The report projects strong growth in the coming years, with significant opportunities for expansion into new markets and segments. The report suggests strategic opportunities for existing players and potential entrants, emphasizing the importance of innovation, technological adaptation, and strong customer service.

India Flexible Workspace Industry Segmentation

-

1. Type

- 1.1. Private Officees

- 1.2. Coworking Offices

- 1.3. Virtual Offices

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and Consumer Goods

- 2.4. Other End Users

-

3. City

- 3.1. Delhi

- 3.2. Mumbai

- 3.3. Bangalore

- 3.4. Hyderabad

- 3.5. Pune

- 3.6. Rest of India

India Flexible Workspace Industry Segmentation By Geography

- 1. India

India Flexible Workspace Industry Regional Market Share

Geographic Coverage of India Flexible Workspace Industry

India Flexible Workspace Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Change in Work Culture; Increase in Foreign Investment

- 3.3. Market Restrains

- 3.3.1. High Competition and Saturation; Lease Flexibility

- 3.4. Market Trends

- 3.4.1. Increasing Number of Startups and Freelancers in the Country To Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Flexible Workspace Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Private Officees

- 5.1.2. Coworking Offices

- 5.1.3. Virtual Offices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Delhi

- 5.3.2. Mumbai

- 5.3.3. Bangalore

- 5.3.4. Hyderabad

- 5.3.5. Pune

- 5.3.6. Rest of India

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Spring House Coworking**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mumbai Coworking

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Smartworks

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skootr

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 WeWork

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innov

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IndiQube

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goodworks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 91Springboard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Awfis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Spring House Coworking**List Not Exhaustive

List of Figures

- Figure 1: India Flexible Workspace Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Flexible Workspace Industry Share (%) by Company 2025

List of Tables

- Table 1: India Flexible Workspace Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Flexible Workspace Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: India Flexible Workspace Industry Revenue Million Forecast, by City 2020 & 2033

- Table 4: India Flexible Workspace Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Flexible Workspace Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Flexible Workspace Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 7: India Flexible Workspace Industry Revenue Million Forecast, by City 2020 & 2033

- Table 8: India Flexible Workspace Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Flexible Workspace Industry?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the India Flexible Workspace Industry?

Key companies in the market include Spring House Coworking**List Not Exhaustive, Mumbai Coworking, Smartworks, Skootr, WeWork, Innov, IndiQube, Goodworks, 91Springboard, Awfis.

3. What are the main segments of the India Flexible Workspace Industry?

The market segments include Type, End User, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Change in Work Culture; Increase in Foreign Investment.

6. What are the notable trends driving market growth?

Increasing Number of Startups and Freelancers in the Country To Drive the Market.

7. Are there any restraints impacting market growth?

High Competition and Saturation; Lease Flexibility.

8. Can you provide examples of recent developments in the market?

August 2023: WeWork India has opened a new office in New Delhi, their 50th location in the country, and it's their first foray into the city. The property, Eldeco Centre, is designed to meet the needs of businesses and has 700 desks. It's their seventh location in the city, and they've leased 54,000 square feet of office space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Flexible Workspace Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Flexible Workspace Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Flexible Workspace Industry?

To stay informed about further developments, trends, and reports in the India Flexible Workspace Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence