Key Insights

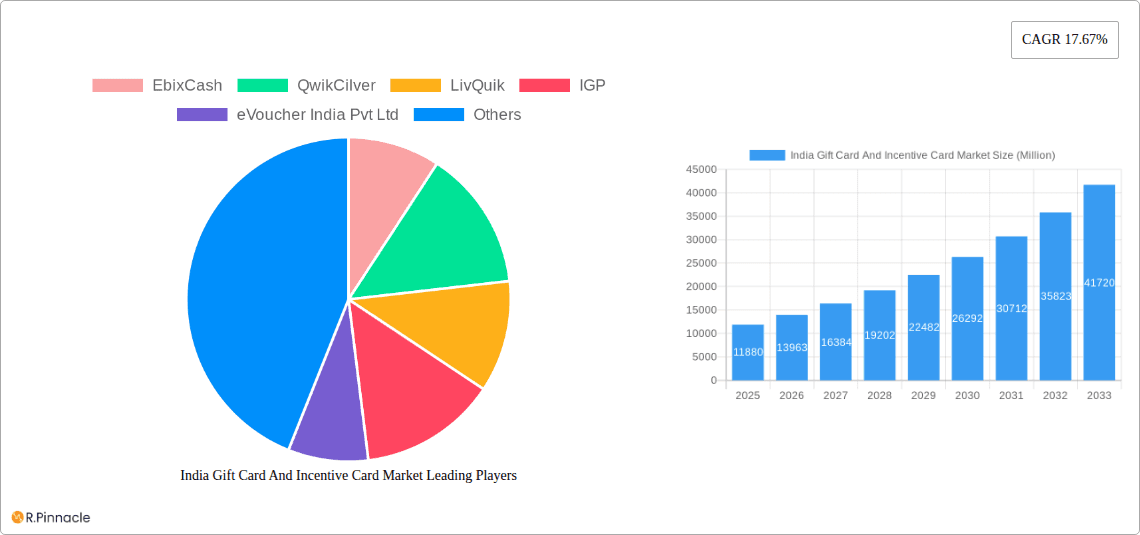

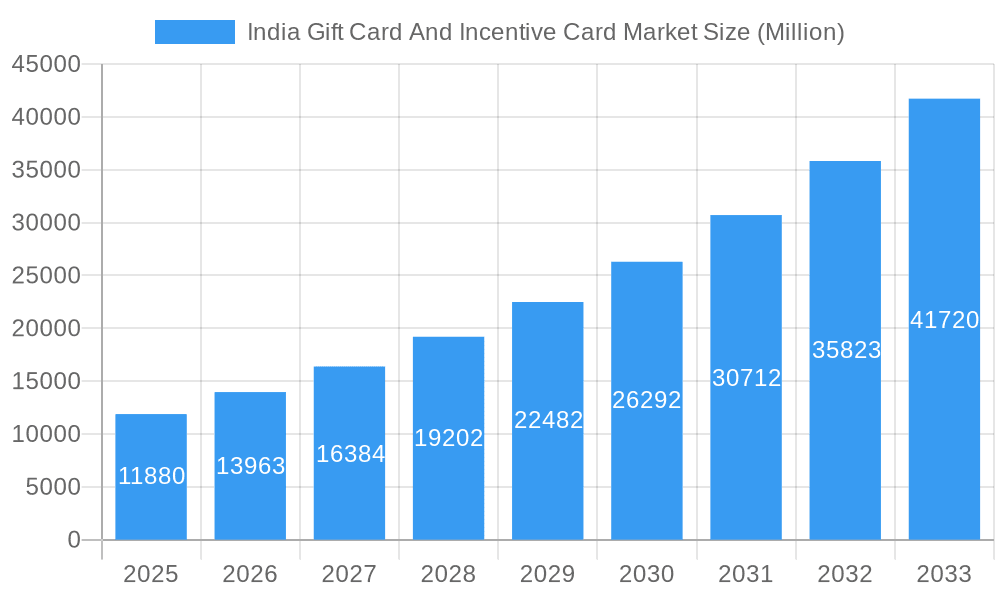

The India gift card and incentive card market is experiencing robust growth, projected to reach a market size of $11.88 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 17.67% from 2019 to 2033. This expansion is fueled by several key drivers. The increasing adoption of digital payments and e-commerce platforms facilitates seamless gift card purchasing and redemption, significantly broadening the market's reach. Furthermore, the rising disposable incomes of the Indian middle class and a burgeoning trend towards experiential gifting are boosting demand. Corporates are increasingly leveraging incentive cards for employee engagement and reward programs, adding to the market's momentum. The market is segmented by card type (physical vs. digital), distribution channel (online vs. offline), and target demographic (individuals vs. corporates). Leading players like EbixCash, QwikCilver, and others are contributing significantly to market growth through strategic partnerships, innovative product offerings, and aggressive marketing campaigns. However, challenges such as security concerns related to digital gift cards and the need to address consumer awareness in certain regions could impact the market's trajectory. Despite these challenges, the long-term outlook remains positive, given the expanding digital economy and changing consumer preferences within India.

India Gift Card And Incentive Card Market Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates continued strong growth driven by factors such as increased smartphone penetration, growing online retail sales, and the evolving preferences of younger generations towards digital gifting. Competitive intensity is expected to remain high as existing players consolidate their market share and new entrants continue to emerge. To maintain growth, companies must focus on enhancing security features, developing user-friendly platforms, and offering personalized gifting experiences to cater to the diverse preferences of the Indian consumer base. Diversification of product offerings and strategic alliances will also play a crucial role in shaping the market's future landscape. Government initiatives promoting digitalization further bolster the market's prospects, ensuring a sustained period of expansion and evolution in the coming years.

India Gift Card And Incentive Card Market Company Market Share

India Gift Card and Incentive Card Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Gift Card and Incentive Card Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

India Gift Card And Incentive Card Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the Indian gift card and incentive card market. The market is characterized by a mix of established players and emerging startups, leading to a moderately fragmented structure. Key players like EbixCash, QwikCilver, LivQuik, IGP, eVoucher India Pvt Ltd, Woohoo, Zingoy, Giftstoindia24x, GyFTR, and You Got a Gift (list not exhaustive) compete on factors including product offerings, distribution networks, and technological capabilities.

- Market Concentration: The market exhibits moderate concentration, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Drivers: The increasing adoption of digital technologies, evolving consumer preferences, and the rise of e-commerce are key innovation drivers. The development of mobile-first solutions and the integration of loyalty programs are transforming the market.

- Regulatory Framework: The Reserve Bank of India (RBI) regulations play a significant role in shaping the market. Compliance with KYC/AML norms is crucial for all players.

- Product Substitutes: Other forms of digital payments and rewards programs pose some level of substitution, but the unique aspects of gift cards, such as ease of gifting and targeted promotions, maintain distinct market appeal.

- End-User Demographics: The target audience spans diverse demographics, from millennials and Gen Z to older generations, with varied spending habits and preferences influencing market segmentation.

- M&A Activities: The market has witnessed several M&A activities in recent years, with deal values ranging from xx Million to xx Million. These activities reflect consolidation and efforts to expand market reach and product offerings.

India Gift Card And Incentive Card Market Market Dynamics & Trends

The Indian gift card and incentive card market is experiencing significant growth, driven by increasing digital adoption, a burgeoning e-commerce sector, and a rise in corporate gifting. The market is witnessing rapid technological advancements, impacting consumer preferences and competitive dynamics. The strong growth is attributed to factors like increased disposable incomes, changing consumer preferences towards experiential gifts, and growing adoption of online and mobile platforms for gift purchases. This results in a high market penetration rate expected to reach xx% by 2033.

The CAGR of the market during the historical period (2019-2024) was estimated at xx%, driven by factors such as the expansion of e-commerce, rising disposable incomes, and evolving consumer preferences. The forecast period (2025-2033) is expected to see an even higher CAGR of xx%, owing to the increasing adoption of digital payment methods and the growth of the fintech sector. Technological disruptions like the integration of blockchain technology for enhanced security and transparency are shaping the future of the market. Competitive dynamics involve strategies such as product diversification, strategic partnerships, and aggressive marketing campaigns to capture market share.

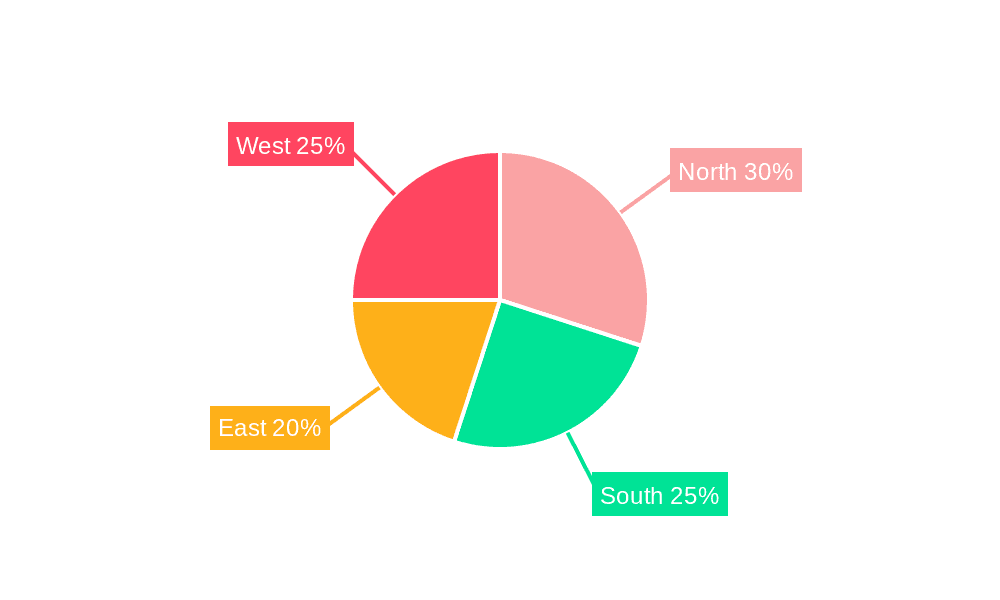

Dominant Regions & Segments in India Gift Card And Incentive Card Market

The Indian gift card and incentive card market exhibits significant regional variations. While data on specific regions is unavailable to present here, it’s anticipated that metropolitan areas with higher internet penetration and disposable income will lead in market share.

- Key Drivers for Dominant Regions:

- Economic Growth: Regions with higher GDP growth rates generally exhibit higher demand for gift cards and incentive cards.

- Urbanization: Increased urbanization leads to a higher concentration of potential customers.

- Digital Infrastructure: Robust digital infrastructure facilitates online transactions and wider reach for digital gift cards.

- Government Initiatives: Supportive government policies and initiatives can boost market growth.

The market is segmented based on various factors, including card type (physical vs. digital), distribution channel (online vs. offline), and end-user (individuals vs. corporates). Data regarding the specific dominance of these segments is not currently available but is anticipated that the digital segment will show greater growth than the physical.

India Gift Card And Incentive Card Market Product Innovations

Recent innovations in the Indian gift card and incentive card market focus on enhancing user experience and security. Digital gift cards with enhanced features, such as personalized messaging and flexible redemption options, are gaining popularity. The integration of loyalty programs with gift cards is becoming increasingly common, providing additional incentives to customers. Technological advancements, such as blockchain technology for enhanced security and mobile-first solutions, are shaping product development and competitive advantages.

Report Scope & Segmentation Analysis

This report segments the India Gift Card and Incentive Card Market based on various factors including card type (physical and digital), distribution channel (online and offline), end-user (individuals and corporates), and redemption type (physical and digital). Each segment exhibits unique growth trajectories and competitive dynamics. The digital segment is projected to show rapid growth, driven by increased internet penetration and mobile adoption. The corporate segment holds significant potential, fueled by the rising popularity of employee rewards and incentive programs.

Key Drivers of India Gift Card And Incentive Card Market Growth

Several factors contribute to the growth of the India Gift Card and Incentive Card Market: the expanding e-commerce sector, increasing smartphone penetration, and the rising popularity of online gifting. Government initiatives promoting digital payments and a growing middle class with increasing disposable income also contribute. Technological advancements, such as improved mobile payment infrastructure and innovative loyalty programs, further accelerate market growth. The convenience and flexibility of digital gift cards, coupled with targeted marketing campaigns, are boosting market expansion.

Challenges in the India Gift Card And Incentive Card Market Sector

The Indian Gift Card and Incentive Card Market faces challenges, including the need for robust security measures to prevent fraud and maintaining consumer trust. The complexities of regulatory compliance, particularly related to KYC/AML norms, add another layer of operational complexity. Maintaining a high level of customer service is crucial, particularly in managing issues related to card activation, redemption, and customer support. Competition from other digital payment methods and the need for continuous innovation to stay ahead of the curve pose ongoing challenges.

Emerging Opportunities in India Gift Card And Incentive Card Market

The Indian Gift Card and Incentive Card Market offers significant opportunities. The expansion into Tier 2 and Tier 3 cities, where internet and mobile penetration is steadily increasing, presents a large untapped market. Developing innovative gift card solutions tailored to specific consumer segments, such as personalized experiences or charity-linked gift cards, can also generate significant growth. Collaborations with businesses across diverse industries to expand redemption options further broaden the market reach.

Leading Players in the India Gift Card And Incentive Card Market Market

- EbixCash

- QwikCilver

- LivQuik

- IGP

- eVoucher India Pvt Ltd

- Woohoo

- Zingoy

- Giftstoindia24x

- GyFTR

- You Got a Gift

Key Developments in India Gift Card And Incentive Card Market Industry

- December 2023: Pine Labs’ Qwikcilver and Foodpanda partnered to launch Foodpanda Gift Cards, enhancing convenience for customers.

- October 2023: YES Bank and ONDC launched the ONDC Network Gift Card, expanding access to various brands and sellers.

Future Outlook for India Gift Card And Incentive Card Market Market

The future outlook for the India Gift Card and Incentive Card Market is promising, driven by sustained growth in the digital economy, rising consumer spending, and ongoing technological innovation. The market is poised for significant expansion as digital adoption continues and new technologies like blockchain enhance security and transparency. Strategic partnerships and collaborations will be key to unlocking further growth potential in this dynamic and evolving market.

India Gift Card And Incentive Card Market Segmentation

-

1. Card Type

- 1.1. E-Gift card

- 1.2. Physical card

-

2. Consumer Type

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

India Gift Card And Incentive Card Market Segmentation By Geography

- 1. India

India Gift Card And Incentive Card Market Regional Market Share

Geographic Coverage of India Gift Card And Incentive Card Market

India Gift Card And Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.3. Market Restrains

- 3.3.1. Strong Growth in the E-Commerce Market is Driving the Gift Card Industry

- 3.4. Market Trends

- 3.4.1. The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Gift Card And Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. E-Gift card

- 5.1.2. Physical card

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EbixCash

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 QwikCilver

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LivQuik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IGP

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 eVoucher India Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Woohoo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zingoy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Giftstoindia24x

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GyFTR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 You Got a Gift**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EbixCash

List of Figures

- Figure 1: India Gift Card And Incentive Card Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Gift Card And Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 2: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 3: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 4: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 5: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: India Gift Card And Incentive Card Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Gift Card And Incentive Card Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Gift Card And Incentive Card Market Revenue Million Forecast, by Card Type 2020 & 2033

- Table 10: India Gift Card And Incentive Card Market Volume Billion Forecast, by Card Type 2020 & 2033

- Table 11: India Gift Card And Incentive Card Market Revenue Million Forecast, by Consumer Type 2020 & 2033

- Table 12: India Gift Card And Incentive Card Market Volume Billion Forecast, by Consumer Type 2020 & 2033

- Table 13: India Gift Card And Incentive Card Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: India Gift Card And Incentive Card Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: India Gift Card And Incentive Card Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Gift Card And Incentive Card Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Gift Card And Incentive Card Market?

The projected CAGR is approximately 17.67%.

2. Which companies are prominent players in the India Gift Card And Incentive Card Market?

Key companies in the market include EbixCash, QwikCilver, LivQuik, IGP, eVoucher India Pvt Ltd, Woohoo, Zingoy, Giftstoindia24x, GyFTR, You Got a Gift**List Not Exhaustive.

3. What are the main segments of the India Gift Card And Incentive Card Market?

The market segments include Card Type, Consumer Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

6. What are the notable trends driving market growth?

The Thriving E-Commerce Market is Fueling the Growth of the Gift Card Industry.

7. Are there any restraints impacting market growth?

Strong Growth in the E-Commerce Market is Driving the Gift Card Industry.

8. Can you provide examples of recent developments in the market?

In December 2023, Pine Labs’ Qwikcilver and Foodpanda collaborated to introduce Foodpanda Gift Cards, a more advanced solution that allows Foodpanda customers to redeem and check their purchases conveniently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Gift Card And Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Gift Card And Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Gift Card And Incentive Card Market?

To stay informed about further developments, trends, and reports in the India Gift Card And Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence