Key Insights

The India home textile market, valued at $9.6 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.84% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes, coupled with a burgeoning middle class, are fueling increased demand for higher-quality home furnishings. A shift towards improved living standards and a preference for aesthetically pleasing and comfortable home environments are also significant contributors. Furthermore, the growing popularity of online retail channels provides convenient access to a wider variety of products, boosting market penetration. While the market is segmented across product types (bed linen, bath linen, kitchen linen, upholstery, floor coverings) and distribution channels (supermarkets, specialty stores, online, others), the online segment is expected to experience the most rapid growth due to its convenience and expanding reach. Major players like IKEA, Bombay Dyeing, and Welspun Group are leveraging these trends, investing in product innovation and expanding their online presence to capture market share. However, potential restraints include fluctuations in raw material prices and increasing competition from both domestic and international brands.

India Home Textile Market Market Size (In Billion)

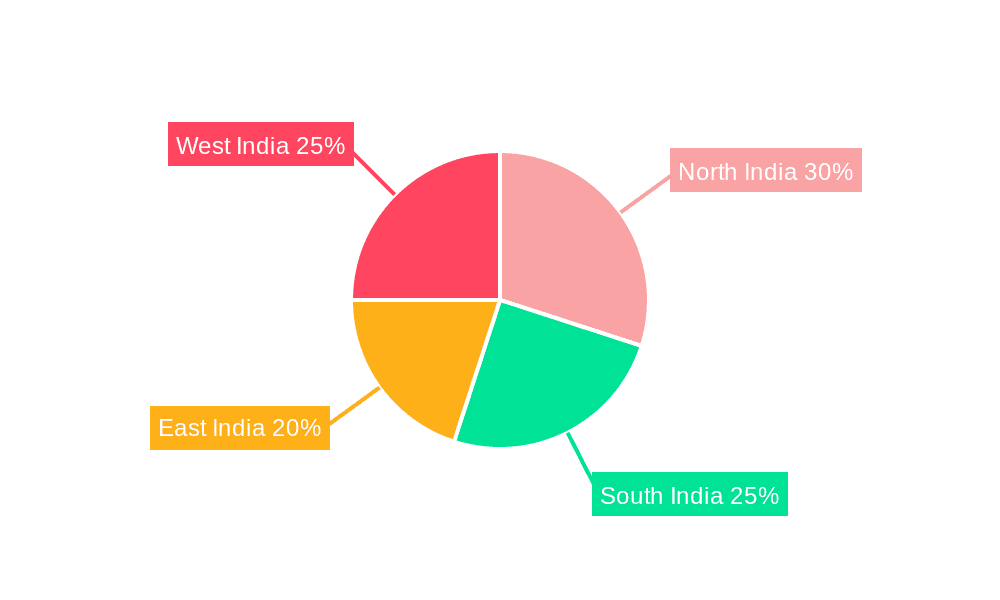

The regional distribution of the market shows variations in growth potential across North, South, East, and West India. While precise regional data is unavailable, it's reasonable to assume that regions with higher population density and economic activity will demonstrate stronger growth. Considering the CAGR of 9.84%, we can project a gradual increase in market size over the forecast period, with online sales consistently outpacing traditional retail channels. This projection considers factors such as sustained economic growth, evolving consumer preferences, and the continuous adaptation of major players to market trends. Analyzing regional differences in consumer behavior and purchasing power will be crucial for companies aiming for effective market penetration and sustained growth.

India Home Textile Market Company Market Share

India Home Textile Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Home Textile Market, offering valuable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The market is valued at XX Million in 2025 and is expected to reach XX Million by 2033.

India Home Textile Market Structure & Innovation Trends

The Indian home textile market exhibits a moderately concentrated structure, with key players like Welspun Group, Trident Limited, and Indo Count Industries Ltd holding significant market share. However, the market also accommodates numerous smaller players, particularly in the artisanal and handloom segments. Innovation is driven by factors such as increasing consumer demand for sustainable and technologically advanced products, coupled with evolving design aesthetics. Government initiatives promoting the textile industry and favorable trade policies contribute significantly. Product substitution is minimal, with natural fibers like cotton maintaining a strong position, albeit facing competition from synthetic alternatives. The end-user demographic is diverse, ranging from budget-conscious consumers to high-end luxury buyers. Mergers and acquisitions (M&A) activity has been significant, illustrated by Indo Count Industries Limited’s acquisition of GHCL Ltd.'s home textile business in 2022, valued at XX Million. Other notable M&A deals in the recent past have totaled approximately XX Million, indicative of consolidation within the sector. The regulatory framework, while generally supportive, presents challenges relating to compliance and standards.

India Home Textile Market Dynamics & Trends

The India Home Textile Market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a shift towards improved living standards. Technological advancements in manufacturing processes, such as automation and precision machinery, are enhancing efficiency and product quality. Consumer preferences are evolving towards sustainable, eco-friendly products, and personalization is gaining traction. The market is witnessing intensified competition, with both domestic and international players vying for market share. The CAGR for the forecast period (2025-2033) is projected at XX%, indicating substantial growth potential. Market penetration of online sales channels is increasing steadily, with a projected XX% market share by 2033.

Dominant Regions & Segments in India Home Textile Market

Leading Region: The northern region of India currently dominates the market due to robust textile manufacturing infrastructure and high consumer demand. Key drivers include favorable economic policies that support the industry, well-developed distribution networks, and a large concentration of both producers and consumers.

Dominant Product Segment: Bed linen currently holds the largest market share, driven by high demand from a large population and the versatility of the product, catering to various budgets and preferences.

Leading Distribution Channel: Online channels are rapidly gaining market share due to increasing internet penetration and consumer preference for convenience. However, supermarkets and hypermarkets remain significant distribution channels, particularly for budget-conscious buyers. Specialty stores cater to the higher end of the market.

The South and West regions are emerging as significant contributors due to their developing economies and increased consumer purchasing power. The growth of the bath linen and kitchen linen segments is also expected, supported by evolving lifestyles.

India Home Textile Market Product Innovations

The Indian home textile market is witnessing significant product innovations, with a focus on functional fabrics, such as antimicrobial and stain-resistant materials. Technological advancements in weaving techniques and printing processes are enhancing product aesthetics and functionality. Sustainable and eco-friendly products, incorporating recycled materials and organic cotton, are gaining popularity, aligning with growing environmental consciousness among consumers. These innovations cater to the expanding middle class and the preference for high-quality, durable, and aesthetically pleasing home textiles.

Report Scope & Segmentation Analysis

This report segments the India Home Textile Market based on product type (Bed Linen, Bath Linen, Kitchen Linen, Upholstery, Floor Covering) and distribution channels (Supermarkets & Hypermarkets, Specialty Stores, Online, Other Distribution Channels). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail, providing a comprehensive understanding of the market landscape. The report projects significant growth for the online channel and a sustained dominance of cotton-based products within the bed linen category. Competition within each segment is analyzed, considering established players and emerging competitors.

Key Drivers of India Home Textile Market Growth

The growth of the India Home Textile Market is primarily driven by several factors. Rising disposable incomes fuel consumer spending on home furnishings. Government initiatives promoting the textile sector, such as financial incentives and infrastructure development, stimulate growth. Furthermore, increased urbanization is creating a demand for modern, aesthetically pleasing home textiles. Technological advancements in manufacturing boost efficiency and quality, while evolving consumer preferences drive product innovation.

Challenges in the India Home Textile Market Sector

The India Home Textile Market faces several challenges. Fluctuations in raw material prices, especially cotton, affect profitability. Intense competition, both domestically and internationally, puts pressure on margins. Maintaining high quality standards and complying with stringent regulations pose ongoing operational challenges. Supply chain disruptions and logistical complexities can also impact market operations.

Emerging Opportunities in India Home Textile Market

The Indian home textile market presents several opportunities. The growing preference for sustainable and eco-friendly products provides a niche for businesses focusing on organic and recycled materials. The increasing demand for personalized and customized home textiles opens avenues for bespoke designs and services. Technological advancements in smart home textiles, incorporating features like temperature regulation and antimicrobial properties, offer promising avenues for innovation. The expansion of e-commerce provides access to wider markets and enhances customer reach.

Leading Players in the India Home Textile Market Market

- IKEA Systems B V

- Bombay Dyeing

- Alok Industries Ltd

- Himatsingka

- Trident Limited

- William Sanoma Inc

- S Kumars Nationwide Limited

- Vardhman Textiles Limited

- Raymond Group

- Indo Count Industries Ltd

- Welspun Group

- DCM Textiles

- Bed Bath & Beyond Inc

Key Developments in India Home Textile Market Industry

- November 2023: Raymond launched "Regio Italia," a luxury wool suiting fabric, signifying a push into the premium segment.

- April 2022: Indo Count Industries Limited acquired GHCL Ltd.'s home textile business, enhancing its market position and capabilities.

- January 2022: Vandewiele NV and Savio India merged, creating a stronger integrated service provider in the Indian market.

Future Outlook for India Home Textile Market Market

The future of the India Home Textile Market is promising, with continued growth fueled by rising disposable incomes, technological advancements, and evolving consumer preferences. Strategic partnerships, innovative product development, and a focus on sustainability will be crucial for success. The market is expected to witness increased consolidation and a heightened focus on e-commerce channels. The premium segment is poised for significant growth, driven by rising demand for luxury and personalized home textiles.

India Home Textile Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Home Textile Market Segmentation By Geography

- 1. India

India Home Textile Market Regional Market Share

Geographic Coverage of India Home Textile Market

India Home Textile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The expanding middle-class population in India is contributing to the growth of the home textile market. As more households move into the middle-income bracket

- 3.2.2 they are investing in home furnishings and textiles to improve their living conditions.

- 3.3. Market Restrains

- 3.3.1 Price sensitivity among Indian consumers

- 3.3.2 particularly in lower-income segments

- 3.3.3 can limit spending on premium or luxury home textiles. Price fluctuations of raw materials and inflation can impact affordability and demand

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly home textiles in India. Consumers are increasingly seeking products made from organic cotton

- 3.4.2 recycled materials

- 3.4.3 and eco-friendly dyes

- 3.4.4 reflecting a broader global trend towards environmental consciousness.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Home Textile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IKEA Systems B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bombay Dyeing

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alok Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Himatsingka

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trident Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 William Sanoma Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 S Kumars Nationwide Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vardhman Textiles Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Raymond Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indo Count Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Welspun Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DCM Textiles

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Bed Bath & Beyond Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 IKEA Systems B V

List of Figures

- Figure 1: India Home Textile Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Home Textile Market Share (%) by Company 2025

List of Tables

- Table 1: India Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Home Textile Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: India Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Home Textile Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Home Textile Market?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the India Home Textile Market?

Key companies in the market include IKEA Systems B V, Bombay Dyeing, Alok Industries Ltd, Himatsingka, Trident Limited, William Sanoma Inc, S Kumars Nationwide Limited, Vardhman Textiles Limited, Raymond Group, Indo Count Industries Ltd, Welspun Group, DCM Textiles, Bed Bath & Beyond Inc.

3. What are the main segments of the India Home Textile Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.60 Million as of 2022.

5. What are some drivers contributing to market growth?

The expanding middle-class population in India is contributing to the growth of the home textile market. As more households move into the middle-income bracket. they are investing in home furnishings and textiles to improve their living conditions..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly home textiles in India. Consumers are increasingly seeking products made from organic cotton. recycled materials. and eco-friendly dyes. reflecting a broader global trend towards environmental consciousness..

7. Are there any restraints impacting market growth?

Price sensitivity among Indian consumers. particularly in lower-income segments. can limit spending on premium or luxury home textiles. Price fluctuations of raw materials and inflation can impact affordability and demand.

8. Can you provide examples of recent developments in the market?

In November 2023, Raymond launched an international range of luxury suiting fabrics, "Regio Italia". Regio Italia is a luxury wool suiting fabric crafted and designed in Italy to meet the demand in India for international luxury fashion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Home Textile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Home Textile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Home Textile Market?

To stay informed about further developments, trends, and reports in the India Home Textile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence