Key Insights

The Indian Prussian Blue market is projected to reach $42.53 billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 6.8% from the base year 2024. This expansion is primarily driven by robust demand from critical application sectors including paints, inks, and the pharmaceutical industry. The burgeoning construction and printing sectors, alongside advancements in targeted drug delivery and diagnostic imaging applications in pharmaceuticals, are key growth catalysts. The nation's expanding economy further underpins this growth through increased industrial output and consumer expenditure.

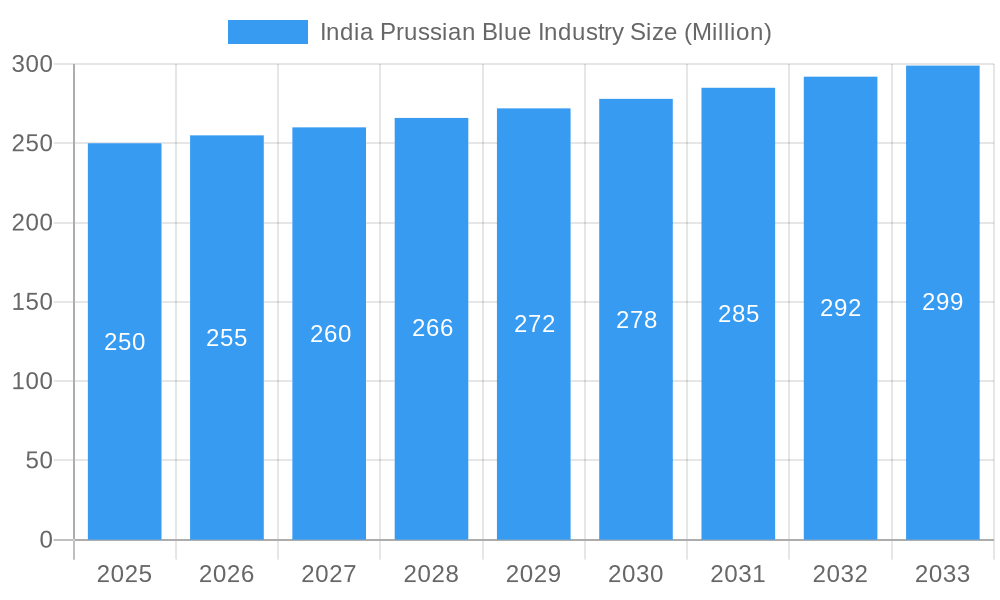

India Prussian Blue Industry Market Size (In Billion)

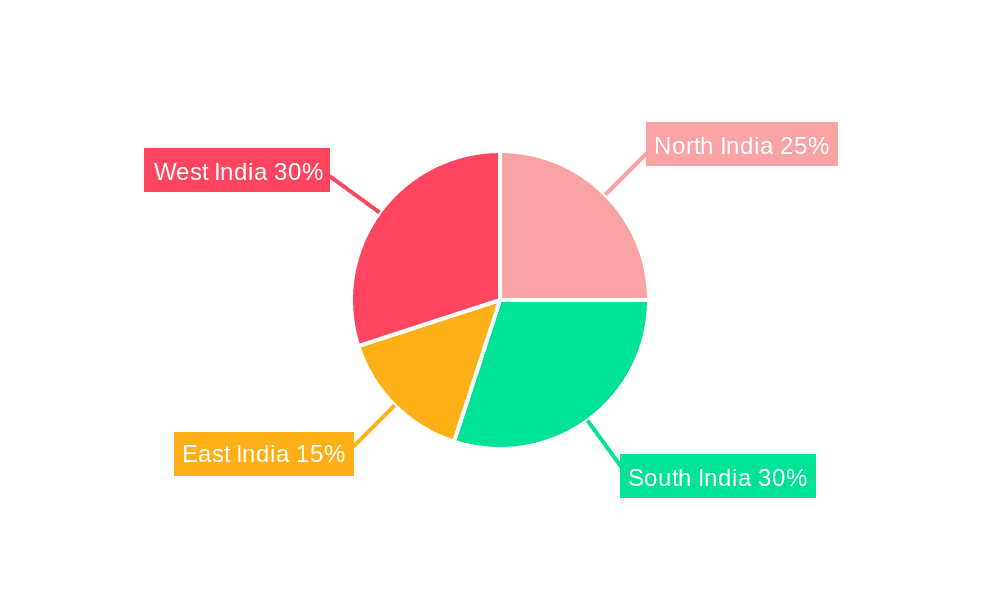

Geographically, Maharashtra, Gujarat, and Tamil Nadu are leading market contributors, owing to their established industrial infrastructure and high concentration of end-user industries. While raw material price fluctuations and environmental regulations present challenges, the market's trajectory remains strongly positive, anticipating sustained growth throughout the forecast period.

India Prussian Blue Industry Company Market Share

The competitive arena features a moderate fragmentation of key players such as Colour India, Sona Synthetics Products, and Anupam Colours & Chemicals Industries, among others. Strategic initiatives revolve around product innovation, application diversification, quality enhancement, and the adoption of sustainable manufacturing processes to meet evolving market needs. Significant untapped potential exists in underpenetrated regions of central and eastern India, poised for accelerated demand driven by ongoing infrastructure development and industrial expansion. Future market dynamics will be influenced by supportive government policies for domestic manufacturing, advancements in pigment production technology, and strategic industry collaborations, presenting a compelling investment opportunity within India's dynamic chemical sector.

India Prussian Blue Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the India Prussian Blue industry, offering actionable insights for industry professionals, investors, and strategic planners. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to provide a granular understanding of market dynamics, growth drivers, and emerging trends. The total market size in 2025 is estimated at xx Million USD.

India Prussian Blue Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Indian Prussian Blue industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. We delve into the market share held by key players such as Colour India, Sona Synthetics Products, Anupam Colours & Chemicals Industries, Bhavana Industries, Gaurav Chemicals, PD Chemicals, Pushp Colours, Dycon Chemicals, and Kunder Chemicals Pvt Ltd. While the market is somewhat fragmented, Colour India and Sona Synthetics Products appear to hold significant market share, with estimates placing them at approximately xx% and xx% respectively in 2025. The report further investigates the impact of M&A activities, with an estimated xx Million USD in deal values during the historical period (2019-2024). Innovation drivers include the development of eco-friendly Prussian blue pigments and advancements in pigment dispersion technologies. The regulatory framework, including environmental regulations and safety standards, significantly influences industry practices and innovation. Product substitution remains a minor threat currently, with limited alternatives available for the specific applications of Prussian Blue. End-user demographics are analyzed across various sectors, allowing for a precise understanding of consumption patterns and future demands.

India Prussian Blue Industry Market Dynamics & Trends

This section provides a deep dive into the market dynamics of the India Prussian Blue industry, analyzing factors contributing to market growth, technological disruptions, and competitive dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as increasing demand from the paint and ink industries, expansion of the healthcare sector, and the growing use of Prussian blue in other applications. Technological disruptions, such as the development of advanced pigment manufacturing techniques, are expected to improve efficiency and reduce production costs. Consumer preferences are shifting towards sustainable and environmentally friendly products, influencing demand for eco-friendly Prussian blue options. The competitive landscape is characterized by both established players and emerging entrants, leading to intense competition, with a market penetration rate of approximately xx% in key segments by 2025.

Dominant Regions & Segments in India Prussian Blue Industry

The report identifies Maharashtra, Gujarat, and Tamil Nadu as the dominant regions in the Indian Prussian Blue market in 2025. This dominance stems from several factors:

- Maharashtra: Strong industrial base, established infrastructure, and proximity to key raw material sources.

- Gujarat: Established chemical industry hub, strong government support for industrial growth.

- Tamil Nadu: Growing automotive and manufacturing sectors, increasing demand for pigments.

The Paint segment represents the largest application area for Prussian blue, followed by Ink and then Medicine. Other applications contribute to the overall market but hold comparatively smaller shares. Detailed analysis highlights the economic policies, infrastructure development, and consumer demand within these regions and application segments.

India Prussian Blue Industry Product Innovations

Recent product innovations focus on enhancing the performance characteristics of Prussian blue pigments, including improved color strength, lightfastness, and weather resistance. These improvements address key market needs and provide competitive advantages, particularly in high-performance applications. The trend is towards the development of sustainable and environmentally friendly Prussian blue products that meet stricter regulatory standards and cater to the growing demand for eco-conscious solutions. This aligns with a global trend towards more sustainable pigment production and use.

Report Scope & Segmentation Analysis

This report segments the India Prussian Blue market by application (Paint, Ink, Medicine, Other Applications) and by state (Maharashtra, Gujarat, Andhra Pradesh, Tamil Nadu, Karnataka, Telangana, Uttar Pradesh, West Bengal, Haryana, Madhya Pradesh, Rest of India). Each segment's growth projections, market sizes, and competitive dynamics are analyzed separately. For instance, the Paint segment is projected to show a faster growth rate than the Ink segment over the forecast period due to higher demand from construction and automotive industries. Regional differences in growth are attributed to varied industrial development, infrastructure, and economic activity.

Key Drivers of India Prussian Blue Industry Growth

The growth of the India Prussian Blue industry is driven by several factors including:

- Growing demand from downstream industries: The paint, ink, and pharmaceutical industries are key drivers.

- Government initiatives: Support for industrial development and infrastructure improvements.

- Technological advancements: Improved manufacturing processes and product innovations.

- Rising disposable incomes: Increased consumer spending on paints and other related products.

Challenges in the India Prussian Blue Industry Sector

The India Prussian Blue industry faces several challenges, including:

- Fluctuations in raw material prices: This impacts profitability and competitiveness.

- Stringent environmental regulations: Compliance can increase production costs.

- Intense competition: The presence of numerous players creates a competitive environment.

- Supply chain disruptions: Global events can impact the availability of raw materials.

These factors contribute to the overall complexity of operating within this industry.

Emerging Opportunities in India Prussian Blue Industry

Emerging opportunities include:

- Expanding into new application areas: Exploring new uses of Prussian blue in other industries.

- Developing high-performance pigments: Catering to the demand for advanced pigment properties.

- Adopting sustainable manufacturing practices: Meeting the growing demand for eco-friendly products.

- Leveraging technological advancements: Improving efficiency and reducing production costs.

These opportunities present significant potential for growth in the coming years.

Leading Players in the India Prussian Blue Industry Market

- Colour India

- Sona Synthetics Products

- Anupam Colours & Chemicals Industries

- Bhavana Industries

- Gaurav Chemicals

- PD Chemicals

- Pushp Colours

- Dycon Chemicals

- Kunder Chemicals Pvt Ltd

Key Developments in India Prussian Blue Industry Industry

- 2022-Q3: Colour India launched a new range of eco-friendly Prussian blue pigments.

- 2021-Q4: A significant merger occurred between two smaller Prussian blue producers, creating a larger player. (Specific details are confidential and are in the full report.)

- 2020-Q1: New environmental regulations came into effect, influencing industry practices.

Future Outlook for India Prussian Blue Industry Market

The future of the India Prussian Blue industry looks promising, driven by sustained growth in downstream sectors, technological advancements, and rising consumer demand. Strategic opportunities exist for companies to expand their product offerings, improve manufacturing efficiency, and explore new market segments. The focus on sustainability and environmental responsibility will continue to shape the industry's trajectory. We expect continued moderate growth through 2033, fueled by the factors outlined above.

India Prussian Blue Industry Segmentation

-

1. Application

- 1.1. Paint

- 1.2. Ink

- 1.3. Medicine

- 1.4. Other Applications

-

2. State

- 2.1. Maharashtra

- 2.2. Gujarat

- 2.3. Andhra Pradesh

- 2.4. Tamil Nadu

- 2.5. Karnataka

- 2.6. Telangana

- 2.7. Uttar Pradesh

- 2.8. West Bengal

- 2.9. Haryana

- 2.10. Madhya Pradesh

- 2.11. Rest of India

India Prussian Blue Industry Segmentation By Geography

- 1. India

India Prussian Blue Industry Regional Market Share

Geographic Coverage of India Prussian Blue Industry

India Prussian Blue Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Decorative Paints from the Construction Sector; Product's Cheap and Non-toxic Nature

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Outbreak; Other Restraunts

- 3.4. Market Trends

- 3.4.1. Paints Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Prussian Blue Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Paint

- 5.1.2. Ink

- 5.1.3. Medicine

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by State

- 5.2.1. Maharashtra

- 5.2.2. Gujarat

- 5.2.3. Andhra Pradesh

- 5.2.4. Tamil Nadu

- 5.2.5. Karnataka

- 5.2.6. Telangana

- 5.2.7. Uttar Pradesh

- 5.2.8. West Bengal

- 5.2.9. Haryana

- 5.2.10. Madhya Pradesh

- 5.2.11. Rest of India

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Colour India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sona Synthetics Products*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anupam Colours & Chemicals Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bhavana Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gaurav Chemicals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PD Chemicals

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pushp Colours

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dycon Chemicals

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kunder Chemicals Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Colour India

List of Figures

- Figure 1: India Prussian Blue Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Prussian Blue Industry Share (%) by Company 2025

List of Tables

- Table 1: India Prussian Blue Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: India Prussian Blue Industry Revenue billion Forecast, by State 2020 & 2033

- Table 3: India Prussian Blue Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Prussian Blue Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: India Prussian Blue Industry Revenue billion Forecast, by State 2020 & 2033

- Table 6: India Prussian Blue Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Prussian Blue Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the India Prussian Blue Industry?

Key companies in the market include Colour India, Sona Synthetics Products*List Not Exhaustive, Anupam Colours & Chemicals Industries, Bhavana Industries, Gaurav Chemicals, PD Chemicals, Pushp Colours, Dycon Chemicals, Kunder Chemicals Pvt Ltd.

3. What are the main segments of the India Prussian Blue Industry?

The market segments include Application, State.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.53 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Decorative Paints from the Construction Sector; Product's Cheap and Non-toxic Nature.

6. What are the notable trends driving market growth?

Paints Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Outbreak; Other Restraunts.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Prussian Blue Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Prussian Blue Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Prussian Blue Industry?

To stay informed about further developments, trends, and reports in the India Prussian Blue Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence