Key Insights

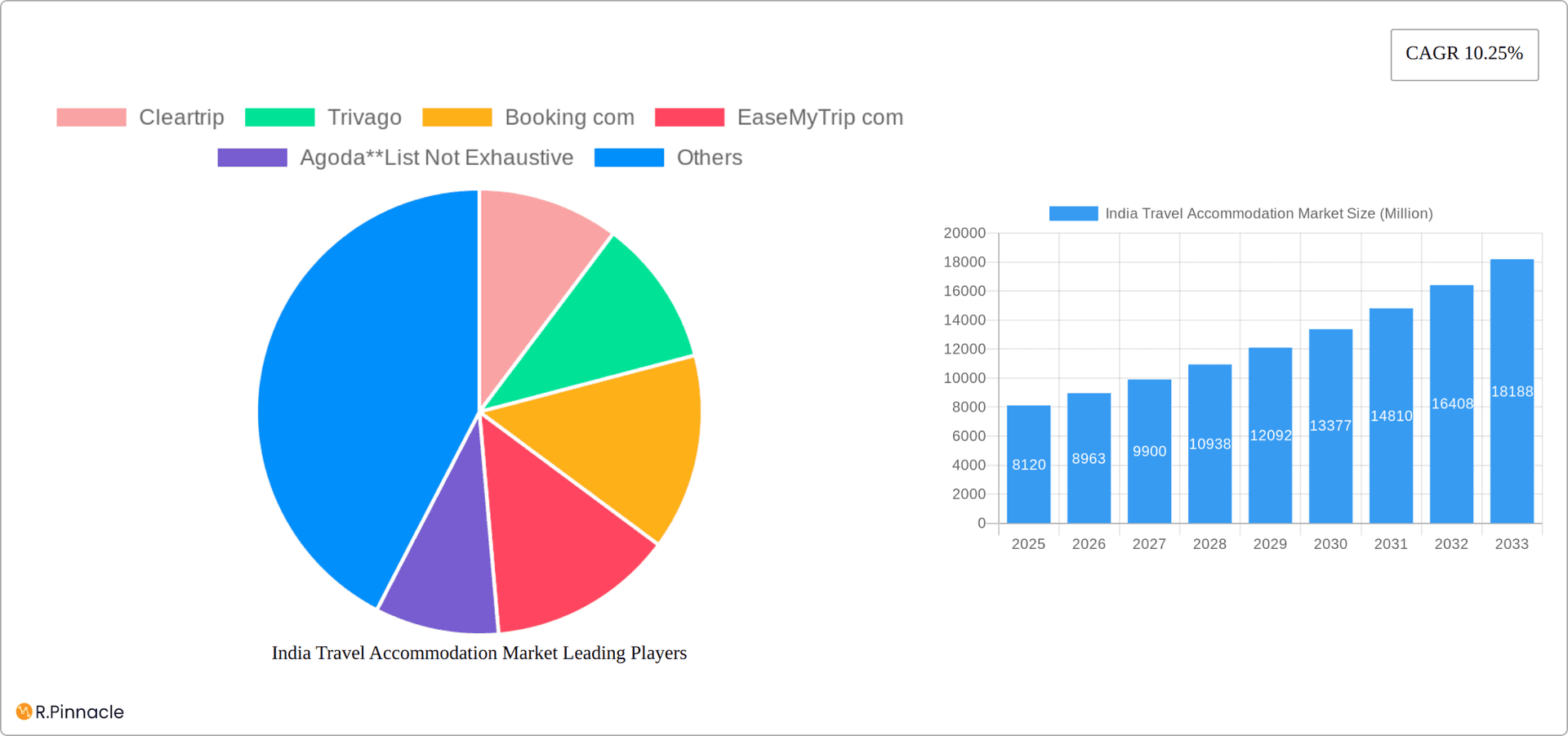

The India travel accommodation market, valued at approximately $8.12 billion in 2025, is projected to experience robust growth, driven by a burgeoning middle class with increasing disposable incomes, a rise in domestic tourism, and the expanding popularity of online travel booking platforms. The compound annual growth rate (CAGR) of 10.25% from 2025 to 2033 indicates significant market expansion. Key drivers include improved infrastructure, government initiatives promoting tourism, and the growing preference for convenient and cost-effective online booking options. The market is segmented by platform (mobile applications and websites) and booking mode (third-party online portals and direct/captive portals), with mobile applications experiencing faster growth due to increased smartphone penetration. Competition is fierce, with major players like MakeMyTrip, Goibibo, Booking.com, Cleartrip, and OYO Rooms vying for market share. Regional variations exist, with North and South India potentially exhibiting higher growth due to established tourism infrastructure and popular destinations. Challenges include seasonality, infrastructure gaps in certain regions, and the need to address concerns around safety and security for travelers. The market's future growth hinges on sustained economic growth, infrastructure development, and the continued adoption of online travel booking platforms. The expanding range of accommodation options, from budget-friendly hostels to luxury hotels, caters to diverse traveler preferences, contributing to the market's overall dynamism.

India Travel Accommodation Market Market Size (In Billion)

The forecast period (2025-2033) presents substantial opportunities for businesses in the travel accommodation sector. Strategic investments in technology, marketing, and customer service will be crucial for success. Furthermore, adapting to evolving consumer preferences and focusing on personalized travel experiences will play a significant role in shaping future market trends. The continuous development of innovative booking platforms and the adoption of sustainable tourism practices will also shape the future of this rapidly expanding market. Players that effectively address the challenges and capitalize on the opportunities will likely experience significant growth within the Indian travel accommodation landscape.

India Travel Accommodation Market Company Market Share

India Travel Accommodation Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India travel accommodation market, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The report leverages extensive data analysis to predict a market size of XX Million by 2033, offering a critical understanding of this rapidly evolving sector.

India Travel Accommodation Market Market Structure & Innovation Trends

The Indian travel accommodation market exhibits a dynamic interplay of established players and emerging startups. Market concentration is moderate, with key players such as MakeMyTrip, Goibibo, and OYO Rooms holding significant market share, though the exact figures fluctuate yearly. However, the market is characterized by intense competition, driven by continuous innovation in technology and service offerings. The regulatory framework, while evolving, generally supports the growth of the sector. Substitutes, such as homestays and budget guesthouses, exert pressure on the pricing strategy of established players. The end-user demographic is broad, encompassing both domestic and international tourists, with varying preferences based on age, income, and travel style. M&A activity has been significant in recent years, with deal values ranging from XX Million to XX Million, primarily focused on consolidation and expansion into new market segments. Examples include the recent Microsoft partnership with MakeMyTrip, highlighting the growing importance of technological integration.

- Market Concentration: Moderate, with top players holding significant, but not dominant, market share.

- Innovation Drivers: Technological advancements, evolving consumer preferences, and competitive pressure.

- Regulatory Framework: Supportive, with ongoing developments shaping the industry landscape.

- Product Substitutes: Homestays, budget guesthouses, and peer-to-peer accommodation platforms.

- End-User Demographics: Diverse, encompassing domestic and international travelers with varying needs.

- M&A Activities: Significant activity observed, focused on consolidation and expansion.

India Travel Accommodation Market Market Dynamics & Trends

The Indian travel accommodation market is experiencing robust growth, fueled by a burgeoning middle class, rising disposable incomes, and increasing internet and smartphone penetration. Technological disruptions, particularly the rise of mobile booking platforms and AI-powered travel assistants, are reshaping the consumer experience. Consumer preferences are shifting towards personalized experiences, value-for-money offerings, and seamless booking processes. Competitive dynamics are intense, with companies vying for market share through aggressive marketing campaigns, strategic partnerships, and innovative service offerings. The market is expected to register a CAGR of XX% during the forecast period (2025-2033), with market penetration steadily increasing across various segments.

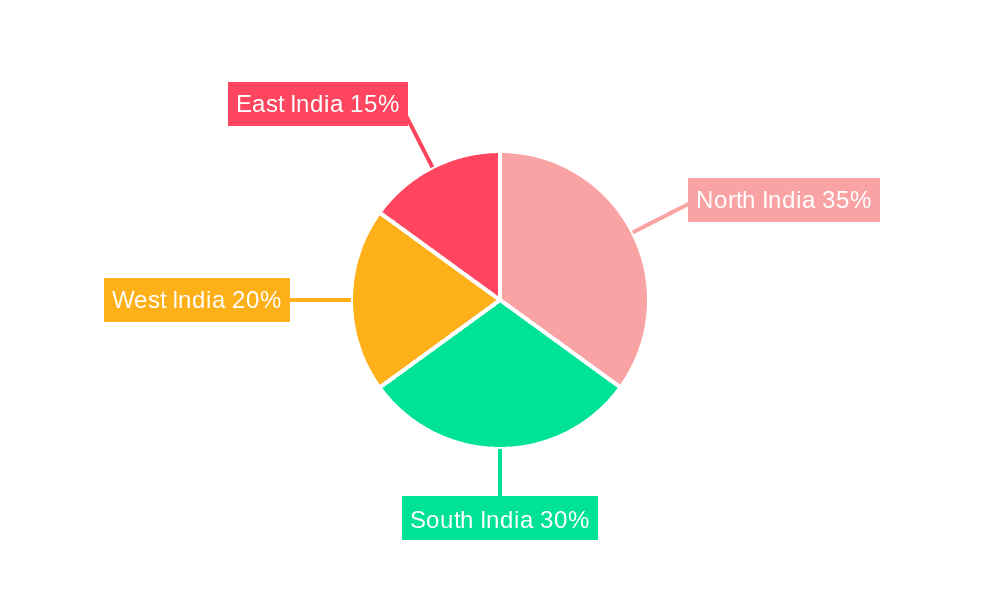

Dominant Regions & Segments in India Travel Accommodation Market

The Indian travel accommodation market demonstrates strong regional variations, with metropolitan areas like Mumbai, Delhi, Bengaluru, and Chennai exhibiting the highest demand. Key drivers in these regions include robust economic activity, well-developed infrastructure, and a large concentration of both business and leisure travelers.

- By Platform:

- Mobile Application: Dominates the market due to widespread smartphone usage and ease of access. Key drivers include user-friendly interfaces and personalized recommendations.

- Website: Maintains a significant presence, particularly among users who prefer detailed information and comprehensive search functionalities.

- By Mode of Booking:

- Third-Party Online Portals: This segment holds the largest market share due to the extensive reach and competitive pricing offered by major platforms. Key drivers include a wide selection of properties, user reviews, and secure payment gateways.

- Direct/Captive Portals: This segment is growing as hotels and chains strive for direct bookings, reducing commission fees and strengthening customer relationships.

India Travel Accommodation Market Product Innovations

The Indian travel accommodation market is witnessing a rapid evolution of product offerings, driven by both technological advancements and the ever-changing needs of the modern traveler. AI-powered recommendation engines, capable of curating personalized travel itineraries based on individual preferences, are becoming increasingly prevalent. The rise of voice-assisted booking, particularly in regional Indian languages, is lowering the barrier to entry for a wider range of users. Furthermore, the integration of robust loyalty programs and seamless payment gateways enhance customer experience and drive repeat bookings. These innovations are not merely incremental improvements; they are strategically shaping the competitive landscape, providing significant competitive advantages for companies that embrace them effectively. The focus is on creating a more efficient, personalized, and enjoyable booking process from initial search to final checkout.

Report Scope & Segmentation Analysis

This comprehensive report segments the India travel accommodation market along key parameters to provide a granular understanding of market dynamics. The primary segmentation focuses on platform (mobile application and website) and booking mode (third-party online travel agents (OTAs) and direct/captive portals). Each segment is meticulously analyzed based on its growth projections, current market size, future potential, and the competitive forces at play. Detailed market sizing is provided for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering a clear trajectory of market evolution.

- By Platform: Mobile applications are poised for accelerated growth compared to websites, driven by the widespread adoption of smartphones and the increasing preference for mobile-first experiences.

- By Mode of Booking: Third-party online travel agents (OTAs) are expected to maintain a substantial market share due to their established brand recognition and comprehensive service offerings. However, direct booking portals are projected to experience robust growth fueled by the implementation of effective hotel loyalty programs and targeted direct engagement strategies.

Key Drivers of India Travel Accommodation Market Growth

Several factors contribute to the robust growth of the Indian travel accommodation market. These include the rapid expansion of the middle class, increasing disposable incomes fueling leisure travel, and the escalating popularity of domestic tourism. Technological advancements, such as mobile booking platforms and AI-powered travel services, also play a significant role. Moreover, government initiatives promoting tourism and infrastructure development have further spurred market expansion.

Challenges in the India Travel Accommodation Market Sector

Despite the positive outlook, the sector faces several challenges. These include infrastructure limitations in some regions, which can hinder accessibility and impact the overall tourist experience. The fluctuating currency exchange rates can also affect pricing and international tourism. Intense competition among various platforms necessitates robust marketing and technological investments to maintain market competitiveness.

Emerging Opportunities in India Travel Accommodation Market

The Indian travel accommodation market presents a wealth of compelling opportunities for growth and innovation. The escalating popularity of sustainable tourism and experiential travel is creating a demand for eco-friendly accommodations and curated travel packages that cater to specific interests and preferences. The burgeoning rural tourism sector presents significant opportunities to develop accommodations and related services in less explored regions, contributing to both economic development and the diversification of the travel landscape. Further technological innovations, such as immersive experiences through virtual reality (VR) and augmented reality (AR), hold the potential to significantly enhance the customer experience and attract new market segments seeking unique and engaging travel options.

Leading Players in the India Travel Accommodation Market Market

- Cleartrip

- Trivago

- Booking.com

- EaseMyTrip.com

- Agoda

- OYO Rooms

- IRCTC

- Goibibo

- MakeMyTrip.com

Key Developments in India Travel Accommodation Market Industry

- February 2024: EaseMyTrip expanded its market reach by launching its 10th offline retail outlet, strategically supplementing its robust online presence.

- February 2024: EaseMyTrip forged a strategic partnership with Zaggle to integrate travel booking seamlessly with expense management services, creating a convenient and unified user experience.

- May 2023: MakeMyTrip collaborated with Microsoft to introduce voice-assisted booking capabilities in multiple Indian languages, broadening accessibility and enhancing convenience for a wider user base.

Future Outlook for India Travel Accommodation Market Market

The Indian travel accommodation market is poised for sustained growth, driven by a confluence of factors including rising disposable incomes, increased domestic and international tourism, and ongoing technological advancements. The market is expected to witness increasing consolidation, with larger players acquiring smaller companies to expand their market share and service offerings. Further innovation in personalization and technology will continue to shape the customer experience, attracting both domestic and international travelers.

India Travel Accommodation Market Segmentation

-

1. Platform

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive Portals

India Travel Accommodation Market Segmentation By Geography

- 1. India

India Travel Accommodation Market Regional Market Share

Geographic Coverage of India Travel Accommodation Market

India Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels

- 3.2.2 Resorts

- 3.2.3 and Airbnb Options for Consumers Driving the Market's Growth

- 3.3. Market Restrains

- 3.3.1. Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Growth of Digital Payments Is Boosting the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive Portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cleartrip

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trivago

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Booking com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EaseMyTrip com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agoda**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OYO Rooms

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IRCTC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goibibo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MakeMyTrip com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cleartrip

List of Figures

- Figure 1: India Travel Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Travel Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: India Travel Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Travel Accommodation Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: India Travel Accommodation Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 6: India Travel Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Travel Accommodation Market?

The projected CAGR is approximately 10.25%.

2. Which companies are prominent players in the India Travel Accommodation Market?

Key companies in the market include Cleartrip, Trivago, Booking com, EaseMyTrip com, Agoda**List Not Exhaustive, OYO Rooms, IRCTC, Goibibo, MakeMyTrip com.

3. What are the main segments of the India Travel Accommodation Market?

The market segments include Platform, Mode of Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Travel Bloggers Is Promoting Tourism Driving the Market's Growth; Rising Number of Hotels. Resorts. and Airbnb Options for Consumers Driving the Market's Growth.

6. What are the notable trends driving market growth?

Rising Growth of Digital Payments Is Boosting the Growth of the Market.

7. Are there any restraints impacting market growth?

Difficulty in Handling Customer Queries and Cancellation Policies; High Convenience Fees Impacting the Market's Growth.

8. Can you provide examples of recent developments in the market?

February 2024: India’s biggest online travel tech platform, EaseMyTrip, opened its first offline retail outlet in the state of Madhya Pradesh, Indore. This is the 10th offline store launched under the brand's franchise model, which is a testament to its commitment to efficiently serving its customers online and offline. The new offline store is aimed at reaching out to its offline customers who are looking for a personalized meet-and-greet experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the India Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence