Key Insights

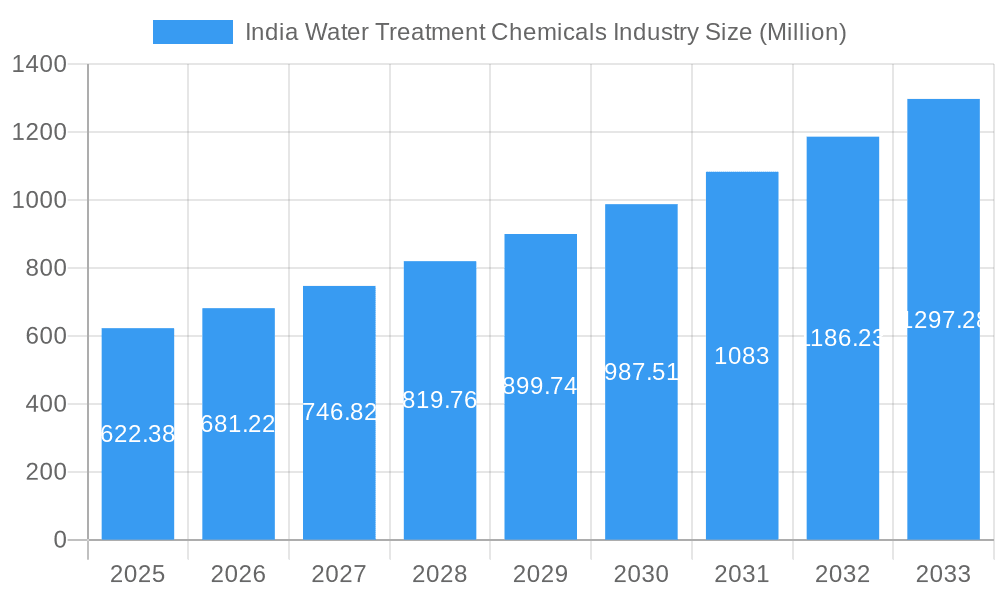

The India water treatment chemicals market is experiencing robust growth, projected to reach \$622.38 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 9.00% from 2025 to 2033. This expansion is driven by several key factors. Increasing industrialization and urbanization are leading to higher water consumption and stricter environmental regulations, necessitating advanced water treatment solutions. The rising prevalence of waterborne diseases is also fueling demand for effective disinfection and purification technologies. Furthermore, government initiatives promoting water conservation and infrastructure development are creating a favorable environment for market growth. Key players like Dow, Ecolab (Nalco), and Solvay are actively investing in research and development, introducing innovative products catering to specific water treatment needs across various sectors, including municipal, industrial, and commercial applications.

India Water Treatment Chemicals Industry Market Size (In Million)

The market segmentation is likely diversified, encompassing various chemical types (coagulants, flocculants, disinfectants, etc.) and application areas (municipal water treatment, industrial wastewater treatment, swimming pool treatment, etc.). While precise segment-wise data is unavailable, we can infer a significant contribution from industrial wastewater treatment due to the increasing industrial activity. The competitive landscape is characterized by a mix of multinational corporations and domestic players. The presence of established international companies alongside emerging Indian players indicates a healthy mix of innovation and localized expertise, further contributing to the market's dynamism. Future growth will likely be influenced by technological advancements in water treatment, evolving regulatory frameworks, and increasing consumer awareness regarding water quality.

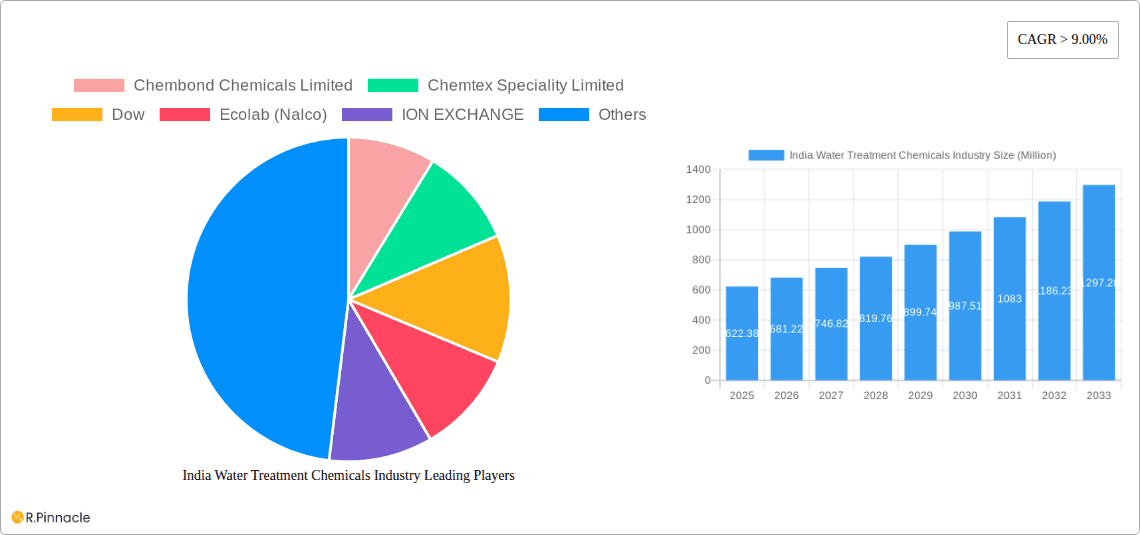

India Water Treatment Chemicals Industry Company Market Share

India Water Treatment Chemicals Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Water Treatment Chemicals industry, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future potential. The report projects a xx Million market size by 2033, showcasing significant growth opportunities.

India Water Treatment Chemicals Industry Market Structure & Innovation Trends

The Indian water treatment chemicals market is characterized by a mix of large multinational corporations and domestic players. Market concentration is moderate, with the top five players holding an estimated xx% market share in 2025. Key players include Chembond Chemicals Limited, Chemtex Speciality Limited, Dow, Ecolab (Nalco), ION EXCHANGE, Lonza, Nouryon, SicagenChem, SNF, Solenis, Solvay, Thermax Limited, and VASU CHEMICALS LLP. The list is not exhaustive.

Innovation is driven by increasing demand for sustainable and efficient water treatment solutions, stringent environmental regulations, and the growing adoption of advanced technologies like AI and membrane filtration. Regulatory frameworks, including those from the Central Pollution Control Board (CPCB), significantly influence product development and market access. The industry also witnesses substitution with newer, more environmentally friendly chemicals. M&A activities, such as Thermax's acquisition of a stake in TSA Process Equipments (see Key Developments), are reshaping the competitive landscape. In 2024, the total value of M&A deals in the sector was estimated at xx Million. End-user demographics are diverse, encompassing industrial, municipal, and agricultural sectors.

India Water Treatment Chemicals Industry Market Dynamics & Trends

The Indian water treatment chemicals market is experiencing robust growth, driven by factors such as increasing industrialization, urbanization, rising water scarcity, and stricter environmental regulations. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of AI and IoT in water treatment plants, are enhancing efficiency and reducing operational costs. Consumer preferences are shifting towards sustainable and eco-friendly solutions, driving demand for bio-based and less-toxic chemicals. The competitive landscape is dynamic, with both domestic and international players vying for market share. Market penetration of advanced water treatment technologies is steadily increasing, with a notable rise in the adoption of membrane filtration systems in various sectors.

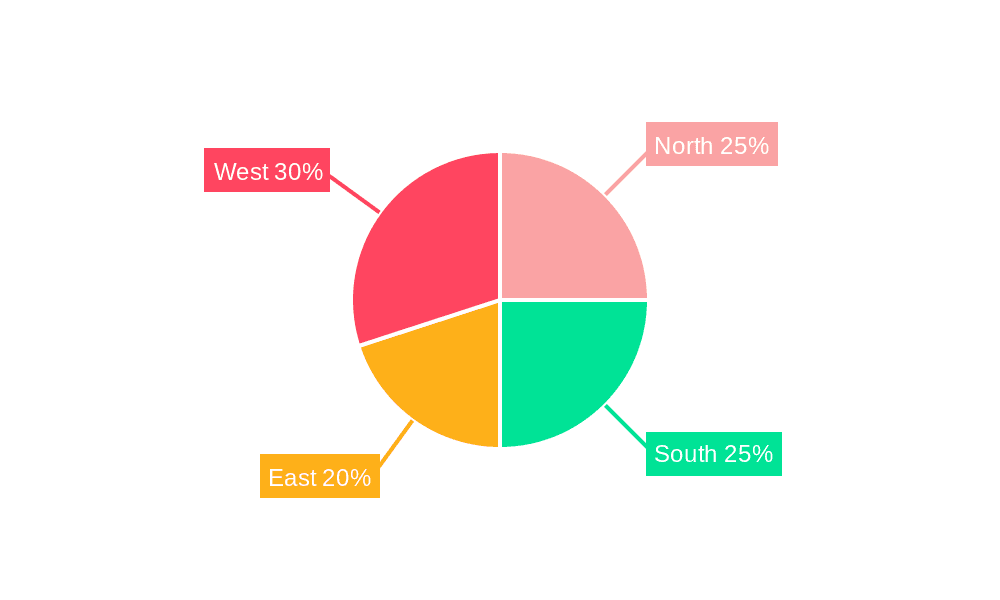

Dominant Regions & Segments in India Water Treatment Chemicals Industry

The western and southern regions of India dominate the water treatment chemicals market due to higher industrial activity and a greater focus on water infrastructure development. Maharashtra, Gujarat, Tamil Nadu, and Karnataka are key contributors.

- Key Drivers for Dominant Regions:

- Robust industrial growth, particularly in manufacturing and pharmaceuticals.

- Higher investments in water infrastructure projects.

- Stringent environmental regulations promoting advanced treatment technologies.

- Growing awareness of water conservation and management.

The industrial segment holds the largest share of the market, driven by the increasing demand for high-purity water in various industries like power generation, pharmaceuticals, and food & beverages. The municipal segment is also experiencing significant growth, propelled by government initiatives focused on improving water supply and sanitation infrastructure.

India Water Treatment Chemicals Industry Product Innovations

Recent product innovations focus on developing environmentally friendly, high-efficiency water treatment chemicals. This includes bio-based coagulants, advanced oxidation processes, and membrane cleaning agents. These innovations are tailored to meet the specific needs of various applications and offer cost-effectiveness and sustainability advantages. Technological advancements in nanotechnology and biotechnology are paving the way for new chemical formulations with improved performance and reduced environmental impact.

Report Scope & Segmentation Analysis

The report segments the market based on product type (coagulants, flocculants, disinfectants, etc.), application (municipal, industrial, agricultural), and region. Growth projections vary across segments, with the industrial segment showing the fastest growth. Market sizes are provided for each segment, highlighting the dominant players and their competitive strategies. The competitive dynamics vary significantly across each segment, with some dominated by established multinational companies and others characterized by local manufacturers.

Key Drivers of India Water Treatment Chemicals Industry Growth

The growth of the Indian water treatment chemicals industry is driven by several factors, including rapid urbanization and industrialization leading to increased water demand. Government initiatives promoting water conservation and sanitation infrastructure development further propel the market. Stringent environmental regulations mandating the use of advanced water treatment technologies are also significant growth catalysts. Finally, the rising awareness of waterborne diseases and the need for safe drinking water fuel demand for effective water treatment solutions.

Challenges in the India Water Treatment Chemicals Industry Sector

The industry faces challenges including fluctuations in raw material prices and supply chain disruptions. Regulatory compliance requirements can be complex and demanding, particularly for smaller companies. Competition from both domestic and international players also poses a significant challenge. The overall impact of these factors translates into fluctuating profit margins and investment uncertainty for many companies in the sector.

Emerging Opportunities in India Water Treatment Chemicals Industry

Significant opportunities exist in the development and adoption of sustainable and eco-friendly water treatment technologies. The growing demand for high-purity water in emerging industries, such as pharmaceuticals and electronics, creates lucrative prospects. Government initiatives focused on water conservation and rural sanitation present significant untapped market potential.

Leading Players in the India Water Treatment Chemicals Industry Market

- Chembond Chemicals Limited

- Chemtex Speciality Limited

- Dow

- Ecolab (Nalco)

- ION EXCHANGE

- Lonza

- Nouryon

- SicagenChem

- SNF

- Solenis

- Solvay

- Thermax Limited

- VASU CHEMICALS LLP *List Not Exhaustive

Key Developments in India Water Treatment Chemicals Industry Industry

- February 2024: Thermax Group acquires a 51% stake in TSA Process Equipments, expanding its high-purity water treatment solutions portfolio.

- October 2023: WABAG Group partners with Pani Energy Inc. to leverage AI for optimizing water treatment plants, improving efficiency and reducing costs.

- September 2022: Toray Industries Inc. establishes a research center in Chennai, boosting R&D in water treatment membrane technology.

Future Outlook for India Water Treatment Chemicals Industry Market

The Indian water treatment chemicals market is poised for sustained growth, driven by long-term trends in urbanization, industrialization, and the increasing focus on water security. Strategic opportunities abound for companies that can innovate, adapt to changing regulations, and offer sustainable and cost-effective solutions. The market's future is bright, with significant potential for expansion and diversification.

India Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides and Disinfectants

- 1.2. Coagulants and Flocculants

- 1.3. Corrosion and Scale Inhibitors

- 1.4. Defoamers and Defoaming Agents

- 1.5. pH Adjuster and Softener

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Oil and Gas

- 2.3. Chemical Manufacturing (including Petrochemicals)

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Pulp and Paper

- 2.7. Other End-user Industries

India Water Treatment Chemicals Industry Segmentation By Geography

- 1. India

India Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of India Water Treatment Chemicals Industry

India Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Corrosion and Scale Inhibitors Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides and Disinfectants

- 5.1.2. Coagulants and Flocculants

- 5.1.3. Corrosion and Scale Inhibitors

- 5.1.4. Defoamers and Defoaming Agents

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufacturing (including Petrochemicals)

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Pulp and Paper

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chembond Chemicals Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemtex Speciality Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecolab (Nalco)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ION EXCHANGE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lonza

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nouryon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SicagenChem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SNF

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Solenis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Solvay

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Thermax Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VASU CHEMICALS LLP*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Chembond Chemicals Limited

List of Figures

- Figure 1: India Water Treatment Chemicals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: India Water Treatment Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Water Treatment Chemicals Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: India Water Treatment Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Water Treatment Chemicals Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Water Treatment Chemicals Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the India Water Treatment Chemicals Industry?

Key companies in the market include Chembond Chemicals Limited, Chemtex Speciality Limited, Dow, Ecolab (Nalco), ION EXCHANGE, Lonza, Nouryon, SicagenChem, SNF, Solenis, Solvay, Thermax Limited, VASU CHEMICALS LLP*List Not Exhaustive.

3. What are the main segments of the India Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 622.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Corrosion and Scale Inhibitors Segment.

7. Are there any restraints impacting market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

8. Can you provide examples of recent developments in the market?

February 2024: Thermax Group signs an agreement to acquire a 51% stake in TSA Process Equipments to offer a one-stop solution for high-purity water requirements of its customers in sectors such as pharma, biopharma, personal care, and food and beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the India Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence