Key Insights

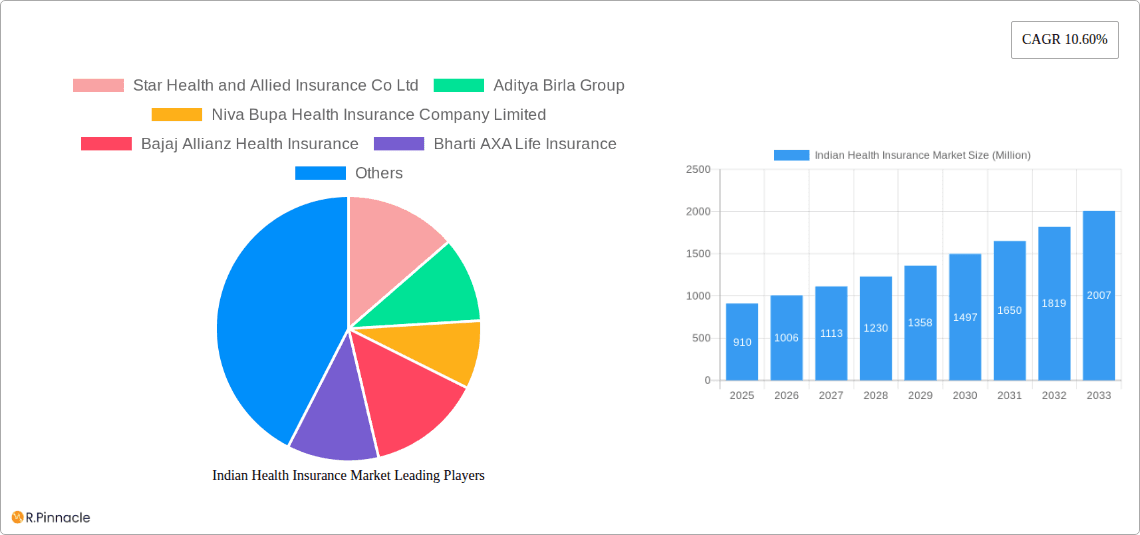

The Indian Health Insurance Market is poised for substantial growth, driven by increasing health awareness, rising healthcare costs, and supportive government initiatives. With a current market size of approximately 910 Million USD in 2025, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of 10.60% over the forecast period of 2025-2033. This remarkable expansion is fueled by a growing demand for comprehensive health coverage among individuals and families, particularly in the wake of recent health crises. The rising prevalence of lifestyle diseases and an aging population further underscore the critical need for robust health insurance solutions. Government schemes promoting financial inclusion and health security are also playing a pivotal role in expanding the market's reach across diverse demographics.

Indian Health Insurance Market Market Size (In Million)

The market's dynamism is further illustrated by its segmentation. Public and private sector insurers, alongside standalone health insurance companies, are actively competing to capture market share. A significant trend is the growing preference for individual and family floater policies, indicating a shift towards personalized and comprehensive protection. The increasing adoption of digital platforms and bancassurance channels for distribution is revolutionizing accessibility, making health insurance more convenient for consumers. While growth is robust, potential restraints such as limited awareness in rural areas and affordability concerns for certain segments present challenges that stakeholders are actively addressing through product innovation and targeted outreach. Nonetheless, the overarching trajectory points towards a thriving and increasingly indispensable health insurance landscape in India.

Indian Health Insurance Market Company Market Share

Indian Health Insurance Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

Gain unparalleled insights into the rapidly evolving Indian health insurance market with this in-depth, SEO-optimized report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis is essential for industry professionals, insurers, policymakers, and investors seeking to understand market dynamics, growth drivers, and emerging opportunities. Leverage high-ranking keywords such as "Indian health insurance," "health insurance India," "medical insurance market," "health insurance companies India," and "health insurance trends" to boost your search visibility. This report provides actionable insights and strategic recommendations, offering a deep dive into market structure, competitive landscape, product innovations, and regional dominance.

Indian Health Insurance Market Market Structure & Innovation Trends

The Indian health insurance market is characterized by a dynamic interplay of public and private sector players, with a growing number of standalone health insurance companies contributing to market innovation. Market concentration is influenced by regulatory frameworks, with IRDAI setting stringent guidelines for product development and claims settlement. The competitive landscape features established players alongside agile newcomers, constantly pushing the boundaries of product offerings and service delivery. Key innovation drivers include the increasing demand for comprehensive coverage, the rise of digital health platforms, and a focus on preventative healthcare. Product substitutes, such as out-of-pocket health expenditure and government-sponsored health schemes, also influence market dynamics. End-user demographics, spanning minors to senior citizens, necessitate a diverse range of tailored insurance products. Merger and acquisition (M&A) activities, while currently moderate, are expected to increase as companies seek to consolidate market share and expand their reach. For instance, in August 2022, Abu Dhabi Investment Authority invested Rs 665 crores in Aditya Birla Health Insurance, signaling significant investor confidence.

Indian Health Insurance Market Market Dynamics & Trends

The Indian health insurance market is experiencing robust growth, driven by a confluence of factors including rising healthcare awareness, increasing disposable incomes, and the growing burden of lifestyle-related diseases. The market penetration, currently at approximately 10%, has significant room for expansion, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. Technological disruptions are playing a pivotal role, with the widespread adoption of online platforms, mobile applications, and AI-powered tools revolutionizing customer engagement, policy issuance, and claims processing. Insurers are leveraging data analytics to offer personalized products and underwriting, enhancing customer experience and operational efficiency. Consumer preferences are shifting towards comprehensive coverage options, including critical illness plans, disease-specific policies, and critical illness riders, reflecting a heightened awareness of potential health risks. The competitive dynamics are intensifying, with both public sector insurers and private players vying for market share through innovative product launches, strategic alliances, and aggressive marketing campaigns. The recent strategic alliance between Bajaj Allianz Life Insurance and City Union Bank in July 2022 exemplifies the growing trend of bancassurance partnerships aimed at expanding customer reach. The increasing affordability of health insurance, coupled with government initiatives promoting health insurance, further fuels market growth. The rising medical inflation, estimated at xx% annually, also underscores the critical need for adequate health insurance coverage, acting as a significant market growth driver.

Dominant Regions & Segments in Indian Health Insurance Market

The Indian health insurance market exhibits significant regional and segment-wise dominance. The Western region of India, comprising states like Maharashtra, Gujarat, and Goa, currently leads in terms of health insurance penetration and premium collection. This dominance can be attributed to higher per capita income, greater urbanization, and a more developed healthcare infrastructure in these states.

Key drivers for regional dominance include:

- Economic Policies: Pro-growth economic policies at the state level foster business and financial services growth.

- Infrastructure Development: Robust healthcare infrastructure, including a higher density of hospitals and specialized medical facilities, increases the demand for health insurance.

- Awareness and Literacy: Higher levels of financial literacy and health awareness contribute to increased uptake of insurance products.

Analyzing by Type of Insurance Provider, Private Sector Insurers currently hold a dominant share of the market, driven by their agility in product innovation, customer-centric approaches, and aggressive marketing strategies. Standalone Health Insurance Companies are also carving out a significant niche, focusing exclusively on health insurance products and offering specialized solutions. Public Sector Insurers, while having a long-standing presence, are adapting to the competitive landscape by enhancing their digital offerings and product diversification.

In terms of Type of Customer, Non-Corporate individuals and families constitute the largest segment. The growing middle class and the increasing understanding of health risks are fueling the demand for individual and family floater policies.

Type of Coverage sees Family or Floater (Group) Insurance Coverage gaining significant traction, as it offers cost-effective solutions for entire households. However, Individual Insurance Coverage remains a substantial segment, catering to the specific needs of individuals.

Regarding Product Type, General Insurance policies that include health coverage are widespread. However, there is a discernible rise in demand for Disease-specific Insurance, such as cancer insurance or critical illness plans, reflecting a proactive approach to specific health threats.

By Demographics, Adults form the largest customer base, followed by Senior Citizens, who have a higher propensity to seek health insurance due to age-related health concerns. The market for Minors is also growing, with parents increasingly opting for child health insurance plans.

The Distribution Channel landscape is diverse. Online channels are rapidly growing, offering convenience and transparency. Bancassurance partnerships are also proving highly effective, leveraging the vast branch networks of banks. Individual Agents and Brokers continue to play a crucial role in educating and acquiring customers, especially in Tier 2 and Tier 3 cities.

Indian Health Insurance Market Product Innovations

Product innovations in the Indian health insurance market are increasingly focused on customization, affordability, and digital accessibility. Insurers are developing disease-specific insurance plans catering to prevalent health conditions like diabetes, cardiovascular diseases, and cancer, offering tailored benefits and sum insured options. The integration of tele-health services and wellness programs within insurance policies is a significant trend, encouraging preventative healthcare and incentivizing healthy lifestyles. Competitive advantages are being realized through the use of AI and data analytics for personalized underwriting, dynamic pricing, and faster claims processing. The market is witnessing the emergence of micro-insurance products for lower-income segments and parametric insurance solutions for specific health events. This focus on technology-driven, customer-centric product development is crucial for market penetration and customer retention.

Report Scope & Segmentation Analysis

This report meticulously segments the Indian health insurance market across several key dimensions to provide granular insights. The Type of Insurance Provider is analyzed, encompassing Public Sector Insurers, Private Sector Insurers, and Standalone Health Insurance Companies, each with distinct market shares and growth trajectories. The Type of Customer segment focuses on Non-Corporate individuals and families, highlighting their evolving insurance needs. Type of Coverage is detailed, differentiating between Individual Insurance Coverage and Family or Floater (Group) Insurance Coverage, with projected growth rates for each. The Product Type segmentation includes Disease-specific Insurance and General Insurance, with an emphasis on the rising demand for specialized plans. The Demographics segment covers Minors, Adults, and Senior Citizens, detailing their respective market sizes and growth potential. Finally, Distribution Channel analysis explores the dominance of Online, Bancassurance, Individual Agents, Brokers, Corporate Agents, Direct to Customers, and Other Distribution Channels, projecting their future influence and market penetration.

Key Drivers of Indian Health Insurance Market Growth

The Indian health insurance market's growth is propelled by several interconnected factors. A rapidly expanding middle class with increasing disposable incomes is a primary driver, leading to a greater ability to afford health insurance premiums. Growing awareness regarding health and wellness, amplified by the COVID-19 pandemic, has significantly elevated the perceived importance of health insurance. Furthermore, rising healthcare costs and medical inflation necessitate financial protection against unforeseen medical expenses. Government initiatives, such as the Ayushman Bharat scheme, aimed at providing health insurance coverage to vulnerable populations, are also contributing to market expansion and financial inclusion. Technological advancements, including the proliferation of digital platforms and mobile penetration, are enhancing accessibility, convenience, and affordability, further stimulating demand.

Challenges in the Indian Health Insurance Market Sector

Despite robust growth, the Indian health insurance sector faces several hurdles. Low insurance penetration, particularly in rural areas, remains a significant challenge, stemming from a lack of awareness, affordability issues, and complex product structures. Regulatory complexities and the evolving nature of guidelines can sometimes create operational challenges for insurers. The high cost of medical treatments, coupled with increasing claims, puts pressure on profitability and necessitates careful premium pricing. Intense competition among numerous players can lead to aggressive pricing strategies, potentially impacting margins. Furthermore, issues related to claim settlement processes, including delays and rejections, can erode customer trust and lead to dissatisfaction. The inadequate availability of skilled personnel in the insurance sector also presents a human resource challenge.

Emerging Opportunities in Indian Health Insurance Market

The Indian health insurance market is ripe with emerging opportunities. The underserved rural population presents a vast untapped market, with potential for innovative products and distribution models tailored to their needs. The growing prevalence of non-communicable diseases (NCDs) opens avenues for specialized insurance products and wellness programs that focus on prevention and management. The increasing adoption of InsurTech solutions, such as AI, blockchain, and IoT, offers significant opportunities to enhance operational efficiency, personalize customer experiences, and improve fraud detection. The rise of corporate wellness programs and employee benefit schemes provides a steady revenue stream for group health insurance providers. Furthermore, partnerships with healthcare providers, diagnostic centers, and pharmacies can create integrated healthcare ecosystems, offering value-added services to policyholders.

Leading Players in the Indian Health Insurance Market Market

- Star Health and Allied Insurance Co Ltd

- Aditya Birla Group

- Niva Bupa Health Insurance Company Limited

- Bajaj Allianz Health Insurance

- Bharti AXA Life Insurance

- Religare

- HDFC Ergo

- Oriental Insurance

- ICICI Lombard

- United India Insurance

- Reliance Health Insurance

- New India Assurance

- National Assurance

- Cigna TTK

Key Developments in Indian Health Insurance Market Industry

- August 2022: The boards of Aditya Birla Capital Ltd and its subsidiary Aditya Birla Health Insurance Co. Ltd approved an investment of Rs 665 crores by Abu Dhabi Investment Authority (ADIA) in the health insurer. The funds will be used to fuel the growth of the health insurer.

- July 2022: Bajaj Allianz Life Insurance formed a strategic alliance with City Union Bank, one of India's oldest private sector banks. This collaboration will enable the private life insurer to provide a diverse range of life insurance solutions to the bank's existing and prospective customers across its 727 branches.

Future Outlook for Indian Health Insurance Market Market

The future outlook for the Indian health insurance market is exceptionally bright, projecting continued robust growth and significant transformation. The market is poised to witness an accelerated pace of innovation, driven by technological advancements and evolving consumer demands. The increasing emphasis on preventive healthcare and wellness programs will lead to the development of more holistic insurance solutions. Digitalization will further revolutionize customer engagement, policy management, and claims processing, making insurance more accessible and efficient. Expansion into Tier 2 and Tier 3 cities, coupled with tailored products for rural populations, will be a key growth enabler. Strategic partnerships, consolidations, and the emergence of new InsurTech players will reshape the competitive landscape. The ongoing efforts by the government to improve health infrastructure and promote financial inclusion will further catalyze market expansion, positioning India as a key global player in the health insurance domain. The projected market size is estimated to reach INR xx Million by 2033.

Indian Health Insurance Market Segmentation

-

1. Type of Insurance Provider

- 1.1. Public Sector Insurers

- 1.2. Private Sector Insurers

- 1.3. Standalone Health Insurance Companies

-

2. Type of Customer

- 2.1. Non-Corporate

-

3. Type of Coverage

- 3.1. Individual Insurance Coverage

- 3.2. Family or Floater (Group)Insurance Coverage

-

4. Product Type

- 4.1. Disease- specific Insurance

- 4.2. General Insurance

-

5. Demographics

- 5.1. Minors

- 5.2. Adults

- 5.3. Senior Citizens

-

6. Distribution Channel

- 6.1. Direct to Customers

- 6.2. Brokers

- 6.3. Individual Agents

- 6.4. Corporate Agents

- 6.5. Online

- 6.6. Bancassurance

- 6.7. Other Distribution Channels

Indian Health Insurance Market Segmentation By Geography

- 1. India

Indian Health Insurance Market Regional Market Share

Geographic Coverage of Indian Health Insurance Market

Indian Health Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indian Health Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance Provider

- 5.1.1. Public Sector Insurers

- 5.1.2. Private Sector Insurers

- 5.1.3. Standalone Health Insurance Companies

- 5.2. Market Analysis, Insights and Forecast - by Type of Customer

- 5.2.1. Non-Corporate

- 5.3. Market Analysis, Insights and Forecast - by Type of Coverage

- 5.3.1. Individual Insurance Coverage

- 5.3.2. Family or Floater (Group)Insurance Coverage

- 5.4. Market Analysis, Insights and Forecast - by Product Type

- 5.4.1. Disease- specific Insurance

- 5.4.2. General Insurance

- 5.5. Market Analysis, Insights and Forecast - by Demographics

- 5.5.1. Minors

- 5.5.2. Adults

- 5.5.3. Senior Citizens

- 5.6. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.6.1. Direct to Customers

- 5.6.2. Brokers

- 5.6.3. Individual Agents

- 5.6.4. Corporate Agents

- 5.6.5. Online

- 5.6.6. Bancassurance

- 5.6.7. Other Distribution Channels

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Star Health and Allied Insurance Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aditya Birla Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Niva Bupa Health Insurance Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bajaj Allianz Health Insurance

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bharti AXA Life Insurance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Religare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HDFC Ergo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oriental Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ICICI Lombard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 United India Insurance

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Reliance Health Insurance

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 New India Assurance

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 National Assurance

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Cigna TTK**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Star Health and Allied Insurance Co Ltd

List of Figures

- Figure 1: Indian Health Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indian Health Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Indian Health Insurance Market Revenue Million Forecast, by Type of Insurance Provider 2020 & 2033

- Table 2: Indian Health Insurance Market Volume Trillion Forecast, by Type of Insurance Provider 2020 & 2033

- Table 3: Indian Health Insurance Market Revenue Million Forecast, by Type of Customer 2020 & 2033

- Table 4: Indian Health Insurance Market Volume Trillion Forecast, by Type of Customer 2020 & 2033

- Table 5: Indian Health Insurance Market Revenue Million Forecast, by Type of Coverage 2020 & 2033

- Table 6: Indian Health Insurance Market Volume Trillion Forecast, by Type of Coverage 2020 & 2033

- Table 7: Indian Health Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Indian Health Insurance Market Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 9: Indian Health Insurance Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 10: Indian Health Insurance Market Volume Trillion Forecast, by Demographics 2020 & 2033

- Table 11: Indian Health Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Indian Health Insurance Market Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Indian Health Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 14: Indian Health Insurance Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 15: Indian Health Insurance Market Revenue Million Forecast, by Type of Insurance Provider 2020 & 2033

- Table 16: Indian Health Insurance Market Volume Trillion Forecast, by Type of Insurance Provider 2020 & 2033

- Table 17: Indian Health Insurance Market Revenue Million Forecast, by Type of Customer 2020 & 2033

- Table 18: Indian Health Insurance Market Volume Trillion Forecast, by Type of Customer 2020 & 2033

- Table 19: Indian Health Insurance Market Revenue Million Forecast, by Type of Coverage 2020 & 2033

- Table 20: Indian Health Insurance Market Volume Trillion Forecast, by Type of Coverage 2020 & 2033

- Table 21: Indian Health Insurance Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Indian Health Insurance Market Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 23: Indian Health Insurance Market Revenue Million Forecast, by Demographics 2020 & 2033

- Table 24: Indian Health Insurance Market Volume Trillion Forecast, by Demographics 2020 & 2033

- Table 25: Indian Health Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Indian Health Insurance Market Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Indian Health Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Indian Health Insurance Market Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indian Health Insurance Market?

The projected CAGR is approximately 10.60%.

2. Which companies are prominent players in the Indian Health Insurance Market?

Key companies in the market include Star Health and Allied Insurance Co Ltd, Aditya Birla Group, Niva Bupa Health Insurance Company Limited, Bajaj Allianz Health Insurance, Bharti AXA Life Insurance, Religare, HDFC Ergo, Oriental Insurance, ICICI Lombard, United India Insurance, Reliance Health Insurance, New India Assurance, National Assurance, Cigna TTK**List Not Exhaustive.

3. What are the main segments of the Indian Health Insurance Market?

The market segments include Type of Insurance Provider, Type of Customer, Type of Coverage, Product Type, Demographics, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.91 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Government Subsidized Health Insurance Schemes is Boosting the Sales of Health and Medical Insurance Policies.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022 : the boards of Aditya Birla Capital Ltd and its subsidiary Aditya Birla Health Insurance Co. Ltd approved an investment of Rs 665 crores by Abu Dhabi Investment Authority in the health insurer on Friday (ADIA). The funds will be used to fuel the growth of the health insurer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indian Health Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indian Health Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indian Health Insurance Market?

To stay informed about further developments, trends, and reports in the Indian Health Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence