Key Insights

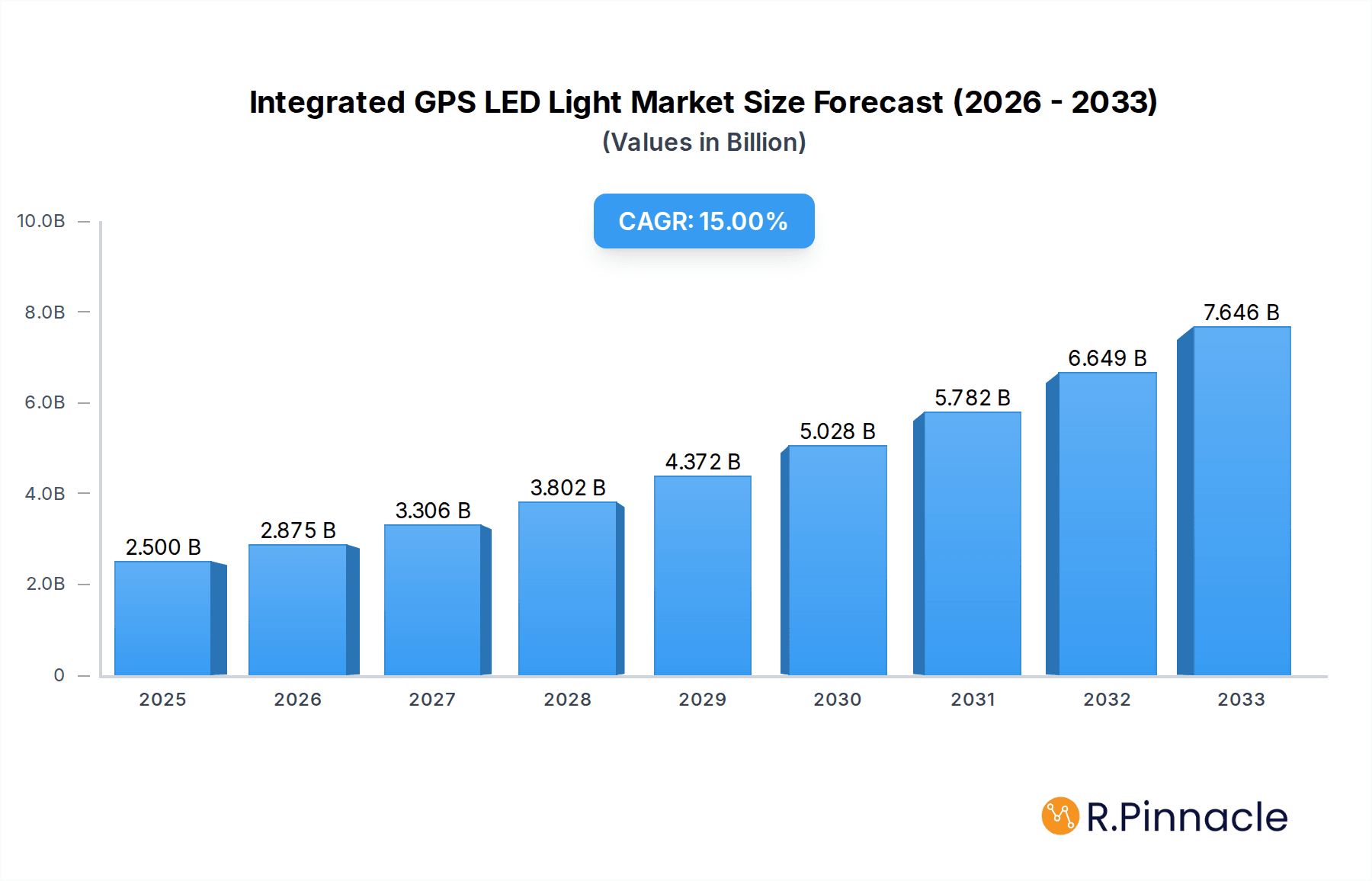

The Integrated GPS LED Light market is poised for robust expansion, driven by increasing urbanization, smart city initiatives, and the demand for efficient and intelligent lighting solutions. Valued at an estimated $2.5 billion in 2025, the market is projected to witness a significant CAGR of 15% through 2033. This growth trajectory is underpinned by the unique advantages offered by integrated GPS technology, enabling precise location tracking, optimized energy consumption, and enhanced operational efficiency for street lighting, industrial facilities, and other critical infrastructure. The escalating need for smart city infrastructure, coupled with advancements in LED technology and IoT integration, is fueling the adoption of these sophisticated lighting systems. Furthermore, the emphasis on sustainability and reduced carbon footprints globally further bolsters the market, as GPS-enabled LED lights allow for dynamic dimming and scheduling, leading to substantial energy savings.

Integrated GPS LED Light Market Size (In Billion)

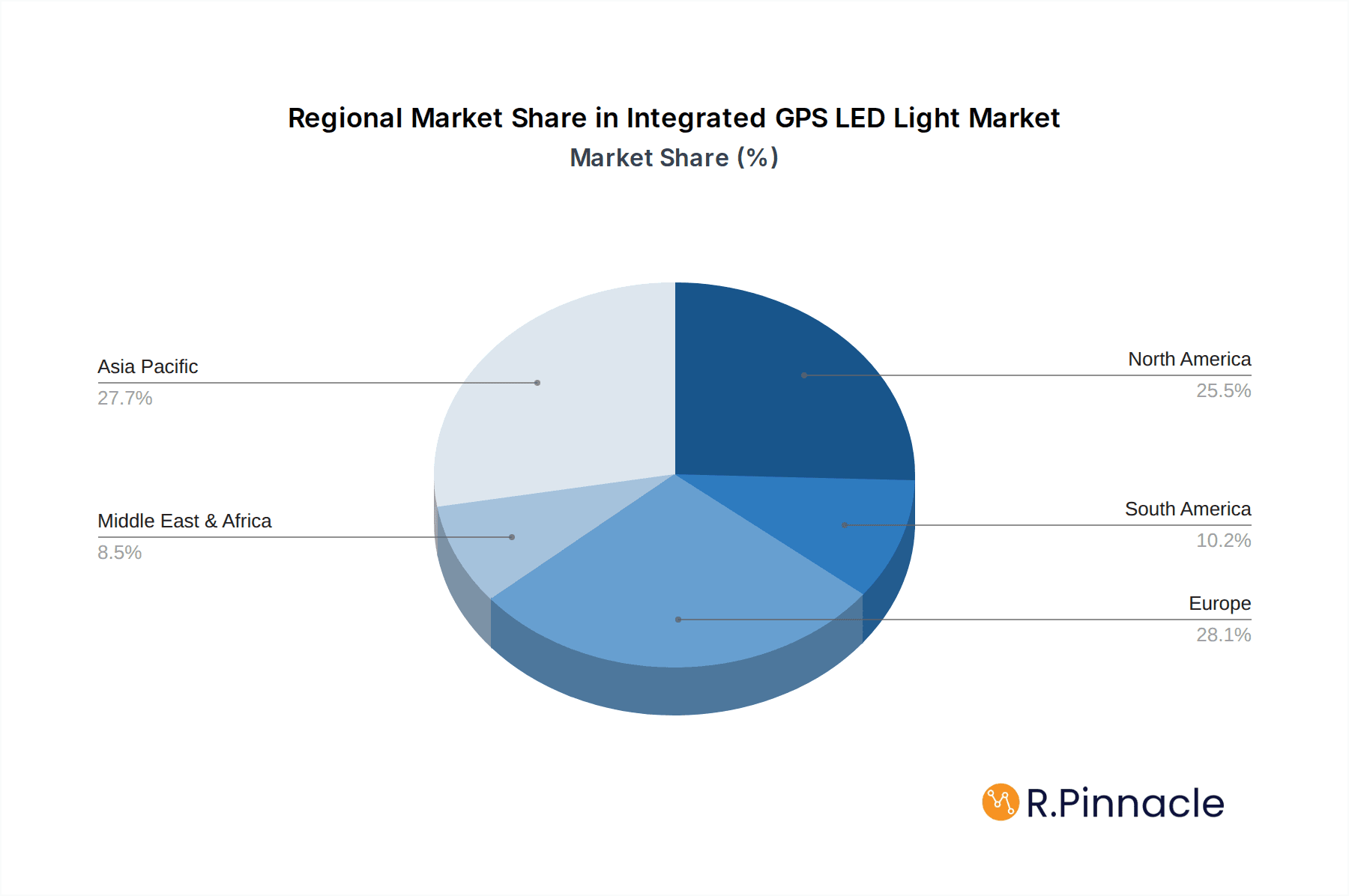

The market's expansion will be propelled by a confluence of factors. Key growth drivers include government investments in smart city development, the rising adoption of energy-efficient lighting solutions, and the growing demand for real-time monitoring and control of public infrastructure. While the market is experiencing a surge in innovation and deployment, certain restraints, such as the initial high cost of integrated systems and the need for specialized installation and maintenance expertise, may present challenges. However, the continuous decline in component costs and the increasing awareness of the long-term economic and environmental benefits are expected to mitigate these restraints. The market is segmented by application into City Road, Industrial Park, and Other, with City Road applications dominating the current landscape. By type, Wired and Wireless segments cater to diverse installation requirements. Geographically, Asia Pacific, led by China and India, is expected to emerge as a significant growth engine due to rapid industrialization and substantial smart city projects, while North America and Europe will continue to be mature markets with a strong focus on technological upgrades and sustainability.

Integrated GPS LED Light Company Market Share

Integrated GPS LED Light Market: Unlocking Precision and Efficiency in Urban and Industrial Landscapes

This comprehensive report offers an in-depth analysis of the global Integrated GPS LED Light market, providing critical insights for industry stakeholders. Delving into market structure, dynamics, regional dominance, product innovations, and future outlook, this report is your definitive guide to understanding the evolving landscape of intelligent lighting solutions. With a study period spanning from 2019 to 2033, and detailed forecasts based on a 2025 base and estimated year, our analysis ensures you are equipped with the most current and forward-looking information.

Integrated GPS LED Light Market Structure & Innovation Trends

The Integrated GPS LED Light market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, estimated to be around 60% combined. Key innovation drivers include advancements in miniaturization of GPS modules, enhanced LED efficiency, and the development of robust, weather-resistant materials. Regulatory frameworks are increasingly favoring smart city initiatives and energy-efficient solutions, providing a tailwind for market adoption. While direct product substitutes are limited, traditional lighting systems without GPS functionality represent an indirect substitute. End-user demographics are shifting towards municipalities, industrial park operators, and smart infrastructure developers, emphasizing functionality and cost-effectiveness. Mergers and acquisitions (M&A) activity has been steady, with an estimated total deal value of over 1 billion during the historical period, indicating consolidation and strategic partnerships to expand market reach and technological capabilities.

Integrated GPS LED Light Market Dynamics & Trends

The Integrated GPS LED Light market is poised for substantial expansion, driven by an anticipated Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period. This robust growth is fueled by a confluence of technological advancements and increasing global demand for intelligent infrastructure. The core of this expansion lies in the inherent advantages of GPS-enabled LED lights, offering unparalleled precision in location tracking, asset management, and operational efficiency across various applications.

Technological disruptions are a significant catalyst, with continuous improvements in GPS accuracy and reliability, coupled with the ever-increasing energy efficiency and lifespan of LED technology. The integration of IoT capabilities further enhances the value proposition, allowing for remote monitoring, control, and data analytics, transforming static lighting infrastructure into dynamic, data-generating assets. This interconnectedness fosters smarter cities and more efficient industrial operations.

Consumer preferences are increasingly leaning towards solutions that offer not only illumination but also integrated functionality. Municipalities are actively seeking to optimize urban traffic flow, enhance public safety through precisely located lighting, and streamline maintenance operations. Similarly, industrial parks are leveraging these lights for improved asset tracking, zone management, and enhanced security protocols. The demand for sustainable and energy-efficient solutions also plays a crucial role, as GPS LED lights contribute to reduced energy consumption and operational costs.

The competitive landscape is characterized by a dynamic interplay between established lighting manufacturers and emerging technology providers. Companies are focusing on developing innovative product features, such as advanced analytics, seamless integration with existing smart city platforms, and robust, long-lasting designs. Strategic collaborations and partnerships are becoming more prevalent as companies aim to leverage each other's expertise in GPS technology, IoT, and lighting solutions to capture a larger market share. The market penetration of Integrated GPS LED Lights is still in its nascent stages, presenting a significant opportunity for early adopters and innovative players to establish a strong foothold. The overall market penetration is projected to grow from less than 5% in the base year to over 20% by the end of the forecast period.

Dominant Regions & Segments in Integrated GPS LED Light

North America is currently emerging as the dominant region in the Integrated GPS LED Light market, with an estimated market share exceeding 30%. This dominance is underpinned by substantial government investment in smart city initiatives and critical infrastructure upgrades, alongside a strong emphasis on technological innovation. Within North America, the United States leads the charge, driven by advanced technological adoption and a proactive approach to smart infrastructure development.

The City Road application segment holds the largest market share, estimated at over 45% of the total market. Key drivers for this segment include the pressing need for enhanced urban mobility, improved public safety through precisely controlled lighting, and the deployment of intelligent traffic management systems. The inherent ability of GPS-enabled lights to provide accurate location data is invaluable for city planning, emergency response coordination, and real-time traffic monitoring, contributing to more efficient and safer urban environments. The investment in smart city projects globally is expected to exceed 1 billion annually by 2025, directly impacting the adoption of such lighting solutions.

In terms of Types, the Wired segment currently dominates, accounting for approximately 60% of the market. This is primarily due to the established infrastructure for power delivery in most urban and industrial settings, and the perceived reliability and lower initial cost associated with wired connections for large-scale deployments. However, the Wireless segment is experiencing rapid growth, with an anticipated CAGR of over 20% due to advancements in battery technology and the flexibility it offers in deployment, especially in remote or hard-to-reach areas, and for applications where cable laying is impractical or cost-prohibitive. The development of low-power wireless communication protocols is further accelerating this trend.

Integrated GPS LED Light Product Innovations

Product innovations in the Integrated GPS LED Light market are centered around enhancing functionality and seamless integration. Key developments include the miniaturization of GPS components for sleeker luminaire designs, increased power efficiency for extended battery life in wireless variants, and the incorporation of advanced analytics for real-time environmental monitoring. Competitive advantages are being forged through the development of self-healing networks, robust weatherproofing for extreme conditions, and intuitive user interfaces for simplified management. These technological advancements cater to the growing demand for smart, connected, and highly reliable lighting solutions across diverse applications.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Integrated GPS LED Light market across various key segments.

City Road: This segment, projected to grow at a CAGR of approximately 18%, represents the largest application. Its dominance is driven by smart city development and the need for intelligent traffic and safety management. Market size in this segment is estimated to be over 1 billion in the base year.

Industrial Park: Expected to witness a CAGR of around 16%, this segment is crucial for asset tracking, security, and operational efficiency within industrial zones. Its market size is estimated to be over 1 billion in the base year.

Other: This segment, encompassing diverse applications like smart agriculture, remote asset monitoring, and specialized infrastructure, is projected to grow at a CAGR of approximately 14%, indicating a steady expansion into niche markets.

Wired: Currently the dominant type, this segment is expected to grow at a CAGR of 12%. Its strength lies in established power infrastructure and perceived reliability for large-scale deployments, with a market size estimated over 1 billion.

Wireless: This segment, poised for rapid growth at a CAGR exceeding 20%, offers flexibility and ease of deployment. Its expanding market size is attributed to advancements in battery technology and IoT connectivity, with an estimated market size of over 1 billion in the base year.

Key Drivers of Integrated GPS LED Light Growth

The Integrated GPS LED Light market is propelled by several interconnected growth drivers. Technological advancements in GPS accuracy, LED efficiency, and IoT integration are fundamental. The increasing adoption of smart city initiatives by governments worldwide, coupled with a focus on energy efficiency and sustainability, creates a strong demand for intelligent lighting solutions. Furthermore, the growing need for enhanced asset management and security in industrial parks and other critical infrastructure applications significantly contributes to market expansion. The falling costs of GPS modules and LED components are also making these advanced lighting solutions more accessible.

Challenges in the Integrated GPS LED Light Sector

Despite its promising growth, the Integrated GPS LED Light sector faces several challenges. High initial investment costs for widespread deployment can be a barrier for some municipalities and organizations. Regulatory hurdles and standardization issues across different regions can complicate market entry and product interoperability. Supply chain disruptions, as experienced globally, can impact the availability and cost of essential components. Furthermore, cybersecurity concerns related to connected devices and data privacy require robust solutions. Competitive pressures from established lighting manufacturers and the need for continuous innovation also present ongoing challenges. The estimated impact of these challenges on market growth is a potential reduction of 5-8% in CAGR.

Emerging Opportunities in Integrated GPS LED Light

The Integrated GPS LED Light market is ripe with emerging opportunities. The expansion of smart agriculture presents a significant avenue for precision lighting and monitoring. Growing demand for remote asset tracking and management in sectors like logistics and infrastructure maintenance offers new application areas. The development of AI-powered analytics integrated with GPS LED lights can unlock predictive maintenance and operational optimization insights. Furthermore, the increasing focus on green infrastructure and smart urban planning by governments worldwide provides fertile ground for innovation and adoption. The exploration of new materials for enhanced durability and cost-effectiveness also presents opportunities.

Leading Players in the Integrated GPS LED Light Market

- Acuity Brands

- Cree

- Osram

- Nichia Corporation

- Seoul Semiconductor

- Everlight Electronics

- OPPLE

- ANNHUNG

- Junming

- Yantai Navigation Lights Electronic Technology

Key Developments in Integrated GPS LED Light Industry

- 2023/08: Acuity Brands launched a new series of smart streetlights with integrated GPS and IoT capabilities, enhancing urban management and safety.

- 2023/05: Cree announced advancements in LED chip technology, improving energy efficiency and lifespan for GPS-enabled lighting solutions.

- 2022/11: Osram unveiled a new compact GPS module designed for seamless integration into various luminaire designs, catering to the trend of miniaturization.

- 2022/07: Nichia Corporation showcased their latest high-performance LEDs suitable for outdoor applications requiring precise location data.

- 2021/12: Seoul Semiconductor introduced enhanced outdoor lighting solutions with improved weather resistance and longer operational life, ideal for GPS integration.

- 2021/09: Everlight Electronics highlighted their commitment to smart lighting solutions, including GPS-enabled options for industrial and urban use.

- 2020/06: OPPLE expanded its smart lighting portfolio with the introduction of GPS-tracked lighting for enhanced asset management in industrial environments.

- 2020/03: ANNHUNG introduced cost-effective GPS LED light solutions targeting smart city development projects.

- 2019/11: Junming focused on enhancing the connectivity and data transfer capabilities of their GPS LED light offerings.

- 2019/08: Yantai Navigation Lights Electronic Technology emphasized the robustness and reliability of their GPS LED lights for demanding environments.

Future Outlook for Integrated GPS LED Light Market

The future outlook for the Integrated GPS LED Light market is exceptionally bright, driven by the escalating demand for smart, connected, and efficient infrastructure. Continued technological innovation, particularly in AI and edge computing, will unlock advanced functionalities, enabling lights to become more autonomous and insightful. The expanding scope of smart city projects and the growing imperative for sustainable development will significantly accelerate market penetration. Strategic collaborations and the development of standardized protocols will foster greater interoperability and drive down costs, making these solutions accessible to a wider range of applications and markets. The market is projected to witness exponential growth, exceeding 10 billion in value by the end of the forecast period.

Integrated GPS LED Light Segmentation

-

1. Application

- 1.1. City Road

- 1.2. Industrial Park

- 1.3. Other

-

2. Types

- 2.1. Wired

- 2.2. Wireless

Integrated GPS LED Light Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Integrated GPS LED Light Regional Market Share

Geographic Coverage of Integrated GPS LED Light

Integrated GPS LED Light REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Integrated GPS LED Light Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. City Road

- 5.1.2. Industrial Park

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Integrated GPS LED Light Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. City Road

- 6.1.2. Industrial Park

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Integrated GPS LED Light Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. City Road

- 7.1.2. Industrial Park

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Integrated GPS LED Light Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. City Road

- 8.1.2. Industrial Park

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wired

- 8.2.2. Wireless

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Integrated GPS LED Light Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. City Road

- 9.1.2. Industrial Park

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wired

- 9.2.2. Wireless

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Integrated GPS LED Light Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. City Road

- 10.1.2. Industrial Park

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wired

- 10.2.2. Wireless

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Acuity Brands

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cree

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Osram

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nichia Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seoul Semiconductor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Everlight Electronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OPPLE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ANNHUNG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Junming

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yantai Navigation Lights Electronic Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Acuity Brands

List of Figures

- Figure 1: Global Integrated GPS LED Light Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Integrated GPS LED Light Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Integrated GPS LED Light Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Integrated GPS LED Light Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Integrated GPS LED Light Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Integrated GPS LED Light Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Integrated GPS LED Light Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Integrated GPS LED Light Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Integrated GPS LED Light Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Integrated GPS LED Light Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Integrated GPS LED Light Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Integrated GPS LED Light Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Integrated GPS LED Light Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Integrated GPS LED Light Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Integrated GPS LED Light Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Integrated GPS LED Light Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Integrated GPS LED Light Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Integrated GPS LED Light Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Integrated GPS LED Light Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Integrated GPS LED Light Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Integrated GPS LED Light Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Integrated GPS LED Light Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Integrated GPS LED Light Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Integrated GPS LED Light Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Integrated GPS LED Light Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Integrated GPS LED Light Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Integrated GPS LED Light Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Integrated GPS LED Light Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Integrated GPS LED Light Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Integrated GPS LED Light Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Integrated GPS LED Light Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Integrated GPS LED Light Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Integrated GPS LED Light Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Integrated GPS LED Light Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Integrated GPS LED Light Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Integrated GPS LED Light Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Integrated GPS LED Light Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Integrated GPS LED Light Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Integrated GPS LED Light Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Integrated GPS LED Light Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Integrated GPS LED Light Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Integrated GPS LED Light Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Integrated GPS LED Light Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Integrated GPS LED Light Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Integrated GPS LED Light Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Integrated GPS LED Light Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Integrated GPS LED Light Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Integrated GPS LED Light Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Integrated GPS LED Light Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Integrated GPS LED Light Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated GPS LED Light?

The projected CAGR is approximately 15%.

2. Which companies are prominent players in the Integrated GPS LED Light?

Key companies in the market include Acuity Brands, Cree, Osram, Nichia Corporation, Seoul Semiconductor, Everlight Electronics, OPPLE, ANNHUNG, Junming, Yantai Navigation Lights Electronic Technology.

3. What are the main segments of the Integrated GPS LED Light?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Integrated GPS LED Light," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Integrated GPS LED Light report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Integrated GPS LED Light?

To stay informed about further developments, trends, and reports in the Integrated GPS LED Light, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence