Key Insights

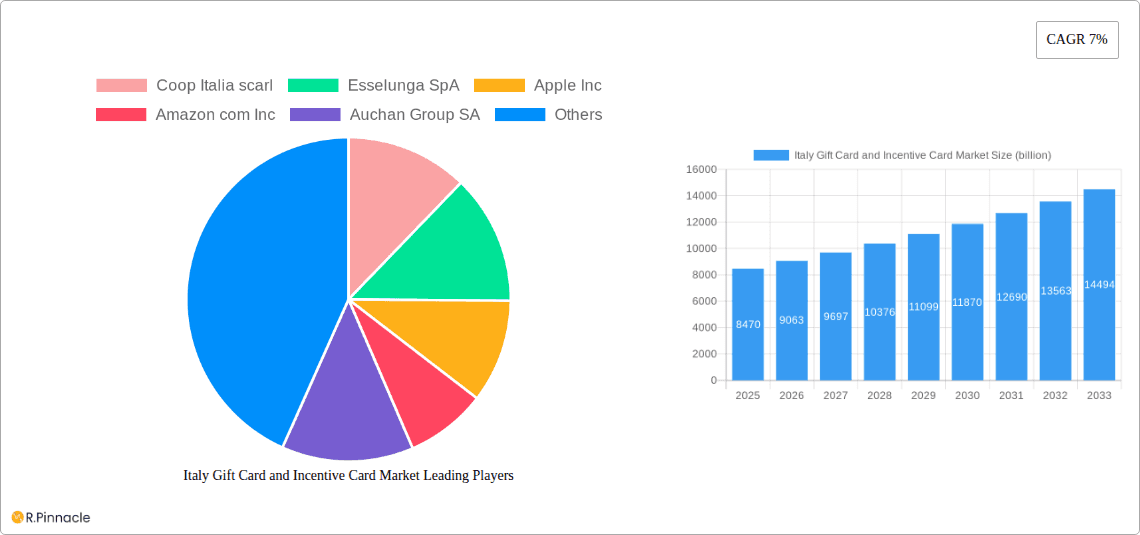

The Italy Gift Card and Incentive Card Market is poised for robust growth, projected to reach €8.47 billion in 2025, driven by a CAGR of 7%. This expansion is fueled by a confluence of evolving consumer preferences, a desire for flexible gifting solutions, and increasing adoption by businesses for employee rewards and customer loyalty programs. The market benefits from a strong existing retail infrastructure and a growing digital payment ecosystem. The dominance of offline distribution channels, while significant, is steadily being complemented by the surge in online sales, reflecting a broader shift in consumer purchasing habits. Key spend categories like E-commerce, supermarkets, and health & wellness are expected to be major contributors to market value, indicating a diverse range of applications for gift and incentive cards. The market's trajectory suggests a continued upward trend, with innovation in card features and accessibility playing a crucial role in sustained development.

Italy Gift Card and Incentive Card Market Market Size (In Billion)

The market segmentation highlights a dynamic landscape, with both closed-loop and open-loop cards catering to distinct consumer needs, from retail consumers seeking personal gifts to corporate consumers leveraging them for motivational purposes. While the market is largely concentrated within Italy, the established presence of major retail players and the increasing penetration of digital platforms suggest a fertile ground for further development. Future growth will likely be influenced by advancements in mobile payment integration, personalized gifting experiences, and the ongoing digitalization of businesses. The market's resilience and adaptability are evident in its ability to cater to varied spending habits across different retail segments, from everyday essentials to specialized purchases. Understanding these nuances will be critical for stakeholders aiming to capitalize on the opportunities within this expanding sector.

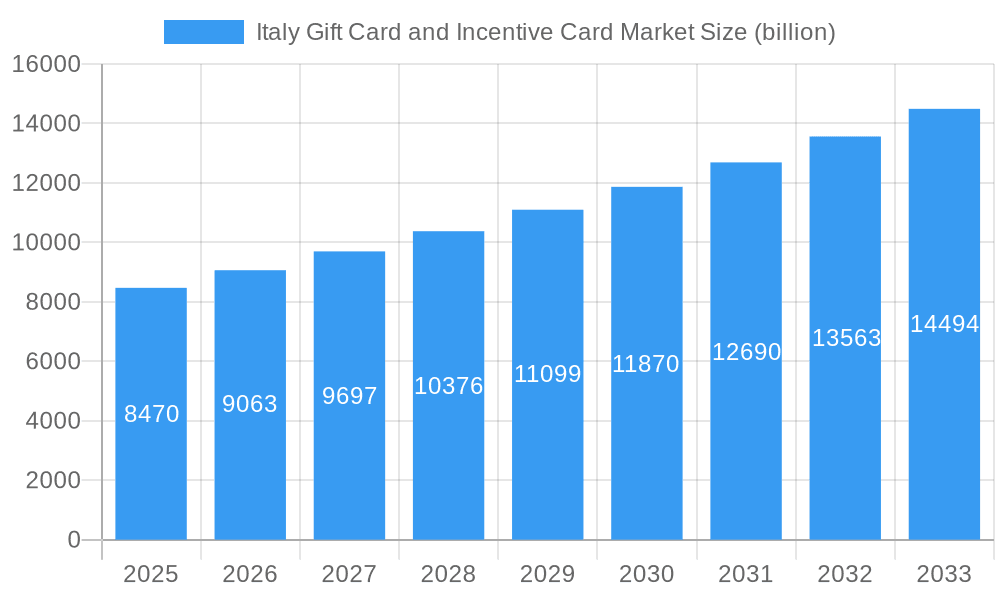

Italy Gift Card and Incentive Card Market Company Market Share

This in-depth report provides a strategic overview and granular analysis of the Italy Gift Card and Incentive Card Market, offering actionable insights for stakeholders seeking to capitalize on this dynamic sector. Covering the historical period from 2019 to 2024, the base year of 2025, and extending to a comprehensive forecast period through 2033, this study delves into market structure, dynamics, segmentation, and future outlook. With an estimated market value of $XX billion in 2025, the Italy gift card and incentive card market is poised for significant expansion, driven by evolving consumer behavior, technological advancements, and corporate gifting trends.

Italy Gift Card and Incentive Card Market Market Structure & Innovation Trends

The Italy Gift Card and Incentive Card Market exhibits a moderately concentrated structure, with a blend of large global players and agile domestic companies vying for market share. Innovation is primarily driven by the increasing demand for personalized digital gift solutions, seamless integration with e-commerce platforms, and the expanding use of incentive cards for employee recognition and customer loyalty programs. Regulatory frameworks, while evolving, generally support market growth by promoting transparency and consumer protection. Product substitutes, such as direct cash transfers and physical gift items, are present but are increasingly outpaced by the convenience and perceived value of gift and incentive cards. End-user demographics show a growing adoption across all age groups, with a notable surge in digital-native consumers. Mergers and acquisitions (M&A) are anticipated to play a role in market consolidation, particularly as companies seek to expand their digital capabilities and geographic reach. Key M&A deal values are projected to reach $XX billion by 2028. Market share for top players is estimated to range from 5% to 15% in 2025.

- Market Concentration: Moderate to High

- Innovation Drivers: Digitalization, personalization, corporate gifting

- Regulatory Frameworks: Evolving, consumer-focused

- Product Substitutes: Cash, physical gifts, direct discounts

- End-User Demographics: Broad adoption, increasing digital engagement

- M&A Activities: Expected to increase for consolidation and capability expansion

Italy Gift Card and Incentive Card Market Market Dynamics & Trends

The Italy Gift Card and Incentive Card Market is propelled by a robust set of growth drivers, including the escalating adoption of e-commerce, a thriving retail sector, and the growing preference for flexible gifting options. Technological advancements, particularly in mobile payment integration and blockchain for enhanced security, are revolutionizing the way gift and incentive cards are distributed and redeemed. Consumer preferences are shifting towards experiences and personalized rewards, leading to a demand for diverse spend categories beyond traditional retail. The competitive landscape is characterized by intense rivalry among established retailers, digital gift card providers, and financial institutions. Market penetration is projected to reach XX% by 2030, fueled by an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period. The increasing digitization of transactions and the normalization of online shopping further bolster market expansion. Corporate adoption of incentive cards for employee engagement and client appreciation is a significant trend, contributing to sustained demand.

Dominant Regions & Segments in Italy Gift Card and Incentive Card Market

The E-commerce & departmental stores segment is expected to dominate the Italy Gift Card and Incentive Card Market, driven by the convenience and vast product selection offered by online retailers and large departmental stores. This dominance is further amplified by the Online distribution channel, which has witnessed exponential growth in recent years, mirroring global e-commerce trends.

- Dominant Segment: E-commerce & Departmental Stores

- Key Drivers: Convenience, vast product selection, competitive pricing, seamless online redemption.

- Analysis: The increasing reliance on online platforms for both shopping and gifting has cemented the position of e-commerce and departmental stores. Retailers are increasingly offering branded gift cards that can be easily purchased and redeemed online, providing a flexible and appealing option for consumers. The ability to offer a wide range of products caters to diverse gifting needs, from electronics to fashion and home goods.

- Dominant Distribution Channel: Online

- Key Drivers: Accessibility, convenience, speed of delivery (digital codes), broader reach.

- Analysis: The shift towards digital purchasing has made online distribution the most critical channel for gift and incentive cards. Consumers can purchase these cards anytime, anywhere, often receiving digital codes instantly, which is particularly attractive for last-minute gift purchases. This channel also allows for direct marketing and promotional campaigns by card issuers and retailers.

- Dominant Consumer Type: Retail Consumer

- Key Drivers: Personal gifting, self-purchase for discounts, experiential gifting.

- Analysis: While corporate consumers represent a significant portion, the sheer volume of personal gift-giving and self-purchasing for personal benefit makes the retail consumer segment the largest. The desire for flexibility, the ability to control spending, and the appeal of receiving a desired item as a gift contribute to this dominance.

- Dominant Card Type: Closed-loop card

- Key Drivers: Brand loyalty, targeted promotions, higher profit margins for issuers.

- Analysis: Closed-loop cards, which can only be redeemed at a specific retailer or group of retailers, are highly prevalent. These cards foster brand loyalty and allow businesses to control the customer experience. They are often used for promotional activities and loyalty programs, offering significant value to both the issuer and the consumer who can access specific discounts or benefits.

- Dominant Spend Category: Supermarket, Hypermarket and convenience store

- Key Drivers: Everyday necessity, broad appeal, ease of purchase and redemption.

- Analysis: Gift cards for supermarkets and convenience stores are universally appealing due to the essential nature of their products. They serve as practical gifts for individuals and are often used in corporate incentive programs where employees can purchase daily necessities. Their widespread accessibility and consistent demand make them a consistently strong segment.

Italy Gift Card and Incentive Card Market Product Innovations

Product innovations in the Italy Gift Card and Incentive Card Market are increasingly focused on enhancing user experience and expanding utility. Digital gift cards, redeemable via QR codes or digital wallets, offer unparalleled convenience. Integration with loyalty programs and the introduction of personalized e-gifting platforms provide tailored gifting solutions. Blockchain technology is being explored to improve security and transparency in transactions. The competitive advantage lies in offering seamless redemption processes, diverse spend options, and engaging digital interfaces that cater to the evolving preferences of tech-savvy consumers.

Report Scope & Segmentation Analysis

This report meticulously segments the Italy Gift Card and Incentive Card Market across several key dimensions. The Card Type segmentation includes Closed-loop cards and Open-loop cards. Consumer Type is analyzed through Retail Consumer and Corporate Consumer. Spend Category covers E-commerce & departmental stores, Restaurants & bars, Supermarket, Hypermarket and convenience store, Entertainment & gaming, Specialty store, Health & wellness, Travel, and Others. Finally, the Distribution Channel is divided into Online and Offline. Each segment is projected to exhibit varying growth rates and market sizes, with detailed analysis of competitive dynamics and growth projections provided within the report. For instance, the E-commerce & departmental stores segment is expected to grow at a CAGR of XX% from 2025 to 2033, reaching an estimated market size of $XX billion by 2033.

Key Drivers of Italy Gift Card and Incentive Card Market Growth

The Italy Gift Card and Incentive Card Market is experiencing robust growth driven by several pivotal factors. The pervasive adoption of e-commerce and digital payment solutions offers unparalleled convenience and accessibility for both purchase and redemption. The burgeoning trend of corporate gifting and employee incentive programs, aimed at boosting morale and productivity, provides a significant demand stream. Furthermore, evolving consumer preferences towards experiential gifts and personalized rewards are spurring innovation in the types and applications of gift cards. Government initiatives promoting digital transactions and consumer protection also contribute to a favorable market environment.

Challenges in the Italy Gift Card and Incentive Card Market Sector

Despite its promising growth, the Italy Gift Card and Incentive Card Market faces several challenges. Regulatory hurdles related to consumer protection and anti-money laundering laws can sometimes slow down innovation and adoption. The increasing sophistication of fraud and security threats necessitates continuous investment in robust security measures. Intense competition among a wide array of providers, including retailers, financial institutions, and dedicated gift card platforms, can lead to price pressures and reduced profit margins. Furthermore, reliance on a stable economic environment and consumer spending power makes the market susceptible to economic downturns.

Emerging Opportunities in Italy Gift Card and Incentive Card Market

The Italy Gift Card and Incentive Card Market is ripe with emerging opportunities. The increasing demand for sustainable and eco-friendly gifting options presents a chance for the development of digital-only and low-impact gift card solutions. Expansion into niche markets, such as wellness and personalized experiences, can unlock new consumer segments. The integration of gift cards with loyalty programs and influencer marketing offers novel avenues for promotion and customer engagement. Furthermore, the untapped potential of the B2B segment for employee rewards and corporate event gifting remains a significant area for growth.

Leading Players in the Italy Gift Card and Incentive Card Market Market

- Coop Italia scarl

- Esselunga SpA

- Apple Inc

- Amazon com Inc

- Auchan Group SA

- Gruppo Eurospin

- Carrefour SA

- Crai Secom SpA

- Schwarz Beteiligungs GmbH

- Selex Gruppo Commerciale SpA

Key Developments in Italy Gift Card and Incentive Card Market Industry

- 2021: Amilon Srl entered into a partnership with Eataly to extend the sale of its digital gift cards to companies, enhancing corporate gifting options.

- 2020: Instagram in Italy officially announced the addition of its new gift card, food order, and fundraiser tools for stories and profiles, which is expected to provide businesses with another way to generate income during the ongoing crisis.

Future Outlook for Italy Gift Card and Incentive Card Market Market

The future outlook for the Italy Gift Card and Incentive Card Market is exceptionally positive, driven by ongoing digital transformation and evolving consumer behavior. The market is expected to witness sustained growth, propelled by the increasing demand for personalized and flexible gifting solutions across both B2C and B2B segments. Strategic opportunities lie in embracing innovative technologies like AI for personalized recommendations and further integrating gift cards into broader loyalty and reward ecosystems. The continued expansion of e-commerce and the growing acceptance of digital payments will solidify the market's trajectory, presenting a fertile ground for investment and strategic partnerships.

Italy Gift Card and Incentive Card Market Segmentation

-

1. Card Type

- 1.1. Closed-loop card

- 1.2. Open-loop card

-

2. Consumer type

- 2.1. Retail Consumer

- 2.2. Corporate Consumer

-

3. spend category

- 3.1. E-commerce & departmental stores

- 3.2. Restaurants & bars

- 3.3. Supermarket

- 3.4. Hypermarket and convenience store

- 3.5. entertainment & gaming

- 3.6. specialty store

- 3.7. Health & wellness

- 3.8. travel

- 3.9. Others

-

4. distribution channel

- 4.1. Online

- 4.2. Offline

Italy Gift Card and Incentive Card Market Segmentation By Geography

- 1. Italy

Italy Gift Card and Incentive Card Market Regional Market Share

Geographic Coverage of Italy Gift Card and Incentive Card Market

Italy Gift Card and Incentive Card Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Online Shopping is Driving Up Demand for Gift Cards

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Gift Card and Incentive Card Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. Closed-loop card

- 5.1.2. Open-loop card

- 5.2. Market Analysis, Insights and Forecast - by Consumer type

- 5.2.1. Retail Consumer

- 5.2.2. Corporate Consumer

- 5.3. Market Analysis, Insights and Forecast - by spend category

- 5.3.1. E-commerce & departmental stores

- 5.3.2. Restaurants & bars

- 5.3.3. Supermarket

- 5.3.4. Hypermarket and convenience store

- 5.3.5. entertainment & gaming

- 5.3.6. specialty store

- 5.3.7. Health & wellness

- 5.3.8. travel

- 5.3.9. Others

- 5.4. Market Analysis, Insights and Forecast - by distribution channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coop Italia scarl

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esselunga SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Apple Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon com Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Auchan Group SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gruppo Eurospin

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carrefour SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crai Secom SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schwarz Beteiligungs GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Selex Gruppo Commerciale SpA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Coop Italia scarl

List of Figures

- Figure 1: Italy Gift Card and Incentive Card Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Gift Card and Incentive Card Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by Card Type 2020 & 2033

- Table 2: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by Consumer type 2020 & 2033

- Table 3: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by spend category 2020 & 2033

- Table 4: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 5: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by Card Type 2020 & 2033

- Table 7: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by Consumer type 2020 & 2033

- Table 8: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by spend category 2020 & 2033

- Table 9: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 10: Italy Gift Card and Incentive Card Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Gift Card and Incentive Card Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Italy Gift Card and Incentive Card Market?

Key companies in the market include Coop Italia scarl, Esselunga SpA, Apple Inc, Amazon com Inc, Auchan Group SA, Gruppo Eurospin, Carrefour SA, Crai Secom SpA, Schwarz Beteiligungs GmbH, Selex Gruppo Commerciale SpA**List Not Exhaustive.

3. What are the main segments of the Italy Gift Card and Incentive Card Market?

The market segments include Card Type, Consumer type, spend category, distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.47 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Online Shopping is Driving Up Demand for Gift Cards.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2021, Amilon Srl entered into a partnership with Eataly to extend the sale of its digital gift cards to companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Gift Card and Incentive Card Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Gift Card and Incentive Card Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Gift Card and Incentive Card Market?

To stay informed about further developments, trends, and reports in the Italy Gift Card and Incentive Card Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence