Key Insights

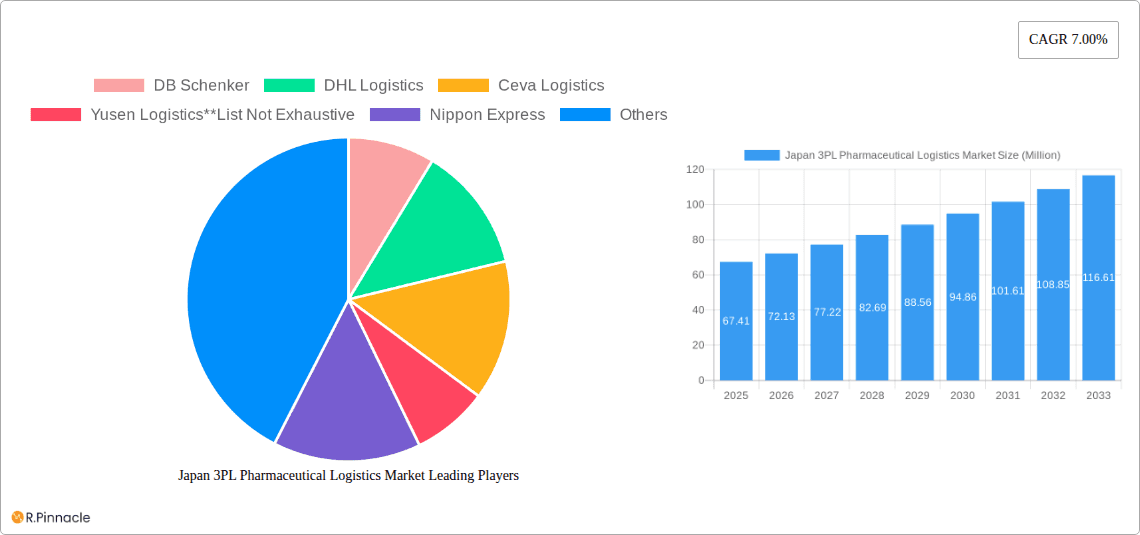

The Japan 3PL Pharmaceutical Logistics market, valued at $67.41 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for temperature-sensitive pharmaceuticals, stringent regulatory requirements necessitating specialized handling and storage, and the rising prevalence of chronic diseases fueling pharmaceutical consumption are major contributors. Furthermore, the Japanese pharmaceutical industry's ongoing efforts to enhance supply chain efficiency and reduce costs through outsourcing to third-party logistics providers (3PLs) are significantly boosting market growth. The market is segmented by service type (domestic and international transportation management, value-added warehousing and distribution) and temperature control (controlled/cold chain and non-controlled/non-cold chain logistics). The cold chain segment holds a significant share due to the nature of pharmaceutical products. Key players like DB Schenker, DHL Logistics, and Kuehne + Nagel are actively competing in this market, leveraging their expertise in specialized logistics and technology to cater to the demanding needs of the pharmaceutical sector. Regional variations exist within Japan, with Kanto, Kansai, and Chubu regions likely dominating the market due to higher pharmaceutical manufacturing and consumption.

Japan 3PL Pharmaceutical Logistics Market Market Size (In Million)

The forecast period (2025-2033) presents significant opportunities for 3PL providers specializing in pharmaceutical logistics. Investments in advanced technologies such as track-and-trace systems, real-time monitoring, and data analytics are crucial for companies to maintain a competitive edge. Growth will likely be further fueled by the increasing adoption of automation in warehouses and transportation, aimed at improving efficiency and reducing operational costs. However, challenges remain, including navigating complex Japanese regulations, maintaining consistent cold chain integrity across diverse geographical locations, and managing potential disruptions to the supply chain. Despite these challenges, the long-term outlook for the Japan 3PL Pharmaceutical Logistics market remains positive, driven by an aging population, rising healthcare expenditure, and increasing pharmaceutical innovation.

Japan 3PL Pharmaceutical Logistics Market Company Market Share

Japan 3PL Pharmaceutical Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Japan 3PL Pharmaceutical Logistics Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The study period encompasses historical data (2019-2024), estimated figures for 2025, and forecasts extending to 2033. This report is crucial for understanding the intricacies of this rapidly evolving market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Japan 3PL Pharmaceutical Logistics Market Structure & Innovation Trends

This section analyzes the structural composition of the Japan 3PL pharmaceutical logistics market, encompassing market concentration, innovative drivers, regulatory landscapes, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities.

The market exhibits a moderately consolidated structure, with several major players holding significant market share. For instance, DB Schenker, DHL Logistics, Ceva Logistics, and Yusen Logistics are key contributors. However, smaller niche players also exist, leading to a diverse competitive landscape. The market share of the top 5 players is estimated at approximately xx%.

- Innovation Drivers: Stringent regulatory compliance, increasing demand for temperature-sensitive drug handling, and advancements in logistics technology are key innovation drivers.

- Regulatory Framework: Japan's pharmaceutical regulatory framework is stringent, influencing logistics operations and investments in compliance technologies.

- Product Substitutes: The emergence of new technologies in transportation and warehousing presents both opportunities and challenges to established players.

- End-User Demographics: The aging population in Japan and the rising prevalence of chronic diseases drive demand for pharmaceutical products, impacting logistics needs.

- M&A Activity: Recent M&A activity, such as Nippon Express's acquisition of Cargo-Partner for up to $1.5 Billion, signifies consolidation trends and expansion strategies within the market. The total value of M&A deals in the sector from 2019 to 2024 is estimated at xx Million.

Japan 3PL Pharmaceutical Logistics Market Dynamics & Trends

This section delves into the market's dynamic nature, examining growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors.

The increasing prevalence of chronic diseases in Japan, coupled with the rising demand for specialized pharmaceutical products, is a primary growth catalyst. Technological advancements in cold chain logistics, data analytics, and automation are transforming the industry. Furthermore, evolving consumer preferences towards efficient and reliable delivery systems and a growing focus on sustainable logistics practices are reshaping the competitive landscape. Market penetration of advanced logistics technologies is projected to reach xx% by 2033. The competitive dynamics are characterized by intense rivalry among established players and emerging competitors. Strategic alliances, technological innovations, and service diversification are common competitive strategies.

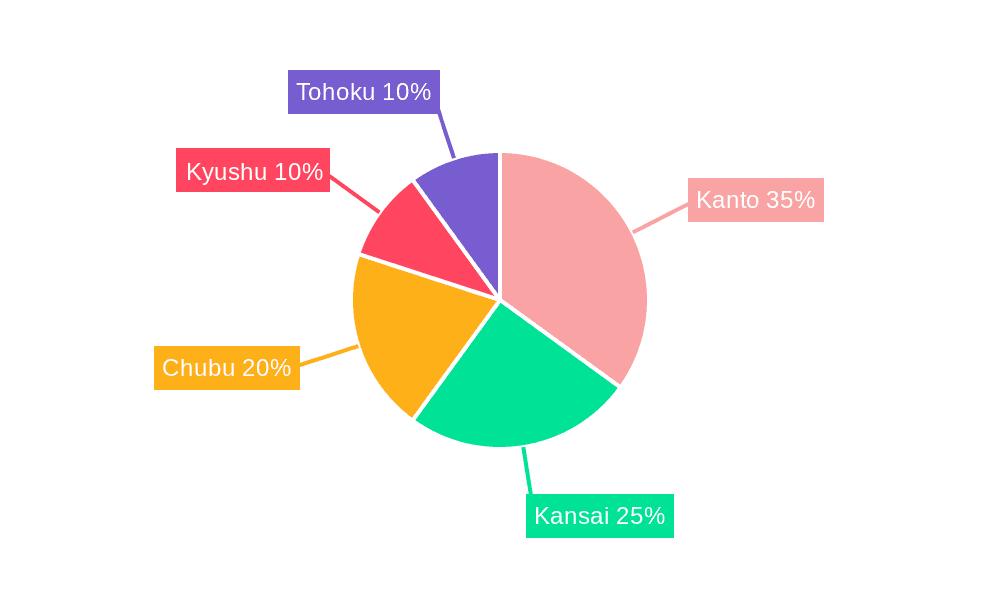

Dominant Regions & Segments in Japan 3PL Pharmaceutical Logistics Market

This section identifies the leading regions and segments within the Japan 3PL pharmaceutical logistics market.

By Service:

- Domestic Transportation Management: This segment dominates due to the high volume of domestic pharmaceutical shipments within Japan. Key drivers include well-established transportation infrastructure and efficient domestic distribution networks.

- International Transportation Management: Growth is fueled by increasing global trade in pharmaceuticals and Japan's role in global pharmaceutical manufacturing and distribution. Challenges include navigating international regulations and maintaining cold chain integrity across borders.

- Value-added Warehousing and Distribution: This segment experiences significant growth due to the need for specialized warehousing facilities, inventory management solutions, and value-added services such as labeling, packaging, and kitting.

By Temperature Control:

- Controlled/Cold Chain Logistics: This segment holds a larger market share due to the temperature-sensitive nature of many pharmaceutical products. Stringent regulatory requirements regarding temperature control during transportation and storage further drive market growth.

- Non-controlled/Non-Cold Chain Logistics: This segment caters to pharmaceuticals that do not require stringent temperature control, resulting in a smaller market share compared to cold chain logistics.

The Kanto region, encompassing Tokyo and surrounding areas, represents the most dominant region due to the concentration of pharmaceutical companies, research institutions, and distribution hubs. This dominance is driven by factors such as robust infrastructure, skilled workforce, and strategic geographic location.

Japan 3PL Pharmaceutical Logistics Market Product Innovations

Recent innovations encompass advancements in temperature-controlled packaging, real-time tracking and monitoring systems, and automated warehouse management systems. These advancements enhance efficiency, improve product safety, and ensure regulatory compliance. The market is witnessing increased adoption of blockchain technology for enhanced supply chain transparency and traceability. These innovations address the growing demand for improved efficiency, enhanced visibility, and robust security within the pharmaceutical supply chain.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation of the Japan 3PL pharmaceutical logistics market by service type (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution) and temperature control (Controlled/Cold Chain Logistics, Non-controlled/Non-Cold Chain Logistics). Each segment is analyzed with regards to market size, growth projections, and competitive dynamics, providing a granular understanding of the market landscape. For example, the cold chain logistics segment is projected to witness robust growth, driven by the increasing demand for temperature-sensitive pharmaceuticals.

Key Drivers of Japan 3PL Pharmaceutical Logistics Market Growth

Several key factors drive the growth of the Japan 3PL pharmaceutical logistics market. These include the increasing demand for pharmaceutical products fueled by an aging population and rising prevalence of chronic diseases. Stringent regulatory requirements necessitate specialized logistics solutions. Technological advancements in cold chain technology, automation, and data analytics are transforming operational efficiency. Government initiatives promoting healthcare infrastructure development are also playing a significant role.

Challenges in the Japan 3PL Pharmaceutical Logistics Market Sector

The market faces challenges such as high infrastructure costs, stringent regulatory compliance requirements, and the complexities associated with managing temperature-sensitive pharmaceutical products. Supply chain disruptions, particularly those arising from natural disasters, pose significant risks. Intense competition and rising labor costs also present obstacles for market participants. The total cost of regulatory compliance is estimated at xx Million annually.

Emerging Opportunities in Japan 3PL Pharmaceutical Logistics Market

Emerging opportunities include the growing adoption of digital technologies, such as IoT and AI, for enhanced supply chain visibility and efficiency. The rise of e-commerce for pharmaceutical products presents new distribution challenges and opportunities. There is also a growing focus on sustainable logistics solutions, driven by environmental concerns. The expansion into niche segments, such as specialized cold chain logistics for biopharmaceuticals, also presents lucrative opportunities.

Leading Players in the Japan 3PL Pharmaceutical Logistics Market Market

- DB Schenker

- DHL Logistics

- Ceva Logistics

- Yusen Logistics

- Nippon Express

- FedEx

- Mitsubishi Logistics

- Kuehne + Nagel

- Kerry Logistics

- Suzuken Group

Key Developments in Japan 3PL Pharmaceutical Logistics Market Industry

- May 2023: Nippon Express acquires Cargo-Partner for up to $1.5 billion, strengthening its global presence.

- December 2022: JCR Pharmaceuticals establishes a European logistics platform in Luxembourg, expanding its international reach.

Future Outlook for Japan 3PL Pharmaceutical Logistics Market Market

The Japan 3PL pharmaceutical logistics market is poised for continued growth, driven by technological advancements, rising demand for pharmaceutical products, and increasing focus on regulatory compliance. Strategic partnerships, investments in innovative technologies, and expansion into niche segments will be key success factors. The market's future potential is significant, with substantial opportunities for growth and expansion in the coming years.

Japan 3PL Pharmaceutical Logistics Market Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. Temperature Control

- 2.1. Controlled/Cold Chain Logistics

- 2.2. Non-controlled/Non-Cold Chain Logistics

Japan 3PL Pharmaceutical Logistics Market Segmentation By Geography

- 1. Japan

Japan 3PL Pharmaceutical Logistics Market Regional Market Share

Geographic Coverage of Japan 3PL Pharmaceutical Logistics Market

Japan 3PL Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Generics drugs market growing in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan 3PL Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Temperature Control

- 5.2.1. Controlled/Cold Chain Logistics

- 5.2.2. Non-controlled/Non-Cold Chain Logistics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceva Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suzuken Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Japan 3PL Pharmaceutical Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan 3PL Pharmaceutical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 3: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 6: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan 3PL Pharmaceutical Logistics Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Japan 3PL Pharmaceutical Logistics Market?

Key companies in the market include DB Schenker, DHL Logistics, Ceva Logistics, Yusen Logistics**List Not Exhaustive, Nippon Express, FedEx, Mitsubishi Logistics, Kuehne + Nagel, Kerry Logistics, Suzuken Group.

3. What are the main segments of the Japan 3PL Pharmaceutical Logistics Market?

The market segments include Service, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Generics drugs market growing in the country.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

May 2023: Nippon Express, the seventh-largest third-party logistics provider in the world by gross revenue, has agreed to acquire Austrian logistics company Cargo-Partner for up to $1.5 billion, advancing its strategy to become a global mega-freight forwarder.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan 3PL Pharmaceutical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan 3PL Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan 3PL Pharmaceutical Logistics Market?

To stay informed about further developments, trends, and reports in the Japan 3PL Pharmaceutical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence