Key Insights

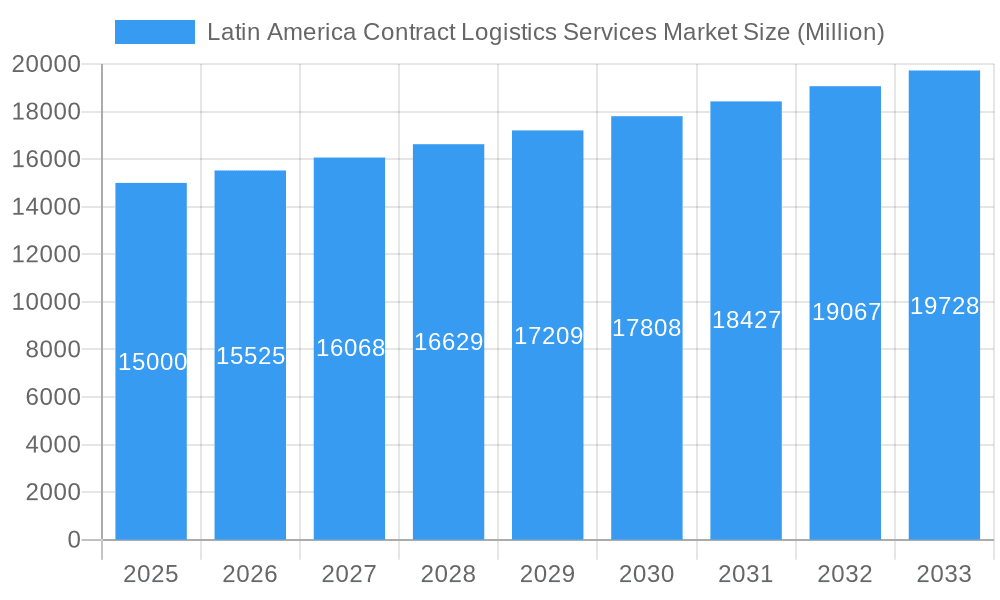

The Latin American contract logistics services market is poised for significant expansion, projected to grow at a compound annual growth rate (CAGR) of 6.34%. This growth is propelled by the escalating adoption of e-commerce, the robust expansion of manufacturing sectors including automotive and food & beverage, and the increasing necessity for optimized supply chain management across diverse geographies. The market size is estimated at $21.5 billion in the base year 2025. Key growth drivers include the rising demand for outsourced logistics solutions to enhance operational efficiency and reduce costs, particularly among small and medium-sized enterprises (SMEs) seeking to leverage external expertise. The industrial machinery and automotive sectors are primary contributors, followed by the food & beverage and chemical industries. Brazil, Mexico, and Argentina currently lead the regional market, with substantial growth anticipated in other Latin American nations as infrastructure development and globalization efforts advance. Potential restraints include currency volatility, regional infrastructure limitations, and regulatory complexities. Nevertheless, sustained investment in technological advancements, such as automation and digitalization, coupled with an increasing emphasis on sustainable and resilient supply chains, indicates a positive long-term outlook through 2033.

Latin America Contract Logistics Services Market Market Size (In Billion)

The competitive environment is dynamic, characterized by the presence of global leaders like DHL, UPS, and FedEx, alongside prominent regional players. While established companies present high barriers to entry, the expanding Latin American economy offers considerable market opportunities. The growing demand for specialized services, such as temperature-controlled logistics for the food & beverage sector and advanced warehousing solutions for industrial applications, presents lucrative avenues for specialized providers. Market segmentation by service type (insourced vs. outsourced) also highlights opportunities for both comprehensive and niche service providers. Detailed analysis of specific sub-segments within each industry and geographic region will further illuminate market dynamics and future growth prospects.

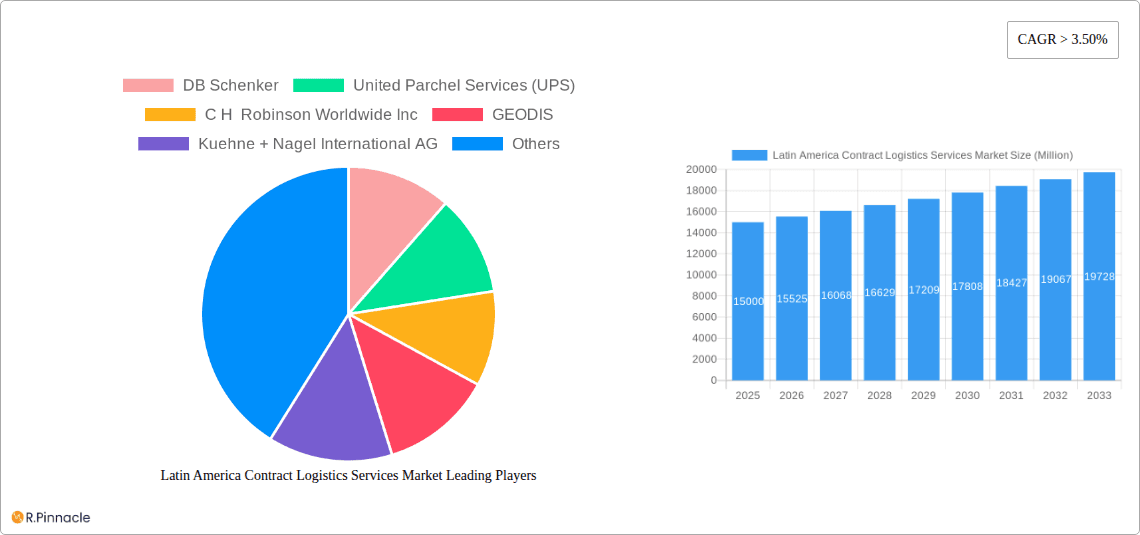

Latin America Contract Logistics Services Market Company Market Share

Latin America Contract Logistics Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America Contract Logistics Services market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and growth opportunities across various segments. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Latin America Contract Logistics Services Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Latin American contract logistics services market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities.

The market exhibits a moderately concentrated structure, with key players like DB Schenker, United Parcel Service (UPS), C.H. Robinson Worldwide Inc., GEODIS, Kuehne + Nagel International AG, FedEx, CEVA Logistics, DHL Supply Chain, Penske Logistics, DSV, and other significant players holding substantial market share. Precise market share data for individual players is unavailable for this report and requires further research. However, industry estimations suggest a combined market share of approximately xx% for the top 10 players in 2025.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Drivers: Technological advancements in supply chain management software, automation, and data analytics.

- Regulatory Frameworks: Varying regulations across Latin American countries impacting operational efficiency and compliance.

- Product Substitutes: Limited direct substitutes, but alternative transportation modes and in-house logistics solutions pose indirect competition.

- End-User Demographics: Growth primarily driven by industrial machinery & automotive, food & beverage, and chemical sectors.

- M&A Activities: Significant M&A activity observed in recent years, with deal values totaling approximately xx Million in the past five years (2019-2024). Specific deal details are beyond the scope of this report.

Latin America Contract Logistics Services Market Dynamics & Trends

This section delves into the key dynamics shaping the Latin American contract logistics services market. The market's growth is fueled by several factors, including the expanding e-commerce sector, increasing cross-border trade, and the growing need for efficient supply chain management within diverse industries.

Technological disruptions, such as the adoption of automation, AI, and blockchain technology, are transforming logistics operations, leading to increased efficiency, cost optimization, and improved transparency. Consumer preferences are shifting towards faster delivery times and enhanced tracking capabilities, pressuring companies to adopt innovative logistics solutions. Competitive dynamics are characterized by intense rivalry among established players and emerging startups, fostering innovation and driving down prices. Market penetration rates vary widely across countries and segments, with higher penetration in more developed economies and industries with higher logistics intensity.

Dominant Regions & Segments in Latin America Contract Logistics Services Market

This section delves into the leading regions, countries, and segments that are shaping the Latin American contract logistics services market, highlighting key contributing factors to their prominence.

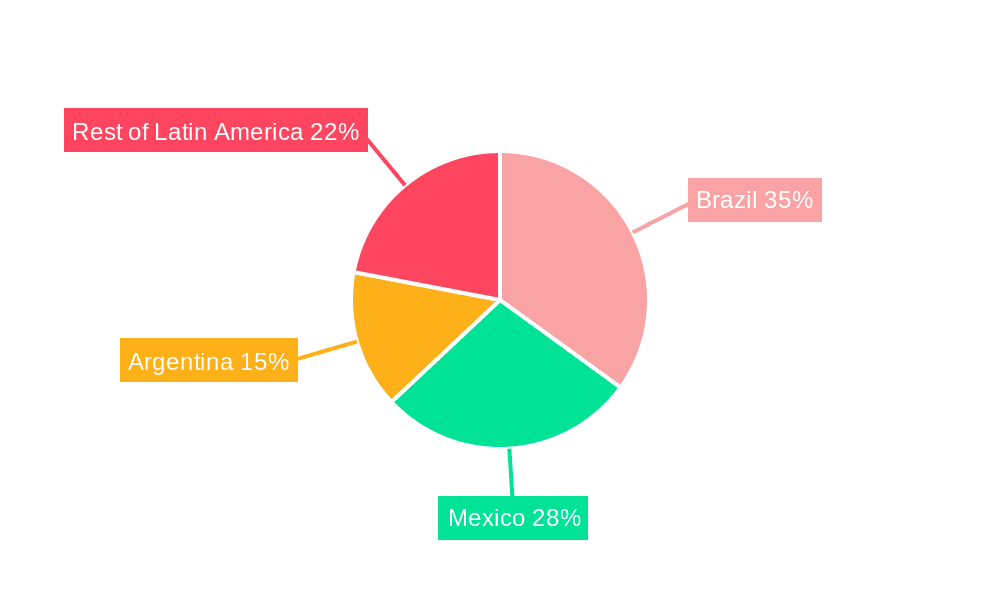

Dominant Region/Country: Brazil stands as the current market leader, propelled by its substantial economy and a well-established, diverse industrial base. Mexico closely follows, benefiting significantly from its strategic geographical proximity to the United States market and its robust manufacturing sector, particularly in sectors serving North American demand.

Dominant Segments:

- By Type: Outsourced contract logistics services represent the dominant segment. This trend is fueled by an increasing number of companies strategically choosing to delegate non-core operational functions to specialized, expert third-party logistics (3PL) providers, allowing them to focus on their core competencies and achieve greater operational efficiency.

- By End User: The industrial machinery & automotive sector remains a pivotal driver, exhibiting a high demand for sophisticated and tailored logistics solutions to manage the inherent complexities of their global and regional supply chains. Concurrently, the food and beverage industry is demonstrating significant growth potential, driven by expanding consumer bases and evolving distribution needs.

Key Drivers of Regional/Segment Dominance:

- Brazil: Sustained economic growth, a powerful and expanding manufacturing sector, substantial investments in infrastructure development, and a large, dynamic consumer market are key pillars of Brazil's dominance.

- Mexico: Its advantageous proximity to the US market, continuous growth in manufacturing activities, and a well-developed and continuously improving logistics infrastructure are crucial factors behind its strong performance.

- Industrial Machinery & Automotive: The intricate nature of their supply chains, which often involve the movement of large, specialized, and high-value components, necessitates highly specialized and reliable logistics services, thus driving demand in this segment.

- Food & Beverage: Escalating consumer demand, the imperative adherence to stringent quality and safety regulations, and the critical need for efficient, temperature-controlled transportation solutions throughout the supply chain are driving growth and innovation in this vital sector.

Latin America Contract Logistics Services Market Product Innovations

The Latin American contract logistics services market is witnessing a wave of transformative product and service innovations. These advancements are primarily centered around enhancing operational efficiency, improving supply chain visibility, and elevating customer satisfaction. Notable innovations include the widespread deployment of advanced Warehouse Management Systems (WMS) that optimize inventory control and streamline warehouse operations. Furthermore, the integration of Internet of Things (IoT) devices is revolutionizing real-time tracking of goods, providing unprecedented transparency across the supply chain. The adoption of Automated Guided Vehicles (AGVs) and other robotic solutions is significantly boosting warehouse productivity and reducing human error. The market fit for these innovations is exceptionally high, as businesses across Latin America are actively seeking to optimize their logistics operations, reduce costs, and ultimately enhance their competitive edge by delivering faster and more reliable services to their end customers.

Report Scope & Segmentation Analysis

This report segments the Latin American contract logistics services market by type (insourced and outsourced) and by end-user (industrial machinery and automotive, food and beverage, chemicals, and other end users). Growth projections vary significantly across segments, with outsourced services expected to exhibit faster growth than insourced solutions. Market sizes are calculated based on revenue generated, with substantial variations across segments and regions. Competitive dynamics are influenced by factors like the level of market concentration, technological advancements, and regulatory changes.

Key Drivers of Latin America Contract Logistics Services Market Growth

The Latin American contract logistics services market is experiencing robust growth, propelled by a confluence of powerful market forces. The unprecedented expansion of e-commerce is a primary catalyst, creating a surge in demand for efficient last-mile delivery and sophisticated warehousing solutions. Increasing cross-border trade, facilitated by evolving trade agreements and economic integration, further fuels the need for specialized international logistics services. Across various industries, there is a rising demand for integrated and efficient supply chain solutions that can manage complexity and drive cost savings. Technological advancements, particularly in the realms of automation, artificial intelligence (AI), and advanced data analytics, are enabling logistics providers to offer more intelligent and predictive services. Moreover, supportive government initiatives focused on infrastructure development, such as improvements in ports, roads, and rail networks, along with policies promoting trade liberalization, are creating a more conducive environment for market expansion.

Challenges in the Latin America Contract Logistics Services Market Sector

The Latin American contract logistics services market faces several challenges, including infrastructure limitations in certain regions, inconsistent regulatory frameworks across countries, security concerns, and fluctuating fuel prices. These factors can increase operational costs, delay delivery times, and impact overall market growth.

Emerging Opportunities in Latin America Contract Logistics Services Market

The Latin American contract logistics services market is ripe with emerging opportunities, offering significant avenues for growth and development. The continued proliferation of e-commerce presents ongoing demand for innovative fulfillment, last-mile delivery, and reverse logistics solutions. There is a burgeoning demand for highly specialized logistics services, particularly in areas such as temperature-controlled transportation for perishables and pharmaceuticals, and hazardous materials handling, driven by evolving industry needs and stricter regulations. The strategic adoption of cutting-edge technologies like Artificial Intelligence (AI) for predictive analytics and route optimization, and blockchain for enhanced transparency and security in supply chains, represents a significant area for innovation and service differentiation. Furthermore, less developed regions within Latin America, often characterized by nascent logistics infrastructure, present substantial untapped market potential for companies willing to invest in establishing robust service offerings and building foundational infrastructure.

Leading Players in the Latin America Contract Logistics Services Market Market

Key Developments in Latin America Contract Logistics Services Market Industry

- January 2023: DHL announces expansion of its warehousing facilities in Brazil.

- June 2022: UPS invests in new technology for improved tracking and delivery in Mexico.

- October 2021: DB Schenker partners with a local company to improve its last-mile delivery network in Colombia. (Further details require additional research)

Future Outlook for Latin America Contract Logistics Services Market Market

The future of the Latin American contract logistics services market looks promising, driven by continuous economic growth, infrastructure development, and technological advancements. Strategic partnerships, expansion into new markets, and the adoption of innovative logistics solutions will be key to success in this dynamic market. The market is poised for significant expansion, presenting lucrative opportunities for both established players and new entrants.

Latin America Contract Logistics Services Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Industrial Machinery and Automotive

- 2.2. Food and Beverage

- 2.3. Chemicals

- 2.4. Other End Users

-

3. Geography

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Colombia

- 3.4. Chile

- 3.5. Rest of Latin America

Latin America Contract Logistics Services Market Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Chile

- 5. Rest of Latin America

Latin America Contract Logistics Services Market Regional Market Share

Geographic Coverage of Latin America Contract Logistics Services Market

Latin America Contract Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. Growth in the Automotive Sector is Spearheading the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Industrial Machinery and Automotive

- 5.2.2. Food and Beverage

- 5.2.3. Chemicals

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Mexico Latin America Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insourced

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Industrial Machinery and Automotive

- 6.2.2. Food and Beverage

- 6.2.3. Chemicals

- 6.2.4. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Mexico

- 6.3.2. Brazil

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil Latin America Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insourced

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Industrial Machinery and Automotive

- 7.2.2. Food and Beverage

- 7.2.3. Chemicals

- 7.2.4. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Mexico

- 7.3.2. Brazil

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia Latin America Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insourced

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Industrial Machinery and Automotive

- 8.2.2. Food and Beverage

- 8.2.3. Chemicals

- 8.2.4. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Mexico

- 8.3.2. Brazil

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Chile Latin America Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Insourced

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Industrial Machinery and Automotive

- 9.2.2. Food and Beverage

- 9.2.3. Chemicals

- 9.2.4. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Mexico

- 9.3.2. Brazil

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Latin America Latin America Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Insourced

- 10.1.2. Outsourced

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Industrial Machinery and Automotive

- 10.2.2. Food and Beverage

- 10.2.3. Chemicals

- 10.2.4. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Mexico

- 10.3.2. Brazil

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Parchel Services (UPS)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 C H Robinson Worldwide Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEODIS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kuehne + Nagel International AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FedEx

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CEVA Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DHL Supply Chain

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Penske Logistics**List Not Exhaustive 6 3 Other Companies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DSV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Latin America Contract Logistics Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Contract Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Contract Logistics Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Latin America Contract Logistics Services Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Latin America Contract Logistics Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin America Contract Logistics Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Contract Logistics Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Latin America Contract Logistics Services Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Latin America Contract Logistics Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Latin America Contract Logistics Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Latin America Contract Logistics Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Latin America Contract Logistics Services Market Revenue billion Forecast, by End User 2020 & 2033

- Table 11: Latin America Contract Logistics Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Latin America Contract Logistics Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Latin America Contract Logistics Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Latin America Contract Logistics Services Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Latin America Contract Logistics Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Latin America Contract Logistics Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Latin America Contract Logistics Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Latin America Contract Logistics Services Market Revenue billion Forecast, by End User 2020 & 2033

- Table 19: Latin America Contract Logistics Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Contract Logistics Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Contract Logistics Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Latin America Contract Logistics Services Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Latin America Contract Logistics Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Latin America Contract Logistics Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Contract Logistics Services Market?

The projected CAGR is approximately 6.34%.

2. Which companies are prominent players in the Latin America Contract Logistics Services Market?

Key companies in the market include DB Schenker, United Parchel Services (UPS), C H Robinson Worldwide Inc, GEODIS, Kuehne + Nagel International AG, FedEx, CEVA Logistics, DHL Supply Chain, Penske Logistics**List Not Exhaustive 6 3 Other Companies, DSV.

3. What are the main segments of the Latin America Contract Logistics Services Market?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

Growth in the Automotive Sector is Spearheading the Market.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Contract Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Contract Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Contract Logistics Services Market?

To stay informed about further developments, trends, and reports in the Latin America Contract Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence