Key Insights

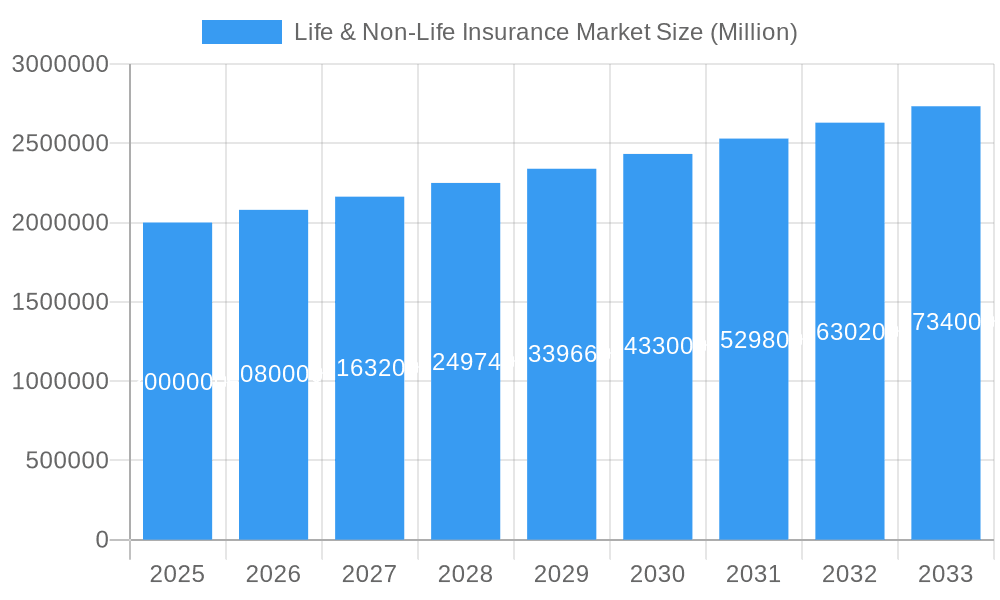

The global Life & Non-Life Insurance market is experiencing robust growth, driven by factors such as increasing health consciousness, rising disposable incomes, and expanding regulatory frameworks promoting financial inclusion. The period from 2019 to 2024 witnessed significant expansion, setting the stage for continued growth projected through 2033. While precise market size figures for 2019-2024 are not provided, considering a typical CAGR for this sector (let's assume a conservative 5% for illustrative purposes), and a 2025 market size (we'll assume $2 trillion for the sake of this example), we can infer a substantial increase over the historical period. This growth is further fueled by the adoption of innovative technologies like Insurtech, which streamlines processes, enhances customer experience, and opens up new avenues for market penetration in underserved regions. The aging global population also contributes significantly to the demand for life insurance products, particularly those catering to long-term care and retirement planning.

Life & Non-Life Insurance Market Market Size (In Million)

The forecast period (2025-2033) is expected to see continued expansion, albeit potentially at a slightly moderated CAGR (let's assume 4% for the forecast period). This moderation might stem from market saturation in some developed regions and increased competition. However, emerging markets present significant untapped potential, driving further growth. The diversification of product offerings, including micro-insurance and customized policies, will be key to capturing this potential. The industry will continue to face challenges such as regulatory changes, economic fluctuations, and the need for effective risk management, necessitating continuous adaptation and innovation to maintain sustainable growth.

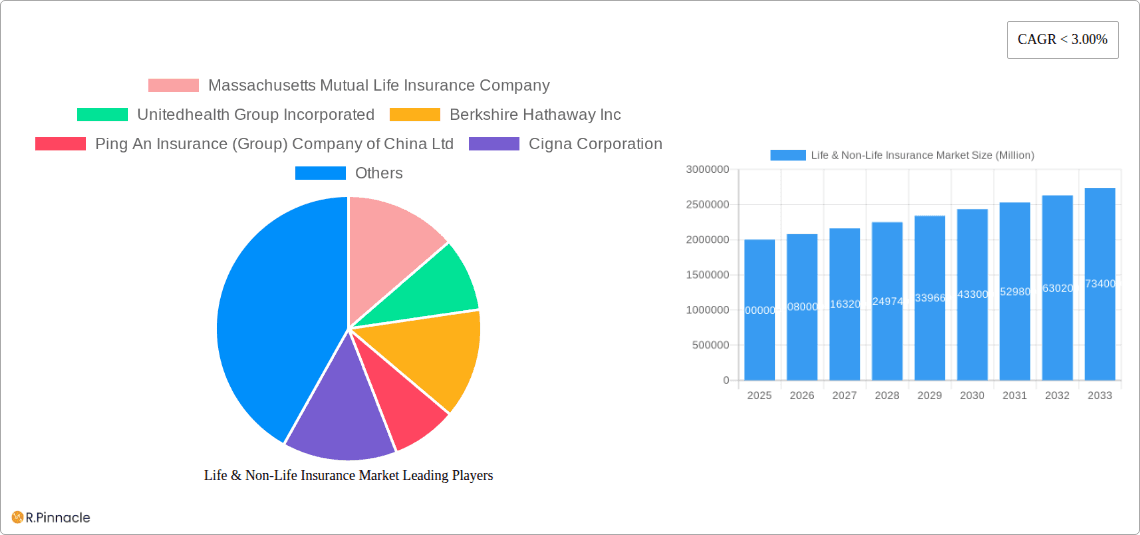

Life & Non-Life Insurance Market Company Market Share

Life & Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Life & Non-Life Insurance market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages rigorous data analysis to illuminate market trends, challenges, and opportunities. The study encompasses a detailed examination of key players, including Massachusetts Mutual Life Insurance Company, UnitedHealth Group Incorporated, Berkshire Hathaway Inc, Ping An Insurance (Group) Company of China Ltd, Cigna Corporation, CHINA LIFE INSURANCE COMPANY LIMITED, Anthem Inc, AETNA HEALTH INSURANCE (THAILAND) PUBLIC COMPANY LIMITED, The People's Insurance Company (Group) of China Limited, and NIPPON LIFE INSURANCE COMPANY, among others.

Life & Non-Life Insurance Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key trends shaping its evolution. We examine market concentration, identifying the leading players and their respective market shares. The report also delves into innovation drivers, including technological advancements and regulatory changes, assessing their impact on product development and market dynamics. Furthermore, the analysis explores the influence of mergers and acquisitions (M&A) activities, quantifying deal values and their implications for market consolidation. Finally, we examine end-user demographics and their evolving insurance needs.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 5 players controlling an estimated xx% of the global market share in 2025.

- M&A Activity: The period 2019-2024 witnessed significant M&A activity, with total deal values exceeding $xx Million. These transactions reflect strategic consolidation and expansion efforts among key players.

- Innovation Drivers: Technological advancements such as AI, big data analytics, and Insurtech solutions are driving innovation in product offerings and service delivery. Regulatory changes are also influencing product design and distribution strategies.

- Regulatory Frameworks: Varying regulatory landscapes across different geographies significantly influence market dynamics and competitive strategies.

Life & Non-Life Insurance Market Dynamics & Trends

This section provides a detailed analysis of the key factors driving market growth, including economic expansion, rising consumer awareness, and evolving demographics. The report also explores the impact of technological disruptions, such as the rise of Insurtech platforms and digital distribution channels, on market dynamics. Consumer preferences, particularly the increasing demand for personalized and customized insurance solutions, are examined in detail. Competitive dynamics, including pricing strategies, product differentiation, and brand positioning, are also analyzed to understand the competitive landscape. The CAGR for the forecast period (2025-2033) is estimated to be xx%, with market penetration expected to reach xx% by 2033.

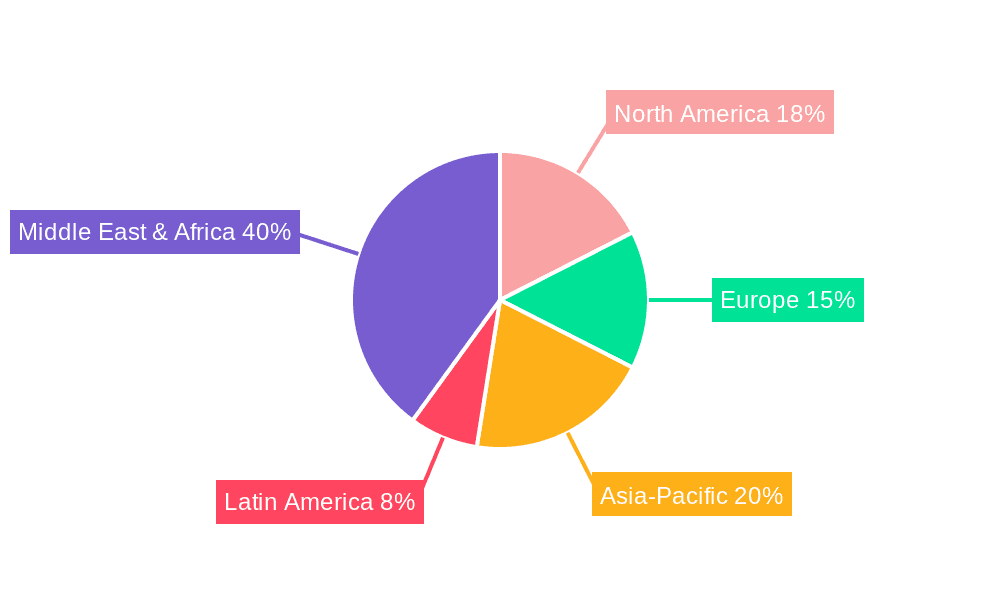

Dominant Regions & Segments in Life & Non-Life Insurance Market

This section identifies the leading regions and segments within the Life & Non-Life Insurance market. A detailed dominance analysis is presented, explaining the factors contributing to the success of these regions and segments.

Leading Region/Segment: [Insert leading region/segment – e.g., North America's life insurance segment] dominates the market due to [reasons – e.g., high per capita income, robust regulatory environment, well-developed insurance infrastructure].

Key Drivers (Bullet Points):

- Strong economic growth

- Favorable demographic trends

- Government support and initiatives

- Advanced technological infrastructure

Life & Non-Life Insurance Market Product Innovations

Recent product developments reflect a strong focus on leveraging technology to enhance customer experience, personalize offerings, and improve operational efficiency. The integration of AI and big data analytics allows for more accurate risk assessment and personalized pricing, while the rise of Insurtech platforms provides new avenues for product distribution and customer engagement. These innovations are proving to be significant competitive advantages, enabling insurers to capture market share and enhance profitability.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the Life & Non-Life Insurance market based on [mention specific segmentation criteria, e.g., product type, distribution channel, customer demographics]. Each segment's market size, growth projections, and competitive dynamics are analyzed separately. [Include a paragraph summarizing each segment's market size, growth rate, and competitive landscape for each segment].

Key Drivers of Life & Non-Life Insurance Market Growth

The Life & Non-Life Insurance market is experiencing robust growth driven by several factors. Technological advancements, such as AI-powered risk assessment and personalized insurance products, are streamlining operations and enhancing customer experiences. Economic expansion in emerging markets is driving increased insurance penetration, while favorable regulatory frameworks are promoting market growth.

Challenges in the Life & Non-Life Insurance Market Sector

The industry faces significant challenges, including stringent regulatory compliance requirements that increase operational costs and complexity. Supply chain disruptions and volatile economic conditions can also impact profitability. Intense competition among established players and the emergence of Insurtech disruptors pose further challenges. These factors can collectively impact market growth and profitability.

Emerging Opportunities in Life & Non-Life Insurance Market

Several emerging trends offer significant opportunities for growth. The expansion of insurance coverage into underserved markets presents a considerable market expansion potential. Technological innovations, such as blockchain and IoT, are creating new opportunities for product development and risk management. The increasing demand for personalized and customized insurance products provides an opportunity to cater to evolving consumer preferences.

Leading Players in the Life & Non-Life Insurance Market Market

- Massachusetts Mutual Life Insurance Company

- UnitedHealth Group Incorporated

- Berkshire Hathaway Inc

- Ping An Insurance (Group) Company of China Ltd

- Cigna Corporation

- CHINA LIFE INSURANCE COMPANY LIMITED

- Anthem Inc

- AETNA HEALTH INSURANCE (THAILAND) PUBLIC COMPANY LIMITED

- The People's Insurance Company (Group) of China Limited

- NIPPON LIFE INSURANCE COMPANY

Key Developments in Life & Non-Life Insurance Market Industry

- [Month, Year]: [Description of key development and its impact, e.g., Launch of a new AI-powered claims processing system by Company X, resulting in a 15% reduction in processing time].

- [Month, Year]: [Description of key development and its impact].

- [Month, Year]: [Description of key development and its impact].

- [Month, Year]: [Description of key development and its impact].

Future Outlook for Life & Non-Life Insurance Market Market

The Life & Non-Life Insurance market is poised for continued growth, driven by technological advancements, expanding insurance penetration in developing economies, and the increasing demand for personalized insurance products. Strategic partnerships, mergers and acquisitions, and investments in innovative technologies will shape the future competitive landscape. The market's potential for growth remains significant, offering promising opportunities for players who can adapt to evolving market dynamics and capitalize on emerging trends.

Life & Non-Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. channel of distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

Life & Non-Life Insurance Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of NA

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of NA

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of AP

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest

Life & Non-Life Insurance Market Regional Market Share

Geographic Coverage of Life & Non-Life Insurance Market

Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Global M&A Activity in Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by channel of distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-Life Insurance

- 6.1.2.1. Home

- 6.1.2.2. Motor

- 6.1.2.3. Others

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by channel of distribution

- 6.2.1. Direct

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. Europe Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-Life Insurance

- 7.1.2.1. Home

- 7.1.2.2. Motor

- 7.1.2.3. Others

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by channel of distribution

- 7.2.1. Direct

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Asia Pacific Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-Life Insurance

- 8.1.2.1. Home

- 8.1.2.2. Motor

- 8.1.2.3. Others

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by channel of distribution

- 8.2.1. Direct

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. South America Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-Life Insurance

- 9.1.2.1. Home

- 9.1.2.2. Motor

- 9.1.2.3. Others

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by channel of distribution

- 9.2.1. Direct

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Middle East Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-Life Insurance

- 10.1.2.1. Home

- 10.1.2.2. Motor

- 10.1.2.3. Others

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by channel of distribution

- 10.2.1. Direct

- 10.2.2. Agency

- 10.2.3. Banks

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Massachusetts Mutual Life Insurance Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unitedhealth Group Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Berkshire Hathaway Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ping An Insurance (Group) Company of China Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cigna Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CHINA LIFE INSURANCE COMPANY LIMITED

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Anthem Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AETNA HEALTH INSURANCE (THAILAND) PUBLIC COMPANY LIMITED

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The People's Insurance Company (Group) of China Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NIPPON LIFE INSURANCE COMPANY*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Massachusetts Mutual Life Insurance Company

List of Figures

- Figure 1: Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Life & Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2020 & 2033

- Table 3: Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 5: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2020 & 2033

- Table 6: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: US Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of NA Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 12: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2020 & 2033

- Table 13: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: UK Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of NA Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 21: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2020 & 2033

- Table 22: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: India Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: China Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of AP Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 28: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2020 & 2033

- Table 29: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 33: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2020 & 2033

- Table 34: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: UAE Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Saudi Arabia Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life & Non-Life Insurance Market?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Life & Non-Life Insurance Market?

Key companies in the market include Massachusetts Mutual Life Insurance Company, Unitedhealth Group Incorporated, Berkshire Hathaway Inc, Ping An Insurance (Group) Company of China Ltd, Cigna Corporation, CHINA LIFE INSURANCE COMPANY LIMITED, Anthem Inc, AETNA HEALTH INSURANCE (THAILAND) PUBLIC COMPANY LIMITED, The People's Insurance Company (Group) of China Limited, NIPPON LIFE INSURANCE COMPANY*List Not Exhaustive.

3. What are the main segments of the Life & Non-Life Insurance Market?

The market segments include Insurance Type, channel of distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Global M&A Activity in Insurance Industry:.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence