Key Insights

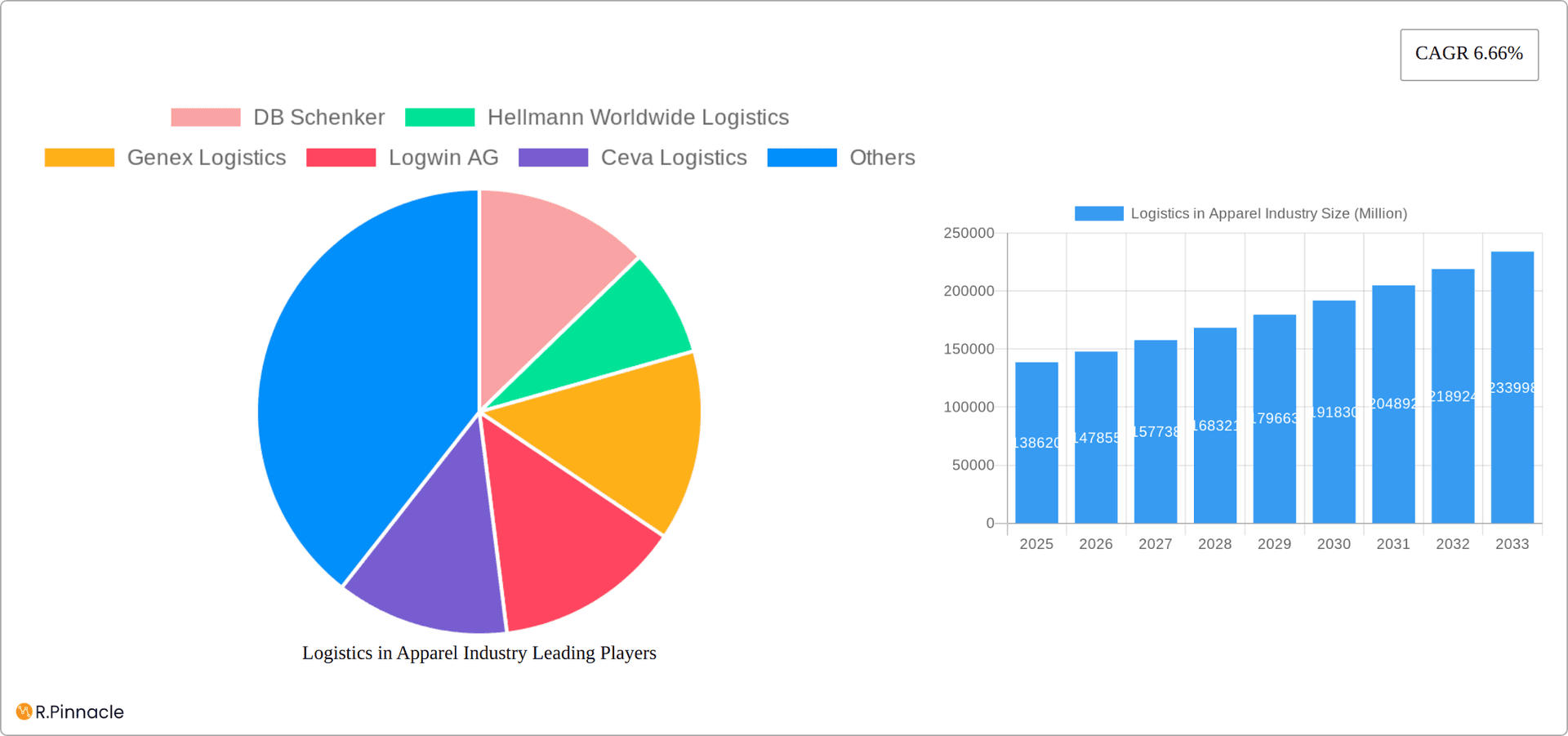

The global logistics market for the apparel industry, valued at $138.62 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.66% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of e-commerce and the resulting surge in demand for faster and more efficient delivery significantly fuels market growth. Furthermore, the growing preference for omnichannel retail strategies necessitates sophisticated logistics solutions capable of handling diverse distribution channels and order fulfillment complexities. Globalization and the expansion of international apparel brands contribute to the increasing need for reliable and cost-effective cross-border logistics services. Finally, technological advancements, such as the implementation of warehouse management systems (WMS), transportation management systems (TMS), and advanced analytics, are optimizing supply chain efficiency and transparency, further bolstering market growth.

Logistics in Apparel Industry Market Size (In Billion)

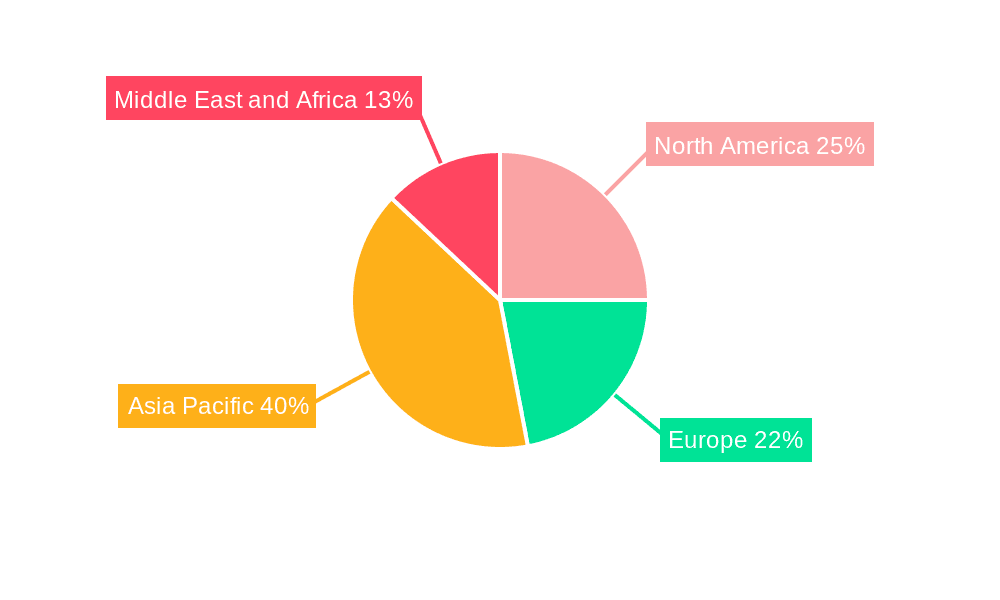

Significant regional variations exist within the market. Asia-Pacific, driven by robust manufacturing and consumption in countries like China, India, and Japan, holds a substantial market share. North America and Europe also contribute significantly, with strong established apparel industries and sophisticated logistics networks. However, emerging markets in the Middle East and Africa are expected to witness considerable growth due to increasing apparel consumption and infrastructural development. The market is segmented by service type, with transportation, warehousing, and inventory management constituting the largest segment. Other value-added services, encompassing activities like labeling, packaging, and quality control, are also experiencing notable growth, reflecting the increasing focus on end-to-end supply chain management within the apparel sector. Key players in the market include established global logistics providers such as DHL, DSV, and Expeditors, alongside specialized apparel logistics companies. Competition is intense, with companies vying to offer innovative solutions and enhance their service offerings to meet the evolving demands of apparel brands and retailers.

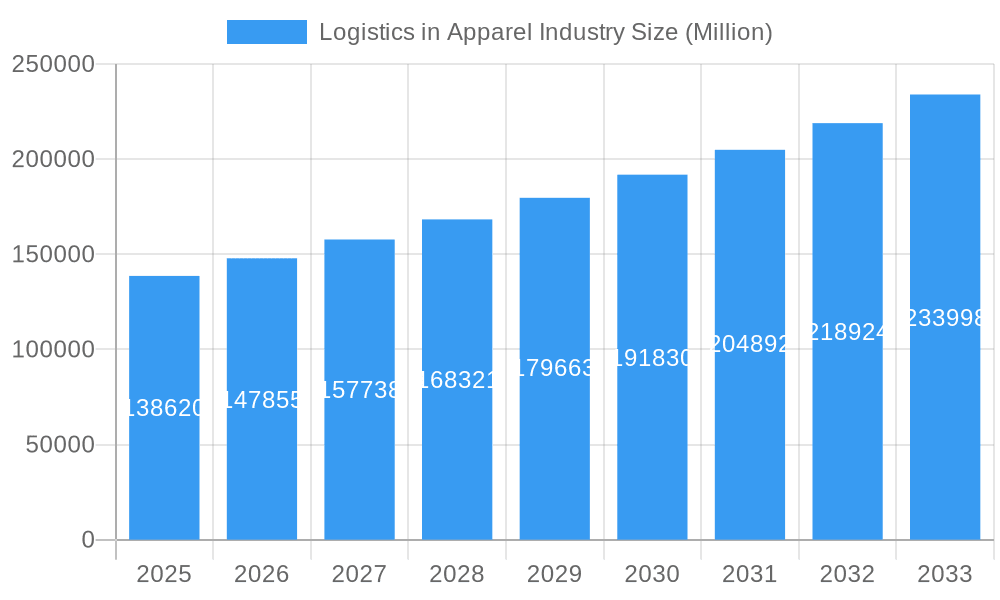

Logistics in Apparel Industry Company Market Share

Logistics in Apparel Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the global logistics in apparel industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities. The market is segmented by service type: Transportation, Warehousing and Inventory Management, and Other Value-Added Services. The report projects a market value exceeding $XX Million by 2033, showcasing significant growth potential.

Logistics in Apparel Industry Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players and their market share. The report examines innovation drivers, including technological advancements and evolving consumer preferences, impacting the $XX Million market. It also delves into regulatory frameworks, the presence of product substitutes, end-user demographics, and the impact of mergers and acquisitions (M&A) activities. The analysis includes metrics such as market share percentages and M&A deal values, revealing the dynamic nature of this $XX Million industry. For instance, the report will detail how the significant M&A activity of the past few years has reshaped the competitive landscape, with deals valued at $XX Million influencing market consolidation and innovation strategies. The influence of regulatory changes on supply chain efficiency and sustainability initiatives will also be explored, along with an in-depth look at the growing demand for sustainable and ethical logistics solutions.

- Market Concentration: Analysis of market share distribution among key players.

- Innovation Drivers: Technological advancements driving efficiency and sustainability.

- Regulatory Frameworks: Impact of government policies on industry operations.

- Product Substitutes: Examination of alternative solutions and their market penetration.

- End-User Demographics: Analysis of consumer trends and their influence on logistics needs.

- M&A Activities: Review of major mergers and acquisitions and their impact on market structure.

Logistics in Apparel Industry Market Dynamics & Trends

This section provides a detailed analysis of the market dynamics shaping the apparel logistics industry. Growth drivers like e-commerce expansion and globalization are explored, alongside technological disruptions such as automation and AI, impacting the $XX Million market. The report assesses shifting consumer preferences towards faster delivery and sustainable practices, and analyzes competitive dynamics among key players. Key performance indicators (KPIs) such as CAGR and market penetration rates will illustrate the rapid pace of industry transformation. The analysis also examines the impact of macroeconomic factors, such as economic growth and fluctuating fuel prices, on market growth trajectories. Furthermore, the increasing importance of supply chain resilience and risk mitigation strategies will be highlighted, given the vulnerability of the apparel industry to global disruptions. The report projects a CAGR of XX% for the forecast period, driven by these dynamic forces.

Dominant Regions & Segments in Logistics in Apparel Industry

The apparel logistics market, valued at $XX Million, is characterized by distinct regional and segmental dominance. This section provides a detailed analysis of the factors driving this concentration, including economic policies, infrastructure development, evolving consumer behavior, and the rise of e-commerce. We examine the interplay between these factors and their influence on market share and growth trajectories within specific geographic areas and service types. The analysis delves into both macro-economic trends and micro-level operational efficiencies that contribute to market leadership.

- Leading Region/Country: This analysis goes beyond simple market size figures to explore the underlying reasons for a region's or country's leadership. We investigate factors such as proximity to manufacturing hubs, access to advanced infrastructure, skilled labor pools, and favorable government regulations that contribute to its dominance in apparel logistics. Specific examples and case studies will illustrate these key contributing factors.

- Dominant Segment (By Service): A deep dive into the performance of Transportation, Warehousing & Inventory Management, and Other Value-Added Services, identifying the key players and growth drivers within each.

- Transportation: A granular analysis of road, rail, sea, and air freight, considering factors like cost-effectiveness, speed, reliability, and environmental impact in the context of the apparel industry's specific needs. Emerging transportation models like last-mile delivery optimization will also be examined.

- Warehousing & Inventory Management: This section will focus not only on automated warehousing technologies but also on the broader strategies for inventory optimization, including demand forecasting, efficient order fulfillment, and effective warehouse layout design, all within the context of the fast-paced fashion industry.

- Other Value-Added Services: Beyond basic logistics, we explore the growing importance of customized services like last-mile delivery solutions tailored to the apparel sector, efficient reverse logistics for returns and repairs, and sophisticated labeling and tagging services for enhanced traceability and brand protection.

- Key Drivers: This section presents a comprehensive overview of economic policies (e.g., free trade agreements, tax incentives), infrastructure development (e.g., port modernization, improved road networks), technological advancements (e.g., automation, AI), and consumer trends (e.g., e-commerce growth, fast fashion) that are shaping the landscape of apparel logistics. The interplay between these drivers will be carefully considered.

Logistics in Apparel Industry Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in apparel logistics, focusing on technological advancements and their impact on market fit within the $XX Million market. The integration of technologies like AI-powered route optimization, blockchain for enhanced transparency, and RFID for improved inventory tracking are highlighted. Emphasis will be placed on how these innovations are creating new efficiencies, reducing costs, and improving overall supply chain visibility.

Report Scope & Segmentation Analysis

This report covers the entire value chain of the apparel logistics industry, segmented by service type: Transportation, Warehousing and Inventory Management, and Other Value-Added Services. Each segment is analyzed with respect to its growth projections, market size, and competitive dynamics within the $XX Million market. The report provides a detailed understanding of the market structure and the interplay between different segments. Market size and growth projections are provided for each segment.

Key Drivers of Logistics in Apparel Industry Growth

Several factors contribute to the growth of the apparel logistics industry, including technological advancements (automation, AI, and data analytics), economic growth in emerging markets, and supportive government regulations (tax incentives, infrastructure investments). These factors are intertwined, creating a synergistic effect that fuels market expansion within the $XX Million market.

Challenges in the Logistics in Apparel Industry Sector

The apparel logistics sector faces challenges such as regulatory hurdles (customs compliance, trade restrictions), supply chain disruptions (natural disasters, geopolitical instability), and intense competitive pressures (price wars, capacity constraints). These challenges can significantly impact operational efficiency and profitability, creating a need for adaptable and resilient strategies within the $XX Million market. The report quantifies the impact of these challenges on market growth.

Emerging Opportunities in Logistics in Apparel Industry

Emerging opportunities abound in the apparel logistics industry, including the expansion into new markets (e-commerce growth in developing countries), the adoption of innovative technologies (blockchain for traceability, drone delivery), and a growing focus on sustainable and ethical practices (reducing carbon emissions, promoting fair labor). These opportunities represent significant potential for growth and innovation within the $XX Million market.

Leading Players in the Logistics in Apparel Industry Market

- DB Schenker

- Hellmann Worldwide Logistics

- Genex Logistics

- Logwin AG

- Ceva Logistics

- Nippon Express

- PVS Fulfillment-Service GmbH

- Apparel Logistics Group Inc

- Agility Logistics

- Deutsche Post DHL Group

- Bollore Logistics

- BGROUP SRL

- GAC Group

- DSV

- Expeditors International of Washington Inc

Key Developments in Logistics in Apparel Industry Industry

- November 2021: DHL sponsored a stage of Tokyo Girls Collection (TGC) for the first time, partnering with FASBEE to facilitate global e-commerce sales of showcased apparel. This highlights the growing integration of logistics and fashion marketing.

- November 2021: DSV and New Balance expanded their partnership, tripling the volume stored and distributed through a new, automated 60,000 sq. m warehouse facility. This demonstrates the increasing demand for efficient and scalable warehousing solutions in the apparel industry.

Future Outlook for Logistics in Apparel Industry Market

The future of apparel logistics is bright, driven by continued e-commerce growth, technological advancements, and a growing emphasis on sustainability. Strategic opportunities exist for companies that can adapt to evolving consumer preferences, leverage technological innovations, and build resilient supply chains. The $XX Million market is poised for sustained growth and transformation in the coming years.

Logistics in Apparel Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing, and Inventory Management

- 1.3. Other Value-added Services

Logistics in Apparel Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. South Korea

- 1.5. ASEAN

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Brazil

- 2.4. Mexico

- 2.5. Rest of Americas

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. Italy

- 3.4. Spain

- 3.5. France

- 3.6. Rest of Europe

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

Logistics in Apparel Industry Regional Market Share

Geographic Coverage of Logistics in Apparel Industry

Logistics in Apparel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of online apparel sales; The demand for faster delivery and quicker time to market

- 3.3. Market Restrains

- 3.3.1. Highly perishable fashion trends; High cost of technology and infrastructure

- 3.4. Market Trends

- 3.4.1. Growing Online Apparel Sales and Changing Consumer Behavior

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics in Apparel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing, and Inventory Management

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Logistics in Apparel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing, and Inventory Management

- 6.1.3. Other Value-added Services

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. North America Logistics in Apparel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing, and Inventory Management

- 7.1.3. Other Value-added Services

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Logistics in Apparel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing, and Inventory Management

- 8.1.3. Other Value-added Services

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Logistics in Apparel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing, and Inventory Management

- 9.1.3. Other Value-added Services

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 DB Schenker

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hellmann Worldwide Logistics

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Genex Logistics

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Logwin AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ceva Logistics

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nippon Express

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PVS Fulfillment-Service GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Apparel Logistics Group Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Agility Logistics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Deutsche Post DHL Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bollore Logistics

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 BGROUP SRL**List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 GAC Group

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 DSV

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Expeditors International of Washington Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 DB Schenker

List of Figures

- Figure 1: Global Logistics in Apparel Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Logistics in Apparel Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: Asia Pacific Logistics in Apparel Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: Asia Pacific Logistics in Apparel Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Asia Pacific Logistics in Apparel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Logistics in Apparel Industry Revenue (Million), by Service 2025 & 2033

- Figure 7: North America Logistics in Apparel Industry Revenue Share (%), by Service 2025 & 2033

- Figure 8: North America Logistics in Apparel Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Logistics in Apparel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Logistics in Apparel Industry Revenue (Million), by Service 2025 & 2033

- Figure 11: Europe Logistics in Apparel Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Logistics in Apparel Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Logistics in Apparel Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Logistics in Apparel Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Middle East and Africa Logistics in Apparel Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Middle East and Africa Logistics in Apparel Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East and Africa Logistics in Apparel Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics in Apparel Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Logistics in Apparel Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Logistics in Apparel Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Global Logistics in Apparel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: India Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: ASEAN Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of Asia Pacific Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Logistics in Apparel Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global Logistics in Apparel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Brazil Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Mexico Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Americas Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Logistics in Apparel Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 19: Global Logistics in Apparel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Germany Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Logistics in Apparel Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 27: Global Logistics in Apparel Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Saudi Arabia Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Africa Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Middle East and Africa Logistics in Apparel Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics in Apparel Industry?

The projected CAGR is approximately 6.66%.

2. Which companies are prominent players in the Logistics in Apparel Industry?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics, Genex Logistics, Logwin AG, Ceva Logistics, Nippon Express, PVS Fulfillment-Service GmbH, Apparel Logistics Group Inc, Agility Logistics, Deutsche Post DHL Group, Bollore Logistics, BGROUP SRL**List Not Exhaustive, GAC Group, DSV, Expeditors International of Washington Inc.

3. What are the main segments of the Logistics in Apparel Industry?

The market segments include Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 138.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of online apparel sales; The demand for faster delivery and quicker time to market.

6. What are the notable trends driving market growth?

Growing Online Apparel Sales and Changing Consumer Behavior.

7. Are there any restraints impacting market growth?

Highly perishable fashion trends; High cost of technology and infrastructure.

8. Can you provide examples of recent developments in the market?

November 2021 - DHL sponsored a stage of TGC for the first time in the international logistics industry, offering an express ticket to style worldwide. In this project, DHL teamed up with "FASBEE", a global fashion e-commerce site, to enable people overseas to purchase products introduced on the sponsored stage of Mynavi TGC 2021 A/W.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics in Apparel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics in Apparel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics in Apparel Industry?

To stay informed about further developments, trends, and reports in the Logistics in Apparel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence