Key Insights

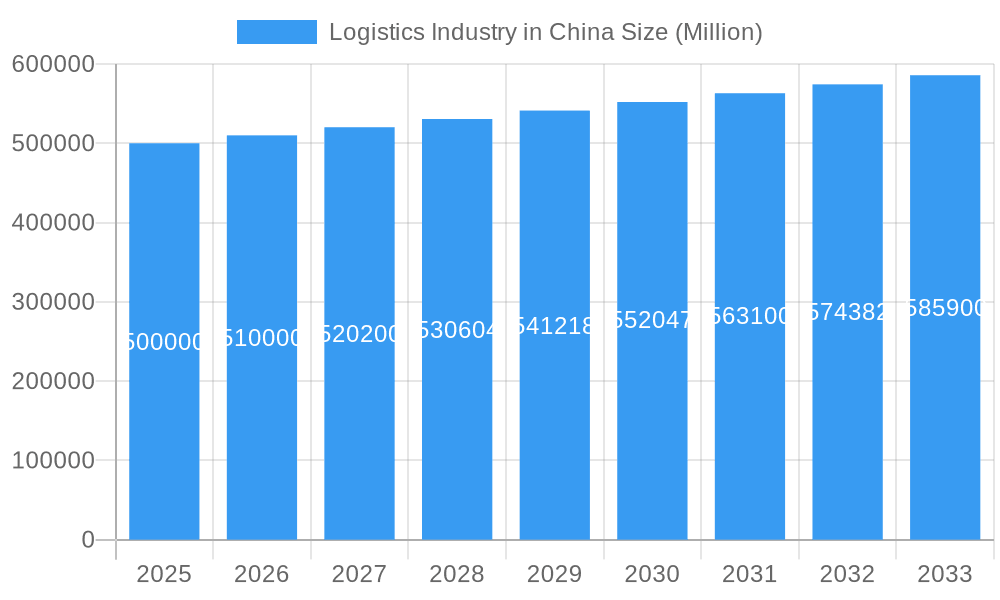

The Chinese logistics market is a dynamic sector offering substantial investment potential. Projected to reach $200 billion by 2025, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This robust growth is propelled by China's burgeoning e-commerce industry, extensive infrastructure development, and government-led supply chain optimization initiatives. Key end-user industries such as manufacturing, energy, and construction are significant contributors, driving demand for efficient domestic and international logistics solutions. While challenges like labor costs and regulatory landscapes exist, the market's segmentation across transportation, forwarding, warehousing, and value-added services, alongside a competitive field including domestic leaders like Sinotrans and global players such as Kuehne + Nagel and Agility, presents diverse opportunities for strategic investment.

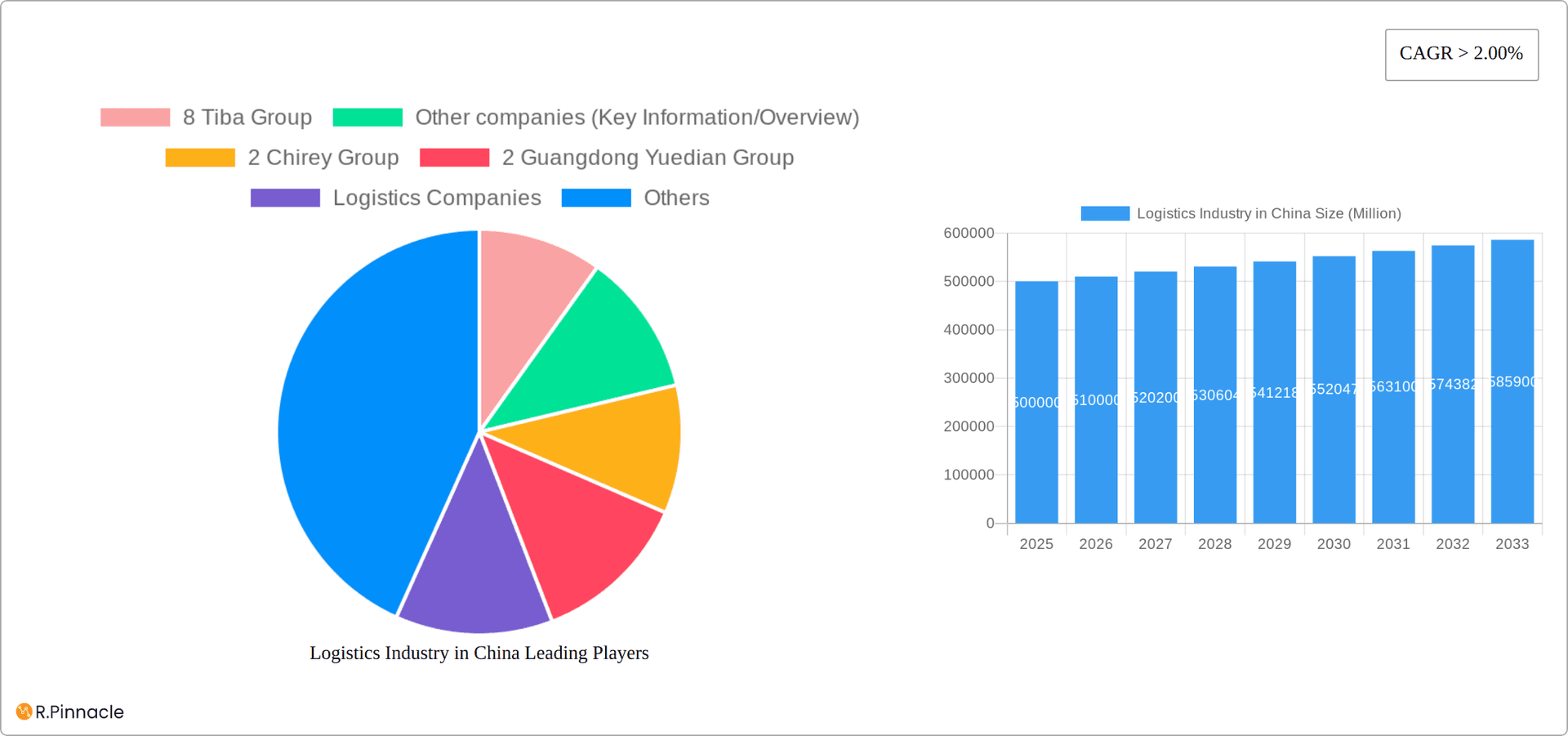

Logistics Industry in China Market Size (In Billion)

The competitive environment features a blend of established multinational corporations and agile, specialized logistics providers, demanding strategic market entry and expansion approaches. Future success will be driven by the adoption of technological advancements, including automation and big data analytics, alongside a commitment to sustainability and environmental compliance. E-commerce growth and the demand for expedited delivery services will necessitate continuous innovation across the logistics value chain. Integrating technology, enhancing operational efficiency, and delivering value-added services are paramount for meeting the evolving demands of the Chinese market.

Logistics Industry in China Company Market Share

Logistics Industry in China: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of China's logistics industry, offering valuable insights for industry professionals, investors, and strategic planners. The report covers market structure, dynamics, key players, and future growth prospects, utilizing data from 2019 to 2024 (historical period) and projecting to 2033, with 2025 as the base and estimated year. The total market size is predicted to reach xx Million by 2033.

Logistics Industry in China Market Structure & Innovation Trends

China's logistics market is characterized by a complex interplay of large state-owned enterprises, privately-owned companies, and multinational players. Market concentration is moderate, with a few dominant players alongside numerous smaller firms. Innovation is driven by technological advancements (e.g., AI, IoT, automation) and government policies promoting efficiency and sustainability. The regulatory framework, while evolving, presents both opportunities and challenges. Product substitutes, such as improved transportation networks, are impacting the market share of traditional logistics providers. The end-user demographics are diverse, spanning various sectors with varying logistical demands. M&A activities have been significant, with deal values exceeding xx Million in recent years, consolidating the industry and reshaping the competitive landscape.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Activity: Significant consolidation observed in the period 2019-2024, with total deal value exceeding xx Million.

- Regulatory Framework: Focus on improving infrastructure and enhancing efficiency.

- Innovation Drivers: Technological advancements in automation, AI, and digitalization.

Logistics Industry in China Market Dynamics & Trends

The Chinese logistics industry is a dynamic and rapidly evolving sector, propelled by a trifecta of robust e-commerce expansion, a surging industrial output, and substantial, ongoing government investment in sophisticated infrastructure development. This growth is further amplified by significant technological disruptions. The integration of autonomous vehicles, advanced robotics in warehousing, and the transformative potential of blockchain technology are fundamentally reshaping operational efficiencies and entire supply chains. Simultaneously, evolving consumer expectations for faster, more reliable, and transparent delivery services are exerting immense pressure on the industry to continuously enhance speed, precision, and overall efficiency. The competitive landscape is characterized by intense rivalry, with companies aggressively vying for market share through relentless technological innovation, strategic service differentiation, and the formation of crucial partnerships. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is conservatively projected at XX%, with market penetration rates showing a marked increase across a diverse array of logistics segments.

Dominant Regions & Segments in Logistics Industry in China

China's eastern coastal regions, notably Shanghai, Guangdong, and Jiangsu, stand as the undeniable epicenters of logistics activity. This dominance is attributed to their superior, well-established infrastructure networks, including world-class ports, extensive road and rail systems, and their strategic proximity to major international trade routes. Furthermore, these regions host a dense concentration of high-volume manufacturing facilities and burgeoning e-commerce hubs. Within the broader logistics market, the Transportation segment, by service type, commands the largest market share, underscoring the fundamental role of moving goods. Complementing this, the Manufacturing sector emerges as the dominant end-user segment, a clear indicator of the immense reliance of China's vast industrial base on efficient and effective logistics solutions.

-

Key Drivers for Eastern Coastal Regions:

- Advanced Infrastructure: Unparalleled development of ports, highways, high-speed rail, and airports.

- Economic Powerhouse: High concentration of leading manufacturing enterprises and rapidly expanding e-commerce platforms.

- Strategic Government Support: Proactive policies and significant financial investment aimed at bolstering logistics infrastructure and innovation.

- Dominant Segments Analysis: The preeminence of the Transportation segment is a direct consequence of the sheer volume of goods constantly in transit, both domestically and internationally. The Manufacturing sector's leading position as an end-user highlights its critical dependence on seamless logistics for raw material procurement, in-process movement, and finished product distribution, solidifying its integral role in the nation's economic engine.

Logistics Industry in China Product Innovations

The Chinese logistics landscape is a hotbed of innovation, with cutting-edge advancements rapidly being integrated into daily operations. These include the widespread adoption of highly automated warehousing systems that significantly boost efficiency and reduce manual labor, the pioneering use of drone delivery services for last-mile solutions in urban and remote areas, and the sophisticated implementation of advanced route optimization software that minimizes transit times and fuel consumption. These technological breakthroughs are not only enhancing operational efficiency and driving down costs but also demonstrably improving delivery speeds and reliability, thereby bestowing a significant competitive advantage upon early adopters. A notable trend is the industry's increasing commitment to sustainable practices, with a growing emphasis on eco-friendly transportation methods and greener logistics solutions gaining significant traction.

Report Scope & Segmentation Analysis

This report segments the Chinese logistics market by service (Transportation, Forwarding, Warehousing, Other Value-added Services) and end-user (Oil and Gas, Petrochemical, Mining and Quarrying, Energy and Power, Construction, Manufacturing, Other End-Users). Each segment's growth projection, market size, and competitive dynamics are analyzed. For instance, the Transportation segment is projected to grow at xx% CAGR, driven by increasing e-commerce and industrial output, while the Manufacturing segment remains the largest end-user sector.

Key Drivers of Logistics Industry in China Growth

Several factors contribute to the industry's growth: robust economic growth fueling demand for goods movement, government investments in infrastructure development (e.g., high-speed rail networks), technological advancements improving efficiency and reducing costs, and the rise of e-commerce creating a massive demand for efficient logistics solutions.

Challenges in the Logistics Industry in China Sector

Despite its impressive growth, the Chinese logistics industry grapples with several persistent challenges. These include infrastructure bottlenecks that can still emerge in certain less developed or rapidly expanding regions, the continuous upward pressure from increasing labor costs, and the fierce intensity of market competition. Navigating the complexities of regulatory frameworks across different provinces and sectors also presents an ongoing hurdle. Furthermore, the industry remains susceptible to supply chain disruptions stemming from geopolitical uncertainties and global events, which have historically impacted operations and profitability. For instance, estimated losses in 2024 attributed to such disruptions amounted to approximately XX Million.

Emerging Opportunities in Logistics Industry in China

Opportunities exist in areas such as last-mile delivery solutions, cold chain logistics for perishable goods, and the growing demand for cross-border e-commerce logistics. The adoption of green logistics and sustainable practices offers significant potential for growth and differentiation.

Leading Players in the Logistics Industry in China Market

- 8 Tiba Group

- 2 Chirey Group

- 2 Guangdong Yuedian Group

- 14 Kuehne + Nagel (Kuehne + Nagel)

- 12 Global Star Logistics (China) Co Ltd

- 1 China Gezhouba Group Corporation International Engineering Company

- 3 China National Chemical Engineering Group

- 7 CJ Smart Cargo

- 15 Agility Logistics Pvt Ltd (Agility Logistics)

- 1 Broekman Logistics

- Rhenus Logistics

- Trans Global Projects Group (TGP)

- S F Systems(Group)Ltd

- Ziegler Group

- Dextrans Worldwide Group

- GEFCO S A

- Keyun Group

- Dolphin Logistcis Co Ltd

- TPL Project Stock Company

- Shanghai Beetle Supply Chain Management Company Limited

- 6 Sinotrans (HK) Logistics Ltd (Sinotrans)

- 4 Kerry Logistics Network Limited (Kerry Logistics)

- 13 Sunshine Int'l Logistics Co ltd

- 10 InterMax Logistics Solution Limited

- 5 Trans Global Projects Group (TGP)

- 5 China Civil Engineering Construction Corporation

- 9 Mitsubishi Logistics Corporation (Mitsubishi Logistics)

- 1 COSCO Shipping Logistics Co Ltd (COSCO Shipping)

- 4 China Railway Construction Corporation

- 3 Translink International Logistics Group

- 11 Wangfoong Transportation Ltd

Key Developments in Logistics Industry in China Industry

- January 2023: Maersk inaugurated its state-of-the-art green and smart logistics center in Shanghai's Lin-gang Special Area. This significant investment of US$174 million underscores a strong commitment to integrating sustainable practices and advanced technology within its operations, setting a benchmark for the industry.

- January 2022: The Ocean Alliance launched its innovative Day 7 Product, a strategic initiative that prominently features the deployment of 26 dual-fuel LNG-powered container ships. This development clearly signals the industry's proactive response to evolving environmental regulations and its commitment to reducing its carbon footprint.

Future Outlook for Logistics Industry in China Market

The Chinese logistics industry is poised for continued growth, driven by ongoing e-commerce expansion, investments in infrastructure, and technological innovation. The focus on sustainability and the adoption of advanced technologies will shape the future competitive landscape. Strategic partnerships and mergers & acquisitions will continue to reshape the market structure, creating opportunities for both established players and new entrants.

Logistics Industry in China Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Forwarding

- 1.3. Warehousing

- 1.4. Other Value-added Services

-

2. End-user

- 2.1. Oil and Gas, Petrochemical

- 2.2. Mining and Quarrying

- 2.3. Energy and Power

- 2.4. Construction

- 2.5. Manufacturing

- 2.6. Other En

Logistics Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics Industry in China Regional Market Share

Geographic Coverage of Logistics Industry in China

Logistics Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Cost - Intensive4.; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Wind power is expected to propel the demand for project logistics services through the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Forwarding

- 5.1.3. Warehousing

- 5.1.4. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Oil and Gas, Petrochemical

- 5.2.2. Mining and Quarrying

- 5.2.3. Energy and Power

- 5.2.4. Construction

- 5.2.5. Manufacturing

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Forwarding

- 6.1.3. Warehousing

- 6.1.4. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Oil and Gas, Petrochemical

- 6.2.2. Mining and Quarrying

- 6.2.3. Energy and Power

- 6.2.4. Construction

- 6.2.5. Manufacturing

- 6.2.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Forwarding

- 7.1.3. Warehousing

- 7.1.4. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Oil and Gas, Petrochemical

- 7.2.2. Mining and Quarrying

- 7.2.3. Energy and Power

- 7.2.4. Construction

- 7.2.5. Manufacturing

- 7.2.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Forwarding

- 8.1.3. Warehousing

- 8.1.4. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Oil and Gas, Petrochemical

- 8.2.2. Mining and Quarrying

- 8.2.3. Energy and Power

- 8.2.4. Construction

- 8.2.5. Manufacturing

- 8.2.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Forwarding

- 9.1.3. Warehousing

- 9.1.4. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Oil and Gas, Petrochemical

- 9.2.2. Mining and Quarrying

- 9.2.3. Energy and Power

- 9.2.4. Construction

- 9.2.5. Manufacturing

- 9.2.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Forwarding

- 10.1.3. Warehousing

- 10.1.4. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Oil and Gas, Petrochemical

- 10.2.2. Mining and Quarrying

- 10.2.3. Energy and Power

- 10.2.4. Construction

- 10.2.5. Manufacturing

- 10.2.6. Other En

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 8 Tiba Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Other companies (Key Information/Overview)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 2 Chirey Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 2 Guangdong Yuedian Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Logistics Companies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 14 Kuehne + Nagel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 12 Global Star Logistics (China) Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 1 China Gezhouba Group Corporation International Engineering Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3 China National Chemical Engineering Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 7 CJ Smart Cargo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 15 Agility Logistics Pvt Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 6 Sinotrans (HK) Logistics Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Engineering/EPC Companies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 4 Kerry Logistics Network Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 13 Sunshine Int'l Logistics Co ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 10 InterMax Logistics Solution Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 5 Trans Global Projects Group (TGP)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 5 China Civil Engineering Construction Corporation*

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 9 Mitsubishi Logistics Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 1 COSCO Shipping Logistics Co Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 4 China Railway Construction Corporation

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 3 Translink International Logistics Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 11 Wangfoong Transportation Ltd

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 8 Tiba Group

List of Figures

- Figure 1: Global Logistics Industry in China Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 9: South America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 10: South America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 11: South America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 12: South America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 15: Europe Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 21: Middle East & Africa Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East & Africa Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 23: Middle East & Africa Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Middle East & Africa Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 27: Asia Pacific Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 28: Asia Pacific Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 29: Asia Pacific Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Asia Pacific Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Logistics Industry in China Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 17: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 29: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 30: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 39: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Industry in China?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Logistics Industry in China?

Key companies in the market include 8 Tiba Group, Other companies (Key Information/Overview), 2 Chirey Group, 2 Guangdong Yuedian Group, Logistics Companies, 14 Kuehne + Nagel, 12 Global Star Logistics (China) Co Ltd, 1 China Gezhouba Group Corporation International Engineering Company, 3 China National Chemical Engineering Group, 7 CJ Smart Cargo, 15 Agility Logistics Pvt Ltd, 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited, 6 Sinotrans (HK) Logistics Ltd, Engineering/EPC Companies, 4 Kerry Logistics Network Limited, 13 Sunshine Int'l Logistics Co ltd, 10 InterMax Logistics Solution Limited, 5 Trans Global Projects Group (TGP), 5 China Civil Engineering Construction Corporation*, 9 Mitsubishi Logistics Corporation, 1 COSCO Shipping Logistics Co Ltd, 4 China Railway Construction Corporation, 3 Translink International Logistics Group, 11 Wangfoong Transportation Ltd.

3. What are the main segments of the Logistics Industry in China?

The market segments include Service, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 200 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce.

6. What are the notable trends driving market growth?

Wind power is expected to propel the demand for project logistics services through the forecast period.

7. Are there any restraints impacting market growth?

4.; Cost - Intensive4.; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

January 2023: Maersk and the administrative body of the Shanghai Free Trade Zone signed a land grant agreement late in December 2022 for the Lin-gang new area. This is the first green and smart flagship logistics center from Maersk to open in China. It has low or very low greenhouse gas emissions. The project will begin in the third quarter of 2024 and cost 174 million US dollars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Industry in China?

To stay informed about further developments, trends, and reports in the Logistics Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence