Key Insights

The Qatar luxury goods market presents substantial growth opportunities, aligning with broader trends across the Middle East and Africa (MEA). Driven by high per capita income, a robust tourism sector, and an expanding affluent demographic with a strong affinity for premium brands, Qatar's luxury market is poised for significant expansion. The overall MEA luxury goods market is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.38%. Given Qatar's economic dynamism and strategic importance, its luxury goods market is expected to mirror or slightly exceed this regional growth rate. Key growth catalysts include rising disposable incomes, a desire for status-symbol brands, and the influx of tourists contributing to luxury expenditures. The market is segmented by product categories such as apparel, footwear, accessories, jewelry, and watches, as well as by distribution channels including single-brand and multi-brand retail, and online platforms. Major global luxury conglomerates, alongside other international and regional contenders, are key market participants. Potential challenges involve economic sensitivities and competitive pressures from neighboring luxury hubs; however, sustained economic development and increasing demand for luxury products ensure a positive long-term outlook.

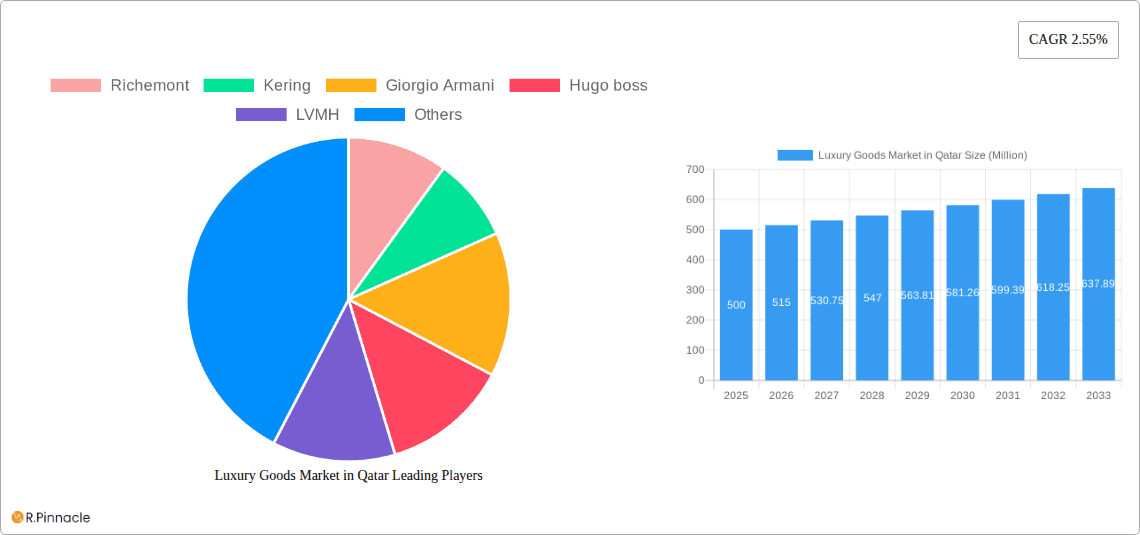

Luxury Goods Market in Qatar Market Size (In Million)

Key drivers underpinning this anticipated growth include Qatar's strategic investments in infrastructure and tourism, attracting high-net-worth individuals and international visitors, which in turn stimulates demand. Furthermore, the young and affluent Qatari consumer base actively engages with luxury goods, favoring globally recognized brands and exclusive offerings. The e-commerce segment for luxury goods in Qatar is experiencing accelerated growth, creating new avenues for both established and emerging brands. Despite potential headwinds such as economic fluctuations and global supply chain vulnerabilities, Qatar's considerable purchasing power and the nation's commitment to economic diversification position its luxury goods market for sustained expansion. The estimated market size for Qatar's luxury goods sector in the base year 2025 is 563.28 million.

Luxury Goods Market in Qatar Company Market Share

Luxury Goods Market in Qatar: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning luxury goods market in Qatar, covering the period 2019-2033. It offers actionable insights for industry professionals, investors, and stakeholders seeking to understand the market's dynamics, growth potential, and competitive landscape. The report leverages extensive market research and data analysis to deliver a clear and concise overview of this lucrative sector. The Base Year is 2025, and the Estimated and Forecast Period is 2025-2033. The Historical Period covered is 2019-2024. The market size is projected to reach xx Million by 2033.

Luxury Goods Market in Qatar Market Structure & Innovation Trends

This section analyzes the competitive landscape of Qatar's luxury goods market, focusing on market concentration, innovation drivers, regulatory frameworks, and key industry activities. We delve into the market share held by major players and the impact of mergers and acquisitions (M&A) on market dynamics.

- Market Concentration: The Qatari luxury goods market is characterized by a mix of established international brands and emerging local players. LVMH, Richemont, Kering, and Chanel hold significant market share, while local players are increasingly gaining prominence. The market share of these top players is estimated at xx% in 2025.

- Innovation Drivers: Innovation in product design, materials, and technology are key drivers of growth. Sustainability and personalization are emerging trends shaping the industry.

- Regulatory Frameworks: Qatar's regulatory environment is supportive of foreign investment and has relatively low import tariffs on luxury goods.

- Product Substitutes: The primary substitutes for luxury goods are often higher-quality mid-range products and experiences.

- End-User Demographics: The market is primarily driven by high-net-worth individuals (HNWIs) and affluent consumers with a preference for high-quality, exclusive products.

- M&A Activities: The number of M&A deals in the Qatar luxury goods market has been xx in the past five years, with a total deal value of approximately xx Million. These activities reflect increasing competition and consolidation within the sector.

Luxury Goods Market in Qatar Market Dynamics & Trends

The Qatari luxury goods market is a vibrant and rapidly evolving landscape, characterized by robust growth and a sophisticated consumer base. This section delves into the core dynamics shaping this market, exploring the interplay of growth drivers, technological advancements, shifting consumer preferences, and the competitive environment.

Fueling the market's expansion is Qatar's exceptional economic resilience, consistently high disposable incomes, and a thriving tourism sector that attracts a discerning global clientele. The digital revolution is profoundly transforming the luxury experience, with sophisticated e-commerce platforms and hyper-personalized marketing campaigns now integral to driving sales and enhancing customer engagement. Furthermore, a powerful surge in conscious consumerism is evident, with an increasing demand for sustainable sourcing and ethically produced luxury items influencing brand strategies and product development. The competitive arena is a dynamic battleground, where both established international powerhouses and agile local brands fiercely compete for market share, spurring continuous innovation and an ever-expanding array of exclusive offerings. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be approximately XX%, with market penetration anticipated to reach XX% by 2033.

Dominant Regions & Segments in Luxury Goods Market in Qatar

This section provides a detailed breakdown of the leading regions, geographical areas, and product segments that are spearheading the growth and defining the contours of the luxury goods market in Qatar. We analyze the underlying factors that contribute to the dominance of these areas and categories.

- By Type: The Watches and Jewelry segment continues its reign as the market's most substantial category, driven by an insatiable appetite for exquisite timepieces and rare precious gemstones. Following closely is the Clothing and Apparel segment, demonstrating significant traction fueled by the enduring allure of high-fashion designer brands. Other notable segments include Leather Goods, Footwear, Cosmetics & Fragrances, and Accessories, each carving out their distinct market share.

- By Distribution Channel: While Single-brand Stores remain the cornerstone of luxury retail, offering an unparalleled and immersive shopping experience, the ascendancy of Online Stores is undeniable. This digital channel is rapidly expanding its reach, providing convenience and accessibility, and is becoming increasingly crucial for market penetration. Department stores and multi-brand luxury boutiques also play a vital role in catering to diverse consumer needs.

- By Gender: The Qatari luxury market adeptly caters to both male and female consumers, with both segments exhibiting robust growth potential. While the specific market share may fluctuate, the demand for luxury products transcends gender, with a growing emphasis on gender-neutral and inclusive offerings.

Key Drivers of Dominance:

- Favorable Economic Environment and Government Support: Qatar's strategic economic policies, encompassing attractive tax incentives, streamlined investment promotion initiatives, and a commitment to fostering a business-friendly climate, have been instrumental in cultivating a fertile ground for the luxury goods sector to flourish.

- World-Class Infrastructure and Retail Excellence: The nation boasts an impressive array of world-class infrastructure, including opulent shopping malls that rival international standards and state-of-the-art airport facilities. This sophisticated ecosystem enhances the overall shopping experience, significantly contributing to attracting both local aficionados and affluent international tourists.

- Growing Disposable Income and Affluent Demographics: A consistent rise in disposable incomes and the presence of a substantial affluent demographic within Qatar create a strong foundational demand for high-value luxury goods.

Luxury Goods Market in Qatar Product Innovations

The luxury goods market in Qatar is at the forefront of product innovation, with brands continuously pushing boundaries to captivate a discerning clientele. A significant trend is the integration of advanced, sustainable materials and cutting-edge technological features, all aimed at enriching the customer experience and resonating with environmentally conscious consumers. Innovations such as intricately designed smartwatches that blend luxury aesthetics with smart functionality, and personalized jewelry meticulously crafted using advanced 3D printing technology, exemplify this forward-thinking approach. These advancements are expertly tailored to meet and exceed the evolving tastes and sophisticated expectations of the Qatari consumer base, solidifying the market's reputation for exclusivity and modernity.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Qatari luxury goods market across various parameters.

By Type: Clothing and Apparel, Footwear, Bags, Jewellery, Watches, Other Accessories. Each segment's growth projection, market size, and competitive landscape are analyzed.

By Distribution Channel: Single Brand Stores, Multi Brand Stores, Online Stores, Other Distribution Channels. Each channel's market share and growth potential are examined.

By Gender: Male, Female. The specific market sizes and growth projections for each gender segment are detailed.

Key Drivers of Luxury Goods Market in Qatar Growth

The sustained and impressive growth of the luxury goods market in Qatar is propelled by a confluence of powerful factors. The nation's exceptional economic stability and consistent growth in disposable incomes form a bedrock of demand. This is further amplified by a burgeoning tourism sector that brings in a significant influx of affluent international shoppers. The increasing global appeal and recognition of luxury brands, coupled with the continuous development of sophisticated retail infrastructure, including high-end shopping malls and a burgeoning e-commerce presence, play a pivotal role. Moreover, proactive government initiatives aimed at bolstering tourism and attracting foreign investment serve as crucial catalysts, actively stimulating and expanding the market's reach and potential.

Challenges in the Luxury Goods Market in Qatar Sector

While the Qatari luxury goods market exhibits considerable strength, it is not without its challenges. Global economic uncertainties and fluctuations can directly impact consumer spending power and discretionary income, potentially leading to shifts in demand. Furthermore, the intricate nature of global supply chains presents inherent risks of disruptions, which can result in production delays and increased operational costs. The intensely competitive landscape, characterized by the presence of both globally renowned luxury brands and a growing number of formidable local players, necessitates continuous adaptation and strategic differentiation to maintain market share and customer loyalty.

Emerging Opportunities in Luxury Goods Market in Qatar

Qatar’s luxury goods market presents numerous opportunities, including the growth of e-commerce, increasing demand for personalized luxury goods, and a rising focus on sustainability. Expansion into niche luxury sectors like bespoke tailoring and unique experiences further presents considerable potential for growth.

Key Developments in Luxury Goods Market in Qatar Industry

- November 2022: Launch of Ounass, a luxury e-commerce website offering a wide range of luxury brands and product categories. This significantly expands access to luxury goods for Qatari consumers and boosts online sales.

- April 2022: Opening of the first Louis Vuitton store at Qatar Duty-Free in Hamad International Airport. This move enhances brand visibility and accessibility to international travelers, contributing to increased sales and brand awareness.

Future Outlook for Luxury Goods Market in Qatar Market

The future of the Qatari luxury goods market appears promising. Continued economic growth, increasing tourism, and ongoing investments in infrastructure are expected to drive market expansion. The growing adoption of e-commerce and the focus on personalized luxury experiences will create new opportunities for growth. Strategic partnerships and collaborations will play a crucial role in shaping the market’s trajectory.

Luxury Goods Market in Qatar Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single Brand Stores

- 2.2. Multi Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Gender

- 3.1. Male

- 3.2. Female

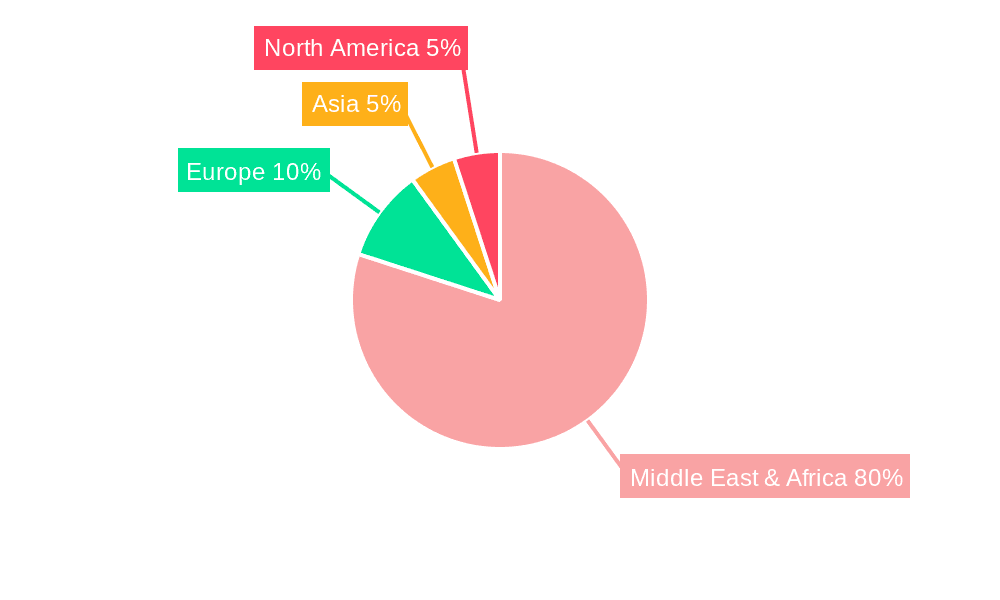

Luxury Goods Market in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in Qatar Regional Market Share

Geographic Coverage of Luxury Goods Market in Qatar

Luxury Goods Market in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Qatar becoming the Luxury Fashion Hub to Support Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Gender

- 5.3.1. Male

- 5.3.2. Female

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single Brand Stores

- 6.2.2. Multi Brand Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Gender

- 6.3.1. Male

- 6.3.2. Female

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single Brand Stores

- 7.2.2. Multi Brand Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Gender

- 7.3.1. Male

- 7.3.2. Female

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single Brand Stores

- 8.2.2. Multi Brand Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Gender

- 8.3.1. Male

- 8.3.2. Female

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single Brand Stores

- 9.2.2. Multi Brand Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Gender

- 9.3.1. Male

- 9.3.2. Female

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single Brand Stores

- 10.2.2. Multi Brand Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Gender

- 10.3.1. Male

- 10.3.2. Female

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Richemont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giorgio Armani

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hugo boss

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LVMH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puig

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Joyalukkas

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Prada SpA*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rolex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Richemont

List of Figures

- Figure 1: Global Luxury Goods Market in Qatar Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 3: North America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 7: North America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 8: North America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 9: North America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 11: South America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 13: South America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 15: South America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 16: South America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 17: South America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 21: Europe Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 23: Europe Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 24: Europe Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 27: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 31: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 32: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 35: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 39: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 40: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 4: Global Luxury Goods Market in Qatar Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 8: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 15: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 22: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 35: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 43: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 45: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in Qatar?

The projected CAGR is approximately 5.38%.

2. Which companies are prominent players in the Luxury Goods Market in Qatar?

Key companies in the market include Richemont, Kering, Giorgio Armani, Hugo boss, LVMH, Chanel, Puig, Joyalukkas, PVH, Prada SpA*List Not Exhaustive, Rolex.

3. What are the main segments of the Luxury Goods Market in Qatar?

The market segments include Type, Distribution Channel, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 563.28 million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Qatar becoming the Luxury Fashion Hub to Support Market Growth.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: A luxury e-commerce website, Ounass, was launched in Qatar, where consumers can shop for luxury brands, including Gucci, Saint Laurent, Balenciaga, etc. Consumers can shop for men's, women's, and children's ready-to-wear clothing, handbags, footwear, cosmetics, fine jewelry, and home goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in Qatar?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence