Key Insights

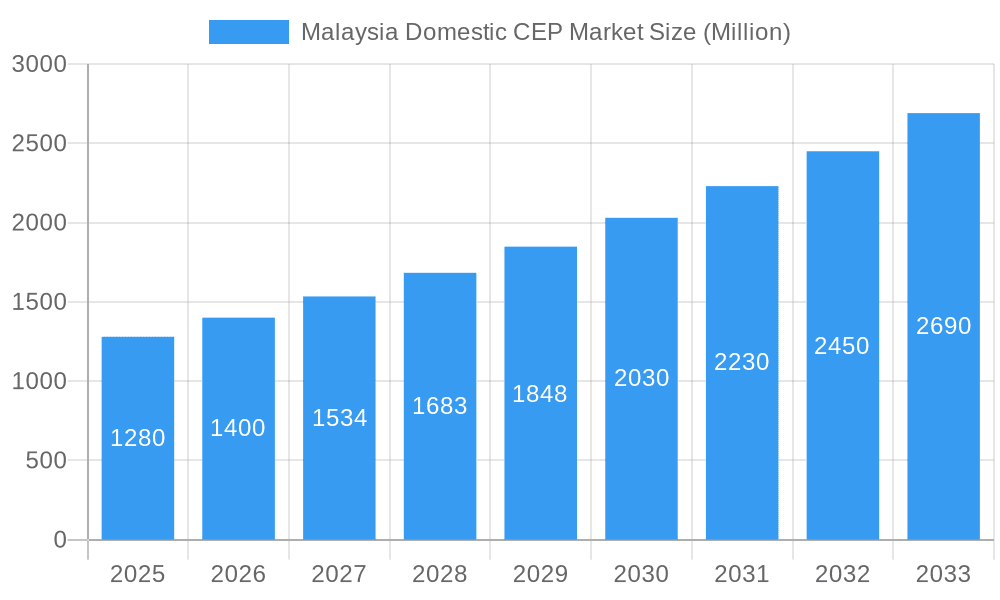

The Malaysia domestic courier, express, and parcel (CEP) market exhibits robust growth, projected to reach a market size of USD 1.28 billion in 2025, expanding at a compound annual growth rate (CAGR) of 9.24%. This significant expansion is fueled by the burgeoning e-commerce sector in Malaysia, a rising middle class with increased disposable income driving online shopping, and the increasing adoption of digital payment methods facilitating seamless transactions. The market's growth is further propelled by the government's initiatives promoting digitalization and logistics infrastructure improvements, such as enhanced warehousing facilities and last-mile delivery networks. However, challenges persist, including increasing fuel costs impacting operational expenses and fierce competition among established players like Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, and Ta-Q-Bin, leading to price wars and margin pressures. Furthermore, maintaining consistent service quality and managing delivery times efficiently, especially in remote areas, remains a crucial aspect for market participants. The market is segmented based on service type (express, standard, etc.), delivery type (B2B, B2C, C2C), and geographic location. Future growth will hinge on companies' ability to leverage technology for improved efficiency, expand into underserved areas, and enhance customer experience to gain a competitive edge.

Malaysia Domestic CEP Market Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates continued growth, with a potential acceleration driven by technological advancements in areas like automation and route optimization, further improving delivery speeds and reducing costs. The market is expected to witness increased consolidation, with larger players acquiring smaller companies to gain market share and expand their service offerings. Furthermore, the increasing adoption of sustainable delivery practices and the growing demand for specialized services, such as temperature-controlled deliveries for pharmaceuticals or perishable goods, will present opportunities for niche players. However, regulatory changes and potential economic fluctuations could impact overall market growth. Companies need to continuously adapt their strategies to navigate these challenges effectively and capitalize on emerging growth avenues within the dynamic Malaysian CEP landscape.

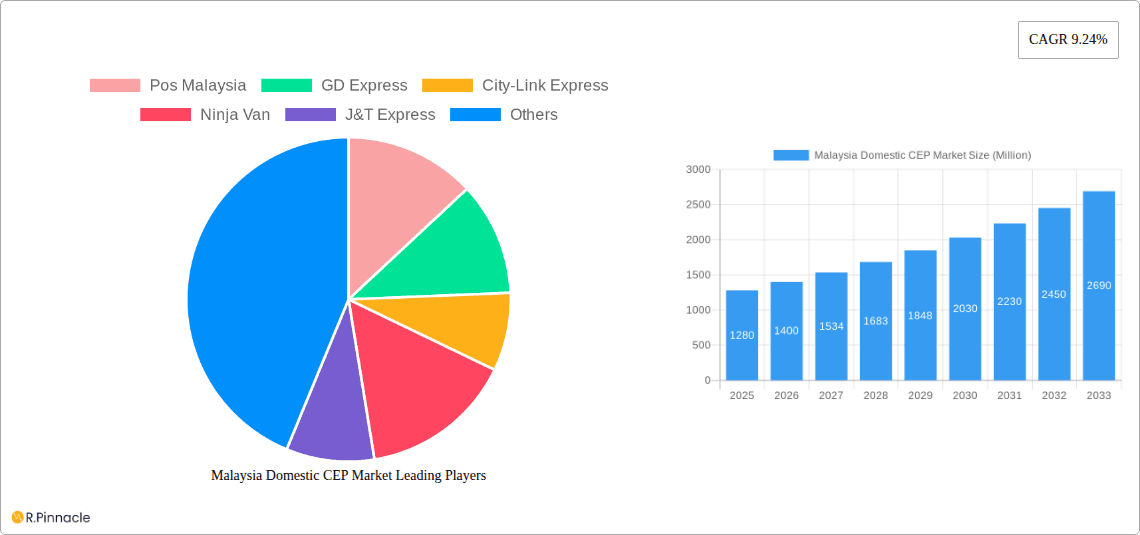

Malaysia Domestic CEP Market Company Market Share

Malaysia Domestic CEP Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Malaysia Domestic Courier, Express, and Parcel (CEP) market from 2019 to 2033. It offers actionable insights for industry professionals, investors, and strategists seeking to understand the market dynamics, key players, and future growth potential. The report leverages extensive data analysis, covering market size, segmentation, competitive landscape, and emerging trends. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an invaluable resource for navigating the complexities of the Malaysian CEP sector.

Malaysia Domestic CEP Market Market Structure & Innovation Trends

The Malaysian domestic CEP market exhibits a moderately concentrated structure, with several key players vying for market share. Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, and Ta-Q-Bin are prominent examples, though the market also includes numerous smaller players. Precise market share data for each company varies across sub-segments and changes yearly. However, Pos Malaysia and GD Express historically hold the largest portions. Recent years have witnessed significant innovation driven by the rise of e-commerce and the need for faster, more efficient delivery solutions. Regulatory frameworks, while generally supportive of market growth, are constantly evolving to address issues such as consumer protection and competition. Product substitutes, primarily traditional postal services and localized delivery networks, continue to exert some pressure, although the dominant trend favors the CEP sector. End-user demographics demonstrate a strong correlation between e-commerce adoption rates and CEP market growth, particularly amongst younger generations. Mergers and acquisitions (M&A) activity has been moderate. While specific deal values are not publicly available in all instances, a few recent deals valued at xx Million have resulted in market consolidation.

Malaysia Domestic CEP Market Market Dynamics & Trends

The Malaysian domestic CEP market is characterized by robust growth, driven primarily by the booming e-commerce sector and increasing consumer demand for faster and more reliable delivery services. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was approximately xx%, and is projected to remain robust at xx% during the forecast period (2025-2033). Market penetration, currently estimated at xx%, is expected to increase significantly due to rising smartphone penetration, improved digital literacy, and the expansion of online retail across various sectors. Technological disruptions, including the adoption of automated sorting systems, route optimization software, and delivery drones, are transforming operational efficiency and delivery speed. Consumer preferences for same-day or next-day delivery options are shaping the competitive dynamics, pushing companies to invest in advanced logistics capabilities. The competitive landscape is characterized by intense competition, with both established players and new entrants vying for market share.

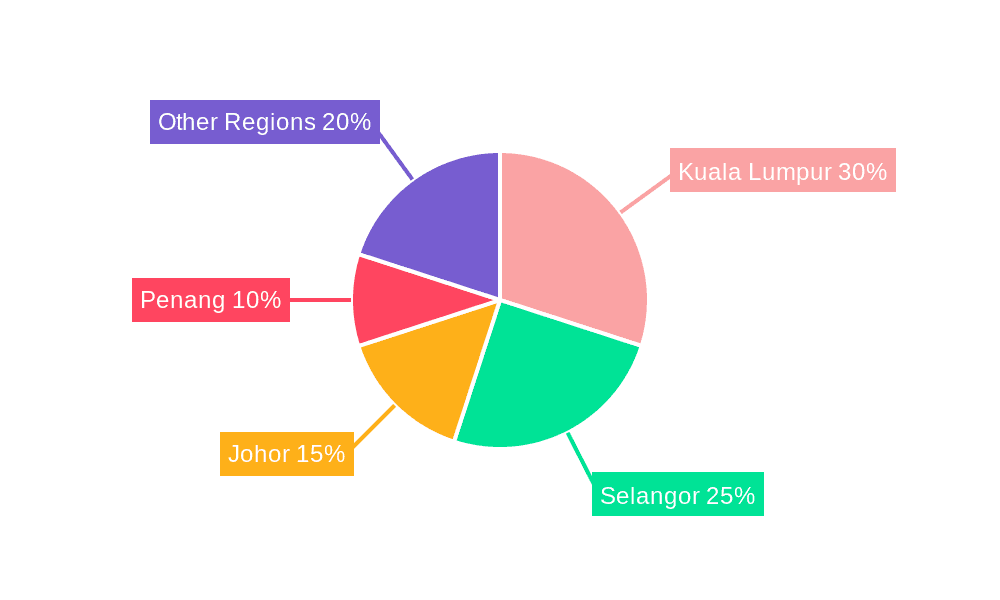

Dominant Regions & Segments in Malaysia Domestic CEP Market

The Kuala Lumpur metropolitan area and Selangor state remain the dominant regions within the Malaysian domestic CEP market. This dominance stems from a high concentration of population, businesses, and e-commerce activities.

- Key Drivers for Kuala Lumpur/Selangor dominance:

- High population density and consumer base.

- Robust e-commerce infrastructure and activity.

- Concentrated business districts fostering high parcel volumes.

- Well-developed transportation networks facilitating efficient delivery.

- Strong government support for logistics infrastructure development.

While other regions are experiencing growth, the concentrated nature of economic activity in the Klang Valley region continues to drive a disproportionate share of CEP activity. Segment-wise, the B2C segment overwhelmingly dominates, fueled by the exponential rise of online shopping. The B2B segment, while showing steady growth, remains smaller in relative terms.

Malaysia Domestic CEP Market Product Innovations

Recent product innovations in the Malaysian CEP market focus on enhancing speed, reliability, and customer experience. This includes the introduction of real-time tracking systems, improved delivery management technologies, and specialized services for handling fragile or temperature-sensitive goods, as exemplified by Ninja Van's expansion into perishable goods delivery. The integration of advanced analytics and machine learning is optimizing delivery routes and improving operational efficiency.

Report Scope & Segmentation Analysis

This report segments the Malaysian domestic CEP market based on service type (express, standard, etc.), delivery type (B2B, B2C), package size and weight, and region. Each segment displays unique growth trajectories and competitive dynamics. For instance, the express segment commands a higher price point and experiences faster growth, while the standard segment holds a larger market share due to price sensitivity. B2C is the largest segment by volume, while B2B showcases a higher average revenue per shipment.

Key Drivers of Malaysia Domestic CEP Market Growth

Several factors fuel the growth of the Malaysian domestic CEP market: the rapid expansion of e-commerce, driven by increasing internet and smartphone penetration; improved logistics infrastructure, including better roads, warehousing facilities, and sorting centers; supportive government policies aimed at promoting e-commerce growth and digitalization; and the increasing demand for faster and more reliable delivery services from consumers.

Challenges in the Malaysia Domestic CEP Market Sector

The Malaysian CEP market faces challenges, including intense competition, which keeps profit margins under pressure; rising fuel costs and labor expenses; regulatory hurdles concerning licensing and compliance; and the need for consistent investment in infrastructure to support increasing parcel volumes. Supply chain disruptions, though less frequent than in some global markets, still present a potential impediment.

Emerging Opportunities in Malaysia Domestic CEP Market

Opportunities abound in the Malaysian domestic CEP market, including the expansion of services into underserved rural areas; the adoption of innovative technologies, such as drone delivery and autonomous vehicles; the growth of specialized services, catering to niche sectors like pharmaceuticals and perishable goods; and the increasing integration of e-commerce platforms with CEP providers.

Leading Players in the Malaysia Domestic CEP Market Market

- Pos Malaysia

- GD Express

- City-Link Express

- Ninja Van

- J&T Express

- DHL E-commerce

- Skynet

- ABX Express

- Nationwide Express

- Ta-Q-Bin

- 6 Other Companies

- 3 Other Companies

Key Developments in Malaysia Domestic CEP Market Industry

- April 2024: Ninja Van expands services to include perishable goods, signifying a move toward specialized logistics capabilities and tapping into a growing market segment.

- January 2024: DTDC enters the Malaysian market, potentially increasing competition and adding capacity to the overall logistics network.

Future Outlook for Malaysia Domestic CEP Market Market

The future of the Malaysian domestic CEP market looks bright. Continued e-commerce growth, technological advancements, and supportive government policies will drive market expansion. Strategic opportunities exist for companies that can adapt to evolving consumer preferences, invest in efficient technologies, and offer specialized services. The market's projected CAGR of xx% indicates a significant growth trajectory over the forecast period.

Malaysia Domestic CEP Market Segmentation

-

1. Business Model

- 1.1. Business-to-business (B2B)

- 1.2. Customer-to-customer (C2C)

- 1.3. Business-to-consumer(B2C)

-

2. Type

- 2.1. E-commerce

- 2.2. Non-e-commerce

-

3. End User

- 3.1. Service

- 3.2. Wholesale and Retail

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End Users

Malaysia Domestic CEP Market Segmentation By Geography

- 1. Malaysia

Malaysia Domestic CEP Market Regional Market Share

Geographic Coverage of Malaysia Domestic CEP Market

Malaysia Domestic CEP Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce

- 3.4. Market Trends

- 3.4.1. Booming Smartphone Sales in E-Commerce Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Domestic CEP Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Customer-to-customer (C2C)

- 5.1.3. Business-to-consumer(B2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-commerce

- 5.2.2. Non-e-commerce

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Service

- 5.3.2. Wholesale and Retail

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pos Malaysia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GD Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 City-Link Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ninja Van

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL E-commerce

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skynet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABX Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nationwide Express

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pos Malaysia

List of Figures

- Figure 1: Malaysia Domestic CEP Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Domestic CEP Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 2: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 3: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Malaysia Domestic CEP Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Malaysia Domestic CEP Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Domestic CEP Market Revenue Million Forecast, by Business Model 2020 & 2033

- Table 10: Malaysia Domestic CEP Market Volume Billion Forecast, by Business Model 2020 & 2033

- Table 11: Malaysia Domestic CEP Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Malaysia Domestic CEP Market Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Malaysia Domestic CEP Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Malaysia Domestic CEP Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Malaysia Domestic CEP Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Malaysia Domestic CEP Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Domestic CEP Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Malaysia Domestic CEP Market?

Key companies in the market include Pos Malaysia, GD Express, City-Link Express, Ninja Van, J&T Express, DHL E-commerce, Skynet, ABX Express, Nationwide Express, Ta-Q-Bin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Malaysia Domestic CEP Market?

The market segments include Business Model, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

6. What are the notable trends driving market growth?

Booming Smartphone Sales in E-Commerce Segment.

7. Are there any restraints impacting market growth?

4.; Growing Demand for Fast and Reliable Delivery Services4.; Rise of E-commerce.

8. Can you provide examples of recent developments in the market?

April 2024: Ninja Van, a local express logistics company, broadened its services to transport perishable items, such as fresh fruit and sashimi, alongside its traditional parcel and online order deliveries.January 2024: DTDC, an express logistics company, announced its foray into the Malaysian market. This move was facilitated by its subsidiary, DTDC Global Express PTE Ltd, which inaugurated an office in Kuala Lumpur. The newly minted office, bolstering DTDC's presence in Southeast Asia, will primarily focus on providing advanced trans-shipment services to clients in Southeast Asia and the Australian peninsula, as per DTDC's official statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Domestic CEP Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Domestic CEP Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Domestic CEP Market?

To stay informed about further developments, trends, and reports in the Malaysia Domestic CEP Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence