Key Insights

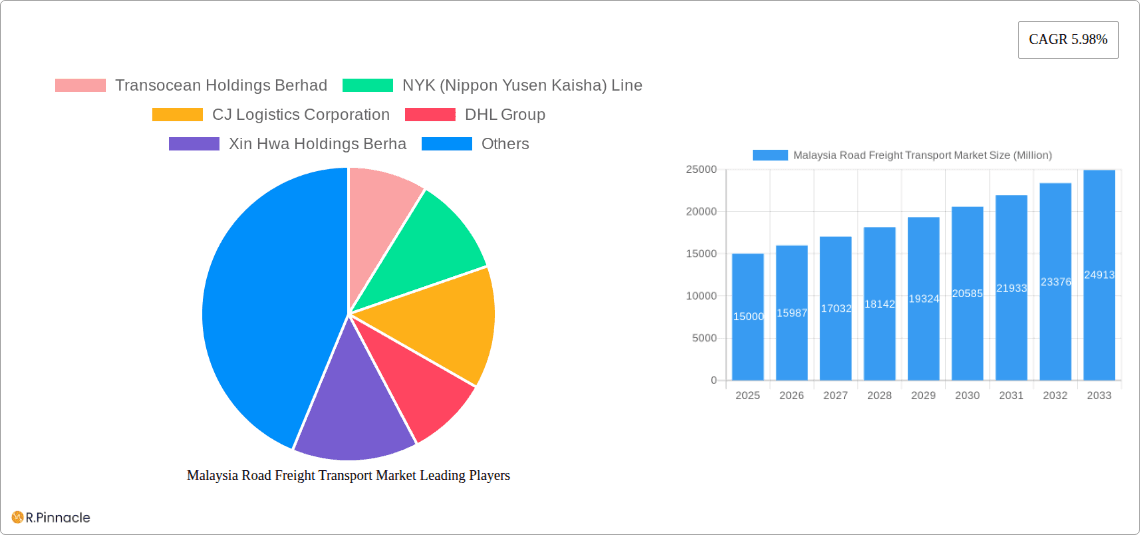

The Malaysian road freight transport market is projected to reach 29.7 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. This growth is driven by the expanding e-commerce sector, necessitating efficient last-mile delivery solutions, and the robust manufacturing and construction industries, requiring comprehensive FTL and LTL services. Increased intra-ASEAN trade further bolsters demand for international freight. Key challenges include volatile fuel prices, driver shortages, and evolving environmental and safety regulations. Opportunities lie within temperature-controlled logistics for perishables and containerized shipping.

Malaysia Road Freight Transport Market Market Size (In Billion)

The competitive environment comprises global leaders such as DHL and FedEx, alongside prominent domestic providers like Tiong Nam Logistics and Taipanco Sdn Bhd. The industry is embracing advanced technologies, including GPS tracking and route optimization, to boost supply chain efficiency and transparency. Ongoing infrastructure development, particularly in road networks, is expected to accelerate market expansion. A growing focus on sustainability is leading to investments in alternative fuels and eco-friendly fleets, aligning with regulatory requirements and environmental concerns.

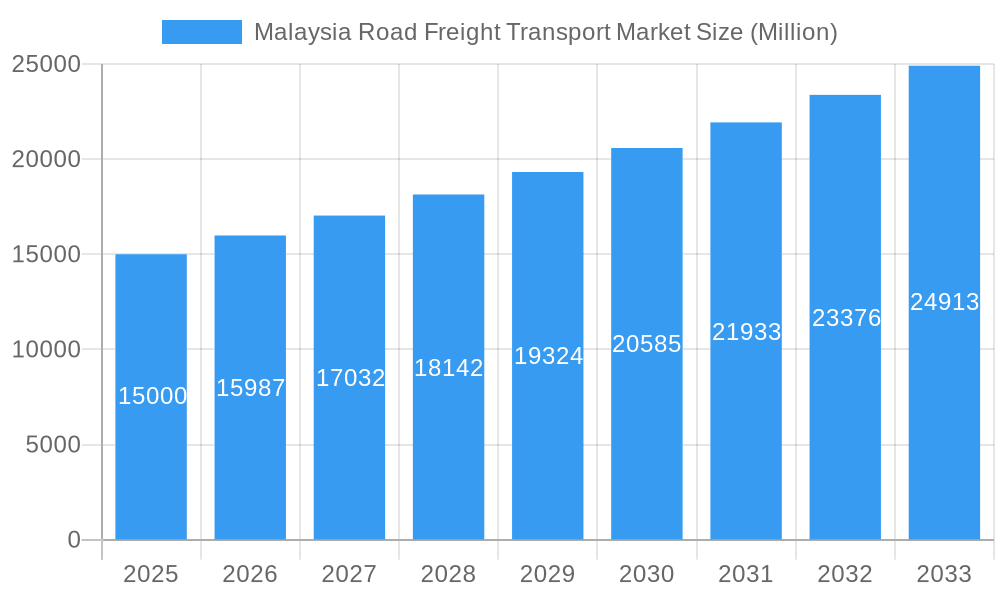

Malaysia Road Freight Transport Market Company Market Share

Malaysia Road Freight Transport Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Malaysia road freight transport market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, and future opportunities within this crucial sector. The study period (2019-2024) provides a historical perspective, while the forecast period (2025-2033) projects future trends, enabling informed decision-making.

Malaysia Road Freight Transport Market Structure & Innovation Trends

The Malaysian road freight transport market exhibits a moderately concentrated structure, with several large players holding significant market share. Transocean Holdings Berhad, NYK Line, CJ Logistics Corporation, DHL Group, and Xin Hwa Holdings Berhad are among the key market participants, vying for dominance in various segments. Market share dynamics are influenced by factors like fleet size, technological capabilities, and strategic partnerships. The estimated market share for these top 5 players in 2025 is approximately xx%.

Innovation within the market is driven by several factors:

- Technological advancements: Adoption of telematics, GPS tracking, and route optimization software enhance efficiency and reduce operational costs. The emergence of autonomous vehicles also presents significant potential for future market disruption.

- Regulatory frameworks: Government regulations regarding safety, emissions, and licensing play a critical role in shaping market dynamics. Compliance requirements often drive investment in new technologies and operational improvements.

- Product substitutes: While road freight remains dominant, alternative modes of transport such as rail and coastal shipping compete for market share, particularly for long-haul movements.

- End-user demographics: The growing e-commerce sector fuels demand for faster and more reliable last-mile delivery services, influencing market segment growth.

- M&A activities: Recent mergers and acquisitions, such as FM Global Logistics' acquisition of CAC Logistics Services for USD 5.5 Million in September 2023, illustrate the consolidation trend within the market and the drive for regional expansion. The total value of M&A deals in the sector between 2019 and 2024 is estimated at xx Million USD.

Malaysia Road Freight Transport Market Market Dynamics & Trends

The Malaysian road freight transport market is characterized by robust growth, driven primarily by expanding industrial activity, rising e-commerce penetration, and increased cross-border trade. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by government initiatives focused on infrastructure development and the strengthening of logistics networks. The market penetration of technology-driven solutions is steadily increasing, with a projected xx% penetration by 2033. However, competitive pressures from both established players and new entrants necessitate continuous innovation and operational efficiency improvements. Consumer preferences are shifting towards greater transparency, speed, and reliability in freight services. Companies are adapting to meet these expectations by implementing advanced tracking systems and improving customer service.

Dominant Regions & Segments in Malaysia Road Freight Transport Market

The dominant regions within the Malaysian road freight transport market are concentrated around major industrial hubs and port cities. These areas benefit from established infrastructure, higher population densities, and stronger economic activity. The FTL (Full Truck Load) segment currently holds the largest market share, driven by the transport of larger quantities of goods. However, the LTL (Less than Truck Load) segment is experiencing significant growth, particularly fueled by the rise of e-commerce and the increased demand for small parcel deliveries. Within the goods configuration, solid goods comprise a larger market share compared to fluid goods.

Key drivers for dominance in various segments include:

- Economic policies: Government incentives aimed at fostering industrial development and promoting trade directly impact market demand.

- Infrastructure: The quality and accessibility of road networks significantly influence transportation costs and efficiency.

- Technological advancements: The adoption of efficient transportation management systems and tracking technologies enhances operational efficiency.

Further analysis shows that domestic freight transport currently constitutes the largest share of the market. However, international freight transportation is witnessing impressive growth due to the country’s strategic geographical position and its expanding trade links with neighbouring countries and beyond. The manufacturing, wholesale and retail trade, and construction sectors are the major end-user industries driving demand.

Malaysia Road Freight Transport Market Product Innovations

Recent product innovations in the Malaysian road freight transport market revolve around improving efficiency, transparency, and sustainability. The integration of telematics and real-time tracking systems enhances visibility throughout the supply chain. This is complemented by the use of advanced route optimization software, reducing fuel consumption and transportation time. The growing adoption of electric vehicles, demonstrated by DHL's recent investment in electric vans and scooters, signifies a shift toward environmentally friendly logistics solutions, responding to growing sustainability concerns. These innovations are aimed at improving service quality, reducing costs and increasing the market competitiveness of companies.

Report Scope & Segmentation Analysis

This report segments the Malaysian road freight transport market across various parameters:

- Truckload Specification: FTL and LTL, with FTL projecting faster growth due to the expansion of manufacturing and industrial production.

- Containerization: Containerized and Non-Containerized, where containerized freight commands a larger share due to its efficiency and security.

- Distance: Long Haul and Short Haul, with short haul segment experiencing greater dynamism due to e-commerce growth.

- Goods Configuration: Fluid Goods and Solid Goods, where solid goods dominate due to the significant presence of manufacturing and retail.

- Temperature Control: Non-Temperature Controlled and Temperature Controlled, with steady growth in temperature-controlled transport for sensitive goods.

- End User Industry: Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others, with Manufacturing and Wholesale & Retail Trade driving the majority of the demand.

- Destination: Domestic and International, with both segments exhibiting healthy growth.

Each segment's market size, growth projections, and competitive dynamics are analyzed in detail within the full report.

Key Drivers of Malaysia Road Freight Transport Market Growth

The growth of the Malaysian road freight transport market is propelled by a multitude of factors. The expanding manufacturing and industrial sectors create a significant demand for efficient logistics solutions. The booming e-commerce industry fuels the need for reliable last-mile delivery services. Government investments in infrastructure development and initiatives aimed at improving logistics infrastructure further bolster market growth. Technological advancements such as GPS tracking, route optimization software, and the increasing adoption of electric vehicles improve efficiency and reduce operational costs. These factors synergistically contribute to the positive growth trajectory of the market.

Challenges in the Malaysia Road Freight Transport Market Sector

The Malaysian road freight transport market faces several challenges. Congestion in major urban areas leads to increased transportation times and higher operational costs. The fluctuating price of fuel poses a significant risk, impacting profitability. Driver shortages and competition for skilled labor remain a persistent issue. Stricter environmental regulations pose challenges for older vehicle fleets, requiring investment in newer, more compliant vehicles. These factors can hinder market growth if not addressed effectively.

Emerging Opportunities in Malaysia Road Freight Transport Market

The Malaysian road freight transport market presents various emerging opportunities. The increasing adoption of technology, such as the implementation of blockchain technology for improved supply chain traceability, presents substantial opportunities. The growing demand for sustainable and environmentally friendly logistics solutions, such as the expansion of electric vehicle fleets, opens new avenues for innovation. The increasing focus on last-mile delivery solutions for the burgeoning e-commerce sector also creates significant market potential. These trends provide ample prospects for growth and innovation.

Leading Players in the Malaysia Road Freight Transport Market Market

- Transocean Holdings Berhad

- NYK (Nippon Yusen Kaisha) Line

- CJ Logistics Corporation

- DHL Group

- Xin Hwa Holdings Berhad

- FM Global Logistics

- GAC Malaysia

- FedEx

- Tiong Nam Logistics

- Taipanco Sdn Bhd

Key Developments in Malaysia Road Freight Transport Market Industry

- September 2023: FM Global Logistics Holdings Bhd acquired CAC Logistics Services Pte Ltd for RM18.86 million (USD 5.5 million), expanding its regional footprint.

- September 2023: CJ Logistics launched a transport platform, ‘the unban,’ connecting shippers and carriers, improving market efficiency.

- November 2023: DHL Express added 44 electric vans and seven electric scooters, strengthening its commitment to sustainable logistics.

Future Outlook for Malaysia Road Freight Transport Market Market

The future outlook for the Malaysian road freight transport market remains positive. Continued economic growth, expansion of e-commerce, and government investments in infrastructure will drive market expansion. Technological advancements will continue to reshape the industry, increasing efficiency and sustainability. Strategic partnerships and mergers and acquisitions will further consolidate the market, leading to enhanced service offerings and improved competitiveness. The overall market potential is significant, offering attractive opportunities for both established players and new entrants.

Malaysia Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Malaysia Road Freight Transport Market Segmentation By Geography

- 1. Malaysia

Malaysia Road Freight Transport Market Regional Market Share

Geographic Coverage of Malaysia Road Freight Transport Market

Malaysia Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transocean Holdings Berhad

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NYK (Nippon Yusen Kaisha) Line

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CJ Logistics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xin Hwa Holdings Berha

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FM Global Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GAC Malaysia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tiong Nam Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Taipanco Sdn Bhd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transocean Holdings Berhad

List of Figures

- Figure 1: Malaysia Road Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Malaysia Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Malaysia Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Malaysia Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: Malaysia Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: Malaysia Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: Malaysia Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: Malaysia Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: Malaysia Road Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: Malaysia Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: Malaysia Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: Malaysia Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: Malaysia Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: Malaysia Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: Malaysia Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: Malaysia Road Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Road Freight Transport Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Malaysia Road Freight Transport Market?

Key companies in the market include Transocean Holdings Berhad, NYK (Nippon Yusen Kaisha) Line, CJ Logistics Corporation, DHL Group, Xin Hwa Holdings Berha, FM Global Logistics, GAC Malaysia, FedEx, Tiong Nam Logistics, Taipanco Sdn Bhd.

3. What are the main segments of the Malaysia Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

November 2023: DHL Express reaffirmed its commitment to clean mobility by adding 44 electric vans and seven electric scooters in Malaysia. This latest investment builds on the company’s milestone of being the first in the country to deploy electric vehicles for logistics use in October 2022.September 2023: FM Global Logistics Holdings Bhd has acquired Singapore-based CAC Logistics Services Pte Ltd for RM18.86 million (USD 5.5 million) cash, as it looks to expand its footing regionally. CAC is principally engaged in general warehousing, road transportation and other related services.September 2023: CJ Logistics has launched a transport platform called ‘the unban,’ connecting shippers and carriers, addressing entrenched transport issues and bringing a transformative wind to the freight transport market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Malaysia Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence