Key Insights

The India CNG and LPG vehicle market is poised for substantial expansion, projecting a CAGR of 6.8%. With an estimated market size of 11 billion in the base year of 2025, the sector's growth is propelled by rising fuel prices, stringent emission regulations, and government initiatives promoting cleaner transportation. Passenger cars and three-wheelers are key market segments, with a notable increase in CNG-powered commercial vehicles. Geographic distribution indicates a higher concentration in urban centers of North and West India, attributed to superior infrastructure and enhanced consumer awareness. Technological advancements in engine efficiency and vehicle performance further stimulate market growth. Key challenges include limited refueling infrastructure and concerns regarding the long-term availability of CNG and LPG. Despite these hurdles, continuous infrastructure development and supportive policies are expected to drive consistent market expansion.

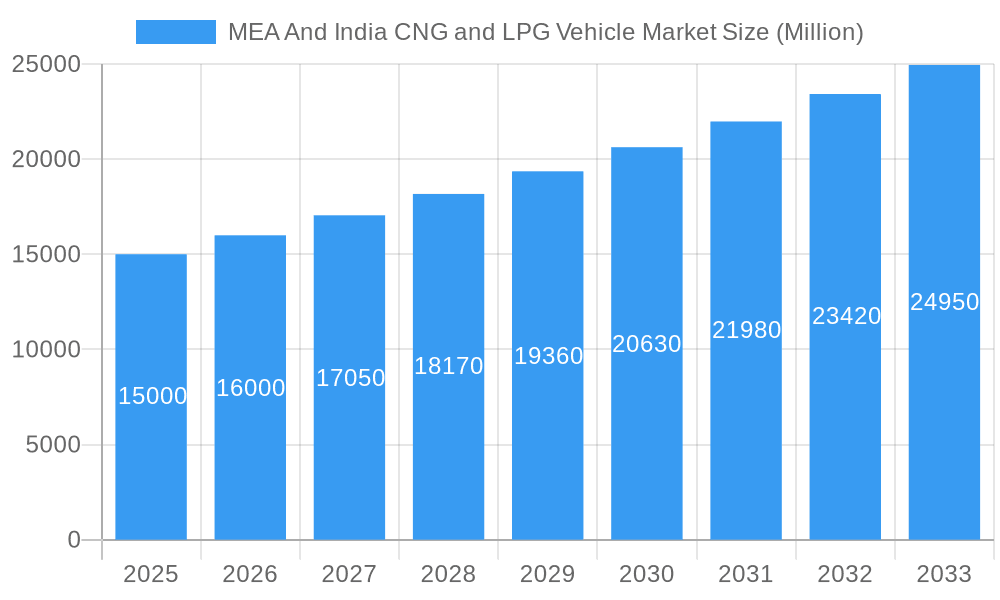

MEA And India CNG and LPG Vehicle Market Market Size (In Billion)

The MEA region presents a developing yet promising market for CNG and LPG vehicles. Growth drivers include increasing urbanization, escalating fuel costs, and government encouragement of cleaner fuel adoption. However, the MEA market faces unique challenges such as varied regulatory frameworks across nations, infrastructure deficits, and differing levels of consumer awareness. Market dynamics are significantly shaped by the distinct needs of individual countries within the region. Expected growth rates in MEA are anticipated to be lower than India, with significant future expansion projected for commercial and passenger vehicle segments. Key industry players with robust market presence are instrumental in shaping the industry's trajectory.

MEA And India CNG and LPG Vehicle Market Company Market Share

MEA and India CNG and LPG Vehicle Market Analysis: Forecast to 2033

This comprehensive report offers an in-depth analysis of the MEA and India CNG and LPG vehicle market from 2019 to 2033, with a specific focus on 2025. It examines market structure, dynamics, key players, and future growth potential, providing critical insights for industry stakeholders. Leveraging extensive data analysis, the report forecasts market trends and identifies lucrative opportunities within this dynamic sector.

MEA And India CNG and LPG Vehicle Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the MEA and India CNG and LPG vehicle market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of established global players and regional manufacturers. Market share is currently dominated by a few key players, with Tata Motors Limited, Maruti Suzuki India Limited, and Mahindra & Mahindra Limited holding significant positions. However, the market shows signs of increasing fragmentation with the entry of new players focusing on niche segments.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market in 2024 is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Stringent emission norms, rising fuel costs, and government incentives for alternative fuel vehicles are driving innovation in CNG and LPG technology.

- Regulatory Frameworks: Government policies promoting the adoption of cleaner transportation fuels are significantly impacting market growth.

- Product Substitutes: Competition from electric vehicles (EVs) and other alternative fuel vehicles poses a challenge, although CNG and LPG vehicles still hold a cost advantage in certain segments.

- End-User Demographics: The market is driven by diverse end-users, including commercial fleets, public transportation, and individual consumers.

- M&A Activities: The past five years have witnessed xx M&A deals valued at approximately xx Million, primarily focused on technology acquisition and market expansion.

MEA And India CNG and LPG Vehicle Market Market Dynamics & Trends

This section delves into the key market dynamics and trends shaping the MEA and India CNG and LPG vehicle market. The market exhibits robust growth, fueled by increasing environmental concerns, government regulations promoting cleaner fuels, and the cost-effectiveness of CNG and LPG compared to traditional fuels. Technological advancements in engine efficiency and fuel delivery systems further contribute to market expansion. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), driven by strong growth in commercial vehicle segments and increasing adoption in passenger cars. Market penetration of CNG and LPG vehicles is expected to reach xx% by 2033. Competitive dynamics are marked by intense rivalry among established players and the emergence of new entrants, especially in the three-wheeler segment.

Dominant Regions & Segments in MEA And India CNG and LPG Vehicle Market

India currently dominates the MEA and India CNG and LPG vehicle market, driven by strong government support for alternative fuels and a large addressable market. Within India, certain states with robust infrastructure and favorable policies demonstrate significantly higher market penetration than others.

- By Vehicle Type: The commercial vehicle segment (trucks and buses) contributes significantly to the overall market volume, with three-wheelers representing a substantial market share. Passenger cars are growing steadily but lag behind commercial vehicles.

- By Fuel Type: CNG currently holds a larger market share than LPG, due to its wider availability and lower cost. However, LPG is expected to witness growth in certain niche segments.

Key Drivers for India's Dominance:

- Extensive CNG and LPG infrastructure development

- Favorable government policies and subsidies

- Cost-effectiveness of CNG and LPG compared to other fuels

- High demand from commercial vehicle operators

- Growing awareness of environmental concerns.

MEA And India CNG and LPG Vehicle Market Product Innovations

Ongoing innovation in CNG and LPG vehicle technology focuses on improving fuel efficiency, reducing emissions, and enhancing vehicle performance. Key advancements include the development of advanced fuel injection systems, optimized engine designs, and the integration of advanced safety features. These innovations cater to the evolving needs of consumers and regulatory requirements, ensuring that CNG and LPG vehicles remain competitive with alternative fuel options.

Report Scope & Segmentation Analysis

This report provides a granular segmentation analysis of the MEA and India CNG and LPG vehicle market across various parameters:

- By Vehicle Type: Three-wheelers, Passenger Cars, Trucks (Light, Medium, and Heavy), Buses. Each segment is analyzed in terms of market size, growth projections, and competitive landscape.

- By Fuel Type: CNG and LPG. Detailed analysis of market dynamics, growth drivers, and challenges for each fuel type is provided.

Growth projections for each segment are presented for the forecast period (2025-2033), highlighting the potential for investment and expansion.

Key Drivers of MEA And India CNG and LPG Vehicle Market Growth

The growth of the MEA and India CNG and LPG vehicle market is driven by several factors including:

- Government Regulations: Stringent emission norms and supportive policies incentivize the adoption of cleaner fuel vehicles.

- Economic Factors: The relatively lower cost of CNG and LPG compared to traditional fuels makes them attractive to consumers and businesses.

- Technological Advancements: Improvements in engine technology and fuel efficiency enhance the appeal of CNG and LPG vehicles.

Challenges in the MEA And India CNG and LPG Vehicle Market Sector

The MEA and India CNG and LPG vehicle market faces challenges such as:

- Infrastructure Limitations: Uneven distribution of CNG and LPG filling stations restricts market expansion in certain regions.

- Supply Chain Issues: Potential disruptions in the supply of CNG and LPG can impact market stability.

- Competition from EVs: The growing popularity of electric vehicles presents a significant competitive challenge.

Emerging Opportunities in MEA And India CNG and LPG Vehicle Market

Emerging opportunities in the market include:

- Expansion into rural markets: Significant potential exists for growth in underserved regions with limited access to alternative fuels.

- Technological advancements: Innovations in fuel efficiency and emission reduction technology will further drive market growth.

- Government initiatives: Continued support from governments will play a crucial role in market expansion.

Leading Players in the MEA And India CNG and LPG Vehicle Market Market

- MAN SE

- Bajaj Auto Limited

- Tata Motors Limited

- Eicher Motors Limited

- IVECO S.p.A

- Mahindra & Mahindra Limited

- Maruti Suzuki India Limited

- Ford Motor Company

- The Hyundai Motor Company

Key Developments in MEA And India CNG and LPG Vehicle Market Industry

- 2023: Introduction of new CNG-powered commercial vehicles by Tata Motors.

- 2022: Government announcement of further incentives for CNG vehicle adoption.

- 2021: Significant investment in CNG infrastructure by private companies.

Future Outlook for MEA And India CNG and LPG Vehicle Market Market

The MEA and India CNG and LPG vehicle market is poised for sustained growth, driven by technological innovation, supportive government policies, and the increasing adoption of alternative fuels. The market's future success hinges on continued investment in infrastructure, technological advancements in fuel efficiency and emission control, and the sustained competitive advantage of CNG and LPG against alternative fuels. This will create ample opportunities for market expansion and attract further investments in the years to come.

MEA And India CNG and LPG Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Three-wheelers

- 1.2. Passenger Cars

- 1.3. Trucks ( Light, Medium, and Heavy)

- 1.4. Buses

-

2. Fuel Type

- 2.1. CNG

- 2.2. LPG

-

3. Geography

-

3.1. Middle-East

- 3.1.1. Kingdom of Saudi Arabia

- 3.1.2. United Arab Emirates

- 3.1.3. Turkey

- 3.1.4. Egypt

- 3.1.5. Qatar

- 3.1.6. Rest of Middle-East

-

3.2. Africa

- 3.2.1. South Africa

- 3.2.2. Kenya

- 3.2.3. Uganda

- 3.2.4. Tanzania

- 3.2.5. Nigeria

- 3.2.6. Rest of Africa

- 3.3. India

-

3.1. Middle-East

MEA And India CNG and LPG Vehicle Market Segmentation By Geography

-

1. Middle East

- 1.1. Kingdom of Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Turkey

- 1.4. Egypt

- 1.5. Qatar

- 1.6. Rest of Middle East

-

2. Africa

- 2.1. South Africa

- 2.2. Kenya

- 2.3. Uganda

- 2.4. Tanzania

- 2.5. Nigeria

- 2.6. Rest of Africa

- 3. India

MEA And India CNG and LPG Vehicle Market Regional Market Share

Geographic Coverage of MEA And India CNG and LPG Vehicle Market

MEA And India CNG and LPG Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry is Expected to Boost the Luxury Yacht Market

- 3.3. Market Restrains

- 3.3.1. Luxury Yacht Charter and Used Yacht to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Environmental And Cost Benefits Associated With Natural Gas Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA And India CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Three-wheelers

- 5.1.2. Passenger Cars

- 5.1.3. Trucks ( Light, Medium, and Heavy)

- 5.1.4. Buses

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. CNG

- 5.2.2. LPG

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East

- 5.3.1.1. Kingdom of Saudi Arabia

- 5.3.1.2. United Arab Emirates

- 5.3.1.3. Turkey

- 5.3.1.4. Egypt

- 5.3.1.5. Qatar

- 5.3.1.6. Rest of Middle-East

- 5.3.2. Africa

- 5.3.2.1. South Africa

- 5.3.2.2. Kenya

- 5.3.2.3. Uganda

- 5.3.2.4. Tanzania

- 5.3.2.5. Nigeria

- 5.3.2.6. Rest of Africa

- 5.3.3. India

- 5.3.1. Middle-East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.4.2. Africa

- 5.4.3. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Middle East MEA And India CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Three-wheelers

- 6.1.2. Passenger Cars

- 6.1.3. Trucks ( Light, Medium, and Heavy)

- 6.1.4. Buses

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. CNG

- 6.2.2. LPG

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Middle-East

- 6.3.1.1. Kingdom of Saudi Arabia

- 6.3.1.2. United Arab Emirates

- 6.3.1.3. Turkey

- 6.3.1.4. Egypt

- 6.3.1.5. Qatar

- 6.3.1.6. Rest of Middle-East

- 6.3.2. Africa

- 6.3.2.1. South Africa

- 6.3.2.2. Kenya

- 6.3.2.3. Uganda

- 6.3.2.4. Tanzania

- 6.3.2.5. Nigeria

- 6.3.2.6. Rest of Africa

- 6.3.3. India

- 6.3.1. Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Africa MEA And India CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Three-wheelers

- 7.1.2. Passenger Cars

- 7.1.3. Trucks ( Light, Medium, and Heavy)

- 7.1.4. Buses

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. CNG

- 7.2.2. LPG

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Middle-East

- 7.3.1.1. Kingdom of Saudi Arabia

- 7.3.1.2. United Arab Emirates

- 7.3.1.3. Turkey

- 7.3.1.4. Egypt

- 7.3.1.5. Qatar

- 7.3.1.6. Rest of Middle-East

- 7.3.2. Africa

- 7.3.2.1. South Africa

- 7.3.2.2. Kenya

- 7.3.2.3. Uganda

- 7.3.2.4. Tanzania

- 7.3.2.5. Nigeria

- 7.3.2.6. Rest of Africa

- 7.3.3. India

- 7.3.1. Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. India MEA And India CNG and LPG Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Three-wheelers

- 8.1.2. Passenger Cars

- 8.1.3. Trucks ( Light, Medium, and Heavy)

- 8.1.4. Buses

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. CNG

- 8.2.2. LPG

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Middle-East

- 8.3.1.1. Kingdom of Saudi Arabia

- 8.3.1.2. United Arab Emirates

- 8.3.1.3. Turkey

- 8.3.1.4. Egypt

- 8.3.1.5. Qatar

- 8.3.1.6. Rest of Middle-East

- 8.3.2. Africa

- 8.3.2.1. South Africa

- 8.3.2.2. Kenya

- 8.3.2.3. Uganda

- 8.3.2.4. Tanzania

- 8.3.2.5. Nigeria

- 8.3.2.6. Rest of Africa

- 8.3.3. India

- 8.3.1. Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 MAN S

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bajaj Auto Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Tata Motors Limited

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eicher Motors Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 IVECO S p A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Mahindra & Mahindra Limited

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Maruti Suzuki India Limited

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Ford Motor Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 The Hyundai Motor Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 MAN S

List of Figures

- Figure 1: MEA And India CNG and LPG Vehicle Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: MEA And India CNG and LPG Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 7: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Kingdom of Saudi Arabia MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Turkey MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Egypt MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Qatar MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Middle East MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 16: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 17: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: South Africa MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Kenya MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Uganda MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Tanzania MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Nigeria MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Africa MEA And India CNG and LPG Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 26: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 27: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: MEA And India CNG and LPG Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA And India CNG and LPG Vehicle Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the MEA And India CNG and LPG Vehicle Market?

Key companies in the market include MAN S, Bajaj Auto Limited, Tata Motors Limited, Eicher Motors Limited, IVECO S p A, Mahindra & Mahindra Limited, Maruti Suzuki India Limited, Ford Motor Company, The Hyundai Motor Company.

3. What are the main segments of the MEA And India CNG and LPG Vehicle Market?

The market segments include Vehicle Type, Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry is Expected to Boost the Luxury Yacht Market.

6. What are the notable trends driving market growth?

Environmental And Cost Benefits Associated With Natural Gas Vehicles.

7. Are there any restraints impacting market growth?

Luxury Yacht Charter and Used Yacht to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA And India CNG and LPG Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA And India CNG and LPG Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA And India CNG and LPG Vehicle Market?

To stay informed about further developments, trends, and reports in the MEA And India CNG and LPG Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence