Key Insights

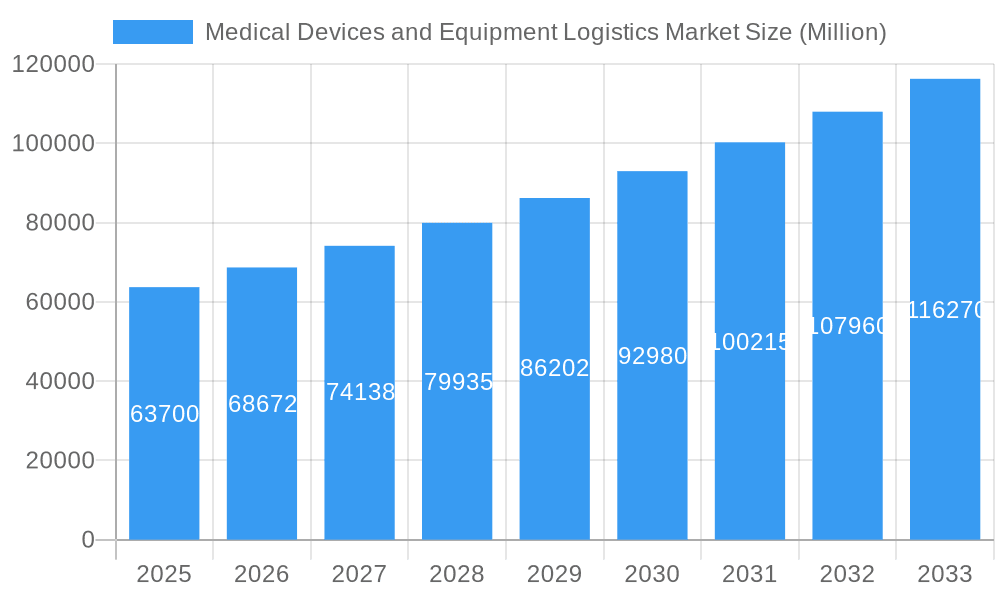

The global medical devices and equipment logistics market is experiencing robust growth, projected to reach a substantial size. The market's Compound Annual Growth Rate (CAGR) of 7.81% from 2019 to 2024 indicates a significant upward trajectory. This expansion is driven by several key factors. The increasing prevalence of chronic diseases necessitates the efficient and timely delivery of medical devices and equipment, fueling demand. Furthermore, advancements in medical technology are introducing sophisticated, often temperature-sensitive, devices, requiring specialized logistics solutions. E-commerce expansion within the healthcare sector also contributes to market growth, demanding robust and reliable delivery networks. Stringent regulatory requirements and the need for secure handling further emphasize the importance of specialized logistics providers. Competitive pressures within the industry are driving innovation in areas like cold chain logistics, real-time tracking, and data analytics to improve efficiency and transparency throughout the supply chain.

Medical Devices and Equipment Logistics Market Market Size (In Billion)

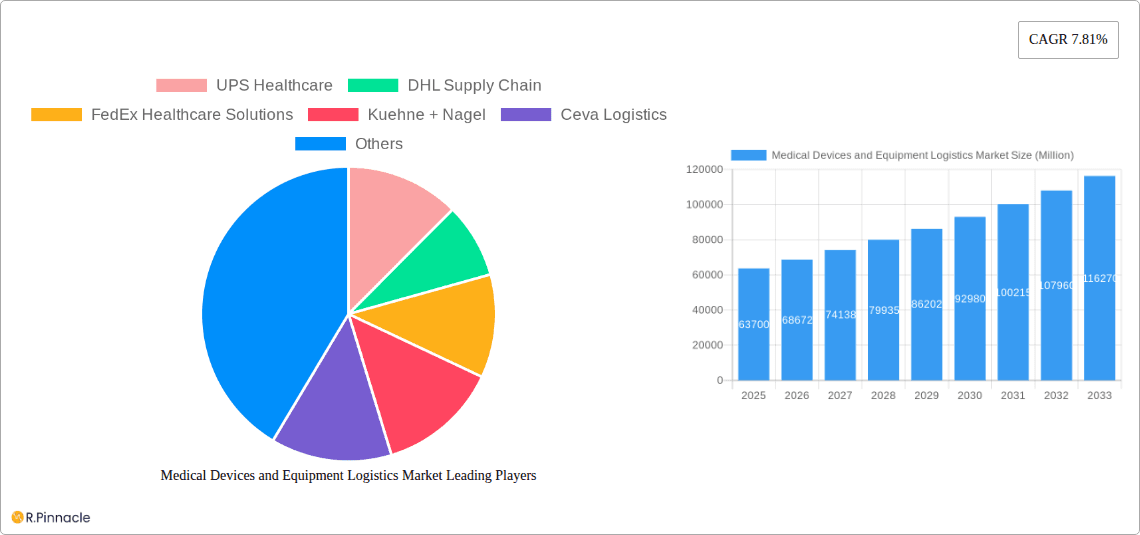

Major players like UPS Healthcare, DHL Supply Chain, FedEx Healthcare Solutions, and Kuehne + Nagel dominate the market, leveraging their extensive networks and expertise. However, smaller, specialized logistics providers are also emerging, offering niche services catering to specific segments within the medical device and equipment sector. The market is segmented by various factors including transportation mode (air, sea, road), device type (implantable, diagnostic, therapeutic), and geographic location. While precise regional breakdowns are unavailable, it's reasonable to assume a substantial market share is held by North America and Europe due to their advanced healthcare infrastructure and high per capita healthcare expenditure. The forecast period of 2025-2033 promises continued growth, driven by ongoing technological advancements and the expanding global healthcare landscape. The continued rise in demand for specialized services, particularly in temperature-sensitive logistics, will shape the competitive landscape and offer attractive opportunities for market entrants and established players alike.

Medical Devices and Equipment Logistics Market Company Market Share

Medical Devices and Equipment Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Medical Devices and Equipment Logistics Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 (Base Year: 2025, Estimated Year: 2025). Discover key market trends, competitive landscapes, and growth opportunities within this dynamic sector.

Medical Devices and Equipment Logistics Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players and their strategies. We examine market concentration, identifying the leading companies and their respective market shares. The report explores innovation drivers such as technological advancements in cold chain logistics, automation, and data analytics. Further, the analysis delves into the regulatory landscape, its impact on market players, and the influence of substitute products. End-user demographics are profiled, along with a detailed review of mergers and acquisitions (M&A) activity within the sector, including deal values (in Millions).

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share (xx%). Smaller niche players focus on specialized segments.

- Innovation Drivers: Advancements in real-time tracking, AI-powered route optimization, and blockchain technology for enhanced transparency are shaping the market.

- Regulatory Framework: Stringent regulations concerning temperature-sensitive pharmaceuticals and medical devices influence operational practices and compliance costs.

- Product Substitutes: Limited direct substitutes exist, given the specialized nature of medical device logistics; however, alternative transportation modes compete based on cost and efficiency.

- End-User Demographics: Hospitals, pharmaceutical companies, medical device manufacturers, and research institutions constitute the primary end-users.

- M&A Activity: Significant M&A activity (xx deals valued at xx Million) has been observed in recent years, driven by consolidation and expansion strategies.

Medical Devices and Equipment Logistics Market Dynamics & Trends

This section examines the factors driving market growth, including increasing demand for specialized logistics solutions, the rising prevalence of chronic diseases, and an expanding global healthcare infrastructure. We analyze the impact of technological disruptions, such as the Internet of Things (IoT) and automation, on market dynamics. The analysis also explores consumer preferences for enhanced visibility and security in the supply chain, as well as the competitive landscape. Key metrics, including compound annual growth rate (CAGR) and market penetration, are presented.

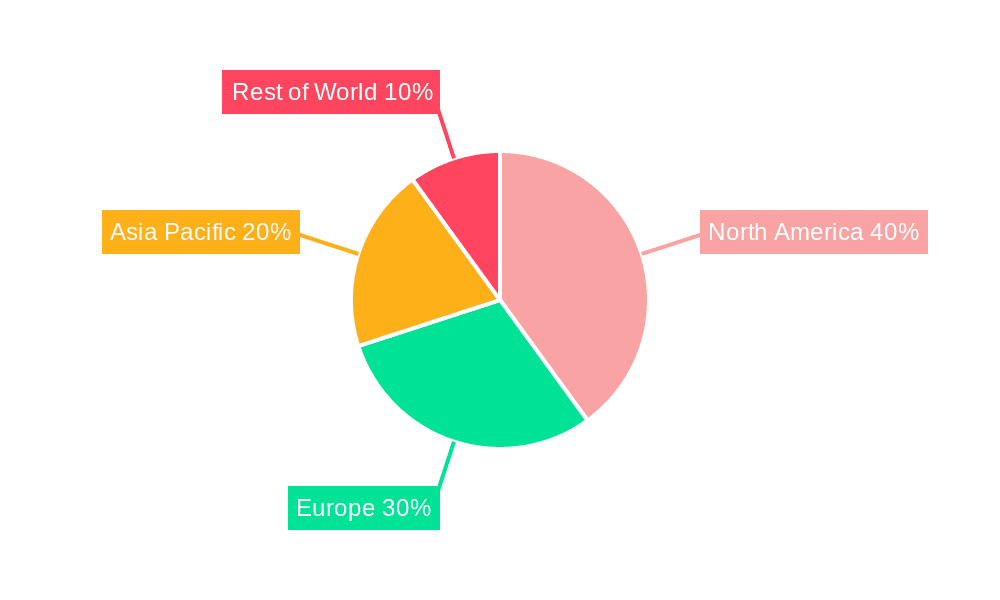

Dominant Regions & Segments in Medical Devices and Equipment Logistics Market

This section identifies the leading regions and segments within the Medical Devices and Equipment Logistics Market. Detailed analysis is provided for the dominant region, including key drivers of market growth.

- Dominant Region: North America currently holds the largest market share, driven by factors such as robust healthcare infrastructure, high per capita healthcare expenditure and technological advancements.

- Key Drivers (North America):

- Stringent regulatory framework fostering specialized logistics solutions.

- High adoption rate of advanced technologies such as IoT and AI.

- Significant investment in healthcare infrastructure.

- Well-established cold chain logistics networks.

(Similar analysis will be provided for other regions including Europe and Asia-Pacific)

Medical Devices and Equipment Logistics Market Product Innovations

Recent product innovations focus on enhancing temperature control, real-time monitoring capabilities, and data analytics for improved supply chain visibility. This includes sophisticated tracking systems, specialized packaging solutions, and automated warehousing systems. These innovations address critical market needs for improved efficiency, safety, and regulatory compliance.

Report Scope & Segmentation Analysis

The report segments the market based on various criteria, including modality, temperature sensitivity, and end-user. Each segment’s growth projections, market sizes, and competitive dynamics are detailed.

- Modality Segmentation: (Details on air, sea, road, rail etc. with growth projections and market sizes)

- Temperature Sensitivity Segmentation: (Details on refrigerated, ambient etc. with growth projections and market sizes)

- End-User Segmentation: (Details on hospitals, clinics, pharmaceutical companies etc. with growth projections and market sizes)

Key Drivers of Medical Devices and Equipment Logistics Market Growth

The market's growth is propelled by several factors: the increasing demand for medical devices and pharmaceuticals, stringent regulatory requirements mandating secure and efficient logistics, technological advancements enabling enhanced tracking and monitoring, and rising healthcare expenditure globally. Government initiatives promoting healthcare infrastructure development further contribute to market expansion.

Challenges in the Medical Devices and Equipment Logistics Market Sector

The sector faces challenges such as stringent regulatory compliance requirements, fluctuating fuel prices impacting transportation costs, and the need for substantial investments in technology and infrastructure to meet evolving customer demands. Supply chain disruptions, exacerbated by global events, also pose significant risks. These challenges can lead to increased operational costs and reduced efficiency.

Emerging Opportunities in Medical Devices and Equipment Logistics Market

Emerging opportunities lie in the adoption of advanced technologies, such as AI-powered route optimization and blockchain for enhanced traceability. The growth of personalized medicine and the expanding clinical trial landscape present significant opportunities for specialized logistics solutions. Expanding into emerging markets also offers substantial potential for market expansion.

Leading Players in the Medical Devices and Equipment Logistics Market Market

Key Developments in Medical Devices and Equipment Logistics Market Industry

- April 2024: UPS Healthcare invested USD 60 Million in expanding its Italian footprint, adding 100,000 sq. m of warehouse space. This significantly enhances its capacity for handling medical and pharmaceutical products.

- February 2024: FedEx Express launched the FedEx Life Science Center in Mumbai, India, boosting its clinical trial supply chain capabilities domestically and internationally.

Future Outlook for Medical Devices and Equipment Logistics Market Market

The Medical Devices and Equipment Logistics Market is poised for continued growth, driven by technological advancements, increasing healthcare spending, and the expansion of global healthcare infrastructure. Strategic partnerships, acquisitions, and investments in innovative logistics solutions will shape the market's future trajectory. The focus will remain on enhancing efficiency, security, and regulatory compliance within the supply chain.

Medical Devices and Equipment Logistics Market Segmentation

-

1. Product Type

- 1.1. Medical Devices

- 1.2. Medical Equipment

Medical Devices and Equipment Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Medical Devices and Equipment Logistics Market Regional Market Share

Geographic Coverage of Medical Devices and Equipment Logistics Market

Medical Devices and Equipment Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Global Expansion of Healthcare Services; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Global Expansion of Healthcare Services; Technological Advancements

- 3.4. Market Trends

- 3.4.1. Medical Devices Manufacturer Integrate Cutting-edge Logistics Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Medical Devices

- 5.1.2. Medical Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Medical Devices

- 6.1.2. Medical Equipment

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Medical Devices

- 7.1.2. Medical Equipment

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Medical Devices

- 8.1.2. Medical Equipment

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Medical Devices

- 9.1.2. Medical Equipment

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Medical Devices

- 10.1.2. Medical Equipment

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UPS Healthcare

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Supply Chain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FedEx Healthcare Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kuehne + Nagel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ceva Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cardinal Health

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Owens & Minor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DB Schenker

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DSV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 World Courier**List Not Exhaustive 7 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 UPS Healthcare

List of Figures

- Figure 1: Global Medical Devices and Equipment Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Medical Devices and Equipment Logistics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 5: North America Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 12: Europe Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 13: Europe Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 15: Europe Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Asia Pacific Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East and Africa Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East and Africa Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South America Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 36: South America Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 37: South America Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: South America Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 39: South America Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South America Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South America Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 7: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Germany Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: France Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Italy Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 35: China Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: China Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Japan Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: India Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Australia Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Australia Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 48: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 49: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: GCC Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: GCC Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: South Africa Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Africa Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Rest of Middle East and Africa Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 58: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 59: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Brazil Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Argentina Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Argentina Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Devices and Equipment Logistics Market?

The projected CAGR is approximately 7.81%.

2. Which companies are prominent players in the Medical Devices and Equipment Logistics Market?

Key companies in the market include UPS Healthcare, DHL Supply Chain, FedEx Healthcare Solutions, Kuehne + Nagel, Ceva Logistics, Cardinal Health, Owens & Minor, DB Schenker, DSV, World Courier**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Medical Devices and Equipment Logistics Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Global Expansion of Healthcare Services; Technological Advancements.

6. What are the notable trends driving market growth?

Medical Devices Manufacturer Integrate Cutting-edge Logistics Solutions.

7. Are there any restraints impacting market growth?

Global Expansion of Healthcare Services; Technological Advancements.

8. Can you provide examples of recent developments in the market?

April 2024: UPS Healthcare channeled EUR 55 million (USD 60 million) into expanding its footprint in Italy. This investment sees the addition of 100,000 sq. m of warehouse space, split between Passo Corese, near Rome, and Somaglia in Lodi. With this financial commitment, UPS Healthcare aims to align the Passo Corese and Somaglia facilities with stringent distribution and manufacturing practices, ensuring the safe storage of medical and pharmaceutical products.February 2024: FedEx Express, a subsidiary of FedEx Corp., inaugurated the 'FedEx Life Science Center' in Mumbai, marking a milestone in India's and the global clinical trial supply chain. This new center is designed to cater to the storage and logistics needs of healthcare clients participating in clinical trials, both domestically in India and internationally shipping to the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Devices and Equipment Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Devices and Equipment Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Devices and Equipment Logistics Market?

To stay informed about further developments, trends, and reports in the Medical Devices and Equipment Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence