Key Insights

The Mexico caustic soda market is poised for significant expansion, projected to reach $12.69 billion by 2025 and grow at a compound annual growth rate (CAGR) of 3.2% between 2025 and 2033. This robust growth is propelled by escalating demand from Mexico's thriving chemical and pulp & paper industries, major end-users of caustic soda. The increasing need for cleaning agents, textiles, and water treatment solutions further fuels market expansion. The competitive landscape is characterized by established global entities such as Covestro AG, Dow, and FMC Corporation, alongside dynamic regional players like QUÍMICA TREZA. However, market dynamics are influenced by the volatility of raw material pricing and stringent environmental regulations. Segmentation analysis typically categorizes the market by product form (solid and liquid) and diverse applications, with regional consumption patterns exhibiting notable variations. Government initiatives aimed at fostering industrial development and infrastructure enhancement are expected to contribute to future market growth.

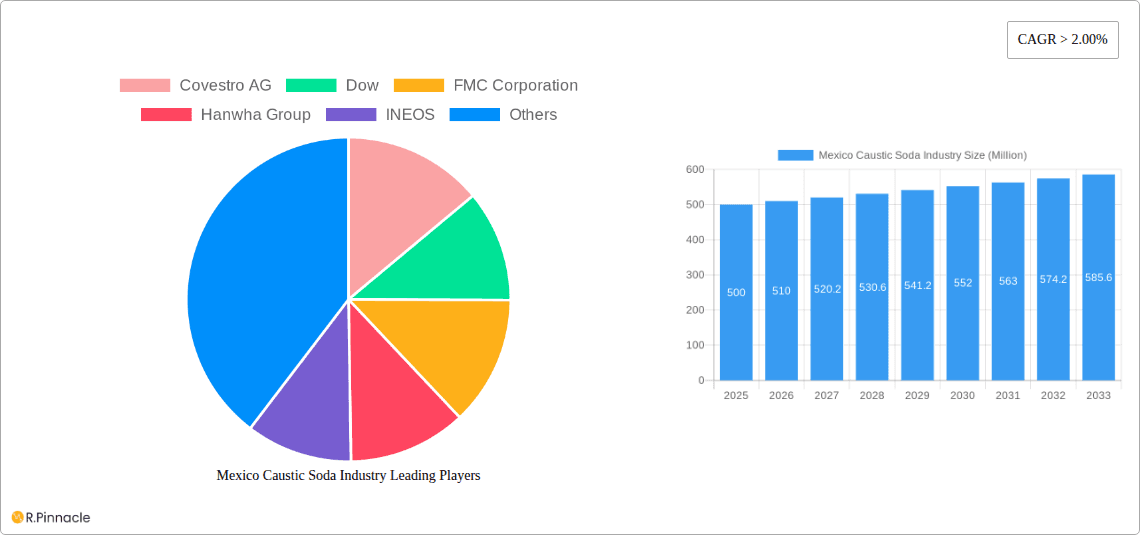

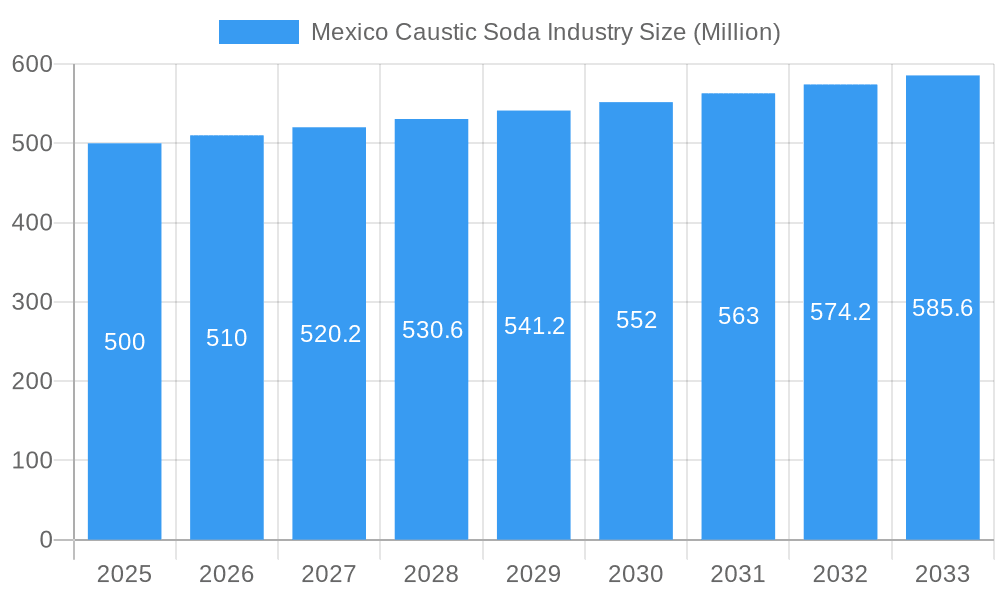

Mexico Caustic Soda Industry Market Size (In Billion)

The forecast period, 2025-2033, indicates sustained market expansion driven by consistent demand across key industrial sectors. While specific segment data is proprietary, regions undergoing rapid industrialization are anticipated to exhibit higher growth trajectories. Industry participants are likely prioritizing innovation, cost efficiency, and distribution network expansion to secure market leadership. Strategic imperatives may include the adoption of sustainable practices to align with environmental mandates, thereby appealing to environmentally conscious consumers and businesses. The long-term outlook for the Mexican caustic soda market remains optimistic, underpinned by ongoing industrial advancements and a growing consumer base. Continuous assessment of external economic factors and international trade policies is vital for precise market forecasting. Granular regional data analysis will offer deeper insights into growth potential across Mexico's diverse economic zones.

Mexico Caustic Soda Industry Company Market Share

Mexico Caustic Soda Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Mexico Caustic Soda industry, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025-2033, this report unveils the market's structure, dynamics, and future potential. The study includes detailed segmentation, competitive landscape analysis, and key growth drivers impacting the Mexican Caustic Soda market, projected to reach xx Million by 2033.

Mexico Caustic Soda Industry Market Structure & Innovation Trends

The Mexican Caustic Soda market exhibits a moderately concentrated structure, with key players like Covestro AG, Dow, FMC Corporation, Hanwha Group, INEOS, Kemira, Manuchar Mexico, Nouryon, Occidental Petroleum Corporation, Olin Corporation, QUÍMICA TREZA, SABIC, Solvay, and Westlake Chemical Corporation holding significant market share. The combined market share of the top five players is estimated at xx%. Innovation is driven by the demand for sustainable and cost-effective production methods, leading to investments in membrane cell technology and improved energy efficiency. Regulatory frameworks, including environmental regulations and safety standards, significantly impact operations. Product substitutes, such as alternative cleaning agents, pose a moderate threat, while M&A activities have been relatively limited in recent years, with the largest deal valued at approximately xx Million in 2022. End-user demographics reveal a significant demand from the pulp and paper, chemical, and water treatment sectors.

Mexico Caustic Soda Industry Market Dynamics & Trends

The Mexican Caustic Soda market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include rising demand from various end-use industries, particularly the booming construction and manufacturing sectors. Technological advancements, such as the adoption of more efficient production processes, further contribute to market expansion. Consumer preferences are shifting towards environmentally friendly and sustainable products, pushing manufacturers to adopt greener production methods. Competitive dynamics are characterized by price competition and strategic partnerships. Market penetration of membrane cell technology is gradually increasing, reaching approximately xx% in 2025. However, challenges such as fluctuating raw material prices and energy costs pose a potential threat to market growth.

Dominant Regions & Segments in Mexico Caustic Soda Industry

The Northern region of Mexico dominates the Caustic Soda market, driven by the concentration of major industrial clusters and robust infrastructure. Key drivers include:

- Favorable Government Policies: Supportive government initiatives aimed at promoting industrial growth.

- Developed Infrastructure: Well-established transportation networks facilitating efficient raw material sourcing and product distribution.

- Proximity to Key End-Users: Strategic location near major consumers of caustic soda.

This region accounts for approximately xx% of the total market volume. While other regions are experiencing growth, the Northern region maintains its leading position due to its established industrial base and favorable conditions. The dominant segment is the chemical industry, accounting for approximately xx% of total consumption.

Mexico Caustic Soda Industry Product Innovations

Recent product innovations focus on high-purity caustic soda for specialized applications and improved formulations for enhanced performance and reduced environmental impact. Manufacturers are emphasizing the development of sustainable and efficient production processes to improve cost-effectiveness and minimize environmental footprint. This aligns with the growing demand for environmentally friendly products, offering a strong competitive advantage.

Report Scope & Segmentation Analysis

The report segments the Mexican Caustic Soda market based on product type (liquid, solid), application (pulp & paper, chemical processing, water treatment, others), and region (North, Central, South). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. For instance, the pulp & paper segment is expected to demonstrate the highest CAGR, driven by the expanding paper industry in Mexico.

Key Drivers of Mexico Caustic Soda Industry Growth

The growth of the Mexico Caustic Soda industry is propelled by several key factors. Firstly, the expansion of the chemical and related manufacturing industries creates a robust demand for caustic soda. Secondly, the increasing construction activity necessitates a higher supply of caustic soda for various applications. Finally, supportive government policies, encouraging industrial development and infrastructure improvements, have further stimulated growth.

Challenges in the Mexico Caustic Soda Industry Sector

The sector faces challenges including fluctuations in raw material prices, particularly chlorine and salt, which directly impact production costs. Furthermore, stringent environmental regulations necessitate significant investments in pollution control technologies, increasing operational expenditures. Intense competition from both domestic and international players exerts pressure on profit margins.

Emerging Opportunities in Mexico Caustic Soda Industry

Significant opportunities exist in the growing demand for sustainable and eco-friendly production processes, coupled with the rising adoption of membrane cell technology. Expanding into new market segments, such as the renewable energy sector, presents a pathway for growth. Focusing on the development and adoption of high-purity caustic soda catering to niche applications, could also yield significant returns.

Leading Players in the Mexico Caustic Soda Industry Market

- Covestro AG

- Dow

- FMC Corporation

- Hanwha Group

- INEOS

- Kemira

- Manuchar Mexico

- Nouryon

- Occidental Petroleum Corporation

- Olin Corporation

- QUÍMICA TREZA

- SABIC

- Solvay

- Westlake Chemical Corporation

*List Not Exhaustive

Key Developments in Mexico Caustic Soda Industry

- 2022 Q3: Increased investment in membrane cell technology by a major player.

- 2023 Q1: Launch of a new high-purity caustic soda product by a leading manufacturer.

- 2024 Q2: Announcement of a strategic partnership between two key players to expand production capacity.

Future Outlook for Mexico Caustic Soda Industry Market

The future of the Mexican Caustic Soda market appears promising, with continued growth driven by expanding industrial activity and the increasing adoption of sustainable production methods. Strategic investments in research and development, coupled with strategic partnerships and expansions, will further propel market growth. The focus on high-purity products and niche applications presents significant potential for increased profitability.

Mexico Caustic Soda Industry Segmentation

-

1. Production Process

- 1.1. Membrane Cell

- 1.2. Diaphragm Cell

- 1.3. Other Production Processes

-

2. Application

- 2.1. Pulp & Paper

- 2.2. Organic Chemical

- 2.3. Inorganic Chemical

- 2.4. Soap & Detergent

- 2.5. Alumina

- 2.6. Water Treatment

- 2.7. Textile

- 2.8. Other Application Sectors

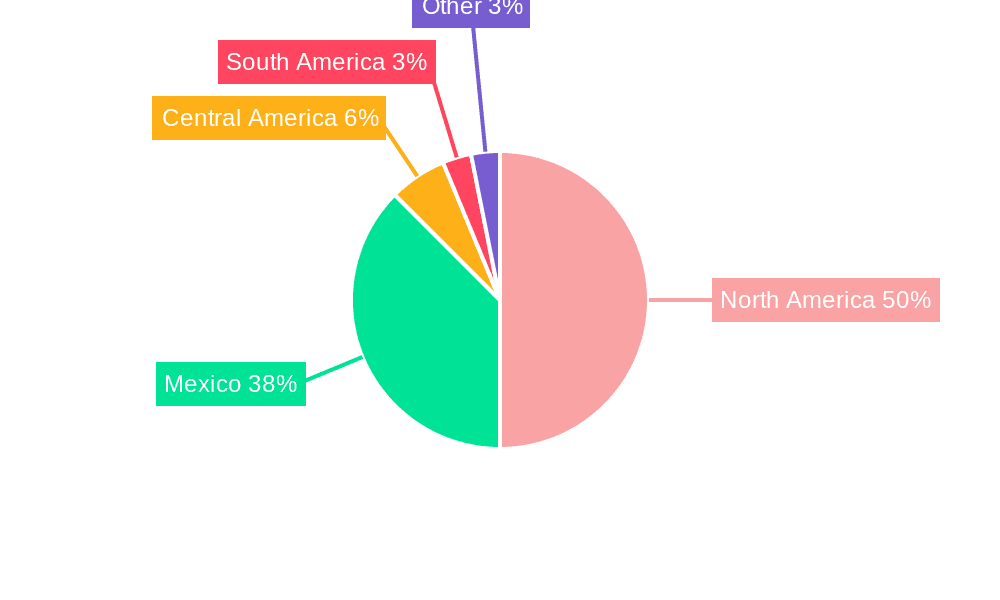

Mexico Caustic Soda Industry Segmentation By Geography

- 1. Mexico

Mexico Caustic Soda Industry Regional Market Share

Geographic Coverage of Mexico Caustic Soda Industry

Mexico Caustic Soda Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Paper and Paperboards; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Paper and Paperboards; Other Drivers

- 3.4. Market Trends

- 3.4.1. High Demand from Pulp & Paper Application to Boost Caustic Soda Market in Mexico

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Caustic Soda Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 5.1.1. Membrane Cell

- 5.1.2. Diaphragm Cell

- 5.1.3. Other Production Processes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pulp & Paper

- 5.2.2. Organic Chemical

- 5.2.3. Inorganic Chemical

- 5.2.4. Soap & Detergent

- 5.2.5. Alumina

- 5.2.6. Water Treatment

- 5.2.7. Textile

- 5.2.8. Other Application Sectors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Covestro AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dow

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FMC Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hanwha Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 INEOS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kemira

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Manuchar Mexico

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nouryon

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Occidental Petroleum Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Olin Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 QUÍMICA TREZA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SABIC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Solvay

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Westlake Chemical Corporation*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Covestro AG

List of Figures

- Figure 1: Mexico Caustic Soda Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Caustic Soda Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Caustic Soda Industry Revenue billion Forecast, by Production Process 2020 & 2033

- Table 2: Mexico Caustic Soda Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Mexico Caustic Soda Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Caustic Soda Industry Revenue billion Forecast, by Production Process 2020 & 2033

- Table 5: Mexico Caustic Soda Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Mexico Caustic Soda Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Caustic Soda Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Mexico Caustic Soda Industry?

Key companies in the market include Covestro AG, Dow, FMC Corporation, Hanwha Group, INEOS, Kemira, Manuchar Mexico, Nouryon, Occidental Petroleum Corporation, Olin Corporation, QUÍMICA TREZA, SABIC, Solvay, Westlake Chemical Corporation*List Not Exhaustive.

3. What are the main segments of the Mexico Caustic Soda Industry?

The market segments include Production Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.69 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Paper and Paperboards; Other Drivers.

6. What are the notable trends driving market growth?

High Demand from Pulp & Paper Application to Boost Caustic Soda Market in Mexico.

7. Are there any restraints impacting market growth?

; Increasing Demand for Paper and Paperboards; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Caustic Soda Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Caustic Soda Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Caustic Soda Industry?

To stay informed about further developments, trends, and reports in the Mexico Caustic Soda Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence