Key Insights

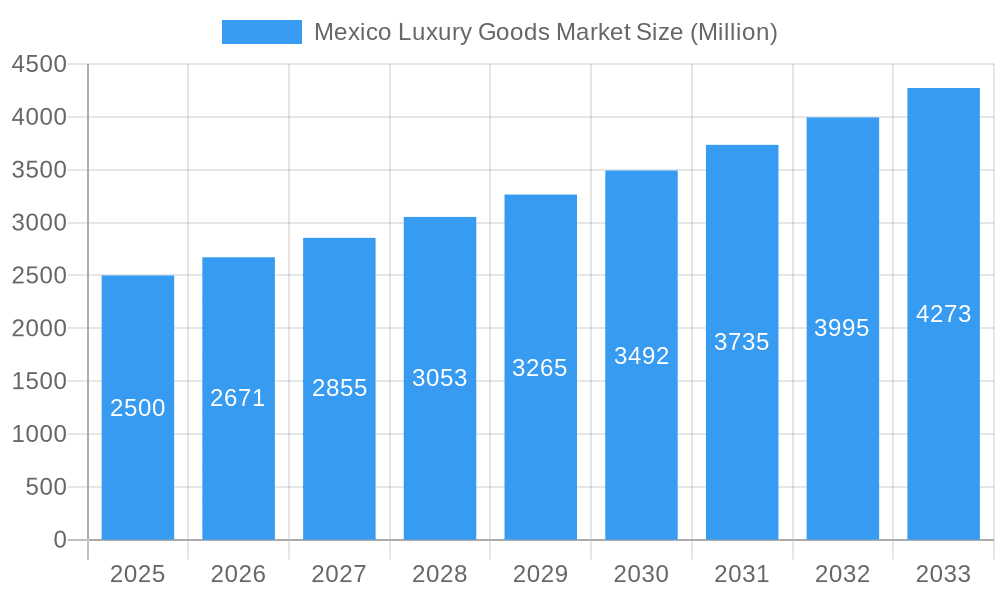

The Mexico luxury goods market is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 6.83%. Based on current market dynamics and industry trends, the estimated market size for 2025 is projected to be between $2-3 billion. This expansion is driven by a growing affluent population in Mexico, characterized by increasing disposable income and a strong affinity for premium brands. Enhanced tourism, particularly from the United States, further stimulates demand for high-value products. The market encompasses diverse product categories, including apparel, footwear, accessories, watches, and jewelry, distributed through single-brand and multi-brand retail outlets, as well as online platforms. The e-commerce segment is experiencing rapid expansion, supported by advancements in digital infrastructure and broader internet accessibility. Key challenges to market growth include economic volatility, currency fluctuations, and potential import tariff adjustments. Despite these hurdles, the long-term market outlook remains optimistic, with significant growth potential anticipated across all segments. A blend of established international luxury houses and emerging local designers contributes to the market's vibrancy. Strategic development of both online and offline retail channels is paramount for sustained success.

Mexico Luxury Goods Market Market Size (In Billion)

The forecast period from 2025 to 2033 indicates continued market expansion. Building upon the 2025 estimate and factoring in the projected CAGR, the Mexico luxury goods market is expected to reach between $4-6 billion by 2033. This growth will be underpinned by an expanding luxury consumer base, innovative brand marketing, and improved economic stability within Mexico. Online sales are anticipated to be the fastest-growing segment, aligning with global e-commerce trends in the luxury sector. Successfully navigating economic uncertainties and import regulations will be critical for brands aiming for long-term prosperity. Effective strategies will involve targeted marketing, emphasizing brand heritage and exclusivity, and fostering influencer relationships to secure market share.

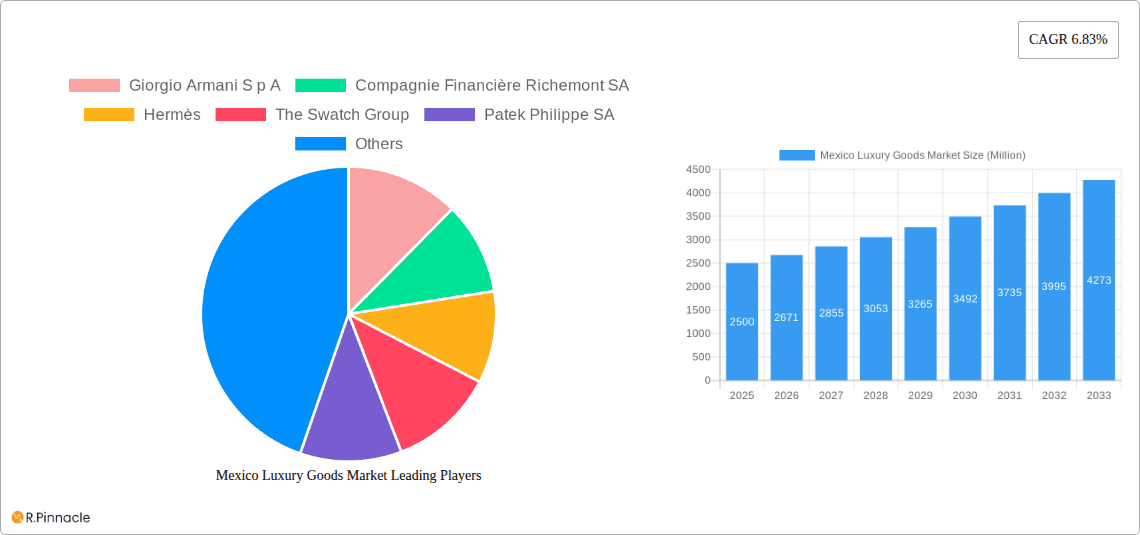

Mexico Luxury Goods Market Company Market Share

Mexico Luxury Goods Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico luxury goods market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis and expert insights to illuminate the current market landscape and predict future trends. The report's detailed segmentation and analysis of key players provide actionable intelligence for navigating this dynamic sector. The market size is projected to reach xx Million by 2033.

Mexico Luxury Goods Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Mexican luxury goods market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. The market is characterized by a moderate level of concentration, with key players like LVMH, Kering, and Richemont holding significant market share. However, the presence of numerous smaller, niche brands contributes to a diverse and dynamic market.

- Market Concentration: The top 5 players hold approximately xx% of the market share, indicating a moderately concentrated market. Smaller players, focusing on niche segments, contribute significantly to market diversity.

- Innovation Drivers: Consumer demand for unique and personalized experiences drives innovation in product design, materials, and distribution channels. Sustainability and ethical sourcing are also key drivers.

- Regulatory Framework: The regulatory environment in Mexico impacts pricing, labeling, and import/export procedures for luxury goods. Compliance is crucial for market entry and success.

- Product Substitutes: The market faces competition from both affordable luxury brands and high-street brands, particularly in clothing and accessories segments. Innovation and brand prestige are crucial for differentiation.

- End-User Demographics: The primary target market consists of high-net-worth individuals (HNWIs) and upper-middle-class consumers, with a growing segment of younger, digitally savvy luxury consumers.

- M&A Activities: The past five years have witnessed xx M&A deals in the Mexican luxury goods market, with deal values totaling approximately xx Million. These transactions reflect strategic expansions and consolidations within the sector.

Mexico Luxury Goods Market Dynamics & Trends

This section explores the market dynamics, focusing on growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The Mexican luxury goods market is expected to experience robust growth, driven by rising disposable incomes, increasing tourism, and a growing preference for luxury goods among affluent consumers.

The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is expected to increase as more consumers enter the luxury goods market. Technological disruptions, such as the rise of e-commerce and personalized marketing, are reshaping the industry. Shifting consumer preferences towards sustainability and ethical sourcing are also influencing market trends. The competitive landscape remains dynamic, with established brands facing competition from both emerging domestic and international players.

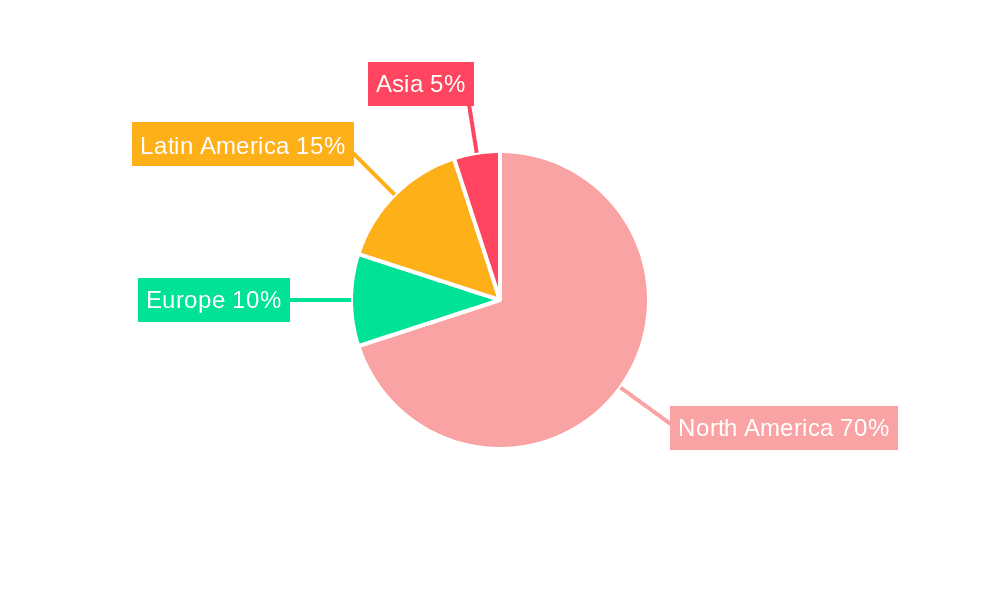

Dominant Regions & Segments in Mexico Luxury Goods Market

This section identifies the leading regions and segments within the Mexican luxury goods market. Analysis indicates that major metropolitan areas like Mexico City and Guadalajara are the dominant regions, driven by higher purchasing power and concentration of affluent consumers.

By Type:

- Watches: This segment holds a significant market share due to the high demand for luxury watches from established brands.

- Jewelry: The jewelry sector displays considerable growth, driven by a rising preference for precious metals and gemstone jewelry.

- Bags: Luxury handbags and luggage are popular among affluent consumers, contributing to segment growth.

By Distribution Channel:

- Single-Brand Stores: These stores offer a premium brand experience, contributing to the sector's dominance.

- Online Stores: This channel is growing rapidly due to increasing internet penetration and consumer preference for online shopping convenience.

Key drivers of regional dominance include economic policies that stimulate consumer spending, developed retail infrastructure, and a strong tourism industry.

Mexico Luxury Goods Market Product Innovations

Recent years have witnessed significant product innovations in the Mexican luxury goods market. Brands are focusing on sustainable materials, technological integration (smart watches, personalized jewelry), and unique designs to differentiate themselves. The market displays a strong preference for personalized experiences and bespoke items, driving the adoption of made-to-order services. Technological trends, such as augmented reality (AR) for virtual try-ons and personalized recommendations, are enhancing the customer shopping experience.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Mexican luxury goods market segmented by type (Clothing and Apparel, Footwear, Bags, Watches, Jewelry, Other Accessories) and distribution channel (Single-Brand Stores, Multi-Brand Stores, Online Stores, Other Distribution Channels). Each segment's growth projections, market size, and competitive dynamics are meticulously analyzed, offering a detailed understanding of the market's structure and dynamics. Growth projections vary across segments, with Watches and Jewelry segments displaying strong growth potential.

Key Drivers of Mexico Luxury Goods Market Growth

The growth of the Mexican luxury goods market is propelled by several key factors: rising disposable incomes among the affluent population, increased tourism, a growing preference for luxury goods amongst younger consumers, and government initiatives aimed at boosting the economy. The expanding middle class contributes significantly to market growth, while technological advancements in product design and distribution channels further fuel market expansion.

Challenges in the Mexico Luxury Goods Market Sector

Challenges facing the sector include economic volatility, fluctuating exchange rates that impact pricing, counterfeit goods, and stringent import regulations. Supply chain disruptions can also impact availability and pricing, while increasing competition from both domestic and international brands presents a significant challenge.

Emerging Opportunities in Mexico Luxury Goods Market

Emerging opportunities lie in expanding into smaller cities with growing affluent populations, capitalizing on the rise of e-commerce, and adopting sustainable and ethical practices. Leveraging technology to enhance the customer experience through personalized marketing and AR/VR applications presents further opportunities for growth.

Leading Players in the Mexico Luxury Goods Market Market

Key Developments in Mexico Luxury Goods Market Industry

- October 2020: Hermès launched its first beauty line, Rouge Hermès, expanding its product portfolio.

- November 2021: Chanel opened a new store in Malaysia dedicated to its shoe collections, showcasing brand expansion strategies.

- February 2022: TOUS launched a new concept store in Kuala Lumpur, Malaysia, indicating brand expansion and market penetration efforts.

Future Outlook for Mexico Luxury Goods Market Market

The future outlook for the Mexican luxury goods market is positive, with projected continued growth fueled by increasing disposable incomes, expanding tourism, and a growing preference for luxury goods among consumers. Strategic opportunities exist for brands that can adapt to changing consumer preferences, embrace sustainable practices, and leverage technology to enhance the customer experience. The market's dynamism and potential for further growth make it an attractive sector for investment and expansion.

Mexico Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Mexico Luxury Goods Market Segmentation By Geography

- 1. Mexico

Mexico Luxury Goods Market Regional Market Share

Geographic Coverage of Mexico Luxury Goods Market

Mexico Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference for E-commerce Platform to Purchase Luxury Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermès

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Swatch Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Patek Philippe SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PRADA S P A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Estee Lauder Companies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Mexico Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Mexico Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Mexico Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Luxury Goods Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the Mexico Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Compagnie Financière Richemont SA, Hermès, The Swatch Group, Patek Philippe SA, PRADA S P A, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Kering, Rolex SA, H & M Hennes & Mauritz AB (H&M), The Estee Lauder Companies.

3. What are the main segments of the Mexico Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Increasing Preference for E-commerce Platform to Purchase Luxury Goods.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2022, TOUS, the Spanish luxury brand launched a new concept store in Kuala Lumpur, Malaysia. The new boutique features a large assortment of key categories including bags, jewelry, gemstones, and perfumes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Mexico Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence