Key Insights

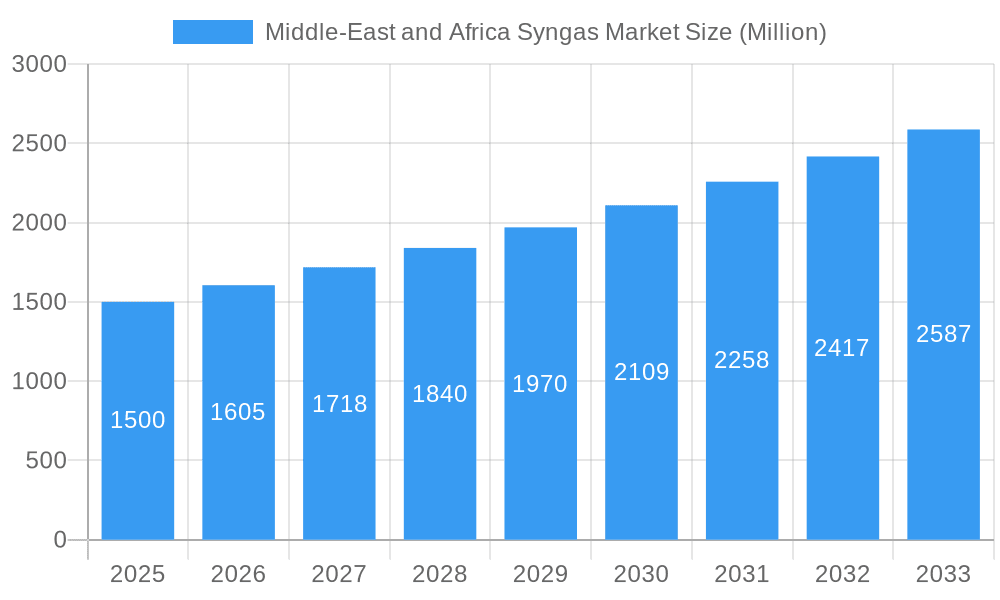

The Middle East and Africa syngas market is poised for significant expansion, driven by escalating energy needs and the imperative for cleaner energy solutions. The market is projected to reach $258.1 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8% from the 2025 base year. This growth trajectory is underpinned by the region's substantial coal and natural gas reserves, key feedstocks for syngas production. Furthermore, the burgeoning power generation sector and increasing demand for chemicals and dimethyl ether (DME) as alternative fuels are key growth drivers. Dominant technologies such as steam reforming, partial oxidation, and auto-thermal reforming further solidify market expansion. Despite considerations regarding high initial capital investment and emission control, the market outlook remains optimistic, fueled by strategic diversification of energy sources and a concerted effort to reduce carbon footprints. Government initiatives supporting renewable energy and industrial diversification across African nations are accelerating this momentum. Substantial investments in infrastructure and technological advancements are anticipated to propel market growth in the forthcoming years. The wide-ranging applications of syngas, from power generation to chemical manufacturing, underscore its significant market potential.

Middle-East and Africa Syngas Market Market Size (In Billion)

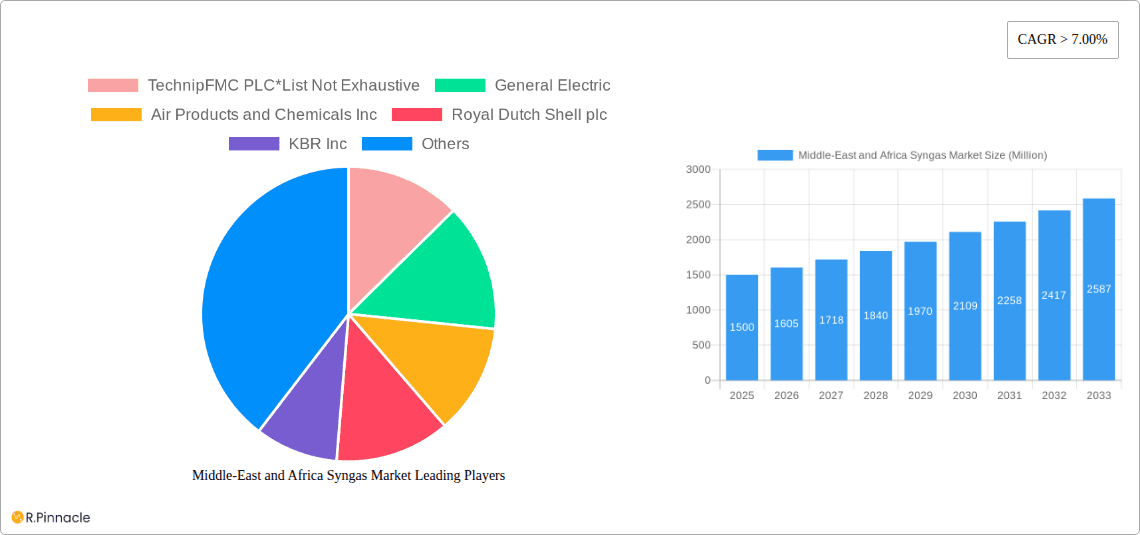

Within the Middle East and Africa, the syngas market is segmented by gasifier type (fixed bed, entrained flow, fluidized bed), application (power generation, chemicals, DME), feedstock (coal, natural gas, petroleum, petcoke, biomass), and technology (steam reforming, partial oxidation, auto-thermal reforming, combined/two-step reforming, biomass gasification). The presence of leading industry players, including TechnipFMC, General Electric, Air Products and Chemicals, and Royal Dutch Shell, highlights the region's competitive landscape and investment activity. The abundant reserves of coal and natural gas, coupled with escalating industrialization and a drive for energy security, position the Middle East and Africa syngas market for substantial growth throughout the forecast period. While specific regional data for the Middle East requires further investigation, the overall market trends and resource availability suggest a significant contribution from this area.

Middle-East and Africa Syngas Market Company Market Share

Middle East & Africa Syngas Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East & Africa Syngas market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, dominant segments, and future outlook. The report leverages extensive data and analysis to deliver actionable insights into market size, growth projections, competitive landscape, and emerging opportunities.

Middle East & Africa Syngas Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Middle East & Africa syngas market, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a moderate level of concentration, with key players such as TechnipFMC PLC, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, KBR Inc, BASF SE, Linde plc, Air Liquide, BP plc, and SABIC holding significant market share. However, the presence of several smaller players indicates a dynamic and competitive environment.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Stringent environmental regulations, coupled with the need for energy diversification and the growing demand for clean energy sources are pushing innovation in syngas technologies, particularly those focusing on carbon capture and utilization.

- Regulatory Frameworks: Government initiatives and policies promoting clean energy and sustainable development significantly impact the market growth and investment decisions. Variations in regulatory frameworks across different countries within the region influence market dynamics.

- Product Substitutes: The availability of alternative fuels and energy sources poses competitive pressure on the syngas market.

- End-User Demographics: The key end-users of syngas include the power generation, chemicals, and liquid fuels sectors, with their specific demands influencing market segmentation.

- M&A Activities: The market has witnessed several M&A activities in recent years, with larger companies acquiring smaller players to consolidate their market positions and gain access to new technologies. The total deal value for M&A transactions during the historical period (2019-2024) is estimated at xx Million.

Middle East & Africa Syngas Market Dynamics & Trends

The Middle East & Africa syngas market is projected to experience significant growth driven by several factors. The increasing demand for electricity from power generation, coupled with the expanding chemical industry and the push towards cleaner energy sources are key drivers. Technological advancements in gasification and syngas processing technologies are further enhancing efficiency and cost-effectiveness. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. Market penetration of syngas in various applications is also expected to increase substantially, with significant growth in the power generation and chemicals sectors. Competitive dynamics are shaped by technological innovation, cost optimization, and strategic partnerships. Consumer preference for cleaner energy solutions also influences market growth. Challenges include volatile feedstock prices and the need for continuous technological upgrades to meet evolving environmental regulations.

Dominant Regions & Segments in Middle East & Africa Syngas Market

The Middle East & Africa syngas market exhibits significant regional variations in growth and segment dominance.

Dominant Regions: The xx region is currently the leading market, driven by factors such as xx. xx and xx are other significant markets with potential for substantial growth.

- Key Drivers for Dominant Regions:

- Economic Policies: Government support for clean energy initiatives and investment in infrastructure.

- Infrastructure: Availability of gas pipelines and processing facilities.

- Feedstock Availability: Abundant reserves of natural gas and coal.

Dominant Segments:

- Gasifier Type: Entrained flow gasifiers hold a significant market share due to their efficiency in handling diverse feedstocks.

- Application: The power generation segment is expected to witness the highest growth due to rising energy demands.

- Feedstock: Natural gas is currently the dominant feedstock, although biomass is gaining traction.

- Technology: Steam reforming is the most widely used technology, while advancements in auto-thermal reforming are driving market growth.

A detailed analysis of each segment's market size, growth projections, and competitive dynamics is provided in the full report.

Middle East & Africa Syngas Market Product Innovations

Recent years have witnessed considerable innovation in syngas production technologies, including advancements in gasification processes, improved carbon capture and utilization techniques, and the development of more efficient syngas conversion technologies. These innovations are enhancing the efficiency, cost-effectiveness, and environmental sustainability of syngas production. New applications for syngas are also emerging, particularly in the production of green chemicals and sustainable fuels, driven by growing environmental concerns. This is leading to a shift towards more sustainable and environmentally friendly syngas production methods.

Report Scope & Segmentation Analysis

This report comprehensively segments the Middle East & Africa syngas market based on gasifier type (Fixed Bed, Entrained Flow, Fluidized Bed), application (Power Generation, Chemicals, Dimethyl Ether, Liquid Fuels, Gaseous Fuels), feedstock (Coal, Natural Gas, Petroleum, Pet-coke, Biomass), and technology (Steam Reforming, Partial Oxidation, Auto-thermal Reforming, Combined or Two-step Reforming, Biomass Gasification). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. Growth projections vary across segments, with certain applications and technologies exhibiting higher growth potential compared to others. Competitive dynamics vary based on the technological advancements and access to resources within each segment.

Key Drivers of Middle East & Africa Syngas Market Growth

The Middle East & Africa syngas market growth is propelled by several key factors. The increasing demand for electricity, the expansion of the chemicals industry, and stringent environmental regulations incentivizing cleaner energy sources are major drivers. Furthermore, government initiatives promoting renewable energy and investments in research and development for carbon capture and utilization are contributing significantly. Technological advancements leading to improved efficiency and cost-effectiveness also contribute to market expansion.

Challenges in the Middle East & Africa Syngas Market Sector

Despite the market's growth potential, several challenges exist. Fluctuations in feedstock prices, the high capital expenditure required for syngas plant construction, and stringent environmental regulations necessitate continuous technological upgrades and cost optimization strategies. Competition from alternative fuels and the need for robust infrastructure development pose further challenges. The impact of these challenges on market growth is quantified in the detailed report.

Emerging Opportunities in Middle East & Africa Syngas Market

The market presents lucrative opportunities for businesses focusing on the development and deployment of advanced syngas technologies. The growing demand for sustainable fuels and chemicals offers scope for innovative product development and application. Government support for clean energy and investment in research and development further presents promising avenues for growth. Expansion into new geographical areas with abundant feedstock resources also provides potential.

Leading Players in the Middle East & Africa Syngas Market

- TechnipFMC PLC

- General Electric

- Air Products and Chemicals Inc

- Royal Dutch Shell plc

- KBR Inc

- BASF SE

- Linde plc

- Air Liquide

- BP plc

- SABIC

Key Developments in Middle East & Africa Syngas Market Industry

- 2022 Q4: Partnership between TechnipFMC PLC and a Middle Eastern company for the development of a new syngas technology.

- 2023 Q1: Acquisition of a smaller syngas producer by Air Products and Chemicals Inc in South Africa.

- 2023 Q2: Significant investment by Royal Dutch Shell plc in R&D for carbon capture and utilization in a syngas plant in Egypt.

- 2024 Q1: Government of xx announces a new initiative to promote syngas as a clean energy source, including subsidies for the construction of syngas plants.

Future Outlook for Middle East & Africa Syngas Market

The Middle East & Africa syngas market is poised for strong growth, fueled by increasing energy demand, government support for clean energy, and continuous technological advancements. Strategic partnerships, investments in R&D, and expansion into new applications will drive further market expansion. The market's future potential is substantial, offering significant opportunities for both established players and new entrants.

Middle-East and Africa Syngas Market Segmentation

-

1. Feedstock

- 1.1. Coal

- 1.2. Natural Gas

- 1.3. Petroleum

- 1.4. Pet-coke

- 1.5. Biomass

-

2. Technology

- 2.1. Steam Reforming

- 2.2. Partial Oxidation

- 2.3. Auto-thermal Reforming

- 2.4. Combined or Two-step Reforming

- 2.5. Biomass Gasification

-

3. Gasifier Type

- 3.1. Fixed Bed

- 3.2. Entrained Flow

- 3.3. Fluidized Bed

-

4. Application

- 4.1. Power Generation

-

4.2. Chemicals

- 4.2.1. Methanol

- 4.2.2. Ammonia

- 4.2.3. Oxo Chemicals

- 4.2.4. n-Butanol

- 4.2.5. Hydrogen

- 4.2.6. Dimethyl Ether

- 4.3. Liquid Fuels

- 4.4. Gaseous Fuels

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle-East and Africa

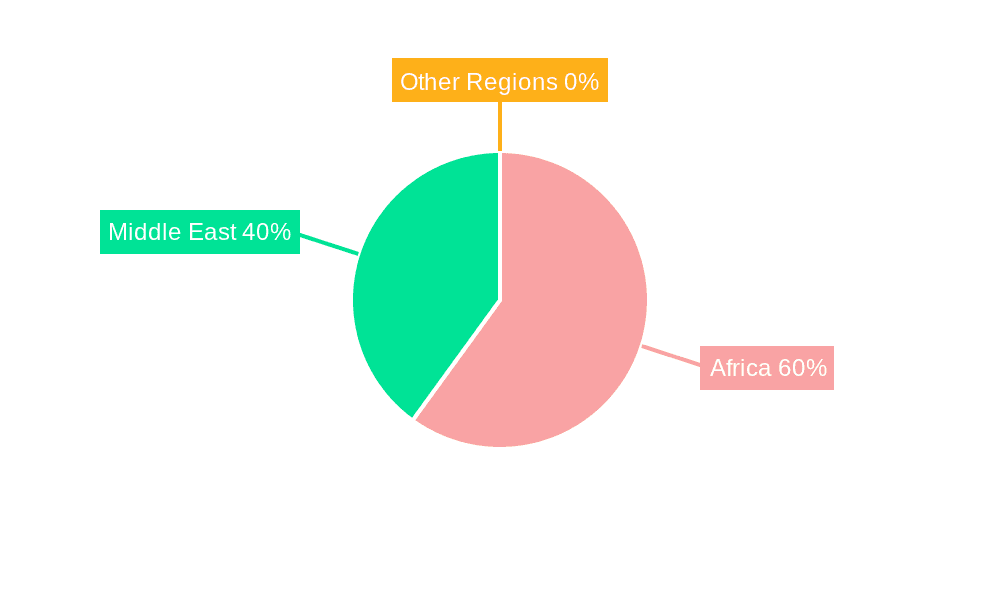

Middle-East and Africa Syngas Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle-East and Africa Syngas Market Regional Market Share

Geographic Coverage of Middle-East and Africa Syngas Market

Middle-East and Africa Syngas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Electricity; Growing Chemical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Funding

- 3.4. Market Trends

- 3.4.1. Increasing Usage in Power Generation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Coal

- 5.1.2. Natural Gas

- 5.1.3. Petroleum

- 5.1.4. Pet-coke

- 5.1.5. Biomass

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Steam Reforming

- 5.2.2. Partial Oxidation

- 5.2.3. Auto-thermal Reforming

- 5.2.4. Combined or Two-step Reforming

- 5.2.5. Biomass Gasification

- 5.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 5.3.1. Fixed Bed

- 5.3.2. Entrained Flow

- 5.3.3. Fluidized Bed

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Power Generation

- 5.4.2. Chemicals

- 5.4.2.1. Methanol

- 5.4.2.2. Ammonia

- 5.4.2.3. Oxo Chemicals

- 5.4.2.4. n-Butanol

- 5.4.2.5. Hydrogen

- 5.4.2.6. Dimethyl Ether

- 5.4.3. Liquid Fuels

- 5.4.4. Gaseous Fuels

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. South Africa

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. Saudi Arabia Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 6.1.1. Coal

- 6.1.2. Natural Gas

- 6.1.3. Petroleum

- 6.1.4. Pet-coke

- 6.1.5. Biomass

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Steam Reforming

- 6.2.2. Partial Oxidation

- 6.2.3. Auto-thermal Reforming

- 6.2.4. Combined or Two-step Reforming

- 6.2.5. Biomass Gasification

- 6.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 6.3.1. Fixed Bed

- 6.3.2. Entrained Flow

- 6.3.3. Fluidized Bed

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Power Generation

- 6.4.2. Chemicals

- 6.4.2.1. Methanol

- 6.4.2.2. Ammonia

- 6.4.2.3. Oxo Chemicals

- 6.4.2.4. n-Butanol

- 6.4.2.5. Hydrogen

- 6.4.2.6. Dimethyl Ether

- 6.4.3. Liquid Fuels

- 6.4.4. Gaseous Fuels

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. South Africa

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Feedstock

- 7. South Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 7.1.1. Coal

- 7.1.2. Natural Gas

- 7.1.3. Petroleum

- 7.1.4. Pet-coke

- 7.1.5. Biomass

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Steam Reforming

- 7.2.2. Partial Oxidation

- 7.2.3. Auto-thermal Reforming

- 7.2.4. Combined or Two-step Reforming

- 7.2.5. Biomass Gasification

- 7.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 7.3.1. Fixed Bed

- 7.3.2. Entrained Flow

- 7.3.3. Fluidized Bed

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Power Generation

- 7.4.2. Chemicals

- 7.4.2.1. Methanol

- 7.4.2.2. Ammonia

- 7.4.2.3. Oxo Chemicals

- 7.4.2.4. n-Butanol

- 7.4.2.5. Hydrogen

- 7.4.2.6. Dimethyl Ether

- 7.4.3. Liquid Fuels

- 7.4.4. Gaseous Fuels

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. South Africa

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Feedstock

- 8. Rest of Middle East and Africa Middle-East and Africa Syngas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 8.1.1. Coal

- 8.1.2. Natural Gas

- 8.1.3. Petroleum

- 8.1.4. Pet-coke

- 8.1.5. Biomass

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Steam Reforming

- 8.2.2. Partial Oxidation

- 8.2.3. Auto-thermal Reforming

- 8.2.4. Combined or Two-step Reforming

- 8.2.5. Biomass Gasification

- 8.3. Market Analysis, Insights and Forecast - by Gasifier Type

- 8.3.1. Fixed Bed

- 8.3.2. Entrained Flow

- 8.3.3. Fluidized Bed

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Power Generation

- 8.4.2. Chemicals

- 8.4.2.1. Methanol

- 8.4.2.2. Ammonia

- 8.4.2.3. Oxo Chemicals

- 8.4.2.4. n-Butanol

- 8.4.2.5. Hydrogen

- 8.4.2.6. Dimethyl Ether

- 8.4.3. Liquid Fuels

- 8.4.4. Gaseous Fuels

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. South Africa

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Feedstock

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 General Electric

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Air Products and Chemicals Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Royal Dutch Shell plc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 KBR Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Linde plc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Air Liquide

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BP p l c

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SABIC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 TechnipFMC PLC*List Not Exhaustive

List of Figures

- Figure 1: Middle-East and Africa Syngas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Syngas Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 2: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 3: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 6: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 7: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 11: Middle-East and Africa Syngas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 13: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 14: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 15: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 17: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 18: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 19: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 26: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 27: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 29: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 30: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 31: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 35: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Middle-East and Africa Syngas Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 38: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Feedstock 2020 & 2033

- Table 39: Middle-East and Africa Syngas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 40: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 41: Middle-East and Africa Syngas Market Revenue billion Forecast, by Gasifier Type 2020 & 2033

- Table 42: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Gasifier Type 2020 & 2033

- Table 43: Middle-East and Africa Syngas Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Middle-East and Africa Syngas Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Middle-East and Africa Syngas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Middle-East and Africa Syngas Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Syngas Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Middle-East and Africa Syngas Market?

Key companies in the market include TechnipFMC PLC*List Not Exhaustive, General Electric, Air Products and Chemicals Inc, Royal Dutch Shell plc, KBR Inc, BASF SE, Linde plc, Air Liquide, BP p l c, SABIC.

3. What are the main segments of the Middle-East and Africa Syngas Market?

The market segments include Feedstock, Technology, Gasifier Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 258.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Electricity; Growing Chemical Industry.

6. What are the notable trends driving market growth?

Increasing Usage in Power Generation Industry.

7. Are there any restraints impacting market growth?

; High Capital Investment and Funding.

8. Can you provide examples of recent developments in the market?

Partnerships between companies for syngas technology development

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Syngas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Syngas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Syngas Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Syngas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence