Key Insights

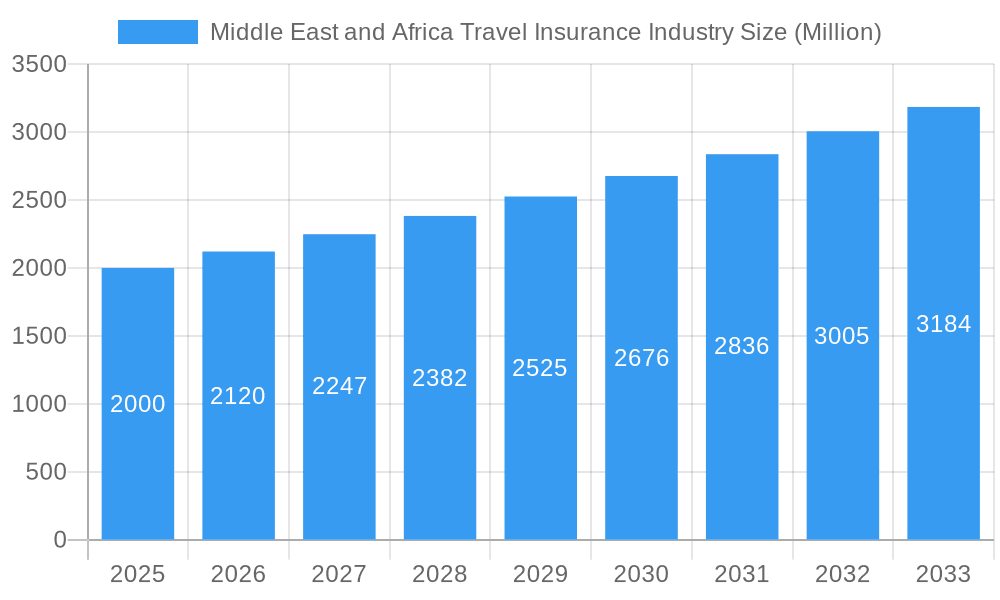

The Middle East and Africa travel insurance market, currently valued at approximately \$XX million (estimated based on provided CAGR and market trends), is projected to experience robust growth, exceeding a compound annual growth rate (CAGR) of 6.00% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes across the region, coupled with a growing middle class, are leading to increased international travel among residents. Furthermore, a surge in tourism to the Middle East and Africa itself is boosting demand for both single-trip and annual multi-trip travel insurance policies. Government initiatives promoting tourism and investment in infrastructure further contribute to this positive trajectory. The market is segmented by distribution channels, with insurance companies, intermediaries, banks, and brokers playing significant roles in product distribution. Demand is also stratified by traveler demographics, including a substantial segment of senior citizens, educational travelers, and families. While challenges such as economic fluctuations and regional political instability could pose some constraints, the overall outlook remains optimistic.

Middle East and Africa Travel Insurance Industry Market Size (In Billion)

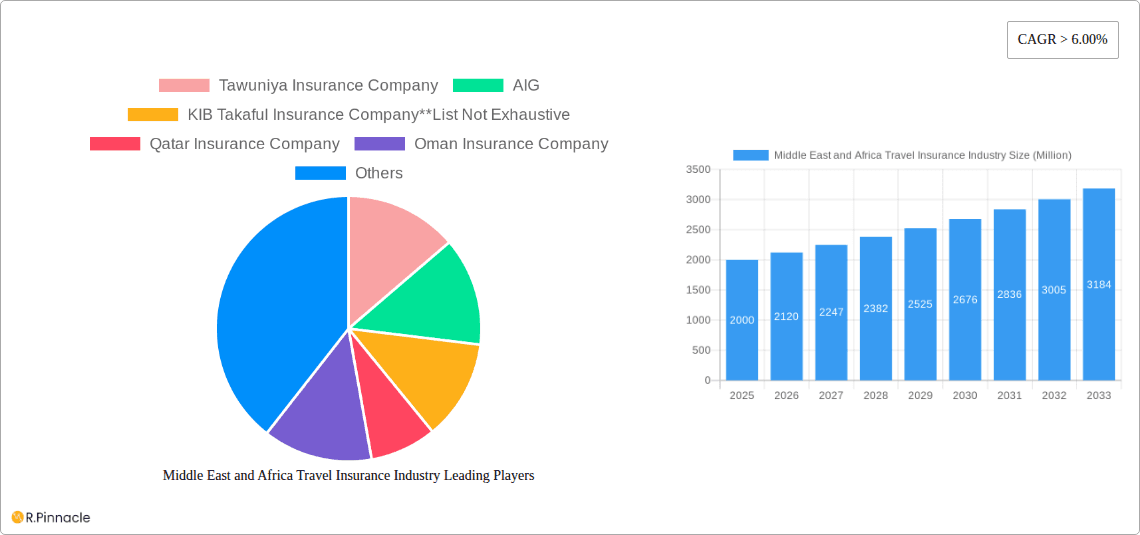

The dominance of several established players, including Tawuniya Insurance Company, AIG, KIB Takaful Insurance Company, Qatar Insurance Company, Oman Insurance Company, RSA, AXA Insurance, Union Insurance, Doha Insurance Company, and Chubb, shapes the competitive landscape. However, the market also presents opportunities for smaller insurers and specialized providers catering to niche segments. Growth is expected to be particularly strong in countries experiencing rapid economic growth and increased tourism infrastructure development, such as the UAE and Saudi Arabia. The increasing awareness of the importance of travel insurance for mitigating potential risks associated with unforeseen events during travel is a significant driver of market expansion. Furthermore, the evolving digital landscape and the adoption of online insurance platforms are expected to enhance access to travel insurance products and drive further growth in the coming years. Market players are expected to focus on product innovation and enhanced customer service to maintain their competitiveness within this dynamic market.

Middle East and Africa Travel Insurance Industry Company Market Share

Middle East & Africa Travel Insurance Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa travel insurance market, offering invaluable insights for industry professionals, investors, and strategic planners. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report unveils the market's size, segmentation, dynamics, and future trajectory. Expect detailed analysis of key players like Tawuniya Insurance Company, AIG, KIB Takaful Insurance Company, Qatar Insurance Company, Oman Insurance Company, RSA, AXA Insurance, Union Insurance, Doha Insurance Company, and Chubb (list not exhaustive).

Middle East and Africa Travel Insurance Industry Market Structure & Innovation Trends

This section analyzes the market concentration, identifying key players and their market share. We explore innovation drivers such as technological advancements and changing consumer preferences. The report delves into the regulatory landscape, examining its impact on market growth. Analysis of product substitutes, end-user demographics (including Senior Citizens, Education Travelers, and Family Travelers), and significant M&A activities (including deal values) within the period will be provided. For instance, the Gulf Insurance Group's acquisition of AXA operations in 2021 significantly reshaped the competitive landscape. We will quantify the market share of major players and analyze the value of key M&A deals, providing a comprehensive overview of the market structure and its evolution. Expected total market value in 2025 is estimated at xx Million.

Middle East and Africa Travel Insurance Industry Market Dynamics & Trends

This section details the market's growth drivers, including rising tourism, increased disposable incomes, and the expansion of the middle class across the region. We will analyze technological disruptions, such as the rise of Insurtech and digital distribution channels, and their influence on market dynamics. Consumer preferences and their shift towards specific insurance types (Single-Trip vs. Annual Multi-Trip) are also thoroughly examined. The competitive dynamics, including pricing strategies, product differentiation, and market share battles among key players, are analyzed with specific market penetration rates and Compound Annual Growth Rates (CAGR) provided for the forecast period.

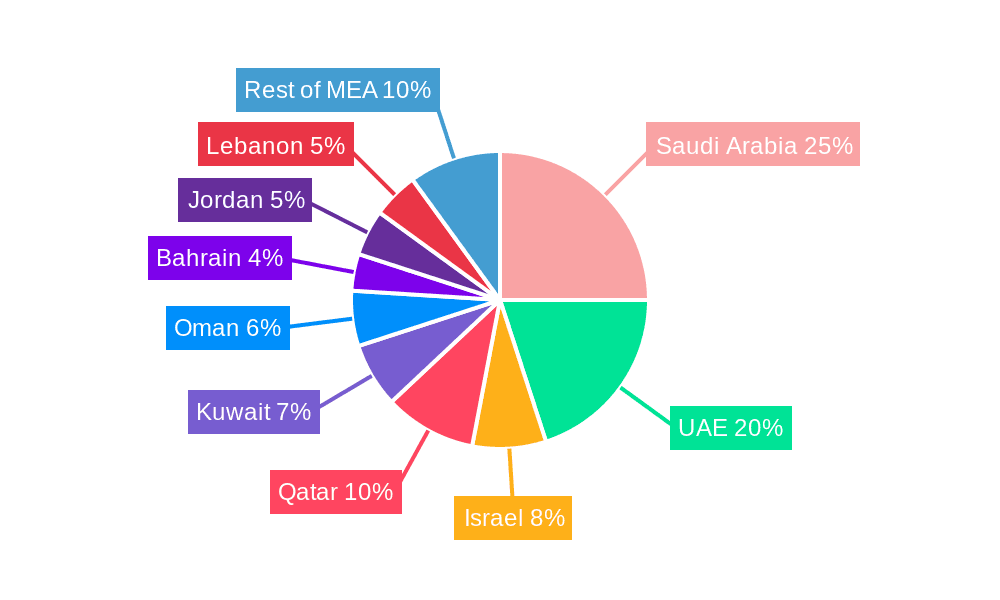

Dominant Regions & Segments in Middle East and Africa Travel Insurance Industry

This section identifies the leading regions and segments within the Middle East and Africa travel insurance market. We will analyze dominance based on factors like:

- Type: Single-Trip Travel Insurance vs. Annual Multi-Trip Travel Insurance – identifying the faster-growing segment and reasons for its dominance.

- Distribution Channel: Insurance Companies, Insurance Intermediaries, Banks, Insurance Brokers, and Others – assessing the market share of each channel and analyzing their growth trajectories.

- End-User: Senior Citizens, Education Travelers, Family Travelers, and Others – determining the most significant end-user segments and the underlying reasons for their dominance.

Detailed analysis will explain the dominance of specific regions and countries, examining key drivers such as economic policies, tourism infrastructure, and regulatory frameworks that contribute to the observed market share.

Middle East and Africa Travel Insurance Industry Product Innovations

This section highlights recent product developments within the travel insurance sector in the Middle East and Africa. We discuss innovative product features, applications, and their competitive advantages, emphasizing the integration of technology and the successful adaptation to market needs. Specific examples of product innovations will be provided, illustrating the market's response to evolving consumer needs and technological advancements.

Report Scope & Segmentation Analysis

The report comprehensively segments the market based on:

Type: Single-Trip and Annual Multi-Trip Travel Insurance, providing market size and growth projections for each segment. Competitive dynamics within each segment will also be examined.

Distribution Channel: Insurance Companies, Insurance Intermediaries, Banks, Insurance Brokers, and Others, with an analysis of each channel's market share and growth trajectory.

End-User: Senior Citizens, Education Travelers, Family Travelers, and Others, focusing on the market size, growth projections, and competitive dynamics within each end-user segment.

Key Drivers of Middle East and Africa Travel Insurance Industry Growth

Several factors are driving the growth of the Middle East and Africa travel insurance market. These include: increasing tourism, rising disposable incomes, favorable government regulations promoting insurance penetration, and the expanding adoption of digital technologies.

Challenges in the Middle East and Africa Travel Insurance Industry Sector

The Middle East and Africa travel insurance market faces challenges including: relatively low insurance penetration rates in some countries, stringent regulatory requirements, and the prevalence of informal insurance practices. These challenges, along with their impact on market growth and profitability, will be quantified where possible.

Emerging Opportunities in Middle East and Africa Travel Insurance Industry

Opportunities for growth exist in untapped markets within the region, particularly in the expansion of digital insurance platforms and the development of innovative insurance products tailored to specific needs.

Leading Players in the Middle East and Africa Travel Insurance Industry Market

- Tawuniya Insurance Company

- AIG

- KIB Takaful Insurance Company

- Qatar Insurance Company

- Oman Insurance Company

- RSA

- AXA Insurance

- Union Insurance

- Doha Insurance Company

- Chubb

Key Developments in Middle East and Africa Travel Insurance Industry

- September 2021: Gulf Insurance Group completes acquisition deal for AXA operations in the region.

- April 2022: Saudi Arabia launches the world's first travel insurance for camel transport accidents.

Future Outlook for Middle East and Africa Travel Insurance Industry Market

The future outlook for the Middle East and Africa travel insurance market is positive, driven by continued economic growth, increasing tourism, and the expanding adoption of technology. The market is poised for significant expansion, presenting attractive opportunities for both established and new players. The report concludes with strategic recommendations for market participants aiming to leverage these opportunities for success.

Middle East and Africa Travel Insurance Industry Segmentation

-

1. Type

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-Trip Travel Insurance

-

2. Distribution Channel

- 2.1. Insurance Companies

- 2.2. Insurance Intermediaries

- 2.3. Banks

- 2.4. Insurance Brokers

- 2.5. Others

-

3. End-User

- 3.1. Senior Citizens

- 3.2. Education Travelers

- 3.3. Family Travelers

- 3.4. Others

Middle East and Africa Travel Insurance Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Travel Insurance Industry Regional Market Share

Geographic Coverage of Middle East and Africa Travel Insurance Industry

Middle East and Africa Travel Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. A Tech Savvy Demography Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Travel Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-Trip Travel Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Companies

- 5.2.2. Insurance Intermediaries

- 5.2.3. Banks

- 5.2.4. Insurance Brokers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Senior Citizens

- 5.3.2. Education Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tawuniya Insurance Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AIG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KIB Takaful Insurance Company**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qatar Insurance Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oman Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RSA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AXA Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Union Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Doha Insurance Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chubb

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tawuniya Insurance Company

List of Figures

- Figure 1: Middle East and Africa Travel Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Travel Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Middle East and Africa Travel Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Travel Insurance Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Travel Insurance Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Middle East and Africa Travel Insurance Industry?

Key companies in the market include Tawuniya Insurance Company, AIG, KIB Takaful Insurance Company**List Not Exhaustive, Qatar Insurance Company, Oman Insurance Company, RSA, AXA Insurance, Union Insurance, Doha Insurance Company, Chubb.

3. What are the main segments of the Middle East and Africa Travel Insurance Industry?

The market segments include Type, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

A Tech Savvy Demography Drives the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

April 2022 - Saudi Arabia has launched the world's first travel insurance to cover accidents that take place when transporting camels, Saudi Press Agency (SPA) reported. The Saudi Camel Club said it has collaborated with the Swiss Finance House to insure against road accidents and deaths that take place while camels are being picked up or dropped off. An insurance platform allows owners to subscribe to insurance for their camels remotely, and then receive an insurance policy online.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Travel Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Travel Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Travel Insurance Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Travel Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence