Key Insights

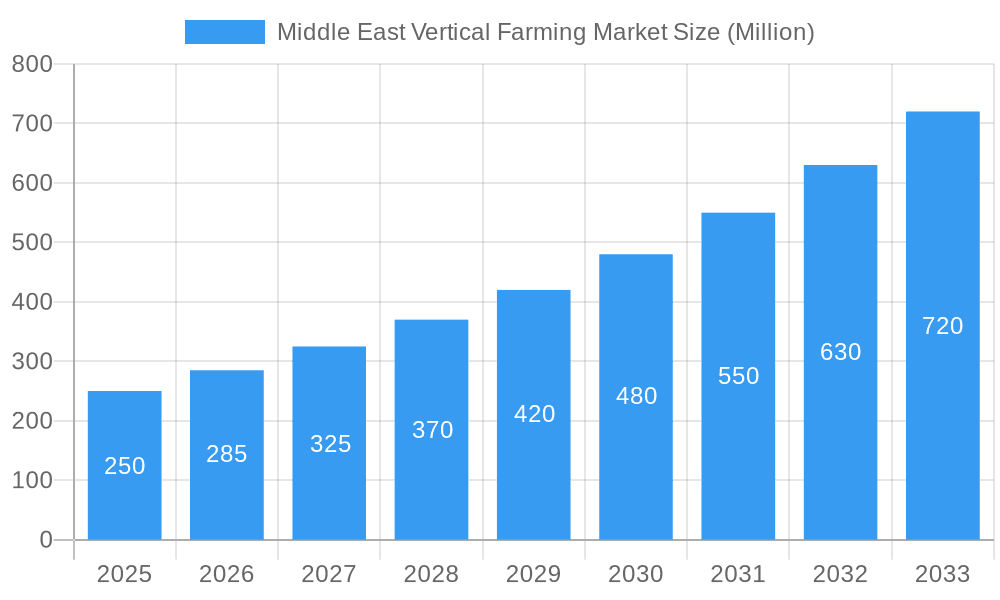

The Middle East vertical farming market is experiencing robust growth, driven by factors such as increasing urbanization, water scarcity, and a rising demand for fresh produce year-round. The region's arid climate and limited arable land make vertical farming a particularly attractive solution, enabling sustainable food production in challenging environments. The market's Compound Annual Growth Rate (CAGR) of 14.20% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. This growth is fueled by substantial investments in innovative technologies like aeroponics, hydroponics, and aquaponics, optimizing resource utilization and increasing yields. Various segments contribute to this expansion, with fruits and vegetables dominating the crop type segment, followed by herbs and microgreens, driven by the rising popularity of healthy diets. Building-based vertical farms currently hold a larger market share compared to shipping container farms, but the latter segment is expected to witness significant growth due to its scalability and cost-effectiveness. Key players, including Madar Farms, Crop One Holdings Inc., and Aero Farms, are leading the market's innovation and expansion, contributing to its overall development. The UAE, Saudi Arabia, and Qatar are leading the regional adoption of vertical farming, given their supportive government policies and substantial investments in sustainable agriculture.

Middle East Vertical Farming Market Market Size (In Million)

The projected market size for 2025, based on the provided CAGR and historical data, indicates a substantial market value. While precise figures aren't available, considering the rapid growth and substantial investments, a reasonable estimate would place the market value in the hundreds of millions of dollars. Further growth is expected across all segments, with technological advancements further driving efficiency and affordability. The continued focus on sustainable agriculture and food security within the Middle East is likely to propel the market toward continued expansion throughout the forecast period (2025-2033), making it an attractive sector for investment and further technological development. Challenges remain, including high initial capital investment and the need for skilled labor, but the potential for long-term economic and environmental benefits makes this market a highly promising area.

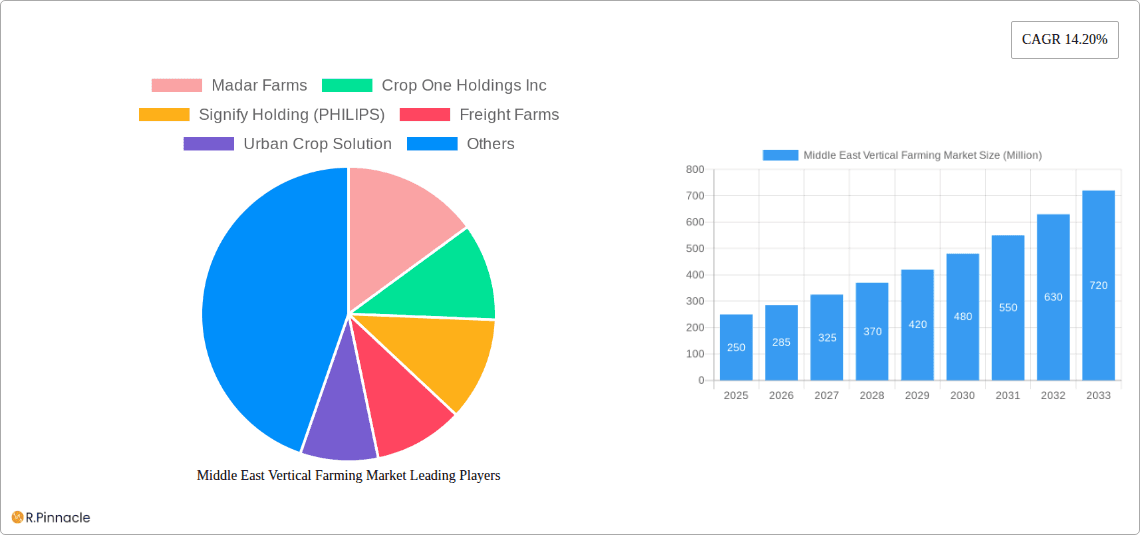

Middle East Vertical Farming Market Company Market Share

Middle East Vertical Farming Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East vertical farming market, offering invaluable insights for industry professionals, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market is segmented by crop type, growth mechanism, and farm structure, providing a granular understanding of the various market dynamics at play. The report values are expressed in Millions.

Middle East Vertical Farming Market Structure & Innovation Trends

The Middle East vertical farming market exhibits a moderately concentrated structure, with key players like AeroFarms, Crop One Holdings, and Madar Farms holding significant market share. Market share data for 2024 shows AeroFarms with an estimated xx%, Crop One Holdings with xx%, and Madar Farms with xx%, while the remaining market is fragmented amongst smaller players and startups. Innovation is driven by factors like water scarcity, food security concerns, and the region's growing urban population. Regulatory frameworks vary across countries, influencing market access and investment. Product substitutes include traditional agriculture, though vertical farming offers advantages in terms of yield and resource efficiency.

- Market Concentration: Moderately concentrated, with key players holding a significant share.

- Innovation Drivers: Water scarcity, food security, urbanization, and technological advancements.

- Regulatory Frameworks: Vary across countries, impacting market access and investment.

- M&A Activity: The report includes details of significant M&A activities, including deal values (e.g., the partnership between AeroFarms and QFZA), showcasing market consolidation trends.

Middle East Vertical Farming Market Dynamics & Trends

The Middle East vertical farming market is experiencing significant growth, driven by increasing demand for fresh produce, technological advancements, and government support for sustainable agriculture. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%. Market penetration is increasing as awareness of the benefits of vertical farming grows, with consumers increasingly prioritizing locally sourced, sustainable food. However, challenges exist, including high initial investment costs and the need for specialized skills and technology. Competition is intensifying as more companies enter the market, leading to innovation in technology and business models.

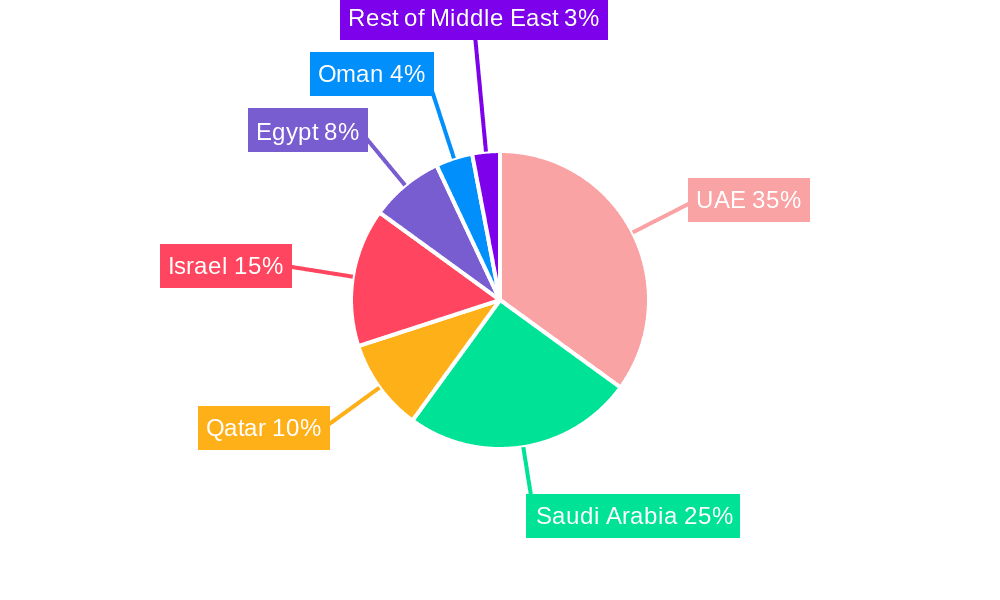

Dominant Regions & Segments in Middle East Vertical Farming Market

The United Arab Emirates (UAE) currently leads the Middle East vertical farming market, driven by strong government support, significant investments in infrastructure, and a high concentration of vertical farming projects. Saudi Arabia and Qatar are also emerging as key markets.

Dominant Segments:

- By Crop Type: Fruits and vegetables currently hold the largest market share, followed by herbs and micro-greens.

- By Growth Mechanism: Hydroponics dominates due to its established technology and lower cost compared to aeroponics or aquaponics. However, aeroponics is witnessing rapid growth due to its potential for higher yields.

- By Structure: Building-based vertical farms currently dominate, but shipping container farms are gaining traction due to their scalability and ease of deployment.

Key Drivers:

- Economic Policies: Government initiatives promoting food security and sustainable agriculture.

- Infrastructure: Access to advanced technologies, energy, and water resources.

Middle East Vertical Farming Market Product Innovations

Recent product developments focus on improving yield, efficiency, and automation in vertical farming systems. This includes advancements in LED lighting, precision climate control, and automated harvesting technologies. Companies are also developing innovative crop varieties optimized for vertical farming environments. These innovations enhance the market fit of vertical farming by addressing concerns about cost and scalability.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Middle East vertical farming market across various segments:

- By Crop Type: Fruits and vegetables, herbs and micro-greens, flowers and ornamentals, other crop types. Each segment's growth projections and market size are detailed in the report.

- By Growth Mechanism: Aeroponics, hydroponics, and aquaponics. The report analyzes the competitive landscape and growth potential of each mechanism.

- By Structure: Building-based vertical farms and shipping container vertical farms. The report assesses the advantages and challenges of each structure.

Key Drivers of Middle East Vertical Farming Market Growth

The market's growth is propelled by several factors:

- Water Scarcity: Vertical farming requires significantly less water compared to traditional farming.

- Food Security Concerns: The region's increasing population necessitates more efficient and sustainable food production methods.

- Technological Advancements: Continuous innovation in LED lighting, automation, and controlled environment agriculture (CEA).

- Government Support: Initiatives to promote sustainable agriculture and food security.

Challenges in the Middle East Vertical Farming Market Sector

The market faces challenges including:

- High Initial Investment Costs: Establishing vertical farms requires substantial capital investment.

- Energy Consumption: Vertical farming can be energy-intensive, increasing operating costs.

- Skilled Labor Shortages: The industry requires specialized skills and training.

Emerging Opportunities in Middle East Vertical Farming Market

Emerging opportunities include:

- Expansion into New Markets: Growing demand for fresh produce across different regions within the Middle East.

- Technological Advancements: New technologies for automation, AI-based crop monitoring, and improved yield.

- Integration with Smart City Initiatives: Vertical farming aligns with sustainable city planning.

Leading Players in the Middle East Vertical Farming Market Market

- Madar Farms

- Crop One Holdings Inc

- Signify Holding (PHILIPS)

- Freight Farms

- Urban Crop Solution

- Intelligent Growth Solutions

- Aero Farms

Key Developments in Middle East Vertical Farming Market Industry

- July 2022: Crop One Holdings and Emirates Flight Catering opened the world's largest vertical farm in Dubai.

- February 2022: Silal and AeroFarms signed a Memorandum of Understanding (MoU) for research and development collaboration.

- November 2022: AeroFarms announced plans to expand into Qatar with a partnership with QFZA and DVC.

Future Outlook for Middle East Vertical Farming Market Market

The Middle East vertical farming market is poised for significant growth, driven by continued technological advancements, increasing investment, and strong government support. Strategic opportunities exist for companies to expand their operations, innovate in technology, and cater to the growing demand for locally sourced, sustainable food. The market is expected to witness consolidation, with larger players acquiring smaller companies to expand their market share and enhance their technological capabilities.

Middle East Vertical Farming Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East Vertical Farming Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Vertical Farming Market Regional Market Share

Geographic Coverage of Middle East Vertical Farming Market

Middle East Vertical Farming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Emphasis of GCC Countries on Food Security

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Vertical Farming Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Madar Farms

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Crop One Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Signify Holding (PHILIPS)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Freight Farms

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Urban Crop Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Intelligent Growth Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aero Farms

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Madar Farms

List of Figures

- Figure 1: Middle East Vertical Farming Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Vertical Farming Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Vertical Farming Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East Vertical Farming Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East Vertical Farming Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East Vertical Farming Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East Vertical Farming Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East Vertical Farming Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East Vertical Farming Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East Vertical Farming Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East Vertical Farming Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East Vertical Farming Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East Vertical Farming Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East Vertical Farming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Vertical Farming Market?

The projected CAGR is approximately 14.20%.

2. Which companies are prominent players in the Middle East Vertical Farming Market?

Key companies in the market include Madar Farms, Crop One Holdings Inc, Signify Holding (PHILIPS), Freight Farms, Urban Crop Solution, Intelligent Growth Solutions, Aero Farms.

3. What are the main segments of the Middle East Vertical Farming Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Emphasis of GCC Countries on Food Security.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

November 2022: AeroFarms announced its plan to expand further in the Middle East with a partnership with QFZA and Doha Venture Capital (DVC) to build a commercial indoor vertical farm in Qatar Free Zones (QFZ) that offers unparalleled connectivity and access to the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Vertical Farming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Vertical Farming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Vertical Farming Market?

To stay informed about further developments, trends, and reports in the Middle East Vertical Farming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence