Key Insights

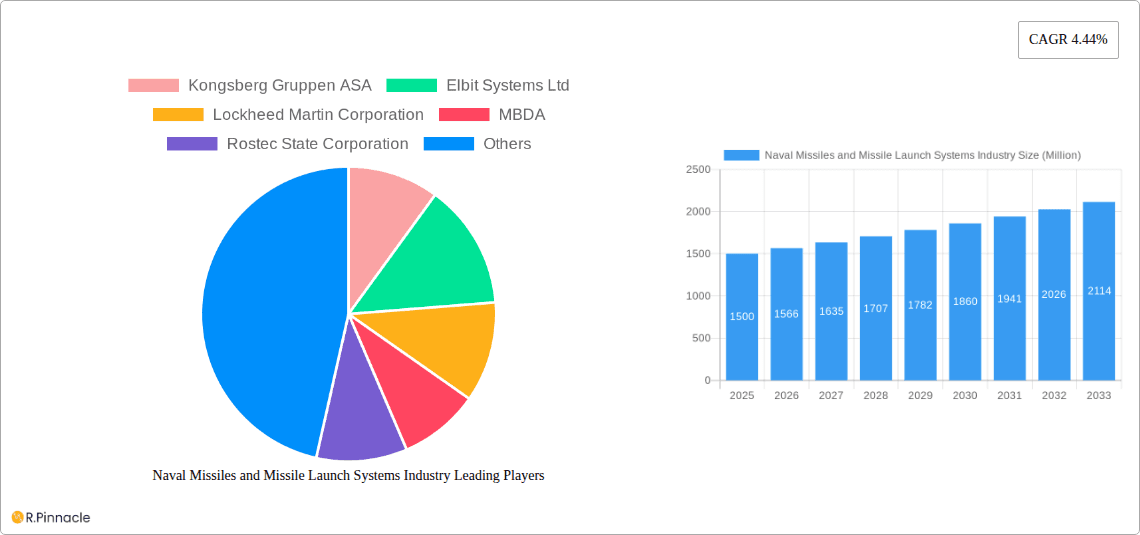

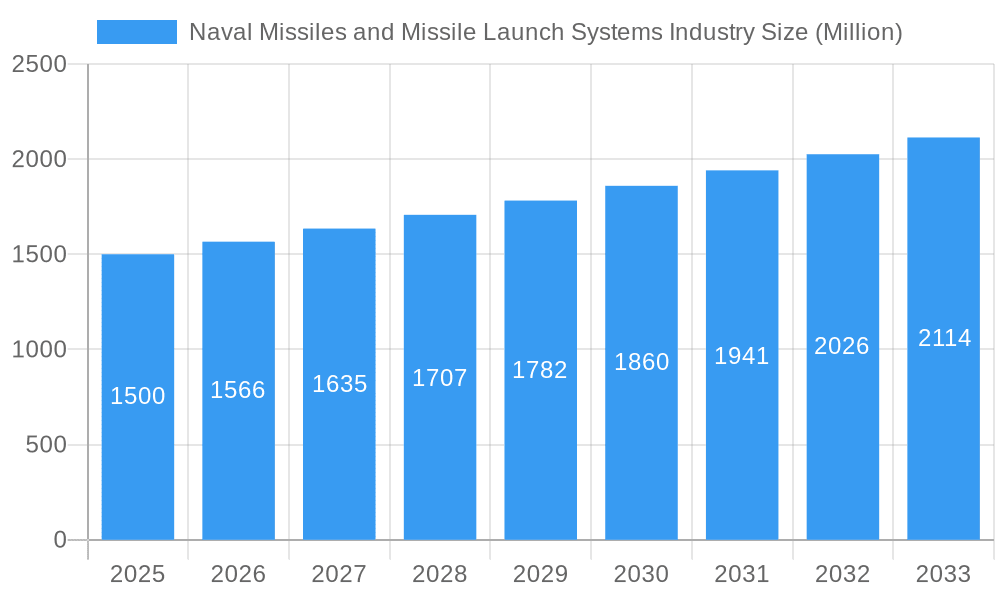

The naval missiles and missile launch systems market, valued at $1.5 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, increasing naval modernization efforts globally, and the demand for advanced anti-ship and land-attack capabilities. A Compound Annual Growth Rate (CAGR) of 4.44% from 2025 to 2033 indicates a significant expansion of this market over the forecast period. Key market drivers include the continuous development of hypersonic missiles, the integration of advanced sensor technologies for improved target acquisition, and the rising adoption of unmanned and autonomous systems for enhanced operational efficiency and reduced risk to personnel. Growth is further fueled by the increasing focus on asymmetric warfare and the need for effective defense against evolving threats. Market segments show strong potential across all areas, with surface vessels and submarines representing major application areas, while missile systems and launch systems represent the core technological components. While increased R&D investments and technological advancements present significant opportunities, potential restraints include the high cost of development and deployment, stringent regulatory approvals, and technological complexities associated with integrating advanced systems into existing naval platforms. The Asia-Pacific region, particularly China and India, is expected to witness significant growth due to substantial investments in their naval capabilities. North America and Europe will also remain key players due to their advanced technological capabilities and strong defense budgets. Competition amongst major players like Kongsberg Gruppen ASA, Elbit Systems Ltd., Lockheed Martin Corporation, and others is intense, promoting innovation and driving down costs over the long-term.

Naval Missiles and Missile Launch Systems Industry Market Size (In Billion)

The forecast for 2026-2033 suggests a steady growth trajectory, mirroring global defense spending trends and the continued emphasis on naval power projection. Specific growth within segments will depend upon technological advancements and the priorities of key naval powers. Surface vessel applications are anticipated to maintain the largest market share given the wide range of missions they undertake. Submarines, while representing a smaller market segment, hold significant strategic importance and are poised for strong growth due to their inherent stealth capabilities and the increasing importance of underwater warfare. The development of new missile types with improved range, accuracy, and lethality will be pivotal in driving market expansion. Furthermore, successful collaborations between defense companies and governments for joint development programs and technology transfers will be instrumental in accelerating the growth of the naval missiles and missile launch systems market.

Naval Missiles and Missile Launch Systems Industry Company Market Share

Naval Missiles and Missile Launch Systems Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Naval Missiles and Missile Launch Systems industry, covering market structure, dynamics, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes market size exceeding xx Million across various segments and geographical regions.

Naval Missiles and Missile Launch Systems Industry Market Structure & Innovation Trends

The Naval Missiles and Missile Launch Systems market is characterized by a moderately concentrated structure with several dominant players holding significant market share. Kongsberg Gruppen ASA, Lockheed Martin Corporation, MBDA, and Raytheon Technologies (RTX Corporation) are key players, collectively commanding an estimated xx% market share in 2025. Innovation is driven by the constant need for enhanced accuracy, range, and countermeasure capabilities, fueled by geopolitical tensions and technological advancements. Stringent regulatory frameworks, including export controls and international arms treaties, significantly influence market dynamics. Product substitutes, such as directed energy weapons, are emerging but currently hold limited market penetration. The end-user demographics primarily consist of naval forces from developed and developing nations. M&A activity has been relatively moderate in recent years, with deal values averaging xx Million per transaction. Notable examples include (specific M&A examples with values if available, otherwise "xx Million" will be used).

- Market Concentration: High (estimated xx% by top 4 players)

- Innovation Drivers: Enhanced accuracy, range, countermeasures, and emerging technologies.

- Regulatory Landscape: Stringent export controls and international treaties.

- M&A Activity: Moderate, with average deal values of xx Million.

Naval Missiles and Missile Launch Systems Industry Market Dynamics & Trends

The Naval Missiles and Missile Launch Systems market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include increasing defense budgets globally, modernization of naval fleets, and the growing need for advanced anti-ship and anti-submarine warfare capabilities. Technological disruptions, such as hypersonic missile development and AI-powered targeting systems, are reshaping the competitive landscape. Consumer preferences (i.e., naval forces) are shifting towards systems with improved lethality, survivability, and network integration. Competitive dynamics are intensifying, with established players investing heavily in R&D and emerging players entering the market with innovative solutions. Market penetration of new technologies like hypersonic missiles remains low (estimated at xx%) but is expected to increase significantly by 2033.

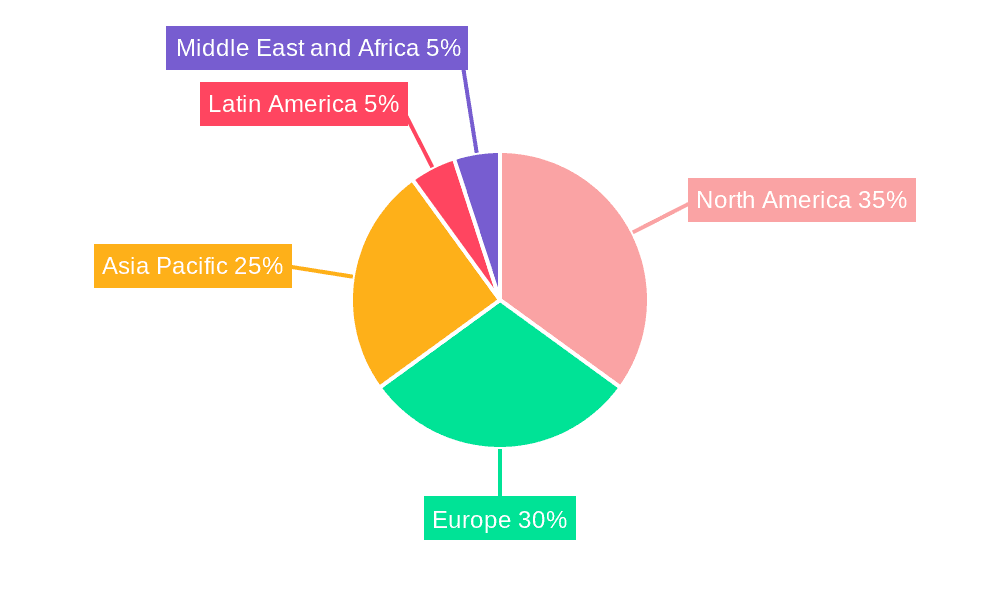

Dominant Regions & Segments in Naval Missiles and Missile Launch Systems Industry

North America and Europe currently dominate the Naval Missiles and Missile Launch Systems market, accounting for an estimated xx% of the global market share in 2025. This dominance is primarily attributed to:

- North America: High defense spending, technological leadership, and a strong naval presence.

- Europe: Significant investment in naval modernization programs and a robust industrial base.

Key Drivers for Dominant Regions:

- High defense budgets: Significant allocation of resources to naval modernization.

- Technological advancements: Strong R&D capabilities and innovation ecosystems.

- Geopolitical factors: Regional security concerns driving demand for advanced systems.

Dominant Segments:

- Missiles: Anti-ship missiles hold the largest market share due to the high demand for naval defense capabilities.

- Surface Vessels: The majority of missile systems are deployed on surface vessels, reflecting their crucial role in naval operations.

Naval Missiles and Missile Launch Systems Industry Product Innovations

Recent product innovations include the development of hypersonic missiles, advanced seeker technologies, and network-centric warfare capabilities. These advancements offer improved accuracy, range, and survivability, addressing the evolving needs of modern naval warfare. The focus on integrating AI and machine learning to enhance targeting accuracy and autonomy is another key trend. These innovations significantly improve the effectiveness and operational efficiency of naval missile systems, creating a competitive advantage for manufacturers.

Report Scope & Segmentation Analysis

This report segments the Naval Missiles and Missile Launch Systems market by:

Systems: Missiles (Anti-ship, Anti-submarine, Cruise), Launch Systems (Vertical Launch Systems, Surface-to-Air Missile Launchers)

Application: Surface Vessels (Frigates, Destroyers, Corvettes), Submarines.

Each segment exhibits unique growth projections and competitive dynamics; for example, the anti-ship missile segment is expected to witness robust growth due to increased geopolitical tensions and naval modernization efforts globally. Market sizes are estimated at xx Million for each major segment.

Key Drivers of Naval Missiles and Missile Launch Systems Industry Growth

Several factors fuel the growth of the Naval Missiles and Missile Launch Systems industry. These include:

- Increasing defense budgets: Governments globally are increasing their military spending, particularly on naval modernization programs.

- Technological advancements: Continuous innovation in missile technology is driving demand for advanced systems.

- Geopolitical instability: Rising geopolitical tensions are further bolstering demand for naval defense capabilities.

Challenges in the Naval Missiles and Missile Launch Systems Industry Sector

The industry faces several challenges, including:

- Stringent export controls: Regulations restrict the sale and transfer of advanced missile systems.

- Supply chain disruptions: Global supply chain vulnerabilities can impact production and delivery schedules.

- Intense competition: The market is characterized by intense competition among established and emerging players. This competition impacts pricing and profitability.

Emerging Opportunities in Naval Missiles and Missile Launch Systems Industry

Significant opportunities exist in:

- Emerging markets: Developing nations are investing in naval capabilities, creating new market opportunities.

- New technologies: Hypersonic and directed energy weapons present potential future market segments.

- Network-centric warfare: Integration of missile systems into networked environments is a growing trend.

Leading Players in the Naval Missiles and Missile Launch Systems Industry Market

- Kongsberg Gruppen ASA

- Elbit Systems Ltd

- Lockheed Martin Corporation

- MBDA

- Rostec State Corporation

- IAI

- Rafael Advanced Defense Systems Ltd

- RTX Corporation

- ROKETSAN A.Ş

- BAE Systems plc

- Saab AB

- Defense Research and Development Organization (DRDO)

Key Developments in Naval Missiles and Missile Launch Systems Industry Industry

- April 2022: KONGSBERG awarded a contract by the Commonwealth of Australia for NSM missiles under Project SEA1300, replacing Harpoon missiles.

- November 2022: The UK and Norway announced a defense cooperation agreement to enhance UK frigate and destroyer missile systems capabilities.

Future Outlook for Naval Missiles and Missile Launch Systems Industry Market

The Naval Missiles and Missile Launch Systems market is poised for continued growth, driven by ongoing naval modernization efforts, technological advancements, and geopolitical factors. Strategic opportunities exist for companies that can innovate, adapt to changing market demands, and effectively navigate the complex regulatory environment. The integration of AI and hypersonic technology will further accelerate market expansion.

Naval Missiles and Missile Launch Systems Industry Segmentation

-

1. Systems

- 1.1. Missiles

- 1.2. Launch Systems

-

2. Application

- 2.1. Surface Vessels

- 2.2. Submarines

Naval Missiles and Missile Launch Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Naval Missiles and Missile Launch Systems Industry Regional Market Share

Geographic Coverage of Naval Missiles and Missile Launch Systems Industry

Naval Missiles and Missile Launch Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Missiles Segment To Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Naval Missiles and Missile Launch Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Systems

- 5.1.1. Missiles

- 5.1.2. Launch Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Surface Vessels

- 5.2.2. Submarines

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Systems

- 6. North America Naval Missiles and Missile Launch Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Systems

- 6.1.1. Missiles

- 6.1.2. Launch Systems

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Surface Vessels

- 6.2.2. Submarines

- 6.1. Market Analysis, Insights and Forecast - by Systems

- 7. Europe Naval Missiles and Missile Launch Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Systems

- 7.1.1. Missiles

- 7.1.2. Launch Systems

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Surface Vessels

- 7.2.2. Submarines

- 7.1. Market Analysis, Insights and Forecast - by Systems

- 8. Asia Pacific Naval Missiles and Missile Launch Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Systems

- 8.1.1. Missiles

- 8.1.2. Launch Systems

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Surface Vessels

- 8.2.2. Submarines

- 8.1. Market Analysis, Insights and Forecast - by Systems

- 9. Latin America Naval Missiles and Missile Launch Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Systems

- 9.1.1. Missiles

- 9.1.2. Launch Systems

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Surface Vessels

- 9.2.2. Submarines

- 9.1. Market Analysis, Insights and Forecast - by Systems

- 10. Middle East and Africa Naval Missiles and Missile Launch Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Systems

- 10.1.1. Missiles

- 10.1.2. Launch Systems

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Surface Vessels

- 10.2.2. Submarines

- 10.1. Market Analysis, Insights and Forecast - by Systems

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kongsberg Gruppen ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elbit Systems Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MBDA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rostec State Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IAI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rafael Advanced Defense Systems Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RTX Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ROKETSAN A S

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BAE Systems plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saab AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Defense Research and Development Organization (DRDO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Kongsberg Gruppen ASA

List of Figures

- Figure 1: Global Naval Missiles and Missile Launch Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Systems 2025 & 2033

- Figure 3: North America Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Systems 2025 & 2033

- Figure 4: North America Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Systems 2025 & 2033

- Figure 9: Europe Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Systems 2025 & 2033

- Figure 10: Europe Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Systems 2025 & 2033

- Figure 15: Asia Pacific Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Systems 2025 & 2033

- Figure 16: Asia Pacific Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Systems 2025 & 2033

- Figure 21: Latin America Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Systems 2025 & 2033

- Figure 22: Latin America Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Systems 2025 & 2033

- Figure 27: Middle East and Africa Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Systems 2025 & 2033

- Figure 28: Middle East and Africa Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Naval Missiles and Missile Launch Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Naval Missiles and Missile Launch Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Systems 2020 & 2033

- Table 2: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Systems 2020 & 2033

- Table 5: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Systems 2020 & 2033

- Table 10: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Systems 2020 & 2033

- Table 18: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Systems 2020 & 2033

- Table 26: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Systems 2020 & 2033

- Table 31: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Naval Missiles and Missile Launch Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Egypt Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Naval Missiles and Missile Launch Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Naval Missiles and Missile Launch Systems Industry?

The projected CAGR is approximately 4.44%.

2. Which companies are prominent players in the Naval Missiles and Missile Launch Systems Industry?

Key companies in the market include Kongsberg Gruppen ASA, Elbit Systems Ltd, Lockheed Martin Corporation, MBDA, Rostec State Corporation, IAI, Rafael Advanced Defense Systems Ltd, RTX Corporation, ROKETSAN A S, BAE Systems plc, Saab AB, Defense Research and Development Organization (DRDO.

3. What are the main segments of the Naval Missiles and Missile Launch Systems Industry?

The market segments include Systems, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Missiles Segment To Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: The United Kingdom disclosed a defense cooperation agreement with the Norwegian government, aiming to enhance the capabilities of the UK's eleven frigates and destroyers by integrating advanced missile systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Naval Missiles and Missile Launch Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Naval Missiles and Missile Launch Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Naval Missiles and Missile Launch Systems Industry?

To stay informed about further developments, trends, and reports in the Naval Missiles and Missile Launch Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence